UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 13, 2024

Date of Report (Date of earliest event reported)

GSE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-14785

|

52-1868008

|

|

(State of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

6940 Columbia Gateway Dr., Suite 470, Columbia, MD 21046

|

|

(Address of principal executive offices and zip code)

|

|

(410) 970-7800

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

|

GVP

|

|

The NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. ☐

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Appointment of Damian DeLongchamp as Chief Operating Officer

On May 13, 2024, GSE Systems, Inc. (the “Company”) announced the appointment of Damian DeLongchamp as the newly appointed Chief Operating Officer of the Company. Mr. DeLongchamp joined the Company in [April 2023] and

most recently served as the Vice President of GSE Engineering, Programs & Performance. Mr. DeLongchamp brings over 20 years of utility experience both domestically and abroad. His experience encompasses various roles in nuclear, fossil and green

energy encompassing a wide spectrum of managerial, operational, technical and engineering responsibilities.

Mr. DeLongchamp and the Company are currently parties to an Employment Agreement, dated April 1, 2023, which governs the terms of Mr. DeLongchamp’s employment with the Company. Effective immediately,

the Company has agreed to increase Mr. DeLongchamp’s Base Salary (as defined in the Employment Agreement) to $275,000. Mr. DeLongchamp and the Company have further agreed to revisit the terms of the Employment Agreement in the ordinary course. These

terms were memorialized in a letter agreement dated May 8, 2024 (the “Letter Agreement”).

Under Mr. DeLongchamp’s existing Employment Agreement, Mr. DeLongchamp serves for a term of one year with annual renewals occurring automatically if neither the Company nor Mr. DeLongchamp notifies

the other of an intent to terminate the Employment Agreement at least thirty days prior to December 31 of the then-current year. The Company initially agreed to pay Mr. DeLongchamp a Base Salary of $200,000 in April 2023. Mr. DeLongchamp is eligible

for a bonus of up to 25% of his Base Salary and is eligible to receive a grant of restricted stock units, options, or other equity-based incentive compensation, in each case subject to achievement of annual performance goals determined by the Board

of Directors. Mr. DeLongchamp is entitled to participate in all employee benefits available to senior executives or employees of the Company. During the term of the Employment Agreement, and for a twelve (12) month period following termination of the

Employment Agreement, Mr. DeLongchamp shall not compete with the Company or solicit employees or customers of the Company.

If the Company terminates Mr. DeLongchamp’s employment for a reason other than Death, Disability or Cause (as defined in the Employment Agreement), or if Mr. DeLongchamp terminates his employment for

Good Reason (as defined in the Employment Agreement), then Mr. DeLongcahamp will (subject to certain conditions) receive his Base Salary for a period of three (3) months and benefits for the same time period, each running from the date of termination

of his employment, payable as and when salaries are generally paid to executive officers of the Company and benefits at the same level as available on the date of termination, and he will also receive, on the date that annual bonuses are paid to

similarly situated employees but no later than two and one-half months following the end of the calendar year in which the termination occurs, a bonus equal to the sum of his bonus if he had been employed for the full year and the pro-rated amount

through his date of termination. If Mr. DeLongchamp terminates his employment for Good Reason, or the Company terminates his employment for any reason other than Cause, in each case within twelve (12) months following a Change of Control (as defined

in the Employment Agreement) of the Company, then Mr. DeLongchamp will (subject to certain conditions) receive his Base Salary and benefits for a period of three (3) months from the date of termination of his employment, payable as and when salaries

are generally paid to executive officers of the Company and benefits at the same level as available on the date of termination, and he will also receive, on the date of termination, a lump sum equal to the greater of (i) the actual amount of bonus

earned by him as of such date or (ii) the target amount of bonus earned by him for the period during which his employment terminates.

The foregoing description of the Employment Agreement and the Letter Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Employment

Agreement and the Letter Agreement, which are filed as Exhibits 10.1 and 10.2 to this Current Report, respectively, on Form 8-K and are incorporated by reference herein.

|

Item 7.01.

|

Regulation FD Disclosure.

|

Press Release

On May 13, 2024, the Company issued a press release announcing the appointment of Mr. Delongchamp. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated by reference herein.

The information in this Item 7.01 (including Exhibit 99.1 attached hereto) is being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be

subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any

general incorporation language in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

10.1

|

Employment Agreement, dated April 1, 2023, by and between GSE Systems, Inc. and Damian Delongchamp

|

|

| |

|

|

|

10.2

|

Letter Agreement, dated May 8, 2024, by and between GSE Systems, Inc. and Damian Delongchamp

|

|

|

99.1

|

Press Release dated May 13, 2024 (furnished pursuant to Item 7.01)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

| |

|

GSE SYSTEMS, INC.

|

| |

|

|

|

| |

|

By:

|

/s/ Emmett Pepe

|

| |

|

|

Emmett Pepe

|

| |

|

|

Chief Financial Officer

|

Date: May 14, 2024

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement, dated as of April 1, 2023 (the “Effective Date”), by and between GSE Systems, Inc., a Delaware corporation with principal executive offices at 6940 Columbia Gateway Drive, Suite 470, Columbia, Maryland

21046 (the “Company”), and Damian DeLongchamp, residing at 2640 South 159th Avenue, Goodyear, Arizona 85338 (“Executive”).

BACKGROUND

The Company and the Executive desire that the Executive be employed by the Company and have

entered into this Employment Agreement to set forth the terms and conditions on which the Executive shall be employed by the Company.

NOW, THEREFORE, in consideration of the premises, the mutual promises, covenants, and

conditions herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto intending to be legally bound hereby agree as follows:

|

1.

|

Employment. The

Company hereby agrees to employ Executive, and Executive hereby agrees to be employed by the Company, upon the terms and subject to the conditions set forth in this Agreement.

|

|

2.

|

Capacity and Duties.

