false

0000948320

0000948320

2023-12-11

2023-12-11

0000948320

LFMD:CommonStockParValueMember

2023-12-11

2023-12-11

0000948320

LFMD:SeriesCumulativeMember

2023-12-11

2023-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 11, 2023

LIFEMD,

INC.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-39785 |

|

76-0238453 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

800

Third Avenue, Suite 2800

New

York, NY 10022

(Address

of principal executive offices, including zip code)

(866)

351-5907

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any

of the following provisions:

| ☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Common

Stock, par value $0.01 per share

|

|

LFMD |

|

The

Nasdaq Global Market |

Series

A Cumulative Perpetual Preferred Stock, par value $0.0001 per share

|

|

LFMDP |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.02 Unregistered Sales of Equity Securities.

Medifast

Collaboration and Private Placement

On

December 11, 2023, LifeMD, Inc., (the “Company”) entered into a collaboration with Medifast, Inc. through and with

certain of its wholly-owned subsidiaries (“Medifast”) (collectively, the “Parties”). Pursuant to certain

agreements between the Parties, Medifast has agreed to pay to the Company the amount of $10 million to support the collaboration,

funding enhancements to the Company platform, operations and supporting infrastructure, of which $5 million was paid at the closing on

December 12, 2023, and the remainder is to be paid in two $2.5 million installments on March 31, 2024 and June 30, 2024 (or earlier

upon the Company’s achievement of certain program milestones). These agreements contain customary representations, warranties,

and other obligations of the Parties.

In

addition, in connection with the collaboration, on December 11, 2023, the Company entered into a Stock Purchase Agreement with

Medifast’s wholly-owned subsidiary Jason Pharmaceuticals, Inc. (the “Purchaser”), whereby the Company issued 1,224,425

shares of its common stock, par value $0.01 per share, in a private placement (the “Private Placement”) at a purchase price

of $8.1671 per share, for aggregate proceeds of approximately $10,000,000. Also therein, the Company granted the Purchaser the right,

for a period contemporaneous with the ongoing collaboration, to appoint one non-voting observer to the Board of Directors of the Company,

entitled to attend Board meetings. The Private Placement closed on December 12, 2023.

Contemporaneously,

the Company and the Purchaser entered into a Registration Rights Agreement, dated December 11, 2023 (the “Registration Rights Agreement”),

under which the Company, upon demand by Medifast, will register the shares of common stock sold thereunder.

The

issuance of shares of Common Stock in the Private Placement described above were made in reliance on the exemption from registration

afforded under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and/or Rule 506 of

Regulation D under the Securities Act.

Cleared Purchase Agreement

As

previously disclosed, on January 11, 2022, the Company entered into a Stock Purchase Agreement (the “Cleared Purchase Agreement),

as amended on February 4, 2003 (the “First Amendment”), by and among the Company, Cleared Technologies, PBC, a

Delaware public benefit corporation (“Cleared”) and the stockholders of Cleared identified therein (the “Sellers”).

On October 17, 2023, the Company issued 117,583 shares of its common stock related to the fourth of five quarterly installment

payments due to the Sellers under the Cleared Purchase Agreement. The First Amendment, among other things, reduced the total purchase

price for Cleared’s stock by $250 thousand to a total of $3.67 million, of which $460 thousand was paid at closing,

with the remaining amount to be paid in the five quarterly installments beginning on or before February 6, 2023 and ending January

15, 2024.

The

issuances of shares of the Company’s common stock pursuant to the First Amendment described above were made in reliance

on the exemption from registration afforded under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D under the Securities

Act.

Stock

Awards and Options

In

the fourth quarter of 2023, through the date of this report, the Company has issued 526,125 shares of its common stock to its

employees related to vested restricted stock units (“RSUs”) and restricted stock awards (“RSAs”) granted under

its 2020 Equity and Incentive Plan and amendments thereto (the “Plan”). In the same period, the

Company has issued 37,500 shares of its common stock on the exercise of stock options that were granted under the Plan.

The

issuances of shares pursuant to the RSUs, RSAs, and stock options identified above were not registered under the Securities Act of 1933,

as amended. Such issuances were made in reliance upon the exemption from registration provided by Section 4(a)(2) under the Securities

Act and/or Rule 506 of Regulation D under the Securities Act.

Item

7.01 Regulation FD Disclosure.

On

December 13, 2023, the Company issued a press release, attached as Exhibit 99.1 to this Current Report on Form 8-K, announcing the collaboration

with Medifast, the Private Placement and related transactions.

The

information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the

Exchange Act, except as expressly set forth by specific reference in such filing.

