SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

(Rule 13d-101)

(AMENDMENT NO. 2)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

Frontier Investment Corp

(Name of Issuer)

Class A Ordinary Shares, $0.0001 par value

(Title of Class of Securities)

G36816 109

(CUSIP Number)

Frontier Disruption Capital

PO Box 309, Ugland House

Grand Cayman, Cayman Islands

Tel: (302) 351-3367

With a copy to:

Giovanni Caruso, Esq.

Loeb & Loeb LLP

345 Park Avenue

New York, New York 10154

(212) 407-4000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June

29, 2023

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page. |

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| 1 |

NAME OF REPORTING PERSON

Frontier Disruption Capital |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS

WC |

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Island |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

4,999,999 (1) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

4,999,999 (1) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,999,999 (1) |

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

64.65%(2) |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| (1) | Consists of 4,999,999 Class A Ordinary Shares, excludes 1 Class B Ordinary Share which will convert

into one share of Class A Ordinary Shares on a one-for-one basis, subject to adjustment pursuant to certain anti-dilution rights and held

directly by Frontier Disruption Capital, a Cayman Islands exempted company which is 100% owned by FIM Partners, a DIFC, Dubai, U.A.E.

based company. Arif Mansuri is the sole Director of Frontier Disruption Capital and therefore has voting and investment power over the

shares of Class A Ordinary Shares held by Frontier Disruption Capital. Excludes 6,125,000 shares of Class A Ordinary Shares underlying

private placement warrants held directly by Frontier Disruption Capital that are not presently exercisable. |

| (2) | Based on 7,733,695 Class A ordinary shares outstanding as of November 21, 2023 as reported in the Issuer’s quarterly report

on Form 10-Q filed with the Securities and Exchange Commission on November 21, 2023. |

| 1 |

NAME OF REPORTING PERSON

FIM PARTNERS |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS

WC |

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

DIFC, Dubai, U.A.E. |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

4,999,999 (1)(2) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

4,999,999 (1)(2) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,999,999 (1)(2) |

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

64.65%(3) |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| (1) | Consists of 4,999,999 Class A Ordinary Shares, excludes 1 Class B Ordinary Share which will convert

into one share of Class A Ordinary Shares on a one-for-one basis, subject to adjustment pursuant to certain anti-dilution rights and held

directly by Frontier Disruption Capital, a Cayman Islands exempted company which is 100% owned by FIM Partners, a DIFC, Dubai, U.A.E.

based company. Arif Mansuri is the sole Director of Frontier Disruption Capital and therefore has voting and investment power over the

shares of Class A Ordinary Shares held by Frontier Disruption Capital. Excludes 6,125,000 shares of Class A Ordinary Shares underlying

private placement warrants held directly by Frontier Disruption Capital that are not presently exercisable. |

| (2) | Based on 7,733,695 Class A ordinary shares outstanding as of November 21, 2023 as reported in the Issuer’s quarterly report

on Form 10-Q filed with the Securities and Exchange Commission on November 21, 2023. |

| 1 |

NAME OF REPORTING PERSON

Arif Mansuri |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS

WC |

|

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

DIFC, Dubai, U.A.E. |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

4,999,999 (1)(2) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

4,999,999 (1)(2) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,999,999 (1)(2) |

|

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

64.65%(3) |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| (1) | Consists of 4,999,999 Class A Ordinary Shares, excludes 1 Class B Ordinary Share which will convert

into one share of Class A Ordinary Shares on a one-for-one basis, subject to adjustment pursuant to certain anti-dilution rights and held

directly by Frontier Disruption Capital, a Cayman Islands exempted company which is 100% owned by FIM Partners, a DIFC, Dubai, U.A.E.

based company. Arif Mansuri is the sole Director of Frontier Disruption Capital and therefore has voting and investment power over the

shares of Class A Ordinary Shares held by Frontier Disruption Capital. Excludes 6,125,000 shares of Class A Ordinary Shares underlying

private placement warrants held directly by Frontier Disruption Capital that are not presently exercisable. |

| (2) | Based on 7,733,695 Class A ordinary shares outstanding as of November 21, 2023 as reported in the Issuer’s quarterly report

on Form 10-Q filed with the Securities and Exchange Commission on November 21, 2023. |

EXPLANATORY NOTE

This Amendment No.2 to Schedule 13D (this “Amendment”)

amends the report on Schedule 13D filed on July 12, 2021 as amended on February 15, 2023 (the “Schedule 13D”) by: (i)

Frontier Disruption Capital, a Cayman Islands exempted company (the “Sponsor”), (ii) FIM Partners, a DIFC, Dubai,

UAE, company (“FIM Partners”), and (iii) Arif Mansuri (each, a “Reporting Person” and

collectively, the “Reporting Persons”) with respect to the Class A ordinary shares, par value $0.0001 per share (the

“Class A Ordinary Shares”), of Frontier Investment Corp. (the “Issuer”).

Capitalized terms used and not otherwise defined

in this Amendment have the meanings ascribed to them in the Schedule 13D. Except as expressly amended and supplemented by this Amendment,

the Schedule 13D is not amended or supplemented in any respect, and the disclosures set forth in the Schedule 13D, other than as amended

herein are incorporated by reference herein. The information set forth in response to each

separate Item below shall be deemed to be a response to all Items where such information is relevant.

