Gevo Restarts Production of Isobutanol in

March 2016 Following Completion of Capital Projects

Gevo, Inc. (NASDAQ:GEVO) today announced financial results for the

three months ended December 31, 2015. Key highlights for Gevo

included:

- Gevo restarted the production of isobutanol at its production

facility in Luverne, Minnesota following the completion of capital

projects designed to decrease the cost of production for isobutanol

by bringing “in-house” parts of the process that have previously

been done by third parties. Gevo continues to target isobutanol

production levels at Luverne in the range of 750,000 to 1 million

gallons in 2016, and a decrease in the variable cost of isobutanol

production at Luverne to a range of $3.00-$3.50/gallon**, enabling

isobutanol to be produced at a positive contribution margin, based

on an expected average selling price for isobutanol of between

$3.50-$4.50/gallon.

- On March 28, 2016, Gevo announced that ASTM International

Committee D02 on Petroleum Products, Liquid Fuels, and Lubricants

and Subcommittee D02.J on Aviation Fuel passed a concurrent ballot

this week approving the revision of ASTM D7566 (Standard

Specification for Aviation Turbine Fuel Containing Synthesized

Hydrocarbons) to include alcohol to jet synthetic paraffinic

kerosene (ATJ-SPK) derived from renewable isobutanol (the “D02.J

Ballot”). The D02.J Ballot passed two levels of ASTM

technical scrutiny: subcommittee and main committee ballot and is

in the final stages of Society Review. The ASTM process is

substantially complete as it relates to the approval of the D02.J

Ballot. In order to fully complete the process, the ASTM

still needs to close the Society Review, perform a final ballot

tally, and publish the revision of ASTM D7566 (Standard

Specification for Aviation Turbine Fuel Containing Synthesized

Hydrocarbons) on its website. It is expected that these final

actions will be completed by the ASTM in early April.

- Gevo entered into a license agreement and joint development

agreement with Porta Hnos. S.A. (Porta) to construct multiple

isobutanol plants in Argentina using corn as a feedstock, the first

of which is expected to be wholly owned by Porta and is anticipated

to begin producing isobutanol in 2017. The first plant is

expected to have a production capacity of up to five million

gallons of isobutanol per year. Once the plant is operational, Gevo

expects to generate revenues from this licensing arrangement,

through royalties, sales and marketing fees, and other revenue

streams such as yeast sales. The production capacity of any

additional plants is still to be determined.

“We are very pleased to have restarted the production of

isobutanol at Luverne. The capital improvement projects came in on

time and on budget. While we expect that there will be a learning

curve associated with operating the new equipment, the production

and cost targets that we set out in September 2015 remain the same.

As we ramp up the isobutanol production levels at Luverne, we

expect to be able to announce new customer relationships across all

our core markets, namely the alcohol-to-jet fuel (ATJ), marina,

off-road, isooctane and solvents markets,” said Dr. Patrick Gruber,

Chief Executive Officer.

* - ‘non-GAAP cash EBITDA loss’ is calculated by adding back

depreciation and non-cash stock compensation to GAAP Loss From

Operations** - Assumes corn price of $3.65 per bushel and nets the

value of the isobutanol distiller’s grains (the “iDGs™”)

Financial Highlights

Revenues for the fourth quarter of 2015 were $7.3 million

compared with $9.5 million in the same period in 2014. During the

fourth quarter of 2015, revenues derived at the Luverne plant were

$6.5 million, a decrease of $2.3 million from the same period in

2014. This decrease was primarily a result of lower ethanol

production, as well as lower ethanol prices.

During the fourth quarter of 2015, hydrocarbon revenues were

$0.2 million, a decrease of $0.3 million from the same period in

2014. This decrease was primarily a result of timing of shipments

of finished products from Gevo’s hydrocarbons demonstration plant

located in Silsbee, Texas.

