KEWAUNEE SCIENTIFIC CORP /DE/FALSE000005552900000555292023-06-282023-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 28, 2023

Kewaunee Scientific Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-5286 | | 38-0715562 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File

Number) | | (IRS Employer

Identification No.) |

2700 West Front Street

Statesville, NC 28677

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (704) 873-7202

N/A

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $2.50 par value | | KEQU | | The Nasdaq Global Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On June 28, 2023, Kewaunee Scientific Corporation issued a press release announcing its financial results for the fourth quarter and fiscal year ended April 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | KEWAUNEE SCIENTIFIC CORPORATION

(Registrant) |

| | |

| Date: June 28, 2023 | | By | /s/ Donald T. Gardner III |

| | | Donald T. Gardner III |

| | | Vice President, Finance |

| | | Chief Financial Officer |

Kewaunee Scientific Reports

Results for Fiscal Year and Fourth Quarter

Exchange: NASDAQ (KEQU) Contact: Donald T. Gardner III

704/871-3274

STATESVILLE, N.C. June 28, 2023 – PRNewswire / Kewaunee Scientific Corporation (NASDAQ: KEQU) today announced results for its fourth quarter and its fiscal year ended April 30, 2023.

Fiscal Year 2023 Fourth Quarter Results:

Sales during the fourth quarter of fiscal year 2023 were $53,986,000, an increase of 8.6% compared to sales of $49,715,000 from the prior year's fourth quarter. The increase was a result of higher international segment sales when compared to the prior period due to the continued delivery of several large projects awarded over the course of the past eighteen months.

Pre-tax earnings for the quarter were $2,322,000 compared to $2,345,000 for the prior year period. Net earnings for the quarter were $1,005,000 compared to a net loss of $362,000 for the prior year. EBITDA1 for the quarter was $3,307,000 compared to $2,969,000 for the prior year period. Diluted earnings per share were $0.34, as compared to a diluted loss per share of $0.13 in the prior year's fourth quarter.

Domestic Segment - Domestic sales for the quarter were $35,123,000, a decrease of 6.9% from sales of $37,720,000 in the prior year period. Net earnings for the domestic segment were $2,402,000 compared to $2,380,000 in the prior year period. Domestic segment EBITDA was $2,991,000 compared to $2,957,000 for the prior year period. During the fourth quarter, the Company fulfilled most of the outstanding performance obligations for the remaining direct orders in its order backlog, the majority of which were priced and executed prior to the broad-based inflation experienced during the previous fiscal year.

International Segment - International sales for the quarter were $18,863,000, an increase of 57.3% from sales of $11,995,000 in the prior year period. This increase in sales was due to the continued delivery of several large projects awarded over the course of the past eighteen months. Net income for the international segment was $1,106,000 compared to $1,020,000 in the prior year period. International segment EBITDA was $1,546,000 compared to $1,456,000 for the prior year period. EBITDA for the quarter was reduced by $293,000, when compared to the previous year period due to a change in the Corporate cost allocation methodology after completing a revised transfer pricing study.

Corporate Segment – Corporate segment net loss was $2,503,000 for the quarter, as compared to $3,762,000 in the prior year period. Corporate segment EBITDA loss for the quarter was $1,230,000, a favorable improvement of 14.8% from corporate segment EBITDA loss of

1 EBITDA is a non-GAAP financial measure. See the table below for a reconciliation of EBITDA and segment EBITDA to net earnings (loss), the most directly comparable GAAP measure.

CORPORATE OFFICES ● P. O. BOX 1842, STATESVILLE, NORTH CAROLINA 28687-1842 ● 2700 WEST FRONT STREET, STATESVILLE, NORTH CAROLINA 28677-2927

PHONE 704-873-7202 ● FAX 704-873-1275

$1,444,000 for the prior year period. The improved EBITDA was driven by the Corporate cost allocation methodology change discussed above, partially offset by higher pension-related expenses.

