As filed with the Securities and Exchange

Commission on August 8 , 2023

Registration Statement No. 333-273158

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

AMENDMENT NO. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Netcapital

Inc.

(Exact name of

registrant as specified in its charter) |

| Utah |

|

6199 |

|

87-0409951 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

No.) |

1 Lincoln Street

Boston, MA 02111

Phone: (781) 925-1700

(Address, Including

Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Coreen Kraysler

Chief Financial

Officer

1 Lincoln Street

Boston, MA 02111

Phone: (781) 925-1700

(Name, Address, Including

Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Richard

A. Friedman, Esq.

Greg Carney,

Esq. |

Oded Har-Even,

Esq.

Angela Gomes, Esq. |

| Sheppard Mullin Richter

& Hampton, LLP |

Sullivan & Worcester

LLP |

| 30 Rockefeller Plaza |

1633 Broadway |

| New York, NY 10112 |

New York, NY 10019 |

| Phone: (212) 653-8700 |

Phone: (212) 660-5002 |

Approximate date

of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities

being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box. ☒

If this Form is filed

to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier registration statement for the same offering. ☐

If this Form is a

post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier registration statement for the same offering: ☐

Indicate by check

mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or

an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act of 1934, as amended.

| Large accelerated

filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If an emerging growth

company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant

hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant

shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission,

acting pursuant to Section 8(a) may determine.

The

information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities or accept an

offer to buy these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This

prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer

or sale is not permitted.

PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

AUGUST 8 , 2023 |

Up to 7,473,842 Shares of Common Stock

Up to 7,473,842 Pre-Funded Warrants for Common Stock

Netcapital Inc.

We are offering an aggregate of up to 7,473,842 shares

of our common stock, $0.001 par value per share in a firm commitment public offering.

We are also offering to each purchaser whose purchase

of shares of our common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of common stock immediately

following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants to purchase

shares of common stock (“pre-funded warrants”), in lieu of shares of common stock. Each pre-funded warrant will be exercisable

for one share of our common stock. The purchase price of each pre-funded warrant will equal the price per share of common stock being

sold to the public, minus $0.01, and the exercise price of each pre-funded warrant will be $0.01 per share. For each pre-funded warrant

that we sell, the number of shares of our common stock that we are offering will be decreased on a one-for-one basis.

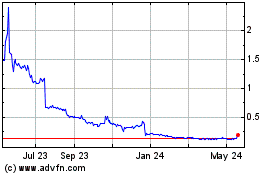

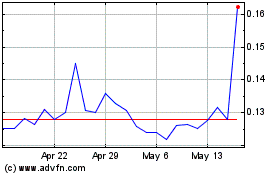

Our common stock and warrants are listed on the Nasdaq

Capital Market under the symbols “NCPL” and “NCPLW” respectively. We have not applied, and do not intend to apply,

to list the pre-funded warrants on The Nasdaq Capital Market. On August 3, 2023 , the closing price of our common stock and warrants

on the Nasdaq Capital Market was $ 0.669 per share. The trading price of our common stock has been, and may continue to be, subject

to wide price fluctuations in response to various factors, many of which are beyond our control, including those described in “Risk

Factors.”

The

number of shares of common stock and pre-funded warrants offered by this prospectus and all other applicable information has been determined

based on an assumed public offering price of $ 0.669 per

share of common stock, which is the last reported sales price of our common stock of $ 0.669 on August 3, 2023 . The actual

public offering price of the shares of common stock and pre-funded warrants will be determined between the underwriters and us at the

time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of

our business, and may be at a discount to the current market price. Therefore, the assumed public offering price per share of common

stock used throughout this prospectus may not be indicative of the actual public offering price for the shares of common stock. See “Determination

of the Offering Price” for additional information.

Investing in our securities involves a high degree

of risk. See “Risk Factors” beginning on page 13 of this prospectus for a discussion of information that should be considered

in connection with an investment in our securities. Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

| |

|

|

Per Share |

|

Per Pre-Funded Warrant |

|

|

|

|

Total |

|

| Public offering price |

|

|

$ |

|

|

$ |

|

|

|

|

$ |

|

|

| Underwriting discounts and commissions(1) |

|

|

$ |

|

|

$ |

|

|

|

|

$ |

|

|

| Proceeds to us, before expenses(2) |

|

|

$ |

|

|

$ |

|

|

|

|

$ |

|

|

| (1) |

Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the gross proceeds payable to the underwriters. We refer you to “Underwriting” beginning on page 66 for additional information regarding underwriters’ compensation. |

| (2) |

The amount of offering proceeds to us presented

in this table does not give effect to any exercise of: (i) the over-allotment option we have granted to ThinkEquity LLC,

the representative of the several underwriters in t his offering ( the “Representative”), (ii) warrants

to purchase shares of our common stock (“Representative’s Warrants”), to be issued to

the Representative (as described below), or (iii) the pre-funded warrants. |

We have granted a 45-day option to the Representative

to purchase up to 1,121,077 additional shares of our common stock and/or pre-funded warrants or any combination thereof, representing

15% of the shares of common stock and pre-funded warrants sold in the offering, solely to cover over-allotments, if any.

The underwriters expect to deliver the securities

to purchasers in the offering on or about ,

2023.

ThinkEquity

The date

of this prospectus is , 2023

TABLE OF CONTENTS

You

should rely only on information contained in this prospectus and the documents incorporated by reference

herein. We have not, and the underwriters have not, authorized anyone to provide you with additional information

or information different from that contained in this prospectus and the documents incorporated by reference

herein. We are not making an offer of these securities in any state or other jurisdiction where the offer

is not permitted. The information in this prospectus may only be accurate as of the date on the front of

this prospectus regardless of time of delivery of this prospectus or any sale of our securities. If any statement

in this prospectus is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference—the statement in the document having the later date modifies or

supersedes the earlier statement.

No person

is authorized in connection with this prospectus to give any information or to make any representations about us, the common stock

hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus and

the documents incorporated by reference herein. If any other information or representation is given or made, such information or

representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a

solicitation of an offer to buy our common stock in any circumstance under which the offer or solicitation is unlawful. Neither the

delivery of this prospectus nor any distribution of our common stock in accordance with this prospectus shall, under any circumstances,

imply that there has been no change in our affairs since the date of this prospectus.

Neither we nor

the Representative have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe

any restrictions relating to, this offering and the distribution of this prospectus and the documents incorporated by reference herein. |

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus contains

express or implied forward-looking statements that are based on our management’s beliefs and assumptions and on information currently

available to our management. Statements regarding our future results of operations and financial position, business strategy and plans

and objectives of management for future operations. All statements, other than statements of historical fact, contained in this prospectus

and in any related prospectus supplement are forward-looking statements. In some cases, you can identify forward-looking statements by

terminology such as “may,” “could,” “will,” “would,” “should,” “expect,”

“plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,”

“seek,” “contemplate,” “project,” “continue,” “potential,” “ongoing”

or the negative of these terms or other comparable terminology.

