As filed with the Securities and Exchange Commission

on February 2, 2024

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMMUNOME, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

77-0694340 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

665 Stockton Drive, Suite 300

Exton, PA 19341

(610) 321-3700

(Address of Principal Executive Offices)

Immunome, Inc. 2020 Equity Incentive Plan

Immunome, Inc. 2020 Employee Stock Purchase

Plan

Individual Nonqualified Stock Option Award

(Inducement Grant)

(Full title of the plan)

Clay Siegall, Ph.D.

Chief Executive Officer

Immunome, Inc.

665 Stockton Drive, Suite 300

Exton, PA 19341

(610) 321-3700

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Thomas A. Coll, Esq.

Carlos Ramirez, Esq.

Dylan Kornbluth, Esq.

Cooley LLP

10265 Science Center Drive

San Diego, California 92121

Tel: (858) 550-6000

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

|

|

Accelerated filer |

|

¨ |

| |

|

|

|

|

| Non-accelerated filer |

|

x |

|

|

|

Smaller reporting company |

|

x |

| |

|

|

|

|

| |

|

|

|

|

|

Emerging growth company |

|

x |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This registration statement on Form S-8 (this

“registration statement”) registers an aggregate of 7,254,949 additional shares of common stock, par value $0.0001 per share

(“common stock”), of Immunome, Inc. (the “Registrant”) consisting of (i) 4,685,351 additional shares

issuable under the Registrant’s 2020 Equity Incentive Plan, as amended (the “2020 Plan”), representing an increase of

(x) 2,955,280 shares reserved under the 2020 Plan effective August 23, 2023, pursuant to the approval of the Registrant’s

board of directors and stockholders, and (y) 1,730,071 shares reserved under the 2020 Plan effective January 1, 2024, by operation

of the 2020 Plan’s “evergreen” provision, (ii) 432,518 additional shares issuable under the Registrant’s

2020 Employee Stock Purchase Plan (the “2020 ESPP”) effective January 1, 2024, by operation of the 2020 ESPP’s

“evergreen” provision, and (iii) 2,137,080 shares issuable upon the exercise of a non-qualified stock option award granted

to Clay Siegall, Ph.D. as an inducement material to entry into employment with the Registrant, in accordance with Nasdaq Listing Rule 5635(c)(4).

Pursuant

to General Instruction E to Form S-8, and only with respect to the common stock being registered under the 2020 Plan and 2020 ESPP,

this registration statement incorporates by reference the Registrant’s registration statements on Form S-8 filed with

the Securities and Exchange Commission (the “Commission”) on March 25, 2021 (File No. 333-254731) and March 16, 2023 (File No. 333-270598), in each case as relating to the 2020 Plan and 2020 ESPP, and except to the extent supplemented, amended

or superseded by the information set forth herein.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information called for by Part I of Form S-8

is omitted from this Registration Statement in accordance with Rule 428 of the Securities Act of 1933, as amended (the “Securities

Act”), and the instructions to Form S-8. In accordance with the rules and regulations of the Commission and the instructions

to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses

or prospectus supplements pursuant to Rule 424 of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant

with the Commission are incorporated by reference into this Registration Statement:

| (a) | The Registrant’s Annual Report on Form

10-K for the fiscal year ended December 31, 2022, filed with the Commission on March 16, 2023; |

| | | |

| (b) | The Registrant’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023, and September

30, 2023, filed with the Commission on May

5, 2023, August 9, 2023,

and November 9, 2023,

respectively; |

| | | |

| (c) | The Registrant’s Current Reports on Form 8-K filed with the Commission on January

6, 2023, January

6, 2023, January

30, 2023, June

13, 2023, June

29, 2023, July

5, 2023, September

21, 2023, October

4, 2023 (as amended on November

22, 2023), November

8, 2023, December

26, 2023, December

29, 2023, January

2, 2024, and January

8, 2024; and |

| | | |

| (d) | The description of the Registrant’s Common Stock set forth

in the Registration Statement on Form

8-A filed with the Commission on September 30, 2020, including any amendments or reports filed for the purpose of updating such description. |

All documents subsequently filed by the Registrant

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all

securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof

from the date of filing of such documents; provided, however, that documents or information, or portions thereof, which are furnished

and not filed in accordance with the rules of the Commission shall not be deemed incorporated by reference into this Registration

Statement. Any statement contained herein or in a document, all or a portion of which is incorporated or deemed to be incorporated by

reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement

herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not constitute a part of this Registration Statement, except as so

modified or superseded.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 145 of the General

Corporation Law of the State of Delaware (the “DGCL”) provides that a corporation may indemnify directors and

officers as well as other employees and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid

in settlement actually and reasonably incurred by such person in connection with any threatened, pending or completed actions, suits or

proceedings in which such person is made a party by reason of such person being or having been a director, officer, employee or agent

of the Registrant. The DGCL provides that Section 145 is not exclusive of other rights to which those seeking indemnification may

be entitled under any bylaws, agreement, vote of stockholders or disinterested directors or otherwise. The Registrant’s Amended

and Restated Certificate of Incorporation and Amended and Restated Bylaws provide for indemnification by the Registrant of its directors

and officers to the fullest extent permitted by the DGCL.

Section 102(b)(7) of

the DGCL permits a corporation to provide in its Amended and Restated Certificate of Incorporation that a director of the corporation

shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director,

except for liability (1) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (2) for

acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) for unlawful payments

of dividends or unlawful stock repurchases redemptions or other distributions or (4) for any transaction from which the director

derived an improper personal benefit. The Registrant’s Amended and Restated Certificate of Incorporation provides for such limitation

of liability to the fullest extent permitted by the DGCL.

The Registrant has entered

into indemnification agreements with each of its directors and executive officers to provide contractual indemnification in addition to

the indemnification provided in our Amended and Restated Certificate of Incorporation. Each indemnification agreement provides for indemnification

and advancements by the Registrant of certain expenses and costs relating to claims, suits or proceedings arising from his or her service

to the Registrant or, at our request, service to other entities, as officers or directors to the maximum extent permitted by applicable

law. We believe that these provisions and agreements are necessary to attract qualified directors.