Executive shall be employed in the capacity of Vice President of Programs and Performance of the Company, shall report to the Chief Executive Officer of the Company, and shall have the duties, responsibilities and authorities normally

undertaken by the Vice President of Programs and Performance of a company, including without limitation the duties set forth in Exhibit A hereto, as

well as such other duties, responsibilities, and authorities as are assigned to him by the Chief Executive Officer or the Board of Directors of the Company (the “Board”). The Company shall retain the right to modify the Executive’s job title and responsibilities pursuant to the legitimate business needs of the Company, provided that any such modification in title or

responsibilities is consistent with the Executive’s role as an executive officer of the Company and his background, experience and skills. The Executive shall devote his business time and attention to the performance of his duties hereunder

and will not engage in any other business, profession or occupation for compensation or otherwise without the prior written consent of the Chief Executive Officer and the Board. Executive will spend his working time for the Company, when

not traveling on Company business, at the Company’s headquarters or other work location approved by the Chief Executive Officer. The Executive will be permitted to act or serve as a director, trustee, or committee member of a business,

civic, or charitable organization as long as such activities do not interfere with the performance of the Executive’s duties and responsibilities to the Company as provided hereunder. Executive may also act to manage Executive’s own

personal passive investments so long as such activities do not materially interfere with the performance of Executive’s duties and responsibilities to the Company as provided hereunder.

|

|

3.

|

Term of Employment.

The term of this Agreement shall commence on the Effective Date and continue through December 31, 2023 (the “Initial Term”). The

Initial Term shall be automatically extended for an additional one year period on December 31 of each year, beginning December 31, 2023, unless

either party provides written notice to the other of its intention not to extend at least 30 days prior to such date (as so extended, the “Term”).

|

4. Compensation. During the Term, subject to all the

terms and conditions of this Agreement, and as compensation for all services to be rendered by Executive under this Agreement, the Company shall pay to or provide Executive with the following:

a. Base Salary. The

Company shall pay to Executive an annual base salary (the “Base Salary”) of Two Hundred Thousand Dollars ($200,000) less applicable withholdings, taxes and deductions. Beginning in 2024, the Chief Executive Officer shall review the Executive’s Base

Salary at least annually with the Compensation Committee of the Board (the “Compensation Committee”), and the Compensation Committee may, but

shall not be required to, recommend to the Chief Executive Officer an increase in the Base Salary during the Term based upon changes in cost of living, the Executive’s performance, and other factors deemed relevant by the Compensation Committee.

The Base Salary will be payable at such intervals as salaries are paid generally to other executive officers of the Company.

b. Bonus.

|

i.

|

For each fiscal year of the Term beginning with fiscal year 2023, the Executive shall be eligible to earn

an annual bonus award (the “Bonus”) of up to 25% of Base Salary, based upon the achievement of annual performance goals established by

the Compensation Committee for the Company as a whole. The amount of Bonus to be paid to Executive for any year of this Agreement may be prorated for the number of months in which Executive was employed by the Company during such year.

|

|

ii.

|

After the Company publicly reports its financial performance for the second quarter of any fiscal year in

which the Executive is eligible to receive a Bonus, if the Compensation Committee determines that the Company is on-target to achieve at least the minimum annual Bonus target amounts, then the Compensation Committee may, in its sole

discretion, authorize payment to the Executive of 10% of the amount of Bonus that is projected to be earned for the full year; provided, however, that the Executive shall be required to repay to the Company any amount so paid in the event

that such amount exceeds the total Bonus amount actually earned during such year, as finally calculated based on full-year financial performance.

|

c. Equity-Based Incentive

Compensation. Each fiscal year during the Term beginning January 1, 2024, the Executive will have the potential to receive a

grant of restricted stock units, options, or other equity-based incentive compensation as the Chief Executive Officer may determine based on Compensation Committee recommendations and as approved by the Board, subject to all of the terms and

conditions set forth in the Company’s 1995 Long Term Incentive Plan. All such grants of equity-based incentive compensation shall be made via a written grant agreement issued to Executive.

d. Benefits. Executive

shall be entitled to participate in all employee benefit plans maintained by the Company for its senior executives or employees including, without limitation, the Company’s medical, dental, vision, 401(k), and life insurance plans and the following

benefits:

|

i.

|

Paid Time Off.

Executive shall be entitled to use up to twenty-two (22) days of paid time off in accordance with the Company’s policies.

|

|

ii.

|

Medical/Dental/Vision

Insurance. The Company shall pay the same portion of Executive’s monthly Medical, Dental, and Vision Insurance premiums in association with Company provided health insurance plans as it pays for other employees employed at

Executive’s level.

|

|

iii.

|

Other Benefits.

Executive shall be eligible to participate in all benefit plans (including 401(k) and life insurance plans) sponsored or maintained by the Company for its executive officers, to the extent permitted under applicable law and subject to the

terms of each plan. Nothing in this Agreement obligates the Company to adopt, maintain, or refrain from amending, freezing, or terminating any benefit plan, regardless of whether such action affects Executive or executive officers as a

group.

|

|

5.

|

Business Expenses.

The Company shall reimburse Executive for all reasonable expenses (including, but not limited to, continuing education, business travel, and customer entertainment expenses) incurred by him in connection with his employment hereunder in

accordance with the written policy and guidelines established by the Company for expense reimbursement.

|

|

6.

|

Non-Competition, Non-Solicitation, Non-Disparagement.

|

|

a.

|

Acknowledgements.

The Executive acknowledges and agrees that the services to be rendered by the Executive to the Company are of a special and unique character; that the Executive will obtain knowledge and skill relevant to the Company’s industry, methods of

doing business and marketing and investment strategies by virtue of the Executive’s employment; and that the restrictive covenants and other terms and conditions of this Agreement are reasonable and reasonably necessary to protect the

legitimate business interest of the Company. The Executive further acknowledges that: the amount of the Executive’s compensation reflects, in part, the Executive’s obligations and the Company’s rights under this Agreement; that the

Executive has no expectation of any additional compensation, royalties or other payment of any kind not otherwise referenced herein in connection herewith; and that the Executive will not be subject to undue hardship by reason of his full

compliance with the terms and conditions of this Agreement or the Company’s enforcement thereof. All of the obligations set forth herein shall be in addition to, and not in substitution for or replacement of, any other obligations that

Executive owes to the Company pursuant to any other agreement containing similar covenants.

|

|

b.

|

Non-Competition.

