Liberty Media Corporation (“Liberty Media” or “Liberty”)

(NASDAQ: LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLYVK) today

reported third quarter 2023 results. Headlines include(1):

- Attributed to Liberty SiriusXM Group

- SiriusXM reported third quarter 2023 operating and financial

results

- Third quarter 2023 revenue of $2.27 billion

- Net income of $363 million, up 47% year-over-year; diluted EPS

of $0.09

- Adjusted EBITDA(2) of $747 million; up 4% year-over-year

- Free cash flow(2) of $291 million

- Year-to-date capital returns to SiriusXM stockholders total

$555 million

- SiriusXM reiterated 2023 financial guidance; planned November

8th next generation event

- Liberty Media’s ownership of SiriusXM was 83.5% as of October

27th

- Retired remaining $199 million outstanding principal amount of

1.375% cash convertible notes in October

- Attributed to Formula One Group

- Announced multi-year regional partnership with American Express

to become official payments partner in the Americas

- Confirmed renewal of Pirelli as global tire partner through

2027

- Expanded partnership with DAZN for exclusive broadcast rights

in Spain through 2026

- Formula 1 repriced $1.7 billion Term Loan B in October,

reducing margin from 3.00% to 2.25%

- Entered into definitive agreement to acquire Quint in

September

- Attributed to Liberty Live Group

- Fair value of Live Nation investment was $5.8 billion as of

September 30th

- Issued $1.15 billion of 2.375% Live Nation exchangeable senior

debentures in September

- Used a portion of proceeds to repurchase $858 million aggregate

principal amount of 0.5% Live Nation exchangeable senior

debentures

“Liberty made a proposal for a combination of Liberty SiriusXM

and Sirius in September, and we are confident that rationalizing

this structure into a single, simplified equity will create value

for all shareholders. SiriusXM drove strong adjusted EBITDA growth

in the third quarter and we look forward to the reveal of their new

streaming app and in-car innovations next week that substantially

enhance their value proposition with consumers, especially younger

audiences,” said Greg Maffei, Liberty Media President and CEO. “At

Formula 1, the Las Vegas Grand Prix is two weeks away and will be

the highest attended sporting event drawing the biggest viewing

audience in Vegas history. This event will deliver a spectacular

fan experience and is accruing long-lasting commercial benefits for

the broader Formula 1 ecosystem. Live Nation remains positioned for

a record-breaking 2023 after delivering their largest quarterly AOI

ever.”

Corporate Updates

On July 18, 2023, Liberty Media completed the split-off of the

Braves and its associated mixed-use development (the “Split-Off”)

into the separate public company Atlanta Braves Holdings, Inc.

(“Atlanta Braves Holdings”). The Braves Group was a tracking stock

of Liberty Media prior to the Split-Off and therefore its results

are reflected in Liberty’s historical consolidated results.

On August 3, 2023, Liberty Media completed the reclassification

of its then-existing common stock to create the Liberty Live Group

common stock (the “Reclassification”). Following the

Reclassification, Liberty SiriusXM Group is comprised of Liberty

Media’s interest in SiriusXM, Formula One Group is comprised of

Liberty Media’s ownership of F1 and other minority investments, and

Liberty Live Group is comprised of Liberty Media’s interest in Live

Nation and other minority investments. The Split-Off and

Reclassification are reflected in Liberty’s consolidated financial

statements on a prospective basis.

Discussion of Results

Unless otherwise noted, the following discussion compares

financial information for the three months ended September 30, 2023

to the same period in 2022.

LIBERTY SIRIUSXM GROUP – The following table provides the

financial results attributed to Liberty SiriusXM Group for the

third quarter of 2023. In the third quarter, $22 million of

corporate level selling, general and administrative expense

(including stock-based compensation expense) was allocated to

Liberty SiriusXM Group.

3Q22

3Q23

% Change

amounts in millions

Liberty SiriusXM Group

Revenue

SiriusXM

$

2,280

$

2,271

—

%

Total Liberty SiriusXM Group

$

2,280

$

2,271

—

%

Operating Income (Loss)

SiriusXM

444

550

24

%

Corporate and other

(10

)

(22

)

(120

)%

Total Liberty SiriusXM Group

$

434

$

528

22

%

Adjusted OIBDA (Loss)

SiriusXM

722

748

4

%

Corporate and other

(9

)

(12

)

(33

)%

Total Liberty SiriusXM Group

$

713

$

736

3

%

SiriusXM is a separate publicly traded company and additional

information about SiriusXM can be obtained through its website and

filings with the Securities and Exchange Commission. SiriusXM

reported its stand-alone third quarter results on October 31, 2023.

For additional detail on SiriusXM’s financial results for the third

quarter, please see SiriusXM’s earnings release posted to its

Investor Relations website. For presentation purposes on page one

of this release, we include the results of SiriusXM, as reported by

SiriusXM, without regard to the purchase accounting adjustments

applied by us for purposes of our financial statements. Liberty

Media believes the presentation of financial results as reported by

SiriusXM is useful to investors as the comparability of those

results is best understood in the context of SiriusXM's historical

financial presentation.

The businesses and assets attributed to Liberty SiriusXM Group

consist primarily of Liberty Media’s interest in SiriusXM, which

includes its subsidiary Pandora.

FORMULA ONE GROUP – The following table provides the

financial results attributed to Formula One Group for the third

quarter of 2023. In the third quarter, Formula One Group incurred

$23 million of corporate level selling, general and administrative

expense (including stock-based compensation expense).

“Formula 1 continues to experience sell-out crowds, record race

attendance and strong growth across our social and digital

platforms, outpacing that of other major sports leagues. This

growth is attracting commercial partners, including our recent

agreement with American Express that marks the first new sports

vertical they have sponsored in over a decade,” said Stefano

Domenicali, Formula 1 President and CEO. “We are making material

progress on our sustainability initiatives, including reducing F1’s

corporate emissions and amplifying F1 Academy by fully integrating

the series into the 2024 F1 calendar with participation from all

ten F1 teams.”

