Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 September 2023 - 6:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number 001-38440

Grindrod Shipping Holdings Ltd.

1 Temasek Avenue

#10-02 Millenia Tower

Singapore 039192

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On September 29, 2023, Grindrod

Shipping Holdings Ltd. (the “Company”) issued a press release announcing the effective date of a proposed capital reduction

and notice of the record date and the cash distribution date in relation to such capital reduction. A copy of the press release is filed

as Exhibit 99.1 to this Report on Form 6-K.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

GRINDROD SHIPPING HOLDINGS LTD. |

| |

|

|

| Dated: September 29, 2023 |

|

/s/ Edward Buttery |

| |

|

Name: Edward Buttery |

| |

|

Title: Chief Executive Officer |

Exhibit 99.1

GRINDROD SHIPPING HOLDINGS LTD. ANNOUNCES EFFECTIVE

DATE OF THE PROPOSED CAPITAL REDUCTION AND NOTICE OF THE RECORD DATE AND THE CASH DISTRIBUTION DATE FOR THE PROPOSED CAPITAL REDUCTION

Singapore, September 29, 2023: —

Grindrod Shipping Holdings Ltd. (NASDAQ: GRIN) (JSE: GSH) (“Grindrod Shipping” or the “Company” or “we”

or “us” or “our”), a global provider of maritime transportation services predominantly in the drybulk sector,

today announced the effective date of the proposed capital reduction and notice of the record date and the cash distribution date.

| 1.1 | The board of directors (the “Board”) of the Company refers to the Notice of Extraordinary

General Meeting dated July 13, 2023 (the “Notice”) and the extraordinary general meeting of the shareholders of the Company

(the “Shareholders”) convened on August 10, 2023 (the “EGM”) where the special resolution in relation to the Proposed

Capital Reduction (as defined in the Notice) and the Proposed Cash Distributions (as defined in the Notice) was duly passed by the Shareholders

during the EGM. |

| 1.2 | Unless otherwise defined, all capitalised terms and references used herein shall bear the same meaning

ascribed to them in the Notice. |

| 2 | Effective Date of Capital Reduction |

| 2.1 | The Board wishes to inform Shareholders that the Company has lodged the relevant documents required under

Sections 78E(2)(c) and (d) of the Companies Act with ACRA on September 29, 2023. With the lodgement of the aforesaid documents, the Proposed

Capital Reduction will take effect as of September 29, 2023. |

| 2.2 | Pursuant to the Proposed Capital Reduction, the fully paid-up share capital of the Company will be reduced

by USD 32.44 million (being an amount within the maximum Reduction Amount of USD 45.00 million as set out in paragraph 2.1(a) of the Notice).

Based on the fully paid-up share capital of the Company as at the date hereof, the fully paid-up share capital of the Company will be

reduced from USD 320.68 million to USD 288.24 million. |

| 2.3 | Accordingly, an amount of USD 32.44 million will be distributed to Entitled Shareholders (as defined below). |

| 3 | Notice of Record Date and Cash Distribution In Two Tranches |

| 3.1 | The Company will reduce the share capital and distribute cash in two tranches; the first

distribution of $1.01598 per ordinary share, payable on or about October 26, 2023 and the second distribution of $0.63193 per

ordinary share, payable on or about December 11, 2023, to all shareholders of record as of October 20, 2023 (the “Record

Date”). As of September 29, 2023, there are 19,472,008 common shares of the Company outstanding. As at record date of October

20, 2023, the number of common shares of the Company will be increased to 19,685,590, including the consideration shares to be

issued for the previously announced purchase of the shares of Taylor Maritime Management Limited and Tamar Ship Management Limited. These agreements are subject to customary closing conditions with an estimated

closing date of October 3, 2023. We can provide no assurance that we will complete the acquisition until such time that the agreements

have been executed and implemented. |

| 3.2 | In view of the Record Date of October 20, 2023, shareholders may not reposition shares between the JSE

and the U.S. Register during the period from October 18, 2023, until October 20, 2023. |

| 3.3 | The capital distribution to be distributed by the Company is regarded as a “capital distribution” and is not subject to

any tax in Singapore. |

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act 1995 with respect to Grindrod Shipping’s financial condition,

results of operations, cash flows, business strategies, operating efficiencies, competitive position, growth opportunities, plans and

objectives of management, and other matters. These forward-looking statements, including, among others, those relating to our future business

prospects, revenues and income, are necessarily estimates and involve a number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking statements. Accordingly, these forward-looking statements should be considered

in light of various important factors, including those set forth below. Words such as “may,” “expects,” “intends,”

“plans,” “believes,” “anticipates,” “hopes,” “estimates,” and variations of

such words and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on

the information available to, and the expectations and assumptions deemed reasonable by Grindrod Shipping at the time these statements

were made. Although Grindrod Shipping believes that the expectations reflected in such forward-looking statements are reasonable, no assurance

can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon

a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond

the control of Grindrod Shipping. Actual results may differ materially from those expressed or implied by such forward-looking statements.

Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking

statements include, without limitation, Grindrod Shipping’s future operating or financial results; the strength of world economies,

including, in particular, in China and the rest of the Asia-Pacific region; the effects of the COVID-19 pandemic on our operations and

the demand and trading patterns for the drybulk market, and the duration of these effects; cyclicality of the drybulk market, including

general drybulk shipping market conditions and trends, including fluctuations in charter hire rates and vessel values; changes in supply

and demand in the drybulk shipping industry, including the market for Grindrod Shipping’s vessels; changes in the value of Grindrod

Shipping’s vessels; changes in Grindrod Shipping’s business strategy and expected capital spending or operating expenses,

including drydocking, surveys, upgrades and insurance costs; competition within the drybulk industry; seasonal fluctuations within the

drybulk industry; Grindrod Shipping’s ability to employ its vessels in the spot market and its ability to enter into time charters

after its current charters expire; general economic conditions and conditions in the oil and coal industries; Grindrod Shipping’s

ability to satisfy the technical, health, safety and compliance standards of its customers; the failure of counterparties to our contracts

to fully perform their obligations with Grindrod Shipping; Grindrod Shipping’s ability to execute its growth strategy; international

political and economic conditions including additional tariffs imposed by China and the United States; potential disruption of shipping

routes due to weather, accidents, political events, natural disasters or other catastrophic events; vessel breakdowns; corruption, piracy,

military conflicts, political instability and terrorism in locations where we may operate, including the recent conflicts between Russia

and Ukraine and tensions between China and Taiwan; fluctuations in interest rates and foreign exchange; changes in the costs associated

with owning and operating Grindrod Shipping’s vessels; changes in, and Grindrod Shipping’s compliance with, governmental,

tax, environmental, health and safety regulations including the International Maritime Organization, or IMO 2020, regulations limiting

sulfur content in fuels; potential liability from pending or future litigation; Grindrod Shipping’s ability to procure or have access

to financing, its liquidity and the adequacy of cash flows for its operation; the continued borrowing availability under Grindrod Shipping’s

debt agreements and compliance with the covenants contained therein; Grindrod Shipping’s ability to fund future capital expenditures

and investments in the construction, acquisition and refurbishment of its vessels; Grindrod Shipping’s dependence on key personnel;

Grindrod Shipping’s expectations regarding the availability of vessel acquisitions and its ability to buy and sell vessels and to

charter-in vessels as planned or at prices we deem satisfactory; adequacy of Grindrod Shipping’s insurance coverage; effects of

new technological innovation and advances in vessel design; and the other factors set out in “Item 3. Key Information-Risk Factors”

in our Annual Report on Form 20-F for the year ended December 31, 2022 filed with the Securities and Exchange Commission on March 23,

2023. Grindrod Shipping undertakes no obligation to update publicly or release any revisions to these forward-looking statements to reflect

events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events except as required by

law.

|

Company Contact:

Edward Buttery

CEO

Grindrod Shipping Holdings Ltd.

1 Temasek Avenue, #10-02 Millenia Tower,

Singapore, 039192

Email: ir@grindrodshipping.com

Website: www.grinshipping.com |

Investor Relations:

Email: ir@grindrodshipping.com |

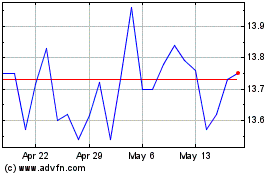

Grindrod Shipping (NASDAQ:GRIN)

Historical Stock Chart

From Apr 2024 to May 2024

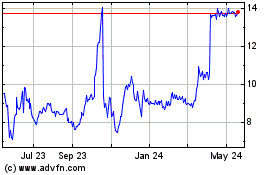

Grindrod Shipping (NASDAQ:GRIN)

Historical Stock Chart

From May 2023 to May 2024