Fourth quarter total revenue year-over-year

growth of 12.0% to $35.7 million; full year total revenue growth of

14.1% to $136.0 million.

Fourth quarter ARR of $142.8 million up, 15.7%

year-over-year

Fourth quarter net loss of $5.9 million

Fourth quarter positive adjusted EBITDA of $0.5

million

Last bullet point under Full Year 2023 Guidance should read:

Adjusted EBITDA is now expected to be in the range of $3 million to

$6 million.

The updated release reads:

LIVEVOX ANNOUNCES FOURTH QUARTER AND FULL

YEAR 2022 FINANCIAL RESULTS

Fourth quarter total revenue year-over-year

growth of 12.0% to $35.7 million; full year total revenue growth of

14.1% to $136.0 million.

Fourth quarter ARR of $142.8 million up, 15.7%

year-over-year

Fourth quarter net loss of $5.9 million

Fourth quarter positive adjusted EBITDA of $0.5

million

LiveVox Holdings, Inc. (“LiveVox” or the “Company”) (NASDAQ:

LVOX), a leading global enterprise cloud communications company,

today announced financial results for its fourth quarter and full

year ended December 31, 2022.

“Despite a complicated macroeconomic environment, we are pleased

to see both increased revenue and positive adjusted EBITDA in the

fourth quarter, both of which are above our guidance range,” said

John DiLullo, Chief Executive Officer of LiveVox. “Our improved

financial results in the fourth quarter is further evidence that

LiveVox is executing well against its stated balanced growth

strategy. I could not be more proud of or excited about the results

our team has achieved and the momentum we see building in 2023 and

beyond.”

Fourth Quarter 2022 Financial Highlights

- Revenue: Total revenue was $35.7 million for the fourth

quarter of 2022, up 12.0% compared to $31.9 million for the fourth

quarter of 2021.

- Contract Revenue: Contract revenue was $28.8 million for

the fourth quarter of 2022, up 18.3% compared to $24.3 million for

the fourth quarter of 2021.

- Gross Profit and Gross Margin: Gross profit was $23.7

million for the fourth quarter of 2022, up 35.5% compared to $17.5

million for the fourth quarter of 2021; Gross margin was 66.4% for

the fourth quarter of 2022, compared to 54.9% for the fourth

quarter of 2021.

- Non-GAAP Gross Profit* and Non-GAAP Gross Margin*:

Non-GAAP gross profit was $24.3 million for the fourth quarter of

2022, up 29.3% compared to $18.8 million for the fourth quarter of

2021; Non-GAAP gross margin was 68.1% for the fourth quarter of

2022, compared to 59.0% for the fourth quarter of 2021.

- Net loss: Net loss was $5.9 million for the fourth

quarter of 2022, compared to net loss of $11.8 million for the

fourth quarter of 2021.

- Adjusted EBITDA*: Adjusted EBITDA was $0.5 million for

the fourth quarter of 2022, compared to Adjusted EBITDA loss of

$7.0 million for the fourth quarter of 2021.

Full Year 2022 Financial Highlights

- Revenue: Total revenue was $136.0 million for the full

year 2022, up 14.1% compared to $119.2 million for the full year

2021.

- Contract Revenue: Contract revenue was $108.7 million

for the full year 2022, up 20.2% compared to $90.5 million for the

full year 2021.

- Gross Profit and Gross Margin: Gross profit was $85.0

million for the full year 2022, up 45.0% compared to $58.6 million

for the full year 2021. Gross margin was 62.5% for the full year

2022, compared to 49.1% for the full year 2021.

- Non-GAAP Gross Profit* and Non-GAAP Gross Margin*:

Non-GAAP gross profit was $88.3 million for the full year 2022, up

21.6% compared to $72.6 million for the full year 2021; Non-GAAP

gross margin was 64.9% for the full year 2022, compared to 60.9%

for the full year 2021.