Because of the Company’s legitimate business interest as described herein and the good and valuable consideration offered to the Executive, during the Term and for the six-month period beginning on the last day of the Executive’s employment

with the Company, the Executive agrees and covenants not to engage in Prohibited Activity within the United States. For purposes of this Section 6, “Prohibited Activity” means any activity to which the Executive provides the same or similar services to that of which he provided for the Company, directly or indirectly, in whole or in part, as an employee, employer,

owner, operator, manager, advisor, consultant, agent, employee, partner, director, stockholder, officer, volunteer, intern, or any other similar capacity to an entity engaged in the same or similar business as the Company anywhere in the

United States. Nothing herein shall prohibit the Executive from purchasing or owning less than five percent (5%) of the publicly traded securities of any corporation, provided that such ownership represents a passive investment and that the

Executive is not a controlling person of, or a member of a group that controls, such corporation.

|

|

c.

|

Non-solicitation of

Employees. The Executive agrees and covenants that during the Term and for the 12-month period beginning on the last day of the Executive’s employment with the Company Executive shall not to directly or indirectly solicit,

hire, recruit, attempt to hire or recruit, or induce the termination of employment of any employee of the Company whom the Executive worked with or came to know as a result of Executive’s employment with the Company.

|

|

d.

|

Non-solicitation of

Customers. The Executive understands and acknowledges that because of the Executive’s experience with and relationship to the Company, he will have access to and learn about much or all of the Company’s customer information.

“Customer Information” includes, but is not limited to, names, phone numbers, addresses, e-mail addresses, order history, order

preferences, chain of command, pricing information and other information identifying facts and circumstances specific to the customer. The Executive understands and acknowledges that loss of this customer relationship and/or goodwill will

cause significant and irreparable harm to the Company. The Executive agrees and covenants, during the Term and for the 12-month period following the termination of Executive’s employment for any reason, not to directly or indirectly

solicit, contact (including but not limited to e-mail, regular mail, express mail, telephone, fax, instant message, and all forms of social media), attempt to contact or meet with the Company’s current customers for purposes of offering or

accepting goods or services similar to or competitive with those offered by the Company or for purposes of inducing any such customer to terminate its relationship with the Company.

|

e. Confidential Information.

i. Executive recognizes that Executive’s position with Company is one of the highest trust and confidence and that Executive will

have access to and contact with the trade secrets and confidential and proprietary business information of Company. All Confidential Information (as defined below) which Executive may now possess, may obtain during the Term, or may create prior to

the end of the Term relating to the business of the Company or of any of its customers or suppliers shall not be published, disclosed, or made accessible by him to any other person, firm, entity, or corporation either during or after the

termination of his employment or used by him except during the Term in the business and for the benefit of the Company, in each case without prior written permission of the Company.

|

ii.

|

Executive covenants and agrees that, as between the Executive and the Company, all right, title and interest

in and to any Confidential Information shall be the exclusive property of the Company, even if such information becomes publicly available. Executive agrees immediately to disclose to the Company all Confidential Information conceived or

developed in whole or in part by Executive during the term of Executive’s employment with the Company and to assign to the Company any right, title or interest Executive may have in such Confidential Information. Executive agrees to execute

any instruments and to do all other things reasonably requested by the Company (both during and after Executive’s employment with the Company) in order to vest more fully in the Company all ownership rights in those items hereby transferred

by Executive to the Company. If any one or more of the items described herein are protectable by copyright and are deemed in any way to fall within the definition of “work made for hire,” as such term is defined in 17 U.S.C. §101, such work

shall be considered a “work made for hire,” the copyright of which shall be owned solely, completely and exclusively by the Company. If any one or more of the aforementioned items are protectable by copyright and are not considered to be

included in the categories of works covered by the “work made for hire” definition contained in 17 U.S.C. §101, all rights with respect to such items shall be deemed to be assigned and transferred completely and exclusively to the Company

under this Agreement. Executive shall return all tangible evidence of any Confidential Information to the Company prior to or at the termination of his employment. All computer, company phones, and other electronic storage devices shall be

returned with their contents fully intact, and no attempt should be made to “clean” or “wipe” any such devices. Executive shall provide any passwords necessary to access any electronic equipment or files. Executive also agrees to allow the

Company, upon reasonable notice, to access to any electronic storage device that Executive owns or controls to permit the Company to inspect for and remove any Confidential Information.

|

|

iii.

|

For purposes of this Agreement, “Confidential Information” means any and all non-public information related to the Company or any of its subsidiaries that is not generally known by others with whom they compete or do business including but

not limited to the Company’s trade secrets, ideas, inventions, discoveries, research and development activities, technology, software, computer source code and object code, processes, formulas, techniques, “know-how,” designs, drawings and

specifications, trade secrets, and intellectual property, systems, procedures, manuals, cost and pricing information, product development strategies, marketing information, quoting information, mailing lists, solicitations, proposals, bids,

contracts, confidential reports and work product prepared in connection with projects and contracts, supporting information for any of the above items, records pertaining to the business of any Company customer or active prospect, including

without limitation, knowledge of the customer’s current business or staffing needs, records of government agencies and offices and contacts with whom the Company has done business or is seeking to do business, records of contractors and

contacts with whom the Company has done business or is seeking to do business, records of subcontractors and contacts with whom the Company has done business or is seeking to do business, the identities of, and records pertaining to,

current or former employees of the Company or potential hires and their compensation arrangements with the Company, records of vendors and suppliers of personnel or material, accounting and financial information, business plans and budgets,

and all other information pertaining to the business activities and affairs of the Company of every nature and type, and all information and materials received by the Company in confidence (or subject to non-disclosure or similar

