Liberty Media Corporation Prices Offering of Series C Liberty Formula One Common Stock

21 August 2024 - 10:15PM

Business Wire

Expect Proceeds Will Partially Fund MotoGP™ Acquisition and

General Corporate Purposes

Liberty Media Corporation (“Liberty Media”) (Nasdaq: LSXMA,

LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLVYK) announced today that it

has priced the previously-announced public offering of 10,650,000

shares of its Series C Liberty Formula One Common Stock (“FWONK”)

at a public offering price of $77.50 per share. Liberty Media also

granted the underwriter of the offering an option to purchase up to

an additional 1,597,500 FWONK shares.

The offering is expected to close on August 22, 2024, subject to

the satisfaction of customary closing conditions, and is expected

to result in approximately $825,375,000 in gross proceeds to

Liberty Media, before deducting the underwriter’s discounts and

estimated offering expenses payable by Liberty Media (assuming no

exercise of the underwriter’s option to purchase additional

shares). Liberty Media intends to exercise its option to deliver

additional cash in lieu of shares of FWONK as part of its

previously disclosed proposed acquisition (the “Acquisition”) of

Dorna Sports, S.L., such that all the consideration paid will be

comprised of cash and no shares of FWONK will be issued to the

sellers. Liberty Media expects to use the net proceeds from the

sale of shares in this offering (i) to fund the increase in total

cash consideration for the Acquisition, which is expected to close

by year-end 2024 and (ii) for general corporate purposes, including

the repayment of debt. Completion of the offering is not

conditioned upon consummation of the Acquisition. If the

Acquisition is not consummated for any reason, the net proceeds

from this offering would be available for general corporate

purposes and attributed to the Formula One Group tracking

stock.

Goldman Sachs & Co. LLC is acting as the sole underwriter

for the offering.

The offering is being made pursuant to an effective registration

statement on Form S-3 filed with the Securities and Exchange

Commission (the “SEC”). The offering will be made only by means of

the prospectus that forms a part of the registration statement,

copies of which may be obtained by contacting: Goldman Sachs &

Co. LLC, Attention: Prospectus Department, 200 West Street, New

York, New York 10282, by phone at (866) 471-2526 or by email at

prospectus-ny@ny.email.gs.com; or by visiting the EDGAR database on

the SEC’s website at www.sec.gov.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy any of the securities, nor shall

there be any sale of these securities, in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of

any such state or jurisdiction.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements relating to the intended closing of

an offering of shares, the size of the offering, the use of

proceeds therefrom and the consummation of the Acquisition. All

statements other than statements of historical fact are

“forward-looking statements” for purposes of federal and state

securities laws. These forward-looking statements generally can be

identified by phrases such as “possible,” “potential,” “intends” or

“expects” or other words or phrases of similar import or future or

conditional verbs such as “will,” “may,” “might,” “should,”

“would,” “could,” or similar variations. These forward-looking

statements involve many risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by such statements, including, without limitation, general market

conditions. These forward-looking statements speak only as of the

date of this press release, and Liberty Media expressly disclaims

any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statement contained herein to

reflect any change in Liberty Media’s expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based. Please refer to the publicly

filed documents of Liberty Media, including its Registration

Statement on Form S-3 (File No. 333-281660), and its most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, for

additional information about Liberty Media and about the risks and

uncertainties related to Liberty Media’s business which may affect

the statements made in this press release.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad

range of media, communications, sports and entertainment

businesses. Those businesses are attributed to three tracking stock

groups: the Liberty SiriusXM Group, the Formula One Group and the

Liberty Live Group. The businesses and assets attributed to the

Liberty SiriusXM Group (NASDAQ: LSXMA, LSXMB, LSXMK) include

Liberty Media’s interest in SiriusXM. The businesses and assets

attributed to the Formula One Group (NASDAQ: FWONA, FWONK) include

Liberty Media’s subsidiaries Formula 1 and Quint, and other

minority investments. The businesses and assets attributed to the

Liberty Live Group (NASDAQ: LLYVA, LLYVK) include Liberty Media’s

interest in Live Nation and other minority investments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240820045814/en/

Shane Kleinstein, 720-875-5432

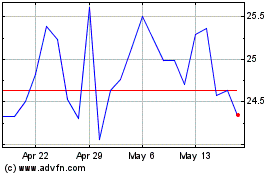

Liberty Media (NASDAQ:LSXMA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Liberty Media (NASDAQ:LSXMA)

Historical Stock Chart

From Nov 2023 to Nov 2024