Marten Transport Announces Third Quarter Results

18 October 2022 - 7:01AM

Marten Transport, Ltd. (Nasdaq/GS:MRTN) today reported a 20.6%

improvement in net income to $25.6 million, or 32 cents per diluted

share, for the third quarter ended September 30, 2022, from $21.3

million, or 26 cents per diluted share, for the third quarter of

2021 – the Company’s fifteenth consecutive year-over-year increase

in quarterly profitability. For the first nine months of 2022, net

income improved 39.8% to $84.8 million, or $1.03 per diluted share,

from $60.7 million, or 73 cents per diluted share, for the first

nine months of 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Results Comparison |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage |

|

Percentage |

|

Percentage |

|

Percentage |

|

Percentage |

|

Percentage |

|

|

|

|

Increase |

|

Increase |

|

Increase |

|

Increase |

|

Increase |

|

Increase |

|

|

|

|

Three

Months |

|

Three

Months |

|

Three

Months |

|

Year |

|

Year |

|

Year |

|

|

|

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

|

|

|

September

30, |

|

June

30, |

|

March

31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

|

2022 vs. 2021 |

|

2022 vs. 2021 |

|

2022 vs. 2021 |

|

2021 vs. 2020 |

|

2020 vs. 2019 |

|

2019 vs. 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

revenue |

29.1 |

% |

|

41.8 |

% |

|

28.8 |

% |

|

11.4 |

% |

|

3.7 |

% |

|

7.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

revenue, net of fuel surcharges |

21.8 |

% |

|

32.1 |

% |

|

23.8 |

% |

|

8.3 |

% |

|

6.8 |

% |

|

8.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

income |

18.5 |

% |

|

43.5 |

% |

|

49.4 |

% |

|

19.8 |

% |

|

21.9 |

% |

|

8.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income |

20.6 |

% |

|

47.8 |

% |

|

52.9 |

% |

|

22.9 |

% |

|

13.8 |

% |

|

11.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenue improved 29.1% to $324.4

million for the third quarter of 2022 from $251.3 million for the

third quarter of 2021. Excluding fuel surcharges, operating revenue

improved 21.8% to $269.3 million for the 2022 quarter from $221.2

million for the 2021 quarter. Fuel surcharge revenue increased to

$55.1 million for the 2022 quarter from $30.1 million for the 2021

quarter due to significantly higher fuel prices.

Operating revenue improved 33.2% to $941.3

million for the first nine months of 2022 from $706.8 million for

the first nine months of 2021. Excluding fuel surcharges, operating

revenue improved 25.8% to $783.8 million for the 2022 period from

$623.0 million for the 2021 period. Fuel surcharge revenue

increased to $157.5 million for the 2022 period from $83.7 million

for 2021 period.

Operating income improved 18.5% to $33.8 million

for the third quarter of 2022 from $28.5 million for the third

quarter of 2021, and also improved 36.5% to $110.6 million for the

first nine months of 2022 from $81.0 million for the first nine

months of 2021.

Operating expenses as a percentage of operating

revenue were 89.6% for the third quarter of 2022 and 88.7% for the

third quarter of 2021. Operating expenses as a percentage of

operating revenue, with both amounts net of fuel surcharges, were

87.5% for the 2022 quarter and 87.1% for the 2021 quarter.

Operating expenses as a percentage of operating

revenue improved to 88.3% for the first nine months of 2022 from

88.5% for the first nine months of 2021. Operating expenses as a

percentage of operating revenue, with both amounts net of fuel

surcharges, improved to 85.9% from 87.0%.

Executive Chairman Randolph L. Marten stated,

“The smart, hard work of our talented people executing our unique

business model has produced improvements of 29.1% in top-line and

20.6% in bottom-line results over the third quarter of 2021. These

results overcame significantly less gain on disposition of our

revenue equipment, the negative effect of Hurricane Ian on our

sizable Southeast truckload and dedicated operations, and a

decrease in our intermodal volumes and margins resulting from

weakness in rail service aggravated by the threat of a rail labor

strike in mid-September.”

