Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

27 December 2023 - 8:35AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

HAWAIIAN HOLDINGS INC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

Alaska. HAWAIIAN TACK Contact AIRLINES Guests, Employees & Communities Delivering substantial benefits for all stakeholders The

combination of complementary domestic, international, and cargo networks is expected to enhance competition and expand choice for consumers on the West Coast and throughout the Hawaian lands Investing in employees and communities in Hawai’i As

one of Hawlargest employers, Hiwwalan Airlines has a 94-year legacy of commitment to employees, local communities, culture and the natural environment. As an integrated company, Alaska Airlines and Hawaian Arlines will continue this stewardship and

maintain a strong pce and investment in Hawa The combed company will drive - Growth in union-represented jobs - Strong operational presence in Hawai - Expansion of workforce development initiatives Investment in local communities, regenerative

tourism, and education and understanding of Hawaiian language and culture Environmental stewardship and sustainability Alaska Airlines ha committed to balding upon both song commitment to environmental stewardship, including Alaka Ainfo part path to

net by 2040 Continued commitment to sustainability in arms of greenhouse gas emission reaction and fun efficiency, waste reduction and recycling, supporting healthy ecosystems, and local sourcing Supporting materials What people are saying H TH

HAWAFI LODGING & TOURISM ASSOCIATION “...we are encouraged by their continued commitment to Hawaii’s communities, people, heritage, culture, and Aloha Spirit.” MMCC “I think it’s marvelous to have two airlines with a

tremendous track record of serving Hawaii 90 plus years combine... Mali | Kannermann, Kawall Sosting & Tour Action PUBLIC

Alaska. Investors Vad väntakt A HAWAIIAN Guests, Employees & Communes Newsroom FAQS Contact ©2003 Alaska Alem, inc. All

rights rmatýnd. Alaska HAWAIIAN Investors Compelling strategic and financial rationale This complementary combination strategicaly with Alaca Afnet longrtanding founding coins for West Coast, and croutons an imponow global platform to further

enhance Aka Airlines’ organic growth. The transaction in dover active value creation for Alaska Alines shareh providing giant oremum for Hawaiian Airlines shade Compelling transaction rationale Adds US market and

Allaska Creates Delivers Expands Combines noot Jahanced wet her petata apdo Transaction overview • Aleahirmation of $1.00 per share

for a total equity value of $10 billion provión a coming premium for an insiders » Transaction multiple of 208 tires revenue, apoioimataly one third the average of recent transactions + Approximately $235 million of expected run-rate

synergies afecta conservative est of the transaction’a ayer potential, the clude other idened upside opportunes that could be asked. + Expected to be accretive to permings in the frater outcome and accvolve to 1010 by vaar thing integration

costs, with returns above of capital No anticipated material impact on long-term balance sheet matica, with mourn to target 24 Supporting materials What people are saying J.P.Morgan TD we’re hard-pressed to identify any facets of the deal that

don’t echo our prevailing thoughts on the merits of consolidation, For those requiring a monosyllabic sound bite: this one makes sense to us.” “This transaction makes good common sense for both airlines. For Alaska, it enables

international growth in the Asia Pacific region..... For Hawaiian, it enables their passengers to fly to more places HAWAIIAN Employ Communities FAC Comect

***

Forward-Looking Statements

This communication

contains forward-looking statements subject to the safe harbor protection provided by the federal securities laws, including statements relating to the expected timing of the closing of the pending acquisition (the “Transaction”) of

Hawaiian Holdings Inc. (“Hawaiian Holdings”) by Alaska Air Group, Inc. (“Alaska Air Group”); considerations taken into account by Alaska Air Group’s and Hawaiian Holdings’ Boards of Directors in approving the

Transaction; and expectations for Alaska Air Group and Hawaiian Holdings following the closing of the Transaction. There can be no assurance that the Transaction will in fact be consummated. Risks and uncertainties that could cause actual results to

differ materially from those indicated in the forward-looking statements include: the possibility that Hawaiian Holdings shareholders may not approve the adoption of the merger agreement; the risk that a condition to closing of the Transaction may

not be satisfied (or waived); the ability of each party to consummate the Transaction; that either party may terminate the merger agreement or that the closing of the Transaction might be delayed or not occur at all; possible disruption related to

the Transaction to Alaska Air Group’s or Hawaiian Holding’s current plans or operations, including through the loss of customers and employees; the diversion of management time and attention from ongoing business operations and

opportunities; the response of competitors to the Transaction; a failure to (or delay in) receiving the required regulatory clearances for the Transaction; uncertainties regarding Alaska Air Group’s ability to successfully integrate the

operations of Hawaiian Holdings and Alaska Air Group and the time and cost to do so; the outcome of any legal proceedings that could be instituted against Hawaiian Holdings, Alaska Air Group or others relating to the Transaction; Alaska Air

Group’s ability to realize anticipated cost savings, synergies or growth from the Transaction in the timeframe expected or at all; legislative, regulatory and economic developments affecting the business of Alaska Air Group and Hawaiian

Holdings; general economic conditions including those associated with pandemic recovery; the possibility and severity of catastrophic events, including but not limited to, pandemics, natural disasters, acts of terrorism or outbreak of war or

hostilities; and other risks and uncertainties detailed in periodic reports that Alaska Air Group and Hawaiian Holdings file with the Securities and Exchange Commission (“SEC”). All forward-looking statements in this communication are

based on information available to Alaska Air Group and Hawaiian Holdings as of the date of this communication. Alaska Air Group and Hawaiian Holdings each expressly disclaim any obligation to publicly update or revise the forward-looking statements,

except as required by law.