Forward-looking statements

are subject to significant business, economic and competitive risks, uncertainties and contingencies, many of which are difficult to

predict and beyond our control, which could cause our actual results to differ materially from the results expressed or implied in such

forward-looking statements. These and other risks, uncertainties and contingencies are described elsewhere in this prospectus, including

under “Risk Factors,” and in the documents incorporated by reference herein, and include the following factors:

| |

· |

capital

requirements and the availability of capital to fund our growth and to service our existing debt; |

| |

· |

difficulties

executing our growth strategy, including attracting new issuers and investors; |

| |

· |

our

anticipated use of the net proceeds from this offering; |

| |

· |

economic

uncertainties and business interruptions resulting from the coronavirus COVID-19 global pandemic

and its aftermath;

|

| |

· |

as

restrictions related to the coronavirus COVID-19 global pandemic are removed and face-to-face economic

activities normalize, it may be difficult for us to maintain the recent sales gains that we have

experienced;

|

| |

·

|

all

the risks of acquiring one or more complementary businesses, including identifying a suitable target,

completing comprehensive due diligence uncovering all information relating to the target, the financial

stability of the target, the impact on our financial condition of the debt we may incur in acquiring

the target, the ability to integrate the target’s operations with our existing operations,

our ability to retain management and key employees of the target, among other factors attendant to

acquisitions of small, non-public operating companies;

|

| |

· |

difficulties

in increasing revenue per issuer; |

| |

· |

challenges

related to hiring and training fintech employees at competitive wage rates; |

| |

· |

difficulties

in increasing the average number of investments made per investor; |

| |

· |

shortages

or interruptions in the supply of quality issuers; |

| |

· |

our

dependence on a small number of large issuers to generate revenue; |

| |

· |

negative

publicity relating to any one of our issuers; |

| |

· |

competition

from other online capital portals with significantly greater resources than we have; |

| |

· |

changes

in investor tastes and purchasing trends; |

| |

· |

our

inability to manage our growth; |

| |

· |

our

inability to maintain an adequate level of cash flow, or access to capital, to meet growth expectations; |

| |

· |

changes

in senior management, loss of one or more key personnel or an inability to attract, hire, integrate

and retain skilled personnel;

|

| |

· |

labor

shortages, unionization activities, labor disputes or increased labor costs, including increased

labor costs resulting from the demand for qualified employees;

|

| |

· |

our

vulnerability to increased costs of running an online portal on Amazon Web Services; |

| |

· |

our

vulnerability to increasing labor costs; |

| |

· |

the

impact of governmental laws and regulation; |

| |

· |

failure

to obtain or maintain required licenses; |

| |

· |

changes

in economic or regulatory conditions and other unforeseen conditions that prevent or delay the development

of a secondary trading market for shares of equity that are sold on our online portal;

|

| |

· |

inadequately

protecting our intellectual property or breaches of security of confidential user information; and |

| |

· |

our

expectations regarding having our securities listed on The Nasdaq Capital Market. |

These forward-looking

statements speak only as of the date of this prospectus. Except as required by applicable law, we do not plan to publicly update or revise

any forward-looking statements contained in this prospectus after we distribute this prospectus, whether as a result of any new information,

future events or otherwise.

TRADEMARKS AND

TRADE NAMES

This prospectus includes

trademarks that are protected under applicable intellectual property laws and are the Company’s property or the property of one

of the Company’s subsidiaries. This prospectus also contains trademarks, service marks, trade names and/or copyrights of other

companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this

prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the owner will

not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names.

INDUSTRY AND MARKET

DATA

Unless otherwise indicated, information contained

in this prospectus concerning the Company’s industry and the markets in which it operates, including market position and market

opportunity, is based on information from management’s estimates, as well as from industry publications and research, surveys and

studies conducted by third parties. The third-party sources from which the Company has obtained information generally state that the information

contained therein has been obtained from sources believed to be reliable, but the Company cannot assure you that this information is accurate

or complete. The Company has not independently verified any of the data from third-party sources nor has it verified the underlying economic

assumptions relied upon by those third parties. Similarly, internal company surveys, industry forecasts and market research, which the

Company believes to be reliable, based upon management’s knowledge of the industry, have not been verified by any independent sources.

The Company’s internal surveys are based on data it has collected over the past several years, which it believes to be reliable.

Management estimates are derived from publicly available information, its knowledge of the industry, and assumptions based on such information

and knowledge, which management believes to be reasonable and appropriate. However, assumptions and estimates of the Company’s future

performance, and the future performance of its industry, are subject to numerous known and unknown risks and uncertainties, including

those described under the heading “Risk Factors” in this prospectus and those described elsewhere in this prospectus, and

the other documents the Company files with the U.S. Securities and Exchange Commission (the “SEC”), from time to time. These

and other important factors could result in its estimates and assumptions being materially different from future results. You should read

the information contained in this prospectus completely and with the understanding that future results may be materially different and

worse from what the Company expects. See the information included under the heading “Special Note Regarding Forward-Looking Statements.”

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere,

or incorporated by reference, in this prospectus and does not contain all the information that you should consider in making your investment

decision. Before deciding to invest in our securities, you should read this entire prospectus carefully, including the sections of this

prospectus entitled “Risk Factors” beginning on page 13 of this prospectus, the information included in any free writing prospectus

that we have authorized for use in connection with this offering, and the documents incorporated by reference herein. Unless the context

otherwise requires, references in this prospectus to the “Company,” “we,” “us,” and “our”

refer to Netcapital Inc. and its subsidiaries.

Company Overview

Netcapital Inc. is a fintech company with a

scalable technology platform that allows private companies to raise capital online from accredited and non-accredited investors. We give

all investors the opportunity to access investments in private companies. Our model is disruptive to traditional private equity investing

and is based on Title III, Regulation Crowdfunding (“Reg CF”) of the Jumpstart Our Business Startups Act (“JOBS Act”).

We generate fees from listing private companies on our portals. Our consulting group, Netcapital Advisors Inc. provides marketing and

strategic advice in exchange for cash and equity positions. The Netcapital funding portal is registered with the SEC, is a member of the

Financial Industry Regulatory Authority (“FINRA”), a registered national securities association, and provides investors with

opportunities to invest in private companies.

Our Business

We

provide private companies with access to investments from accredited and non-accredited retail investors through our online portal (www.netcapital.com).