“We continue to drive strong fleet growth with

our approach to overcoming the national shortage of qualified

drivers of applying a heightened emphasis on structurally improving

our drivers’ jobs and work-life balance by collaborating with our

customers, while also increasing our driver compensation. This

growth provides momentum to the coming quarters as we began this

year’s fourth quarter with 199 more of the industry’s top drivers

than we employed at the beginning of the third quarter – and have

now increased our number of drivers by 621, or 22.6%, since June

30, 2021.”

|

|

|

|

|

|

|

|

Operating

Results Since the Pandemic Began – Percentage Increase Over Same

Quarter of Prior Year |

|

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

|

Q2 2022 |

|

Q1 2022 |

|

Q4 2021 |

|

Q3 2021 |

|

Q2 2021 |

|

Q1 2021 |

|

Q4 2020 |

|

Q3 2020 |

|

Q2 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenue |

29.1 |

% |

|

41.8 |

% |

|

28.8 |

% |

|

17.4 |

% |

|

16.3 |

% |

|

9.4 |

% |

|

2.0 |

% |

|

4.7 |

% |

|

0.5 |

% |

|

0.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenue, net of fuel surcharges |

21.8 |

% |

|

32.1 |

% |

|

23.8 |

% |

|

12.5 |

% |

|

12.8 |

% |

|

5.0 |

% |

|

2.5 |

% |

|

8.8 |

% |

|

3.8 |

% |

|

4.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

income |

18.5 |

% |

|

43.5 |

% |

|

49.4 |

% |

|

20.0 |

% |

|

16.8 |

% |

|

12.9 |

% |

|

33.1 |

% |

|

36.0 |

% |

|

21.8 |

% |

|

26.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

20.6 |

% |

|

47.8 |

% |

|

52.9 |

% |

|

26.1 |

% |

|

17.9 |

% |

|

18.1 |

% |

|

31.3 |

% |

|

24.5 |

% |

|

8.8 |

% |

|

19.4 |

% |

|

|

|

|

|

|

Current Investor Presentation

Marten Transport, with headquarters in Mondovi,

Wis., is a multifaceted business offering a network of refrigerated

and dry truck-based transportation capabilities across the

Company’s five distinct business platforms - Truckload, Dedicated,

Intermodal, Brokerage and MRTN de Mexico. Marten is one of the

leading temperature-sensitive truckload carriers in the United

States, specializing in transporting and distributing food,

beverages and other consumer packaged goods that require a

temperature-controlled or insulated environment. The Company offers

service in the United States, Mexico and Canada, concentrating on

expedited movements for high-volume customers. Marten’s common

stock is traded on the Nasdaq Global Select Market under the symbol

MRTN.

This press release contains certain statements

that may be considered forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements include a discussion of Marten’s prospects for

future growth and by their nature involve substantial risks and

uncertainties, and actual results may differ materially from those

expressed in such forward-looking statements. Important factors

known to the Company that could cause actual results to differ

materially from those discussed in the forward-looking statements

are discussed in Part I, Item 1A of the Company’s Annual Report on

Form 10-K for the year ended December 31, 2021. The Company

undertakes no obligation to correct or update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

CONTACTS: Tim Kohl, Chief Executive Officer, and

Jim Hinnendael, Executive Vice President and Chief Financial

Officer, of Marten Transport, Ltd., 715-926-4216.

MARTEN TRANSPORT,

LTD.CONSOLIDATED CONDENSED BALANCE

SHEETS

| |

September 30, |

|

|

December 31, |

|

| (In

thousands, except share information) |

2022 |

|

|

2021 |

|

|

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

71,492 |

|

|

$ |

56,995 |

|

|

Receivables: |

|

|

|

|

|

|

|

|

Trade, net |

|

124,587 |

|

|

|

99,003 |

|

|

Other |

|

4,443 |

|

|

|

6,971 |

|

|

Prepaid expenses and other |

|

24,787 |

|

|

|

23,980 |

|

|

Total current assets |

|

225,309 |

|

|

|

186,949 |

|

| |

|

|

|

|

|

|

|

|

Property and equipment: |

|

|

|

|

|

|

|

|

Revenue equipment, buildings and land, office equipment and

other |

|

1,046,476 |

|

|

|

956,476 |

|

|

Accumulated depreciation |

|

(334,504 |

) |

|

|

(274,199 |

) |

|

Net property and equipment |

|

711,972 |

|

|

|

682,277 |

|

|

Other noncurrent assets |

|

1,421 |

|

|

|

1,464 |

|

|

Total assets |

$ |

938,702 |

|

|

$ |

870,690 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

43,188 |

|

|

$ |

20,150 |

|

|

Insurance and claims accruals |

|

45,664 |

|

|

|

42,014 |

|

|

Accrued and other current liabilities |

|

36,605 |

|

|

|

31,395 |

|

|

Total current liabilities |

|

125,457 |

|

|

|

93,559 |

|

|

Deferred income taxes |

|

130,594 |

|

|

|

125,163 |

|

|

Noncurrent operating lease liabilities |

|

214 |

|

|

|

291 |

|

|

Total liabilities |

|

256,265 |

|

|

|

219,013 |

|

| |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value per share; 2,000,000 shares

