false

0001094038

0001094038

2024-08-12

2024-08-12

0001094038

dei:FormerAddressMember

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

August 12, 2024

Date of Report (Date of earliest event reported)

MARKER THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-37939 |

45-4497941 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

2450 Holcombe Blvd, Suite BCM-A, MS: BCM251

Houston,

Texas |

|

77021 |

| (Address of principal executive offices) |

|

(Zip Code) |

(713) 400-6400

Registrant’s telephone number, including

area code

9350 Kirby Drive, Suite 300

Houston, Texas 77054

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

MRKR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 8.01. | Other Information |

On August 12, 2024, Marker Therapeutics, Inc. (the

“Company”) issued a press release announcing that the Company was awarded a $2 million grant from the National Institutes

of Health (NIH) Small Business Innovation Research (SBIR) program to support the clinical investigation of MT-601 in patients with non-Hodgkin’s

lymphoma (NHL) who have relapsed following anti-CD19 chimeric antigen receptor (CAR) T cell therapy.

A copy of the Press Release

is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Marker Therapeutics, Inc. |

| |

|

|

| Dated: August 12, 2024 |

By: |

/s/ Juan Vera |

| |

|

Juan Vera |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

Marker Therapeutics Awarded $2 Million Grant

from NIH in Support of Phase 1 Study Investigating MT-601 in CAR-Relapsed Patients with Non-Hodgkin’s Lymphoma

Marker Therapeutics to receive non-dilutive

funding from NIH Small Business Innovation Research Program based on preliminary clinical results and non-clinical data in lymphoma

Houston, TX – August 12, 2024 –

Marker Therapeutics, Inc. (Nasdaq: MRKR), a clinical-stage immuno-oncology company focusing on developing next-generation T cell-based

immunotherapies for the treatment of hematological malignancies and solid tumor indications, today announced that the Company has been

awarded a $2 million grant from the National Institutes of Health (NIH) Small Business Innovation Research (SBIR) program to support

the clinical investigation of MT-601 in patients with non-Hodgkin’s lymphoma (NHL) who have relapsed following anti-CD19 chimeric

antigen receptor (CAR) T cell therapy.

The SBIR grant has been awarded based in part

on Marker’s preliminary clinical data in patients with lymphoma (Press Release, September 11, 2023) as well as non-clinical

data demonstrating the anti-tumor activity of MT-601 on anti-CD19 CAR resistant lymphoma cells (Press Release, May 31, 2023).

The proceeds of the grant will support the nationwide multi-center Phase 1 APOLLO study (ClinicalTrials.gov identifier: NCT05798897),

evaluating the safety and efficacy of MT-601, a multi-tumor associated antigen (multiTAA)-specific T cell product, in patients with relapsed

NHL including those previously treated with anti-CD19 CAR-T cell therapy. Including this SBIR grant, the Company has been awarded over

$19 million in non-dilutive funding proceeds.

“We are pleased to receive the SBIR grant

from the NIH to support our clinical Phase 1 study in CAR-relapsed patients with non-Hodgkin’s lymphoma,” said Juan Vera,

M.D., President and CEO of Marker Therapeutics. “Although anti-CD19 CAR-T cells are rapidly expanding as a treatment option in patients

with hematological malignancies, approximately 40-60% of patients will relapse within the first year of therapy with currently no standard

of care for patients post CD19-targeting CAR-T cells. The NIH award process is highly competitive, and we believe that the decision the

NIH made suggests the potential scientific merit and the capacity of Marker’s APOLLO study to address an unmet medical need.”

Dr. Vera continued: “While our results

of the APOLLO study are preliminary, as we move through the dose escalation part of the study, we are encouraged by the objective responses

observed in all three study participants treated at City of Hope (Press Release, April 8, 2024) and the lack of cytokine release

syndrome (CRS) or immune effector cell associated neurotoxicity syndrome (ICANS) observed. We will continue to closely monitor all patients

for long-term treatment effects and durability of response, and with the non-dilutive funding support from NIH we look forward to treating

additional participants in this Phase 1 study.”

“This grant award is a testimony of our

continued commitment to apply for non-dilutive funding and allows us to leverage our data to drive innovation and growth while maximizing

shareholder value. Obtaining non-dilutive funding is an ongoing effort, and we are actively applying for additional opportunities as they

become available,” concluded Dr. Vera.

About the NIH SBIR Program

The NIH Small Business Innovation Research (SBIR)

Program sets aside more than $1.2 billion from its Research & Development Funding to specifically support early-stage small businesses

throughout the United States. Many companies leverage the NIH SBIR funding to attract the partners and investors needed to take an innovation

to market. The Small Business program focuses on a variety of high-impact technologies including research tools, diagnostics, digital

health, drugs, and medical devices, and can provide the seed funding needed to bring scientific innovations from bench to bedside.

