false

0001734750

0001734750

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 14, 2024

Movano Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40254 |

|

82-4233771 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 6800 Koll Center Parkway, Pleasanton, CA |

|

94566 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code (415) 651-3172

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

MOVE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On November 14, 2024, Movano Inc. announced its financial results for

the quarter ended September 30, 2024. A copy of the press release is being furnished as Exhibit 99 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibit 99 attached

hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in

such filing.

Item 9.01. Financial Statements and

Exhibits.

The exhibits to this Current Report on Form 8-K are listed below and

incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Movano Inc. |

| |

|

| Date: November 14, 2024 |

By: |

/s/ Jeremy Cogan |

| |

Name: |

Jeremy Cogan |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99

Movano Health Reports Q3 2024 Financial Results

and

Provides Business Update

Highlights successful Evie Ring back-in-stock

execution

Updates status of EvieMED 510(k) application

review

Focuses on launch of EvieMED and securing B2B

opportunities

Conference Call at 2:00 PM PT/ 5:00 PM ET Today

PLEASANTON, Calif. – November

14, 2024 – Movano Health (Nasdaq: MOVE), a pioneer in health technology, reported third quarter 2024 results and provided a business

update.

The Company continues to remain focused on

three key business initiatives.

| ● | Successful execution of the Evie Ring direct-to-consumer

business (D2C) following the September 17th back-in-stock launch, bolstered by an enhanced product experience and improved

operations across manufacturing, logistics and customer service. |

| ● | Securing FDA 510(k) clearance for the EvieMED Ring and pursuing

initial business-to-business (B2B) commercial agreements across the healthcare sector. |

| ● | Advancing cuffless blood pressure and noninvasive glucose

monitoring clinical studies with Movano Health’s proprietary and patented System-on-a-Chip (SoC). |

“We are pleased with our Evie Ring D2C

performance and continue to be laser focused on improving the consumer experience, including the upcoming launch of our Android app, as

we head into the holiday period in order to maximize our sales potential,” said John Mastrototaro, President and CEO of Movano Health.

“Additionally, we look forward to the successful completion of the 510(k) application review process of the EvieMED Ring and continue

to focus on the game changing opportunities that we believe EvieMED could unlock for our healthcare partners.”

Recent Operating Highlights and Milestones

| ● | On September 17, 2024, Movano Health successfully launched a back-in-stock campaign for the Evie Ring D2C business. On October 30,

2024, the Company also shared the official announcement of its first brand partnership with content creator Heidi D’Amelio. |

| ● | The Company continues to work collaboratively with the FDA and remains in the final stage of its FDA 510(k) application review process

for the EvieMED Ring. The EvieMED Ring is designed to not only provide medical device functionality with its pulse oximetry feature, but

also offer numerous wellness metrics related to sleep, activity and logging of mood, energy and health symptoms. This summer, Movano Health

secured a positive resolution after responding to initial FDA questions related to EvieMED’s wellness features and metrics. During

the week of October 28, 2024, the Company submitted a complete response package to additional clarifying questions related to the medical

aspects of EvieMED. |

| ● | Movano Health continues to make important progress on the B2B front in anticipation of an expected 510(k) clearance, re-engaging with

a number of potential partners across the full spectrum of healthcare use cases. For example, the Company has entered into the agreement

phase with a large healthcare company for a pilot program in Q1 2025 using the EvieMed Ring as part of an overall metabolic solution to

address chronic disease. |

| ● | Movano Health tested its newly developed blood pressure wrist wearable as part of a November 5th and 6th hypoxia

clinical trial that took place at the University of California, San Francisco. The updated device features an additional 12 mmWave antennas,

which together with the Company’s custom RF chip, delivers enhanced data collection with less impact of placement while also featuring

a slimmer design, making it easier and more comfortable to wear. In addition, the new wearable monitors a host of other vital signs including

pulse rate, blood oxygen saturation (Sp02), respiration rate and ECG waveforms. |

Third Quarter 2024 and Recent Financial

Highlights

| ● | In Q3 2024, Movano Health shipped 339 Evie Rings. |

| ● | The Company reported an operating loss of $7.4 million in Q3 2024, compared to an operating

loss of $9.1 million in Q3 2023. |

| ● | Total cash and cash equivalents at September 30, 2024 were $11.3 million. |

| ● | On October 29, 2024, the Company implemented a 1-for-15 reverse stock split of the issued shares of its common stock. The reverse

stock split was intended to increase the bid price of the common stock to enable the Company to regain compliance for continued listing

on The Nasdaq Capital Market. On November 12, 2024, the Company was informed by Nasdaq that it had regained compliance with the minimum

bid price requirement. |

Conference Call

Management will host a conference call and live audio webcast to discuss

these results and provide a business update today at 2:00 pm PT/5:00 pm ET.

Attendees can access the live webcast here or on the investors section

of Movano Health’s website at https://ir.movano.com. The conference call can be accessed by dialing 1-877-407-0989 (domestic), or

1 201-389-0921 (international). Attendees can also use the Call Me Link in which they will be dialed in to the conference call instantly

on the number provided with no hold time. An archived webcast will be available on Movano Health’s website approximately one hour after

the completion of the event and for two years thereafter.

