Investors Title Company (Nasdaq: ITIC) today announced results

for the third quarter ended September 30, 2023. The Company

reported net income of $7.1 million, or $3.75 per diluted share,

for the three months ended September 30, 2023, compared to $7.9

million, or $4.17 per diluted share, for the prior year period.

Revenues decreased 21.3% to $61.4 million, compared with $78.0

million for the prior year quarter, primarily as the result of

decreases in the Company’s title insurance business and other

investment income. The reduction in title insurance revenues is

attributable to an overall decline in the level of real estate

transaction volumes resulting from higher average mortgage interest

rates and ongoing housing inventory constraints. Changes in other

investment income are due to fluctuations in the carrying value of

the underlying investments and distributions received. The lower

levels of title insurance activity and other investment income were

partially offset by increases in non-title services revenue and

interest income and an improvement in net investment (losses)

gains. The increase in revenue from non-title services was mainly

due to an increase in like-kind exchange revenues. The impact of

positive changes in the estimated fair value of equity security

investments resulted in a decrease in net investment losses

compared to the prior year period.

Operating expenses decreased 22.3% compared to the prior year

period, primarily due to reductions in expenses which fluctuate

with title insurance volume. Commissions to agents decreased by

$9.7 million, commensurate with the decrease in agent premium

volume. Personnel expenses decreased by $2.5 million, primarily due

to reductions in incentive compensation and reductions in staffing

levels. Other expenses were down $2.7 million, mainly due to the

impact of lower title insurance volumes and a reduction in the

level of contractors engaged in software development activities.

The provision for claims, and office and technology expenses,

remained consistent with the prior year period.

Income before income taxes decreased to $8.6 million for the

current quarter, versus $10.1 million in the prior year period.

Excluding the impact of net investment (losses) gains, adjusted

income before income taxes (non-GAAP) decreased 23.0% to $9.4

million for the quarter, versus $12.2 million in the prior year

period (see Appendix A for a reconciliation of this non-GAAP

measure to the most directly comparable GAAP measure).

For the nine months ended September 30, 2023, net income

decreased $527 thousand to $15.9 million, or $8.37 per diluted

share, versus $16.4 million, or $8.63 per diluted share, for the

prior year period. Revenues decreased 21.5% to $171.1 million,

compared with $217.9 million for the prior year period. Operating

expenses decreased 23.3% to $151.1 million, compared to $197.1

million for the prior year period. Overall results for the

year-to-date period have been shaped predominantly by the same

factors that affected the third quarter.

Chairman J. Allen Fine commented, “We were pleased to see an

uptick in revenues this quarter over the second quarter, as we

entered what is traditionally a more favorable time of year for

real estate activity. Market conditions remained challenging, as

interest rates rose to levels not seen in over 20 years. Partially

offsetting reductions in title insurance revenues, investment

earnings continued to benefit from higher average interest

rates.

“Regardless of current market conditions, the strength of our

balance sheet allows us to remain focused on the execution of our

long-term business strategy. We will continue to navigate this

market cycle by balancing expense discipline with ongoing targeted

investments in growing our business and improving our competitive

positioning.”

Investors Title Company’s subsidiaries issue and underwrite

title insurance policies. The Company also provides investment

management services and services in connection with tax-deferred

exchanges of like-kind property.

Cautionary Statements Regarding

Forward-Looking Statements

Certain statements contained herein constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements may be identified by the use

of words such as “plan,” expect,” “aim,” “believe,” “project,”

“anticipate,” “intend,” “estimate,” “should,” “could,” “would,” and

other expressions that indicate future events and trends. Such

statements include, among others, any statements regarding the

Company’s expected performance for this year, future home price

fluctuations, changes in home purchase or refinance demand,

activity and the mix thereof, interest rate changes, expansion of

the Company’s market presence, enhancing competitive strengths,

development in housing affordability, wages, unemployment or

overall economic conditions or statements regarding our actuarial

assumptions and the application of recent historical claims

experience to future periods. These statements involve a number of

risks and uncertainties that could cause actual results to differ

materially from anticipated and historical results. Such risks and

uncertainties include, without limitation: the cyclical demand for

title insurance due to changes in the residential and commercial

real estate markets; the occurrence of fraud, defalcation or

misconduct; variances between actual claims experience and

underwriting and reserving assumptions, including the limited

predictive power of historical claims experience; declines in the

performance of the Company’s investments; government regulations;

changes in the economy, including those resulting from a shutdown

of the U.S. Government; the impact of inflation and responses by

government regulators, including the Federal Reserve, such as

increases in interest rates; the impact of the COVID-19 pandemic

(including any of its variants) on the economy and the Company’s

business; loss of agency relationships, or significant reductions

in agent-originated business; difficulties managing growth, whether

organic or through acquisitions and other considerations set forth

under the caption “Risk Factors” in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022 as filed with the

Securities and Exchange Commission, and in subsequent filings.