The Company's order backlog was $147.9 million on April 30, 2023, decreasing from $153.2 million on January 31, 2023 and $173.9 million on April 30, 2022. This change in backlog is principally driven by the substantial completion of the previously announced Dangote Oil project in Lagos, Nigeria during the fiscal year and a reduction in market demand within the ASEAN marketplace. The Company's order backlog for the United States and Indian markets finished the year similar to prior year levels as order rates in these markets remain strong.

"Kewaunee delivered one of the best quarters in the Company's history as our Associates finished fiscal year 2023 on a high note," said Thomas D. Hull III, Kewaunee's President, and Chief Executive Officer. "Profitability improved throughout the year as our teams continued to operate the business with excellence."

"Our domestic team remained focused on supporting our dealer and distribution partners, concluding a year of significant transition. We have materially completed our remaining performance obligations for the previously discussed direct projects, which were priced and awarded prior to the broad-based inflation experienced during the prior fiscal year. We continue to encourage and support our dealer and distribution partners' investment in their organizations so they can better serve their respective territories and we can grow our businesses together. We ended the year well positioned with a strong go-to-market strategy, a healthy order backlog, and a robust opportunity pipeline."

"Our international team has been awarded several large, high-profile projects over the past two years. The fourth quarter of fiscal year 2023 was very strong. This resulted in a significant increase in sales when compared to the prior year quarter. The international team wrapped up what was a record year for both sales and earnings for the segment during the fourth quarter. I could not be prouder of how the team performed during the year."

Fiscal Year 2023 Full Year Results:

Sales during fiscal year 2023 were $219,494,000, an increase of 30.0% compared to sales of $168,872,000 from the prior year. Pre-tax earnings for the fiscal year were $4,498,000 compared to a pre-tax loss of $2,485,000 for the prior year. Net earnings for the fiscal year were $738,000, compared to a net loss of $6,126,000 for the prior year. EBITDA for the fiscal year was $7,517,000 compared to $394,000 for the prior fiscal year. Diluted earnings per share was $0.25, as compared to a loss per share of $2.20 in the prior fiscal year.

Domestic Segment - Domestic sales for the fiscal year were $146,716,000, an increase of 15.7% from sales of $126,848,000 in the prior year. This increase was primarily driven by the pricing of new orders in response to higher raw material input costs. Domestic segment net earnings were $3,408,000 compared to a net loss of $229,000 in the prior fiscal year. Domestic segment EBITDA was $5,802,000 compared to $2,223,000 for the prior year. Domestic segment profitability was negatively impacted during the year by the completion of direct contracts which were priced and awarded prior to the broad-based inflation experienced in the prior fiscal year. Many of these direct contracts were delivered at a loss for the Company.

International Segment - International sales for the fiscal year were $72,778,000, an increase of 73.2% from sales of $42,024,000 in the prior year. The increase in sales was driven by the delivery of several large projects throughout the fiscal year in India, Asia, and Africa. International segment net earnings were $4,511,000 compared to $2,333,000 in the prior fiscal year. International segment EBITDA was $6,650,000 compared to $3,571,000 for the prior year.

Corporate Segment – Corporate segment net loss was $7,181,000 for the fiscal year, as compared to $8,230,000 in the prior fiscal year. Corporate segment EBITDA loss for the fiscal year was $4,935,000, a favorable improvement of 8.6% from corporate segment EBITDA loss of $5,400,000 for the prior year. The favorable change in EBITDA was primarily driven by increased Corporate allocations of $1,172,000 when compared to the prior year due to the change in transfer pricing methodology discussed above, partially offset by higher pension-related expenses and higher operating expenses.

Total cash on hand on April 30, 2023 was $13,815,000, compared to $6,894,000 on April 30, 2022. Working capital was $47,867,000, compared to $49,272,000 on April 30, 2022. Short-term debt was $3,587,000 on April 30, 2023, compared to $1,588,000 on April 30, 2022, and long-term debt was $29,007,000 on April 30, 2023 compared to $29,704,000 on April 30, 2022. The Company’s debt-to-equity ratio on April 30, 2023 was 1.08-to-1, compared to 1.07-to-1 on April 30, 2022.

