BETHESDA, Md., July 18 /PRNewswire-FirstCall/ -- Eagle Bancorp,

Inc. (the "Company") (NASDAQ:EGBN), the parent company of

EagleBank, today announced net income of $1.9 million ($0.19 per

basic share and per diluted share) for the three months ended June

30, 2008, compared to $2.0 million ($0.21 per basic share and $0.20

per diluted share) for the three months ended June 30, 2007. For

the six months ended June 30, 2008, the Company earned $3.5 million

($0.36 per basic share and $0.35 per diluted share), as compared to

$3.7 million ($0.38 per basic share and $0.37 cents per diluted

share) for 2007, a decline of 4%. "At a time of substantial stress

in our financial markets and instability in many banks, we are

extremely pleased to report consistent net income and continued

asset growth for Eagle Bancorp, Inc. for the second quarter of

2008. Both Eagle Bancorp and EagleBank remain well capitalized,"

noted Ronald D. Paul, Chairman and CEO of Eagle Bancorp, Inc. "In

spite of a continuing difficult interest rate environment, wherein

the Federal Reserve has lowered interest rates sharply to combat a

weakening economic situation, the Company improved an already

strong net interest margin and sustained a long-term trend of

growth in the balance sheet" added Mr. Paul. Growth in average

deposits, other funding sources and loans, along with a slight

expansion of the net interest margin were the major drivers of the

increase in net interest income for the three months ended June 30,

2008 as compared to the same three month period in 2007.

Additionally, the level of Eagle Bancorp's non-performing loans was

stable at June 30, 2008, as compared to March 31, 2008. For the

three months ended June 30, 2008, the Company reported an

annualized return on average assets (ROAA) of 0.84% as compared to

0.77% for the three months ended March 31, 2008 and 1.02% for the

three months ended June 30, 2007; while the annualized return on

average equity (ROAE) for the most recent quarter was 8.81%, as

compared to 7.98% for the three months ended March 31, 2008 and

10.50% for the three months ended June 30, 2007. The most

significant factors affecting these ratios have been changes in the

net interest margin and the contribution to the provision for

credit losses primarily as a result of loan growth. Both lending

and deposit activities showed growth for the three and six months

ended June 30, 2008 as compared to the same periods in 2007. For

the three months ended June 30, 2008, average loans increased 19%

and for the six months ended June 30, 2008, average loans increased

17%. For the three months ended June 30, 2008, average deposits

increased 9% and for the six months ended June 30, 2008, average

deposits increased 8%. Net interest income increased 13% for the

three months ended June 30, 2008 over 2007, as the effect of

favorable balance sheet growth was partially offset by a decline

(11 basis points) in the net interest margin. For the three months

ended June 30, 2008, the net interest margin was 4.34% as compared

to 4.45% for the three months ended June 30, 2007. The Company's

net interest margin remains favorable to peer banking companies.

