FALSE000163565000016356502024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2024

_______________________________

GREEN PLAINS PARTNERS LP

(Exact name of registrant as specified in its charter)

_______________________________

| | | | | | | | |

| Delaware | 001-37469 | 47-3822258 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1811 Aksarben Drive

Omaha, Nebraska 68106

(Address of Principal Executive Offices) (Zip Code)

(402) 884-8700

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Units, Representing Limited Partner Interests | | GPP | | The Nasdaq Stock Market LLC |

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets.

As previously announced, on September 16, 2023, Green Plains Partners LP, a Delaware limited partnership (the “Partnership”), Green Plains Holdings LLC, a Delaware limited liability company and the general partner of the Partnership (the “General Partner”), Green Plains Inc., an Iowa corporation (“GPRE”), GPLP Holdings Inc., a Delaware corporation and a wholly owned subsidiary of GPRE (“Holdings”) and GPLP Merger Sub LLC, a Delaware limited liability company and a wholly owned subsidiary of Holdings (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which, upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub agreed to merge with and into the Partnership, with the Partnership surviving as an indirect, wholly owned subsidiary of GPRE (the “Merger”).

On January 9, 2024, the parties to the Merger Agreement completed the Merger. Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each outstanding common unit representing a limited partner interest in the Partnership (each, a “GPP Common Unit”) other than GPP Common Units owned by GPRE, the General Partner and their respective affiliates (each, a “GPP Public Common Unit” and the holders of such units, the “GPP Unaffiliated Unitholders”) was converted into the right to receive, subject to adjustment as described in the Merger Agreement, (i) 0.405 shares of common stock, par value $0.001 per share, of GPRE (the “GPRE Common Stock” and the shares of GPRE Common Stock issued in the Merger, the “Stock Consideration”) and (ii) an amount of cash equal to $2.50 (as calculated in accordance with the Merger Agreement, and together with the Stock Consideration, the “Merger Consideration”). In addition, at the Effective Time, each of the outstanding awards relating to a GPP Common Unit issued under a Partnership Long-Term Incentive Plan (as defined in the Merger Agreement) became fully vested and was automatically canceled and converted into the right to receive, with respect to each GPP Common Unit subject thereto, the Merger Consideration (plus any accrued but unpaid amounts in relation to distribution equivalent rights). Except for the incentive distribution rights representing limited partner interests in the Partnership, which were automatically canceled immediately prior to the Effective Time for no consideration in accordance with the First Amended and Restated Agreement of Limited Partnership of the Partnership, dated as of July 1, 2015 (as amended), the limited partner interests in the Partnership owned by GPRE, the General Partner and their respective affiliates prior to the Effective Time remained outstanding as limited partner interests in the surviving entity. The economic general partner interest in the Partnership remained outstanding as a general partner interest in the surviving entity immediately following the Effective Time, and the General Partner continued as the sole general partner of the surviving entity. The Merger became effective upon the filing of a properly executed certificate of merger with the Secretary of State of the State of Delaware on January 9, 2024.

Pursuant to the Merger Agreement, GPRE issued approximately 4.7 million shares of GPRE Common Stock and paid $29.2 million in cash to the GPP Unaffiliated Unitholders as the aggregate Merger Consideration described above.

The Merger Agreement is filed as Exhibit 2.1 to the Partnership’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on September 18, 2023, which agreement is incorporated herein by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Merger Agreement and is qualified in its entirety by the terms and conditions of the Merger Agreement. It is not intended to provide any other factual information about the Partnership, GPRE or their respective subsidiaries and affiliates.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

To the extent applicable, the information included under Item 2.01 above is incorporated into this Item 3.01 by reference.

In connection with the consummation of the Merger, The Nasdaq Stock Market LLC (“Nasdaq”) was notified that each outstanding GPP Public Common Unit issued and outstanding immediately prior to the Effective Time was converted into the right to receive the Merger Consideration, pursuant to and subject to the terms and conditions of the Merger Agreement. The Partnership requested that Nasdaq file a notification of removal from listing on Form 25 with the SEC with respect to the delisting of the GPP Public Common Units from Nasdaq and to deregister the GPP Public Common Units under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The GPP Public Common Units were suspended from trading on the Nasdaq after the closing of trading on January 9, 2024. The Partnership also intends to file a certification on Form 15 under the Exchange Act with the SEC requesting the deregistration of the GPP Public Common Units under Section 12(g) of the Exchange Act and suspending the Partnership’s reporting obligations under Section 13 and Section 15(d) of the Exchange Act.

Item 3.03. Material Modification to Rights of Security Holders.

The information set forth under Item 2.01 and Item 3.01 is incorporated into this Item 3.03 by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the consummation of the Merger, at the Effective Time, Brett C. Riley, Clayton E. Killinger and Jerry L. Peters resigned as members of the Board of Directors of the General Partner (the “GP Board of Directors”). The decision of each of Messrs. Riley, Killinger and Peters to resign as a member of the GP Board of Directors was not the result of any disagreement with the General Partner or the Partnership on any matter relating to the operations, policies or practices of the General Partner or the Partnership, and was solely as a result of the Merger.

In connection with the consummation of the Merger, as of the Effective Time, each of James Stark (Chief Financial Officer), James Herbert (Chief Human Resources Officer), Grant Kadavy (Executive Vice President-Commercial Operations), Chris Osowski (Executive Vice President-Operations and Technology) and Patrich Simpkins (Chief Transformation Officer) ceased to serve as officers of the General Partner. The decision of each departing officer to resign as an officer of the General Partner was not the result of any disagreement with the General Partner or the Partnership on any matter relating to the operations, policies or practices of the General Partner or the Partnership, and was solely as a result of the Merger.