3Q22

3Q23

amounts in millions

Formula One Group

Revenue

Formula 1

$

715

$

887

Total Formula One Group

$

715

$

887

Operating Income (Loss)

Formula 1

$

82

$

132

Corporate and other

(18

)

(25

)

Total Formula One Group

$

64

$

107

Adjusted OIBDA (Loss)

Formula 1

$

170

$

215

Corporate and other

(12

)

(18

)

Total Formula One Group

$

158

$

197

The following table provides the operating results of Formula 1

(“F1”).

F1 Operating

Results

3Q22

3Q23

% Change

amounts in millions

Primary Formula 1 revenue

$

624

$

790

27

%

Other Formula 1 revenue

91

97

7

%

Total Formula 1 revenue

$

715

$

887

24

%

Operating expenses (excluding stock-based

compensation):

Team payments

(370

)

(432

)

(17

)%

Other cost of Formula 1 revenue

(124

)

(183

)

(48

)%

Cost of Formula 1 revenue

$

(494

)

$

(615

)

(24

)%

Selling, general and administrative

expenses

(51

)

(57

)

(12

)%

Adjusted OIBDA

$

170

$

215

26

%

Stock-based compensation

(1

)

(1

)

—

%

Depreciation and Amortization(a)

(87

)

(82

)

6

%

Operating income (loss)

$

82

$

132

61

%

Number of races in period

7

8

____________________

a)

Includes $81 million and $74

million of amortization related to purchase accounting as of

September 30, 2022 and September 30, 2023, respectively, that is

excluded from calculations for purposes of team payments.

Primary F1 revenue represents the majority of F1’s revenue and

is derived from (i) race promotion revenue, (ii) media rights fees

and (iii) sponsorship fees.

There were eight races held in the third quarter of 2023,

compared to seven races held in the third quarter of 2022. There

are 22 events scheduled for the 2023 race calendar.

Primary F1 revenue increased in the third quarter with growth

across race promotion, media rights and sponsorship partly driven

by one more race held in the current period, which resulted in a

greater proportion of season-based revenue recognized. Race

promotion revenue also increased due to higher fees generated from

the different mix of events held, with two additional races outside

of Europe, and other contractual increases in fees. Media rights

revenue benefited from increased fees under new and renewed

contractual agreements and continued growth in F1 TV subscription

revenue. Sponsorship revenue also increased due to recognition of

revenue from new sponsors and growth in revenue from existing

sponsors. Other F1 revenue increased in the third quarter primarily

due to higher freight income driven by two additional races held

outside of Europe and higher hospitality revenue generated from the

Paddock Club, partially offset by lower licensing income.

Operating income and adjusted OIBDA(2) increased in the third

quarter. Team payments were higher compared to the prior year due

to the pro rata recognition of payments across the race season with

one more race held, as well as an expectation of increased team

payments for the full year. Other cost of F1 revenue is largely

variable in nature and is mostly derived from servicing both

Primary and Other F1 revenue opportunities. These costs increased

due to higher hospitality costs driven by cost inflation and the

mix of events held in the current period, as well as increased

freight costs due to two additional races outside of Europe. Other

cost of F1 revenue in the third quarter was also impacted by

increased technical, travel and other event-related costs due to

one additional race, as well as increased commissions and partner

servicing costs associated with higher Primary F1 revenue streams,

certain early stage costs of promoting the Las Vegas Grand Prix and

costs incurred for the new F1 Academy series. Selling, general and

administrative expense increased primarily due to higher personnel,

property, IT and marketing costs, some of which is attributable to

the Las Vegas Grand Prix, partially offset by lower legal costs and

foreign exchange favorability. There were $8 million of costs

associated with the planning of the Las Vegas Grand Prix included

in selling, general and administrative expense in the third quarter

of 2023.

The businesses and assets attributed to Formula One Group

consist primarily of Liberty Media’s subsidiary F1 and other

minority investments.

LIBERTY LIVE GROUP - Liberty Media completed the

Reclassification to create the Liberty Live Group tracking stock on

August 3, 2023. In the third quarter, $5 million of corporate level

selling, general and administrative expense (including stock-based

compensation expense) was allocated to Liberty Live Group.

The businesses and assets attributed to Liberty Live Group

consist primarily of Liberty Media’s interest in Live Nation and

other minority investments.

Share Repurchases

There were no repurchases of Liberty Media’s common stock from

August 1, 2023 through October 31, 2023. The total remaining

repurchase authorization for Liberty Media as of November 1, 2023

is $1.1 billion and can be applied to repurchases of common shares

of any of the Liberty Media tracking stocks.

FOOTNOTES

1)

Liberty Media will discuss these

headlines and other matters on Liberty Media's earnings conference

call that will begin at 10:00 a.m. (E.T.) on November 3, 2023. For

information regarding how to access the call, please see “Important

Notice” later in this document.

2)

For definitions of Adjusted OIBDA

(as defined by Liberty Media) and adjusted EBITDA and free cash

flow (as defined by SiriusXM) and applicable reconciliations see

the accompanying schedules.

NOTES

The following financial information with respect to Liberty

Media's equity affiliates, available for sale securities, cash and

debt is intended to supplement Liberty Media's condensed

consolidated balance sheet and statement of operations to be

included in its Form 10-Q for the period ended September 30, 2023.

For purposes of this presentation, financial information with

respect to Liberty Media’s equity affiliates, available for sale

securities, cash and debt for the period ended June 30, 2023 is

also shown adjusted for the Split-Off and the Reclassification.

On August 3, 2023, in connection with the Reclassification,

Liberty Media’s Live Nation investment previously attributed to

Liberty SiriusXM Group and certain private and public assets

previously attributed to Formula One Group were attributed to

Liberty Live Group. Approximately $100 million of cash from Formula

One Group was attributed to Liberty Live Group in connection with

the Reclassification, of which approximately $33 million came from

the partial liquidation of monetizable public holdings previously

held at Formula One Group. Additionally, all intergroup interests

were settled in connection with the Split-Off.