Item

8.01 Other Events.

The

information related to the Medifast collaboration and Private Placement disclosed under Item 3.02 of this Current Report on Form 8-K

is incorporated by reference into this Item 8.01 to the extent required herein.

Item

9.01. Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

LIFEMD,

INC. |

| |

|

|

|

| Dated: |

December

13, 2023 |

By: |

/s/

Eric Yecies |

| |

|

|

Eric

Yecies |

| |

|

|

Chief

Legal Officer and General Counsel |

Exhibit

99.1

LifeMD

and Medifast Partner to Offer Transformative Weight Management Solution

Collaboration

will integrate LifeMD’s telehealth platform and GLP-1 offering for medically qualified patients with OPTAVIA Coach-guided,

healthy lifestyle solution

Medifast

has invested $20 million, including a $10 million payment in support of the collaboration and a $10 million purchase of LifeMD common

stock

Conference

call to discuss LifeMD and Medifast collaboration begins at 10:00 AM EST today

NEW

YORK, Dec. 13, 2023 – LifeMD, Inc.™ (Nasdaq: LFMD), a leading provider of virtual primary care services, today

announced a strategic alliance with Medifast (NYSE: MED), the health and wellness company known for its habit-based and coach-guided

lifestyle solution OPTAVIA®. Under the terms of the agreement, Medifast will utilize LifeMD’s virtual

care technology platform to provide OPTAVIA Clients access to a clinically supported weight management program, including GLP-1

medications. This collaboration further establishes LifeMD in a market that is projected to reach $100 billion by 2030.1 In

addition, LifeMD will have the ability to offer its patients an independent OPTAVIA Coach and other lifestyle support services

as part of its weight management program.

This

collaboration is intended to create a comprehensive, accessible, and coordinated approach to combating the escalating obesity public

health crisis. By blending LifeMD’s and Medifast’s best-in-class capabilities, the collaboration uniquely offers clinical

care complemented by one-on-one OPTAVIA Coach support, clinically proven plans and scientifically developed products, a proprietary

Habits of Health® Transformational System, as well as community support, delivering a complete solution for effective weight management.

As

part of the agreement, Medifast has invested $20 million into LifeMD, including $10 million in contributions to support the collaboration,

funding enhancements to the LifeMD platform, operations and supporting infrastructure, and a $10 million purchase of LifeMD’s common

stock.

“Combining

lifestyle programs and individualized support with top-tier medical care and prescription therapeutics, like GLP-1 medications, is crucial

for improving and sustaining metabolic health outcomes,” said Justin Schreiber, Chairman and CEO of LifeMD. “Medifast’s

proven coaching model and its established OPTAVIA brand is tightly aligned with LifeMD’s innovative virtual care platform

and network of affiliated clinicians. This synergy is not just complementary; it significantly amplifies LifeMD’s impact in the

weight loss sector. With Medifast’s extensive client base and our advanced virtual care services, we believe that together we are

exceptionally positioned to redefine the weight management industry.”

Medifast

and LifeMD agreed to collaborate following a successful pilot program focused on providing personalized support centered on holistic

health rather than weight loss alone. A recent Medifast-commissioned survey revealed that over 40% of consumers with a BMI greater than

27 are interested in prescription weight-loss medication, with even higher interest among those needing to lose more than 35 pounds.2

LifeMD’s robust technology platform, along with its clinician-driven model – including providers licensed across all

50 states – is uniquely suited to support Medifast’s position as a leader in the U.S. weight management industry.

“This

is a pivotal moment for our business as we take the next step in an aggressive transformation to drive growth in this evolving health

and wellness landscape,” said Dan Chard, Chairman and CEO of Medifast. “Millions of people are seeking a solution that I

believe we are uniquely positioned to provide. Together, Medifast and LifeMD expect to offer a comprehensive health offering starting

with weight management, built around a powerful model of support that includes an independent OPTAVIA Coach and a board-certified

affiliated clinician. Both companies have a long-standing scientific and clinical heritage and share a commitment to helping people make

living a healthy lifestyle second nature.”

Medifast

is known for its habit-based and coach-guided lifestyle solution, OPTAVIA, which provides a simple yet comprehensive approach

to help achieve lasting optimal health and wellbeing. OPTAVIA offers clinically proven plans, scientifically developed products

and a framework for habit creation reinforced by 47,100 active earning coaches,3 about 90% of whom started as customers, and

community support. As a physician-founded company with a 40+ year history, Medifast is a leader in the U.S. weight management industry

and has impacted more than 3 million lives to date.

Conference

Call

LifeMD

and Medifast management will hold a conference call to discuss this transaction and answer questions today beginning at 10:00 AM EST.