Gevo also generated grant revenue of $0.5 million during the

fourth quarter of 2015, an increase of $0.4 million from the same

period in 2014. Gevo’s grant revenue is primarily generated through

the work it is doing with the Northwest Advanced Renewables

Alliance to produce isobutanol from cellulosic feedstocks, such as

wood waste, which can then be converted into Gevo’s ATJ.

Cost of goods sold decreased by $1.9 million during the three

months ended December 31, 2015, compared with the same quarter in

2014, due primarily to a decrease in ethanol production, as well as

a cessation of isobutanol production while Gevo was installing new

capital equipment at Luverne, which is designed to decrease the

cost of production of isobutanol. The primary expense

decreases related to raw materials of $0.6 million, other variable

costs of production of $0.8 million and repairs and maintenance of

$0.3 million.

Gross loss was $1.7 million for the three months ended December

31, 2015.

Research and development expense decreased by $1.1 million

during the three months ended December 31, 2015, compared with the

same quarter in 2014, due primarily to a $0.3 million decrease in

employee-related and lab consumable expenses and a $0.7 million

decrease in costs related to the South Hampton facility.

Selling, general and administrative expense decreased by $1.5

million during the three months ended December 31, 2015, compared

with the same quarter in 2014, due primarily to decreases in legal

costs of $2.0 million and consulting and professional fees of $0.6

million, offset by an increase in employee-related expenses of $1.0

million.

Loss from operations in the fourth quarter of 2015 was $6.6

million, compared with $8.9 million in the same quarter in

2014.

Cash EBITDA loss in the fourth quarter of 2015 was $4.2 million,

compared with $6.7 million in the same quarter in 2014.

Interest expense in the fourth quarter of 2015 was $2.1 million,

which was flat in comparison to the same quarter last year.

During the three months ended December 31, 2015, the estimated

fair value of the derivative warrant liability decreased by $2.9

million primarily associated with the decrease in the price of

Gevo’s common stock in the quarter.

Gevo also incurred a non-cash gain of $0.3 million during the

quarter due to the quarterly mark-to-market valuation of the 2017

Notes.

During the three months ended December 31, 2015, there was no

change in the value to the embedded derivatives in the convertible

notes issued in 2012 (2022 Notes), as the derivatives have had no

meaningful value since the third quarter of 2014.

One holder exchanged $2.5 million aggregate principal amount of

outstanding 2022 Notes for 1,107,833 shares of Gevo’s common stock

during the three months ended December 31, 2015. The holder agreed

to waive any accrued but unpaid interest on the exchanged notes. No

holders of the 2022 Notes converted any notes during the

quarter.

The net loss for the fourth quarter of 2015 was $8.0 million,

compared with $11.1 million during the same period in 2014.

Webcast and Conference Call Information

Hosting today’s conference call at 5:30 p.m. EDT (3:30 p.m. MDT)

will be Dr. Patrick Gruber, Chief Executive Officer, Mike Willis,

Chief Financial Officer, and Geoff Williams, General Counsel. They

will review Gevo’s financial results and provide an update on

recent corporate highlights.

To participate in the conference call, please dial 1 (888)

771-4371 (inside the U.S.) or 1 (847) 585-4405 (outside the U.S.)

and reference the access code 42188401.

A replay of the call and webcast will be available two hours

after the conference call ends on March 29, 2016. To access the

replay, please dial 1 (888) 843-7419 (inside the US) or 1 (630)

652-3042 (outside the US) and reference the access code 42188401.

The archived webcast will be available in the Investor Relations

section of Gevo's website at www.gevo.com.

About Gevo

Gevo is a leading renewable technology, chemical products, and

next generation biofuels company. Gevo has developed proprietary

technology that uses a combination of synthetic biology, metabolic

engineering, chemistry and chemical engineering to focus primarily

on the production of isobutanol, as well as related products from

renewable feedstocks. Gevo’s strategy is to commercialize biobased

alternatives to petroleum-based products to allow for the

optimization of fermentation facilities’ assets, with the ultimate

goal of maximizing cash flows from the operation of those assets.

