false 0001835579 0001835579 2024-05-23 2024-05-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 23, 2024

IKENA ONCOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40287 |

|

81-1697316 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

| Ikena Oncology, Inc. 645 Summer Street, Suite 101 |

| Boston, Massachusetts 02210 |

| (Address of principal executive offices, including zip code) |

(857) 273-8343

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trade Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

IKNA |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. |

On May 23, 2024, the Board of Directors (the “Board”) of Ikena Oncology, Inc. (the “Company”) approved a plan to discontinue the clinical development of IK-930, continue clinical development of IK-595 and reduce its current workforce by approximately 53% (the “Restructuring Plan”). On May 28, 2024, the Company announced the Restructuring Plan and the Board’s approval of a process to explore, review and evaluate a range of potential strategic options.

The Restructuring Plan will result in the termination of approximately 18 employees and is expected to be completed in the third quarter of 2024. Following the Restructuring Plan, the Company expects to have approximately 16 full-time employees.

The Company expects to incur costs related to the Restructuring Plan during the three months ended June 30, 2024 related to employee severance and related termination benefits, which are expected to result in approximately $1.2 million in cash expenditures.

| Item 7.01 |

Regulation FD Disclosure. |

On May 28, 2024, the Company issued a press release announcing the Restructuring Plan. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

On May 28, 2024, the Company updated its corporate presentation, attached as Exhibit 99.2 to this Current Report on Form 8-K. The corporate presentation will also be available in the investor relations section of the Company’s website at https://www.ikenaoncology.com/.

The information contained in Item 7.01 of this Current Report on Form 8-K (including Exhibits 99.1 and 99.2) is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

On May 28, 2024, the Company announced the Board’s approval of a process to explore, review and evaluate a range of potential strategic options available to the Company, including without limitation, an acquisition, merger, reverse merger, sale of assets, strategic partnerships or other transactions. There can be no assurance of completion of any particular course of action or a defined timeline for completion. The Company does not expect to make further public comment regarding these matters unless and until the Board has approved a specific option or otherwise concludes its review of strategic options.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon current plans, estimates and expectations of management that are subject to various risks and uncertainties that could cause actual results to differ materially from such statements. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “may,” “will,” “should,” “plan,” “could,” “may,” “continue,” “target,” “contemplate,” “estimate,” “forecast,” “guidance,” “predict,” “possible,” “potential,” “pursue,” “likely,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. All statements, other than historical facts, including statements regarding the Company’s expectations related to the Restructuring Plan and the Board’s exploration of strategic options are forward-looking statements. These forward-looking statements are based on management’s current expectations. Actual results could differ from those projected in any forward-looking statements due to several risk factors, including but not limited to the important factors discussed under the caption “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and its other filings with the U.S. Securities and Exchange Commission. Any forward-looking statements represent management’s estimates as of this date and the Company undertakes no duty to update these forward-looking statements, whether as a result of new information, the occurrence of current events, or otherwise, unless required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Ikena Oncology, Inc. |

|

|

|

| Date: May 28, 2024 |

|

By: |

|

/s/ Mark Manfredi |

|

|

|

|

Mark Manfredi, Ph.D. |

|

|

|

|

President and Chief Executive Officer |

Exhibit 99.1

Ikena Oncology Announces Strategic Update

Ikena to discontinue development of IK-930

IK-595 dose escalation continues in RAS and RAF mutant cancers; Encouraging PK and PD profile shown

to date

Ended first quarter with $157.3 million; Exploring strategic options to maximize shareholder value

BOSTON, May 28, 2024, – Ikena Oncology, Inc. (Nasdaq: IKNA, “Ikena,” “Company”) today announced discontinuation of the clinical IK-930 program, the Company’s TEAD1- selective Hippo pathway inhibitor and continued clinical development of IK-595, a novel

MEK-RAF molecular glue. Concurrently, Ikena is evaluating strategic options for both the Company and its development pipeline.