- Net loss: Net loss was $37.5 million for the full year

2022, compared to net loss of $103.2 million for the full year

2021.

- Adjusted EBITDA*: Adjusted EBITDA loss was $14.8 million

for the full year 2022, compared to Adjusted EBITDA loss of $16.0

million for the full year 2021.

* Additional information regarding the non-GAAP financial

measures discussed in this release, including an explanation of

these measures and how each is calculated, is included below under

the heading “Non-GAAP Financial Measures.” A reconciliation of GAAP

to non-GAAP financial measures has also been provided in the

financial tables included below.

Business Outlook

In determining the financial guidance to provide to investors,

the Company considered its recent business trends and financial

results, current growth plans, strategic initiatives, global

economic outlook and the continued uncertainty of COVID-19 and its

potential impact on the Company’s results. LiveVox emphasizes that

the guidance provided is subject to various important cautionary

factors referenced in the section entitled “Forward-Looking

Statements” below.

As such, LiveVox is providing guidance for its first quarter and

full year 2023 as follows:

- First Quarter of 2023 Guidance:

- Total revenue is expected to be in the range of $34 million to

$35 million, representing growth of 6% to 9% year-over-year.

- Adjusted EBITDA is expected to be in the range of $(0.0)

million to $0.5 million.

- Full Year 2023 Guidance:

- Total revenue is expected to be in the range of $143 million to

$148 million, representing growth of 5% to 9% year-over-year.

- Adjusted EBITDA is now expected to be in the range of $3

million to $6 million.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty regarding, and the

potential variability of, many of the future costs and expenses for

which the Company adjusts, such as depreciation and amortization,

long-term equity incentive bonus, stock-based compensation expense,

interest income (expense), change in the fair value of warrant

liability, other income (expense), provision for income taxes and

severance costs, the effect of which may be significant. Annualized

Recurring Revenue (“ARR”) is calculated as the sum of the most

recent quarter of (i) recurring subscription amounts and (ii)

platform usage charges for all customers, multiplied by 4.

Quarterly Conference Call

LiveVox will host a conference call today at 4:30 p.m. Eastern

Time to review the Company’s financial results for its fourth

quarter and full year ended December 31, 2022. To access this call,

dial 877-300-8521 for the U.S. or Canada, or 412-317-6026 for

callers outside the U.S. or Canada. A live webcast of the

conference call will be accessible from the Investor Relations

section of LiveVox’s website, and a recording will be archived. An

audio replay of this conference call will also be available through

11:59 p.m. Eastern Time , March 22, 2023, by dialing 844-512-2921

for the U.S. or Canada (or 412-317-6671 for callers outside the

U.S. or Canada) and entering passcode 10171791.

About LiveVox, Inc.

LiveVox (Nasdaq: LVOX) is a next generation contact center

platform that powers more than 14 billion omnichannel interactions

a year. By seamlessly unifying blended omnichannel communications,

CRM, AI, and WEM capabilities, the Company’s technology delivers

exceptional agent and customer experiences, while helping to

mitigate compliance risk. With 20 years of cloud experience and

expertise, LiveVox’s CCaaS 2.0 platform is at the forefront of

cloud contact center innovation. The Company has more than 620

global employees and is headquartered in San Francisco, with

offices in Medellin, Colombia; and Bangalore, India. To stay up to

date with everything LiveVox, follow us at @LiveVox or visit

http://livevox.com.

Forward-Looking Statements

Certain statements made in this release are “forward looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

When used in this press release, the words “estimates,”

“projected,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,”

“future,” “propose,” “target,” “goal,” “objective,” “outlook” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements

include, but are not limited to, the quotations of management,

statements relating to expected bookings, expected revenue and

annual recurring revenue from contracts, growth expectations, and

future financial results, including guidance for the 2023 first

quarter and full fiscal year. These statements are not guarantees

of future performance, conditions or results, and involve a number

of known and unknown risks, uncertainties, assumptions and other

important factors, many of which are outside LiveVox’s control,

that could cause actual results or outcomes to differ materially

from those discussed in the forward-looking statements. Any such

forward-looking statements are made pursuant to the safe harbor

provisions available under applicable securities laws and speak

only as of the date of this presentation. LiveVox assumes no

obligation to update or revise any such forward-looking statements

except as required by law.