Gevo produces isobutanol, ethanol and high-value animal feed at its

fermentation plant in Luverne, Minnesota Gevo has also developed

technology to produce hydrocarbon products from renewable alcohols.

Gevo currently operates a biorefinery in Silsbee, Texas, in

collaboration with South Hampton Resources Inc., to produce

renewable jet fuel, octane, and ingredients for plastics like

polyester. Gevo has a marquee list of partners including The

Coca-Cola Company, Toray Industries Inc. and Total SA, among

others. Gevo is committed to a sustainable bio-based economy that

meets society’s needs for plentiful food and clean air and

water.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to a variety of matters, including, without

limitation, statements related to the ability of Gevo to reduce

isobutanol production costs and produce isobutanol at a positive

contribution margin following completion of the capital improvement

projects at Luverne, timing of isobutanol production at Porta’s

first isobutanol plant in Argentina and Gevo’s ability to generate

revenue from its licensing arrangement with Porta, Gevo’s ability

to secure new customer relationships across core markets, the

receipt and timing of ASTM certification and other statements that

are not purely statements of historical fact. These

forward-looking statements are made on the basis of the current

beliefs, expectations and assumptions of the management of Gevo and

are subject to significant risks and uncertainty. Investors are

cautioned not to place undue reliance on any such forward-looking

statements. All such forward-looking statements speak only as of

the date they are made, and Gevo undertakes no obligation to update

or revise these statements, whether as a result of new information,

future events or otherwise. Although Gevo believes that the

expectations reflected in these forward-looking statements are

reasonable, these statements involve many risks and uncertainties

that may cause actual results to differ materially from what may be

expressed or implied in these forward-looking statements. For a

further discussion of risks and uncertainties that could cause

actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to the

business of Gevo in general, see the risk disclosures in the Annual

Report on Form 10-K of Gevo for the year ended December 31, 2014,

as amended, and in subsequent reports on Forms 10-Q and 8-K and

other filings made with the SEC by Gevo.

Non-GAAP Financial Information

Consolidated financial information has been presented in

accordance with GAAP as well as on a non-GAAP basis. On a non-GAAP

basis, financial measures exclude non-cash items such as

depreciation and stock-based compensation. Management believes that

it is useful to supplement its GAAP financial statements with this

non-GAAP information because management uses such information

internally for its operating, budgeting and financial planning

purposes. These non-GAAP financial measures also facilitate

management's internal comparisons to Gevo’s historical performance

as well as comparisons to the operating results of other companies.

In addition, Gevo believes these non-GAAP financial measures are

useful to investors because they allow for greater transparency

into the indicators used by management as a basis for its financial

and operational decision making. Non-GAAP information is not

prepared under a comprehensive set of accounting rules and

therefore, should only be read in conjunction with financial

information reported under U.S. GAAP when understanding Gevo’s

operating performance. A reconciliation between GAAP and non-GAAP

financial information is provided in the financial statement tables

below.

Reverse Stock Split

On April 15, 2015, our Board of Directors approved a reverse

split of our common stock, par value $0.01, at a ratio of

one-for-fifteen. This reverse stock split became

effective on April 20, 2015 and, unless otherwise indicated, all

share amounts, per share data, share prices, exercise prices and

conversion rates set forth in this press release and the

accompanying consolidated financial statements have, where

applicable, been adjusted to reflect this reverse stock split.

Gevo, Inc. Condensed Consolidated

Statements of Operations Information(Unaudited, in

thousands, except share and per share amounts)