The Netcapital funding portal charges a $5,000 engagement fee and a 4.9% success fee for capital raised at closing. In addition, the

portal generates fees for other ancillary services, such as rolling closes. Netcapital Advisors generates fees and equity stakes from

consulting in select portfolio and non-portfolio clients. We generated revenues of $ 8,493,985 , with costs of services of $ 85,038 ,

in the year ended April 30 , 2023 for a gross profit of $ 8,408,947 in the year ended April 30, 2023

as compared to revenues of $5,480,835 with costs of services of $110,115 in the year ended April 30, 2022 for a gross profit of $5,270,720

in the year ended April 30, 2022. In fiscal 2023 and 2022, the average amount raised in a successful offering on the Netcapital

funding portal was $128,170 and $369,478, respectively, and the number of offerings that closed successfully were 49 and 64,

respectively.

Funding

Portal

Netcapital.com

is an SEC-registered funding portal that enables private companies to raise capital online, while investors are able to invest from anywhere

in the world, at any time, with just a few clicks. Securities offerings on the portal are accessible through individual offering pages,

where companies include product or service details, market size, competitive advantages, and financial documents. Companies can accept

investment from anyone, including friends, family, customers, employees, etc. Customer accounts on our platform will not be permitted

to hold digital securities.

In addition

to access to the funding portal, the Netcapital funding portal provides the following services:

● a fully

automated onboarding process;

● automated

filing of required regulatory documents;

● compliance

review;

● custom-built

offering page on our portal website;

● third

party transfer agent and custodial services;

● email

marketing to our proprietary list of investors;

● rolling

closes, which provide potential access to liquidity before final close date of offering;

● assistance

with annual filings; and

● direct

access to our team for ongoing support.

Consulting Business

Our consulting group, Netcapital Advisors,

helps companies at all stages to raise capital. Netcapital Advisors provides strategic advice, technology consulting and online marketing

services to assist with fundraising campaigns on the Netcapital platform. We also act as an incubator and accelerator, taking equity stakes

in select disruptive start-ups.

Netcapital Advisors’ services include:

● incubation of technology start-ups;

● investor introductions;

● online marketing;

● website design, software and software development;

● message crafting, including pitch decks,

offering pages, and ad creation;

● strategic advice; and

● technology consulting.

Valuation Business

Our valuation group, MSG Development Corp.,

prepares valuations.

The valuation services include:

● business valuations;

● fairness and solvency opinions;

● ESOP feasibility and valuation;

● non-cash charitable contributions;

● economic analysis of damages;

● intellectual property appraisals; and

● compensation studies.

Regulatory Overview

In an effort to enhance economic growth and

to democratize access to private investment opportunities, Congress finalized the JOBS Act in 2016. Title III of the JOBS Act enabled

early-stage companies to offer and sell securities to the general public for the first time. The SEC then adopted Reg CF, in order to

implement the JOBS Act’s crowdfunding provisions.

Reg CF has several important features that

changed the landscape for private capital raising and investment. For the first time, this regulation:

| |

● |

Allowed the general public to invest in private companies, no longer limiting early-stage investment opportunities to less than 10% of the population; |

| |

● |

Enabled private companies to advertise their securities offerings to the public (general solicitation); and |

| |

● |

Conditionally exempted securities sold under Section 4(a)(6) from the registration requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). |

Our Market

The traditional funding model restricts access

to capital, investments and liquidity. According to Harvard Business Review, venture capital firms (“VCs”), invest in

fewer than 1% of the companies they consider and only 10% of VC meetings are obtained through cold outreach. In addition, only 2%

of VC funding went to women in 2022, according to PitchBook, while only 1% went to black-owned firms, according to TechCrunch.

Furthermore, under the traditional model, the

average investor lacked access to early-stage investments. Prior to the JOBS Act, almost 90% of U.S. households were precluded from

investing in private deals, per dqydj.com. Liquidity has also been an issue, as private investments are generally locked up until

IPO or takeout.

The JOBS Act helped provide a solution to these

issues by establishing the funding portal industry, which is currently in its infancy. Title III of the JOBS Act outlines Reg CF, which

traditionally allowed private companies to raise up to $1.07 million from all Americans. In March 2021, regulatory enhancements by the

SEC went into effect and increased the limit to $5 million. These amendments increased the offering limits for Reg CF, Regulation A and

Regulation D, Rule 504 offerings as follows: Reg CF increased to $5 million; Regulation D, Rule 504 increased to $10 million from $5 million;

and Regulation A Tier 2 increased to $75 million from $50 million.

There was $494 million raised via Reg CF in

2002, according to Crowdwise. We believe a significant opportunity exists to disrupt private capital markets via the Netcapital funding

portal.

Private capital markets reached $12 trillion

by the first half of 2022, per McKinsey. Within this market, private equity represents the largest share, with assets in excess of $3

trillion and a 10-year CAGR of 10%. Since 2000, global private equity (“PE”), net asset value has increased almost tenfold,

nearly three times faster than the size of the public equity market. Both McKinsey and Boston Consulting Group predict that this strong

growth will continue, as investors allocate increasing amounts to private equity, due to historically higher returns and lower volatility

than public markets. In addition, Boston Consulting Group estimates that there are $42 trillion held in retail investment

accounts, which we believe represents a large pool of potential account holders for us.

Our Technology

The Netcapital platform is a scalable, real-time,

transaction-processing engine that runs without human intervention, 24 hours a day, seven days a week.

For companies raising capital, the technology

provides fully automated onboarding with integrated regulatory filings. Funds are collected from investors and held in escrow until the

offering closes. For entrepreneurs, the technology facilitates access to capital at low cost. For investors, the platform provides access

to investments in private, early-stage companies that were previously unavailable to the general public. Both entrepreneurs and investors

can track and view their investments through their dashboard on netcapital.com. The platform currently has almost 100,000 users.

Scalability was demonstrated in November 2021,

when the platform processed more than 2,000 investments in less than two hours, totaling more than $2 million.

Our infrastructure is designed in a way that

can horizontally scale to meet our capacity needs. Using Docker containers and Amazon Elastic Container

Service (“Amazon ECS”), we are able to automate the creation and launch of our production web and application programming

interface (“API”), endpoints in order to replicate them as needed behind Elastic Load Balancers (ELBs).

Additionally, all of our public facing endpoints

live behind CloudFlare to ensure protection from large scale traffic fluctuations (including distributed denial of service (“DdoS”)

attacks).

Our main database layer is built on Amazon

RDS and features a Multi-AZ deployment that can also be easily scaled up or down as needed. General queries are cached in our API layer,

and we monitor to optimize very complex database queries that are generated by the API. Additionally, we cache the most complex queries

(such as analytics data) in our NoSQL (Mongo) data store for improved performance.

Most of our central processing unit (“CPU”),

intensive data processing happens asynchronously through a worker/jobs system managed by AWS ElastiCache’s Redis endpoint. This

component can be easily fine-tuned for any scale necessary.