Additional information on the assets attributed to each tracking

stock can be found at

https://www.libertymedia.com/about/asset-list.

Fair Value of

Corporate Public Holdings

Adjusted for

Split-Off and

Reclassification

(amounts in millions)

6/30/2023

6/30/2023

9/30/2023

Liberty SiriusXM Group

Live Nation Investment(a)

6,345

NA

NA

Atlanta Braves Holdings, Inc.(b)

NA

72

65

Total Liberty SiriusXM Group

$

6,345

$

72

$

65

Formula One Group

Other Monetizable Public Holdings(c)

148

11

—

Total Formula One Group

$

148

$

11

$

—

Liberty Live Group

Live Nation Investment(a)

NA

6,345

5,783

Other Monetizable Public Holdings(c)

NA

104

102

Total Liberty Live Group

$

NA

$

6,449

$

5,885

Total Liberty Media

$

6,493

$

6,532

$

5,950

____________________

a)

Represents the fair value of the

equity investment in Live Nation. In accordance with GAAP, Liberty

Media accounts for its investment in the equity of Live Nation

using the equity method of accounting and includes it in its

condensed consolidated balance sheet at $243 million and $372

million as of June 30, 2023 and September 30, 2023, respectively.

In connection with the Reclassification, the equity investment in

Live Nation previously held at Liberty SiriusXM Group was

attributed to Liberty Live Group.

b)

Atlanta Braves Holdings value as

of June 30, 2023 adjusted for the Split-Off and Reclassification

represents the fair value of the intergroup interest in Braves

Group previously held by Liberty SiriusXM Group as of June 30,

2023. The intergroup interest represented a quasi-equity interest

which was not represented by outstanding shares of common stock. In

connection with the Split-Off, Liberty SiriusXM Group received 1.8

million shares of Atlanta Braves Holdings Series C common stock to

settle the intergroup interest, and such shares are reflected as a

corporate public holding as of June 30, 2023 adjusted for the

Split-Off and Reclassification and as of September 30, 2023

above.

c)

Represents the carrying value of

other public holdings that are accounted for at fair value.

Excludes intergroup interests. Includes exchange-traded funds

previously held at Formula One Group that were attributed to

Liberty Live Group in connection with the Reclassification.

Cash and Debt

The following presentation is provided to separately identify

cash and debt information.

Adjusted for

Split-Off and

Reclassification

(amounts in millions)

6/30/2023

6/30/2023

9/30/2023

Cash and Cash Equivalents Attributable

to:

Liberty SiriusXM Group(a)

$

311

$

382

$

327

Formula One Group(b)

1,489

1,351

1,470

Liberty Live Group(c)

NA

100

315

Braves Group(d)

131

NA

NA

Total Consolidated Cash and Cash

Equivalents (GAAP)

$

1,931

$

1,833

$

2,112

Debt:

SiriusXM senior notes(e)

$

8,750

$

8,750

$

8,750

Pandora convertible senior notes

20

20

20

1.375% cash convertible notes due

2023(f)

199

199

199

3.75% convertible notes due 2028(f)

575

575

575

2.75% SiriusXM exchangeable senior

debentures due 2049(f)

586

586

586

SiriusXM margin loan

875

875

775

Other subsidiary debt(g)

723

723

635

0.5% Live Nation exchangeable senior

debentures due 2050(f)

920

NA

NA

Live Nation margin loan

—

NA

NA

Total Attributed Liberty SiriusXM Group

Debt

$

12,648

$

11,728

$

11,540

Unamortized discount, fair market value

adjustment and deferred loan costs

82

(18

)

—

Total Attributed Liberty SiriusXM Group

Debt (GAAP)

$

12,730

$

11,710

$

11,540

2.25% convertible notes due 2027(f)

475

475

475

Formula 1 term loan and revolving credit

facility

2,416

2,416

2,411

Other corporate level debt

61

61

59

Total Attributed Formula One Group

Debt

$

2,952

$

2,952

$

2,945

Fair market value adjustment

(2

)

(2

)

(48

)

Total Attributed Formula One Group Debt

(GAAP)

$

2,950

$

2,950

$

2,897

Formula 1 leverage(h)

2.2x

2.2x

2.2x

0.5% Live Nation exchangeable senior

debentures due 2050(f)

NA

920

62

2.375% Live Nation exchangeable senior

debentures due 2053(f)

NA

NA

1,150

Live Nation margin loan

NA

—

—

Total Attributed Liberty Live Group

Debt

NA

$

920

$

1,212

Unamortized discount, fair market value

adjustment and deferred loan costs

NA

100

14

Total Attributed Liberty Live Group

Debt (GAAP)

NA

$

1,020

$

1,226

Atlanta Braves debt

543

NA

NA

Total Attributed Braves Group

Debt

$

543

NA

NA

Deferred loan costs

(4

)

NA

NA

Total Attributed Braves Group Debt

(GAAP)

$

539

NA

NA

Total Liberty Media Corporation Debt

(GAAP)

$

16,219

$

15,680

$

15,663

____________________

a)

Includes $51 million and $53

million of cash held at SiriusXM as of June 30, 2023 and September

30, 2023, respectively. Cash as of June 30, 2023 adjusted for

Split-Off and Reclassification reflects $71 million payment from

Formula One Group to Liberty SiriusXM Group to settle intergroup

interest subsequent to June 30, 2023.

b)

Includes $1,055 million and $947

million of cash held at F1 as of June 30, 2023 and September 30,

2023, respectively. Cash as of June 30, 2023 adjusted for Split-Off

and Reclassification reflects $71 million payment from Formula One

Group to Liberty SiriusXM Group to settle intergroup interest and

$67 million of cash on hand contributed to Liberty Live Group

subsequent to June 30, 2023.

c)

In connection with the

Reclassification, Liberty Live Group was capitalized with $100

million of cash from Formula One Group, of which approximately $33

million came from the partial liquidation of monetizable public

holdings previously held at Formula One Group.

d)

Excludes restricted cash held in

reserves pursuant to the terms of various financial obligations of

$52 million as of June 30, 2023.

e)

Outstanding principal amount of

Senior Notes or Term Loan with no reduction for the net unamortized

discount.

f)

Face amount of the convertible

notes and exchangeable debentures with no fair market value

adjustment.

g)

Includes SiriusXM revolving

credit facility and term loan.

h)

Net debt to covenant OIBDA ratio

of F1 operating business as defined in F1’s credit facilities for

covenant calculations.