Item 1. Security and Issuer.

The information set forth in the Explanatory Note is hereby incorporated

by reference into this Item 1, as applicable.

Item 2. Identity and Background.

The information set forth in the Explanatory Note is hereby incorporated

by reference into this Item 2, as applicable.

The

foregoing persons are sometimes referred to herein as a “Reporting Person” and collectively as the “Reporting

Persons.” The Reporting Persons are filing this Statement jointly. Neither the fact of this filing nor anything contained herein

shall be deemed to be an admission by any of the Reporting Persons that they constitute a “group.”

None of the Reporting Persons

or any of their partners, managers, officers or other controlling persons has, during the last five years, been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors).

None

of the Reporting Persons or any of their partners, managers, officers or other controlling persons has, during the last five years, been

a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or

is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds

or Other Consideration.

The information set forth in Item 4 hereof is hereby incorporated by

reference into this Item 3, as applicable.

Item 4. Purpose of Transaction.

Founder Shares

In connection with the organization of the Issuer,

on March 24, 2021, the Sponsor purchased 7,187,500 founder shares, which are Class B ordinary shares (the “Class B

Ordinary Shares” or “Founder Shares” and, together with the Class A Ordinary Shares, the “Ordinary

Shares”), for an aggregate purchase price of $25,000, or approximately $0.003 per share. On June 24, 2021, the sponsor

effected a surrender of 1,437,500 founder shares to the Issuer for no consideration, resulting in a decrease in the total number of Founder

Shares outstanding from 7,187,500 to 5,750,000. Subsequently on July 6, 2021, an additional 750,000 founder shares were forfeited as a

result of the underwriters failure to exercise the overallotment option, resulting in a decrease in the total number of Founder Shares

outstanding from 5,750,000 to 5,000,000.

On June 29, 2023 the Issuer held an extraordinary

general meeting (the “Special Meeting”), where the shareholders of the Issuer approved a special resolution to the

Amended and Restated Articles of Association and to amend the Investment Management Trust Agreement with its Trustee to extend the time

the Issuer has to consummate a business combination until July 06, 2024. In connection with the shareholders’ vote at the Special

Meeting of shareholders held by the Company on June 29, 2023, 17,266,304 Class A Shares were tendered for redemption, leaving 2,733,696

Class A Shares.

On June 29, 2023, the Company issued an aggregate

of 4,999,999 shares of its Class A Shares to Frontier Disruption Capital, the Company’s sponsor (the “Sponsor”)

and the holder of the Company’s Class B Shares, upon the conversion of an equal number of Class B Shares (the “Conversion”).

The 4,999,999 Class A Shares issued in connection with the Conversion are subject to the same restrictions as applied to the Class B Shares

before the Conversion, including, among other things, certain transfer restrictions, waiver of redemption rights and the obligation to

vote in favor of an initial business combination as described in the prospectus for our initial public offering. There is one Class B

Share remaining.

As described in the Issuer’s registration

statement on Form S-1 (File No. 333-257033, which was declared effective by the Securities and Exchange Commission on June 30,

2021 (the “Registration Statement”), under the heading “Description of Securities—Founder Shares,”

the remaining Class B Share will automatically be converted into a Class A Ordinary Share at the time of the Issuer’s initial

business combination, on a one-for-one basis, subject to certain adjustments described therein and have no expiration date.

Item 5. Interest in Securities

of the Issuer.

(a) and (b) The information on the cover

pages of this Amendment is incorporated herein by reference.

(c) Except for the transactions described in Item 4 of this Amendment,

the Reporting Persons have not engaged in any transactions involving the Ordinary Shares of the Issuer since the date the Schedule 13D

was filed.

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements,

Understandings or Relationships With Respect to Securities of the Issuer.

To the extent required by Item 6, the information contained in Items

3, 4 and 5 of the Amendment above are incorporated herein by reference.

Item 7. Material to be Filed as Exhibits.

SIGNATURE

After reasonable inquiry and to the best of our

knowledge and belief, the undersigned certify that the information set forth in this Statement is true, complete and correct.

In accordance with Rule 13d-1(k)(1)(iii) under

the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of this Statement

on Schedule 13D with respect to the Common Stock of the Company.

Dated: January 19, 2024

FRONTIER DISRUPTION CAPITAL

| /s/ Arif Mansuri |

|

|

Arif Mansuri

Director |

|

| |

|

| FIM PARTNERS |

|

| |

|

| /s/ Arif Mansuri |

|

| Arif Mansuri |

|

Chief Operating Officer

ARIF MANSURI

| /s/ Arif Mansuri |

|

| Arif Mansuri |

|

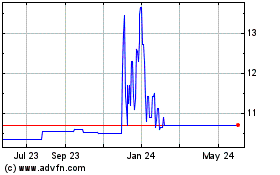

Frontier Investment (NASDAQ:FICVU)

Historical Stock Chart

From Oct 2024 to Oct 2024

Frontier Investment (NASDAQ:FICVU)

Historical Stock Chart

From Oct 2023 to Oct 2024