The Company's net interest margin for the second quarter of 2008

improved by 15 basis points (to 4.34%) over the net interest margin

for the first quarter of 2008 of 4.19%, as the cost of funds was

managed aggressively. The provision for credit losses was $814

thousand for the three months ended June 30, 2008 as compared to

$36 thousand for the three months ended June 30, 2007. The higher

provisioning in the second quarter of 2008 as compared to the

second quarter of 2007 is primarily attributable to higher levels

of loan growth in the second quarter of 2008 versus 2007, increases

in specific reserves for problem and potential problem loans, and

higher levels of net charge-offs in the second quarter of 2008 as

compared to the second quarter of 2007. The provision for credit

losses was $1.5 million for the first six months of 2008 as

compared to $339 thousand in 2007. The higher provisioning in the

first six months of 2008 as compared to 2007 is attributable to

substantially higher levels of loan growth and to increases in

reserve allocations on classified credits. At June 30, 2008 the

allowance for credit losses represented 1.15% of loans outstanding,

unchanged from the allowance percentage at March 31, 2008. The

1.15% allowance represents an increase as compared to 1.12% at

December 31, 2007 and 1.11% at June 30, 2007. The higher allowance

percentage at June 30, 2008 as compared to December 31, 2007 and

June 30, 2007 relates primarily to changes in the portfolio mix and

higher reserve levels for problem loans and potential problem

loans. For the three months ended June 30, 2008, the Company

recorded net charge- offs of $393 thousand as compared to $11

thousand of net charge-offs for the three months ended June 30,

2007. Net charge-offs in the second quarter of 2008 were

attributable to charge-offs in consumer loans (38% of total), the

un-guaranteed portion of SBA Loans (32% of total), and non-real

estate commercial business loans (30% of total). For the six months

ended June 30, 2008 net charge-offs totaled $418 thousand versus

$424 thousand for the six months ended June 30, 2007. Net

charge-offs in the six months ended June 30, 2008 were attributable

to charge-offs in consumer loans (39 % of total), the un-guaranteed

portion of SBA Loans (32% of total), and non-real estate commercial

business loans (29% of total). The ratio of non-performing loans to

total loans improved slightly from 1.54% ($11.7 million) at March

31, 2008 to 1.45% ($11.6 million) at June 30, 2008, a decline of

$100 thousand. However, the ratio was elevated as compared to

December 31, 2007 of 0.74% ($5.3 million) and June 30, 2007 of

0.22% ($1.5 million). The increase in nonperforming loans at June

30, 2008 as compared December 31, 2007 relates primarily to two

commercial real estate loan relationships which have experienced

delays and/or cost overruns in the construction and development

processes. Management believes that the Company is adequately

reserved for these non performing commercial real estate-secured

loans. Noninterest income for the three months ended June 30, 2008

decreased to $970 thousand from $1.2 million for the three months

ended June 30, 2007, a 19% decline. This decline was due to a lower

volume of SBA and residential mortgage loan sales activity, which

activity is subject to significant quarterly variances and no

income from subordinate financing of real estate projects in 2008

versus $227 thousand in the prior year. Income from subordinated

financing activities is subject to wide variances, as it is based

on the sales progress of a limited number of development projects.

Noninterest expenses were $6.5 million for the three months ended

June 30, 2008, as compared to $6.2 million for the three months

ended June 30, 2007, a 5% increase. The primary reasons for this

increase were merit increases and related personnel costs,

increased broker fees, higher internet and license agreement fees

and increased legal, accounting and professional fees. The

efficiency ratio, which measures the level of non-interest expense

to total revenue improved to 63.96% for the three months ended June

30, 2008, as compared to 66.33% for the three months ended June 30,

2007. While the Company continues to make strategic investments in

infrastructure, more attention to overall cost management is being

emphasized. For the six months ended June 30, 2008, the Company

reported an annualized return on average assets (ROAA) of 0.81% as

compared to 0.95% for the first six months of 2007, while the

annualized return on average equity (ROAE) was 8.40%, as compared

to 9.88% for the same six month period in 2007. Declines in these

ratios were due to lower net interest margins, which factor is

affecting all financial institutions, and to higher levels of loan

loss provisioning. For the first six months of 2008, net interest

income increased 10% over the same period for 2007. As noted above,

average loans increased 17% and average deposits increased by 8%.

The net interest margin was 4.26% as compared to 4.43% for the

first six months in 2007, as the effects of a steep decline in

market interest rates impacted the Company. However, as mentioned

above, the Company believes it has managed this significant decline

in market interest rates well and currently has a favorable net

interest margin as compared to peer banking companies. Noninterest

income for the first six months of 2008 was $1.9 million compared

to $2.2 million in the first six months of 2007, a decrease of 13%.