authorized; no shares issued and outstanding |

|

- |

|

|

|

- |

|

|

Common stock, $.01 par value per share; 192,000,000 shares

authorized; 81,096,632 shares at September 30, 2022, and 83,034,404

shares at December 31, 2021, issued and outstanding |

|

811 |

|

|

|

830 |

|

|

Additional paid-in capital |

|

46,366 |

|

|

|

85,718 |

|

|

Retained earnings |

|

635,260 |

|

|

|

565,129 |

|

|

Total stockholders’ equity |

|

682,437 |

|

|

|

651,677 |

|

|

Total liabilities and stockholders’ equity |

$ |

938,702 |

|

|

$ |

870,690 |

|

| |

|

|

|

|

|

|

|

MARTEN TRANSPORT, LTD.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| |

Three Months |

|

|

Nine Months |

|

|

|

Ended September 30, |

|

|

Ended September 30, |

|

| (In

thousands, except per share information) |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

revenue |

$ |

324,448 |

|

|

$ |

251,280 |

|

|

$ |

941,294 |

|

|

$ |

706,768 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries, wages and benefits |

|

99,773 |

|

|

|

81,091 |

|

|

|

285,582 |

|

|

|

229,385 |

|

|

Purchased transportation |

|

64,403 |

|

|

|

52,861 |

|

|

|

189,193 |

|

|

|

138,629 |

|

|

Fuel and fuel taxes |

|

57,299 |

|

|

|

33,909 |

|

|

|

163,004 |

|

|

|

94,853 |

|

|

Supplies and maintenance |

|

14,855 |

|

|

|

11,685 |

|

|

|

40,520 |

|

|

|

33,867 |

|

|

Depreciation |

|

28,381 |

|

|

|

25,371 |

|

|

|

81,389 |

|

|

|

76,598 |

|

|

Operating taxes and licenses |

|

2,748 |

|

|

|

2,606 |

|

|

|

8,051 |

|

|

|

8,036 |

|

|

Insurance and claims |

|

11,949 |

|

|

|

10,501 |

|

|

|

38,096 |

|

|

|

31,338 |

|

|

Communications and utilities |

|

2,135 |

|

|

|

2,181 |

|

|

|

6,639 |

|

|

|

6,320 |

|

|

Gain on disposition of revenue equipment |

|

(1,070 |

) |

|

|

(4,536 |

) |

|

|

(10,422 |

) |

|

|

(11,859 |

) |

|

Other |

|

10,209 |

|

|

|

7,115 |

|

|

|

28,681 |

|

|

|

18,589 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

290,682 |

|

|

|

222,784 |

|

|

|

830,733 |

|

|

|

625,756 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income |

|

33,766 |

|

|

|

28,496 |

|

|

|

110,561 |

|

|

|

81,012 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

(264 |

) |

|

|

(8 |

) |

|

|

(307 |

) |

|

|

(27 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

before income taxes |

|

34,030 |

|

|

|

28,504 |

|

|

|

110,868 |

|

|

|

81,039 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income taxes

expense |

|

8,384 |

|

|

|

7,230 |

|

|

|

26,028 |

|

|

|

20,341 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

$ |

25,646 |

|

|

$ |

21,274 |

|

|

$ |

84,840 |

|

|

$ |

60,698 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

earnings per common share |

$ |

0.32 |

|

|

$ |

0.26 |

|

|

$ |

1.04 |

|

|

$ |

0.73 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted

earnings per common share |

$ |

0.32 |

|

|

$ |

0.26 |

|

|

$ |

1.03 |

|

|

$ |

0.73 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends

paid per common share |

$ |

0.06 |

|

|

$ |

- |

|

|

$ |

0.18 |

|

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends

declared per common share |

$ |

0.06 |

|

|

$ |

0.54 |

|

|

$ |

0.18 |

|

|

$ |

0.62 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARTEN TRANSPORT,

LTD.SEGMENT

INFORMATION(Unaudited)

| |

|

|

|

|

|

|

|

|

Dollar |

|

|

Percentage |

|

| |

|

|

|

|

|

|

|

|

Change |

|

|

Change |

|

| |

Three Months |

|

|

Three Months |

|

|

Three Months |

|

| |

Ended |

|

|

Ended |

|

|

Ended |

|

| |

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| (Dollars in

thousands) |

2022 |

|

|

2021 |

|

|

2022 vs. 2021 |

|

|

2022 vs. 2021 |

|

|

Operating revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload revenue, net of fuel surcharge revenue |

