Molekule Group, Inc. Announces $10.0 Million Private Placement And Amends Loan Agreements to Defer Approximately $6.1 Million of Principal Payments Originally Scheduled for 2023, 2024 and Q1 2025

03 May 2023 - 11:15PM

Molekule Group, Inc. (“Molekule” or the “Company”) (Nasdaq: MKUL),

announced today that it has entered into a securities purchase

agreement with a single institutional investor pursuant to which

the Company agreed to sell in a private placement at an aggregate

purchase price of approximately $9,971,500, (i) 3,400,000 shares of

the Company’s common stock, (ii) a Series A Warrant to purchase up

to 3,125,000 shares of common stock, (iii) a Series B Warrant to

purchase up to 6,250,000 shares of common stock, and (iv) a

Pre-Funded Warrant to purchase up to 2,850,000 shares of common

stock. The private placement is expected to close on or about May

5, 2023, subject to the satisfaction of customary closing

conditions.

The Series A Warrants will have an exercise price of $1.60 per

share; the Series B Warrants will have an exercise price of $1.84

per share; and the Pre-Funded Warrant will have a nominal exercise

price per share. The Series A and B Warrants will become

exercisable following the receipt of stockholder approval and the

filing and distribution of an information statement to the

Company’s stockholders; and the Pre-Funded Warrants will be

exercisable upon issuance. The Series A Warrants will terminate

eight months after they become exercisable. The Series B Warrants

and the Pre-Funded Warrants will terminate five years after they

become exercisable.

The Company also agreed to reduce the exercise price of

1,500,000 outstanding warrants owned by the institutional investor

to $2.00.

The securities described above were offered in a

private placement under Section 4(a)(2) of the Securities Act of

1933, as amended (the “Act”) and Regulation D promulgated

thereunder, and have not been registered under the Act or

applicable state securities laws. Accordingly, the securities may

not be offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Act and such applicable state

securities laws.

Pursuant to a registration rights agreement with

the investor, the Company has agreed to file an initial

registration statement with the Securities and Exchange Commission

(the “SEC”) covering the resale of the shares of common stock to be

issued to the investor and shares of common stock underlying the

warrants described above and to use its best efforts to have the

registration statement declared effective as promptly as

practicable thereafter. The Company plans to use the proceeds to

support the roll-out of its Safe Air-as-a-Service platform through

purchases of inventory and equipment and continued enhancement of

software and technology to support the evolving needs of enterprise

customers.

On May 2, 2023, we reached an agreement in

principal, subject to final documentation, with Silicon Valley

Bank, a division of First Citizens Bank (“SVB”) to amend our

mezzanine loan agreement so as to provide for the deferral of

principal payments from April 2024 to April 2025. We also reached

an agreement in principal with SVB, subject to final documentation,

to amend our senior term loan agreement so as to extend the

maturity date from April 2026 to March 2028. The amendment of our

mezzanine loan agreement to defer principal payments and the

amendment of our senior term loan agreement to extend the maturity

date collectively result in a deferral of approximately $6.1

million of principal payments through Q1 2025. The Company believes

that such additional flexibility will support long-term growth as

it continues to aggressively market its enterprise Safe

Air-as-a-Service platform, conduct research and development and

fund operations.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities nor

will there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

Advisors

The Benchmark Company and Roth Capital Partners

are acting as the exclusive placement agents for the private

placement. Freshfields Bruckhaus Deringer US LLP is acting as

counsel to the Company. ArentFox Schiff LLP is acting as counsel to

the placement agents.

About Molekule

Molekule is on a mission to provide clean indoor

air to everyone, everywhere. With the largest range of proprietary,

FDA-cleared air purification devices on the market, Molekule is

providing consumers, business owners and medical professionals with

hardware and software solutions to better understand and improve

indoor air quality. Its Air Pro, Air Mini+ and Pūrgo™ purification

devices can be applied to virtually any indoor space, including

homes, classrooms, offices, hospitals and more.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based upon current beliefs and

expectations of our management and are subject to known and unknown

risks and uncertainties. Words or expressions such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “estimates,” “may,”

“will,” “projects,” “could,” “should,” “would,” “seek,” “forecast,”

or other similar expressions help identify forward-looking

statements. Factors that could cause actual events to differ

include, but are not limited to:

- general economic

conditions in the markets where we operate;

- the impact of

the COVID-19 pandemic and related prophylactic measures;

- expected timing

of regulatory approvals and product launches;

- non-performance

of third-party vendors and contractors;

- risks related to

our ability to successfully sell our products and the market

reception to and performance of our products;

- our compliance

with, and changes to, applicable laws and regulations;

- our limited

operating history;

- our ability to

manage growth;

- our ability to

obtain additional financing when and if needed;

- our ability to

expand product offerings;

- our ability to

compete with others in our industry;

- our ability to

protect our intellectual property;

- the ability of

certain stockholders to determine the outcome of matters that

require stockholder approval;

- our ability to

retain the listing of our common stock on Nasdaq;

- our ability to

defend against legal proceedings;

- success in

retaining or recruiting, or changes required in, our officers, key

employees or directors;

- the risk that

the merger between Molekule and Aura may not be completed; and

- other economic,

business, competitive, and regulatory factors affecting the

businesses of the Company generally, including but not limited to

those set forth in Molekule’s filings with the SEC, including in

the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of

Molekule’s latest annual report on Form 10-K, as amended, and other

SEC filings.

Forward-looking statements are not guarantees of

future performance and involve risks and uncertainties, and actual

results may differ materially from those in the forward-looking

statements as a result of various factors. Although we believe that

the expectations reflected in the forward-looking statements are

reasonable based on information currently available, we cannot

assure you that the expectations will prove to have been correct.

Accordingly, you should not place undue reliance on these

forward-looking statements. In any event, these statements speak

only as of the date of this release. We assume no obligation to

revise or update any of the forward-looking statements to reflect

events or circumstances after the date of this release or to

reflect new information or the occurrence of unanticipated

events.

Media Contact Press@molekule.com

Investor Relations Contacts Ryan TylerChief

Financial Officer, Molekule Ryan.Tyler@molekule.com

MATTIO Communications molekule@mattio.com

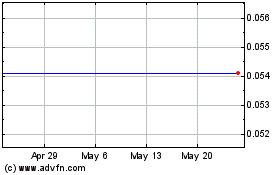

Molekule (NASDAQ:MKUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

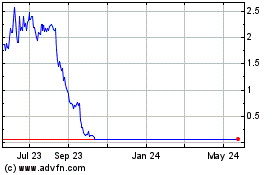

Molekule (NASDAQ:MKUL)

Historical Stock Chart

From Dec 2023 to Dec 2024