“Ikena is dedicated to thoughtfully putting our capital to work towards impactful treatments for patients, and in doing so building value for our

shareholders. Together with our board of directors, we made the difficult decision to wind down the IK-930 program. Going forward, we believe that IK-930’s profile

may enable combination opportunities with other targeted agents through partnerships,” commented Mark Manfredi, Ph.D., Chief Executive Officer of Ikena. “Our MEK-RAF molecular glue, IK-595, continues to progress rapidly in the clinic with encouraging early PK and PD data which supports a potentially differentiated therapeutic index. This is key to treating the broad population of patients

suffering from RAS and RAF mutant cancers where other MEK inhibitors have failed.”

Pipeline & Corporate Updates

IK-930: TEAD1-Selective Hippo Pathway Inhibitor

| |

• |

|

Based on a review of clinical data to date, available resources, and the Company’s strategic priorities, the

Company decided to discontinue development of IK-930 |

| |

• |

|

The IK-930 Phase 1 program will begin winddown activities; treatment will

continue for patients enrolled to date who have derived benefit |

| |

• |

|

The Company will seek strategic options for the program, including potential partners for development of IK-930 in combination with other targeted agents |

IK-595: MEK-RAF Molecular Glue

| |

• |

|

The first two cohorts in the Phase 1 study of IK-595 in patients with RAS

and RAF mutant cancers have cleared; backfilling in select cohorts is planned for the second half of 2024 |

| |

• |

|

Promising early pharmacokinetics (PK) and pharmacodynamics (PD) activity has been observed, with dose dependent

exposure and target modulation measured in the blood |

| |

• |

|

Reached above 80% pERK inhibition at 4 hours post dosing to date, with above 60% inhibition sustained through 24

hours; dose escalation continues |

Corporate Updates

| |

• |

|

In connection with the discontinuation of IK-930 development, the Company

is executing a workforce reduction of approximately 53% |

| |

• |

|

$157 million in cash, cash equivalents and marketable securities as of March 31, 2024

|

| |

• |

|

Concurrently with the continuation of IK-595 development activities,

Ikena has begun to explore a range of available strategic alternatives |

“Ikena is in a strong position to create value through multiple avenues. We have been diligent with our

capital expenditure, fortifying a cash position that may unlock new strategic opportunities for the company, in addition to the parallel partnership potential of our pipeline,” said Jotin Marango, M.D., Ph.D., Ikena’s Chief Financial

Officer.

About Ikena Oncology

Ikena Oncology® develops differentiated therapies for patients in need that target nodes of cancer growth, spread, and therapeutic resistance. Ikena aims to utilize their depth of institutional knowledge and

breadth of tools to efficiently develop the right drug using the right modality for the right patient. To learn more, visit www.ikenaoncology.com.

Forward-Looking Statements

This press release contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, implied and express statements regarding: the timing and advancement of our targeted oncology programs,

including the timing of updates; our expectations regarding the therapeutic benefit of our targeted oncology programs; our ability to efficiently discover and develop product candidates; our ability to obtain and maintain regulatory approval of our

product candidates; expectations with respect to projected cash runway; the anticipated results of our organizational changes; the implementation of our business model; and strategic plans for our business and product candidates. The words

“may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any

forward-looking statements in this press release are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially

from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, those risks and uncertainties related to the timing and advancement of our targeted oncology programs; our expectations

regarding the therapeutic benefit of our targeted oncology programs; our ability to efficiently discover and develop product candidates; the implementation of our business model, and strategic plans for our business and product candidates, the

sufficiency of the Company’s capital resources to fund operating expenses and capital expenditure requirements and the period in which such resources are expected to be available, and other factors discussed in the “Risk Factors”

section of Ikena’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which is on file with the Securities and Exchange Commission (SEC), as updated by any subsequent SEC filings. We

caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events,

conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. Any forward-looking statements contained in this press

release represent our views only as of the date hereof and should not be relied upon as representing its views as of any subsequent date. We explicitly disclaim any obligation to update any forward-looking statements.