$ |

105,905 |

|

|

$ |

86,889 |

|

|

$ |

19,016 |

|

|

|

21.9 |

% |

|

Truckload fuel surcharge revenue |

|

23,471 |

|

|

|

12,728 |

|

|

|

10,743 |

|

|

|

84.4 |

|

|

Total Truckload revenue |

|

129,376 |

|

|

|

99,617 |

|

|

|

29,759 |

|

|

|

29.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dedicated revenue, net of fuel surcharge revenue |

|

86,178 |

|

|

|

68,826 |

|

|

|

17,352 |

|

|

|

25.2 |

|

|

Dedicated fuel surcharge revenue |

|

24,039 |

|

|

|

13,336 |

|

|

|

10,703 |

|

|

|

80.3 |

|

|

Total Dedicated revenue |

|

110,217 |

|

|

|

82,162 |

|

|

|

28,055 |

|

|

|

34.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal revenue, net of fuel surcharge revenue |

|

24,303 |

|

|

|

22,716 |

|

|

|

1,587 |

|

|

|

7.0 |

|

|

Intermodal fuel surcharge revenue |

|

7,600 |

|

|

|

4,031 |

|

|

|

3,569 |

|

|

|

88.5 |

|

|

Total Intermodal revenue |

|

31,903 |

|

|

|

26,747 |

|

|

|

5,156 |

|

|

|

19.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage revenue |

|

52,952 |

|

|

|

42,754 |

|

|

|

10,198 |

|

|

|

23.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating revenue |

$ |

324,448 |

|

|

$ |

251,280 |

|

|

$ |

73,168 |

|

|

|

29.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload |

$ |

14,319 |

|

|

$ |

11,670 |

|

|

$ |

2,649 |

|

|

|

22.7 |

% |

|

Dedicated |

|

13,005 |

|

|

|

8,521 |

|

|

|

4,484 |

|

|

|

52.6 |

|

|

Intermodal |

|

778 |

|

|

|

2,840 |

|

|

|

(2,062 |

) |

|

|

(72.6 |

) |

|

Brokerage |

|

5,664 |

|

|

|

5,465 |

|

|

|

199 |

|

|

|

3.6 |

|

|

Total operating income |

$ |

33,766 |

|

|

$ |

28,496 |

|

|

$ |

5,270 |

|

|

|

18.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload |

|

88.9 |

% |

|

|

88.3 |

% |

|

|

|

|

|

|

|

|

|

Dedicated |

|

88.2 |

|

|

|

89.6 |

|

|

|

|

|

|

|

|

|

|

Intermodal |

|

97.6 |

|

|

|

89.4 |

|

|

|

|

|

|

|

|

|

|

Brokerage |

|

89.3 |

|

|

|

87.2 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio |

|

89.6 |

% |

|

|

88.7 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

ratio, net of fuel surcharges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload |

|

86.5 |

% |

|

|

86.6 |

% |

|

|

|

|

|

|

|

|

|

Dedicated |

|

84.9 |

|

|

|

87.6 |

|

|

|

|

|

|

|

|

|

|

Intermodal |

|

96.8 |

|

|

|

87.5 |

|

|

|

|

|

|

|

|

|

|

Brokerage |

|

89.3 |

|

|

|

87.2 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio, net of fuel surcharges |

|

87.5 |

% |

|

|

87.1 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARTEN TRANSPORT, LTD.