"Our vision for Kewaunee is to be the global supplier of choice with customers in the laboratory furniture and infrastructure markets," said Thomas D. Hull III, Kewaunee's President, and Chief Executive Officer. "In pursuing this vision, we continue to follow the principles that guide our actions:

•We will be easy to do business with;

•We will get closer to our customers;

•We will do everything with the highest quality; and

•We will lead and not follow (we are innovators)."

"Fiscal year 2023 was a transition year for Kewaunee as we emerged from an extremely disruptive period over the past three years dealing with a global pandemic, rapid broad-based inflation, labor shortages and supply chain disruptions. A testament to the character and drive of Kewaunee's leadership team and Associates is that, while managing through these challenges, we continued to invest in and evolve our business. The benefits of these decisions began to appear as we moved through the year and our financial performance steadily improved. Kewaunee ends fiscal year 2023 with a strong global management team, a healthy backlog, improved manufacturing capabilities, and end-use markets which continue to prioritize investment in projects that require the products Kewaunee designs and manufactures."

"Moving forward, Kewaunee will continue to invest in developing world class manufacturing capabilities to support our dealer and distribution partners in growing our businesses together. This investment in our capabilities better positions Kewaunee to be the brand of choice. Kewaunee's future is bright, and I am excited to continue building on our momentum in fiscal 2024."

EBITDA and Segment EBITDA Reconciliation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended April 30, 2022 | | Domestic | | International | | Corporate | | Consolidated |

| Net Earnings (Loss) | | $ | 2,380 | | | $ | 1,020 | | | $ | (3,762) | | | $ | (362) | |

| Add/(Less): | | | | | | | | |

| Interest Expense | | — | | | 13 | | | 223 | | | 236 | |

| Interest Income | | — | | | (59) | | | (196) | | | (255) | |

| Income Taxes | | — | | | 419 | | | 2,254 | | | 2,673 | |

| Depreciation and Amortization | | 577 | | | 63 | | | 37 | | | 677 | |

| EBITDA | | $ | 2,957 | | | $ | 1,456 | | | $ | (1,444) | | | $ | 2,969 | |

| | | | | | | | |

| Quarter Ended April 30, 2023 | | Domestic | | International | | Corporate | | Consolidated |

| Net Earnings (Loss) | | $ | 2,402 | | | $ | 1,106 | | | $ | (2,503) | | | $ | 1,005 | |

| Add/(Less): | | | | | | | | |

| Interest Expense | | — | | | 97 | | | 447 | | | 544 | |

| Interest Income | | — | | | (194) | | | (1) | | | (195) | |

| Income Taxes | | — | | | 449 | | | 779 | | | 1,228 | |

| Depreciation and Amortization | | 589 | | | 88 | | | 48 | | | 725 | |

| EBITDA | | $ | 2,991 | | | $ | 1,546 | | | $ | (1,230) | | | $ | 3,307 | |

| | | | | | | | |

| Fiscal Year to Date April 30, 2022 | | Domestic | | International | | Corporate | | Consolidated |

| Net Earnings (Loss) | | $ | (229) | | | $ | 2,333 | | | $ | (8,230) | | | $ | (6,126) | |

| Add/(Less): | | | | | | | | |

| Interest Expense | | — | | | 30 | | | 602 | | | 632 | |

| Interest Income | | — | | | (197) | | | (202) | | | (399) | |

| Income Taxes | | 50 | | | 1,129 | | | 2,339 | | | 3,518 | |

| Depreciation and Amortization | | 2,402 | | | 276 | | | 91 | | | 2,769 | |

| EBITDA | | $ | 2,223 | | | $ | 3,571 | | | $ | (5,400) | | | $ | 394 | |

| | | | | | | | |

| Fiscal Year to Date April 30, 2023 | | Domestic | | International | | Corporate | | Consolidated |

| Net Earnings (Loss) | | $ | 3,408 | | | $ | 4,511 | | | $ | (7,181) | | | $ | 738 | |