Ikena Contact:

Rebecca Cohen

rcohen@ikenaoncology.com

Exhibit 99.2 ® Corporate Presentation Second Quarter 2024

Confidential 1

Forward Looking Statement Any statements in presentation other than

statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, statements about future expectations, plans and prospects for Ikena Oncology, Inc. including statements regarding the market

and therapeutic potential of IK-595, the size of various patient populations, the expectation that clinical activity will be consistent with preclinical data, the potential partnerships or combinations of IK-595 and other statements containing the

words “will,” “would,” “continue,” “expect,” “should,” “anticipate” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on numerous assumptions and assessments made in light of Ikena’s experience and perception of historical trends, current conditions, business strategies, operating

environment, future developments, geopolitical factors and other factors it believes appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances

that will occur in the future. The various factors that could cause Ikena’s actual results, performance or achievements, industry results and developments to differ materially from those expressed in or implied by such forward-looking

statements, include, but are not limited to, its ability to obtain funding for its operations necessary to complete further development and commercialization of its product candidates, the rate and degree of market acceptance of its product

candidates, its reliance on third-parties, including the ability and willingness of its third-party strategic collaborators to continue research and development activities relating to its development candidates and product candidates, and its

ability to contract with third-party suppliers and manufacturers and their ability to perform adequately. No assurance can be given that such expectations will be realized and persons reading this communication are, therefore, cautioned not to place

undue reliance on these forward-looking statements. Additional risks and information about potential impacts of financial, operational, economic, competitive, regulatory, governmental, technological, and other factors that may affect Ikena can be

found in Ikena’s filings, including its most recently filed Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission, the contents of which are not incorporated by reference into, nor do they form part of, this

communication. Forward-looking statements in this communication are based on information available to us, as of the date of this communication and, while we believe our assumptions are reasonable, actual results may differ materially. Subject to any

obligations under applicable law, we do not undertake any obligation to update any forward-looking statement whether as a result of new information, future developments or otherwise, or to conform any forward-looking statement to actual results,

future events, or to changes in expectations. Confidential 2 2

Ikena is Focused on Differentiated Therapies for RAS and RAF Altered

Cancers Advancing a novel MEK-RAF molecular glue with the potential to transform outcomes in areas of high unmet need Candidate Interventions IND Enabling Phase 1 Later Stage Development Target Indications Monotherapy RAS and RAF altered cancers

IK-595 MEK-RAF Combination Preclinical synergies with multiple agents IK-595 is designed to overcome the limitations of existing MEK and next gen MEK-RAF inhibitors with broad potential for patients with mutations across the RAS field both as a

monotherapy and in combination IK-595 is designed with a greater therapeutic index and strong binding glue of MEK-RAF complex Dose escalation ongoing; early PK and PD data encouraging toward potential optimized therapeutic window; recruiting RASm

and RAFm patients Company ended Q1 2024 with >$157M in cash with ongoing efforts to maximize shareholder value including potential strategic alternatives 3 1 ACS and https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3457779/

Significant Unmet Need in RAS and RAF Altered Cancers Delivering a BIC

MEKi could transform the armamentarium of MAPK targeted therapies Pancreatic cancer is diagnosed in ~500,000 patients annually worldwide, with ~90% harboring KRAS mutations Both incidence and mortality have increased over the last 3 decades

worldwide Effective treatment options are limited resulting in less than 5% of advanced patients alive at 2,4,5 5 years underscoring the significant unmet need Colorectal cancer is the third most common cancer; projected to increase to 3.2 million

new 1 cases worldwide by 2040 & ~40-55% harboring KRASm and/or NRASm RAS/RAF alterations have also been implicated in acquired resistance to EGFRi in CRC As third leading cause of cancer deaths, outcomes in advanced disease are poor with a 15%

1,2 survival rate at 5 years BRAF II/III and CRAFm represent targeted populations across multiple tumor types (~1.4% overall with higher frequency in melanoma, NSCLC and CRC) where IK-595 has a potentially unique MoA advantage in multiple

indications that are 3 completely unaddressed by existing therapies 4 1 2 3 Multi source: Arch Med Sci 2022, Frontiers 2022, `Morgan E, et al. Gut 2023;72:338–344, Nature. 2012 Jun 28;486(7404):537-40; CA Cancer J Clin.