SEGMENT INFORMATION

(Unaudited)

| |

|

|

|

|

|

|

|

|

Dollar |

|

|

Percentage |

|

| |

|

|

|

|

|

|

|

|

Change |

|

|

Change |

|

| |

Nine Months |

|

|

Nine Months |

|

|

Nine Months |

|

| |

Ended |

|

|

Ended |

|

|

Ended |

|

| |

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| (Dollars in

thousands) |

2022 |

|

|

2021 |

|

|

2022 vs. 2021 |

|

|

2022 vs. 2021 |

|

|

Operating revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload revenue, net of fuel surcharge revenue |

$ |

302,883 |

|

|

$ |

254,441 |

|

|

$ |

48,442 |

|

|

|

19.0 |

% |

|

Truckload fuel surcharge revenue |

|

66,255 |

|

|

|

36,032 |

|

|

|

30,223 |

|

|

|

83.9 |

|

|

Total Truckload revenue |

|

369,138 |

|

|

|

290,473 |

|

|

|

78,665 |

|

|

|

27.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dedicated revenue, net of fuel surcharge revenue |

|

248,988 |

|

|

|

202,955 |

|

|

|

46,033 |

|

|

|

22.7 |

|

|

Dedicated fuel surcharge revenue |

|

68,344 |

|

|

|

37,565 |

|

|

|

30,779 |

|

|

|

81.9 |

|

|

Total Dedicated revenue |

|

317,332 |

|

|

|

240,520 |

|

|

|

76,812 |

|

|

|

31.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal revenue, net of fuel surcharge revenue |

|

77,589 |

|

|

|

64,193 |

|

|

|

13,396 |

|

|

|

20.9 |

|

|

Intermodal fuel surcharge revenue |

|

22,923 |

|

|

|

10,150 |

|

|

|

12,773 |

|

|

|

125.8 |

|

|

Total Intermodal revenue |

|

100,512 |

|

|

|

74,343 |

|

|

|

26,169 |

|

|

|

35.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage revenue |

|

154,312 |

|

|

|

101,432 |

|

|

|

52,880 |

|

|

|

52.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating revenue |

$ |

941,294 |

|

|

$ |

706,768 |

|

|

$ |

234,526 |

|

|

|

33.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload |

$ |

45,978 |

|

|

$ |

36,282 |

|

|

$ |

9,696 |

|

|

|

26.7 |

% |

|

Dedicated |

|

37,689 |

|

|

|

28,074 |

|

|

|

9,615 |

|

|

|

34.2 |

|

|

Intermodal |

|

9,911 |

|

|

|

6,151 |

|

|

|

3,760 |

|

|

|

61.1 |

|

|

Brokerage |

|

16,983 |

|

|

|

10,505 |

|

|

|

6,478 |

|

|

|

61.7 |

|

|

Total operating income |

$ |

110,561 |

|

|

$ |

81,012 |

|

|

$ |

29,549 |

|

|

|

36.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload |

|

87.5 |

% |

|

|

87.5 |

% |

|

|

|

|

|

|

|

|

|

Dedicated |

|

88.1 |

|

|

|

88.3 |

|

|

|

|

|

|

|

|

|

|

Intermodal |

|

90.1 |

|

|

|

91.7 |

|

|

|

|

|

|

|

|

|

|

Brokerage |

|

89.0 |

|

|

|

89.6 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio |

|

88.3 |

% |

|

|

88.5 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

ratio, net of fuel surcharges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truckload |

|

84.8 |

% |

|

|

85.7 |

% |

|

|

|

|

|

|

|

|

|

Dedicated |

|

84.9 |

|

|

|

86.2 |

|

|

|

|

|

|

|

|

|

|

Intermodal |

|

87.2 |

|

|

|

90.4 |

|

|

|

|

|

|

|

|

|

|

Brokerage |

|

89.0 |

|

|

|

89.6 |

|

|

|

|

|

|

|

|

|

|

Consolidated operating ratio, net of fuel surcharges |

|

85.9 |

% |

|

|

87.0 |

% |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARTEN TRANSPORT, LTD.

OPERATING STATISTICS

(Unaudited)

| |

Three Months |

|

|

Nine Months |

|

| |

Ended September 30, |

|

|

Ended September 30, |

|

| |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Truckload Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands) |