The technology necessary to operate our funding portal

is licensed from Netcapital Systems LLC, a Delaware limited liability company (“Netcapital DE LLC”), of which Jason

Frishman, Netcapital’s founder, owns a 29% interest, under a license agreement with Netcapital Funding Portal, Inc., for an annual

license fee of $380,000, paid in quarterly installments.

On January 2, 2023, our wholly-owned subsidiary,

Netcapital Systems LLC, a Utah limited liability company (“Netcapital UT LLC”), entered into a software license and services

agreement (the “Templum License Agreement”) with Templum Markets LLC (“Templum”), to provide issuers and investors

on the Netcapital funding portal with the potential for greater distribution and liquidity. Templum is a company that provides capital

markets infrastructure for trading private equity securities, and operates an alternative trading system (“ATS”) with approval

in 53 U.S. states and territories for the trading of unregistered or private securities.

Case Studies

Set forth below are certain selected case

studies of crowdfunding offerings that have been completed and fully funded on the Netcapital funding portal which have gone on to successfully

complete additional offerings. These studies have been included to represent examples of a few of the approximately 225 projects that

have been funded on the Netcapital funding portal through April 30, 2023. Of such projects, approximately 25 have raised the maximum

offering sought and approximately 200 have raised less than the maximum offering sought, with the average size of offering closed on

the Netcapital funding portal being approximately $230,000 per offering as of July 31, 2023.

MAGFAST Case Study

MAGFAST, a wireless charger company, launched an

equity offering on our funding portal in November 2020, with a fundraising goal of $1.07 million. The company sold out the offering

in one day. Almost 1,000 investors successfully invested through our funding portal in a 24-hour period. In November of 2021,

MAGFAST raised approximately $2 million in two hours in a follow-on offering. We believe the rapid sell-out of the MAGFAST offering

demonstrates the proven scalability of our platform. Revenues generated for the Netcapital funding portal for the MAGFAST offering

totaled $389,179.

Energyx Case

Study

In 2021, Energy Exploration Technologies, Inc. or

EnergyX, which has developed an energy efficient and sustainable method to extract lithium, raised $4.3 million on the Netcapital platform.

Lithium is a key component in batteries for electric vehicles. In April of 2023, the company announced a $50 million funding round led

by GM Ventures. In addition to a right of first refusal on any lithium mined, General Motors plans to help EnergyX with technology development.

Revenues generated for the Netcapital funding portal for the EnergyX offerings totaled $224,150.

Vantem Global

Case Study

Vantem Global, a

manufacturer of proprietary, energy-efficient, modular panels to build affordable, net-zero homes, raised a seed round on the Netcapital

platform in November of 2019. In April of 2022, the company closed a Series A round led by Breakthrough Energy Ventures, which was founded

by Bill Gates. Vantem plans to use the funding to build 15 U.S. factories in the U.S. over the next seven years. Revenues generated

for the Netcapital funding portal for the Vantem Global offering totaled $13,312.

Competitive

Advantages

We believe

we provide the lowest cost solution for online capital raising versus our peer group (StartEngine Crowdfunding, Inc., Wefunder Inc. and

Republic Core LLC). We also believe that our access and onboarding of new clients are superior due to our facilitated technology platforms.

Our network is rapidly expanding as a result of our enhanced marketing and broad distribution to reach new investors.

Our competitors

include StartEngine Crowdfunding, Inc., Wefunder,Inc. and Republic Core LLC . Given the rapid growth in the industry and its potential

to disrupt the multi-billion dollar private capital market, there is sufficient room for multiple players.

Our

Strategy

Two major tailwinds

are driving accelerated growth in the shift to the use of online funding portals: (i) the COVID-19 pandemic and (ii) the increase in

funding limits under Reg CF. The pandemic drove a rapid need to bring as many processes as possible online. With travel restrictions

in place and most people in lockdown, entrepreneurs were no longer able to fundraise in person and have increasingly turned to online

capital raising through funding portals.

There are

numerous industry drivers and tailwinds that complement investor demand for access to investments in private companies. To capitalize

on these, our strategy is to:

| |

● |

Generate New

Investor Accounts. Growing the number of investor accounts on our platform is a top priority. Investment dollars that continue to

flow through our platform are the key revenue driver. When issuers advertise their offerings, they are generating new investor accounts

for us at no cost to Netcapital. We plan to supplement our issuers’ spend on advertising by increasing our online marketing

spend as well, which may include virtual conferences going forward. |

| |

● |

Hire Additional

Business Development Staff. We seek to hire additional business development staff that is technology advanced and financially passionate

about capital markets to handle our growing backlog of potential customers. |

| |

● |

Increase the

Number of Companies on Our Platform via Marketing. When a new company lists on our platform, they bring their customers, supporters,

and brand ambassadors as new investors to Netcapital. We plan to increase our marketing budget to help grow our portal and advisory

clients. |

| |

● |

Invest in Technology.

Technology is critical to everything that we do. We plan to invest in developing innovative technologies that enhance our platform

and allow us to pursue additional service offerings. For example, we plan on developing a dedicated mobile app in 2022 to make our

platform more accessible. |

| |

● |

Incubate and accelerate our advisory portfolio clients. The advisory portfolio and our equity interests in select advisory clients represent potential upside for our shareholders. We seek to grow this model of advisory clients. |

| |

● |

Expand Internationally. We believe there is a significant opportunity to expand into Europe and Asia as an appetite abroad grows for U.S. stocks. |

| |

● |

Open

ATS , or secondary transfer feature . Lack of liquidity is a key issue for investors in private companies as private

markets lack a liquidity feature in our targeted market. In January 2023, we entered into the Templum License Agreement

with Templum, operator of an ATS with approval in 53 U.S. states and territories for the trading of unregistered or private securities

to provide issuers and investors on the Netcapital funding portal with the potential for greater distribution and liquidity. A beta

testing platform has been established and the functionality is currently being tested. |

| |

● |

New Verticals Represent a Compelling Opportunity. We operate in a regulated market supported by the JOBS Act. We may pursue expanding our model to include Regulation A and Regulation D offerings. |

Our Management

Our management team is experienced in finance,

technology, entrepreneurship, and marketing.

Martin Kay is our Chief Executive Officer (“CEO”)

and a director. He previously served as Managing Director at Accenture Strategy, from October 2015 to December 2022 and holds a BA in

physics from Oxford University and an MBA from Stanford University Graduate School of Business. Mr. Kay is an experienced C-suite advisor

and digital media entrepreneur, working at the intersection of business and technology. His experience includes oversight of our funding

portal when he served on the board of managers of Netcapital DE LLC from 2017 to 2021.