2020;70(03):145–164; Multi source: Exp Biol Med 2021, 4 Cancer Discov. 2017 Aug;7(8):818-831; Multi source: Clin Med. 2024 Apr 4;13(7):2103, World J Gastroenterol. 2022 Aug 28; 28(32): 4698–4715., A Cancer J Clin. 2021

May;71(3):209-249.

Unique MoA and Differentiated Profile Unlock Efficacy Opportunities

Unachievable with Existing Therapies st Preclinical data shows potential for superiority to 1 gen MEKi, Pan-RAFi and MEK-RAF combinations IK-595 MOA DESIGN FOR SUPERIOR PATHWAY INHIBITION IK-595 glues MEK & RAF in an Stabilizes MEK and all RAF

isoforms in an inactive conformation inactive complex to prevent CRAF bypass and kinase-independent • Inhibits MEK and ERK1/2 phosphorylation CRAF function • Alleviates therapeutic resistance through CRAF-mediated bypass • Less

susceptible to ARAF-mediated resistance RASm TUNED PK ENABLES BREAKS IN NORMAL TISSUE CRAF PK profile designed to maximize human therapeutic index A/B- CRAF MEK RAF IK- 1/2 MEK 595 IK-• Intermittently high exposures to drive antitumor activity

while sparing healthy cells 1/2 595 AIMING TO ADDRESS BROAD UNMET CLINICAL NEED Clinical opportunity in indications unaddressed with current therapies ERK 1/2 • NRASm, KRASm, other MAPK-dependent cancers such as BRAFm type II/III or CRAFm

• Combines synergistically with inhibitors to RAS, compensatory pathways and chemotherapies Confidential 5 5

IK-595 Stabilizes MEK-RAF in an Inactive Conformation IK-595 Co-Crystal

Structure with MEK-BRAF Complex αC-helix locked in an inactive form Inactive confirmation designed to prevent RAF dimer formation; essential for downstream signaling in KRAS/NRAS tumors Confidential 6 6

IK-595 Stabilized MEK-CRAF, MEK-BRAF, and MEK-ARAF Complexes in Cells

Mass spectrometry characterization of MEK/RAF interactions ND: Not detected 4 3 2 1 0 Compounds treated at IC 90 IK-595 also stabilized Class I, II and III BRAF mutant proteins in inactive complex with MEK Confidential 7 7 DMSO Trametinib VS-6766

Trametiglue IK-595 CRAF-MEK Interaction (Fold Induction)

IK-595 Demonstrates Robust and Prolonged pMEK and pERK Inhibition pERK

Inhibition is Downstream of MEK and Prolonged Inhibition Demonstrates Lack of Feedback Activation pMEK Inhibition Indicative of Blocking RAF Activity 5637 (CRAF amplified Bladder) 0.5 In vitro MEK Phosphorylation (HCT116 cells) 0.4 20 0.3 15 0.2 10

0.1 4 0.0 1 10 100 3 Time (Hours) 2 Trametinib Avutomentinib IK-595 1 *Compounds dosed at pERK IC 90 0 NCI-H2122 (KRASmut Lung) AsPC1 (KRASmut Pancreatic) Hours 4 48 4 48 4 48 4 48 4 48 4 48 4 48 4 48 4 48 0.5 DMSO IK-595 Avutomentinib Trametinib

Trametiglue 0.5 PD901 Binimetinib Selumetinib Cobimetinib 0.4 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.0 0.0 1 10 100 1 10 100 Time (Hours) Time (Hours) Confidential 8 8 Normalized pMEK to tMEK Ratio Normalized pERK to tERK Ratio Normalized pERK to tERK Ratio