$ |

129,376 |

|

|

$ |

99,617 |

|

|

$ |

369,138 |

|

|

$ |

290,473 |

|

|

Average revenue, net of fuel surcharges, per tractor per

week(1) |

$ |

4,889 |

|

|

$ |

4,411 |

|

|

$ |

4,980 |

|

|

$ |

4,202 |

|

|

Average tractors(1) |

|

1,648 |

|

|

|

1,499 |

|

|

|

1,560 |

|

|

|

1,553 |

|

|

Average miles per trip |

|

508 |

|

|

|

502 |

|

|

|

512 |

|

|

|

516 |

|

|

Non-revenue miles percentage(2) |

|

11.3 |

% |

|

|

10.1 |

% |

|

|

10.8 |

% |

|

|

10.0 |

% |

|

Total miles (in thousands) |

|

38,441 |

|

|

|

35,945 |

|

|

|

110,565 |

|

|

|

111,513 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dedicated

Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands) |

$ |

110,217 |

|

|

$ |

82,162 |

|

|

$ |

317,332 |

|

|

$ |

240,520 |

|

|

Average revenue, net of fuel surcharges, per tractor per

week(1) |

$ |

4,006 |

|

|

$ |

3,438 |

|

|

$ |

3,977 |

|

|

$ |

3,305 |

|

|

Average tractors(1) |

|

1,637 |

|

|

|

1,523 |

|

|

|

1,605 |

|

|

|

1,574 |

|

|

Average miles per trip |

|

337 |

|

|

|

328 |

|

|

|

340 |

|

|

|

319 |

|

|

Non-revenue miles percentage(2) |

|

1.2 |

% |

|

|

1.1 |

% |

|

|

1.1 |

% |

|

|

1.0 |

% |

|

Total miles (in thousands) |

|

34,513 |

|

|

|

31,511 |

|

|

|

101,400 |

|

|

|

95,765 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Intermodal

Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands) |

$ |

31,903 |

|

|

$ |

26,747 |

|

|

$ |

100,512 |

|

|

$ |

74,343 |

|

|

Loads |

|

7,610 |

|

|

|

8,257 |

|

|

|

24,607 |

|

|

|

24,885 |

|

|

Average tractors |

|

182 |

|

|

|

139 |

|

|

|

173 |

|

|

|

140 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brokerage

Segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (in thousands) |

$ |

52,952 |

|

|

$ |

42,754 |

|

|

$ |

154,312 |

|

|

$ |

101,432 |

|

|

Loads |

|

24,896 |

|

|

|

18,251 |

|

|

|

69,902 |

|

|

|

47,167 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At September

30, 2022 and September 30, 2021: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tractors(1) |

|

3,575 |

|

|

|

3,204 |

|

|

|

|

|

|

|

|

|

|

Average age of company tractors (in years) |

|

1.7 |

|

|

|

1.4 |

|

|

|

|

|

|

|

|

|

|

Total trailers |

|

5,679 |

|

|

|

5,291 |

|

|

|

|

|

|

|

|

|

|

Average age of company trailers (in years) |

|

3.8 |

|

|

|

3.2 |

|

|

|

|

|

|

|

|

|

|

Ratio of trailers to tractors(1) |

|

1.6 |

|

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

Total refrigerated containers |

|

803 |

|

|

|

607 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months |

|

|

Nine Months |

|

| |

Ended September 30, |

|

|

Ended September 30, |

|

| (In

thousands) |

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash

provided by operating activities |

$ |

64,551 |

|

|

$ |

44,544 |

|

|

$ |

163,221 |

|

|

$ |

127,909 |

|

| Net cash

(used for) investing activities |

|

(57,412 |

) |

|

|

(40,704 |

) |

|

|

(92,416 |

) |

|

|

(102,142 |

) |

| Net cash

(used for) financing activities |

|

(4,021 |

) |

|

|

(612 |

) |

|

|

(56,308 |

) |

|

|

(7,994 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

81,061 |

|

|

|

82,907 |

|

|

|

81,889 |

|

|

|

82,835 |

|

|

Diluted |

|

81,347 |

|

|

|

83,372 |

|

|

|

82,155 |

|

|

|

83,380 |

|

|

(1) |

Includes tractors driven by both company-employed drivers and

independent contractors. Independent contractors provided 90 and

101 tractors as of September 30, 2022 and 2021, respectively. |

|

|

|

|

(2) |

Represents the percentage of miles for which the company is not

compensated. |

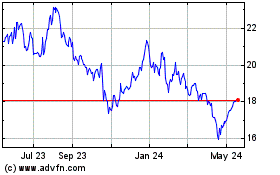

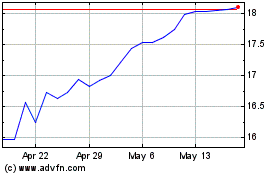

Marten Transport (NASDAQ:MRTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Marten Transport (NASDAQ:MRTN)

Historical Stock Chart

From Jul 2023 to Jul 2024