About MT-601

The Company’s lead product, MT-601, is a

multi-tumor associated antigen (multiTAA)-specific T cell product that utilizes a non-genetically modified approach that specifically

targets six different tumor antigens upregulated in lymphoma cells (Survivin, PRAME, WT-1, NY-ESO-1, SSX-2, MAGE-A4). Marker is currently

investigating MT-601 in the Company-sponsored Phase 1 APOLLO trial (clinicaltrials.gov identifier: NCT05798897) for the treatment of lymphoma

patients who are relapsed after or where CD19 CAR-T cell therapy is not an option.

About APOLLO

The APOLLO trial (clinicaltrials.gov Identifier:

NCT05798897) is a Phase 1, multicenter, open-label study designed to evaluate the safety and efficacy of MT-601 in participants with lymphoma

who relapsed after anti-CD19 CAR-T cell therapy or where anti-CD19 CAR-T cell therapy is not an option. The primary objective of this

exploratory Phase 1 clinical trial is to evaluate the safety and preliminary efficacy of MT-601 in participants with various lymphoma

subtypes. Under the APOLLO trial, it is anticipated that nine clinical sites across the United States will cumulatively enroll up to approximately

30 participants during the dose escalation phase.

About multiTAA-specific T cells

The multi-tumor associated antigen (multiTAA)-specific

T cell platform is a novel, non-genetically modified cell therapy approach that selectively expands tumor-specific T cells from a patient's/donor’s

blood capable of recognizing a broad range of tumor antigens. Unlike other T cell therapies, multiTAA-specific T cells allow the recognition

of hundreds of different epitopes within up to six tumor-specific antigens, thereby reducing the possibility of tumor escape. Since multiTAA-specific

T cells are not genetically engineered, Marker believes that its product candidates will be easier and less expensive to manufacture,

with an improved safety profile, compared to current engineered T cell approaches, and may provide patients with meaningful clinical benefits.

About Marker Therapeutics, Inc.

Marker Therapeutics, Inc. is a Houston, TX-based

clinical-stage immuno-oncology company specializing in the development of next-generation T cell-based immunotherapies for the treatment

of hematological malignancies and solid tumors. Clinical trials that enrolled more than 200 patients across various hematological and

solid tumor indications showed that the Company’s autologous and allogeneic multiTAA-specific T cell products were well tolerated

and demonstrated durable clinical responses. Marker’s goal is to introduce novel T cell therapies to the market and improve patient

outcomes. To achieve these objectives, the Company prioritizes the preservation of financial resources and focuses on operational excellence.

Marker’s unique T cell platform is strengthened by non-dilutive funding from U.S. state and federal agencies supporting cancer research.

To receive future press releases via email, please

visit: https://www.markertherapeutics.com/email-alerts.

Forward-Looking Statements

This release

contains forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Statements in this news release concerning the Company’s expectations, plans, business outlook or future performance, and any other

statements concerning assumptions made or expectations as to any future events, conditions, performance or other matters, are “forward-looking

statements.” Forward-looking statements include statements regarding our intentions, beliefs, projections, outlook, analyses or

current expectations concerning, among other things: our research, development and regulatory activities and expectations relating to

our non-engineered multi-tumor antigen specific T cell therapies; the effectiveness of these programs or the possible range of application

and potential curative effects and safety in the treatment of diseases; the timing, conduct and success of our clinical trials of our

product candidates, including MT-601 for the treatment of patients with lymphoma. Forward-looking

statements are by their nature subject to risks, uncertainties and other factors which could cause actual results to differ materially

from those stated in such statements. Such risks, uncertainties and factors include, but are not limited to the risks set forth in the

Company’s most recent Form 10-K, 10-Q and other SEC filings which are available

through EDGAR at WWW.SEC.GOV. The Company assumes no obligation to update

its forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release

except as may be required by law.

Contacts

Investors

TIBEREND STRATEGIC ADVISORS, INC.

Jonathan Nugent

205-566-3026

jnugent@tiberend.com

v3.24.2.u1

Cover

|

Aug. 12, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity File Number |

001-37939

|

| Entity Registrant Name |

MARKER THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001094038

|

| Entity Tax Identification Number |

45-4497941

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2450 Holcombe Blvd

|

| Entity Address, Address Line Two |

Suite BCM-A

|

| Entity Address, Address Line Three |

MS: BCM251

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77021

|

| City Area Code |

713

|

| Local Phone Number |

400-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MRKR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

9350 Kirby Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77054

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

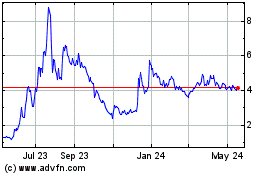

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Dec 2024 to Jan 2025

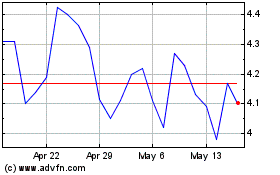

Marker Therapeutics (NASDAQ:MRKR)

Historical Stock Chart

From Jan 2024 to Jan 2025