Normalized pERK to tERK Ratio

IK-595 Dosed Intermittently Maintained In Vivo Efficacy while Improving

Tolerability Long-term IK-595 Intermittent Dosing Well Tolerated Challenging Model Showing Efficacy and Tolerance at Multiple Doses Tumor Volume Tumor Volume Body Weight Change AsPC-1 KRAS G12D PDAC AsPC-1 KRAS G12D PDAC AsPC-1 KRAS G12D PDAC 2000

2000 Vehicle 30 Vehicle IK-595 3 mg/kg IK-595 2mg/kg QD 1500 IK-595 6 mg/kg QOD 1500 20 IK-595 6mg/kg QOD 1000 10 1000 500 0 500 0 -10 0 0 5 10 15 20 25 0 5 10 15 20 25 0 20 40 60 80 Days of Treatment Days of Treatment Days of Treatment IK-595 3

mg/kg QD IK-595 6 mg/kg QOD Vehicle Day 21 Day 21 Body Weight Change Day 21 AsPC-1 KRAS G12D PDAC 10 0 -10 -20 0 20 40 60 80 Days of Treatment Confidential 9 9 Mean tumor volume 3 (mm ) +/- SEM Mean % Body weight change +/-SEM Mean tumor volume 3

(mm ) +/- SEM Body weight change (%)

IK-595 Demonstrated Antitumor Activity Across Tumor Models Bearing

RAS/MAPK Pathway Alterations 5-Day Cell VIability Screen Tumor Responses IK-595 CDX and PDX Models ✱✱✱ RAS/RAF Wild-type 10 KRAS G12C ✱ KRAS G12D KRAS G12V ✱✱✱✱ 150000 5 KRAS G12R KRAS G12S

✱✱✱✱ KRAS G13D 100000 KRAS K117N 0 NRAS Mutant BRAF Class II 50000 BRAF Class III BRAF Fusion -10 -20 NF1 Mutant 0 Confidential 10 10 RAS Wild-Type KRASmut NRASmut BRAFV600 Non-BRAFV600 CRAF Alteration EGFRmut

PI3K-PTENmut Percent Inhibition (AUC) Relative Tumor Volume CRC AML NSCLC NSCLC NSCLC NSCLC PDAC CRC SKCM PDAC SKCM NSCLC NSCLC AML PDAC SKCM AML SKCM NSCLC NSCLC NSCLC BLCA NSCLC PDAC NSCLC CRC BLCA NSCLC HNSC SKCM

Broad IK-595 Antitumor Activity Across MAPK Pathway Mutant Cancer

Models AsPC-1 NCI-H441 ME-21-0234 LU-01-1397 LU-01-1514 NCI-H441 Tumor Growth ME-21-0234 Tumor Growth LU-01-1397 Tumor Growth LU-01-1514 Tumor Growth KRAS G12V NSCLC NRAS G12D SKCM BRAF Class II (G469A) NSCLC BRAF Fusion NSCLC KRAS G12D Pancreatic

KRAS G12V NSCLC NRAS G12D SKCM BRAF Class II (G469A) NSCLC BRAF Fusion NSCLC 1500 Vehicle 2500 2500 1500 2000 Vehicle Vehicle Vehicle Vehicle IK-595 6 mg/kg Q0D 2000 2000 IK-595 6mg/kg QOD IK-595 6 mg/kg Q0D IK-595 6 mg/kg QOD IK-595 6 mg/kg Q0D

1000 1500 1000 1500 1500 1000 1000 1000 500 500 500 500 500 0 0 0 0 0 0 10 20 30 0 10 20 30 0 10 20 30 0 10 20 30 0 5 10 15 Days of Treatment Days of Treatment Days of Treatment Days of Treatment Days of Treatment HCT-116 PSN-1 CR14818 HN-13-0336

SKMES-1 PSN-1 Tumor Growth HN-13-0336 Tumor Growth SKMES-1 Tumor Growth CR14818 Tumor Growth KRAS G12R PDAC NRAS Q61 CRC BRAF Class III HNSCC NF1 Mutant NSCLC KRAS G13D CRC KRAS G12R PDAC NRAS Q61 CRC BRAF Class III NSCLC NF1 NSCLC 2500 Vehicle 2000