The decrease was attributed primarily to lower amounts of gains on

the sale of SBA and residential mortgage loans ($279 thousand

versus $571 thousand) and no income from subordinate financing of

real estate projects in 2008 versus $227 thousand in the prior

year. Noninterest expenses were $12.7 million for the first six

months of 2008, as compared to $12.3 million for 2007, a modest 4%

increase. The primary reasons for this increase were merit

increases, and related personnel cost increases, increased broker

fees, higher internet and license agreement fees and increased

legal, accounting and professional fees. The efficiency ratio for

the first six months of 2008 improved to 64.50% as compared to

66.88% for the same period in 2007. At June 30, 2008, total assets

were $915.8 million compared to $813.0 million at June 30, 2007, a

13% increase. Total deposits amounted to $698.4 million, at June

30, 2008, a 7% increase over deposits of $650.5 million at June 30,

2007, while total loans increased to $795.1 million at June 30,

2008, from $659.2 million at June 30, 2007, a 21% increase. Total

borrowed funds, which include customer repurchase agreements,

increased to $127.7 million at June 30, 2008 from $82.6 million at

June 30, 2007, a 55% increase. This increase in part represents a

heavier reliance on borrowed funds to meet loan growth. The Company

paid a dividend of $0.06 per share for each of the first and second

quarters of 2008 and 2007. The Summary of Financial Information

presented on the following pages provides more detail of the

Company's performance for the six and three months ended June 30,

2008 as compared to the six and three months ended June 30, 2007,

as well as providing eight quarters of trend data. Persons wishing

additional information should refer to the Company's Form 10-K as

amended, for the year ended December 31, 2007 as filed with the

Securities and Exchange Commission (the "SEC"). The Company is the

holding company for EagleBank which commenced operations in 1998.

The Bank is headquartered in Bethesda, Maryland, and conducts full

service commercial banking services through nine offices, located

in Montgomery County, Maryland and Washington, D.C. The Company

focuses on building relationships with businesses, professionals

and individuals in its marketplace. In December 2007, the Company

announced the signing of a definitive agreement to acquire Fidelity

& Trust Financial Corporation, parent of Fidelity & Trust

Bank. At March 31, 2008, Fidelity & Trust Bank had $459 million

of assets. Fidelity & Trust Bank operates six locations, with

one in Northern Virginia, three in Montgomery County, Maryland and

two in the District of Columbia. The transaction is subject to

regulatory and shareholder approvals and the satisfaction of other

conditions, as set forth in the merger agreement. The transaction

is currently anticipated to be completed in the third quarter of

2008. Forward looking Statements: This press release contains

forward looking statements within the meaning of the Securities and

Exchange Act of 1934, as amended, including statements of goals,

intentions, and expectations as to future trends, plans, events or

results of Company operations and policies and regarding general

economic conditions. In some cases, forward-looking statements can

be identified by use of words such as "may," "will," "anticipates,"

"believes," "expects," "plans," "estimates," "potential,"

"continue," "should," and similar words or phrases. These

statements are based upon current and anticipated economic

conditions, nationally and in the Company's market, interest rates

and interest rate policy, competitive factors and other conditions

which by their nature, are not susceptible to accurate forecast and

are subject to significant uncertainty. Because of these

uncertainties and the assumptions on which this discussion and the

forward- looking statements are based, actual future operations and

results in the future may differ materially from those indicated

herein. Readers are cautioned against placing undue reliance on any

such forward-looking statements. The Company's past results are not

necessarily indicative of future performance. ADDITIONAL

INFORMATION ABOUT THE PROPOSED MERGER WITH FIDELITY & TRUST

Eagle Bancorp, Inc. will be filing a proxy statement/prospectus and

other relevant documents concerning the merger with the SEC. The

proxy statement/prospectus will be mailed to the shareholders of

Eagle Bancorp and Fidelity & Trust Financial Corporation.