In addition, as of the Effective Time, the number of members of the GP Board of Directors was decreased from six to three.

Item 7.01. Regulation FD Disclosure.

On January 9, 2024, GPRE and the Partnership issued a joint press release announcing the closing of the Merger. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

The information provided in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Partnership under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed as part of this report.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Green Plains Partners LP |

| | |

| By: Green Plains Holdings LLC, its general partner |

| | |

| Date: January 9, 2024 | By: | /s/ Michelle Mapes |

| | Michelle Mapes |

| | Chief Legal & Administration Officer and Corporate Secretary |

FOR IMMEDIATE RELEASE

Green Plains Inc. Completes Acquisition of Green Plains Partners LP

OMAHA, Neb., January 9, 2024, (BUSINESS WIRE) – Green Plains Inc. (NASDAQ: GPRE) (“Green Plains”) and Green Plains Partners LP (NASDAQ: GPP) (the “Partnership”) today announced the completion of the transactions contemplated by the previously announced Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Green Plains acquired all of the publicly held common units of the Partnership not already owned by Green Plains and its affiliates in exchange for a combination of 0.405 shares of Green Plains common stock and $2.00 in cash, plus an amount of cash equal to unpaid distributions from the end of the last quarter for which a quarterly distribution was made to the closing date, as determined in accordance with the Merger Agreement, without interest, for each outstanding common unit representing a limited partner interest in the Partnership (the “Merger”). As a result of the Merger, the Partnership became an indirect wholly owned subsidiary of Green Plains and the Partnership’s common units will no longer be listed on the NASDAQ, and will be deregistered under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

About Green Plains Inc.

Green Plains Inc. (NASDAQ: GPRE) is a leading biorefining company focused on the development and utilization of fermentation, agricultural and biological technologies in the processing of annually renewable crops into sustainable value-added ingredients. This includes the production of cleaner low carbon biofuels, renewable feedstocks for advanced biofuels and high purity alcohols for use in cleaners and disinfectants. Green Plains is an innovative producer of Ultra-High Protein and novel ingredients for animal and aquaculture diets to help satisfy a growing global appetite for sustainable protein. For more information, visit www.gpreinc.com.

Forward-Looking Statements

All statements in this press release (and oral statements made regarding the subjects of this communication), including those that express a belief, expectation or intention, may be considered forward-looking statements (as defined in Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended) that involve risks and uncertainties that could cause actual results to differ materially from projected results. Without limiting the generality of the foregoing, forward-looking statements contained in this communication include statements relying on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside the control of Green Plains and the Partnership, which could cause actual results to differ materially from such statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include, but are not limited to, statements regarding the expected benefits of the Merger to Green Plains and the Partnership and their shareholders and unitholders, respectively, including with respect to cash flow, expenses and credit quality; the deregistration of the Partnership’s common units and the timing thereof; and the expected future growth, dividends and distributions of the combined company; and plans and objectives of management for future operations. Forward-looking statements may be identified by words such as “believe,” “intend,” “expect,” “may,” “should,” “will,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project” and variations of these words or similar expressions (or the negative versions of such words or expressions). While Green Plains and the Partnership believe that the assumptions concerning future events are reasonable, they caution that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of their businesses. Among the factors that could cause results to differ materially from those indicated by such forward-looking statements are: the failure to realize the anticipated costs savings, synergies and other benefits of the Merger; the possible diversion of management time on Merger-related issues; local, regional and national economic conditions and the impact they may have on Green Plains, the Partnership and their customers; disruption caused by health epidemics, such as the COVID-19 outbreak; conditions in the ethanol and biofuels industry, including a sustained decrease in the level of supply or demand for ethanol and biofuels or a sustained decrease in the price of ethanol or biofuels; commodity market risks, including those that may result from weather conditions; the financial condition of Green Plains’ or the Partnership’s customers; any non-performance by customers of their contractual obligations; changes in customer, employee or supplier relationships resulting from the Merger; changes in safety, health, environmental and other governmental policy and regulation, including changes to tax laws; the results of any reviews, investigations or other proceedings by government authorities; and the performance of Green Plains and the Partnership following the Merger.

The foregoing list of factors is not exhaustive. The forward-looking statements in this press release speak only as of the date they are made and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities and other applicable laws. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond Green Plains’ and the Partnership’s control. These risks, contingencies and uncertainties relate to, among other matters, the risks and uncertainties set forth in the “Risk Factors” section of Green Plains’ and the Partnership’s respective Annual Reports on Form 10-K for the year ended December 31, 2022, and Quarterly Reports on Form 10-Q for the three months ended March 31, 2023, June 30, 2023 and September 30, 2023, respectively, each filed with the Securities and Exchange Commission (the “SEC”), and any other reports filed with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Green Plains Inc. Contacts

Investors: Phil Boggs | Executive Vice President, Investor Relations | 402.884.8700 | phil.boggs@gpreinc.com

Media: Lisa Gibson | Communications Manager | 402.952.4971 | lisa.gibson@gpreinc.com

###

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

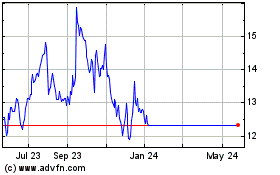

Green Plains Partners (NASDAQ:GPP)

Historical Stock Chart

From Mar 2025 to Apr 2025

Green Plains Partners (NASDAQ:GPP)

Historical Stock Chart

From Apr 2024 to Apr 2025