Coreen Kraysler, CFA, is our Chief Financial

Officer (“CFO”). With over 30 years of investment experience, she was formerly a Senior Vice President and Principal at Independence

Investments, where she managed several 5-star rated mutual funds and served on the Investment Committee. She also worked at Eaton Vance

as a Vice President, Equity Analyst on the Large and Midcap Value teams. She received a B.A. in Economics and French, cum laude from Wellesley

College and a Master of Science in Management from MIT Sloan.

Jason Frishman is the founder and former chief

executive officer of our funding portal subsidiary, Netcapital Funding Portal Inc. Mr. Frishman founded Netcapital Funding Portal Inc.

to help reduce the systemic inefficiencies early-stage companies face in securing capital. He currently holds advisory positions at leading

organizations in the financial technology ecosystem and has spoken as an external expert at Morgan Stanley, University of Michigan,

YPO, and others. Mr. Frishman has a background in the life sciences and previously conducted research in medical oncology at the Dana

Farber Cancer Institute and cognitive neuroscience at the University of Miami, where he graduated summa cum laude with a B.S. in Neuroscience.

Corporate Information

The Company was incorporated in Utah in 1984 as DBS

Investments, Inc. (“DBS”). DBS merged with Valuesetters L.L.C. in December 2003 and changed its name to Valuesetters, Inc.

In November 2020, the Company purchased Netcapital Funding Portal Inc. from Netcapital DE LLC and changed the name of the Company from

Valuesetters, Inc. to Netcapital Inc. In November 2021, the Company purchased MSG Development Corp.

Attached below is an organization chart for

the Company as of the date of this prospectus :

Our principal executive offices are located at State

Street Financial Center, One Lincoln Street, Boston, Massachusetts and our telephone number is 781-925-1700. We maintain a website at www.netcapitalinc.com.

Information contained on or accessible through our website is not, and should not be considered, part of, or incorporated by reference

into, this prospectus and you should not consider any information contained on, or that can be accessed through, our website as part of

this prospectus in deciding whether to purchase our securities.

Implications of Being a Smaller Reporting Company

We have elected to take advantage of certain of the

reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in future filings.

As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies

in which you hold equity interests.

We are a “smaller reporting company,”

meaning that the market value of our stock held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result

of this offering is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal

year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our common stock held by

non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal

year and the market value of our stock held by non-affiliates is less than $700 million. As a smaller reporting company, we may continue

to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller

reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report

on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive

compensation.

Recent Developments

May 2023 Registered Direct

Offering

On May 23, 2023, we entered

into a securities purchase agreement with certain institutional investors, pursuant to which we agreed to issue and sell to such investors,

in a registered direct offering, 1,100,000 shares of our common stock at a price of $1.55 per share , for aggregate gross proceeds

of $1,705,000, before deducting the placement agent's fees and other offering expenses payable by the Company. The offering closed

on May 25, 2023 and we received aggregate net proceeds of $1,468,700. The shares were offered and issued and sold pursuant to

the Company’s shelf registration statement on Form S-3 (File 333-267921) filed by the Company with the SEC under the Securities

Act of 1933, as amended (the “Securities Act”), on October 18, 2022 and declared effective on October 26, 2022.

We used $ 367,167

of the net proceeds from the Offering to repay certain indebtedness, and the remainder of net proceeds for working capital and general

corporate purposes.

Also in connection with

the offering, on May 23, 2023, we entered into a placement agency agreement with ThinkEquity, LLC ( “ThinkEquity”) ,

pursuant to which (i) ThinkEquity acted as placement agent on a “best efforts” basis in connection with the offering ,

(ii) we paid ThinkEquity an aggregate fee equal to 8.0% of the gross proceeds raised in the offering , and reimbursed ThinkEquity

for certain expenses, and (iii) issued to ThinkEquity warrants to purchase up to 55,000 shares of common stock at an

exercise price of $1.94 (the “Placement Agent Warrants”), on May 25, 2023. The Placement Agent Warrants (and the shares of

common stock issuable upon the exercise of the Placement Agent Warrants) were not registered under the Securities Act, and were

offered pursuant to an exemption from the registration requirements of the Securities Act provided in Section 4(a)(2) of the Securities

Act and Rule 506(b) promulgated thereunder.

Repayment of Secured Debt

On May 25, 2023, we paid $367,167 to our secured

lender, Vaxstar LLC, to pay off the remaining $350,000 principal balance and $17,167 in interest, using a portion of the net proceeds

of the offering . Following repayment to Vaxstar LLC the facility was closed and all related agreements were terminated in accordance

with their terms.

Recent Common Stock Issuances.

In April and May 2023, we issued an aggregate

of 450,000 shares of common stock to consultants in consideration of services rendered. In addition, in July 2023, we issued 49,855 shares

of common stock to an unrelated third party, in consideration of a release from such third party related to settlement of an outstanding

debt between such third-party and Netcapital DE LLC. In July 2023, we issued 18,750 shares of our common stock in connection with our

acquisition of a 10% interest in Caesar’s Media Group, Inc. We did not receive any proceeds from these issuances. Such shares were

issued pursuant to the exemption provided by Section 4(a)(2) of the Securities Act.

July 2023 Public Offering

On July 24, 2023, we completed an underwritten

public offering of 1,725,000 shares of our common stock, at a price to the public of $0.70 per share, for aggregate gross proceeds of

$1,207,500, before deducting underwriting discounts and offering expenses payable by us. In conjunction with this offering, we issued

ThinkEquity and its designees warrants to purchase up to 86,250 shares of our common stock at an exercise price of $0.875 per share,

which warrants (and the shares of common stock issuable upon the exercise of such warrants) were not registered under the Securities

Act, and were issued pursuant to an exemption from the registration requirements of the Securities Act provided in Section 4(a)(2) of

the Securities Act and Rule 506(b) promulgated thereunder.

THE OFFERING

| Common Stock offered by us: |

7,473,842 shares

of common stock (assuming no sale of any pre-funded warrants and no exercise of the over-allotment option). |

| |

|

| Pre-funded warrants

offered by us: |

We

are also offering to those purchasers, if any, whose purchase of the common stock in this offering

would result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding common

stock immediately following the consummation of this offering, the opportunity to purchase, if

they so choose, up to pre-funded warrants, in lieu of the common stock that would otherwise result

in ownership in excess of 4.99% (or 9.99%, as applicable) of our outstanding common stock.

The purchase

price of each pre-funded warrant will equal the price per share of common stock being sold to the public in this offering, minus

$0.01, and the exercise price of each pre-funded warrant will be $0.01 per share.

For each pre-funded

warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. The number of warrants

sold in this offering will not change as a result of a change in the mix of the common stock and pre-funded warrants sold.