Important factors, among others, that may affect actual results

or outcomes include risks or liabilities assumed as a result of our

ability to meet financial and operating guidance, ability to

achieve financial targets, and successfully manage capital

expenditures; risks related to the high level of competition in the

cloud contact center industry and the intense competition and

competitive pressures from other companies in the industry in which

the Company operates; risks related to the Company’s reliance on

information systems and the ability to properly maintain the

confidentiality and integrity of data; risks related to the

occurrence of cyber incidents or a deficiency in cybersecurity

protocols; risks related to the ability to obtain third-party

software licenses for use in or with the Company’s products;

general economic and business conditions, including but not limited

to challenges associated with a tight labor market, inflationary

pressures, volatility in foreign exchange rates, supply chain

constraints, recessionary fears, and impacts from the invasion of

Ukraine by Russia; the impact of COVID-19 on LiveVox’s business;

risks related to our intellectual property rights, risks related to

our ability to secure additional financing on favorable terms, or

at all, to meet our capital needs; increased taxes and surcharges

(including Universal Service Fund, whether labeled a “tax,”

“surcharge,” or other designation) on our products which may

increase our customers’ cost of using our products and/or increase

our costs and reduce our profit margins to the extent the costs are

not passed through to our customers, and our potential liability

for past sales and other taxes, surcharges and fees; changes in

government regulation applicable to the collections industry or any

failure of us or our customers to comply with existing regulations;

changes in base interest rates and significant market volatility on

the Company’s business, the Company’s industry and the global

economy; the Company’s ability to successfully manage its recent

leadership transition; as well as those factors described under the

captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operation” and elsewhere in

the Company’s most recent filings with the Securities and Exchange

Commission (“SEC”), including the Company’s most recently filed

reports on Form 10-K and Form 10-Q and subsequent filing.

The information contained in this press release is summary

information that is intended to be considered in the context of

LiveVox’s SEC filings and other public announcements that LiveVox

may make, by press release or otherwise, from time to time. LiveVox

also uses its website to distribute company information, including

performance information, and such information may be deemed

material. Accordingly, investors should monitor LiveVox’s website

(http://www.livevox.com). LiveVox undertakes no duty or obligation

to publicly update or revise the forward-looking statements or

other information contained in this presentation. These materials

contain information about LiveVox and its affiliates and certain of

their respective personnel and affiliates, information about their

respective historical performance and general information about the

market. You should not view information related to the past

performance of LiveVox or information about the market, as

indicative of future results, the achievement of which cannot be

assured.

Consolidated Statements of Operations and

Comprehensive Loss (In thousands, except per share

data)

For the three months

ended December 31,

For the years ended December

31,

2022

2021

2022

2021

2020

(Unaudited)

(Unaudited)

Revenue

$

35,692

$

31,866

$

136,025

$

119,231

$

102,545

Cost of revenue

11,985

14,365

51,058

60,639

39,476

Gross profit

23,707

17,501

84,967

58,592

63,069

Operating expenses

Sales and marketing expense

12,712

13,513

56,160

62,333

29,023

General and administrative expense

8,364

7,535

30,566

44,694

14,291

Research and development expense

7,239

8,083

31,449

52,562

20,160

Total operating expenses

28,315

29,131

118,175

159,589

63,474

Loss from operations

(4,608

)

(11,630

)

(33,208

)

(100,997

)

(405

)

Interest expense, net

1,056

814

3,446

3,732

3,890

Change in the fair value of warrant

liability

—

(567

)

(134

)

(1,242

)

—

Other expense (income), net

(71

)