2500 1500 1500 Vehicle 2000 Vehicle Vehicle IK-595 6 mg/kg Q0D Vehicle IK-595 6 mg/kg QOD 2000 IK-595 6 mg/kg Q0D IK-595 6 mg/kg QOD IK-595 6 mg/kg QOD 1500 1500 1000 1000 1500 1000 1000 1000 500 500 500 500 500 0 0 0 0 0 0 5 10 15 20 25 0 10 20 30

40 0 5 10 15 20 0 5 10 15 20 0 10 20 30 Days of Treatment Days of Treatment Days of Treatment Days of Treatment Days of Treatment Confidential 11 11 Mean tumor volume Mean tumor volume 3 3 (mm ) +/- SEM (mm ) +/- SEM

Superior Anti-tumor Activity Compared to other MAPK Pathway Inhibitors

st Superior activity vs. mutant-specific RAS inhibitors Superior activity vs. 1 Gen MEK inhibitors HCT-116 KRAS G13D CRC Rat Model: Dose / PK KRAS G12C Inhibitor KRAS G12D Inhibitor NCI-H2122 KRAS G12C NSCLC AsPC-1 KRAS G12D PDAC 8000 Vehicle

✱✱✱✱ ✱ ✱ ✱ ✱ 120 120 Trametinib 0.06 mg/kg QD • Trametinib plasma 6000 IK-595 0.3mg/kg QOD 100 100 concentration matches human PK at MTD 80 4000 80 • IK-595 dose chosen for 60

plasma concentration 60 2000 exceeding IC for ~3h 90 40 based on <3x MTD 40 established in 28d rat 0 tox study 0 5 10 15 20 25 Days of Treatment Superior activity vs. 2nd Gen MEK inhibitors Superior activity vs. pan-RAS inhibitor Avutometinib

NST-628 IMM-1-104 KRAS Mutant NRAS Mutant BRAF Mutant 10000 ✱ ✱ ✱ ✱ 10000 ✱ ✱ ✱ ✱ ✱ ✱ ✱ ✱ 100000 10000 ✱✱✱✱ ✱ 10000✱ 100

1000 1000 10000 1000 1000 10 1000 100 100 100 100 100 1 10 10 10 10 10 1 1 1 0.1 1 1 0.1 0.1 0.1 0.1 0.1 IK-595 Avutometinib IK-595 NST-628 0.01 IK-595 RMC-7977 IK-595 IMM-1-104 IK-595 RMC-7977 IK-595 RMC-7977 Confidential 12 12 IK-595 Sotorasib

IK-595 MRTX1133 IC (nM) 3 50 Tumor Volume (mm ) IC (nM) 50 IC (nM) 50 IC (nM) 50 Percent Tumor Growth Inhibition IC (nM) 50 Percent Tumor Growth Inhibition IC (nM) 50

Synergy of IK-595 with Multiple Combo Agents; Broad Expansion

Opportunities Beyond Monotherapy In-Pathway RAS Inhibitors Mediators of Resistance Chemotherapy Combinations KRAS G12C Inhibitors BI-3406 (SOS1 Inhibitor) Lapatinib (EGFR/HER2 Inhibitor) Tucatinib (HER2 Inhibitor) Paclitaxel Loewe Sum of Synergy

Score Loewe Sum of Synergy Score Loewe Sum of Synergy Score Loewe Sum of Synergy Score Loewe Sum of Synergy Score 0 10 20 30 40 50 0 20 40 60 80 0 5 10 15 20 25 0 20 40 60 80 100 0 10 20 30 RMC-6291 NCIH1373 SKCO-1 SKCO-1 HPAC Sotorasib HPAF LS180

LS180 HPAF-II Adagrasib NCIH2122 HCT-116 HCT-116 Divarasib DANG MRTX1133 (KRAS G12D Inhibitor) RMC-4550 (SHP2 Inhibitor) Everolimus (mTOR Inhibitor) Inavolisib (PI3Kα Inhibitor) Gemcitabine Loewe Sum of Synergy Score Loewe Sum of Synergy Score