Each pre-funded

warrant will be immediately exercisable and may be exercised at any time until exercised in full. To better understand the terms

of the pre-funded warrants, you should carefully read the “Description of Securities” section of this prospectus. You

should also read the form of pre-funded warrant, which is filed as an exhibit to the registration statement of this prospectus forms

a part.

|

| |

|

| Common stock

outstanding before the offering |

9,434,132

shares of common stock. |

| |

|

| Common stock to be outstanding after the offering(1) |

16,907,974

shares of common stock. If the Representative’s

over-allotment option is exercised in full, the total number of shares of common stock outstanding immediately after this offering

would be 18,029,051. |

| |

|

| Option to purchase additional shares and pre-funded warrants |

We have granted the Representative a 45-day option

to purchase up to 1,121,077 additional shares of our common stock (and/or up to 1,121,077 additional pre-funded

warrants in lieu thereof) to cover allotments, if any.

The purchase price to be paid per additional share

of common stock or pre-funded warrant by the Representative shall be equal to the public offering price of one share of common stock or

pre-funded warrant, as applicable, less the underwriting discount, and the purchase price to be paid per additional pre-funded warrant

by the Representative shall be $0.00001. |

| |

|

| Use of proceeds |

We estimate that the net

proceeds to us from this offering will be approximately $ 4.4 million, or approximately $5.0 million if the Representative

exercises its over-allotment option in full for shares of common stock or pre-funded warrants only). We intend to use the net proceeds

of this offering for research and development activities (including development of a mobile app), sales and marketing, and for general

working capital purposes and potential acquisitions of other companies, products or technologies,

though no such acquisitions are currently contemplated. See “Use of Proceeds” on page 28. |

| |

|

| Risk factors |

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 13 before deciding to invest in our securities. |

| Trading symbol |

Our common stock is currently listed on the Nasdaq

Capital Market under the trading symbol “NCPL”. We do not intend to apply for the listing of the pre-funded warrants on any

national securities exchange or other trading market. Without an active trading market, the liquidity of the pre-funded warrants will

be limited.

|

| Lock-up Agreements |

We

and our directors and officers and Netcapital DE LLC, as of the date of this prospectus have agreed with the Representative not to

offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into

common stock for a period of six (6) months from the date of this prospectus in the case of the Company’s directors and

officers and three (3) months from the date of this prospectus in the case of the Company and Netcapital DE LLC. See

“Underwriting” section on page . |

| (1) |

The

number of shares of our common stock to be outstanding after this offering is based on 9,434,132 shares of our common stock

outstanding as of August 3 , 2023, and excludes the following: |

| |

∙ |

98,000 shares of common stock reserved for future issuance under our 2021 Equity Incentive Plan and our 2023 Omnibus Equity Incentive Plan; |

| |

∙ |

2,202,000 shares of common stock

issuable upon exercise of outstanding options with a weighted average exercise price of $2.46 per share; |

| |

|

|

| |

∙ |

1,541,682 shares of common stock underlying warrants having a weighted

average exercise price of $5.03 per share;

|

| |

∙ |

18,750 shares of common stock to be issued in connection with our

acquisition of a 10% interest in Caesar Media Group Inc. on October 31, 2023;

|

| |

∙ |

18,750 shares of common

stock to be issued in connection with our acquisition of MSG Development Corp., of which 6,250 shares will be issued on each of October

31, 2023, October 31, 2024 and October 31, 2025; and |

| |

|

|

| |

∙ |

373,692 shares

of common stock underlying the Representative’s Warrants. |

Except as otherwise indicated herein, all information

in this prospectus reflects or assumes:

| |

∙ |

no exercise of the outstanding options or warrants to be issued described above; |

| |

|

|

| |

∙ |

no sale of any pre-funded warrants; and

|

| |

∙ |

no

exercise of the Representative’s option to purchase up to an additional 1,121,077 shares of common stock and/or

pre-funded warrants to purchase up to 1,121,077 shares of common stock, to cover over-allotments, if any. |

SELECTED

HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents our selected historical

consolidated financial data for the periods indicated. The selected historical consolidated financial data for the years ended April

30, 2023 and 2022 are derived from our audited financial statements.

Historical results

are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods,

and results of interim periods are not necessarily indicative of results for the entire year. The data presented below should be read

in conjunction with, and are qualified in their entirety by reference to, “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our consolidated financial statements and the notes thereto included elsewhere in this

prospectus.

| | |

Year

Ended(1) |

| Income Statement Data: | |

April

30, 2023 | |

April

30, 2022 |

| Sales | |

$ | 8,493,985 | | |

$ | 5,480,835 | |

| Cost of operations | |

$ | 6,222,109 | | |

$ | 6,511,981 | |

| Income (loss) from operations | |

$ | 2,271,876 | | |

$ | (1,031,146 | ) |

| Interest expense | |

$ | (93,842 | ) | |

$ | (126,372 | ) |

| Other income (expense)(4) | |

$ | 1,630,938 | | |

$ | 5,205,048 | |

| Income (loss) before income taxes | |

$ | 3,808,972 | | |

$ | 4,047,530 | |

| Benefit (provision) for income taxes | |

$ | (854,000 | ) | |

$ | (544,000 | ) |

| Net income (loss) | |

$ | 2,954,972 | | |

$ | 3,503,530 | |

| Per Share Data: | |

| | | |

| | |

| Net income (loss) per share – basic | |

| 0.63 | | |

| 1.31 | |

| Net income (loss) per share – diluted | |

| 0.63 | | |

| 1.27 | |

| Weighted average shares outstanding – basic | |

| 4,677,214 | | |

| 2,666,173 | |

| Weighted average shares outstanding – diluted | |

| 4,677,464 | | |

| 2,748,480 | |

| Consolidated Statement of Cash Flow Data: | |

| | | |

| | |

| Cash (used in) operating activities | |

$ | (4,617,200 | ) | |

$ | (3,006,667 | ) |

| Net cash provided by (used in) investing activities | |

$ | 200,000 | | |

$ | (319,166 | ) |

| Net cash provided by (used in) financing activities | |

$ | 4,512,716 | | |

$ | 1,325,799 | |

| Balance Sheet Data: | |

April

30,

2023

(Actual) | |

April

30, 2023 (Pro Forma) (4) | |

April

30, 2023 (Pro

Forma, As Adjusted)(5) |

| Cash | |

$ | 569,441 | | |

$ | 2,546,589 | | |

$ | 6,899,089 | |

| Equity

securities at fair value(2) | |

$ | 22,955,445 | | |

$ | 23,138,633 | | |

$ | 23,138,633 | |

| Total

assets | |

$ | 41,820,093 | | |

$ | 44,124,429 | | |

$ | 48,476,929 | |

| Total

debt(3) | |

$ | 2,785,124 | | |

$ | 2,435,124 | | |

$ | 2,435,124 | |

| Total

stockholders’ equity | |

$ | 36,156,452 | | |

$ | 38,869,617 | | |

$ | 43,222,117 | |

| (1) |

We have an April 30 fiscal year end. |

|

(2) |

Investments are monitored for any changes in observable

prices from orderly transactions. |

| (3) |

Total

debt includes two Small Business Administration (“SBA”), loans and a secured loan, covering substantially all of the