Liberty Media and its consolidated subsidiaries are in

compliance with their debt covenants as of September 30, 2023.

The cash and debt narrative below compares financial information

as of June 30, 2023 adjusted for the Split-Off and Reclassification

to financial information as of September 30, 2023. Financial

information for the period ended June 30, 2023 unadjusted for the

Split-Off and Reclassification can be found in the table above.

Total cash and cash equivalents attributed to Liberty SiriusXM

Group decreased $55 million in the third quarter as net debt

repayment at both Liberty SiriusXM Group and SiriusXM, capital

expenditures and return of capital at SiriusXM more than offset

cash from operations at SiriusXM. Included in the cash and cash

equivalents balance attributed to Liberty SiriusXM Group at

September 30, 2023 is $53 million held at SiriusXM. Although

SiriusXM is a consolidated subsidiary, it is a separate public

company with a non-controlling interest, therefore Liberty Media

does not have ready access to SiriusXM’s cash balance. Liberty

SiriusXM Group received $78 million of dividends from SiriusXM

during the quarter.

Total debt attributed to Liberty SiriusXM Group decreased $188

million during the quarter as Liberty SiriusXM Group paid down $100

million under its SiriusXM margin loan and SiriusXM reduced

borrowing under its revolving credit facility. In October, Liberty

SiriusXM Group retired the remaining $199 million outstanding

principal amount of its 1.375% cash convertible notes with cash on

hand.

Total cash and cash equivalents attributed to Formula One Group

increased $119 million during the quarter as cash from operations

at F1 more than offset capital expenditures primarily related to

the Las Vegas Grand Prix. During the third quarter, Formula One

Group announced it entered into a definitive agreement to acquire

Quint. The transaction is expected to close by year-end and will be

funded with Formula One Group cash on hand.

Total debt at Formula One Group was relatively flat in the third

quarter. Formula 1 repriced its $1.7 billion Term Loan B facility

on October 4, 2023, reducing the margin from 3.00% to 2.25%.

Total cash and cash equivalents attributed to Liberty Live Group

increased $215 million and total debt increased $292 million during

the third quarter. During the quarter, Liberty Live Group issued

$1.15 billion aggregate principal amount of 2.375% exchangeable

senior debentures due 2053. A portion of the proceeds were used to

repurchase $858 million aggregate adjusted principal amount of its

0.5% exchangeable senior debentures due 2050 for a total cost of

$918 million. Liberty Live Group expects to use the remaining net

proceeds of the offering to settle its remaining 0.5% exchangeable

senior debentures ahead of the September 2024 put/call date, and

for general corporate purposes. On September 5, 2023, the Live

Nation margin loan was amended, extending the maturity date to

September 2026 while other terms remain unchanged.

In connection with the Reclassification, the 3.75% Liberty

SiriusXM Group convertible notes due 2028 (convertible into LSXMA)

and the 2.25% Formula One Group convertible notes due 2027

(convertible into FWONK) were adjusted to provide for the

conversion and settlement of the notes into the reclassified

Liberty SiriusXM Group and Formula One Group equities,

respectively, at new conversion rates in accordance with each

respective bond indenture. As of September 30, 2023, the conversion

rate for the 3.75% notes is 35.4563 shares of LSXMA and the

conversion rate for the 2.25% notes is 12.0505 shares of FWONK per

$1,000 principal amount of the respective notes.

Important Notice: Liberty Media Corporation (Nasdaq:

LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLYVK) will discuss

Liberty Media's earnings release on a conference call which will

begin at 10:00 a.m. (E.T.) on November 3, 2023. The call can be

accessed by dialing (877) 704-2829 or (215) 268-9864, passcode

13736986 at least 10 minutes prior to the start time. The call will

also be broadcast live across the Internet and archived on our

website. To access the webcast go to

https://www.libertymedia.com/investors/news-events/ir-calendar.

Links to this press release will also be available on the Liberty

Media website.

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements about business strategies, market

potential, future financial performance and prospects, the proposed

combination of Liberty SiriusXM Group and SiriusXM, the Las Vegas

Grand Prix, the proposed transaction with QuintEvents LLC, the

continuation of our stock repurchase plan, our environmental and

social initiatives and other matters that are not historical facts.

These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements, including,

without limitation, the satisfaction of all conditions to the

proposed combination of Liberty SiriusXM Group and SiriusXM, the

satisfaction of all conditions to closing for the transaction with

QuintEvents LLC, possible changes in market acceptance of new

products or services, regulatory matters affecting our businesses,

the unfavorable outcome of pending or future litigation, the

failure to realize benefits of acquisitions, rapid technological

and industry change, failure of third parties to perform, continued

access to capital on terms acceptable to Liberty Media and changes

in law, including consumer protection laws, and their enforcement.

These forward-looking statements speak only as of the date of this

press release, and Liberty Media expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein to reflect any change in

Liberty Media's expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based. Please refer to the publicly filed documents of Liberty

Media, including Amendment No. 5 to Liberty Media’s Registration

Statement on Form S-4 filed on June 8, 2023 and the most recent

Forms 10-K and 10-Q, for additional information about Liberty Media

and about the risks and uncertainties related to Liberty Media's

business which may affect the statements made in this press

release.