The Registrant also maintains

standard policies of insurance under which coverage is provided (1) to its directors and officers against loss arising from claims

made by reason of breach of duty or other wrongful act, while acting in their capacity as directors and officers of the Registrant and

(2) to the Registrant with respect to payments which may be made by the Registrant to such officers and directors pursuant to any

indemnification provision contained in the Registrant’s Amended and Restated Certificate of Incorporation and Amended and Restated

Bylaws or otherwise as a matter of law.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

Exhibit

Number |

|

Description |

| 3.1 |

|

Amended and Restated Certificate of Incorporation of the Registrant (Filed as Exhibit 3.1 to Registrant’s Current Report on Form 8-K filed with the Commission on October 6, 2020 and incorporated herein by reference). |

| 3.2 |

|

Certificate of Amendment, dated October 2, 2023 to the Amended and Restated Certificate of Incorporation of Immunome, Inc. to implement Officer Exculpation (Filed as Exhibit 3.3 to the Registrant’s Current Report on Form 8-K filed with the Commission on October 4, 2023 and incorporated herein by reference). |

| 3.3 |

|

Certificate of Amendment, dated October 2, 2023 to the Amended and Restated Certificate of Incorporation of Immunome, Inc. to implement the Authorized Share Increase (Filed as Exhibit 3.4 to the Registrant’s Current Report on Form 8-K filed with the Commission on October 4, 2023 and incorporated herein by reference). |

| 3.4 |

|

Amended and Restated Bylaws of the Registrant (Filed as Exhibit 3.2 to Registrant’s Current Report on Form 8-K filed with the Commission on October 6, 2020 and incorporated herein by reference). |

| 4.1 |

|

Form of Common Stock Certificate (Filed as Exhibit 4.2 to Amendment No. 1 to Registrant’s Registration Statement on Form S-1/A filed on September 24, 2020 and incorporated herein by reference). |

| 5.1* |

|

Opinion of Cooley LLP. |

| 23.1* |

|

Consent of Ernst & Young LLP, independent registered public accounting firm. |

| 23.2* |

|

Consent of Deloitte & Touche, LLP, independent registered public accounting firm. |

| 23.3* |

|

Consent of Moss Adams LLP, independent auditors. |

| 23.4* |

|

Consent of Cooley LLP (included in Exhibit 5.1). |

| 24.1* |

|

Power of Attorney (included on signature page). |

| 99.1+ |

|

Immunome, Inc. 2020 Equity Incentive Plan (Filed as Exhibit 10.6 to Amendment No. 1 to Registrant’s Registration Statement on Form S-1/A filed with the Commission on September 24, 2020 and incorporated herein by reference). |

| 99.2+ |

|

Forms of Stock Option Grant Notice, Option Agreement, RSU Award Grant Notice and Notice of Exercise for the 2020 Equity Incentive Plan (incorporated by reference to Exhibit 10.7 to Amendment No. 1 to Registrant’s Registration Statement on Form S-1/A filed on September 24, 2020). |

| 99.3+ |

|

Immunome, Inc. 2020 Employee Stock Purchase Plan (Filed as Exhibit 10.8 to Amendment No. 1 to Registrant’s Registration Statement on Form S-1/A filed with the Commission on September 24, 2020 and incorporated herein by reference). |

| 99.4+* |

|

Inducement Non-Qualified Stock Option Agreement, dated June 28, 2023, by and between the Registrant and Clay Siegall, Ph.D. |

| 107* |

|

Filing Fee Table |

*

Filed herewith.

+ Denotes management contract or compensatory plan or arrangement.

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers

or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by

Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts

or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which,

individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed

that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the

form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent

no more than 20% change in the maximum aggregate offering price set forth in Exhibit 107 (Filing Fee Table) to the effective Registration

Statement;

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information

in the Registration Statement;

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the Registration Statement is on Form S-8,

and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished

to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by

reference in the Registration Statement.

(2) That, for the purpose of determining

any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or

Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant

to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the

Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed

in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the

securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for

filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the City of Exton, Commonwealth of Pennsylvania, on February 2, 2024.

| |

IMMUNOME, INC. |

| |

|

|

| |

By: |

/s/ Clay Siegall |

| |

|

Clay Siegall, Ph.D. |

| |

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Clay Siegall, Ph.D.

and Max Rosett, and each of them, as his or her true and lawful attorneys-in-fact and agents, each with full power of substitution, for

him or her in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement

(including post-effective amendments), and to file the same, with all exhibits thereto, and other documents in connection therewith, with

the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to

do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes

as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them,

or their or his or her substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

/s/ Clay Siegall

Clay Siegall, Ph.D. |

|

President, Chief Executive Officer and Chairman of the Board of Directors (Principal Executive Officer) |

|

February 2, 2024 |

| |

|

|

|

|

|

/s/ Max Rosett

Max Rosett |

|

Interim Chief Financial Officer and EVP, Operations (Principal Financial Officer) |

|

February 2, 2024 |

| |

|

|

|

|

|

/s/ Bob Lapetina

Bob Lapetina |

|

VP, Finance and Corporate Controller

(Principal Accounting Officer) |

|

February 2, 2024 |

| |

|

|

|

|

|

/s/ Isaac Barchas

Isaac Barchas |

|

Director |

|

February 2, 2024 |

| |

|

|

|

|

| /s/ Jean-Jacques Bienamié |

|

Director |

|

February 2, 2024 |

| Jean-Jacques Bienamié |

| |

|

|

|

|

|

/s/ James Boylan

James Boylan |

|

Director |

|

February 2, 2024 |

| |

|

|

|

|

|

/s/ Carol Schafer

Carol Schafer |

|

Director |

|

February 2, 2024 |

| |

|

|

|

|

|

/s/ Philip Wagenheim

Philip Wagenheim |

|

Director |

|

February 2, 2024 |

Exhibit

5.1

Thomas A. Coll

+1 858 550 6013

collta@cooley.com

February 2,

2024

Immunome, Inc.