Company’s assets, of $ 350,000 as of April 30, 2023, which was paid in full in May 2023 . A third SBA

loan was forgiven during the year ended April 30, 2022 , and the amount of forgiveness including accrued interest, totaling

$1,904,302, is included in other income. We have applied for forgiveness of approximately $1.9 million of the outstanding SBA loans,

which application we expect to be approved; however such forgiveness is at the discretion of the SBA and we cannot be sure of the

timing or amount of such forgiveness. |

| |

|

| (4) |

The

pro forma column gives effect to: (i) the issuance and sale by us of 1,100,000 shares of common stock in a registered direct offering

at a public offering price of $1.55 per share in May 2023 resulting in the receipt of $1,118,700 in net proceeds after deducting

the placement agent fees and offering expenses and the repayment of $367,167 of outstanding secured debt including accrued interest;

(ii) the issuance of 100,000 shares of common stock in consideration of consulting services in May 2023; (iii) the issuance of 49,855

shares in consideration of a release from an unrelated third party in conjunction with the settlement of an outstanding liability;

(iv) the issuance and sale by us of 1,725,000 shares of common stock in an underwritten public offering at a public offering price

of $0.70 per share in July 2023 resulting in the receipt of $858,448 in net proceeds after deducting the underwriting discounts and

commissions and other offering expenses; and (v) the issuance of 18,750 shares of common stock in July 2023 in connection with the

purchase of a 10% interest in Caesar Media Group, Inc. |

| |

|

| (5) |

The

pro forma as adjusted column gives effect to the issuance of 7,473,842 shares of our common stock (assuming no sale of pre-funded

warrants and exercise of the over-allotment option) in this offering and the receipt of approximately $4.4 million in net proceeds

after underwriting discounts and fees and estimated offering expenses. |

RISK FACTORS

Investing in our

securities involves a high degree of risk. You should carefully consider the risks described below, together with the other information

contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus, before

making your decision to invest in our securities. We cannot assure you that any of the events discussed in the risk factors below will

not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and cash

flows and, if so, our prospects would likely be materially and adversely affected. If any of such events were to happen, the trading

price of our securities in any market that may develop for our securities could decline and you could lose all or part of your investment.

Risks Related to Our Need for Additional Capital

We will need to

raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed

may force us to delay, limit or terminate operations.

Our cash balances at

April 30, 2023 and August 3, 2023 were $569,441 and $940,948, respectively. We will need to raise additional capital following the

completion of this offering of additional equity and/or debt securities and/or the sale of equity positions in

certain portfolio companies for which Netcapital Advisors provides marketing and strategic advice. In the event that we are not able

to raise additional working capital through these methods, we do not expect that our cash on hand will be sufficient to fund our

current operations for the next 12 months. Our operating plan may change as a result of many factors currently unknown to us,

and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government or

other third-party funding or a combination of these approaches. Raising funds in the current economic environment may present

additional challenges. Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional

capital if market conditions are favorable or if we have specific strategic considerations.

Any additional fundraising

efforts may divert our management from their day-to-day activities. In addition, we cannot guarantee that future financing will be available

in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings

or the rights of our stockholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such

issuance, may cause the market price of our shares of common stock to decline. The sale of additional equity or convertible securities

may dilute our existing stockholders. The incurrence of indebtedness would result in increased fixed payment obligations, and we may

be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our

ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability

to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an

earlier stage than otherwise would be desirable and we may be required to relinquish rights to some of our technologies or product candidates

or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and

prospects.

Risks Related

to Our Business and Growth Strategy

We have a limited

operating history and our profits have been generated primarily by unrealized gains from equity securities we own in other companies.

Although we have been profitable, the likelihood of our success must be considered in light of the problems, expenses, difficulties,

complications and delays frequently encountered by a small developing company.

We were incorporated in the State of Utah

in April 1984. Although we have reported earnings in the years ended April 30, 2023 and 2022, the majority of our earnings

came from unrealized gains in equity securities that we own. These securities have observable prices but are not liquid. Furthermore,

the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently

encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will

operate. Since we have a limited operating history, we cannot assure you that our business will maintain profitability.

We have

substantial customer concentration, with a limited number of customers accounting for a substantial portion of our revenues.

We currently derive a significant portion of our

revenues from a limited number of customers. For the year ended April 30, 2023, the Company had one customer that constituted

25% of its revenues, and four customers that each constituted 14% of its revenues. For the year ended April 30, 2022, the

Company had one customer that constituted 22% of its revenues, a second customer that constituted 22% of its revenues, and a third customer

that constituted 18% of its revenues. There are inherent risks whenever a large percentage of total revenues are concentrated with a

limited number of customers. It is not possible for us to predict the future level of demand for our services that will be generated

by these customers or new customers, or the future demand for the products and services of these customers or new customers. If

any of these customers experience declining or delayed sales due to market, economic or competitive conditions, we could be pressured

to reduce the prices we charge for our products which could have an adverse effect on our margins and financial position and could negatively

affect our revenues and results of operations and/or trading price of our common stock.

We operate

in a regulatory environment that is evolving and uncertain.

The regulatory

framework for online capital formation or crowdfunding is very new. The regulations that govern our operations have been in existence

for a very few years. Further, there are constant discussions among legislators and regulators with respect to changing the regulatory

environment. New laws and regulations could be adopted in the United States and abroad. Further, existing laws and regulations may be

interpreted in ways that would impact our operations, including how we communicate and work with investors and the companies that use

our services and the types of securities that our clients can offer and sell on our platform.

We operate

in a highly regulated industry.

We are subject to

extensive regulation and failure to comply with such regulation could have an adverse effect on our business. Further, our subsidiary

Netcapital Funding Portal Inc is registered as a funding portal. As a funding portal we have to comply with stringent regulations, and

the operation of our funding portal is frequently subject to examination, constraints on its business, and in some cases fines. In addition,

some of the restrictions and rules applicable to our subsidiary could adversely affect and limit some of our business plans.

Our

funding portal’s service offerings are relatively new in an industry that is still quickly evolving.

The principal securities regulations that

we work with, Rule 506 (c) and Reg CF, have only been in effect in their current form since 2013 and 2016, respectively. Our ability

to continue to penetrate the market remains uncertain as potential issuer companies may choose to use different platforms or providers

(including, in the case of Rule 506(c) and Regulation A, using their own online platform), or determine alternative methods of financing.