LIBERTY MEDIA

CORPORATION

BALANCE SHEET

INFORMATION

September 30, 2023

(unaudited)

Attributed

Liberty

Formula

Liberty

SiriusXM

One

Live

Intergroup

Consolidated

Group

Group

Group

Eliminations

Liberty

amounts in millions

Assets

Current assets:

Cash and cash equivalents

$

327

1,470

315

—

2,112

Trade and other receivables, net

659

149

—

—

808

Other current assets

357

348

—

—

705

Total current assets

1,343

1,967

315

—

3,625

Investments in affiliates, accounted for

using the equity method

705

43

397

—

1,145

Property and equipment, at cost

3,083

874

—

—

3,957

Accumulated depreciation

(1,829

)

(123

)

—

—

(1,952

)

1,254

751

—

—

2,005

Intangible assets not subject to

amortization

Goodwill

15,209

3,956

—

—

19,165

FCC licenses

8,600

—

—

—

8,600

Other

1,242

—

—

—

1,242

25,051

3,956

—

—

29,007

Intangible assets subject to amortization,

net

1,017

2,924

—

—

3,941

Other assets

567

913

479

(167

)

1,792

Total assets

$

29,937

10,554

1,191

(167

)

41,515

Liabilities and Equity

Current liabilities:

Intergroup payable (receivable)

$

51

(53

)

2

—

—

Accounts payable and accrued

liabilities

1,323

390

2

—

1,715

Current portion of debt

730

32

65

—

827

Deferred revenue

1,248

776

—

—

2,024

Other current liabilities

78

32

—

—

110

Total current liabilities

3,430

1,177

69

—

4,676

Long-term debt

10,810

2,865

1,161

—

14,836

Deferred income tax liabilities

2,207

—

—

(167

)

2,040

Other liabilities

575

149

—

—

724

Total liabilities

17,022

4,191

1,230

(167

)

22,276

Equity / Attributed net assets

9,946

6,363

(62

)

—

16,247

Noncontrolling interests in equity of

subsidiaries

2,969

—

23

—

2,992

Total liabilities and equity

$

29,937

10,554

1,191

(167

)

41,515

LIBERTY MEDIA

CORPORATION

STATEMENT OF OPERATIONS

INFORMATION

Three months ended September

30, 2023 (unaudited)

Attributed

Liberty

Formula

Liberty

SiriusXM

One

Live

Braves

Consolidated

Group

Group

Group

Group

Liberty

amounts in millions

Revenue:

Sirius XM Holdings revenue

$

2,271

—

—

—

2,271

Formula 1 revenue

—

887

—

—

887

Other revenue

—

—

—

49

49

Total revenue

2,271

887

—

49

3,207

Operating costs and expenses, including

stock-based compensation:

Cost of Sirius XM Holdings services

(exclusive of depreciation shown separately below):

Revenue share and royalties

730

—

—

—

730

Programming and content(1)

153

—

—

—

153

Customer service and billing(1)

117

—

—

—

117

Other(1)

57

—

—

—

57

Cost of Formula 1 revenue (exclusive of

depreciation shown separately below)

—

615

—

—

615

Subscriber acquisition costs

87

—

—

—

87

Other operating expenses(1)

72

—

—

38

110

Selling, general and administrative(1)

376

79

5

9

469

Impairment, restructuring and acquisition

costs, net of recoveries

6

—

—

—

6

Depreciation and amortization

145

86

—

3

234

1,743

780

5

50

2,578

Operating income (loss)

528

107

(5

)

(1

)

629

Other income (expense):

Interest expense

(135

)

(56

)

(2

)

(3

)

(196

)

Share of earnings (losses) of affiliates,

net

45

2

90

1

138

Realized and unrealized gains (losses) on

financial instruments, net

17

66

(72

)

—

11

Unrealized gains (losses) on intergroup

interests

4

16

—

(20

)

—

Other, net

6

14

(35

)

1

(14

)

(63

)

42

(19

)

(21

)

(61

)

Earnings (loss) before income taxes

465

149

(24

)

(22

)

568

Income tax (expense) benefit

(100

)

(31

)

5

1

(125

)

Net earnings (loss)

365

118

(19

)

(21

)

443

Less net earnings (loss) attributable to

the noncontrolling interests

58

—

—

—

58

Net earnings (loss) attributable to

Liberty stockholders

$

307

118

(19

)

(21

)

385

(1) Includes stock-based compensation

expense as follows:

Programming and content

10

—

—

—

10

Customer service and billing

1

—

—

—

1

Other

2

—

—

—

2

Other operating expenses

11

—

—

—

11

Selling, general and administrative

33

4

1

1

39

Stock compensation expense

$

57

4

1

1

63

LIBERTY MEDIA

CORPORATION

STATEMENT OF OPERATIONS

INFORMATION

Three months ended September

30, 2022 (unaudited)

Attributed

Liberty

Formula

SiriusXM

One

Braves

Consolidated

Group

Group

Group

Liberty

amounts in millions

Revenue:

Sirius XM Holdings revenue

$

2,280

—

—

2,280

Formula 1 revenue

—

715

—

715

Other revenue

—

—

252

252

Total revenue

2,280

715

252

3,247

Operating costs and expenses, including

stock-based compensation:

Cost of Sirius XM Holdings services

(exclusive of depreciation shown separately below):

Revenue share and royalties

709

—

—

709

Programming and content(1)

156

—

—

156

Customer service and billing(1)

122

—

—

122

Other(1)

54

—

—

54

Cost of Formula 1 revenue (exclusive of

depreciation shown separately below)

—

494

—

494

Subscriber acquisition costs

86

—

—

86

Other operating expenses(1)

69

—

184

253

Selling, general and administrative(1)

424

68

33

525

Impairment, restructuring and acquisition

costs, net of recoveries

69

—

5

74

Depreciation and amortization

157

89

22

268

1,846

651

244

2,741

Operating income (loss)

