Minerva Neurosciences Reports First Quarter 2024 Financial Results and Business Updates

01 May 2024 - 9:30PM

Minerva Neurosciences, Inc. (Nasdaq: NERV), a clinical-stage

biopharmaceutical company focused on the development of therapies

to treat central nervous system (CNS) disorders, today reported

business updates and financial results for the first quarter of

2024 ending March 31, 2024.

Roluperidone NDA Update

On February 27, 2024, the Company announced that the U.S. Food

and Drug Administration (FDA) issued a Complete Response Letter

(CRL) to its New Drug Application (NDA) for roluperidone (f/k/a

MIN-101) for the treatment of negative symptoms in patients with

schizophrenia. The Company is in discussions with the FDA

regarding the issues and clinical deficiencies raised in the

CRL.

Phase 1b Clinical Trial (MIN-101C18)

In the first quarter of 2024, the Company completed a clinical

trial initiated in October 2023 to evaluate the safety,

tolerability, pharmacodynamics and pharmacokinetics of the

co-administration of roluperidone and olanzapine in adult subjects

with moderate to severe negative symptoms of schizophrenia. This

clinical trial (NCT06107803) was designed to investigate the

pharmacodynamic and pharmacokinetic effects and safety of the

concomitant therapy of roluperidone with an established and widely

used antipsychotic. Of the 17 patients enrolled, 13 completed all

17 days of daily dosing of roluperidone at 64 mg. No new safety

signals were observed during the study with few treatment-emergent

adverse events (TEAEs), most of which were mild and all resolved

without sequelae. No emergent clinically significant

electrocardiogram or laboratory abnormalities were observed during

the study. There was no symptomatic worsening during the

administration of roluperidone alone (7 days) or when administered

in combination with olanzapine at 10 mg (10 days).

The study demonstrated that pharmacokinetic interactions between

the two drugs were not relevant.

First Quarter 2024 Financial Results

- Research and development

(R&D) expense: For the three months ended March 31,

2024 and 2023, R&D expense was $4.2 million and $2.7 million,

respectively. R&D expense was higher versus the prior year

period primarily due to costs associated with the FDA’s review of

the Company’s NDA and the conduct of the MIN-101C18 study.

- General and administrative

(G&A) expense: For the three months ended March 31,

2024 and 2023, G&A expense was $2.5 million and $2.7 million,

respectively. G&A expense was lower versus the prior year

period primarily due to lower professional service fees.

- Non-cash interest

expense: For the three months ended March 31, 2024 and

2023, non-cash interest expense for the sale of future royalties

was $2.3 million and $2.0 million, respectively. The increase

versus the prior year period was primarily due to the amortization

of non-cash interest expense for the difference between the balance

of the liability related to the sale of future royalties and the

estimated amount of future royalties to be received over the

royalty period.

- Net loss: Net loss

was $8.6 million for the three months ended March 31, 2024, or net

loss per share of $1.13 basic and diluted, as compared to net loss

of $7.0 million for the three months ended March 31, 2023, or net

loss per share of $1.31 basic and diluted.

- Cash Position:

Cash, cash equivalents and restricted cash at March 31, 2024 were

approximately $34.9 million, as compared to $41.0 million at

December 31, 2023.

About Minerva Neurosciences

Minerva Neurosciences, Inc. is a clinical-stage

biopharmaceutical company focused on developing product candidates

to treat CNS diseases. Minerva’s goal is to transform the lives of

patients with improved therapeutic options, including roluperidone

for negative symptoms of schizophrenia and MIN-301 for Parkinson’s

disease. For more information, please visit the Company’s

website.