covenants). “Confidential Information” also includes all information which Executive receives, is given access to, conceives or develops, or has received, been given access to, conceived or developed, in whole or in part, directly or

indirectly, during the course of Executive’s employment with the Company (in any capacity) or through the use of any of the Company’s facilities or resources or other Confidential Information. Confidential Information does not include any

information that Executive can demonstrate, by clear and convincing documentary evidence: (i) has been or becomes available in the public domain through no breach of an obligation to the Company by Executive; (ii) was known to Executive

prior to the time they obtained such information from the Company or before Executive had an obligation to keep the information confidential; (iii) is part of Executive’s acquired general work skills or is readily ascertainable such as

through reference to general library sources; (iv) was independently developed by Executive outside of the scope of their employment and without resort to information that has been disclosed pursuant to this Agreement or use of Company

resources; (v) is required to be disclosed in order to comply with applicable law or regulation or with any requirement imposed by judicial or administrative process or any governmental or court order provided, however, that Executive will

give the Company prompt prior advance notice of such anticipated compelled disclosure to permit the Company to obtain protective relief if it so chooses; or (vi) is rightfully provided to the Company by a third party who is under no

obligation of confidence to the Company and therefore has the right to disclose, divulge or use such information without violation any obligation to the Company.

|

f. Enforcement. Executive acknowledges

and agrees that the covenants contained herein are fair and reasonable in light of the consideration provided hereunder, and that damages alone shall not be an adequate remedy for any breach by Executive of his covenants which then apply and

accordingly expressly agrees that, in addition to any other remedies which the Company may have, the Company shall be entitled to injunctive relief in any court of competent jurisdiction for any breach or threatened breach of any such covenants by

Executive without the necessity of posting bond. Nothing contained herein shall prevent or delay the Company from seeking, in any court of competent jurisdiction, specific performance or other equitable remedies in the event of any breach or

intended breach by Executive of any of his obligations hereunder.

g. Tolling. The period of time applicable

to any covenant in this Section 6 will be extended by the duration of any violation by Executive of such covenant.

h. Successors. Executive specifically

acknowledges and agrees that these covenants contained in this Section 6 shall be enforceable by any successor to the Company whether by acquisition of substantially all of the assets of the Company, sale or acquisition of a controlling interest in

the Company’s equity, merger, consolidation, reorganization or other change of control.

i. Reformation and Severability. If any

covenant in this Section 6 is held to be unreasonable, arbitrary, or against public policy, such covenant will be considered to be divisible and/or modifiable with respect to scope, time, and geographic area, and such lesser scope, time, or

geographic area, or all of them, as a court of competent jurisdiction may determine to be reasonable, not arbitrary, and not against public policy, will be effective, binding, and enforceable against Executive. Executive further agrees that this

Section 6 is distinct and severable from the remaining agreement and acknowledges and agrees that these restrictions shall remain in effect regardless of any breach or alleged breach by the Company of any of its obligations herein for which

Executive may have a separate and distinct claim against the Company.

7. Patents. Any interest in patents, patent applications, inventions, trade secrets, copyrights, developments, know-how, and processes (“Inventions”) which Executive now or hereafter during the period he is employed by the Company under this Agreement may own or develop relating to the fields in which the Company or any of its subsidiaries may then be

engaged shall belong to the Company; and forthwith upon request of the Company, Executive shall execute all such assignments and other

documents and take all such other action as the Company may reasonably request in order to vest in the Company all his right, title, and interest in and to all Inventions, free and clear of all liens, charges, and encumbrances.

8. Termination. Executive’s employment hereunder may be terminated prior to the expiration of the Term under the following circumstances:

|

a.

|

Death.

Executive’s employment hereunder shall terminate upon his death.

|

|

b.

|

Disability. If,

as a result of Executive’s incapacity due to physical or mental illness, Executive shall have been unable to perform his duties hereunder on a full-time basis for a period of three consecutive months, or for 180 days in any 12-month period,

with or without reasonable accommodation (a “Disability”), the Company may, on 30 days written Notice of Termination (defined in

Section 8(e)), terminate Executive’s employment if Executive fails to return to the performance of his duties hereunder on a full-time basis within said period. For purpose of this Agreement, “disability” shall be defined as Executive’s

inability, due to a mental or physical condition, to perform the essential functions of Executive’s position, with or without reasonable accommodation, for a period of three consecutive months, or for 180 days in any 12-month period.

|

|

c.

|

Cause. The

Company may terminate Executive’s employment hereunder immediately for Cause. For purposes of this Agreement, the Company shall have

|

“Cause” to terminate Executive’s employment upon the occurrence of any of the following:

|

i.

|

the willful and continued failure by Executive to substantially perform his material duties or obligations

hereunder (other than any such failure resulting from Executive’s incapacity due to physical or mental illness), after written demand for substantial performance is delivered by the Company that specifically identifies the manner in which

the Company believes Executive has not substantially performed his duties or obligations, and provides the Executive with at least 30 days to effect a cure;

|

|

ii.

|

the willful engaging by Executive in misconduct which, in the reasonable opinion of the Board, will have a

material adverse effect on the reputation, operations, prospects or business relations of the Company;

|

|

iii.

|

the conviction of Executive of any felony or misdemeanor punishable by up to one year in jail or the entry

by Executive of any plea of nolo contendere in response to an indictment for a crime involving moral turpitude;

|

|

iv.

|

Executive abuses alcohol, illegal drugs or other controlled substances which impact Executive’s performance

of his duties or uses, possesses or is impaired by or under the influence of illegal drugs or controlled substances on the premises of the Company or any of its subsidiaries or while working or representing the Company or any of its

subsidiaries, provided that the Executive may consume alcohol in reasonable amounts when made available at a Company or client function or meal; or

|

|

v.

|

the material breach by Executive of a material term or condition of this Agreement.

|

|

vi.

|

the commission or attempted commission of any act of willful misconduct or fraud, misappropriation of

property belonging to the Company, embezzlement or similar acts of dishonesty related to the Company, or its owners, officers, employees, agents, or any related companies, or any of its customers

|

|

vii.

|

intentional and willful misconduct that may subject the Company to criminal or civil liability, including

but not limited to engaging in any discriminatory or sexually harassing behavior;

|

|

viii.

|

breach of the Executive’s duty of loyalty to the Company or diversion or usurpation of corporate

opportunities properly belonging to the Company;

|

For purposes of this Section 8(c), no act, or failure to act, on Executive’s part shall be considered “willful” if

it was done, or omitted to be done, by him in good faith and with the reasonable belief that his action or omission was in the best interest of the Company. Notwithstanding the foregoing, Executive’s employment shall not be deemed to have been

terminated for Cause without the following delivery to Executive of a Notice of Termination in accordance with Section 8(e).

|

d.

|

Termination Without Cause.