| Add/(Less): | | | | | | | | |

| Interest Expense | | — | | | 210 | | | 1,524 | | | 1,734 | |

| Interest Income | | — | | | (603) | | | (358) | | | (961) | |

| Income Taxes | | — | | | 2,250 | | | 889 | | | 3,139 | |

| Depreciation and Amortization | | 2,394 | | | 282 | | | 191 | | | 2,867 | |

| EBITDA | | $ | 5,802 | | | $ | 6,650 | | | $ | (4,935) | | | $ | 7,517 | |

About Non-GAAP Measures

EBITDA and Segment EBITDA are calculated as net earnings (loss), less interest expense and interest income, income taxes, depreciation, and amortization. We believe EBITDA and Segment EBITDA allow management and investors to compare our performance to other companies on a consistent basis without regard to depreciation and amortization, which can vary significantly between companies depending upon many factors. EBITDA and Segment EBITDA are not calculations based upon generally accepted accounting principles, and the method for calculating EBITDA and Segment EBITDA can vary among companies. The amounts included in the EBITDA and Segment EBITDA calculations, however, are derived from amounts included in the historical statements of operations. EBITDA and Segment EBITDA should not be considered as

alternatives to net earnings (loss) or operating earnings (loss) as an indicator of the Company’s operating performance, or as an alternative to operating cash flows as a measure of liquidity.

About Kewaunee Scientific

Founded in 1906, Kewaunee Scientific Corporation is a recognized global leader in the design, manufacture, and installation of laboratory, healthcare, and technical furniture products. The Company’s products include steel and wood casework, fume hoods, adaptable modular systems, moveable workstations, stand-alone benches, biological safety cabinets, and epoxy resin work surfaces and sinks.

The Company’s corporate headquarters are located in Statesville, North Carolina. Sales offices are located in the United States, India, Saudi Arabia, and Singapore. Three manufacturing facilities are located in Statesville serving the domestic and international markets, and one manufacturing facility is located in Bangalore, India serving the local, Asian, and African markets. Kewaunee Scientific's website is located at http://www.kewaunee.com.

This press release contains statements that the Company believes to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release, including statements regarding the Company's future financial condition, results of operations, business operations and business prospects, are forward-looking statements. Words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "predict," "believe" and similar words, expressions and variations of these words and expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions, and other important factors that could significantly impact results or achievements expressed or implied by such forward-looking statements. Such factors, risks, uncertainties and assumptions include, but are not limited to: competitive and general economic conditions, including disruptions from government mandates, both domestically and internationally, as well as supplier constraints and other supply disruptions; changes in customer demands; technological changes in our operations or in our industry; dependence on customers' required delivery schedules; risks related to fluctuations in the Company’s operating results from quarter to quarter; risks related to international operations, including foreign currency fluctuations; changes in the legal and regulatory environment; changes in raw materials and commodity costs; acts of terrorism, war, governmental action, natural disasters and other Force Majeure events. The cautionary statements made pursuant to the Reform Act herein and elsewhere by us should not be construed as exhaustive. We cannot always predict what factors would cause actual results to differ materially from those indicated by the forward-looking statements. Over time, our actual results, performance, or achievements will likely differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such difference might be significant and harmful to our stockholders' interest. Many important factors that could cause such a difference are described under the caption "Risk Factors," in Item 1A of our Annual Report on Form 10-K for the most recent fiscal year ended April 30, which you should review carefully, and in our subsequent quarterly reports on Form 10-Q and current reports on Form 8-K. These reports are available on our investor relations website at www.kewaunee.com and on the SEC website at www.sec.gov. These forward-looking statements speak only as of the date of this document. The Company assumes no obligation, and expressly disclaims any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Kewaunee Scientific Corporation

Consolidated Statements of Operations

($ and shares in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

April 30, | | Twelve Months Ended

April 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 53,986 | | | $ | 49,715 | | | $ | 219,494 | | | $ | 168,872 | |

| Cost of products sold | 43,625 | | | 40,388 | | | 183,906 | | | 144,652 | |

| Gross profit | 10,361 | | | 9,327 | | | 35,588 | | | 24,220 | |

| Operating expenses | 7,660 | | | 7,086 | | | 30,224 | | | 26,828 | |

| Operating earnings (loss) | 2,701 | | | 2,241 | | | 5,364 | | | (2,608) | |

| Pension (expense) income | (18) | | | 89 | | | (71) | | | 355 | |

| Other income, net | 183 | | | 251 | | | 939 | | | 400 | |

| Interest expense | (544) | | | (236) | | | (1,734) | | | (632) | |

| Earnings (loss) before income taxes | 2,322 | | | 2,345 | | | 4,498 | | | (2,485) | |