Investors and security holders of Eagle Bancorp and Fidelity &

Trust Financial Corporation are urged to read the proxy

statement/prospectus, the documents incorporated by reference in

the proxy statement/prospectus, the other documents filed with the

SEC and the other relevant materials when they become available

because they will contain important information about Eagle

Bancorp, Fidelity & Trust Financial Corporation and the Merger

Agreement and the transactions contemplated by the Merger

Agreement. Investors will be able to obtain these documents free of

charge at the SEC's web site (http://www.sec.gov/). In addition,

documents filed with the SEC by Eagle Bancorp, Inc. will be

available free of charge from Eagle Bancorp's Investor Relations at

301/986-1800, or from Eagle Bancorp's website at

http://www.eaglebankmd.com/. The directors, executive officers, and

certain other members of management and employees of Eagle Bancorp

and its subsidiaries are participants in the solicitation of

proxies in favor of the issuance of shares pursuant to the merger

from the shareholders of Eagle Bancorp. Information about the

directors and executive officers of Eagle Bancorp is set forth in

Eagle Bancorp's proxy statement for the 2008 annual meeting of

shareholders filed with the SEC on March 31, 2008. Additional

information regarding the interests of such participants will be

included in the proxy statement/prospectus and the other relevant

documents filed with the SEC when they become available. Eagle

Bancorp, Inc. Statements of Financial Condition (in thousands) June

30, December 31, June 30, 2008 2007 2007 (Unaudited) (Audited)

(Unaudited) Assets Cash and due from banks $18,565 $15,408 $24,899

Interest bearing deposits with banks and other short term

investments 1,391 4,490 4,383 Federal funds sold 63 244 28,146

Investment securities available for sale, at fair value 79,585

87,117 72,449 Loans held for sale 1,484 2,177 2,854 Loans 795,102

716,677 659,233 Less: Allowance for credit losses (9,154) (8,037)

