false

0000763532

0000763532

2023-08-16

2023-08-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 16, 2023

LSI INDUSTRIES INC.

(Exact name of Registrant as Specified in its Charter)

|

Ohio

|

|

01-13375

|

|

31-0888951

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

10000 Alliance Road, Cincinnati, Ohio

|

45242

|

|

| |

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code (513) 793-3200

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, no par value |

|

LYTS |

|

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

| |

1.

|

Fiscal Year 2024 Long Term Incentive Plan

|

On August 16, 2023, the Compensation Committee (the "Committee") of the Board of Directors of LSI Industries Inc. (the "Company") adopted the FY2024 Long Term Incentive Plan (the "LTIP"). The LTIP provides for the issuance of share-based awards to named executive officers and other employees of the Company pursuant to the LSI Industries Inc. Omnibus Award Plan (the "2019 Omnibus Award Plan"). The LTIP advances the Company’s commitment to performance-based compensation practices by providing participants an opportunity to earn equity-based awards upon the achievement of certain pre-established long-term performance objectives. Pursuant to the LTIP, on and effective as of the close of business on August 16, 2023, the Committee approved the award of restricted stock units (“RSUs”) and performance stock units ("PSUs") to the Company's executives and certain other officers and employees based on pre-established performance objectives and goals. The Committee established the targets under the LTIP for the Company’s principal executive officer, principal financial officer, and other named executive officers, and made grants, as follows:

|

Named Executive Officer

|

LTIP Target as a Percentage of Base Salary

|

RSUs

|

PSUs

|

|

James Clark, CEO

|

214%

|

47,022

|

70,533

|

|

James Galeese, EVP & CFO

|

141%

|

16,928

|

25,392

|

|

Thomas Caneris, EVP Human Resources and General Counsel

|

88%

|

10,345

|

15,517

|

|

Jeffrey Bastian, VP & Chief Accounting Officer

|

52%

|

4,389

|

6,583

|

Terms of the PSUs

| |

●

|

Performance Cycle. The performance cycle begins on July 1, 2023 and ends on June 30, 2026.

|

| |

●

|

Performance Criteria. The performance criteria for the PSUs are tied to Company performance. With respect to all named executive officers, Company performance is measured for purposes of the PSUs by comparing the Company’s cumulative Adjusted EBITDA for the year ended June 30, 2026 to a targeted cumulative Adjusted EBITDA for the 2026 fiscal year set by the Committee; and by comparing the Company’s return on net assets ("RONA") as of and for the year ended June 30, 2026 to a target RONA for the 2026 fiscal year set by the Committee. With respect to all named executive officers, the cumulative Adjusted EBITDA target accounts for 50% of their respective performance target and the remaining 50% is determined by achievement of a target measure of RONA.

|

| |

●

|

Award Payouts. Award payouts for the PSUs are based on the percentage of the performance target achieved. Generally, the percentage of the award earned at the end of the performance cycle based on the cumulative Adjusted EBITDA performance target shall be determined according to the following schedule; however, the actual LTIP award payout will be interpolated between the percentages set forth in the chart based on actual results:

|

|

Performance Level - Cumulative Adjusted EBITDA

|

|

Payout Level

|

|

<85% of Performance Target

|

|

0% of Award Target

|

|

85% of Performance Target

|

|

50% of Award Target

|

|

100% of Performance Target

|

|

100% of Award Target

|

|

> 110% of Performance Target

|

|

200% of Award Target

|

Generally, the percentage of the award earned at the end of the performance cycle based on the percentage of the RONA performance targets achieved shall be determined according to the following schedule; however, the actual LTIP award payout will be interpolated between the percentages set forth in the chart based on actual results:

|

Performance Level - RONA

|

|

Payout Level

|

|

<50% of Performance Target

|

|

0% of Award Target

|

|

50% of Performance Target

|

|

50% of Award Target

|

|

100% of Performance Target

|

|

100% of Award Target

|

|

> 110% of Performance Target

|

|

200% of Award Target

|

| |

●

|

Payment of Awards. PSU awards shall be made in stock and will be distributed on a specific date by which the Committee reasonably expects it will be able to determine whether and the extent to which the performance target applicable to such award was met. The Company will make the distribution of the PSUs awards to participants as soon as administratively practicable following the date of the award determination.

|

Award Agreements. Awards of RSUs and PSUs are made under the LTIP pursuant to award agreements with each recipient on the terms described in this Current Report on Form 8-K.

Vesting and Forfeiture. Recipients of LTIP awards generally must remain continuously employed full-time by the Company until the date designated for payout under the applicable award agreement for the LTIP period. Exceptions may be provided for termination of employment by reason of death, disability, retirement and change in control. RSUs vest annually in equal installments over three years. The vesting of PSUs is subject to the achievement of RONA and cumulative adjusted EBITDA objectives over a three-year performance cycle.

Change in Control. In the event of a change in control event described in Section 2(e) of the 2019 Omnibus Award Plan (“CIC”), unless the successor company assumes, replaces or substitutes all unvested portions of RSUs with substantially identical terms, RSUs shall vest in full upon the executive’s termination of employment within twenty-four (24) months of a CIC when such termination is by the Company without Cause (defined in the 2019 Omnibus Award Plan) or by the executive for Good Reason (defined in the award agreement). Upon a CIC, PSUs will convert at the target performance level into time-based RSUs vesting in equal installments over three years commencing from the date of original grant, irrespective of the Company’s actual achievement of performance objectives.