665

Stockton Drive, Suite 300

Exton,

PA 19341

Ladies

and Gentlemen:

We

have acted as counsel to Immunome, Inc., a Delaware corporation (the “Company”), in connection with the

filing by the Company of a Registration Statement on Form S-8 (the “Registration Statement”) with the

Securities and Exchange Commission (the “Commission”) covering the offering of up to 7,254,949 shares (the

“Shares”) of the Company’s Common Stock, $0.0001 par value per share (the “Common Stock”),

consisting of (i) 4,685,351 shares of Common Stock issuable pursuant to the Company’s 2020 Equity Incentive Plan (the “Incentive

Plan”), (ii) 432,518 shares of Common Stock issuable pursuant to the Company’s 2020 Employee Stock Purchase

Plan (together with the Incentive Plan, the “Plans”), and (iii) 2,137,080 shares of Common Stock issuable

upon the exercise of a stock option granted to an employee as an inducement award (the “Award”).

In

connection with this opinion, we have examined and relied upon (i) the Registration Statement and related prospectuses, (ii) the

Plans and the Award, (iii) the Company’s certificate of incorporation and bylaws, each as currently in effect, and (iv) such

other records, documents, opinions certificates, memoranda and instruments as in our judgment are necessary or appropriate to enable

us to render the opinion expressed below. We have assumed the genuineness of all signatures, the authenticity of all documents submitted

to us as originals, the conformity to originals of all documents submitted to us as copies, the accuracy, completeness and authenticity

of certificates of public officials, and the due authorization, execution and delivery of all documents by all persons other than by

the Company where authorization, execution and delivery are prerequisites to the effectiveness thereof. As to certain factual matters,

we have relied upon a certificate of an officer of the Company and have not independently verified such matters.

Our

opinion is expressed only with respect to the General Corporation Law of the State of Delaware. We express no opinion to the extent that

any other laws are applicable to the subject matter hereof and express no opinion and provide no assurance as to compliance with any

federal or state securities law, rule or regulation.

On

the basis of the foregoing, and in reliance thereon, we are of the opinion that the Shares, when sold and issued in accordance with the

Plans, the Award, the Registration Statement and the related prospectuses, will be validly issued, fully paid and nonassessable (except

as to shares issued pursuant to deferred payment arrangements under the Incentive Plan, which will be fully paid and nonassessable when

such deferred payments are made in full).

This

opinion is limited to the matters expressly set forth in this letter, and no opinion should be implied, or may be inferred, beyond the

matters expressly stated. This opinion speaks only as to law and facts in effect or existing as of the date hereof and we have no obligation

or responsibility to update or supplement this opinion to reflect any facts or circumstances that may hereafter come to our attention

or any changes in law that may hereafter occur.

Cooley

LLP 10265 Science Center Drive San Diego, CA 92121

t: (858) 550-6000 f: (858) 550-6420 cooley.com

February 2,

2024

Page Two

We

consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that

we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended, or the rules and

regulations of the Commission thereunder.

Sincerely,

Cooley

LLP

| By: | /s/

Thomas A. Coll |

|

| | Thomas

A. Coll |

|

Cooley

LLP 10265 Science Center Drive San Diego, CA 92121

t: (858) 550-6000 f: (858) 550-6420 cooley.com

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in

the Registration Statement (Form S-8) pertaining to the 2020 Equity Incentive Plan, 2020 Employee Stock Purchase Plan, and Individual

Nonqualified Stock Option Award (Inducement Grant) of Immunome, Inc. of our report dated March 16, 2023, with respect to the

financial statements of Immunome, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2022,

filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Philadelphia, Pennsylvania

February 2, 2024

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference

in this Registration Statement on Form S-8 of our report dated March 28, 2022, relating to the financial statements of Immunome, Inc.

appearing in the Annual Report on Form 10-K of Immunone, Inc. for the year ended December 31, 2022.

/s/ Deloitte & Touche, LLP

Philadelphia, Pennsylvania

February 2, 2024

Exhibit 23.3

Consent of Independent Auditors

We consent to the incorporation by reference in this Registration

Statement of Immunome, Inc. on Form S-8, of our report dated August 8, 2023, relating to the financial statements of Morphimmune, Inc.

as of and for the years ended December 31, 2022 and 2021, appearing in the Current Report on Form 8-K/A of Immunome, Inc. dated September

29, 2023, filed with the Securities and Exchange Commission.

/s/ Moss Adams LLP

Seattle, Washington

February 2, 2024

Exhibit 99.4

Immunome, Inc.

Stock

Option Grant Notice

Immunome, Inc.

(the “Company”), pursuant to the terms of this Stock Option Grant Notice (this “Grant Notice”)

and the Stock Option Agreement attached hereto, hereby grants to you (“Optionholder”) an option to purchase

the number of shares of the Common Stock set forth below (the “Option”) as an inducement material to you entering

into employment with the Company in compliance with Nasdaq Listing Rule 5635(c)(4).

| Optionholder: | |

Clay B. Siegall, Ph.D. |

| | |

|

| Date of Grant: | |

June 28, 2023 |

| | |

|

| Vesting Commencement Date: | |

Effective Time (as defined

below) |

| | |

|

| Number of Shares of Common

Stock Subject to Option: | |

2,137,080 |

| | |

|

| Exercise Price (Per Share): | |

$5.91 |

| | |

|

| Total Exercise Price: | |

$12,630,142.8 |

| | |

|

| Expiration Date: | |

June 28, 2033 |

| | |

|

| Type of Grant: | |

Nonstatutory Stock Option |

Exercise and

Vesting Schedule: Subject to the Optionholder’s Continuous Service through each applicable vesting date, the Option will vest

as follows:

25% of

the shares vest and become exercisable at the one-year anniversary of the consummation of the merger (the “Effective Time”)

of Ibiza Merger Sub, Inc. (“Merger Sub”) into Morphimmune Inc. (“Morphimmune”),

as contemplated by the Agreement and Plan of Merger and Reorganization dated as of June 29, 2023 (the “Merger Agreement”),

by and between Morphimmune, the Company and Merger Sub, pursuant to which Morphimmune would become a wholly owned subsidiary of the Company

(the “Transaction”); and 75% of the shares vest and become exercisable in thirty-six (36) successive equal

monthly installments thereafter.