About Movano Health

Founded in 2018, Movano Inc. (Nasdaq: MOVE) dba Movano Health, maker

of the Evie Ring (www.eviering.com), is developing a suite of purpose-driven healthcare solutions to bring medical-grade data to the forefront

of wearables. Featuring modern and flexible form factors, Movano Health’s devices offer an innovative approach to delivering trusted data

to both customers and enterprises, capturing a comprehensive picture of an individual’s health data and uniquely translating it

into personalized and intelligent insights.

Movano Health is developing its proprietary technologies and wearable

medical device solutions to enable the future use of data as a tool to proactively monitor and manage health outcomes across a number

of patient populations that exist in healthcare. For more information on Movano Health, visit https://movanohealth.com/.

Forward Looking Statements

This press release contains forward-looking statements concerning our

expectations, anticipations, intentions, beliefs, or strategies regarding the future. These forward-looking statements are based on assumptions

that we have made as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual results,

conditions, and events to differ materially from those anticipated. Therefore, you should not place undue reliance on forward-looking

statements. Examples of forward-looking statements include, among others, statements we make regarding plans with respect to the commercial

launches of the Evie Ring and EvieMED; our expectations regarding potential commercial opportunities; planned cost-cutting initiatives;

anticipated FDA clearance decisions with respect to our products; expected future operating results; product development and features,

product releases, clinical trials and regulatory initiatives; our strategies, positioning and expectations for future events or performance.

Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in our

most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, and in our other reports filed with the Securities

and Exchange Commission, including under the caption “Risk Factors.” Any forward-looking statement in this release speaks only

as of the date of this release. We undertake no obligation to publicly update any forward-looking statement, whether written or oral,

that may be made from time to time, whether as a result of new information, future developments or otherwise.

Investor Relations

Jill Schmidt PR

t: 847-904-2806

e: jill@jillschmidtpr.com

Movano Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 11,272 | | |

$ | 6,118 | |

| Payroll tax credit, current portion | |

| 233 | | |

| 450 | |

| Vendor deposits | |

| 9 | | |

| 399 | |

| Inventory | |

| 2,033 | | |

| 1,114 | |

| Prepaid expenses and other current assets | |

| 467 | | |

| 442 | |

| Total current assets | |

| 14,014 | | |

| 8,523 | |

| Property and equipment, net | |

| 237 | | |

| 342 | |

| Payroll tax credit, noncurrent portion | |

| 55 | | |

| 169 | |

| Other assets | |

| 761 | | |

| 387 | |

| Total assets | |

$ | 15,067 | | |

$ | 9,421 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,896 | | |

$ | 3,118 | |

| Deferred revenue | |

| 20 | | |

| 1,252 | |

| Other current liabilities | |

| 2,317 | | |

| 1,529 | |

| Total current liabilities | |

| 4,233 | | |

| 5,899 | |

| Noncurrent liabilities: | |

| | | |

| | |

| Early exercised stock option liability | |

| — | | |

| 23 | |

| Other noncurrent liabilities | |

| 583 | | |

| 50 | |

| Total noncurrent liabilities | |

| 583 | | |

| 73 | |

| Total liabilities | |

| 4,816 | | |

| 5,972 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock | |

| 10 | | |

| 6 | |

| Additional paid-in capital | |

| 153,732 | | |

| 127,823 | |

| Accumulated deficit | |

| (143,491 | ) | |

| (124,380 | ) |

| Total stockholders’ equity | |

| 10,251 | | |

| 3,449 | |

| Total liabilities and stockholders’ equity | |

$ | 15,067 | | |

$ | 9,421 | |

Movano Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(In thousands, except share and per share data)

(Unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

$ | 50 | | |

$ | — | | |

$ | 902 | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | |

| COSTS AND EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 845 | | |

| — | | |

| 2,440 | | |

| — | |

| Research and development | |

| 3,404 | | |

| 5,636 | | |

| 9,198 | | |

| 13,701 | |

| Sales, general and administrative | |

| 3,180 | | |

| 3,443 | | |

| 8,794 | | |

| 9,965 | |

| Total costs and expenses | |

| 7,429 | | |

| 9,079 | | |

| 20,432 | | |

| 23,666 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (7,379 | ) | |

| (9,079 | ) | |

| (19,530 | ) | |

| (23,666 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Interest and other income, net | |

| 178 | | |

| 117 | | |

| 419 | | |

| 341 | |

| Other income (expense), net | |

| 178 | | |

| 117 | | |

| 419 | | |

| 341 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss and total comprehensive loss | |

$ | (7,201 | ) | |

$ | (8,962 | ) | |

$ | (19,111 | ) | |

$ | (23,325 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (1.06 | ) | |

$ | (2.65 | ) | |

$ | (3.33 | ) | |

$ | (7.99 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in computing net loss per share, basic and diluted | |

| 6,816,339 | | |

| 3,380,763 | | |

| 5,733,007 | | |

| 2,921,201 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

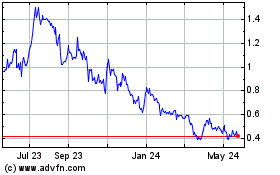

Movano (NASDAQ:MOVE)

Historical Stock Chart

From Mar 2025 to Apr 2025

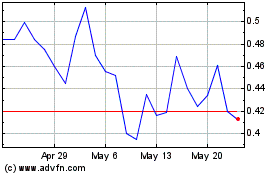

Movano (NASDAQ:MOVE)

Historical Stock Chart

From Apr 2024 to Apr 2025