(26

)

138

(459

)

154

Total other expense, net

985

221

3,450

2,031

4,044

Pre-tax loss

(5,593

)

(11,851

)

(36,658

)

(103,028

)

(4,449

)

Provision for (benefit from) income

taxes

343

(19

)

817

166

196

Net loss

$

(5,936

)

$

(11,832

)

$

(37,475

)

$

(103,194

)

$

(4,645

)

Comprehensive loss

Net loss

$

(5,936

)

$

(11,832

)

$

(37,475

)

$

(103,194

)

$

(4,645

)

Other comprehensive income (loss), net of

tax

Foreign currency translation

adjustment

(123

)

(67

)

(484

)

(94

)

12

Net unrealized gain (loss) on marketable

securities

257

(177

)

(1,235

)

(177

)

—

Total other comprehensive income (loss),

net of tax

134

(244

)

(1,719

)

(271

)

12

Comprehensive loss

$

(5,802

)

$

(12,076

)

$

(39,194

)

$

(103,465

)

$

(4,633

)

Net loss per share

Net loss per share—basic and diluted

$

(0.06

)

$

(0.13

)

$

(0.41

)

$

(1.29

)

$

(0.07

)

Weighted average shares outstanding—basic

and diluted

92,606

91,466

92,003

79,964

66,637

Consolidated Balance Sheets (In

thousands, except per share data)

As of

December 31,

2022

December 31,

2021

ASSETS

Current assets:

Cash and cash equivalents

$

20,742

$

47,217

Restricted cash, current

—

100

Marketable securities, current

48,182

7,226

Accounts receivable, net

21,447

20,128

Deferred sales commissions, current

3,171

2,691

Prepaid expenses and other current

assets

5,211

6,151

Total Current Assets

98,753

83,513

Property and equipment, net

2,618

3,010

Goodwill

47,481

47,481

Intangible assets, net

16,655

20,195

Operating lease right-of-use assets

4,920

5,483

Deposits and other

371

664

Marketable securities, net of current

—

42,148

Deferred sales commissions, net of

current

7,356

6,747

Deferred tax asset, net

1

—

Total Assets

$

178,155

$

209,241

LIABILITIES & STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

5,987

$

6,490

Accrued expenses

12,399

13,855

Deferred revenue, current

1,318

1,307

Term loan, current

982

561

Operating lease liabilities, current

1,655

1,946

Finance lease liabilities, current

11

26

Total current liabilities

22,352

24,185

Long term liabilities:

Deferred revenue, net of current

338

456

Term loan, net of current

53,585

54,459

Operating lease liabilities, net of

current

3,649

4,046

Finance lease liabilities, net of

current

—

11

Deferred tax liability, net

—

2

Warrant liability

633

767

Other long-term liabilities

363

337

Total liabilities

80,920

84,263

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value per

share; 25,000 shares authorized and none issued and outstanding as

of December 31, 2022 and 2021.

—

—

Common stock, $0.0001 par value per share;

500,000 shares authorized and 92,729 shares issued and outstanding

as of December 31, 2022; 500,000 shares authorized and 90,697

shares issued and outstanding as of December 31, 2021.

9

9

Additional paid-in capital

264,919

253,468

Accumulated other comprehensive loss

(2,196

)

(477

)

Accumulated deficit

(165,497

)

(128,022

)

Total stockholders’ equity

97,235

124,978

Total liabilities & stockholders’

equity

$

178,155

$

209,241

Consolidated Statements of Cash Flows

(Dollars in thousands)

For the years ended December

31,

2022

2021

2020

Operating activities:

Net loss

$

(37,475

)

$

(103,194

)

$

(4,645

)

Adjustments to reconcile net loss to

net cash provided by (used in) operating activities:

Depreciation and amortization

1,183

2,106

1,876

Amortization of identified intangible

assets

3,541

4,473

4,189

Amortization of deferred loan origination

costs

108

129

143

Amortization of deferred sales

commissions

3,166

2,052

1,259

Non-cash lease expense

1,848

1,622

1,241

Stock-based compensation expense

12,242

3,905

556

Equity incentive bonus

—

32,626

—

Bad debt expense

535

195

636

Loss on disposition of asset

13

—

54

Deferred income tax benefit

(3

)

(191

)

(127

)

Loss (gain) on sale of marketable

securities

42

(4

)

—

Amortization of premium paid on marketable

securities

426

—

—

Change in the fair value of the warrant

liability

(134

)

(1,242

)

—

Changes in assets and

liabilities

Accounts receivable

(1,854

)

(5,810

)

1,934

Other assets

1,233

(3,293

)

(2,296

)

Deferred sales commissions

(4,256

)

(6,761

)

(2,465

)

Accounts payable

(505

)

3,403

1,015

Accrued expenses

(1,897

)

2,199

(1,666

)

Deferred revenue

(107

)

385

579

Operating lease liabilities

(1,949

)

(1,664

)

(1,281

)

Other long-term liabilities

24

7

68

Net cash provided by (used in)

operating activities

(23,819

)

(69,057

)

1,070

Investing activities:

Purchases of property and equipment

(931

)

(1,582

)

(753

)

Purchases of marketable securities

(12,862

)

(50,797

)

—

Proceeds from sale of marketable

securities

3,451

1,250

—

Proceeds from maturities and principal

paydowns of marketable securities

8,901

—

—

Acquisition of businesses, net of cash

acquired

—

—

(20

)

Proceeds from asset acquisition, net of

cash paid

—

1,326

—

Net cash used in investing

activities

(1,441

)

(49,803

)

(773

)

Financing activities:

Proceeds from Merger and PIPE financing,

net of cash paid

—

159,691

—

Repayments on loan payable

(561

)

(1,816

)

(1,152

)

Proceeds from drawdown on line of

credit

—

—

4,672

Repayments of drawdown on line of

credit

—

(4,672

)

—

Debt issuance costs

—

(153

)

—

Payments of contingent consideration

liability

—

(5,969

)

—

Repayments on finance lease

obligations

(26

)

(392

)

(752

)

Payments of employees’ withholding taxes

on net share settlement of share-based awards

(775

)

—

—

Proceeds from the structured payable

arrangement

1,311

—

—

Principal payments under the structured

payable arrangement

(870

)

—

—

Net cash provided by (used in)

financing activities

(921

)

146,689

2,768

Effect of foreign currency translation

(394

)

(78

)

(12

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(26,575

)

27,751

3,053

Cash, cash equivalents, and restricted

cash beginning of period

47,317

19,566

16,513

Cash, cash equivalents, and restricted

cash end of period

$

20,742

$

47,317

$

19,566

For the years ended December

31,

2022

2021

2020

Supplemental disclosure of cash flow

information:

Interest paid

$

3,800

$

3,484

$

3,768

Income taxes paid

402

292

241

Supplemental schedule of noncash

investing activities:

Change in unrealized loss on marketable

securities

$

1,235

$

177

$

—

Equipment and software acquired under

finance lease obligations

—

—

74

Additional right-of-use assets

1,261

3,246

997

Reconciliation of cash, cash equivalents and restricted cash to

the consolidated balance sheets (dollars in thousands):

As of December 31,

2022

2021

2020

Cash and cash equivalents

$

20,742

$

47,217

$

18,098

Restricted cash, current

—

100

1,368

Restricted cash, net of current

—

—

100

Total cash, cash equivalents and

restricted cash

$

20,742

$

47,317

$

19,566

Non-GAAP Financial Measures

Management uses non-GAAP financial measures to evaluate

operating performance. We believe non-GAAP financial measures

provide useful information to investors and others to understand

and evaluate our operating results in the same manner as our

management and board of directors and allows for better comparison

of financial results among our competitors.