Notwithstanding

the foregoing, the Option will accelerate vesting and exercisability in full effective as of the later of (i) the date the Separation

Agreement required under Section 9(b) of the Executive Employment Agreement, dated June 28, 2023, between the Company

and Optionholder (the “Executive Employment Agreement”) becomes effective and enforceable and (ii) the

date on which the Change in Control (as defined below) closes, if Optionholder’s employment is terminated by the Company involuntarily

without Cause (excluding any termination due to death or Disability) or Optionholder resigns for Good Reason within the period commencing

three months prior to the closing date of a Change in Control and continuing through the twelve months following the closing date of

the Change in Control (the “Change in Control Period”).

Optionholder

Acknowledgements:

By your signature

below or by electronic acceptance or authentication in a form authorized by the Company, you understand and agree that:

| • | The

Option is governed by this Grant Notice, the Stock Option Agreement and the Notice of Exercise,

all of which are made a part of this document. This Grant Notice and the Stock Option Agreement

(together, the “Option Agreement”) may not be modified, amended

or revised except in a writing signed by you and a duly authorized officer of the Company. |

| • | You

consent to receive this Grant Notice, the Stock Option Agreement and any other Option-related

documents by electronic delivery and to participate in the Option Agreement through an on-line

or electronic system established and maintained by the Company or another third party designated

by the Company. |

| • | You

have read and are familiar with the provisions of the Option Agreement and the Notice of

Exercise. |

| • | The

Option Agreement sets forth the entire understanding between you and the Company regarding

the acquisition of Common Stock and supersedes all prior oral and written agreements, promises

and/or representations on that subject with the exception of other equity awards previously

granted to you and any written employment agreement, offer letter, severance agreement, written

severance plan or policy, or other written agreement between the Company and you in each

case that specifies the terms that should govern this Option. |

| • | Counterparts

may be delivered via facsimile, electronic mail (including pdf or any electronic signature

complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act or

other applicable law) or other transmission method and any counterpart so delivered will

be deemed to have been duly and validly delivered and be valid and effective for all purposes. |

| IMMUNOME, INC. |

|

CLAY B. Siegall,

Ph.D., OPTIONHOLDER: |

| |

|

|

| By: |

/s/

Purnanand Sarma |

|

/s/

Clay Siegall |

| |

Signature |

|

|

| Title: |

CEO |

|

Date: |

September 21,

2023 |

| Date: |

September 22,

2023 |

|

|

Attachments:

Stock Option Agreement, Notice of Exercise

Immunome, Inc.

Stock

Option Agreement

As

reflected by your Stock Option Grant Notice (“Grant Notice”), Immunome, Inc. (the “Company”)

has granted you an option as an inducement material to your entering into employment as Chief Executive Officer of the Company in compliance

with Nasdaq Listing Rule 5635(c)(4), to purchase a number of shares of Common Stock at the exercise price indicated in your Grant

Notice (the “Option”). Capitalized terms not explicitly defined in this Stock Option Agreement but defined

in the Grant Notice shall have the meanings set forth in the Grant Notice. The terms of your Option as specified in the Grant Notice

and this Stock Option Agreement constitute your Option Agreement.

The general terms and conditions

applicable to your Option are as follows:

“Applicable

Law” means shall mean any applicable securities, federal, state, foreign, material local or municipal or other law, statute,

constitution, principle of common law, resolution, ordinance, code, edict, decree, rule, listing rule, regulation, judicial decision,

ruling or requirement issued, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any

Governmental Body (including under the authority of any applicable self-regulating organization such as the Nasdaq Stock Market, New

York Stock Exchange, or the Financial Industry Regulatory Authority).

“Board”

means the Board of Directors of the Company (or its designee).

“Capitalization

Adjustment” means any change that is made in, or other events that occur with respect to, the Common Stock subject to the

Option after the Effective Time without the receipt of consideration by the Company through merger, consolidation, reorganization, recapitalization,

reincorporation, stock dividend, dividend in property other than cash, large nonrecurring cash dividend, stock split, reverse stock split,

liquidating dividend, combination of shares, exchange of shares, change in corporate structure or any similar equity restructuring transaction,

as that term is used in Statement of Financial Accounting Standards Board Accounting Standards Codification Topic 718 (or any successor

thereto). Notwithstanding the foregoing, the conversion of any convertible securities of the Company will not be treated as a Capitalization

Adjustment.

“Cause”

has the meaning ascribed to such term in the Executive Employment Agreement.

“Change

in Control” or “Change of Control” has the meaning ascribed to such term in the Executive Employment

Agreement.

“Code”

means the Internal Revenue Code of 1986, as amended, including any applicable regulations and guidance thereunder.

“Committee”

means the Compensation Committee and any other committee of Directors to whom authority has been delegated by the Board or Compensation

Committee in accordance with this Option Agreement.

“Common Stock”

means the common stock of the Company. “Company” means Immunome, Inc., a Delaware corporation.

“Compensation

Committee” means the Compensation Committee of the Board.

“Consultant”

means any person, including an advisor, who is (i) engaged by the Company or an Affiliate to render consulting or advisory services

and is compensated for such services, or (ii) serving as a member of the board of directors of an Affiliate and is compensated for

such services. However, service solely as a Director, or payment of a fee for such service, will not cause a Director to be considered

a “Consultant” for purposes of this Option Agreement. Notwithstanding the foregoing, a person is treated as a Consultant

under this Option Agreement only if a Form S-8 Registration Statement under the Securities Act is available to register either the

offer or the sale of the Company’s securities to such person.

“Continuous

Service” means that the Optionholder’s service with the Company or an Affiliate, whether as an Employee, Director

or Consultant, is not interrupted or terminated. A change in the capacity in which the Optionholder renders service to the Company or

an Affiliate as an Employee, Director or Consultant or a change in the Entity for which the Optionholder renders such service, provided

that there is no interruption or termination of the Optionholder’s service with the Company or an Affiliate, will not terminate

the Optionholder’s Continuous Service; provided, however, that if the Entity for which the Optionholder is rendering services

ceases to qualify as an Affiliate, as determined by the Board, such Optionholder’s Continuous Service will be considered to have

terminated on the date such Entity ceases to qualify as an Affiliate. For example, a change in status from an Employee of the Company

to a Consultant of an Affiliate or to a Director will not constitute an interruption of Continuous Service. To the extent permitted by

law, the Board may determine whether Continuous Service will be considered interrupted in the case of (i) any leave of absence approved

by the Board, including sick leave, military leave or any other personal leave, or (ii) transfers between the Company, an Affiliate,

or their successors. Notwithstanding the foregoing, a leave of absence will be treated as Continuous Service for purposes of vesting

in the Option only to such extent as may be provided in the Company’s leave of absence policy, in the written terms of any leave

of absence agreement or policy applicable to the Optionholder, or as otherwise required by law. In addition, to the extent required for

exemption from or compliance with Section 409A, the determination of whether there has been a termination of Continuous Service

will be made, and such term will be construed, in a manner that is consistent with the definition of “separation from service”

as defined under Treasury Regulation Section 1.409A-1(h) (without regard to any alternative definition thereunder).