(7,288) Premises and equipment, net 6,561 6,701 7,158 Accrued

interest and other assets 22,203 21,623 21,182 Total Assets

$915,800 $846,400 $813,016 Liabilities and Stockholders' Equity

Noninterest bearing deposits $143,335 $142,477 $145,263 Interest

bearing transaction 55,017 54,090 52,895 Savings and money market

187,275 177,081 180,415 Time, $100,000 or more 171,127 173,586

155,316 Other time 141,687 83,702 116,603 Total deposits 698,441

630,936 650,492 Customer repurchase agreements and federal funds

purchased 46,129 76,408 40,589 Other borrowings 81,581 52,000

42,000 Other liabilities 5,436 5,890 3,926 Total liabilities

831,587 765,234 737,007 Stockholders' equity 84,213 81,166 76,009

Total Liabilities and Stockholders' Equity $915,800 $846,400

$813,016 Eagle Bancorp, Inc. Statements of Income and Highlights

(in thousands, except per share data) Six Months Ended Three Months

Ended June 30, June 30, 2008 2007 2008 2007 Income Statements

(Unaudited)(Unaudited)(Unaudited)(Unaudited) Total interest income

$28,009 $27,843 $13,995 $14,107 Total interest expense 10,167

11,676 4,753 5,909 Net interest income 17,842 16,167 9,242 8,198

Provision for credit losses 1,534 339 814 36 Net interest income

after provision for credit losses 16,308 15,828 8,428 8,162

Noninterest income (before investment gains) 1,900 2,187 970 1,196

Investment gains 10 7 - - Total noninterest income 1,910 2,194 970

1,196 Salaries and employee benefits 7,286 6,806 3,646 3,454

Premises and equipment expenses 2,183 2,463 1,103 1,255 Marketing

and advertising 195 222 114 131 Other expenses 3,076 2,789 1,669

1,391 Total noninterest expense 12,740 12,280 6,532 6,231 Income

before income tax expense 5,478 5,742 2,866 3,127 Income tax

expense 1,972 2,082 1,011 1,149 Net income $3,506 $3,660 $1,855

$1,978 Per Share Data: Earnings per weighted average share, basic

$0.36 $0.38 $0.19 $0.21 Earnings per weighted average share,

diluted $0.35 $0.37 $0.19 $0.20 Weighted average shares

outstanding, basic 9,807,371 9,510,788 9,833,506 9,532,765 Weighted

average shares outstanding, diluted 9,926,334 9,826,739 9,906,151

9,813,537 Actual shares outstanding 9,842,571 9,563,163 9,842,571

9,563,163 Book value per share at period end $8.56 $7.95 $8.56

$7.95 Dividend per share $0.12 $0.12 $0.06 $0.06 Performance Ratios

(annualized): Return on average assets 0.81% 0.95% 0.84% 1.02%

Return on average equity 8.40% 9.88% 8.81% 10.50% Net interest

margin 4.26% 4.43% 4.34% 4.45% Efficiency ratio (1) 64.50% 66.88%

63.96% 66.33% Other Ratios: Allowance for credit losses to total

loans 1.15% 1.11% 1.15% 1.11% Non-performing loans to total loans

1.45% 0.22% 1.45% 0.22% Net charge-offs (annualized) to average

loans 0.11% 0.13% 0.20% 0.01% Average equity to average assets

9.59% 9.65% 9.51% 9.70% Tier 1 leverage ratio 9.60% 9.85% 9.60%

9.85% Total risk based capital ratio 10.80% 11.87% 10.80% 11.87%

Average Balances (in thousands): Total assets $875,521 $774,688

$891,012 $778,454 Total earning assets $841,348 $735,531 $857,232

$738,501 Total loans (2) $750,768 $642,001 $770,034 $647,714 Total

deposits $669,128 $620,474 $683,151 $624,413 Total borrowings

$117,659 $75,758 $118,634 $74,948 Total stockholders' equity

$83,954 $74,724 $84,708 $75,549 (1) Computed by dividing

noninterest expense by the sum of net interest income and

noninterest income (2) Includes loans held for sale Eagle Bancorp,

Inc. Statements of Income and Highlights (Quarterly Trends) (in

thousands, except per share data) (Unaudited) Three Months Ended

June 30, March 31, Dec. 31, Sept. 30, Income Statements 2008 2008

2007 2007 Total interest income $13,995 $14,014 $14,879 $14,355

Total interest expense 4,753 5,414 6,036 6,017 Net interest income

9,242 8,600 8,843 8,338 Provision for credit losses 814 720 883 421

Net interest income after provision for credit losses 8,428 7,880

7,960 7,917 Noninterest income (before investment gains) 970 930

1,961 1,032 Investment gains (losses) - 10 (1) - Total noninterest

income 970 940 1,960 1,032 Salaries and employee benefits 3,646

3,640 3,784 3,577 Premises and equipment expenses 1,103 1,080 1,180

1,186 Marketing and advertising 114 81 109 134 Other expenses 1,669

1,407 1,395 1,276 Total noninterest expense 6,532 6,208 6,468 6,173

Income before income tax expense 2,866 2,612 3,452 2,776 Income tax