The Executive’s employment hereunder may be terminated without cause by either the Company or the Executive at any time upon at least 60 days’ prior written notice. If the Initial Term is extended pursuant to Section 3 hereof, then

beginning January 1, 2024, and continuing during the remaining portion of the Term, the giving by the Company of notice of its intent not to extend the Term pursuant to Section 3 shall be deemed, at the option of the Executive, to be a

termination of his employment without cause (“Deemed Termination”). Executive may exercise that option by giving written notice thereof

to the Company within 30 days of his receipt of the notice of non-renewal. During the notice period, Executive must fulfill all of Executive’s duties and responsibilities and use Executive’s best efforts to support the transition.

Notwithstanding the foregoing, the Company, at its option, may assign the Executive new of different duties or may instruct Executive not to undertake any duties on behalf of the Company and/or to not be present at the Company’s offices.

Failure to comply with this requirement may result in Termination for Cause described Section 8(c), but otherwise Executive’s salary and benefits will remain unchanged during the 60-day notification period or the 30-day notice period in the

case of a Deemed Termination.

|

|

e.

|

Notice of Termination.

Any termination of Executive’s employment (other than termination pursuant to Section 8(a)) shall be communicated by a Notice of Termination given by the terminating party to the other party hereto. For purposes of this Agreement, a “Notice of Termination” shall mean a written notice which shall indicate the specific termination provision in this Agreement relied upon

and shall set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Executive’s employment under the provision so indicated.

|

|

f.

|

Date of Termination. “Date of Termination” shall mean (i) if Executive’s employment is terminated by his death, the date of his death, (ii) if Executive’s

employment is terminated pursuant to Section 8(b), 30 days after Notice of Termination is given, (iii) if a Deemed Termination occurs, upon the date of Executive’s notice to the Company of exercise of his option to treat such event as a

termination without Cause, and (iv) if Executive’s employment is terminated for any other reason, the date specified in the Notice of Termination, which shall not be earlier than the date on which the Notice of Termination is given.

|

9. Compensation upon Termination or During Disability.

|

a.

|

Disability.

During any period that Executive fails to perform his duties hereunder as a result of Disability (“disability period”), Executive shall

continue to receive his full salary at the rate then in effect for such period until his employment is terminated pursuant to Section 8(b), provided that payments so made to Executive during the disability period shall be reduced by the sum

of the amounts, if any, payable to Executive at or prior to the time of any such payment under disability benefit plans of the Company and which were not previously applied to reduce any such payment, and the Company shall have no further

obligation to the Executive.

|

|

b.

|

For Cause. If

Executive’s employment is terminated for Cause, the Company shall pay Executive his full salary through the Date of Termination at the rate in effect at the time Notice of Termination is given, and the Company shall have no further

obligation to the Executive.

|

c. Any other Reason. If Executive’s

employment shall be terminated by the Company for a reason other than Death, Disability or Cause, or if Executive terminates his employment for Good Reason (defined below), upon and after Executive’s execution of a release of claims in favor of the

Company, its affiliates and their respective officers and directors in a form provided by the Company (the “Release”) and such Release becoming effective:

|

i.

|

if the termination shall occur less than twelve (12) months after the Effective Date hereof, the Company

will continue to pay the Executive his Base Salary for a period of one (1) month, payable at such intervals as salaries are paid generally to other executive officers of the Company;

|

|

ii.

|

if the termination shall occur more than twelve (12) months after the Effective Date hereof, the Company

will continue to pay the Executive his Base Salary for a period of three (3) months, payable at such intervals as salaries are paid generally to other executive officers of the Company;

|

|

iii.

|

if the Executive is eligible for compensation pursuant to Sections 9(c)(i) or (ii) above, then the Executive

shall also continue to be eligible to participate in all medical, dental, and vision insurance benefits (collectively, “Benefits”), on the same terms and at the same level of participation and company contribution to the cost thereof, then

in effect for the same period of time following termination of employment as the Executive receives such compensation pursuant to such subsections, but only if and to the extent Executive remains eligible under the applicable employee

benefit plans and to the extent Executive’s eligibility is not contrary to, or does not negate, the tax favored status of the plans or of the benefits payable under the plan. If Executive is unable to continue to participate in any employee

benefit plan or program provided for under this Agreement, Executive shall be compensated in respect of such inability to participate through payment by GSE to Executive, in advance, of an amount equal to the annual cost that would have

been incurred by GSE if the Executive were able to participate in such plan or program.

|

|

iv.

|

Executive shall receive a prorated Bonus equal to the product of (I) the Bonus, if any, that the Executive

would have earned for the calendar year in which the Date of Termination occurred had he been employed as of the last day of such year, based on the Company’s actual results of operations for such year and (II) a fraction, the numerator of

which is the number of days the Executive was employed by the Company during the year of termination and the denominator of which is the number of days in such year. The prorated Bonus shall be paid on the date that annual bonuses are paid

to similarly situated employees, but in no event later than the date which not later than two and one-half (21/2) months following the end of the calendar year in which the Date of Termination occurs.

|

d. “Good Reason” shall

mean the occurrence of any of the following: (a) Executive’s duties, responsibilities or authority are materially reduced as compared to those of Executive’s current position without his consent; (b) Executive’s Base Salary (as the same may be increased at any time hereafter are materially reduced; (c) Executive’s Benefits are either discontinued or materially reduced, in the aggregate; or

(d) either the Company or any successor company materially breaches this Agreement.