“Corporate

Transaction” means the consummation, in a single transaction or in a series of related transactions, of any one or more

of the following events:

(i) a

sale or other disposition of all or substantially all, as determined by the Board, of the consolidated assets of the Company and its

Subsidiaries;

(ii) a

sale or other disposition of at least 50% of the outstanding securities of the Company;

(iii) a

merger, consolidation or similar transaction following which the Company is not the surviving corporation; or

(iv) a

merger, consolidation or similar transaction following which the Company is the surviving corporation but the shares of Common Stock

outstanding immediately preceding the merger, consolidation or similar transaction are converted or exchanged by virtue of the merger,

consolidation or similar transaction into other property, whether in the form of securities, cash or otherwise.

“Director”

means a member of the Board.

“determine”

or “determined” means as determined by the Board or the Committee (or its designee) in its sole discretion.

“Disability”

has the meaning ascribed to such term in the Executive Employment Agreement. “Entity” means a corporation,

partnership, limited liability company or other entity.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Fair

Market Value” means, as of any date, unless otherwise determined by the Board, the value of the Common Stock (as determined

on a per share or aggregate basis, as applicable) determined as follows:

(i) If

the Common Stock is listed on any established stock exchange or traded on any established market, the Fair Market Value will be the closing

sales price for such stock as quoted on such exchange or market (or the exchange or market with the greatest volume of trading in the

Common Stock) on the date of determination, as reported in a source the Board deems reliable.

(ii) If

there is no closing sales price for the Common Stock on the date of determination, then the Fair Market Value will be the closing selling

price on the last preceding date for which such quotation exists.

(iii) In

the absence of such markets for the Common Stock, or if otherwise determined by the Board, the Fair Market Value will be determined by

the Board in good faith and in a manner that complies with Sections 409A and 422 of the Code.

“Good Reason”

has the meaning ascribed to such term in the Executive Employment Agreement. “Incentive Stock Option” means

an option that is intended to be, and qualifies as, an “incentive stock option”

within the meaning of Section 422

of the Code.

“Nonstatutory

Stock Option” means any option that does not qualify as an Incentive Stock Option.

“Own,”

“Owned,” “Owner,” “Ownership” means that a person or Entity

will be deemed to “Own,” to have “Owned,” to be the “Owner” of, or to have acquired “Ownership”

of securities if such person or Entity, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise,

has or shares voting power, which includes the power to vote or to direct the voting, with respect to such securities.

“Plan

Administrator” means the person, persons, and/or third-party administrator designated by the Company to administer the

day to day operations of this Option Agreement.

“Post-Termination

Exercise Period” means the period following termination of Optionholder’s Continuous Service within which the Option

is exercisable.

“Section 409A”

means Section 409A of the Code and the regulations and other guidance thereunder.

“Securities Act”

means the Securities Act of 1933, as amended.

“Subsidiary”

means, with respect to the Company, (i) any corporation of which more than 50% of the outstanding capital stock having ordinary

voting power to elect a majority of the board of directors of such corporation (irrespective of whether, at the time, stock of any other

class or classes of such corporation will have or might have voting power by reason of the happening of any contingency) is at the time,

directly or indirectly, Owned by the Company, and (ii) any partnership, limited liability company or other entity in which the Company

has a direct or indirect interest (whether in the form of voting or participation in profits or capital contribution) of more than 50%.

(a) You

may generally exercise the vested portion of your Option for whole shares of Common Stock at any time during its term by delivery of

payment of the exercise price and applicable withholding taxes and other required documentation to the Plan Administrator in accordance

with the exercise procedures established by the Plan Administrator, which may include an electronic submission. Optionholder may not

exercise the Option at any time that the issuance of shares of Common Stock upon such exercise would violate Applicable Law.

(b) To

the extent permitted by Applicable Law, you may pay your Option exercise price as follows:

(i)

cash, check, bank draft or money order;

(ii) subject

to Company and/or Committee consent at the time of exercise, pursuant to a “cashless exercise” program if at the time of

exercise the Common Stock is publicly traded;

(iii) subject

to Company and/or Committee consent at the time of exercise, by delivery of previously owned shares of Common Stock; or

(iv) subject

to Company and/or Committee consent at the time of exercise, if the Option is a Nonstatutory Stock Option, by a “net exercise”

arrangement.

(c) By

accepting your Option, you agree that you will not sell, dispose of, transfer, make any short sale of, grant any option for the purchase

of, or enter into any hedging or similar transaction with the same economic effect as a sale with respect to any shares of Common Stock

or other securities of the Company held by you, for a period of one hundred eighty (180) days following the effective date of a registration

statement of the Company filed under the Securities Act or such longer period as the underwriters or the Company will request to facilitate

compliance with FINRA Rule 2241 or any successor or similar rules or regulation (the “Lock-Up Period”);

provided, however, that nothing contained in this section will prevent the exercise of a repurchase option, if any, in favor of

the Company during the Lock-Up Period. You further agree to execute and deliver such other agreements as may be reasonably requested

by the Company or the underwriters that are consistent with the foregoing or that are necessary to give further effect thereto. In order

to enforce the foregoing covenant, the Company may impose stop-transfer instructions with respect to your shares of Common Stock until

the end of such period. You also agree that any transferee of any shares of Common Stock (or other securities) of the Company held by

you will be bound by this Section 2(c). The underwriters of the Company’s stock are intended third party beneficiaries of

this Section 2(c) and will have the right, power and authority to enforce the provisions hereof as though they were a party

hereto.

