false

0001615063

0001615063

2023-11-22

2023-11-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 22, 2023

Inspired

Entertainment, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36689 |

|

47-1025534 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

250

West 57th Street, Suite 415

New

York, New York |

|

10107 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (646) 565-3861

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

INSE |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| |

Item

3.01 |

Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing |

On

November 22, 2023, Inspired Entertainment Inc (“Company”) received a notification letter from the Listing Qualifications

Department of the Nasdaq Stock Market LLC (“Nasdaq”) stating the Company was not in compliance with the requirements of Nasdaq

Listing Rule 5250(c)(1) as a result of not having timely filed its Form 10-Q for the quarter ended September 30, 2023 with the Securities

and Exchange Commission.

Under

the Nasdaq rules, the Company has 60 calendar days, or until January 22, 2024 to file the 2023 Form 10-Q or to submit to Nasdaq a plan

to regain compliance with the Nasdaq Listing Rule. If the Company submits a plan to Nasdaq, which Nasdaq accepts, Nasdaq can grant

an exception of up to 180 calendar days from the Filing’s due date, or until May 7, 2024, to regain compliance. This notification

has no immediate effect on the listing of the Company’s common stock on Nasdaq. However, if the Company fails to timely regain

compliance with Nasdaq Listing Rule 5250(c)(1), the Company’s common stock will be subject to delisting from Nasdaq. This announcement

is made in compliance with Nasdaq Listing Rule 5810(b), which requires prompt disclosure of receipt of a deficiency notification.

The

Company has issued a press release announcing the foregoing notification letter from Nasdaq, which press release is attached to

this Current Report on Form 8-K as Exhibit 99.2 and is incorporated by reference herein.

| |

Item

4.01 |

Changes

in Registrant’s Certifying Accountant. |

(a)

KPMG LLP (“KPMG”) was engaged as the

principal accountants for the Company on March 17, 2023. On November 22, 2023, KPMG was dismissed. The decision was approved by

the Audit Committee of the Board of Directors (“Audit Committee”) in accordance with the authority of the Audit Committee

as specified in its Charter.

KPMG

has not issued any audit reports on the consolidated financial statements of the Company, and therefore, none exist that contain any

adverse opinion or disclaimer of opinion, nor were any qualified or modified as to uncertainty, audit scope, or accounting principles.

As

previously reported in a Form 8-K filing dated November 8, 2023, in connection with the preparation of the consolidated financial statements

for the quarterly period ended September 30, 2023, the Company, in consultation with KPMG, identified certain accounting errors relating

to the compliance with U.S. GAAP in connection with the Company’s accounting policies for capitalizing software development costs

which materially impacts the fairness and reliability of previously issued consolidated financial statements.

During

the interim period from March 17, 2023 through November 22, 2023, the Company had no (1) disagreements with KPMG on any matter of accounting

principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the

satisfaction of KPMG would have caused KPMG to make reference to the subject matter of the disagreements in connection with their report,

or (2) reportable events, except that KPMG advised the Company that: (i) internal controls necessary for the Company to develop reliable

financial statements did not exist, (ii) the firm needed to substantially expand the scope of its audit due to information coming to

its attention that if further investigated may materially impact the fairness or reliability of previously issued financial statements

or to be issued covering the fiscal period subsequent to the date of the 2022 financial statements, (iii) due to the accountant’s

dismissal, the firm did not so expand the scope of its audit or conduct such further investigation, and (iv) due to the accountant’s

dismissal, the issue has not been resolved to the accountant’s satisfaction prior to its dismissal.

The

Company provided KPMG with a copy of the foregoing disclosures prior to the filing of the Current Report on Form 8-K and requested that

KPMG furnish a letter addressed to the Commission, which is attached hereto as Exhibit 99.1.

(b)

On November 22, 2023, the Audit Committee also approved the decision to engage Marcum LLP (“Marcum”)

as principal accountants for the Company’s financial year ending December 31, 2023.

During

the two years ended December 31, 2022 and the interim period from January 1, 2023 through November 22, 2023, neither the Company nor

anyone on the Company’s behalf consulted Marcum regarding either (i) the application of accounting principles to a specified transaction,

either completed or proposed, or the type of audit opinion that might be rendered on financial statements; and as such neither a written

report nor oral advice was provided to the Company that Marcum concluded was an important factor considered by the Company in reaching

a decision as to the accounting, auditing or financial issue; or (ii) any matter that was either the subject of a disagreement (as defined

in Regulation S-K, Item 304(a)(1)(iv) and the related instructions to this item) or a “reportable event” (as defined in Regulation

S-K, Item 304(a)(1)(v)). However, Marcum previously audited the Company’s financial statements for the years ended December 31,

2021 and 2022. As previously disclosed, the Company’s management has determined that such previously issued financial statements

contain accounting errors and should no longer be relied upon.

| |

Item

9.01. |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| November

29, 2023 |

Inspired

Entertainment, Inc. |

| |

|

|

| |

By: |

/s/

Carys Damon |

| |

Name: |

Carys

Damon |

| |

Title: |

General

Counsel |

Exhibit

99.1

KPMG

LLP

Suite

200

1305

Walt Whitman Road

Melville, NY 11747-4302

November

28, 2023

Securities

and Exchange Commission Washington, D.C. 20549

Ladies

and Gentlemen:

We

were previously engaged as principal accountants to audit the consolidated financial statements of Inspired Entertainment, Inc. (the

“Company”), as of and for the year ended December 31, 2023, and the effectiveness of internal control over financial reporting

as of December 31, 2023. On November 22, 2023, we were dismissed.

