0001710340

false

0001710340

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 10, 2023

Eton

Pharmaceuticals, Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-38738 |

|

37-1858472 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

21925

W. Field Parkway, Suite 235

Deer

Park, Illinois |

|

60010-7278 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (847) 787-7361

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

ETON |

|

NASDAQ

Global Market |

Item

2.02. Results of Operations and Financial Condition

On

August 10, 2023, Eton Pharmaceuticals, Inc. issued a press release announcing its financial results for the second quarter ended

June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The

information in this Item 2.02 and the attached Exhibit 99.1 are being furnished and shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The

information in this Item 2.02 and the attached exhibit shall not be incorporated by reference into any registration statement or other

document pursuant to the Securities Act of 1933, as amended.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

Eton

Pharmaceuticals, Inc. |

| |

|

| Date:

August 10, 2023 |

/s/

James Gruber |

| |

James

Gruber |

| |

Chief

Financial Officer and Secretary |

Exhibit

99.1

Eton

Pharmaceuticals Reports Second Quarter 2023 Financial Results

| ●

Total Q2 revenue of $12.0 million and net income of $4.6 million |

| ●

Product

sales and royalty revenue of $6.5 million up 175% from Q2 2022 and 22% from Q1 2023 |

| ●

$21.6

million of cash on hand |

| ●

Launched

Betaine Anhydrous |

| ●

Management

to hold conference call today at 4:30pm ET |

DEER

PARK, Ill., August 10, 2023 (GLOBE NEWSWIRE) — Eton Pharmaceuticals, Inc (“Eton” or “the Company”) (Nasdaq:

ETON), an innovative pharmaceutical company focused on developing and commercializing treatments for rare diseases, today reported financial

results for the quarter ended June 30, 2023.

“With

record product sales, the launch of Betaine Anhydrous, and positive cash flow and earnings, Eton’s second quarter

was exceptional. It was the company’s tenth straight quarter of sequential product revenue growth, driven by robust demand and

record results for ALKINDI SPRINKLE® and Carglumic Acid. Given our strong performance through the first half of the year, we have

increased our revenue expectation and now anticipate reaching approximately $30 million in total revenue this year,” said Sean

Brynjelsen, CEO of Eton Pharmaceuticals.

“With

attractive growth prospects for our existing commercial products, the targeted 2024 launch of ET-400, and the financial resources to

continue adding new products, Eton is very well positioned to deliver long-term growth and achieve our goal of having 10 commercial rare

disease products on the market by the end of 2025,” concluded Brynjelsen.

Second

Quarter and Recent Business Highlights

Tenth

straight quarter of sequential growth in product sales and royalty revenue. Eton reported second quarter 2023 product sales and royalty

revenue of $6.5 million, representing 175% growth over the prior year period and 22% growth over the first quarter of 2023.

Record

sales of ALKINDI SPRINKLE. ALKINDI SPRINKLE saw another record revenue quarter. The Company’s goal is to reach 400 active patients

by the end of the year.

Record

sales of Carglumic Acid. Carglumic Acid also posted another quarter of record revenue. The product is benefiting from the Company’s

recently expanded sales force as well as the launch of Betaine Anhydrous, which shares the same prescriber base and has resulted in increased

interactions with metabolic geneticists.

Strong

launch of Betaine Anhydrous. Betaine Anhydrous was launched in May and has already seen strong adoption by patients. The Company’s

Eton Cares patient support program has received favorable reviews from both patients and prescribers.

Product

candidate ET-400 on track for an NDA submission in Q4 2023. The Company is preparing for an NDA submission in the fourth quarter,

which could result in an approval and commercial launch in 2024. ET-400 is a proprietary liquid formulation of hydrocortisone that, if

approved, would be sold alongside ALKINDI SPRINKLE, and would provide patients with an additional treatment option. The Company believes

ET-400 will accelerate patient adoption, with total combined peak sales of ALKINDI SPRINKLE and ET-400 expected to exceed $50 million

annually.