There are material limitations associated with the use of

non-GAAP financial measures since they exclude significant expenses

and income that are required by GAAP to be recorded in our

financial statements. The definitions of our non-GAAP measures may

differ from the definitions used by other companies and therefore

comparability may be limited. In addition, other companies may

utilize metrics that are not similar to ours. We compensate for

these limitations by analyzing current and future results on a GAAP

basis as well as a non-GAAP basis and by providing specific

information regarding the GAAP items excluded from these non-GAAP

financial measures.

Adjusted EBITDA

We monitor Adjusted EBITDA, a non-generally accepted accounting

principle (“Non-GAAP”) financial measure, to analyze our financial

results and believe that it is useful to investors, as a supplement

to U.S. GAAP measures, in evaluating our ongoing operational

performance and enhancing an overall understanding of our past

financial performance. We believe that Adjusted EBITDA helps

illustrate underlying trends in our business that could otherwise

be masked by the effect of the income or expenses that we exclude

from Adjusted EBITDA. Furthermore, we use this measure to establish

budgets and operational goals for managing our business and

evaluating our performance. We also believe that Adjusted EBITDA

provides an additional tool for investors to use in comparing our

recurring core business operating results over multiple periods

with other companies in our industry. Adjusted EBITDA should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with U.S. GAAP, and our

calculation of Adjusted EBITDA may differ from that of other

companies in our industry. We compensate for the inherent

limitations associated with using Adjusted EBITDA through

disclosure of these limitations, presentation of our consolidated

financial statements in accordance with U.S. GAAP and

reconciliation of Adjusted EBITDA to the most directly comparable

U.S. GAAP measure, net loss. We calculate Adjusted EBITDA as net

loss before (i) depreciation and amortization, (ii) long-term

equity incentive bonus, (iii) stock-based compensation expense,

(iv) interest expense, net, (v) change in the fair value of warrant

liability, (vi) other expense (income), net, (vii) provision for

(benefit from) income taxes, and (viii) other items that do not

directly affect what we consider to be our core operating

performance.

Non-GAAP Gross Profit and Non-GAAP Gross Margin

Percentage

U.S. GAAP defines gross profit as revenue less cost of revenue.

Cost of revenue includes all expenses associated with our various

product offerings. We define Non-GAAP gross profit as gross profit

after adding back the following items: (i) depreciation and

amortization; (ii) long-term equity incentive bonus and stock-based

compensation expenses; and (iii) severance costs. We add back

depreciation and amortization, long-term equity incentive bonus and

stock-based compensation expenses, and severance costs because they

are one-time or non-cash items. We eliminate the impact of these

one-time or non-cash items because we do not consider them

indicative of our core operating performance. Their exclusion

facilitates comparisons of our operating performance on a

period-to-period basis. Therefore, we believe showing Non-GAAP

gross margin to remove the impact of these one-time or non-cash

expenses is helpful to investors in assessing our gross profit and

gross margin performance in a way that is similar to how management

assesses our performance. We calculate Non-GAAP gross margin

percentage by dividing Non-GAAP gross profit by revenue, expressed

as a percentage of revenue.

Management uses Non-GAAP gross profit and Non-GAAP gross margin

percentage to evaluate operating performance and to determine

resource allocation among our various product offerings. We believe

Non-GAAP gross profit and Non-GAAP gross margin percentage provide

useful information to investors and others to understand and

evaluate our operating results in the same manner as our management

and board of directors and allows for better comparison of

financial results among our competitors. Non-GAAP gross profit and

Non-GAAP gross margin percentage may not be comparable to similarly

titled measures of other companies because other companies may not

calculate Non-GAAP gross profit and Non-GAAP gross margin

percentage or similarly titled measures in the same manner as we

do.

Please see tables below for a reconciliation of non-GAAP

measures to the most directly comparable GAAP measures for the

periods presented.