434

64

8

506

Other income (expense):

Interest expense

(130

)

(41

)

(8

)

(179

)

Share of earnings (losses) of affiliates,

net

104

1

6

111

Realized and unrealized gains (losses) on

financial instruments, net

76

24

6

106

Unrealized gains (losses) on intergroup

interests

(16

)

47

(31

)

—

Other, net

13

7

—

20

47

38

(27

)

58

Earnings (loss) before income taxes

481

102

(19

)

564

Income tax (expense) benefit

(135

)

8

(3

)

(130

)

Net earnings (loss)

346

110

(22

)

434

Less net earnings (loss) attributable to

the noncontrolling interests

41

5

—

46

Less net earnings (loss) attributable to

redeemable noncontrolling interest

—

(3

)

—

(3

)

Net earnings (loss) attributable to

Liberty stockholders

$

305

108

(22

)

391

(1) Includes stock-based compensation

expense as follows:

Programming and content

10

—

—

10

Customer service and billing

1

—

—

1

Other

1

—

—

1

Other operating expenses

10

—

—

10

Selling, general and administrative

31

5

3

39

Stock compensation expense

$

53

5

3

61

LIBERTY MEDIA

CORPORATION

STATEMENT OF CASH FLOWS

INFORMATION

Nine months ended September

30, 2023 (unaudited)

Attributed

Liberty

Formula

Liberty

SiriusXM

One

Live

Braves

Consolidated

Group

Group

Group

Group

Liberty

amounts in millions

Cash flows from operating activities:

Net earnings (loss)

$

802

124

(19

)

(109

)

798

Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities:

Depreciation and amortization

460

254

—

37

751

Stock-based compensation

151

14

1

7

173

Non-cash impairment and restructuring

costs

21

—

—

—

21

Share of (earnings) loss of affiliates,

net

(117

)

1

(90

)

(12

)

(218

)

Unrealized (gains) losses on intergroup

interests, net

(68

)

(15

)

—

83

—

Realized and unrealized (gains) losses on

financial instruments, net

145

(83

)

72

(3

)

131

Deferred income tax expense (benefit)

(1

)

19

(4

)

(5

)

9

Intergroup tax allocation

136

(135

)

(1

)

—

—

Intergroup tax (payments) receipts

(90

)

91

—

(1

)

—

Other charges (credits), net

(10

)

6

34

4

34

Changes in operating assets and

liabilities

Current and other assets

5

(122

)

(10

)

(34

)

(161

)

Payables and other liabilities

(136

)

400

14

65

343

Net cash provided (used) by operating

activities

1,298

554

(3

)

32

1,881

Cash flows from investing activities:

Investments in equity method affiliates

and debt and equity securities

(44

)

(173

)

—

—

(217

)

Cash proceeds from dispositions

—

110

1

—

111

Capital expended for property and

equipment, including internal-use software and website

development

(520

)

(308

)

—

(35

)

(863

)

Other investing activities, net

(1

)

(20

)

—

—

(21

)

Net cash provided (used) by investing

activities

(565

)

(391

)

1

(35

)

(990

)

Cash flows from financing activities:

Borrowings of debt

2,601

—

1,135

30

3,766

Repayments of debt

(3,306

)

(64

)

(918

)

(20

)

(4,308

)

Intergroup (repayments) borrowings

273

(273

)

—

—

—

Subsidiary shares repurchased by

subsidiary

(274

)

—

—

—

(274

)

Cash dividends paid by subsidiary

(48

)

—

—

—

(48

)

Taxes paid in lieu of shares issued for

stock-based compensation

(52

)

(8

)

—

(1

)

(61

)

Atlanta Braves Holdings, Inc.

Split-Off

—

—

—

(188

)

(188

)

Reclassification

—

(100

)

100

—

—

Other financing activities, net

38

19

—

9

66

Net cash provided (used) by financing

activities

(768

)

(426

)

317

(170

)

(1,047

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(35

)

(263

)

315

(173

)

(156

)

Cash, cash equivalents and restricted cash

at beginning of period

370

1,733

NA

173

2,276

Cash, cash equivalents and restricted cash

at end of period

$

335

1,470

315

—

2,120

Cash and cash equivalents

$

327

1,470

315

NA

2,112

Restricted cash included in other

assets

8

—

—

NA

8

Total cash and cash equivalents and

restricted cash at end of period

$

335

1,470

315

NA

2,120

LIBERTY MEDIA

CORPORATION

STATEMENT OF CASH FLOWS

INFORMATION

Nine months ended September

30, 2022 (unaudited)

Attributed

Liberty

Formula

SiriusXM

One

Braves

Consolidated

Group

Group

Group

Liberty

amounts in millions

Cash flows from operating activities:

Net earnings (loss)

$

1,188

187

29

1,404

Adjustments to reconcile net earnings

(loss) to net cash provided by operating activities:

Depreciation and amortization

461

272

57

790

Stock-based compensation

152

12

9

173

Non-cash impairment and restructuring

costs

68

—

5

73

Share of (earnings) loss of affiliates,

net

(140

)

—

(18

)

(158

)

Unrealized (gains) losses on intergroup

interests, net

31

(26

)

(5

)

—

Realized and unrealized (gains) losses on

financial instruments, net

(433

)

(100

)

(12

)

(545

)

Deferred income tax expense (benefit)

267

16

(6

)

277

Intergroup tax allocation

80

(95

)

15

—

Intergroup tax (payments) receipts

(66

)

57

9

—

Other charges (credits), net

(20

)

(4

)

(3

)

(27

)

Changes in operating assets and

liabilities

—

—

—

—

Current and other assets

41

(91

)

(52

)

(102

)

Payables and other liabilities

(325

)

188

(8

)

(145

)

Net cash provided (used) by operating

activities

1,304

416

20

1,740

Cash flows from investing activities:

Investments in equity affiliates and debt

and equity securities

(1

)

(35

)

(5

)

(41

)