Additional Information and Where to Find It

Hawaiian Holdings, its directors and certain executive officers are participants in the solicitation of proxies from stockholders in connection with the

Transaction. Hawaiian Holdings plans to file a proxy statement (the “Transaction Proxy Statement”) with the SEC in connection with the solicitation of proxies to approve the Transaction.

Daniel W. Akins, Wendy A. Beck, Earl E. Fry, Lawrence S. Hershfield, C. Jayne Hrdlicka, Peter R. Ingram, Michael E. McNamara, Crystal K. Rose, Mark D.

Schneider, Craig E. Vosburg, Duane E. Woerth and Richard N. Zwern, all of whom are members of Hawaiian Holdings’ board of directors, and Shannon L. Okinaka, Hawaiian Holdings’ chief financial officer, are participants in Hawaiian

Holdings’ solicitation. None of such participants owns in excess of one percent of Hawaiian Holdings’ common stock. Additional information regarding such participants, including their direct or indirect interests, by security holdings or

otherwise, will be included in the Transaction Proxy Statement and other relevant

documents to be filed with the SEC in connection with the Transaction. Please refer to the information relating to the foregoing (other than for Messrs. Akins and Woerth) under the caption

“Security Ownership of Certain Beneficial Owners and Management” in Hawaiian Holdings’ definitive proxy statement for its 2023 annual meeting of stockholders (the “2023 Proxy Statement”), which was filed with the SEC on

April 5, 2023 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1172222/000117222223000022/ha-20230405.htm#i2d8a68908cc64c37bbeca80e509abb72_31. Since the filing of the 2023 Proxy

Statement, (a) each director (other than Mr. Ingram) received a grant of 13,990 restricted stock units that will vest upon the earlier of (i) the day prior to Hawaiian Holdings’ 2024 annual meeting of stockholders or (ii) a

change in control of Hawaiian Holdings; (b) Mr. Ingram received a grant of 163,755 restricted stock units; and (c) Ms. Okinaka received a grant of 57,314 restricted stock units. In the Transaction, equity awards held by

Mr. Ingram and Ms. Okinaka will be treated in accordance with their respective severance and change in control agreements. As of December 1, 2023, Mr. Ingram beneficially owns 340,964 shares and Ms. Okinaka beneficially owns

86,903 shares. The 2023 proxy statement, under the caption “Executive Compensation—Potential Payments Upon Termination or Change in Control,” contains certain illustrative information on the payments that may be owed to

Mr. Ingram and Ms. Okinaka in a change of control of Hawaiian Holdings. As of December 1, 2023, (a) Mr. Woerth beneficially owns 37,389 shares and (b) Mr. Akins beneficially owns no shares. Mr. Akins received a

grant of 13,990 restricted stock units that will vest upon the earlier of (a) the day prior to Hawaiian Holdings’ 2024 annual meeting of stockholders or (b) a change of control.

Promptly after filing the definitive Transaction Proxy Statement with the SEC, Hawaiian Holdings will mail the definitive Transaction Proxy Statement and a

WHITE proxy card to each stockholder entitled to vote at the special meeting to consider the Transaction. STOCKHOLDERS ARE URGED TO READ THE TRANSACTION PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT

DOCUMENTS THAT HAWAIIAN HOLDINGS WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the preliminary and definitive versions of the Transaction Proxy Statement,

any amendments or supplements thereto, and any other relevant documents filed by Hawaiian Holdings with the SEC in connection with the Transaction at the SEC’s website (http://www.sec.gov). Copies of Hawaiian Holdings’ definitive

Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by Hawaiian Holdings with the SEC in connection with the Transaction will also be available, free of charge, at Hawaiian Holdings’

investor relations website (https://newsroom.hawaiianairlines.com/investor-relations), or by writing to Hawaiian Holdings, Inc., Attention: Investor Relations, P.O. Box 30008, Honolulu, HI 96820.

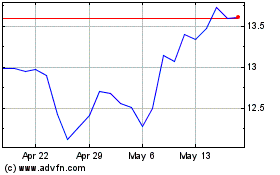

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From Apr 2024 to May 2024

Hawaiian (NASDAQ:HA)

Historical Stock Chart

From May 2023 to May 2024