10. Change of Control.

|

a.

|

If Executive terminates his employment for Good Reason because of a Change of Control within one year

following the effective date of a Change of Control, Executive shall, in lieu of any benefits provided for in Section 9, continue to receive the Base Salary and Benefits that Executive is receiving as of the effective date of the Change of

Control for a period of three (3) months from the date of termination of his employment. Such Base Salary and Benefits shall be paid at such intervals as salaries are paid generally to other executive officers of the Company.

|

|

b.

|

In addition, if the Executive terminates his employment for Good Reason or the Company terminates his

employment for any reason other than Cause, in each case within one year following the effective date of a Change of Control, in lieu of the payment described in Section 9(c)(v), the Executive shall also be entitled to receive, on the Date

of Termination, an amount, payable in one lump sum, equal to the greater of (i) the actual amount of bonus earned by the Executive as of such date or (ii) the target amount of bonus for the period during which the employment of the

Executive terminates.

|

|

c.

|

In the event of Executive’s decision to terminate employment for Good Reason, Executive must give notice

to Company of the existence of the conditions giving rising to the termination for Good Reason within ninety (90) days of the initial existence of the conditions. Upon such notice, Company shall have a period of thirty (30) days during

which it may remedy the conditions (“Cure Period”). If the Company fails to cure the conditions constituting the Good Reason during the

Cure Period to Executive’s reasonable satisfaction, Executive’s termination of employment must occur within a period of ninety (90) days following the expiration of the Cure Period in order for the termination to constitute a termination

pursuant to Good Reason for purposes of this Agreement.

|

|

d.

|

For purposes of this Agreement, a “Change in Control” of the Company shall be deemed to have occurred as of the first day that any one or more of the following conditions shall have been satisfied:

|

|

i.

|

Any Person (other than a Person in control of the Company as of the date of this Agreement, or other than a

trustee or other fiduciary holding securities under an employee benefit plan of the Company, or a company owned directly or indirectly by the stockholders of the Company in substantially the same proportions as their ownership of voting

securities of the Company) becomes the beneficial owner, directly or indirectly, of securities of the Company representing a majority of the combined voting power of the Company’s then outstanding securities; or

|

|

ii.

|

The stockholders of the Company approve: (x) a plan of complete liquidation of the Company (which includes

a termination and liquidation of all Executive’s rights under any arrangement governed by Section 409A of the Internal Revenue Code of 1986, as amended (“Code”); or (y) an agreement for the sale or disposition of all or substantially all

the Company’s assets; or (z) a merger, consolidation, or reorganization of the Company with or involving any other corporation, other than a merger, consolidation, or reorganization that would result in the voting securities of the Company

outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least a majority of the combined voting power of the voting securities

of the Company (or such surviving entity) outstanding immediately after such merger, consolidation, or reorganization.

|

|

iii.

|

For purposes of this definition of Change in Control, “Person” shall have the meaning ascribed to such

term in Section 3(a)(9) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and used in Sections 13(d) and 14(d) thereof, including a “group” as defined in Section 13(d) thereof, and “Beneficial Owner” shall have the meaning ascribed to such term in Rule 13d-3 of the General Rules and regulations under the 1934 Act.

|

|

11.

|

Successors; Binding

Agreement. This Agreement is personal to the Executive and shall not be assigned by the Executive. Any purported assignment by the Executive shall be null and void from the initial date of the purported assignment. The

Company may assign this Agreement to any parent, affiliate, of Company, any entity controlling, controlled by or under common control with the Company, and to any successor or assign (whether direct or indirect, by purchase, merger,

consolidation or otherwise) to all or substantially all of the business or assets of the Company, including without limitation the restrictive covenants provided for in Section 6, which Executive agrees shall be enforceable by any such

successor or assign. The Company will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company, by agreement in form and

substance reasonably satisfactory to Executive, to expressly assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. This

Agreement shall inure to the benefit of the Company and permitted successors and assigns.

|

|

12.

|

No Third Party

Beneficiaries. This Agreement does not create, and shall not be construed as creating, any rights enforceable by any person not a party to this Agreement.

|

|

13.

|

Representations and

Warranties of Executive. Executive represents and warrants to the Company that (a) Executive is under no contractual or other restriction or obligation which is inconsistent with the execution of this Agreement, the

performance of his duties hereunder, or the other rights of the Company hereunder and (b) Executive is under no physical or mental disability that would hinder his performance of duties under this Agreement.

|

|

14.

|

Life Insurance.

If requested by the Company, Executive shall submit to such physical examinations and otherwise take such actions and execute and deliver such documents as may be reasonably necessary to enable the Company, at its expense and for its own

benefit, to obtain life insurance on the life of Executive. Executive has no reason to believe that his life is not insurable with a reputable insurance company at rates now prevailing in the Baltimore metropolitan area for healthy men of

his age.

|

|

15.

|

Modification.