The call will be broadcast live over the Internet, hosted on the Investor Relations section of LifeMD’s investor website at www.ir.lifemd.com

or directly here and will be archived online and available through March 13, 2024. In addition, listeners may dial (877) 451-6152

to join via telephone. A telephonic playback will be available from 2:00 PM EST, December 13, 2023, through December 20, 2023. Participants

can dial (844) 512-2921 and enter access code 13743024 to hear the playback. Slides describing the announcement are available at www.ir.lifemd.com.

About

LifeMD, Inc.

LifeMD

is a leading provider of virtual primary care. LifeMD offers telemedicine, laboratory and pharmacy services, and specialized treatment

across more than 200 conditions, including primary care, men’s health, women’s health, allergy & asthma, and dermatology.

Leveraging a vertically-integrated, proprietary digital care platform, a 50-state affiliated medical group, and a U.S.-based patient

care center, LifeMD is elevating healthcare by increasing access to top-notch and affordable care. For more information, please visit

LifeMD.com.

Cautionary

Note Regarding Forward-Looking Statements

This

news release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended; Section

21E of the Securities Exchange Act of 1934, as amended; and the safe harbor provision of the U.S. Private Securities Litigation Reform

Act of 1995. Forward-looking statements contained in this news release may be identified by the use of words such as: “believe,”

“expect,” “anticipate,” “project,” “should,” “plan,” “will,”

“may,” “intend,” “estimate,” predict,” “continue,” and “potential,”

or, in each case, their negative or other variations or comparable terminology referencing future periods. Examples of forward-looking

statements include, but are not limited to, statements regarding our financial outlook and guidance, short and long-term business performance

and operations, future revenues and earnings, regulatory developments, legal events or outcomes, ability to comply with complex and evolving

regulations, market conditions and trends, new or expanded products and offerings, growth strategies, underlying assumptions, and the

effects of any of the foregoing on our future results of operations or financial condition.

Forward-looking

statements are not historical facts and are not assurances of future performance. Rather, these statements are based on our current expectations,

beliefs, and assumptions regarding future plans and strategies, projections, anticipated and unanticipated events and trends, the economy,

and other future conditions, including the impact of any of the aforementioned on our future business. As forward-looking statements

relate to the future, they are subject to inherent risk, uncertainties, and changes in circumstances and assumptions that are difficult

to predict, including some of which are out of our control. Consequently, our actual results, performance, and financial condition may

differ materially from those indicated in the forward-looking statements. These risks and uncertainties include, but are not limited

to, “Risk Factors” identified in our filings with the Securities and Exchange Commission, including, but not limited to,

our most recently filed Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and any amendments thereto. Even if our actual results,

performance, or financial condition are consistent with forward-looking statements contained in such filings, they may not be indicative

of our actual results, performance, or financial condition in subsequent periods.

Any

forward-looking statement made in the news release is based on information currently available to us as of the date on which this release

is made. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future

events, or otherwise, except as may be required under applicable law or regulation.

Company

Contact

Marc

Benathen, Chief Financial Officer

marc@lifemd.com

Media

Contact

Jessica

Friedeman, Chief Marketing Officer

press@lifemd.com

1

Terence Flynn, Framing the Mounjaro bull case in diabesity, Morgan Stanley Research, September,

14, 2023

2

Independent research commissioned by Medifast, June 2023

3

As publicly announced for Q3 2023

v3.23.3

Cover

|

Dec. 11, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2023

|

| Entity File Number |

001-39785

|

| Entity Registrant Name |

LIFEMD,

INC.

|

| Entity Central Index Key |

0000948320

|

| Entity Tax Identification Number |

76-0238453

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

800

Third Avenue

|

| Entity Address, Address Line Two |

Suite 2800

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10022

|

| City Area Code |

(866)

|

| Local Phone Number |

351-5907

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock Par Value [Member] |

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

LFMD

|

| Security Exchange Name |

NASDAQ

|

| Series Cumulative [Member] |

|

| Title of 12(b) Security |

Series

A Cumulative Perpetual Preferred Stock, par value $0.0001 per share

|

| Trading Symbol |

LFMDP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LFMD_CommonStockParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LFMD_SeriesCumulativeMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

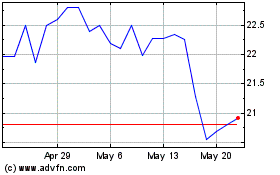

LifeMD (NASDAQ:LFMDP)

Historical Stock Chart

From Apr 2024 to May 2024

LifeMD (NASDAQ:LFMDP)

Historical Stock Chart

From May 2023 to May 2024