Cash proceeds from dispositions

50

51

48

149

Cash (paid) received for acquisitions, net

of cash acquired

(136

)

—

—

(136

)

Capital expended for property and

equipment, including internal-use software and website

development

(279

)

(263

)

(13

)

(555

)

Other investing activities, net

4

73

—

77

Net cash provided (used) by investing

activities

(362

)

(174

)

30

(506

)

Cash flows from financing activities:

Borrowings of debt

3,019

468

135

3,622

Repayments of debt

(3,079

)

(634

)

(235

)

(3,948

)

Intergroup (repayments) borrowings

78

(64

)

(14

)

—

Liberty stock repurchases

(358

)

(37

)

—

(395

)

Subsidiary shares repurchased by

subsidiary

(599

)

—

—

(599

)

Cash dividends paid by subsidiary

(233

)

—

—

(233

)

Taxes paid in lieu of shares issued for

stock-based compensation

(134

)

25

—

(109

)

Other financing activities, net

30

58

(6

)

82

Net cash provided (used) by financing

activities

(1,276

)

(184

)

(120

)

(1,580

)

Effect of foreign exchange rates on cash,

cash equivalents and restricted cash

—

(13

)

—

(13

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(334

)

45

(70

)

(359

)

Cash, cash equivalents and restricted cash

at beginning of period

606

2,074

244

2,924

Cash, cash equivalents and restricted cash

at end of period

$

272

2,119

174

2,565

Cash and cash equivalents

$

264

2,119

159

2,542

Restricted cash included in other current

assets

—

—

15

15

Restricted cash included in other

assets

8

—

—

8

Total cash and cash equivalents and

restricted cash at end of period

$

272

2,119

174

2,565

NON-GAAP FINANCIAL MEASURES AND SUPPLEMENTAL

DISCLOSURES

SCHEDULE 1

To provide investors with additional information regarding our

financial results, this press release includes a presentation of

Adjusted OIBDA, which is a non-GAAP financial measure, for Liberty

SiriusXM Group, Formula One Group, Liberty Live Group and the

former Braves Group, together with reconciliations to operating

income, as determined under GAAP. Liberty Media defines Adjusted

OIBDA as operating income (loss) plus depreciation and

amortization, stock-based compensation, separately reported

litigation settlements, restructuring, acquisition and other

related costs and impairment charges.

Liberty Media believes Adjusted OIBDA is an important indicator

of the operational strength and performance of its businesses by

identifying those items that are not directly a reflection of each

business’ performance or indicative of ongoing business trends. In

addition, this measure allows management to view operating results

and perform analytical comparisons and benchmarking between

businesses and identify strategies to improve performance. Because

Adjusted OIBDA is used as a measure of operating performance,

Liberty Media views operating income as the most directly

comparable GAAP measure. Adjusted OIBDA is not meant to replace or

supersede operating income or any other GAAP measure, but rather to

supplement such GAAP measures in order to present investors with

the same information that Liberty Media's management considers in

assessing the results of operations and performance of its

assets.

The following table provides a reconciliation of Adjusted OIBDA

for Liberty Media to operating income (loss) calculated in

accordance with GAAP for the three months ended September 30, 2022

and September 30, 2023, respectively.

QUARTERLY

SUMMARY

(amounts in millions)

3Q22

3Q23

Liberty SiriusXM Group

Operating income

$

434

$

528

Depreciation and amortization

157

145

Stock compensation expense

53

57

Impairment, restructuring and acquisition

costs, net of recoveries(a)

69

6

Adjusted OIBDA

$

713

$

736

Formula One Group

Operating income

$

64

$

107

Depreciation and amortization

89

86

Stock compensation expense

5

4

Adjusted OIBDA

$

158

$

197

Liberty Live Group

Operating income

$

NA

$

(5

)

Depreciation and amortization

NA

—

Stock compensation expense

NA

1

Adjusted OIBDA

$

NA

$

(4

)

Braves Group

Operating income

$

8

$

(1

)

Depreciation and amortization

22

3

Stock compensation expense

3

1

Impairment, restructuring and acquisition

costs, net of recoveries(a)

5

—

Adjusted OIBDA

$

38

$

3

Liberty Media Corporation

(Consolidated)

Operating income

$

506

$

629

Depreciation and amortization

268

234

Stock compensation expense

61

63

Impairment, restructuring and acquisition

costs, net of recoveries

74

6

Adjusted OIBDA

$

909

$

932

____________________

a)

During the three months ended

September 30, 2023, SiriusXM recorded restructuring related costs

and impairments of $6 million. During the three months ended

September 30, 2022, Sirius XM Holdings recorded an impairment of

$43 million associated with terminated software projects, $16

million related to certain vacated office spaces, $4 million in

connection with furniture and equipment located at the impaired

office spaces and $5 million related to personnel severance, and

Braves Holdings recorded $5 million of impairment losses as a

result of hurricane damage at its spring training facility in

Florida. These charges have been excluded from adjusted OIBDA.

SCHEDULE 2

This press release also includes a presentation of adjusted

EBITDA of SiriusXM, which is a non-GAAP financial measure used by

SiriusXM, together with a reconciliation to SiriusXM's stand-alone

net income, as determined under GAAP. SiriusXM defines adjusted

EBITDA as net income before interest expense, income tax expense

and depreciation and amortization. SiriusXM adjusts EBITDA to

exclude the impact of other expense (income) as well as certain

other charges discussed below. Adjusted EBITDA is a non-GAAP

financial measure that excludes or adjusts for (if applicable): (i)

loss on extinguishment of debt, (ii) share-based payment expense,

(iii) impairment, restructuring and acquisition costs, (iv) legal

settlements/reserves and (v) other significant operating expense

(income) that do not relate to the on-going performance of

SiriusXM’s business. SiriusXM believes adjusted EBITDA is a useful

measure of the underlying trend of its operating performance, which

provides useful information about its business apart from the costs

associated with its capital structure and purchase price

accounting. SiriusXM believes investors find this non-GAAP

financial measure useful when analyzing past operating performance

with current performance and comparing SiriusXM’s operating

performance to the performance of other communications,

entertainment and media companies. SiriusXM believes investors use

adjusted EBITDA to estimate current enterprise value and to make

investment decisions. As a result of large capital investments in

SiriusXM’s satellite radio system, its results of operations

reflect significant charges for depreciation expense. SiriusXM

believes the exclusion of share-based payment expense is useful as

it is not directly related to the operational conditions of its

business. SiriusXM also believes the exclusion of impairment,

restructuring and acquisition related costs, to the extent they

occur during the period, is useful as they are significant expenses

not incurred as part of its normal operations for the period.