Monetized

royalty interests and strengthened financial position. During the quarter, Eton sold its remaining milestone and royalty interests

in ZONISADE®, EPRONTIA®, and the lamotrigine product candidate. In exchange for its interests, Eton received a payment of $5.5

million, which it intends to reinvest in the acquisition of rare disease products. In the second quarter, the company also received a

$0.8 million break-up fee associated with its participation as the stalking horse bidder in an auction process. The Company finished

the quarter with $21.6 million of cash and cash equivalents.

Second

Quarter Financial Results

Net

Revenue: Net sales for the second quarter of 2023 were $12.0 million compared with $7.4 million in the prior year period. Net sales

included $5.5 million of licensing payments received during the quarter related to the sale of Eton’s neurology product royalties

and milestones to Azurity Pharmaceuticals, compared to $5.0 million of licensing revenue in the prior year period related to the sale

of multiple hospital products to Dr. Reddy’s.

Product

sales and royalty revenue were $6.5 million for the second quarter of 2023 compared with $2.4 million in the prior year period,

an increase of 175% over the prior year period and 22% over the first quarter of 2023. The year-over-year increase in product sales

and royalty revenue was primarily driven by growth in ALKINDI SPRINKLE and Carglumic Acid tablets.

Gross

Profit: Gross profit for the second quarter of 2023 was $9.7 million compared with $4.6 million in the prior year period. The growth

was driven by the sale of the Company’s neurology product royalties as well as growth in ALKINDI SPRINKLE and Carglumic Acid. Gross

profit for the prior year period included $1.8 million of non-cash expenses related to the hospital products divestment.

Research

and Development (R&D) Expenses: R&D expenses for the second quarter of 2023 were $1.1 million compared to $0.7 million in

the prior year period. The increase was primarily due to a $0.5 million milestone payment resulting from the successful manufacturing

of registration batches of product candidate ET-600.

General

and Administrative (G&A) Expenses: G&A expenses for the second quarter of 2023 were $4.7 million compared to $5.3 million

in the prior year period. The decrease in G&A expenses was mainly due to decreased FDA fees and legal fees associated with products

sold to Dr. Reddy’s in June 2022.

Net

Income: Net income for the second quarter of 2023 was $4.6 million or $0.18 per basic and diluted share compared to a net loss of

$1.6 million, or $0.06 per basic and diluted share in the prior year period.

Cash

Position: As of June 30, 2023, the Company had cash and cash equivalents of $21.6 million.

Conference

Call and Webcast Information

As

previously announced, Eton will host its second quarter 2023 conference call as follows:

| Date: |

|

Thursday,

August 10, 2023 |

| |

|

|

| Time: |

|

4:30

p.m. ET (3:30 p.m.CT) |

| |

|

|

| Register*

(Audio Only) |

|

Click

here |

In

addition to taking live questions from participants on the conference call, management will be answering emailed questions from investors.

Investors can email questions to: investorrelations@etonpharma.com.

The

live webcast can be accessed on the Investors section of Eton’s website at https://ir.etonpharma.com/. An archived webcast

will be available on Eton’s website approximately two hours after the completion of the event and for 30 days thereafter.

*

Conference call participants should register to obtain their dial-in and passcode details. Please be sure to register using a valid email

address.

Forward-Looking

Statements

Statements

contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995, including statements associated with the expected ability of Eton to

undertake certain activities and accomplish certain goals and objectives. These statements include but are not limited to statements

regarding Eton’s business strategy, Eton’s plans to develop and commercialize its product candidates, the safety and efficacy

of Eton’s product candidates, Eton’s plans and expected timing with respect to regulatory filings and approvals, and the

size and growth potential of the markets for Eton’s product candidates. Because such statements are subject to risks and uncertainties,

actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “believes,”

“anticipates,” “plans,” “expects,” “intends,” “will,” “goal,” “potential”

and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Eton’s

current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of

events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties,

which include, without limitation, risks associated with the process of discovering, developing and commercializing drugs that are safe

and effective for use as human therapeutics, and in the endeavor of building a business around such drugs. These and other risks concerning

Eton’s development programs and financial position are described in additional detail in Eton’s filings with the Securities

and Exchange Commission. All forward-looking statements contained in this press release speak only as of the date on which they were

made. Eton undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date

on which they were made.