Investors Title Company and

Subsidiaries

Consolidated Statements of

Operations

For the Three and Nine Months

Ended September 30, 2023 and 2022

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Revenues:

Net premiums written

$

49,822

$

66,658

$

132,793

$

199,409

Escrow and other title-related fees

4,683

6,136

12,942

17,461

Non-title services

4,636

3,679

14,513

8,889

Interest and dividends

2,313

1,229

6,537

3,055

Other investment income

514

2,173

2,915

4,616

Net investment (losses) gains

(815

)

(2,154

)

720

(16,456

)

Other

257

277

647

924

Total Revenues

61,410

77,998

171,067

217,898

Operating Expenses:

Commissions to agents

23,806

33,478

63,735

97,161

Provision for claims

1,838

1,966

3,897

3,452

Personnel expenses

19,083

21,586

58,451

63,738

Office and technology expenses

4,209

4,274

13,122

12,930

Other expenses

3,864

6,606

11,845

19,783

Total Operating Expenses

52,800

67,910

151,050

197,064

Income before Income Taxes

8,610

10,088

20,017

20,834

Provision for Income Taxes

1,526

2,175

4,167

4,457

Net Income

$

7,084

$

7,913

$

15,850

$

16,377

Basic Earnings per Common Share

$

3.75

$

4.17

$

8.37

$

8.63

Weighted Average Shares Outstanding –

Basic

1,891

1,897

1,894

1,897

Diluted Earnings per Common

Share

$

3.75

$

4.17

$

8.37

$

8.63

Weighted Average Shares Outstanding –

Diluted

1,891

1,897

1,894

1,898

Investors Title Company and

Subsidiaries

Consolidated Balance

Sheets

As of September 30, 2023 and

December 31, 2022

(in thousands)

(unaudited)

September 30,

2023

December 31, 2022

Assets

Cash and cash equivalents

$

30,411

$

35,311

Investments:

Fixed maturity securities,

available-for-sale, at fair value

64,640

53,989

Equity securities, at fair value

31,831

51,691

Short-term investments

103,959

103,649

Other investments

20,144

18,368

Total investments

220,574

227,697

Premiums and fees receivable

17,322

19,047

Accrued interest and dividends

1,111

872

Prepaid expenses and other receivables

14,888

11,095

Property, net

22,093

17,785

Goodwill and other intangible assets,

net

16,588

17,611

Lease assets

6,432

6,707

Other assets

2,496

2,458

Current income taxes recoverable

—

1,174

Total Assets

$

331,915

$

339,757

Liabilities and Stockholders’

Equity

Liabilities:

Reserve for claims

$

37,494

$

37,192

Accounts payable and accrued

liabilities

30,719

47,050

Lease liabilities

6,639

6,839

Current income taxes payable

1,008

—

Deferred income taxes, net

3,387

7,665

Total liabilities

79,247

98,746

Stockholders’ Equity:

Common stock – no par value (10,000

authorized shares; 1,891 and 1,897 shares issued and outstanding as

of September 30, 2023 and December 31, 2022, respectively,

excluding in each period 292 shares of common stock held by the

Company's subsidiary)

—

—

Retained earnings

253,423

240,811

Accumulated other comprehensive (loss)

income

(755

)

200

Total stockholders’ equity

252,668

241,011

Total Liabilities and Stockholders’

Equity

$

331,915

$

339,757

Investors Title Company and

Subsidiaries

Direct and Agency Net Premiums

Written

For the Three and Nine Months

Ended September 30, 2023 and 2022

(in thousands)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

%

2022

%

2023

%

2022

%

Direct

$

17,485

35.1

$

22,112

33.2

$

45,975

34.6

$

69,446

34.8

Agency

32,337

64.9

44,546

66.8

86,818

65.4

129,963

65.2

Total

$

49,822

100.0

$

66,658

100.0

$

132,793

100.0

$

199,409

100.0

Investors Title Company and Subsidiaries

Appendix A Non-GAAP Measures Reconciliation For

the Three and Nine Months Ended September 30, 2023 and 2022

(in thousands) (unaudited)

Management uses various financial and operational measurements,

including financial information not prepared in accordance with

generally accepted accounting principles ("GAAP"), to analyze

Company performance. This includes adjusting revenues to remove the

impact of net investment gains and losses, which are recognized in

net income under GAAP. Net investment gains and losses include

realized gains and losses on sales of investment securities and

changes in the estimated fair value of equity security investments.

For the three and nine months ended September 30, 2023, management

has decided to exclude realized gains and losses on sales of

investment securities in addition to changes in the estimated fair

value of equity security investments for consistency with a similar

change in the presentation in the Consolidated Statement of

Operations. The non-GAAP financial measures for prior year periods

included in this Appendix have also been updated for consistency

with this presentation. Therefore adjusted revenues (non-GAAP) and

adjusted income before income taxes (non-GAAP) below are not

comparable with previously published non-GAAP financial measures

for the Company. Management believes that these measures are useful

to evaluate the Company's internal operational performance from

period to period because they eliminate the effects of external

market fluctuations. The Company also believes users of the

financial results would benefit from having access to such

information, and that certain of the Company’s peers make available

similar information. This information should not be used as a

substitute for, or considered superior to, measures of financial

performance prepared in accordance with GAAP, and may be different

from similarly titled non-GAAP financial measures used by other

companies.

The following tables reconcile non-GAAP financial measurements

used by Company management to the comparable measurements using

GAAP:

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Revenues

Total revenues (GAAP)

$

61,410

$

77,998

$

171,067

$

217,898

Add (Subtract): Net investment losses

(gains)

815

2,154

(720

)

16,456

Adjusted revenues (non-GAAP)

$

62,225

$

80,152

$

170,347

$

234,354

Income before Income Taxes

Income before income taxes (GAAP)

$

8,610

$

10,088

$

20,017

$

20,834

Add (Subtract): Net investment losses

(gains)

815

2,154

(720

)

16,456

Adjusted income before income taxes

(non-GAAP)

$

9,425

$

12,242

$

19,297

$

37,290

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102031053/en/

Elizabeth B. Lewter Telephone: (919) 968-2200

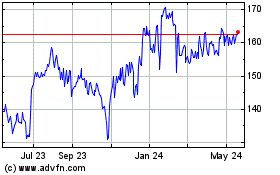

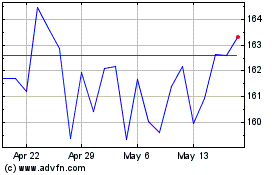

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Nov 2023 to Nov 2024