expense 1,011 961 1,166 1,021 Net income $1,855 $1,651 $2,286

$1,755 Per Share Data: Earnings per weighted average share, basic

$0.19 $0.17 $0.24 $0.18 Earnings per weighted average share,

diluted $0.19 $0.17 $0.23 $0.18 Weighted average shares

outstanding, basic 9,833,506 9,781,237 9,689,422 9,580,790 Weighted

average shares outstanding, diluted 9,906,151 9,933,993 9,884,709

9,838,524 Actual shares outstanding 9,842,571 9,790,252 9,721,315

9,584,029 Book value per share at period end $8.56 $8.53 $8.35

$8.15 Dividend per share $0.06 $0.06 $0.06 $0.06 Performance Ratios

(annualized): Return on average assets 0.84% 0.77% 1.06% 0.88%

Return on average equity 8.81% 7.98% 11.33% 9.09% Net interest

margin 4.34% 4.19% 4.30% 4.34% Efficiency ratio (1) 63.96% 65.07%

59.87% 65.88% Other Ratios: Allowance for credit losses to total

loans 1.15% 1.15% 1.12% 1.09% Non-performing loans to total loans

1.45% 1.54% 0.74% 0.82% Net charge-offs (annualized) to average

loans 0.20% 0.01% 0.15% 0.18% Average equity to average assets

9.51% 9.67% 9.39% 9.69% Tier 1 leverage ratio 9.60% 9.55% 9.46%

9.78% Total risk based capital ratio 10.80% 10.95% 11.21% 11.90%

Average Balances (in thousands): Total assets $891,012 $860,030

$852,243 $799,382 Total earning assets $857,232 $825,463 $816,187

$761,646 Total loans (2) $770,034 $731,501 $687,030 $665,222 Total

deposits $683,151 $655,105 $659,355 $636,573 Total borrowings

$118,634 $116,684 $107,697 $80,952 Total stockholders' equity

$84,708 $83,200 $80,058 $77,468 Three Months Ended June 30, March

31, Dec. 31, Sept. 30, Income Statements 2007 2007 2006 2006 Total

interest income $14,107 $13,736 $13,848 $13,033 Total interest

expense 5,909 5,767 5,466 4,818 Net interest income 8,198 7,969

8,382 8,215 Provision for credit losses 36 303 327 711 Net interest

income after provision for credit losses 8,162 7,666 8,055 7,504

Noninterest income (before investment gains) 1,196 991 906 1,287

Investment gains (losses) - 7 39 (71) Total noninterest income

1,196 998 945 1,216 Salaries and employee benefits 3,454 3,352

3,177 3,104 Premises and equipment expenses 1,255 1,208 1,040 1,107

Marketing and advertising 131 91 221 102 Other expenses 1,391 1,398

1,305 1,383 Total noninterest expense 6,231 6,049 5,743 5,696

Income before income tax expense 3,127 2,615 3,257 3,024 Income tax

expense 1,149 933 1,105 1,124 Net income $1,978 $1,682 $2,152

$1,900 Per Share Data: Earnings per weighted average share, basic

$0.21 $0.18 $0.23 $0.20 Earnings per weighted average share,

diluted $0.20 $0.17 $0.22 $0.19 Weighted average shares

outstanding, basic 9,532,765 9,488,567 9,442,952 9,423,947 Weighted

average shares outstanding, diluted 9,813,537 9,816,711 9,842,928

9,869,514 Actual shares outstanding 9,563,163 9,509,622 9,478,064

9,425,733 Book value per share at period end $7.95 $7.83 $7.69

$7.49 Dividend per share $0.06 $0.06 $0.06 $0.06 Performance Ratios

(annualized): Return on average assets 1.02% 0.88% 1.13% 1.05%

Return on average equity 10.50% 9.23% 11.89% 10.84% Net interest

margin 4.45% 4.41% 4.63% 4.81% Efficiency ratio (1) 66.33% 67.44%

61.57% 60.40% Other Ratios: Allowance for credit losses to total

loans 1.11% 1.14% 1.18% 1.19% Non-performing loans to total loans

0.22% 0.25% 0.32% 0.34% Net charge-offs (annualized) to average

loans 0.01% 0.26% 0.00% (0.02%) Average equity to average assets

9.70% 9.59% 9.49% 9.69% Tier 1 leverage ratio 9.85% 9.70% 9.67%

9.89% Total risk based capital ratio 11.87% 12.00% 11.91% 12.13%

Average Balances (in thousands): Total assets $778,454 $770,880

$756,323 $717,481 Total earning assets $738,501 $732,529 $718,751

$678,225 Total loans (2) $647,714 $636,225 $606,934 $581,874 Total

deposits $624,413 $616,492 $616,929 $589,597 Total borrowings

$74,948 $76,577 $62,711 $53,837 Total stockholders' equity $75,549

$73,890 $71,784 $69,537 (1) Computed by dividing noninterest

expense by the sum of net interest income and noninterest income

(2) Includes loans held for sale DATASOURCE: Eagle Bancorp, Inc.

CONTACT: Ronald D. Paul of Eagle Bancorp, Inc., +1-301-986-1800 Web

site: http://www.eaglebankmd.com/

Copyright

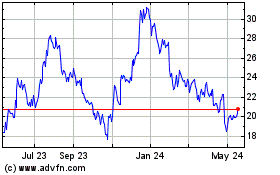

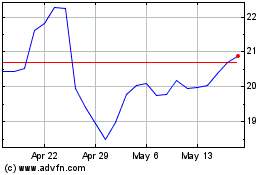

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jul 2023 to Jul 2024