Other Terms & Provisions. Participants are not permitted to transfer LTIP awards, except by will or the laws of descent and distribution. The Company is entitled to withhold from any payments of awards under the LTIP or the 2019 Omnibus Award Plan any and all amounts required to be withheld for federal, state and local withholding taxes. In addition to the above conditions, payment of any incentive award is contingent upon the participant executing a written restrictive covenant agreement.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the form of RSU Award Agreement, form of PSU Award Agreement, and LTIP which shall be filed as an exhibit to a subsequent periodic report.

| |

2.

|

Fiscal Year 2024 Short Term Incentive Plan

|

The Committee also approved and adopted on August 16, 2023 the FY2024 Short Term Incentive Plan for named executive officers (the "STIP").

The STIP provides for performance-based annual cash awards to the Company’s executive officers, and certain other officers and employees of the Company. The STIP advances the Company’s commitment to performance-based compensation practices by providing participants an opportunity to earn annual cash bonuses upon achievement of certain pre-established short-term performance objectives. The STIP performance cycle is for the current fiscal year, beginning on July 1, 2023 and ending on June 30, 2024. The amount of the awards under the STIP are based on Company financial targets for Adjusted EBITDA and Net Sales. Individual participant bonus targets for the Company’s executive officers range between 40% and 80% of base salary.

The Committee established the bonus targets under the STIP for the Company’s named executive officers as follows:

|

Named Executive Officer

|

Bonus Target as % of Base Salary

|

|

James A. Clark, CEO

|

80%

|

|

James E. Galeese, EVP & CFO

|

50%

|

|

Thomas A. Caneris

EVP Human Resources & General Counsel

|

50%

|

|

Jeffrey Bastian, VP & Chief Accounting Officer

|

40%

|

Performance Criteria. The performance criteria under the STIP are comprised eighty percent (80%) on a Company performance-based component of Adjusted EBITDA and twenty percent (20%) based on Net Sales. Company performance will be measured by comparing the Company’s Adjusted EBITDA for the fiscal year ended June 30, 2024 to a target Adjusted EBITDA for the entire 2023 fiscal year set by the Committee and by comparing the Company’s Net Sales for the fiscal year ended June 30, 2024 to a target Net Sales for the entire 2024 fiscal year set by the Committee.

Award Payouts. Award payout levels are based on the percentage of the performance target achieved. Generally, the percentage of the award earned at the end of the performance cycle based on the Adjusted EBITDA and Net Sales performance targets will be determined according to the following schedules; however, the actual award payout will be interpolated between the percentages set forth in the tables below based on actual results:

|

Performance Achievement- Adjusted EBITDA

|

|

Payout Level

|

|

<85% of Performance Target

|

|

0% of Award Target

|

|

85% of Performance Target

|

|

50% of Award Target

|

|

100% of Performance Target

|

|

100% of Award Target

|

|

>110% of Performance Target

|

|

200% of Award Target

|

|

Performance Achievement- Net Sales

|

|

Payout Level

|

|

< 90% of Performance Target

|

|

0% of Award Target

|

|

90% of Performance Target

|

|

50% of Award Target

|

|

100% of Performance Target

|

|

100% of Award Target

|

|

>105% of Performance Target

|

|

200% of Award Target

|

Payment of Awards. Payment of STIP awards will be made in cash. Awards will be paid on a specific date by which the Committee reasonably expects that the performance target applicable to such award was met. The Company will make the payment of the STIP awards to participants as soon as administratively practicable following the date of the award determination.

Vesting and Forfeiture. STIP participants must remain continuously employed full-time by the Company until the award payment date in order to be entitled to receive a payout of an STIP award. Exceptions may be provided for termination of employment by reason of death, disability, retirement and change in control.

Other Terms & Provisions. STIP participants are not permitted to transfer STIP awards, except by will or the laws of descent and distribution. The Company is entitled to withhold from any payments of awards under the STIP any and all amounts required to be withheld for federal, state and local withholding taxes.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the STIP which shall be filed as an exhibit to a subsequent periodic report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

LSI INDUSTRIES INC.

|

| |

|

|

| |

|

BY:/s/ Thomas A. Caneris

|

| |

|

Thomas A. Caneris

|

| |

|

Executive Vice President, Human Resources & General Counsel

|

| |

|

|

Dated: August 22, 2023

v3.23.2

Document And Entity Information

|

Aug. 16, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

LSI INDUSTRIES INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 16, 2023

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

01-13375

|

| Entity, Tax Identification Number |

31-0888951

|

| Entity, Address, Address Line One |

10000 Alliance Road

|

| Entity, Address, City or Town |

Cincinnati

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

45242

|

| City Area Code |

513

|

| Local Phone Number |

793-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LYTS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000763532

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

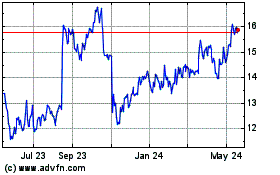

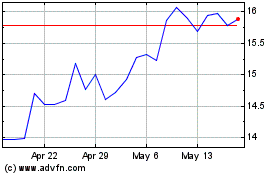

LSI Industries (NASDAQ:LYTS)

Historical Stock Chart

From Apr 2024 to May 2024

LSI Industries (NASDAQ:LYTS)

Historical Stock Chart

From May 2023 to May 2024