Loewe Sum of Synergy Score Loewe Sum of Synergy Score Loewe Sum of Synergy Score 0 20 40 60 0 10 20 30 0 20 40 60 80 0 10 20 30 40 50 0 5 10 15 20 25 NCIH1373 NCI-H1373 NCI-H2122 PSN-1 AsPC-1 HPAF NCI-H2122 DANG NCI-H1373 HPAC NCIH2122 MiaPACA-2

HPAF AsPC-1 RMC-7977 (Pan-RAS Inhibitor) LX-254 (Pan-RAF Inhibitor) Loewe Sum of Synergy Score Loewe Sum of Synergy Score 0 20 40 60 80 100 0 10 20 30 40 DAN-G HPAF PSN-1 NCI-H2122 Mia-PACA-2 AsPC-1 Confidential 13 13

st nd IK-595: Potentially Optimal MAPK Combo Partner, Outperformed 1

and 2 Gen MEKi Preclinically Opportunity for combination with G12Ci and broader RASi field as it develops NCI-H358 KRAS G12C NSCLC Sotorasib Synergy Sotorasib Synergy Tumor Growth Apotosis NCI-H358 KRAS G12C NSCLC Tumor Growth NCI-H358 KRAS G12C

NSCLC NCI-H358 KRAS G12C NSCLC Apoptosis Proliferation 60 1500 ✱ ✱ 1000 100 ✱ ✱ ✱✱ 500 40 90 200 80 20 70 60 0 50 0 0 10 20 30 Days of Treatment Vehicle Sotorasib 10mg/kg IK-595 0.3 mg/kg Sotorasib 10mg/kg +

IK-595 0.3mg/kg Beneficial antitumor activity also observed when IK-595 was combined with G12C on-state inhibitors, G12D inhibitors and pan-KRAS inhibitors as well as in G12C resistant tumor models Confidential 14 14 DMSO Sotorasib IK-595 +

Sotorasib Trametinib + Sotorasib Avutometinib + Sotorasib IK-595 Trametinib Avutometinib Bliss Sum of Synergy Score Apoptotic Cells (%) Tumor Volume 3 (Mean +/- SEM, mm )

Combo Partner of Choice: IK-595 Added Significant Preclinical Tumor

Benefit in Chemo-Resistant PDAC Tumor Growth Tumor Growth PSN-1 KRAS G12R PDAC PSN-1 KRAS G12R PDAC 2500 2000 Vehicle Vehicle IK-595 Irinotecan 2000 Gemcitabine 1500 1500 1000 PSN-1 KRAS G12R PDAC Model IK-595 1000 500 500 Adding IK-595 after tumor

growth 0 0 increases, in multiple chemo 0 10 20 30 40 0 10 20 30 Days of Treatment regimens, include gemcitabine, 1st Days of Treatment line SOC in PDAC, triggered tumor Tumor Growth Tumor Growth PSN-1 KRAS G12R PDAC PSN-1 KRAS G12R PDAC regression

2500 2000 Vehicle Vehicle IK-595 Gemcitabine + IK-595 Oxaliplatin 2000 Abraxane 1500 1500 1000 1000 500 500 0 0 0 10 20 30 40 0 10 20 30 40 Days of Treatment Days of Treatment Confidential 15 15 Tumor Volume Tumor Volume 3 (Mean +/- SEM, mm ) 3

(Mean +/- SEM, mm ) Tumor Volume 3 (Mean +/- SEM, mm ) Tumor Volume 3 (Mean +/- SEM, mm )

First-in-Human Study of IK-595 in Patients with RAS or RAF Altered

Advanced Solid Tumors Clinical Strategy Capitalizes on BIC Profile to Explore Early PoC in MEKi Differentiated Indications Dose Expansion Dose Escalation Dose expansion guided by dose escalation and Advanced Solid Tumor Pts Harboring potential

backfill populations Alterations in the RAS-MAPK Pathway • Starting dose 0.5 mg QoD, currently evaluating 2mg QoD NRASm, including e.g. CRC, melanoma • Safety and Tolerability, RP2D and/or MTD of IK-595 • Pharmacokinetics •