About

Eton Pharmaceuticals

Eton

is an innovative pharmaceutical company focused on developing, acquiring, and commercializing innovative products to address unmet needs

in patients suffering from rare diseases. The Company currently has three commercial rare disease products, ALKINDI SPRINKLE® for

the treatment of pediatric adrenocortical insufficiency, Carglumic Acid for the treatment of hyperammonemia due to N-acetylglutamate

synthase (NAGS) deficiency, and Betaine Anhydrous for the treatment of homocystinuria. The Company has four additional product

candidates in late-stage development: dehydrated alcohol injection, which has received Orphan Drug Designation for the treatment

of methanol poisoning, ZENEO® hydrocortisone autoinjector for the treatment of adrenal crisis, ET-400 for the treatment of adrenocortical

insufficiency, and ET-600 for the treatment of diabetes insipidus. For more information, please visit our website at www.etonpharma.com.

Investor

Relations:

Lisa M. Wilson, In-Site Communications, Inc.

T: 212-452-2793

E:

lwilson@insitecony.com

Eton

Pharmaceuticals, Inc.

Condensed

Statements of Operations

(In

thousands, except per share amounts)

(Unaudited)

| | |

For the three months ended | | |

For the six months ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | |

| | |

| | |

| |

| Licensing revenue | |

$ | 5,500 | | |

$ | 5,000 | | |

$ | 5,500 | | |

$ | 5,000 | |

| Product sales and royalties | |

| 6,497 | | |

| 2,358 | | |

| 11,801 | | |

| 4,534 | |

| Total net revenues | |

| 11,997 | | |

| 7,358 | | |

| 17,301 | | |

| 9,534 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales: | |

| | | |

| | | |

| | | |

| | |

| Licensing revenue | |

| — | | |

| 990 | | |

| — | | |

| 990 | |

| Product sales and royalties | |

| 2,315 | | |

| 1,755 | | |

| 4,273 | | |

| 2,604 | |

| Total cost of sales | |

| 2,315 | | |

| 2,745 | | |

| 4,273 | | |

| 3,594 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 9,682 | | |

| 4,613 | | |

| 13,028 | | |

| 5,940 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 1,125 | | |

| 690 | | |

| 1,660 | | |

| 2,308 | |

| General and administrative | |

| 4,674 | | |

| 5,263 | | |

| 10,019 | | |

| 10,059 | |

| Total operating expenses | |

| 5,799 | | |

| 5,953 | | |

| 11,679 | | |

| 12,367 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 3,883 | | |

| (1,340 | ) | |

| 1,349 | | |

| (6,427 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 800 | | |

| — | | |

| 800 | | |

| — | |

| Interest and other expense, net | |

| (124 | ) | |

| (218 | ) | |

| (250 | ) | |

| (461 | ) |

| Total other income (expense) | |

| 676 | | |

| (218 | ) | |

| 550 | | |

| (461 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income tax expense | |

| 4,559 | | |

| (1,558 | ) | |

| 1,899 | | |

| (6,888 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 4,559 | | |

$ | (1,558 | ) | |

$ | 1,899 | | |

$ | (6,888 | ) |

| Net income (loss) per share, basic | |

$ | 0.18 | | |

$ | (0.06 | ) | |

$ | 0.07 | | |

$ | (0.28 | ) |

| Weighted average number of common shares outstanding, basic | |

| 25,593 | | |

| 25,126 | | |

| 25,560 | | |

| 24,915 | |

| Net income (loss) per share, diluted | |

$ | 0.18 | | |

$ | (0.06 | ) | |

$ | 0.07 | | |

$ | (0.28 | ) |

| Weighted average number of common shares outstanding, diluted | |

| 25,983 | | |

| 25,126 | | |

| 25,949 | | |

| 24,915 | |

Eton

Pharmaceuticals, Inc.