Except for any restrictive covenants in any other agreement between Company and Executive, which shall be in addition to the provisions set forth herein, this Agreement sets forth the entire understanding of the parties with respect to the

subject matter hereof, supersedes all existing agreements and prior discussions between them concerning such subject matter, and may be modified only by a written instrument duly executed by each party. In the event of a conflict between

the terms of this Agreement and any other agreement, the provisions of this Agreement shall control.

|

|

16.

|

Notices. Any

notice or other communication required or permitted to be given hereunder shall be in writing and shall be mailed by certified mail, return receipt requested, or delivered against receipt to the party to whom it is to be given at the

address of such party set forth in the preamble to this Agreement (or to such other address as the party shall have furnished in writing in accordance with the provisions of this Section).

|

|

17.

|

Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, without giving effect to conflict of laws. Any action or proceeding by either of the parties to enforce this Agreement shall be brought

only in a state or federal court located in the state of Maryland. The parties hereby irrevocably submit to the exclusive jurisdiction of such courts and waive the defense of inconvenient forum to the maintenance of any such action or

proceeding in such venue.

|

|

18.

|

409A. This Agreement is intended to

comply with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and any exemption from Section 409A of the Code, and shall in all respects be administered in accordance with and interpreted to ensure compliance with Section 409A

of the Code. Executive’s termination of employment under this Agreement shall be interpreted in a manner consistent with the separation from service rules under Section 409A of the Code. For purposes of Section 409A of the Code, each

payment made under this Agreement shall be treated as a separate payment and the right to a series of payments under this Agreement shall be treat as a right to a series of separate payments. In no event shall Executive, directly or

indirectly, designate the calendar year of the payment. Furthermore, if, at the time of termination of employment with the Company, Company has stock which is publicly traded on an established securities market and Executive is a “specified

employee” (as defined in Section 409A of the Code) and it is necessary to postpone the commencement of any payments or benefits otherwise payable pursuant to this Agreement as a result of such termination of employment to prevent any

accelerated or additional tax under Section 409A of the Code, then Company shall postpone the commencement of the payment of such payment or benefits hereunder (without any reduction in such payments or benefits ultimately paid or provided

to Executive) that are not otherwise paid within the short-deferral exception under Section 409A of the Code and are in excess of the lessor of two (2) times (i) Executive’s then annual compensation or (ii) the limit on compensation then

set forth in Section 401(a)(17) of the Code, until the first payroll date that occurs after the date that is six months following Executive’s separation from service with the Company (within the meaning of Section 409A of the Code). The

accumulated postponed amount shall be paid in a lump sum payment within ten days after the end of the six month period. Notwithstanding any provision of this Agreement to the contrary, in no event shall the timing of the Executive’s

execution of the Release, directly or indirectly, result in the Executive designating the calendar year of payment, and if a payment that is subject to execution of the release could be made in more than one taxable year, payment shall be

made in the later taxable year.

|

|

19.

|

Definitions, Headings, and

Number. A term defined in any part of this Agreement shall have the defined meaning wherever such term is used herein. The headings contained in this Agreement are for reference purposes only and shall not affect in any

manner the meaning or interpretation of this Agreement. In construing this Agreement, feminine or neuter pronouns shall be substituted for those masculine in form, and vice versa, and plural terms shall be substituted for singular and

singular for plural, in any place where the context so requires.

|

|

20.

|

Construction and Interpretation. This Agreement has been discussed and negotiated by, all parties hereto

and their counsel and shall be given a fair and reasonable interpretation in accordance with the terms hereof, without consideration or weight being given to its having been drafted by any party hereto or its counsel.

|

|

21.

|

Severability: Provisions Subject to Applicable Law. All provisions of this Agreement shall be applicable

only to the extent that they do not violate any applicable law, and are intended to be limited to the extent necessary so that they will not render this Agreement invalid, illegal or unenforceable under any applicable law. If any provision

of this Agreement or any application thereof shall be held to be invalid, illegal or unenforceable, the validity, legality and enforceability of other provisions of this Agreement or of any other application of such provision shall in no

way be affected thereby. Additionally, should any provision of this Agreement be deemed to be illegal, invalid, or unenforceable, the Parties hereby agree to allow courts of competent jurisdiction the authority to modify said provisions so

as to become enforceable while preserving the Parties’ original intent.

|

|

22.

|

Counterparts.

This Agreement may be executed in separate counterparts, each of which shall be deemed an original, but all of which taken together shall constitute one and the same instrument. The parties further agree that a facsimile or portable

document file (.pdf) of a version of this Agreement or electronic signature (such as DocuSign) shall be given the same force and effect as an original signature.

|

|

23.

|

Survival. Upon

the expiration or other termination of this Agreement, the respective rights and obligations of the parties hereto shall survive such expiration or other termination to the extent necessary to carry out the intentions of the parties under

this Agreement. Additionally, acknowledges the Parties agree that these restrictions hereunder shall remain in effect regardless of any breach or alleged breach by the Company of any of its obligations herein for which Executive may have a

separate and distinct claim against the Company.

|

|

24.

|

WAIVER

OF JURY TRIAL. EXECUTIVE AND THE COMPANY KNOWINGLY, VOLUNTARILY, AND INTENTIONALLY WAIVE THE RIGHT TO A JURY TRIAL IN ANY LAWSUIT BETWEEN THEM THAT ARISES AT ANY TIME OUT OF THIS AGREEMENT OR EXECUTIVE’S EMPLOYMENT WITH THE

COMPANY, WHETHER AT LAW OR IN EQUITY, WHETHER BASED ON A CLAIM OR COUNTERCLAIM ARISING BEFORE OR AFTER THE EFFECTIVE DATE OF THIS AGREEMENT, REGARDLESS OF THE NATURE OF THE CLAIM OR COUNTERCLAIM, AND INCLUDING CLAIMS UNDER TORT, CONTRACT,

CORPORATE, AND EMPLOYMENT LAWS TO THE FULLEST EXTENT PERMITTED UNDER APPLICABLE LAW.

|

|

25.

|

Attorneys’ Fees.

In the event of a dispute arising out of the interpretation or enforcement of Section 6 of this Agreement, the prevailing party shall be entitled to recover reasonable attorneys’ fees and costs.

|

|

26.

|

Waiver of Rights.

No waiver by the Company or Executive of a right or remedy hereunder shall be deemed to be a waiver of any other right or remedy or of any subsequent right or remedy of the same kind.

|

|

27.

|

Acknowledgment of Full

Understanding. THE EXECUTIVE ACKNOWLEDGES AND AGREES THAT HE HAS FULLY READ, UNDERSTANDS AND VOLUNTARILY ENTERS INTO THIS

AGREEMENT. THE EXECUTIVE ACKNOWLEDGES AND AGREES THAT HE HAS HAD AN OPPORTUNITY TO ASK QUESTIONS AND CONSULT WITH AN ATTORNEY OF HIS CHOICE BEFORE SIGNING THIS AGREEMENT.

|

IN WITNESS WHEREOF, the parties have duly executed this Agreement as of the date first above

written.

