Jaguar Global Growth Corporation I (Nasdaq: JGGC, JGGCR, and JGGCW)

(“Jaguar Global”) and GLAAM, Co., Ltd. (“GLAAM” or “the Company”),

a leading designer and manufacturer of architectural media glass,

and Captivision Inc. (“Captivision”), today announced that GLAAM

has been selected as the main supplier of media glass for two

prominent new properties in South Korea. GLAAM will be supplying

over 16,000 sq. ft. of glass for each of the Mohegan INSPIRE

Entertainment Resort in Incheon and the Magok Meeting, Incentives,

Convention, and Exhibition (“MICE”) complex in Seoul, with its

proprietary G-Glass serving as the main façade of both complexes.

Mohegan INSPIRE Entertainment Resort and

Casino

In April 2023, GLAAM was awarded a contract

worth KRW 6 billion ($4.5 million USD) with Hanhwa ENC, the 12th

largest construction company in Korea, for a media glass

installation at the main entrance of the Mohegan INSPIRE

Entertainment Resort and Casino. GLAAM’s G-Glass was selected for

its unique fusion of media capabilities, total transparency, and

full glass façade functionality.

Located near Incheon Airport, the Mohegan

INSPIRE Entertainment Resort is expected to be the largest

integrated resort in Northeast Asia. The destination property will

feature three five-star hotels, Korea’s first 15,000-seat arena, a

127,000 sq. ft. conference facility, and 400,000 sq. ft. of retail

space, as well as a major casino managed by Mohegan, a leading U.S.

based entertainment, gaming, and hospitality company. GLAAM’s

G-Glass installation is expected to be completed in October 2023,

with the full first phase of the resort anticipated to be completed

in early 2024.

Magok MICE Complex

GLAAM was recently selected by Lotte Engineering

& Construction Co. Ltd., one of Korea’s largest construction

conglomerates, to supply glass for the CP1 Fourth Generation Media

Façade of the Magok MICE Complex in Seoul, for a total project

value of approximately KRW 9 billion ($6.7 million USD). The over

890,000 sq. ft. complex is expected to be completed in 2024 and

will include a state-of-the-art convention center outfitted with a

hotel, office and commercial space, and an advanced media façade

comprised of G-Glass.

The KRW 2.5 trillion ($1.9 billion USD) landmark

development will be Seoul’s largest MICE complex, at roughly twice

the size of Seoul’s current prime exhibition and convention center,

COEX, where GLAAM previously completed a 12,000 sq. ft.

installation.

“We are proud to announce that GLAAM’s

proprietary technology will be featured at two of the most

prominent business developments in South Korea today,” said Dr. Ho

Joon Lee, Co-Founder of GLAAM. “The award of these two high-profile

contracts is a testament to the compelling transparency and

sophisticated media capabilities of our G-Glass and the Company’s

strong pipeline of growth opportunities.”

As previously announced, GLAAM and Jaguar Global have entered

into a definitive business combination agreement. As a result of

the business combination, GLAAM and Jaguar Global shareholders will

exchange their shares for shares in a new combined company that is

named “Captivision Inc.” Captivision’s ordinary shares and warrants

are expected to be listed on the Nasdaq Stock Market under the

proposed ticker symbols “CAPT” and “CAPTW,” respectively.

About Jaguar Global Growth Corporation I

Jaguar Global Growth Corporation I is a partnership between

Jaguar Growth Partners, a global investor in growth companies, and

Hennessy Capital Group, an alternative asset manager for innovative

technology companies. For more information, please visit

www.jaguarglobalgrowth.com.

About GLAAM

GLAAM is the inventor and manufacturer of G-Glass, the world’s

first architectural media glass that combines IT building material

and architectural glass into one standalone product. G-Glass has a

variety of applications, including digital out of home media and

marketing.

To learn more about GLAAM, visit: www.glaam.co.kr/en.

Forward-Looking Statements

This communication includes "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include, without limitation, Jaguar Global’s, GLAAM’s

