Current Report Filing (8-k)

24 May 2023 - 10:08PM

Edgar (US Regulatory)

0001035354

false

0001035354

2023-05-24

2023-05-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 24, 2023

Eloxx

Pharmaceuticals, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-31326 |

|

84-1368850 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

480 Arsenal Way, Suite 130

Watertown, MA 02472

(Address of principal executive offices, including

Zip Code)

(781) 577-5300

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value per share |

ELOX |

The

Nasdaq Capital

Market |

| Item 1.01 |

Entry into a Material Definitive

Agreement. |

On May 24, 2023, Eloxx Pharmaceuticals, Inc. (the

“Company”) entered into a Sales Agreement (the “Oppenheimer Sales Agreement”) with Oppenheimer &

Co. Inc. (“Oppenheimer”) pursuant to which the Company may offer and sell shares of its common stock, par value $0.01

per share (the “Common Stock”), having aggregate gross sales proceeds of up to $50.0 million (the “Shares”),

from time to time, through an “at the market offering” program under which Oppenheimer will act as sales agent. The

shares of Common Stock that may be sold pursuant to the Oppenheimer Sales Agreement will be issued pursuant to the Company’s

shelf registration statement on Form S-3 (File No. 333-258994) (the “Registration Statement”), as supplemented

by the prospectus supplement dated May 24, 2023 relating to the sale of the Common Stock (the “Prospectus

Supplement”). As of March 31, 2023, the date the Company filed its Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, it was subject to the offering limits in General Instruction I.B.6 of Form S-3. As a result of

these limitations, as of May 24, 2023, the Company may currently only offer and sell shares of its Common Stock having an

aggregate offering price of up to $6.5 million pursuant to the Oppenheimer Sales Agreement.

Under the Oppenheimer Sales Agreement, the Company will set the parameters

for the sale of the Shares, including the number of Shares to be issued, the time period during which sales are requested to be made,

limitations on the number of Shares that may be sold in any one trading day and any minimum price below which sales may not be made.

Subject to the terms and conditions of the Oppenheimer Sales Agreement, Oppenheimer may sell the Shares by methods deemed to be an “at

the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, including sales made directly on or through the Nasdaq Capital Market or any other existing trading market for the Common

Stock. The Company has agreed to pay Oppenheimer a commission up to 3.0% of the gross sales proceeds of any shares of Common Stock sold

through Oppenheimer under the Oppenheimer Sales Agreement, and also has provided Oppenheimer with customary indemnification and contribution

rights. The Oppenheimer Sales Agreement may be terminated at any time by either party upon prior written notice to the other party.

The

Company is not obligated to make any sales of Shares under the Oppenheimer Sales Agreement.

The offering of Shares pursuant to the Oppenheimer Sales Agreement will terminate upon the

earlier of (i) the sale of all Common Stock subject to the Oppenheimer Sales Agreement

or (ii) termination of the Oppenheimer Sales Agreement in accordance with its terms.

The representations and warranties contained in the Oppenheimer Sales

Agreement were made only for purposes of the transactions contemplated by the Oppenheimer Sales Agreement as of specific dates and may

have been qualified by certain disclosures between the parties and a contractual standard of materiality different from those generally

applicable under securities laws, among other limitations. The representations and warranties were made for purposes of allocating contractual

risk between the parties to the Oppenheimer Sales Agreement and should not be relied upon as a disclosure of factual information relating

to the Company, Oppenheimer or the transactions described in this Current Report on Form 8-K.

The foregoing description of the material terms of the Oppenheimer

Sales Agreement is qualified in its entirety by reference to the full agreement, a copy of which is filed as Exhibit 1.1 to this

Current Report on Form 8-K and is incorporated herein by reference.

The Shares will be sold pursuant to the Registration Statement, and

offerings of the Shares will be made only by means of the Prospectus Supplement. This Current Report on Form 8-K shall not constitute

an offer to sell or the solicitation of any offer to buy the securities discussed herein, nor shall there be any offer, solicitation

or sale of the securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state.

A legal opinion relating to the Shares is included as Exhibit 5.1

to this Current Report on Form 8-K.

| Item 1.02. | Termination of a Material Definitive Agreement. |

As previously disclosed, on September 30, 2021, the Company entered

into a Sales Agreement (the “SVB Sales Agreement”) with SVB Leerink LLC (“Cowen”) to sell shares of the Company’s

Common Stock with aggregate gross sales proceeds of up to $50 million, from time to time, through an “at the market” equity

offering program under which SVB acted as sales agent.

On May 24, 2023, the SVB Sales Agreement was terminated pursuant

to Section 11(b) thereof. The Company is not subject to any termination penalties related to the termination of the SVB Sales

Agreement. The Company has not sold any shares of Common Stock under the SVB Sales Agreement.

A copy of the SVB Sales Agreement was filed as Exhibit 1.1 to

the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 30, 2021 (the

“Prior Form 8-K”). The description of the SVB Sales Agreement contained in this Current Report on Form 8-K does

not purport to be complete and is qualified in its entirety by reference to the copy of the SVB Sales Agreement filed as Exhibit 1.1

to the Prior Form 8-K.

On May 24, 2023, the Company announced topline results for the ELX-02 Phase 2 trial for Alport Syndrome. The Company has dosed three patients

with ELX-02 in the ongoing proof-of-concept Phase 2 open-label clinical trial (NCT05448755). Two patients have now completed dosing and

the third patient is still receiving ELX-02. One patient that has completed dosing achieved a remission, defined as a urine protein creatinine

ratio (“UPCR”) decline greater than or equal to 50%. For this patient, five out of eight UPCR readings produced an average

of 53% below baseline. Spontaneous reductions in proteinuria are not expected in this population, providing added weight to this result.

The patient achieving remission also demonstrated a significant reduction (-49%) (-p-value p=0.009) in UPCR from baseline versus values

collected over the treatment period. The UPCR value for week 6 was excluded from this analysis as it was deemed to be unreliable due to

delayed processing over a holiday period, potentially resulting in protein degradation and inaccurate proteinuria readings. No significant

change in UPCR was seen in the other patient that has completed 8 weeks of dosing.

Both patients had the same Col4A4 mutation, but were being treated with substantially different levels of renin-angiotensin-aldosterone

system inhibitors. Assessment of COL IV protein restoration remains ongoing as both patients had Col4A4 mutations and the kidney biopsy

assay was designed to assess COL IVA5 protein expression. Consistent with previous clinical studies, ELX-02 has been generally well tolerated

with no discontinuations to date. Kidney biopsies from both patients after 8 weeks of dosing demonstrated no evidence of nephrotoxicity,

further demonstrating tolerability.

| Item 9.01 |

Financial Statements and

Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 24, 2023 |

ELOXX PHARMACEUTICALS, INC. |

| |

|

| |

/s/ Sumit Aggarwal |

| |

Sumit Aggarwal |

| |

President and Chief Executive Officer |

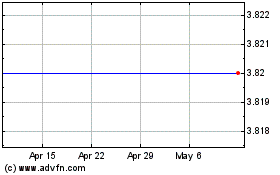

Eloxx Pharmaceuticals (NASDAQ:ELOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

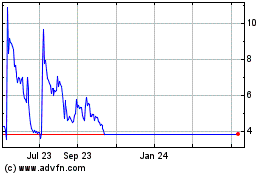

Eloxx Pharmaceuticals (NASDAQ:ELOX)

Historical Stock Chart

From Jul 2023 to Jul 2024