3. TERM.

You may not exercise your Option before the commencement of its term or after its term expires. The term of your Option commences

on the Date of Grant and expires upon the earliest of the following:

(a) immediately

upon the termination of your Continuous Service for Cause;

(b) three

months after the termination of your Continuous Service for any reason other than Cause, Disability or death;

(c) 12

months after the termination of your Continuous Service due to your Disability;

(d) 24

months after your death if you die during your Continuous Service;

(e) immediately

upon a Corporate Transaction if the Board has determined that the Option will terminate in connection with a Corporate Transaction;

(f) the

Expiration Date indicated in your Grant Notice; or

(g) the

day before the 10th anniversary of the Date of Grant.

Notwithstanding

the foregoing, if you die during the period provided in Section 3(b) or 3(c) above, the term of your Option shall not

expire until the earlier of (i) 24 months after your death, (ii) upon any termination of the Option in connection with a Corporate

Transaction, (iii) the Expiration Date indicated in your Grant Notice, or (iv) the day before the tenth anniversary of the

Date of Grant.

If

Optionholder’s Continuous Service terminates for any reason other than for Cause and, at any time during the last thirty days of

the applicable Post-Termination Exercise Period: (i) the exercise of the Optionholder’s Option would be prohibited solely

because the issuance of shares of Common Stock upon such exercise would violate Applicable Law, or (ii) the immediate sale of any

shares of Common Stock issued upon such exercise would violate the Company’s Trading Policy, then the applicable Post-Termination

Exercise Period will be extended to the last day of the calendar month that commences following the date the Option would otherwise expire,

with an additional extension of the exercise period to the last day of the next calendar month to apply if any of the foregoing restrictions

apply at any time during such extended exercise period, generally without limitation as to the maximum permitted number of extensions;

provided, however, that in no event may such Option be exercised after the expiration of its maximum term (as set forth in the Grant

Notice).

Following

the date of such termination, to the extent the Optionholder does not exercise the Option within the applicable Post-Termination Exercise

Period (or, if earlier, prior to the expiration of the maximum term of the Option), such unexercised portion of the Option will terminate,

and the Optionholder will have no further right, title or interest in terminated Option, the shares of Common Stock subject to the terminated

Option, or any consideration in respect of the terminated Option.

4. Withholding

Obligations.

(a) Withholding

Authorization. As a condition to acceptance of the Option, Optionholder authorizes withholding from payroll and any other amounts

payable to Optionholder, and otherwise agree to make adequate provision for any sums required to satisfy any U.S. federal, state, local

and/or foreign tax or social insurance contribution withholding obligations of the Company or an Affiliate, if any, which arise in connection

with the exercise, vesting or settlement of the Option. Accordingly, Optionholder may not be able to exercise the Option even though

the Option is vested, and the Company shall have no obligation to issue shares of Common Stock subject to the Option, unless and until

such obligations are satisfied.

(b) Satisfaction

of Withholding Obligation. The Company may, in its sole discretion, satisfy any U.S. federal, state, local and/or foreign tax or

social insurance withholding obligation relating to the Option by any of the following means or by a combination of such means: (i) causing

the Optionholder to tender a cash payment; (ii) withholding shares of Common Stock from the shares of Common Stock issued or otherwise

issuable to the Optionholder in connection with the Option; (iii) withholding cash from Options settled in cash; (iv) withholding

payment from any amounts otherwise payable to the Optionholder; (v) by allowing the Optionholder to effectuate a “cashless

exercise” pursuant to a program developed under Regulation T as promulgated by the Federal Reserve Board, or (vi) by such

other method as may be set forth in this Option Agreement.

(d) Withholding

Indemnification. As a condition to accepting the Option, in the event that the amount of the Company’s and/or its Affiliate’s

withholding obligation in connection with the Option was greater than the amount actually withheld by the Company and/or its Affiliates,

Optionholder agrees to indemnify and hold the Company and/or its Affiliates harmless from any failure by the Company and/or its Affiliates

to withhold the proper amount.

5. Transferability.

The Option is not transferable, except by will or by the applicable laws of descent and distribution, and is exercisable during

your life only by you; provided, however, that the Board may permit transfer of the Option in a manner that is not prohibited by applicable

tax and securities laws upon the Optionholder’s request, including to a trust if the Optionholder is considered to be the sole

beneficial owner of such trust (as determined under Section 671 of the Code and applicable state law) while such Option is held

in such trust, provided that the Optionholder and the trustee enter into a transfer and other agreements required by the Company. Notwithstanding

the foregoing, subject to the execution of transfer documentation in a format acceptable to the Company and subject to the approval of

the Board or a duly authorized Officer, the Option may be transferred pursuant to a domestic relations order.

6. Adjustments

upon Changes in Common Stock; Other Corporate Events.

(a) Capitalization

Adjustments. In the event of a Capitalization Adjustment, the Board shall appropriately and proportionately adjust the class(es)

and number of securities and exercise price of Common Stock subject to the outstanding Option. The Board shall make such adjustments,

and its determination shall be final, binding and conclusive. Notwithstanding the foregoing, no fractional shares or rights for fractional

shares of Common Stock shall be created in order to implement any Capitalization Adjustment. The Board shall determine an equivalent

benefit for any fractional shares or fractional shares that might be created by the adjustments referred to in the preceding provisions

of this Section.

(b) Dissolution

or Liquidation. In the event of a dissolution or liquidation of the Company, all outstanding Options will terminate immediately prior

to the completion of such dissolution or liquidation, provided, however, that the Board may determine to cause some or all of

the Option to become fully vested and exercisable (to the extent such Option has not previously expired or terminated) before the dissolution

or liquidation is completed but contingent on its completion.

(c) Corporate

Transaction. The following provisions will apply the Option in the event of a Corporate Transaction unless otherwise provided in

any other written agreement between the Company or any Affiliate and the Optionholder or unless otherwise expressly provided by the Board.

The Board has sole and complete discretion to determine to accelerate the vesting and exercisability of all or any of the Option in the

event of a Corporate Transaction.