| Income tax expense | 1,228 | | | 2,673 | | | 3,139 | | | 3,518 | |

| Net earnings (loss) | 1,094 | | | (328) | | | 1,359 | | | (6,003) | |

| Less: Net earnings attributable to the non-controlling interest | 89 | | | 34 | | | 621 | | | 123 | |

| Net earnings (loss) attributable to Kewaunee Scientific Corporation | $ | 1,005 | | | $ | (362) | | | $ | 738 | | | $ | (6,126) | |

| | | | | | | |

| Net earnings (loss) per share attributable to Kewaunee Scientific Corporation stockholders | | | | | | | |

| Basic | $ | 0.36 | | | $ | (0.13) | | | $ | 0.26 | | | $ | (2.20) | |

| Diluted | $ | 0.34 | | | $ | (0.13) | | | $ | 0.25 | | | $ | (2.20) | |

| Weighted average number of common shares outstanding | | | | | | | |

| Basic | 2,830 | | | 2,790 | | | 2,824 | | | 2,786 | |

| Diluted | 2,928 | | | 2,790 | | | 2,902 | | | 2,786 | |

Kewaunee Scientific Corporation

Condensed Consolidated Balance Sheets

($ in thousands)

| | | | | | | | | | | |

| April 30,

2023 | | April 30,

2022 |

| | | | |

| Assets | | | |

| Cash and cash equivalents | $ | 8,078 | | | $ | 4,433 | |

| Restricted cash | 5,737 | | | 2,461 | |

| Receivables, less allowances | 46,081 | | | 41,254 | |

| Inventories | 21,889 | | | 23,796 | |

| | | |

| Note receivable | — | | | 13,457 | |

| Prepaid expenses and other current assets | 6,135 | | | 6,164 | |

| Total Current Assets | 87,920 | | | 91,565 | |

| Net property, plant and equipment | 16,402 | | | 15,121 | |

| Right of use assets | 9,170 | | | 7,573 | |

| | | |

| Other assets | 5,406 | | | 4,514 | |

| Total Assets | $ | 118,898 | | | $ | 118,773 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Short-term borrowings | $ | 3,587 | | | $ | 1,588 | |

| Current portion of financing lease liabilities | 85 | | | 126 | |

| Current portion of operating lease liabilities | 1,967 | | | 1,319 | |

| | | |

| Current portion of financing liability | 642 | | | 575 | |

| | | |

| Accounts payable | 23,599 | | | 27,316 | |

| | | |

| | | |

| | | |

| Other current liabilities | 10,173 | | | 11,369 | |

| Total Current Liabilities | 40,053 | | | 42,293 | |

| Long-term portion of financing lease liabilities | 148 | | | 228 | |

| Long-term portion of operating lease liabilities | 7,136 | | | 6,179 | |

| | | |

| Long-term portion of financing liability | 28,132 | | | 28,775 | |

| | | |

| | | |

| | | |

| Other non-current liabilities | 4,944 | | | 5,118 | |

| Total Liabilities | 80,413 | | | 82,593 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Kewaunee Scientific Corporation Equity | 37,409 | | | 35,694 | |

| Non-controlling interest | 1,076 | | | 486 | |

| Total Stockholders' Equity | 38,485 | | | 36,180 | |

| Total Liabilities and Stockholders' Equity | $ | 118,898 | | | $ | 118,773 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

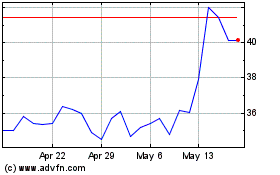

Kewaunee Scientific (NASDAQ:KEQU)

Historical Stock Chart

From Apr 2024 to May 2024

Kewaunee Scientific (NASDAQ:KEQU)

Historical Stock Chart

From May 2023 to May 2024