| |

|

|

Three Months

Ended |

| |

Year Ended December 31, |

December 31, |

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Revenue and

cost of goods sold |

|

|

|

|

| Ethanol sales and related products,

net |

$ |

27,125 |

|

$ |

23,549 |

|

$ |

6,521 |

|

$ |

8,830 |

|

| Hydrocarbon revenue |

|

1,694 |

|

|

3,949 |

|

|

245 |

|

$ |

523 |

|

| Grant and other revenue |

|

1,318 |

|

|

768 |

|

|

531 |

|

|

148 |

|

| Total revenues |

|

30,137 |

|

|

28,266 |

|

|

7,297 |

|

|

9,501 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

38,762 |

|

|

35,582 |

|

|

9,001 |

|

|

10,873 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross loss |

|

(8,625 |

) |

|

(7,316 |

) |

|

(1,704 |

) |

|

(1,372 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

| Research and development

expense |

|

6,610 |

|

|

14,120 |

|

|

1,596 |

|

|

2,706 |

|

| Selling, general and administrative

expense |

|

16,692 |

|

|

18,341 |

|

|

3,286 |

|

|

4,833 |

|

| Total operating expenses |

|

23,302 |

|

|

32,461 |

|

|

4,882 |

|

|

7,539 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(31,927 |

) |

|

(39,777 |

) |

|

(6,586 |

) |

|

(8,911 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

| Interest expense |

|

(8,243 |

) |

|

(8,255 |

) |

|

(2,057 |

) |

|

(2,028 |

) |

| Interest expense - debt issuance

costs |

|

- |

|

|

(3,769 |

) |

|

- |

|

|

(3 |

) |

| Gain (loss) on extinguishment of

debt |

|

232 |

|

|

- |

|

|

(53 |

) |

|

- |

|

| Gain on extinguishment of warrant

liability |

|

1,775 |

|

|

- |

|

|

- |

|

|

| Gain from change in fair value of

embedded derivative of the 2022 Notes |

|

- |

|

|

3,470 |

|

|

- |

|

|

- |

|

| Gain (loss) from change in fair

value of derivative warrant liability |

|

577 |

|

|

6,530 |

|

|

2,938 |

|

|

(242 |

) |

| Gain from change in fair value of

2017 Notes |

|

3,895 |

|

|

648 |

|

|

313 |

|

|

104 |

|

| Loss on issuance of equity |

|

(2,523 |

) |

|

- |

|

|

(2,523 |

) |

|

| Other income |

|

20 |

|

|

8 |

|

|

6 |

|

|

1 |

|

| Total other expense |

|

(4,267 |

) |

|

(1,368 |

) |

|

(1,376 |

) |

|

(2,168 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(36,194 |

) |

$ |

(41,145 |

) |

$ |

(7,962 |

) |

$ |

(11,079 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share - basic

and diluted |

$ |

(2.58 |

) |

$ |

(7.67 |

) |

$ |

(0.44 |

) |

$ |

(1.68 |

) |

| Weighted-average number of

common shares |

|

|

|

|

|

|

|

|

|

|

|

|

| outstanding - basic and

diluted |

|

14,025,048 |

|

|

5,366,162 |

|

|

17,954,451 |

|

|

6,577,828 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gevo, Inc. Condensed Consolidated

Balance Sheet Information (Unaudited, in

thousands)

