Alerus Financial Corporation (Nasdaq: ALRS) and its wholly owned

subsidiary, Alerus Financial, National Association, (together,

“Alerus”) announced today they have received all regulatory

approvals necessary to complete the previously announced

acquisition of HMN Financial, Inc. (Nasdaq: HMNF) and its wholly

owned subsidiary, Home Federal Savings Bank (together, “Home

Federal”). The merger was unanimously approved by the board of

directors of each company. Stockholders of each company approved

the all-stock transaction during special meetings held September

12, 2024. Alerus and Home Federal anticipate the acquisition will

close early in the fourth quarter of 2024, subject to customary

closing conditions.

“This is an exciting time for both Alerus and Home Federal as we

merge our teams and prepare to provide an enhanced financial

services experience for our combined clients,” said Katie Lorenson,

President and CEO at Alerus. “As an experienced acquirer, we are

committed to providing a seamless transition for Home Federal’s

employees and clients and we look forward to helping them achieve

their long-term financial goals.”

“We carefully selected Alerus as our merger partner for many

reasons, but at the top of the list are our similar values and

commitment to client service,” said Brad Krehbiel, President and

Chief Executive Officer of HMNF. “Our merger with Alerus is the

right choice for our stockholders, our clients, and our employees,

and we are excited for the new opportunities this will bring to our

clients and team.”

Upon completion of the transaction, Alerus will have

approximately $5.5 billion in total assets, $3.7 billion in total

loans, $4.3 billion in total deposits, and approximately $43.1

billion in assets under administration and management. The addition

of Home Federal’s 12 branches in Rochester, Minnesota and

throughout southern Minnesota, one branch in Iowa, and one branch

in Wisconsin, will expand Alerus’ footprint to new markets and

increase its total number of branches to 29 locations throughout

the Midwest and Arizona.

About Alerus Financial Corporation

Alerus Financial Corporation (Nasdaq: ALRS) is a commercial

wealth bank and national retirement services provider with

corporate offices in Grand Forks, North Dakota, and the

Minneapolis-St. Paul, Minnesota metropolitan area. Through its

subsidiary, Alerus Financial, N.A., Alerus provides diversified and

comprehensive financial solutions to businesses and consumer

clients, including banking, wealth services, and retirement and

benefits plans and services. Alerus provides clients with a primary

point of contact to help fully understand the unique needs and

delivery channel preferences of each client. Clients are provided

with competitive products, valuable insight, and sound advice

supported by digital solutions designed to meet the clients’

needs.

Alerus has banking and wealth offices in Grand Forks and Fargo,

North Dakota, the Minneapolis-St. Paul, Minnesota metropolitan

area, and Phoenix and Scottsdale, Arizona. Alerus Retirement and

Benefits serves advisors, brokers, employers, and plan participants

across the United States.

About HMN Financial, Inc.

HMN Financial, Inc. (Nasdaq: HMNF) and Home Federal Savings Bank

are headquartered in Rochester, Minnesota. Home Federal operates

twelve full-service offices in Minnesota located in Albert Lea,

Austin, Eagan, Kasson, La Crescent, Owatonna, Rochester (4), Spring

Valley and Winona, one full-service office in Marshalltown, Iowa,

and one full-service office in Pewaukee, Wisconsin. Home Federal

also operates a loan origination office located in La Crosse,

Wisconsin.

Special Note Concerning Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, statements concerning

plans, estimates, calculations, forecasts and projections with

respect to the anticipated future performance of Alerus Financial

Corporation (“Alerus”) and HMN Financial, Inc. (“HMNF”) and

certain plans, expectations, goals, projections and benefits

relating to the merger of HMNF with and into Alerus (the “Merger”),

all of which are subject to numerous assumptions, risks and

uncertainties. These statements are often, but not always,

identified by words such as “may,” “might,” “should,” “could,”

“predict,” “potential,” “believe,” “expect,” “continue,” “will,”

“anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,”

“would,” “annualized,” “target” and “outlook,” or the negative

version of those words or other comparable words of a future or

forward-looking nature. Examples of forward-looking statements

include, among others, statements Alerus makes regarding the

ability of Alerus and HMNF to complete the transactions

contemplated by the agreement and plan of merger (the “Merger

Agreement”), including the parties’ ability to satisfy the

conditions to the consummation of the Merger, statements about the

expected timing for completing the Merger, the potential effects of

the proposed Merger on both Alerus and HMNF, and the possibility of

any termination of the Merger Agreement, and any potential downward

adjustment in the exchange ratio.

Forward-looking statements are not historical facts but instead

express only management’s beliefs regarding future results or

events, many of which, by their nature, are inherently uncertain

and outside of management’s control. It is possible that actual

results and outcomes may differ, possibly materially, from the

anticipated results or outcomes indicated in these forward-looking

statements. In addition to factors disclosed in reports filed by

Alerus and HMNF with the SEC, risks and uncertainties for Alerus,

HMNF and the combined company that may cause actual results or

outcomes to differ materially from those anticipated include, but

are not limited to: (1) the possibility that any of the

anticipated benefits of the proposed Merger will not be realized or

will not be realized within the expected time period; (2) the

risk that integration of HMNF’s operations with those of Alerus

will be materially delayed or will be more costly or difficult than

expected; (3) the parties’ inability to meet expectations

regarding the timing of the proposed Merger; (4) changes to

tax legislation and their potential effects on the accounting for

the Merger; (5) the failure to satisfy other conditions to

completion of the proposed Merger; (6) the failure of the

proposed Merger to close for any other reason; (7) diversion

of managements’ attention from ongoing business operations and

opportunities due to the proposed Merger; (8) the challenges

of integrating and retaining key employees; (9) the effect of

the announcement of the proposed Merger on Alerus’, HMNF’s or the

combined company’s respective customer and employee relationships

and operating results; (10) the possibility that the proposed

Merger may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; (11) the

amount of HMNF’s stockholders’ equity as of the closing date of the

Merger and any potential downward adjustment in the exchange ratio;

(12) the dilution caused by Alerus’ issuance of additional shares

of Alerus’ common stock in connection with the Merger; and (13)

changes in the global economy and financial market conditions and

the business, results of operations and financial condition of

Alerus, HMNF and the combined company. Please refer to Alerus’

Annual Report on Form 10-K for the year ended

December 31, 2023 filed on March 8, 2024 and HMN’s Annual

Report on Form 10-K/A for the year ended December 31, 2023 filed

with the SEC on March 19, 2024, as well as both parties’ other

filings with the SEC, for a more detailed discussion of risks,

uncertainties and factors that could cause actual results to differ

from those discussed in the forward-looking statements.

Any forward-looking statement included in this report is based

only on information currently available to management and speaks

only as of the date on which it is made. Neither Alerus nor HMNF

undertakes any obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise, except as required by law.

Kris Bevill, Public Relations

701.280.5076 (Office) | 701.306.8561 (Cell)

kris.bevill@alerus.com

Melissa Von Arx, Public Relations

507.535.1297 (Office)

melissa.vonarx@hfsb.com

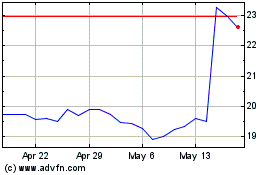

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

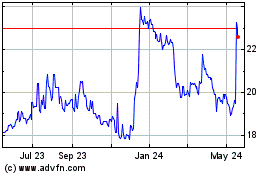

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Feb 2024 to Feb 2025