Condensed

Balance Sheets

(in

thousands, except share and per share amounts)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 21,566 | | |

$ | 16,305 | |

| Accounts receivable, net | |

| 3,084 | | |

| 1,852 | |

| Inventories | |

| 816 | | |

| 557 | |

| Prepaid expenses and other current assets | |

| 867 | | |

| 1,290 | |

| Total current assets | |

| 26,333 | | |

| 20,004 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 46 | | |

| 72 | |

| Intangible assets, net | |

| 4,392 | | |

| 4,754 | |

| Operating lease right-of-use assets, net | |

| 149 | | |

| 188 | |

| Other long-term assets, net | |

| 12 | | |

| 12 | |

| Total assets | |

$ | 30,932 | | |

$ | 25,030 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,300 | | |

$ | 1,766 | |

| Current portion of long-term debt | |

| 1,540 | | |

| 1,033 | |

| Accrued liabilities | |

| 5,748 | | |

| 3,662 | |

| Total current liabilities | |

| 9,588 | | |

| 6,461 | |

| | |

| | | |

| | |

| Long-term debt, net of discount and including accrued fees | |

| 4,553 | | |

| 5,384 | |

| Operating lease liabilities, net of current portion | |

| 66 | | |

| 107 | |

| | |

| | | |

| | |

| Total liabilities | |

| 14,207 | | |

| 11,952 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 11) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock, $0.001 par value; 50,000,000 shares authorized; 25,561,994 and 25,353,119 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | |

| 26 | | |

| 25 | |

| Additional paid-in capital | |

| 117,934 | | |

| 116,187 | |

| Accumulated deficit | |

| (101,235 | ) | |

| (103,134 | ) |

| Total stockholders’ equity | |

| 16,725 | | |

| 13,078 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 30,932 | | |

$ | 25,030 | |

Eton

Pharmaceuticals, Inc.

Condensed

Statements of Cash Flows

(In

thousands)

(Unaudited)

| | |

Six months ended | | |

Six months ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | 1,899 | | |

$ | (6,888 | ) |

| | |

| | | |

| | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 1,657 | | |

| 2,383 | |

| Depreciation and amortization | |

| 424 | | |

| 1,352 | |

| Debt discount amortization | |

| 61 | | |

| 66 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (1,232 | ) | |

| 4,637 | |

| Inventories | |

| (259 | ) | |

| 19 | |

| Prepaid expenses and other assets | |

| 423 | | |

| 1,827 | |

| Accounts payable | |

| 537 | | |

| (475 | ) |

| Accrued liabilities | |

| 2,045 | | |

| 763 | |

| Net cash provided by operating activities | |

| 5,555 | | |

| 3,684 | |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchases of product license rights | |

| — | | |

| (750 | ) |

| Purchases of property and equipment | |

| — | | |

| (26 | ) |

| Net cash used in investing activities | |

| — | | |

| (776 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Repayment of long-term debt | |

| (385 | ) | |

| (385 | ) |

| Proceeds from employee stock purchase plan and stock option exercises | |

| 272 | | |

| 117 | |

| Payment of tax withholding related to net share settlement of stock option exercises | |

| (181 | ) | |

| — | |

| Net cash used in financing activities | |

| (294 | ) | |

| (268 | ) |

| | |

| | | |

| | |

| Change in cash and cash equivalents | |

| 5,261 | | |

| 2,640 | |

| Cash and cash equivalents at beginning of period | |

| 16,305 | | |

| 14,406 | |

| Cash and cash equivalents at end of period | |

$ | 21,566 | | |

$ | 17,046 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information | |

| | | |

| | |

| Cash paid for interest | |

$ | 426 | | |

$ | 378 | |

| Cash paid for income taxes | |

$ | — | | |

$ | — | |

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-38738

|

| Entity Registrant Name |

Eton

Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001710340

|

| Entity Tax Identification Number |

37-1858472

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

21925

W. Field Parkway

|

| Entity Address, Address Line Two |

Suite 235

|

| Entity Address, City or Town |

Deer

Park

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60010-7278

|

| City Area Code |

(847)

|

| Local Phone Number |

787-7361

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

ETON

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

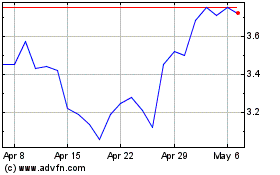

Eton Pharmaceuticals (NASDAQ:ETON)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eton Pharmaceuticals (NASDAQ:ETON)

Historical Stock Chart

From Jul 2023 to Jul 2024