| |

December 31, |

| |

|

2015 |

|

|

2014 |

|

|

Assets |

|

|

| Current assets: |

|

|

| Cash and

cash equivalents |

$ |

17,031 |

|

$ |

6,359 |

|

| Accounts

receivable |

|

1,391 |

|

|

2,361 |

|

|

Inventories |

|

3,487 |

|

|

4,292 |

|

| Prepaid

expenses and other current assets |

|

731 |

|

|

732 |

|

| Total

current assets |

|

22,640 |

|

|

13,744 |

|

| |

|

|

| Property, plant and

equipment, net |

|

76,777 |

|

|

81,240 |

|

| Deposits and other

assets |

|

3,711 |

|

|

3,944 |

|

| Total

assets |

$ |

103,128 |

|

$ |

98,928 |

|

| |

|

|

|

Liabilities |

|

|

| Current

liabilities: |

|

|

| Accounts

payable, accrued liabilities and other current liabilities |

$ |

7,476 |

|

$ |

8,623 |

|

|

Derivative warrant liability |

|

10,493 |

|

|

3,114 |

|

| Current

portion of secured debt, net |

|

332 |

|

|

288 |

|

| Total

current liabilities |

|

18,301 |

|

|

12,025 |

|

| Long-term portion

secured debt, net |

|

153 |

|

|

485 |

|

| 2017 notes recorded at

fair value |

|

21,565 |

|

|

25,460 |

|

| 2022 notes, net |

|

14,636 |

|

|

13,679 |

|

| Other long-term

liabilities |

|

147 |

|

|

315 |

|

| Total

liabilities |

|

54,802 |

|

|

51,964 |

|

| |

|

|

|

|

|

|

| Total

stockholders’ equity |

|

48,326 |

|

|

46,964 |

|

| Total

liabilities and stockholders' equity |

$ |

103,128 |

|

$ |

98,928 |

|

| |

|

|

|

|

|

|

Gevo, Inc. Condensed Consolidated

Cash Flow Information (Unaudited, in

thousands)

| |

|

|

Three Months

Ended |

| |

Year Ended December 31, |

December 31, |

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Operating

Activities |

|

|

|

|

| Net loss |

$ |

(36,194 |

) |

$ |

(41,145 |

) |

$ |

(7,962 |

) |

$ |

(11,079 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

| (Gain)

loss from change in fair value of derivative warrant liability |

|

(577 |

) |

|

(6,530 |

) |

$ |

(2,938 |

) |

|

242 |

|

| Gain from

change in fair value of embedded derivative of the 2022 Notes |

|

- |

|

|

(3,470 |

) |

|

- |

|

|

- |

|

| Gain from

change in fair value of 2017 Notes |

|

(3,895 |

) |

|

(648 |

) |

|

(313 |

) |

|

(104 |

) |

|

Stock-based compensation |

|

2,647 |

|

|

2,860 |

|

|

694 |

|

|

498 |

|

|

Depreciation and amortization |

|

6,573 |

|

|

4,880 |

|

|

1,676 |

|

|

1,666 |

|

| Non-cash

interest expense |

|

3,772 |

|

|

7,860 |

|

|

1,032 |

|

|

1,486 |

|

| (Gain)

loss on extinguishment of debt |

|

(232 |

) |

|

- |

|

|

53 |

|

|

- |

|

| Gain on

extinguishment of warrant liability |

|

(1,775 |

) |

|

- |

|

|

- |

|

|

- |

|

| Loss from

change in fair value of derivatives |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Loss on