and Captivision's expectations with respect to future

performance and anticipated financial impacts of the proposed

business combination, the satisfaction of the closing conditions to

the proposed business combination and the timing of the completion

of the proposed business combination. For example, projections of

future revenue and other metrics are forward-looking statements. In

some cases, you can identify forward-looking statements by

terminology such as "may", "should", "expect", "intend", "will",

"estimate", "anticipate", "believe", "predict", "potential" or

"continue", or the negatives of these terms or variations of them

or similar terminology. Such forward-looking statements are subject

to risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Jaguar Global and

its management, Captivision and GLAAM and its management, as

the case may be, are inherently uncertain. Factors that may cause

actual results to differ materially from current expectations

include, but are not limited to: (1) the occurrence of any event,

change or other circumstances that could give rise to the

termination of the business combination agreement; (2) the outcome

of any legal proceedings or regulatory matters or investigations

that may be instituted against Jaguar Global, GLAAM,

Captivision or others; (3) the inability to complete the

business combination due to the failure to obtain approval of the

shareholders of Jaguar Global or to satisfy other conditions to

closing; (4) changes to the proposed structure of the business

combination that may be required or appropriate as a result of

applicable laws or regulations; (5) the ability to meet stock

exchange listing standards following the consummation of the

business combination; (6) the risk that the business combination

disrupts current plans and operations of Jaguar Global or GLAAM as

a result of the announcement and consummation of the business

combination; (7) the ability to recognize the anticipated benefits

of the business combination, which may be affected by, among other

things, competition, the ability of Captivision to grow and manage

growth profitably, maintain relationships with customers and

suppliers and retain its management and key employees; (8) costs

related to the business combination; (9) changes in applicable laws

or regulations; (10) the possibility that Jaguar Global, GLAAM or

Captivision may be adversely affected by other economic, business,

and/or competitive factors; (11) the impact of COVID-19 on GLAAM's

business and/or the ability of the parties to complete the proposed

business combination; (12) GLAAM's estimates of expenses and

profitability and underlying assumptions with respect to

shareholder redemptions and purchase price and other adjustments;

and (13) other risks and uncertainties set forth in the section

entitled "Risk Factors" and "Cautionary Note Regarding

Forward-Looking Statements" in Jaguar Global’s final prospectus

relating to its initial public offering and in Jaguar Global’s and

Captivision's subsequent filings with the SEC, including the

registration statement on Form F-4, and the definitive proxy

statement/prospectus, relating to the business combination.

Nothing in this communication should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date hereof. None of Jaguar Global,

GLAAM or Captivision undertake any duty to update these

forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed business combination,

Captivision has filed a registration statement on Form F-4

(File No. 333-271649) (the “Registration Statement”) with the

SEC, which includes a document that serves as a joint prospectus

with respect to Captivision securities and proxy statement of

Jaguar Global, referred to as a proxy statement/prospectus. The

Registration Statement was declared effective on September 13,

2023. Jaguar Global’s shareholders and other interested

persons are advised to read the Registration Statement, including

the definitive proxy statement/prospectus and any other documents

filed with the SEC in connection with the proposed business

combination, as these materials contain important information about

Captivision, GLAAM, Jaguar Global and the proposed business

combination. This communication does not contain all

the information that should be considered concerning the proposed

business combination and is not intended to form the basis of any

investment decision or any other decision in respect of the

proposed business combination. The definitive proxy

statement/prospectus and other relevant materials for the proposed

business combination have been mailed to shareholders of Jaguar

Global as of the record date established for voting on the proposed

business combination. Shareholders are also able to obtain copies

of the Registration Statement, including any amendments thereto,

the definitive proxy statement/prospectus and other documents filed

with the SEC, without charge, at the SEC's web site

at www.sec.gov, or upon written request to Jaguar Global at

Jaguar Global Growth Corporation I, 601 Brickell Key Drive, Suite

700, Miami, FL 33131.

Participants in Solicitation

Jaguar Global and its directors and executive officers may be

deemed participants in the solicitation of proxies from Jaguar

Global’s shareholders with respect to the proposed business

combination. A list of the names of Jaguar Global’s directors and

executive officers and a description of their interests in Jaguar

Global is contained in the Registration Statement, which was filed

with the SEC and is available free of charge at the SEC’s website

at www.sec.gov. To the extent such holdings of Jaguar Global’s

securities have changed since the filing of the Registration

Statement, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC.

Captivision, GLAAM and their respective directors and executive

officers may also be deemed to be participants in the solicitation

of proxies from the shareholders of Jaguar Global in connection

with the proposed business combination. A list of the names of such

directors and executive officers and information regarding their

interests in the proposed business combination is contained in the

Registration Statement, which was filed with the SEC and is

available free of charge at the SEC’s website at www.sec.gov.

No Offer or Solicitation

This communication shall not constitute a solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the proposed business combination. This communication

shall also not constitute an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT

BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY

AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION

CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

Contacts:

Jaguar Global Growth Corporation I Media

Contact Dukas Linden Public Relations for Jaguar Global

Growth Corporation I +1 212.704.7385jaguar@dlpr.com

Jaguar Global Growth Corporation I Investor Relations

ContactCody Slach and Jackie KeshnerGateway Group, Inc. +1

949.574.3860JGGC@gateway-grp.com

GLAAM Investor Relations ContactNakyung Kim THE

IR+82.2.785.1109snk@irup.co.kr

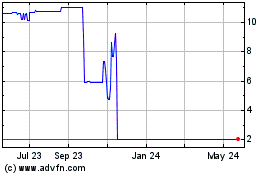

Jaguar Global Growth Cor... (NASDAQ:JGGCU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Jaguar Global Growth Cor... (NASDAQ:JGGCU)

Historical Stock Chart

From Feb 2024 to Feb 2025