Pharmacodynamics in blood and tumor KRASm, including e.g. PDAC, CRC, NSCLC • Antitumor activity per RECIST 1.1 • Flexibility for dose schedule exploration to optimize therapeutic profile Tumor agnostic, e.g. BRAFm type II/III or •

Option to Backfill dose cohorts with targeted expansion CRAFm indications Potential combinations include other targeted therapies in RAS/RAF pathway, mAbs, chemo Ongoing Enrollment in Phase 1 Dose-Escalation Trial of IK-595 as a Monotherapy and in

Combination Confidential 16 16 NCT06270082, Study IK-595-001

Preliminary PK and PD Data Supports Intermittent Dosing and Optimized

Therapeutic Index Robust pathway inhibition observed with recovery in dosing interval Achieved transient, high plasma Dose dependent pERK suppression with concentrations to drive pathway inhibition recovery during dosing interval with recovery

before next dose 1 IK-595 at 1mg approaches Emax of approved MEKi Data from 2mg cycle 1 day 1 pending Preliminary data from the ongoing Study IK-595-001, data cut 05/23/2024 Confidential 17 17 1 Clin Cancer Res 2010 Mar 1;16(5):1613-23.

Preliminary Human PK/PD Consistent with Translational Data in Mouse

Models • IK-595 demonstrated tumor PD and anti-tumor activity in some mouse xenograft models at doses where blood pERK inhibition is >60% 2-4 Hrs after dosing (shaded box) • Doses associated with antitumor activity in mouse models

Data suggest that clinical doses ≥ 2mg could potentially achieve the level of PD associated with antitumor activity in mouse models Confidential 18 18

Ikena is Aims to Address Key Gap in the Targeted RAS Pathway Treatment

Ecosystem Advancing a novel MEK-RAF molecular glue with the potential to transform outcomes in areas of high unmet need Efficient Potential Fast to POTENTIAL BEST IN CLASS MEK/RAFI DATA DRIVEN CLINICAL STRATEGIES Market Strategies as a Monotherapy

• Confirm BIC profile; optimize ✓ Developed to deliver an dose and schedule: optimized therapeutic index Rapid Initiation of • PK/PD/Safety/Efficacy in Combination Strategy to targeted indications ✓ Designed to overcome

Maximize Asset Potential • Monotherapy Testing in RASm, resistance to MAPK targeted RAFm cancers therapies High Unmet Need and • Combinations with potential to Meaningful Market ✓ Potential to rise as broaden indications and move

to Opportunities to Drive combination partner of choice earlier lines Potential Value Ikena ended Q1 2024 with >$157M in cash IK-595 is well positioned for potential near-term value inflections 19

® Confidential 20

v3.24.1.1.u2

Document and Entity Information

|

May 23, 2024 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001835579

|

| Document Type |

8-K

|

| Document Period End Date |

May 23, 2024

|

| Entity Registrant Name |

IKENA ONCOLOGY, INC.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-40287

|

| Entity Tax Identification Number |

81-1697316

|

| Entity Address, Address Line One |

Ikena Oncology, Inc.

|

| Entity Address, Address Line Two |

645 Summer Street

|

| Entity Address, Address Line Three |

Suite 101

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02210

|

| City Area Code |

(857)

|

| Local Phone Number |

273-8343

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

IKNA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

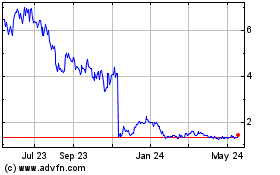

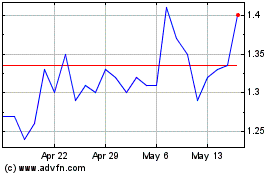

Ikena Oncology (NASDAQ:IKNA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ikena Oncology (NASDAQ:IKNA)

Historical Stock Chart

From Jul 2023 to Jul 2024