Investors may decide to invest their money elsewhere. Further, our potential market may not be as large, or our industry may not grow

as rapidly as anticipated. Success will likely be a factor of investing in the development and implementation of marketing campaigns,

repeat business from both issuer companies and investors, and favorable changes in the regulatory environment.

We have an

evolving business model.

Our business model is one of innovation, including

continuously working to expand our product lines and services to our clients. For example, we are evaluating an expansion into the broker-dealer

space as well as our foray into becoming an alternative trading system. It is unclear whether these services will be successful. Further,

we continuously try to offer additional types of services, and we cannot offer any assurance that any of them will be successful. From

time to time, we may also modify aspects of our business model relating to our service offerings. We cannot offer any assurance that these

or any other modifications will be successful or will not result in harm to the business. We may not be able to manage growth effectively,

which could damage our reputation, limit our growth, and negatively affect our operating results.

We may

be liable for misstatements made by issuers.

Under the Securities Act and the Exchange

Act, issuers making offerings through our funding portal may be liable for inappropriate disclosures, including untrue statements of

material facts or for omitting information that could make the statements misleading. This liability may also extend in Reg CF offerings

to funding portals, such as our subsidiary. Even though due diligence defenses may be available, there can be no assurance that if we

were sued, we would prevail. Further, even if we do succeed, lawsuits are time consuming and expensive, and being a party to such actions

may cause us reputational harm that would negatively impact our business. Moreover, even if we are not liable or a party to a lawsuit

or enforcement action, some of our clients have been and will be subject to such proceedings. Any involvement we may have, including

responding to document production requests, may be time-consuming and expensive as well.

Our

compliance is focused on U.S. laws and we have not analyzed foreign laws regarding the participation of non-U.S. residents.

Some of the

investment opportunities posted on our platform are open to non-U.S. residents. We have not researched all the applicable foreign laws

and regulations, and we have not set up our structure to be compliant with foreign laws. It is possible that we may be deemed in violation

of those laws, which could result in fines or penalties as well as reputational harm. Any violation of foreign laws may limit our ability

in the future to assist companies in accessing money from those investors, and compliance with those laws and regulations may limit our

business operations and plans for future expansion.

Our

cash flow is reliant on one main type of service.

Most of our cash-flow

generating services are variants on one type of service: providing a platform for online capital formation. Our revenues are therefore

dependent upon the market for online capital formation. As such, any downturn in the market could have a material adverse effect on our

business and financial condition.

We depend on

key personnel and face challenges recruiting needed personnel.

Our future success depends on the efforts of a small

number of key personnel, including the founder of our subsidiary, Netcapital Funding Portal Inc., our Chief Executive Officer,

our Chief Financial Officer, and our compliance, engineering and marketing teams. Our software engineer team, as well as our compliance

team and our marketing team are critical to continually innovate and improve our products while operating in a highly regulated industry.

In addition, due to the specialized expertise required, we may not be able to recruit the individuals needed for our business needs.

There can be no assurance that we will be successful in attracting and retaining the personnel we require to operate and be innovative.

We are

vulnerable to hackers and cyber-attacks.

As an internet-based

business, we may be vulnerable to hackers who may access the data of our investors and the issuer companies that utilize our platform.

Further, any significant disruption in service on our funding portal platform or in our computer systems could reduce the attractiveness

of our platform and result in a loss of investors and companies interested in using our platform. Further, we rely on a third-party technology

provider to provide some of our back-up technology as well as act as our escrow agent. Any disruptions of services or cyber-attacks either

on our technology provider, escrow agent, or on us could harm our reputation and materially negatively impact our financial condition

and business.

Our funding

portal relies on one escrow agent to hold investment commitments for issuers.

We currently rely

on First Citizens Bank to provide all escrow services related to offerings on our platform. Any change in this relationship will require

us to find another escrow agent and escrow bank. This change may cause us delays as well as additional costs in transitioning our technology.

We are not allowed to operate our funding portal business without a qualified third-party escrow bank. There are a limited number of

banks that provide this service. As such, if our relationship with our escrow agent is terminated, we may have difficulty finding a replacement

which could have a material adverse effect on our business and results of operations.

If our wholly-owned

subsidiary, Netcapital Funding Portal Inc., fails to comply with its obligations under the license agreement with Netcapital DE LLC under

which the technology to operate our funding portal is licensed to Netcapital Funding Portal Inc., we could lose rights necessary to operate

our funding portal which are important to our business.

Our wholly-owned

subsidiary, Netcapital Funding Portal Inc. has licensed the technology necessary to operate our funding portal from our majority stockholder,

Netcapital DE LLC, of which Mr. Frishman owns a 29% interest. These rights are extremely important to our business. If Netcapital Funding

Portal Inc. fails to comply with any obligations under this license agreement, such license agreement may be subject to termination in

whole or in part, which could severely impact our ability to operate our funding portal which would have a material adverse effect on

our business, financial position and results of operations.

In addition, disputes

may arise regarding the technology subject to a license agreement, including:

| |

● |

the

scope of rights granted under the license agreement and other interpretation-related issues; |

| |

● |

the

extent to which our processes infringe on the technology of Netcapital DE LLC that is not subject to the license agreement; |

| |

● |

the

ownership of inventions and know-how resulting from the joint creation or use of technology by Netcapital DE LLC and us. |

Disputes over technology under the license agreement

with Netcapital DE LLC may prevent or impair our ability to maintain our current license agreement on acceptable terms, and we may be

unable to successfully operate our funding portal. In addition, any failure of Netcapital DE LLC to service the technology subject

to the license agreement or to operate its website could result in our inability to operate our funding portal which would have a material

adverse effect on our business, financial condition and results of operations.

Netcapital

DE LLC relies on third-party software for the technology subject to the license agreement with Netcapital Funding Portal Inc. that

may be difficult to replace or which could cause errors or failures of our funding portal.

Netcapital DE LLC relies

on software licensed from third parties for the technology subject to the license agreement with Netcapital Funding Portal Inc. This software

may not continue to be available at reasonable prices or on commercially reasonable terms, or at all. Any loss by Netcapital DE LLC of

the right to use any of this software could significantly increase our expenses and otherwise result in delays in the provisioning of

our funding portal until equivalent technology is either developed by us or Netcapital DE LLC, or, if available, is identified, obtained

and integrated, which could harm our business. Any errors or defects in third-party software could result in errors or a failure of our

funding portal which could harm our business.

Our

strategy to purchase a portion of early-stage companies may provide us with investments that have no liquidity.

It is our

strategy to sometimes purchase, at an affordable price, part or all of early-stage companies and cross pollinate the ideas, technology