GAAP Net Loss to Adjusted EBITDA

(Dollars in thousands)

Three Months Ended

December 31,

(unaudited)

Years Ended December

31,

2022

2021

2022

2021

2020

Net loss

$

(5,936

)

$

(11,832

)

$

(37,475

)

$

(103,194

)

$

(4,645

)

Non-GAAP adjustments:

Depreciation and amortization

1,173

1,745

4,723

6,579

6,065

Long-term equity incentive bonus and

stock-based compensation expenses

3,364

2,455

12,242

74,489

1,323

Interest expense, net

1,056

814

3,446

3,732

3,890

Change in the fair value of warrant

liability

—

(567

)

(134

)

(1,242

)

—

Other expense (income), net

(71

)

(26

)

138

(460

)

154

Acquisition and financing related fees and

expenses

—

16

10

1,537

25

Transaction-related costs

515

429

796

2,263

707

Golden Gate Capital management fee

expenses

—

—

—

135

781

Provision for (benefit from) income

taxes

343

(19

)

817

166

196

Severance costs

31

—

552

—

—

Other non-recurring expenses

48

—

48

—

—

Adjusted EBITDA

$

523

$

(6,985

)

$

(14,837

)

$

(15,995

)

$

8,496

GAAP Gross Profit to Non-GAAP Gross

Profit (Dollars in thousands)

Three Months Ended

December 31,

(unaudited)

Years Ended December

31,

2022

2021

2022

2021

2020

Gross profit

$

23,707

$

17,501

$

84,967

$

58,592

$

63,069

Depreciation and amortization

338

991

1,633

3,776

3,826

Long-term equity incentive bonus and

stock-based compensation expenses

276

320

1,275

10,197

180

Severance costs

—

—

400

—

—

Non-GAAP gross profit

$

24,321

$

18,812

$

88,275

$

72,565

$

67,075

Gross margin %

66.4

%

54.9

%

62.5

%

49.1

%

61.5

%

Non-GAAP gross margin %

68.1

%

59.0

%

64.9

%

60.9

%

65.4

%

The following table presents the stock-based compensation

expenses included in Company’s results of operations for the three

months ended December 31, 2022 and 2021 and the years ended

December 31, 2022, 2021 and 2020 (dollars in thousands):

Three Months Ended

December 31,

(unaudited)

Years Ended December

31,

2022

2021

2022

2021

2020

Cost of revenue

$

276

$

318

$

1,275

$

500

$

57

Sales and marketing expense

751

553

2,934

865

113

General and administrative expense

1,356

679

4,012

1,169

273

Research and development expense

981

897

4,021

1,371

113

Total stock-based compensation

$

3,364

$

2,447

$

12,242

$

3,905

$

556

The following table presents the long-term equity incentive

bonus included in Company’s results of operations for the three

months ended December 31, 2022 and 2021 and the years ended

December 31, 2022, 2021 and 2020 (dollars in thousands):

Three Months Ended

December 31,

(unaudited)

Years Ended December

31,

2022

2021

2022

2021

2020

Cost of revenue

$

—

$

2

$

—

$

9,697

$

123

Sales and marketing expense

—

4

—

18,405

277

General and administrative expense

—

—

—

18,594

336

Research and development expense

—

2

—

23,888

31

Total long-term equity incentive bonus

$

—

$

8

$

—

$

70,584

$

767

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230302005767/en/

Investors: Alexis Waadt awaadt@livevox.com

Ryan Gardella livevoxIR@icrinc.com

Press: Nick Bandy nbandy@livevox.com

Katie Creaser livevoxPR@icrinc.com

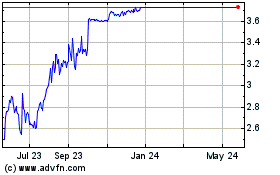

LiveVox (NASDAQ:LVOX)

Historical Stock Chart

From Dec 2024 to Jan 2025

LiveVox (NASDAQ:LVOX)

Historical Stock Chart

From Jan 2024 to Jan 2025