(i) Option

May Be Assumed. In the event of a Corporate Transaction, any surviving corporation or acquiring corporation (or the surviving

or acquiring corporation’s parent company) may assume or continue any or all of the Option or may substitute similar awards for

the outstanding portion of the Option (including but not limited to, awards to acquire the same consideration paid to the stockholders

of the Company pursuant to the Corporate Transaction). A surviving corporation or acquiring corporation (or its parent) may choose to

assume or continue only a portion of the Option or substitute a similar award for only a portion of the Option. The terms of any assumption,

continuation or substitution will be set by the Board.

(ii) Option

Held by Current Optionholders. In the event of a Corporate Transaction in which the surviving corporation or acquiring corporation

(or its parent company) does not assume or continue the outstanding Option or substitute similar awards for the outstanding Option, then

with respect to the Options that have not been assumed, continued or substituted and that are held by Optionholders whose Continuous

Service has not terminated prior to the effective time of the Corporate Transaction (referred to as the “Current Optionholders”),

the vesting of such Options and the time when such Options may be exercised will be accelerated in full to a date prior to the effective

time of such Corporate Transaction (contingent upon the effectiveness of the Corporate Transaction) as the Board determines (or, if the

Board does not determine such a date, to the date that is five (5) days prior to the effective time of the Corporate Transaction),

and such Options will terminate if not exercised (if applicable) at or prior to the effective time of the Corporate Transaction.

(iii) Option

Held by Persons other than Current Optionholders. In the event of a Corporate Transaction in which the surviving corporation or acquiring

corporation (or its parent company) does not assume or continue the outstanding Option or substitute similar awards for the outstanding

Option, then with respect to the Options that have not been assumed, continued or substituted and that are held by persons other than

Current Optionholder, such Option will terminate if not exercised (if applicable) prior to the occurrence of the Corporate Transaction.

(iv) Payment

for Option in Lieu of Exercise. Notwithstanding the foregoing, in the event the Option will terminate if not exercised prior to the

effective time of a Corporate Transaction, the Board may provide, in its sole discretion, that the holder of the Option may not exercise

the Option but will receive a payment, in such form as may be determined by the Board, equal in value, at the effective time, to the

excess, if any, of (1) the value of the property the Optionholder would have received upon the exercise of the Option (including,

at the discretion of the Board, any unvested portion of the Option), over (2) any exercise price payable by such holder in connection

with such exercise.

(d) Appointment

of Stockholder Representative. As a condition to the receipt of this Option, the Optionholder will be deemed to have agreed that

the Option will be subject to the terms of any agreement governing a Corporate Transaction involving the Company, including, without

limitation, a provision for the appointment of a stockholder representative that is authorized to act on the Optionholder’s behalf

with respect to any escrow, indemnities and any contingent consideration.

(e) No

Restriction on Right to Undertake Transactions. This Option and the issuance of shares pursuant to this Option does not affect or

restrict in any way the right or power of the Company or the stockholders of the Company to make or authorize any adjustment, recapitalization,

reorganization or other change in the Company’s capital structure or its business, any merger or consolidation of the Company,

any issue of stock or of options, rights or options to purchase stock or of bonds, debentures, preferred or prior preference stocks whose

rights are superior to or affect the Common Stock or the rights thereof or which are convertible into or exchangeable for Common Stock,

or the dissolution or liquidation of the Company, or any sale or transfer of all or any part of its assets or business, or any other

corporate act or proceeding, whether of a similar character or otherwise.

7. Administration.

The Board will administer this Option Agreement unless and until the Board delegates administration of this Option Agreement

to a Committee or Committees, and will exercise such powers and perform such acts as the Board deems necessary or expedient to promote

the best interests of the Company and that are not in conflict with the provisions of this Option Agreement.

8. No

Liability for Taxes. Except as required by Applicable Law the Company has no duty or obligation to Optionholder to advise

such holder as to the time or manner of exercising the Option. Furthermore, the Company has no duty or obligation to warn or otherwise

advise such holder of a pending termination or expiration of the Option or a possible period in which the Option may not be exercised.

The Company has no duty or obligation to minimize the tax consequences of the Option to the holder of such Option and will not be liable

to any holder of the Option for any adverse tax consequences to such holder in connection with the Option. As a condition to accepting

the Option, you hereby (a) agree to not make any claim against the Company, or any of its Officers, Directors, Employees or Affiliates

related to tax liabilities arising from the Option or other Company compensation and (b) acknowledge that you were advised to consult

with your own personal tax, financial and other legal advisors regarding the tax consequences of the Option and have either done so or

knowingly and voluntarily declined to do so. Additionally, you acknowledge that the Option is exempt from Section 409A only if the

exercise price is at least equal to the “fair market value” of the Common Stock on the date of grant as determined by the

Internal Revenue Service and there is no other impermissible deferral of compensation associated with the Option. Additionally, as a

condition to accepting the Option, you agree not make any claim against the Company, or any of its Officers, Directors, Employees or

Affiliates in the event that the Internal Revenue Service asserts that such exercise is less than the “fair market value”

of the Common Stock on the date of grant as subsequently determined by the Internal Revenue Service.

9. Clawback/Recovery.

The Option is subject to recoupment in accordance with any clawback policy that the Company is required to adopt pursuant to the listing

standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise required

by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other Applicable Law and any clawback policy that the Company otherwise

adopts, to the extent applicable and permissible under Applicable Law. No recovery of compensation under such a clawback policy will

be an event giving rise to Optionholder’s right to voluntary terminate employment upon a “resignation for good reason,”

or for a “constructive termination” or any similar term under any plan of or agreement with the Company.

10. Severability.

If any part of this Option Agreement is declared by any court or governmental authority to be unlawful or invalid, such unlawfulness

or invalidity will not invalidate any portion of this Option Agreement not declared to be unlawful or invalid. Any Section of this

Option Agreement (or part of such a Section) so declared to be unlawful or invalid will, if possible, be construed in a manner which

will give effect to the terms of such Section or part of a Section to the fullest extent possible while remaining lawful and

valid.

11. Other

Documents. You hereby acknowledge receipt of or the right to receive a document providing the information required by Rule 428(b)(1) promulgated

under the Securities Act. In addition, you acknowledge receipt of the Company’s Trading Policy.

* * * *

Notice

of Exercise

Immunome, Inc.