issuance of equity |

|

2,523 |

|

|

- |

|

|

2,523 |

|

|

- |

|

| Other

non-cash expenses |

|

(7 |

) |

|

66 |

|

|

(7 |

) |

|

66 |

|

| Changes in operating

assets and liabilities: |

|

|

|

- |

|

|

- |

|

| Accounts

receivable |

|

970 |

|

|

-1003 |

|

|

(257 |

) |

|

(318 |

) |

|

Inventories |

|

805 |

|

|

(711 |

) |

|

(784 |

) |

|

(265 |

) |

| Prepaid

expenses and other current assets |

|

1 |

|

|

431 |

|

|

(113 |

) |

|

129 |

|

| Accounts

payable, accrued expenses, and long-term liabilities |

|

(2,771 |

) |

|

(1,580 |

) |

|

(752 |

) |

|

1,295 |

|

| Net cash

used in operating activities |

$ |

(28,160 |

) |

$ |

(38,990 |

) |

|

(7,148 |

) |

|

(6,384 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

(1,464 |

) |

|

(4,894 |

) |

|

(1,193 |

) |

|

(341 |

) |

|

Restricted certificate of deposit |

|

- |

|

|

(2,611 |

) |

|

- |

|

|

- |

|

| Proceeds

from sales tax refund for property, plant and equipment |

|

144 |

|

|

- |

|

|

- |

|

|

- |

|

| Net cash

used in investing activities |

|

(1,320 |

) |

|

(7,505 |

) |

|

(1,193 |

) |

|

(341 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

| Payments

on secured debt |

|

(318 |

) |

|

(9,824 |

) |

|

(82 |

) |

|

(104 |

) |

| Debt and

equity offering costs |

|

(3,519 |

) |

|

(5,873 |

) |

|

(734 |

) |

|

(822 |

) |

| Proceeds

from issuance of common stock upon exercise of stock options and

employee stock purchase plan |

|

3 |

|

|

19 |

|

|

- |

|

|

- |

|

| Proceeds

from issuance of common stock and common stock warrants |

|

33,820 |

|

|

18,000 |

|

|

9,970 |

|

|

- |

|

| Proceeds

from the exercise of warrants |

|

10,166 |

|

|

- |

|

|

15 |

|

|

- |

|

| Proceeds

from issuance of convertible debt, net |

|

- |

|

|

25,907 |

|

|

- |

|

|

- |

|

| Net cash

provided by financing activities |

|

40,152 |

|

|

28,229 |

|

|

9,169 |

|

|

(926 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease)

in cash and cash equivalents |

|

10,672 |

|

|

(18,266 |

) |

|

828 |

|

|

(7,651 |

) |

| |

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

| Beginning

of period |

|

6,359 |

|

|

24,625 |

|

|

16,203 |

|

|

14,010 |

|

| Ending of

period |

|

17,031 |

|

|

6,359 |

|

|

17,031 |

|

|

6,359 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Gevo, Inc. Non-GAAP Financial

Information(Unaudited, in thousands)

| |

Year

Ended |

Three Months

Ended |

| |

December 31, |

December 31, |

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Gevo Development, LLC /

Agri-Energy, LLC |

|

|

|

|

| Loss from

operations |

$ |

(12,204 |

) |

$ |

(13,210 |

) |

$ |

(2,636 |

) |

$ |

(2,310 |

) |

|

Depreciation and amortization |

|

5,717 |

|

|

3,943 |

|

|

1,429 |

|

|

1,445 |

|

| Non-cash

stock-based compensation |

|

43 |

|

|

79 |

|

|

14 |

|

|

5 |

|

| Non-GAAP cash EBITDA

loss |

$ |

(6,444 |

) |

$ |

(9,188 |

) |

$ |

(1,193 |

) |

$ |

(860 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo, Inc. |

|

|

|

|

| Loss from

operations |

$ |

(19,723 |

) |

$ |

(26,567 |

) |

$ |

(3,950 |

) |

$ |

(6,601 |

) |

|

Depreciation and amortization |

|

856 |

|

|

937 |

|

|

247 |

|

|

221 |

|

| Non-cash

stock-based compensation |

|

2,604 |

|

|

2,781 |

|

|

680 |

|

|

493 |

|

| Non-GAAP cash EBITDA

loss |

$ |

(16,263 |

) |

$ |

(22,849 |

) |

$ |

(3,023 |

) |

$ |

(5,887 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

| Loss from

operations |

$ |

(31,927 |

) |

$ |

(39,777 |

) |

$ |

(6,586 |

) |

$ |

(8,911 |

) |

|

Depreciation and amortization |

|

6,573 |

|

|

4,880 |

|

|

1,676 |

|

|

1,666 |

|

| Non-cash

stock-based compensation |

|

2,647 |

|

|

2,860 |

|

|

694 |

|

|

498 |

|

| Non-GAAP cash EBITDA

loss |

$ |

(22,707 |

) |

$ |

(32,037 |

) |

$ |

(4,216 |

) |

$ |

(6,747 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Media Contact

David Rodewald

The David James Agency, LLC

+1 805-494-9508

gevo@davidjamesagency.com

Investor Contact

Shawn M. Severson

The Blueshirt Group

+1 415-489-2918

shawn@blueshirtgroup.com

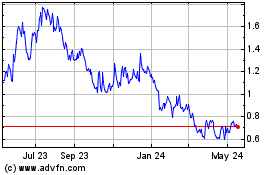

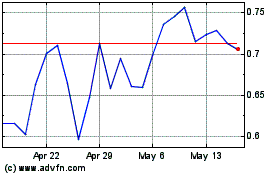

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jul 2023 to Jul 2024