UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material under § 240.14a-12 |

Edify Acquisition Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x |

No fee required |

| |

|

| ¨ |

Fee paid previously with preliminary materials |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

EXPLANATORY NOTE

On December 6, 2022,

the Registrant filed with the Securities and Exchange Commission (the “SEC”) a proxy statement (the “Original Proxy

Statement”) for the Special Meeting of Stockholders to be held on December 21, 2022 at 12:00 p.m. EST. On December 14, 2022, the

Registrant filed with the SEC Supplement No.1, dated December 14, 2022, to the Original Proxy Statement (“Supplement No. 1”

and together with the Original Proxy Statement, the “Definitive Proxy Statement”). The Registrant is filing these definitive

additional proxy materials on December 19, 2022, to amend and supplement certain information in the Definitive Proxy Statement. No other

information in the Definitive Proxy Statement has been revised, supplemented, updated or amended.

SUPPLEMENT NO. 2 DATED DECEMBER 19, 2022

TO

DEFINITIVE PROXY STATEMENT FOR SPECIAL MEETING

OF STOCKHOLDERS OF EDIFY ACQUISITION CORP.

TO BE HELD ON DECEMBER 21, 2022

EDIFY ACQUISITION CORP.

888 7th Avenue, Floor 29

New York, NY 10106

The following supplemental disclosure amends and

restates in its entrety the “Risk Factors” section on page 2 of the Original Proxy Statement:

RISK FACTORS

You should consider carefully all of the risks described in our Annual

Report on Form 10-K, as amended, filed with the SEC on March 31, 2022, our Quarterly Report on Form 10-Q filed with the SEC on August

15, 2022 and in the other reports we file with the SEC before making a decision to invest in our securities. Furthermore, if any of the

following events occur, our business, financial condition and operating results may be materially adversely affected or we could face

liquidation. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. The

risks and uncertainties described in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and below are not the only ones

we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important

factors that adversely affect our business, financial condition and operating results or result in our liquidation.

If we were deemed to be an investment company for purposes of

the Investment Company Act of 1940, as amended (the “Investment Company Act”), we may be forced to abandon our efforts

to complete an initial business combination and instead be required to liquidate the Company. To avoid that result, on or shortly prior

to the 24-month anniversary of the effective date of the registration statement relating to our initial public offering, we will liquidate

the securities held in the trust account and instead hold all funds in the trust account in an interest bearing bank demand deposit accoun,

which may earn less interest than we otherwise would have if the trust account had remained invested in U.S. government securities or

money market funds.

On March 30, 2022, the SEC issued proposed rules (the “SPAC

Rule Proposals”), relating to, among other things, circumstances in which special purpose acquisition companies (“SPACs”)

such as us could potentially be subject to the Investment Company Act and the regulations thereunder. The SPAC Rule Proposals

would provide a safe harbor for such companies from the definition of “investment company” under Section 3(a)(1)(A) of the

Investment Company Act, provided that a SPAC satisfies certain criteria. To comply with the duration limitation of the proposed safe harbor,

a SPAC would have a limited time period to announce and complete a de-SPAC transaction. Specifically, to comply with the safe harbor,

the SPAC Rule Proposals would require a SPAC to file a Current Report on Form 8-K announcing that it has entered into an agreement with

a target company for an initial business combination no later than 18 months after the effective date of the registration statement relating

to the SPAC’s initial public offering. Such SPAC would then be required to complete its initial business combination no later than

24 months after the effective date of the registration statement relating to its initial public offering.

There is currently uncertainty concerning the applicability of

the Investment Company Act to a SPAC, including a company like ours, that has not entered into a definitive agreement

within 18 months after the effective date of the registration statement relating to its initial public offering or that does not

complete its initial business combination within 24 months after such date. We have not entered into a definitive business

combination agreement within 18 months after the effective date of the registration statement relating to our initial public

offering, and do not expect to complete our initial business combination within 24 months of such date. As a result, it is possible

that a claim could be made that we have been operating as an unregistered investment company. If we were deemed to be an investment

company for purposes of the Investment Company Act, we might be forced to abandon our efforts to complete an initial business

combination and instead be required to liquidate. If we are required to liquidate, our investors would not be able to realize the

benefits of owning stock in a successor operating business, including the potential appreciation in the value of our stock and

warrants following such a transaction, and our warrants would expire worthless.

The funds in the trust account have, since our IPO, been held only

in U.S. government securities within the meaning set forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 185 days

or less or in money market funds investing solely in United States Treasuries and meeting certain conditions under Rule 2a-7 under

the Investment Company Act. However, to mitigate the risk of us being deemed to have been operating as an unregistered investment

company (including under the subjective test of Section 3(a)(1)(A) of the Investment Company Act), we will, on or shortly prior to the

24-month anniversary of the effective date of the registration statement relating to our initial public offering, instruct Continental

Stock Transfer & Trust Company, the trustee with respect to the trust account, to liquidate the U.S. government securities or money

market funds held in the trust account and thereafter, until the earlier of consummation of our initial business combination or liquidation,

to hold all funds in the trust account in an interest bearing bank demand deposit account, which may earn less interest than we otherwise

would have if the trust account had remained invested in U.S. government securities or money market funds. This may mean that the amount

of funds available for redemption would not increase, or would only minimally increase, thereby reducing the dollar amount our public

shareholders would receive upon any redemption or liquidation of the Company.

In addition, even prior to the 24-month anniversary of the effective

date of the registration statement relating to our initial public offering, we may be deemed to be an investment company. The longer that

the funds in the trust account are held in short-term U.S. government securities or in money market funds invested exclusively in such

securities, even prior to the 24-month anniversary, there is a greater risk that we may be considered an unregistered investment company,

in which case we may be required to liquidate. Accordingly, we may determine, in our discretion, to liquidate the securities held in the

trust account at any time, even prior to the 24-month anniversary, and instead hold all funds in the trust account in an interest bearing

bank demand deposit account, which may earn less interest than we otherwise would have if the trust account had remained invested in U.S.

government securities or money market funds.

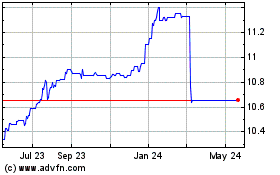

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

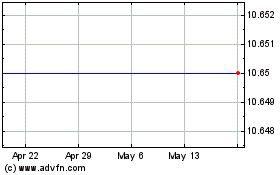

Edify Acquisition (NASDAQ:EAC)

Historical Stock Chart

From Nov 2023 to Nov 2024