GSE SYSTEMS, INC.

By: /s/ Kyle J. Loudermilk

Kyle J. Loudermilk, CEO

/s/ Damian DeLongchamp

Damian DeLongchamp, Executive

Exhibit A

Duties of the Vice President of Programs and Performance

|

•

|

Ensure the business success of the GSE Programs and Performance Division (the “Division”), achieving revenue, orders, gross margin, and other targets as specified by the Chief Executive Officer of the Company.

|

|

•

|

Establish effective key performance indicators (“KPIs”)

for the business and talent of the Division, and manage to those KPIs to ensure success.

|

|

•

|

Provide operational transparency to the Company’s Senior Leadership Team (“SLT”) by tracking and reporting the KPIs to the SLT weekly and providing insight to improvement of underperforming KPIs.

|

|

•

|

Provide executive leadership of the Division, meeting regularly with key leaders of the Division as well as with the SLT to ensure effective

communications, relationship building, and operational success.

|

|

•

|

Meeting regularly with key leaders of the SLT to ensure alignment of Division and overall Company efforts.

|

|

•

|

Communicate and implement the Company’s vision, mission, and overall direction internally and externally.

|

|

•

|

Contribute to and support other members of the SLT to ensure the success of the Division and the Company overall.

|

|

•

|

Evaluate the success of the organization using effective KPIs.

|

Exhibit 10.2

May 8, 2024

Damian DeLongchamp

c/o GSE Systems, Inc.

6940 Columbia Gateway Drive #470

Columbia, Maryland 21046

Re: Employment of Damian DeLongchamp (“Executive”)

Mr. DeLongchamp:

As you are aware, GSE Systems, Inc. (the “Company”) and Executive entered into that certain Employment Agreement, dated April 1, 2023 (the “Agreement”),

pursuant to which Executive is employed by the Company. All capitalized terms utilized but not defined herein shall have the meaning ascribed to them in the Agreement.

The Board of Directors of the Company has appointed you as the Chief Operating Officer and you have accepted the same. You and the Company have further

agreed (i) your Base Salary will be increased to $275,000 per annum; and (ii) you and the Board of Directors of the Company will work together in good faith to revisit the terms of your Employment Agreement and make any and all agreed upon amendments

commensurate with your new position and increased responsibilities.

All other terms of the Employment Agreement (as amended) shall remain in full force and effect.

Sincerely,

GSE SYSTEMS, INC.

By: /s/ Emmett Pepe

Emmett Pepe, CFO

ACCEPTED AND AGREED

/s/ Damian DeLongchamp

Damian DeLongchamp

Exhibit 99.1

GSE Solutions Appoints Damian

DeLongchamp as

Chief Operating Officer

COLUMBIA, MD – May 13, 2024– GSE Solutions (“GSE Systems, Inc.” or “GSE”) (Nasdaq: GVP), a leader in advanced engineering and workforce solutions that

supports the future of clean-energy production and decarbonization initiatives of the power industry, today announced the appointment of Mr. Damian DeLongchamp as Chief Operating Officer (COO).

Mr. DeLongchamp has been with GSE for more than 7 years and most recently was the Vice President of GSE Programs and Performance group. He brings over 20

years of utility experience both domestically and abroad. His experience encompasses various roles in nuclear, fossil and green energy across a wide spectrum of managerial, operational, technical and engineering responsibilities. Mr. DeLongchamp

specializes in regulatory codes and compliance and plant improvement processes.

“I am very pleased to announce the well-deserved appointment of Damian as GSE’s new COO,” said Ravi Khanna, President and CEO of GSE. “Damian has a deep

understanding of the nuclear industry and has the respect and admiration of customers and employees. He is an acknowledged engineering and programs expert with keen business acumen and has been instrumental in securing key client relationships and

contracts over his 7 years. Damian’s experience and leadership will strengthen the management team and be a key asset to the company’s strategic plans in the future.”

“I am excited about the future of GSE and honored to be appointed COO alongside such a talented group of people,” said Damian DeLongchamp, Chief Operating

Officer of GSE. “My main focus will be to identify and secure growth opportunities for GSE, aligning our efforts to nuclear industry spending. We will focus on profitability, utilization and delivery efficiency to grow the engineering business. I

look forward to working directly with Ravi to help move GSE forward.”

###

ABOUT GSE SOLUTIONS

Proven by more than 50 years of experience in the nuclear power industry, GSE knows what it takes to help customers deliver carbon-free electricity safely and

reliably. Today, GSE Solutions leverages top talent, expertise, and technology to help energy facilities achieve next-level power plant performance. GSE’s advanced Engineering and Workforce Solutions divisions offer highly specialized training, engineering design, program compliance, simulation, and technical staffing that reduce risk and optimize plant operations. With more than 1,100 installations and hundreds of

customers in over 50 countries, GSE delivers operational excellence. www.gses.com

Media Contact

Sunny DeMattio

GSE Solutions

Director of Marketing & Communications

sunny.demattio@gses.com

Direct: +1 410.970.7931

Investor Contact

Adam Lowensteiner

Vice President

Lytham Partners

gvp@lythampartners.com

Direct: +1 646.829.9702

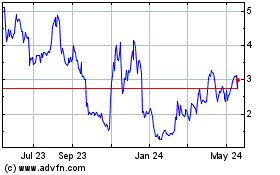

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Oct 2024 to Nov 2024

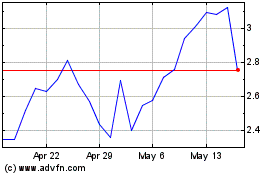

GSE Systems (NASDAQ:GVP)

Historical Stock Chart

From Nov 2023 to Nov 2024