We

have read Inspired Entertainment, Inc.’s statements included under Item 4.01 of its Form 8-K dated November 28, 2023, and we agree

with such statements, except that (i) we are not in a position to agree or disagree with the Company’s statement that the change

in principal accountants was approved by the audit committee of the board of directors; and (ii) we are not in a position to agree or

disagree with the Company’s statements in Item 4.01(b).

Very

truly yours,

KPMG

LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated

with

KPMG International Limited, a private English company limited by guarantee.

Exhibit

99.2

INSPIRED

ENTERTAINMENT, INC. RECEIVES EXPECTED NASDAQ NOTIFICATION

REGARDING

DELAYED FORM 10-Q

NEW

YORK, New York – November 29, 2023 – Inspired Entertainment, Inc. (NASDAQ: INSE) (“Inspired” or the “Company”),

a leading B2B provider of gaming content, technology, hardware and services, today announced that it received a standard notification

letter from the Listing Qualifications Department of the Nasdaq Stock Market (“Nasdaq”) stating the Company was not in compliance

with the requirements of Nasdaq Listing Rule 5250(c)(1) as a result of not having timely filed its Form 10-Q for the quarter ended

September 30, 2023 with the Securities and Exchange Commission.

This

notification has no immediate effect on the listing of the Company’s securities on Nasdaq. Under the Nasdaq rules, the Company

has 60 calendar days, or until January 22, 2024 to file the 2023 Form 10-Q or to submit to Nasdaq a plan to regain compliance with the

Nasdaq Listing Rule. If the Company submits a plan to Nasdaq, which Nasdaq accepts, Nasdaq can grant an exception of up to 180 calendar

days from the Filing’s due date, or until May 7, 2024, to regain compliance. However, if the Company fails to timely regain

compliance with Nasdaq Listing Rule 5250(c)(1), the Company’s common stock will be subject to delisting from Nasdaq.

This

announcement is made in compliance with the Nasdaq Listing Rule 5810(b), which requires prompt disclosure of receipt of a notification

of deficiency.

About

Inspired Entertainment, Inc.

Inspired

offers an expanding portfolio of content, technology, hardware and services for regulated gaming, betting, lottery, social and leisure

operators across retail and mobile channels around the world. The Company’s gaming, virtual sports, interactive and leisure products

appeal to a wide variety of players, creating new opportunities for operators to grow their revenue. The Company operates in approximately

35 jurisdictions worldwide, supplying gaming systems with associated terminals and content for approximately 50,000 gaming machines located

in betting shops, pubs, gaming halls and other route operations; virtual sports products through more than 32,000 retail venues and various

online websites; interactive games for 170+ websites; and a variety of amusement entertainment solutions with a total installed base

of more than 16,000 terminals. Additional information can be found at www.inseinc.com.

Forward

Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements

can be identified by the use of forward-looking terminology such as “expects,” “believes,” “estimates,”

“projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should”

or “anticipates” or the negative or other variations of these or similar words. Although the Company believes that its expectations

are based on reasonable assumptions within the bounds of the Company’s knowledge of its business, there can be no assurance that

actual results, including the impact of the restatement, will not differ materially from its expectations. Meaningful factors that could

cause actual results to differ from expectations include, but are not limited to, risks relating to the final impact of the restatement

on the Company’s financial statements; the impact of the restatement on the Company’s evaluation of the effectiveness of

its internal control over financial reporting and disclosure controls and procedures; delays in the preparation of the financial statements;

the risk that additional information will come to light during the course of the Company’s financial statement and accounting policy

review that alters the scope or magnitude of the restatement; and the risk that the Company will be unable to obtain, if needed, any

required waivers under its debt indenture with respect to a significant delay in filing its periodic reports with the SEC, which could

affect its liquidity; and the risk that the Company may not be able to satisfy the terms of the Plan of Compliance it expects to submit

to Nasdaq, or that Nasdaq will accept the Plan or provide any other accommodations to the Company. The Company does not intend to update

publicly any forward-looking statements, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking

events discussed in this news release may not occur.

Contact:

For

Investors

IR@inseinc.com

+1

(646) 277-1285

For

Press and Sales

inspiredsales@inseinc.com

v3.23.3

Cover

|

Nov. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 22, 2023

|

| Entity File Number |

001-36689

|

| Entity Registrant Name |

Inspired

Entertainment, Inc.

|

| Entity Central Index Key |

0001615063

|

| Entity Tax Identification Number |

47-1025534

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

250

West 57th Street

|

| Entity Address, Address Line Two |

Suite 415

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10107

|

| City Area Code |

(646)

|

| Local Phone Number |

565-3861

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

INSE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

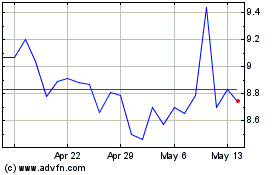

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Apr 2024 to May 2024

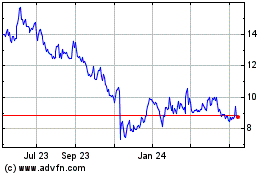

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From May 2023 to May 2024