Adjusted EBITDA has certain limitations in that it does not take

into account the impact to SiriusXM’s consolidated statements of

comprehensive income of certain expenses, including share-based

payment expense. SiriusXM endeavors to compensate for the

limitations of the non-GAAP measure presented by also providing the

comparable GAAP measure with equal or greater prominence and

descriptions of the reconciling items, including quantifying such

items, to derive the non-GAAP measure. Investors that wish to

compare and evaluate SiriusXM’s operating results after giving

effect for these costs, should refer to net income as disclosed in

SiriusXM’s unaudited consolidated statements of comprehensive

income. Since adjusted EBITDA is a non-GAAP financial performance

measure, SiriusXM’s calculation of adjusted EBITDA may be

susceptible to varying calculations; may not be comparable to other

similarly titled measures of other companies; and should not be

considered in isolation, as a substitute for, or superior to

measures of financial performance prepared in accordance with GAAP.

The reconciliation of net income to the adjusted EBITDA is

calculated as follows:

Unaudited

For the Three Months Ended

September 30,

2022

2023

($ in millions)

Net income:

$

247

$

363

Add back items excluded from Adjusted

EBITDA:

Legal settlements and reserves

—

—

Impairment, restructuring and acquisition

costs(a)

69

5

Share-based payment expense

50

48

Depreciation and amortization

134

130

Interest expense

107

106

Other (income) expense

3

3

Income tax expense

110

92

Adjusted EBITDA

$

720

$

747

____________________

a)

As reported by SiriusXM, during

the three months ended September 30, 2023, SiriusXM recorded

restructuring related costs and impairments of $5 million. As

reported by SiriusXM, during the three months ended September 30,

2022, Sirius XM Holdings recorded an impairment of $43 million

associated with terminated software projects, $16 million related

to certain vacated office spaces, $4 million in connection with

furniture and equipment located at the impaired office spaces and

$5 million related to personnel severance. These charges have been

excluded from adjusted OIBDA.

SCHEDULE 3

This press release includes a presentation of free cash flow of

SiriusXM, which is a non-GAAP financial measure used by SiriusXM,

together with a reconciliation to SiriusXM's stand-alone cash flow

provided by operating activities, as determined under GAAP.

SiriusXM’s free cash flow is derived from cash flow provided by

operating activities plus insurance recoveries on its satellites,

net of additions to property and equipment and purchases of other

investments. Free cash flow is a metric that SiriusXM’s management

and board of directors use to evaluate the cash generated by its

operations, net of capital expenditures and other investment

activity. In a capital intensive business, with significant

investments in satellites, SiriusXM looks at its operating cash

flow, net of these investing cash outflows, to determine cash

available for future subscriber acquisition and capital

expenditures, to repurchase or retire debt, to acquire other

companies and to evaluate its ability to return capital to

stockholders. SiriusXM excludes from free cash flow certain items

that do not relate to the on-going performance of its business,

such as cash flows related to acquisitions, strategic and

short-term investments and net loan activity with related parties

and other equity investees. SiriusXM believes free cash flow is an

indicator of the long-term financial stability of its business.

Free cash flow, which is reconciled to "Net cash provided by

operating activities," is a non-GAAP financial measure. This

measure can be calculated by deducting amounts under the captions

"Additions to property and equipment" and deducting or adding

Restricted and other investment activity from "Net cash provided by

operating activities" from the unaudited consolidated statements of

cash flows. Free cash flow should be used in conjunction with other

GAAP financial performance measures and may not be comparable to

free cash flow measures presented by other companies. Free cash

flow should be viewed as a supplemental measure rather than an

alternative measure of cash flows from operating activities, as

determined in accordance with GAAP. Free cash flow is limited and

does not represent remaining cash flows available for discretionary

expenditures due to the fact that the measure does not deduct the

payments required for debt maturities. SiriusXM believes free cash

flow provides useful supplemental information to investors

regarding its current cash flow, along with other GAAP measures

(such as cash flows from operating and investing activities), to

determine its financial condition, and to compare its operating

performance to other communications, entertainment and media

companies. Free cash flow is calculated as follows:

Unaudited

For the Three Months Ended

September 30,

2022

2023

($ in millions)

Cash flow information

Net cash provided by operating

activities

$

412

$

478

Net cash used in investing activities

$

(82

)

$

(189

)

Net cash used in financing activities

$

(416

)

$

(287

)

Free cash flow

Net cash provided by operating

activities

$

412

$

478

Additions to property and equipment

(83

)

(187

)

Free cash flow

$

329

$

291

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102998413/en/

Shane Kleinstein, (720) 875-5432

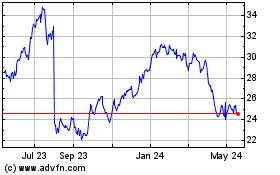

Liberty Media (NASDAQ:LSXMA)

Historical Stock Chart

From Oct 2024 to Nov 2024

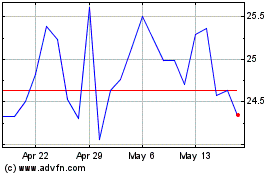

Liberty Media (NASDAQ:LSXMA)

Historical Stock Chart

From Nov 2023 to Nov 2024