665 Stockton

Drive, Suite 300

EXTON, PA 19341

This

constitutes notice to Immunome, Inc. (the “Company”)

that I elect to purchase the below number of shares of Common Stock of the Company (the “Shares”) by exercising

my Option for the price set forth below. Capitalized terms not explicitly defined in this Notice of Exercise but defined in the Grant

Notice or Stock Option Agreement (together, the “Option Agreement”) shall have the meanings set forth in the

Option Agreement. Use of certain payment methods is subject to Company and/or Committee consent and certain additional requirements set

forth in the Option Agreement.

| Type of option: | |

Nonstatutory |

| Date of Grant: | |

|

|

| Number

of Shares as to which Option is exercised: | |

|

|

| Certificates

to be issued in name of: | |

|

|

| Total exercise

price: | |

$ |

|

| Cash, check,

bank draft or money order delivered herewith: | |

$ |

|

| Value of Shares

delivered herewith: | |

$ |

|

| Regulation

T Program (cashless exercise) | |

$ |

|

| Value of

Shares pursuant to net exercise: | |

$ |

|

By

this exercise, I agree (i) to provide such additional documents as you may require pursuant to the terms of the Option Agreement

and (ii) to satisfy the tax withholding obligations, if any, relating to the exercise of this Option as set forth in the Option

Agreement.

I

further agree that, if required by the Company (or a representative of the underwriters) in connection with the first underwritten registration

of the offering of any securities of the Company under the Securities Act, I will not sell, dispose of, transfer, make any short

sale of, grant any option for the purchase of, or enter into any hedging or similar transaction with the same economic effect as a sale

with respect to any shares of Common Stock or other securities of the Company for a period of one hundred eighty (180) days following

the effective date of a registration statement of the Company filed under the Securities Act (or such longer period as the underwriters

or the Company shall request to facilitate compliance with FINRA Rule 2241 or any successor or similar rule or regulation)

(the “Lock- Up Period”). I further agree to execute and deliver such other agreements as may be reasonably

requested by the Company or the underwriters that are consistent with the foregoing or that are necessary to give further effect thereto.

In order to enforce the foregoing covenant, the Company may impose stop-transfer instructions with respect to securities subject to the

foregoing restrictions until the end of such period.

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Immunome, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security

Type |

Security Class Title |

Fee

Calculation

Rule |

Amount

Registered(1) |

Proposed

Maximum

Offering Price

Per Share |

Maximum

Aggregate

Offering Price |

Fee Rate |

Amount of

Registration

Fee |

| Equity |

Common Stock, par value

$0.0001 per share |

Other |

2,955,280(2) |

$16.56(3) |

$48,939,436.80 |

0.00014760 |

$7,223.46 |

| Equity |

Common Stock, par value

$0.0001 per share |

Other |

1,730,071(5) |

$16.56(3) |

$28,649,975.76 |

0.00014760 |

$4,228.74 |

| Equity |

Common Stock, par value

$0.0001 per share |

Other |

432,518(6) |

$14.076(4) |

$6,088,123.37 |

0.00014760 |

$898.61 |

| Equity |

Common Stock, par value

$0.0001 per share |

Other |

2,137,080(7) |

$5.91(8) |

$12,630,142.80 |

0.00014760 |

$1,864.21 |

| Total Offering Amounts |

|

|

$96,307,678.73 |

|

$14,215.02 |

| Total Fee Previously Paid |

|

|

|

|

— |

| Total Fee Offsets |

|

|

|

|

— |

| Net Fee Due |

|

|

|

|

$14,215.02 |

| (1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers any additional number of shares of Common Stock, par value $0.0001 per share (“Common Stock”), of Immunome, Inc. (the “Registrant”) that become issuable under the Immunome, Inc. 2020 Equity Incentive Plan (the “2020 Plan”) and the Immunome, Inc. 2020 Employee Stock Purchase Plan (the “2020 ESPP”) upon stock splits, stock dividends or other distribution, recapitalization or similar events with respect to the shares of Common Stock being registered pursuant to this registration statement. |

| (2) |

Represents shares of Common Stock that were added to the shares authorized for issuance under the 2020 Plan pursuant to an amendment to the 2020 Plan that was duly adopted and approved by the Registrant’s board of directors on August 23, 2023. |

| (3) |

Estimated solely for purposes of calculating the registration fee in accordance with Rules 457(c) and 457(h)(1) under the Securities Act based on the average of the high and low prices of the Registrant’s Common Stock on the Nasdaq Capital Market on February 1, 2024, a date within five business days of the filing of this registration statement. |

| (4) |

Estimated solely for purposes of calculating the registration fee in accordance with Rules 457(c) and 457(h)(1) under the Securities Act based on the average of the high and low prices of the Registrant’s Common Stock on the Nasdaq Capital Market on February 1, 2024, a date within five business days of the filing of this registration statement, multiplied by 85%. Pursuant to the 2020 ESPP, the purchase price of the shares of Common Stock will be 85% of the lesser of the fair market value of the Common Stock on the Offering Date or the Purchase Date (each as defined in the 2020 ESPP). |

| (5) |

Represents shares of Common Stock that were automatically added to the shares authorized for issuance under the 2020 Plan on January 1, 2024 pursuant to an “evergreen” provision contained in the 2020 Plan. |

| (6) |

Represents shares of Common Stock that were automatically added to the shares authorized for issuance under the 2020 ESPP on January 1, 2024 pursuant to an “evergreen” provision contained in the 2020 ESPP. |

| (7) |

Represents shares of Common Stock issuable upon the exercise of an outstanding non-qualified stock option award granted to Clay Siegall, Ph.D., on June 28, 2023 as an inducement material to entry into employment with the Registrant in accordance with Nasdaq Listing Rule 5635(c)(4) (the “Inducement Option Award”). |

| (8) |

Based on the per share exercise price of the Inducement Option Award. |

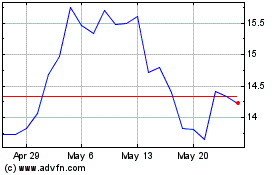

Immunome (NASDAQ:IMNM)

Historical Stock Chart

From May 2024 to Jun 2024

Immunome (NASDAQ:IMNM)

Historical Stock Chart

From Jun 2023 to Jun 2024