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements which are

subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, as amended. Forward-looking

statements are statements that are not historical facts, reflect

management’s expectations as of the date of this press release, and

involve certain risks and uncertainties. Forward-looking statements

include, but are not limited to, statements herein with respect to

expectations concerning Minerva’s ability to remediate or otherwise

resolve issues and deficiencies identified in the CRL. These

forward-looking statements are based on our current expectations

and may differ materially from actual results due to a variety of

factors including, without limitation, Minerva’s ability to address

FDA’s feedback and timing thereof; uncertainties associated with

regulatory processes, including the content and timing of decisions

by the FDA; general risks associated with developing

biopharmaceutical product candidates; management’s ability to

successfully achieve its goals; our ability to raise additional

capital to fund its operations and corporate objectives on terms

acceptable to Minerva; general economic conditions; and other

factors that are described under the caption “Risk Factors” in

Minerva’s filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the Securities and

Exchange Commission on February 22, 2024, as updated by its

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

Copies of reports filed with the SEC are posted on

Minerva’s website at http://ir.minervaneurosciences.com/. The

forward-looking statements in this press release are based on

information available to the Company as of the date hereof, and the

Company disclaims any obligation to update any forward-looking

statements, except as required by law.

Contact:

Investor inquiries:Frederick AhlholmChief

Financial OfficerMinerva Neurosciences,

Inc.info@minervaneurosciences.com

Media inquiries: Helen ShikPrincipalShik

Communications LLChelen@shikcommunications.com

|

CONDENSED CONSOLIDATED BALANCE SHEET DATA |

|

(Unaudited) |

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

|

(in thousands) |

|

ASSETS |

|

Current assets: |

|

|

|

Cash and cash equivalents |

$ |

34,818 |

|

|

$ |

40,913 |

|

|

Restricted cash |

|

100 |

|

|

|

100 |

|

|

Refundable regulatory fee |

|

- |

|

|

|

- |

|

|

Prepaid expenses and other current assets |

|

703 |

|

|

|

989 |

|

|

Total current assets |

|

35,621 |

|

|

|

42,002 |

|

|

Equipment and capitalized software, net |

|

20 |

|

|

|

29 |

|

|

Goodwill |

|

14,869 |

|

|

|

14,869 |

|

|

Total assets |

$ |

50,510 |

|

|

$ |

56,900 |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

Current liabilities: |

|

|

|

Accounts payable |

$ |

1,435 |

|

|

$ |

1,805 |

|

|

Accrued expenses and other current liabilities |

|

1,395 |

|

|

|

1,535 |

|

|

Total current liabilities |

|

2,830 |

|

|

|

3,340 |

|

|

Long-term liabilities: |

|

|

|

Liability related to the sale of future royalties |

|

84,267 |

|

|

|

82,017 |

|

|

Total liabilities |

|

87,097 |

|

|

|

85,357 |

|

|

Stockholders' deficit: |

|

|

|

Common stock |

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

368,796 |

|

|

|

368,357 |

|

|

Accumulated deficit |

|

(405,384 |

) |

|

|

(396,815 |

) |

|

Total stockholders' deficit |

|

(36,587 |

) |

|

|

(28,457 |

) |

|

Total liabilities and stockholders' deficit |

$ |

50,510 |

|

|

$ |

56,900 |

|

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

| |

Three Months Ended March 31,(in thousands,

except per share amounts) |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expenses: |

|

|

|

Research and development |

$ |

4,167 |

|

|

$ |

2,653 |

|

|

General and administrative |

|

2,515 |

|

|

|

2,695 |

|

|

Total operating expenses |

|

6,682 |

|

|

|

5,348 |

|

|

Loss from operations |

|

(6,682 |

) |

|

|

(5,348 |

) |

|

|

|

|

|

Foreign exchange gains (losses) |

|

5 |

|

|

|

(9 |

) |

|

Investment income |

|

358 |

|

|

|

364 |

|

|

Non-cash interest expense for the sale of future royalties |

|

(2,250 |

) |

|

|

(1,977 |

) |

|

Net loss |

$ |

(8,569 |

) |

|

$ |

(6,970 |

) |

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(1.13 |

) |

|

$ |

(1.31 |

) |

| Weighted average shares

outstanding, basic and diluted |

|

7,569 |

|

|

|

5,340 |

|

|

|

|

|

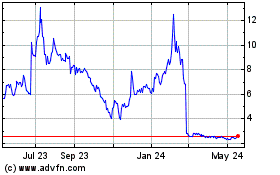

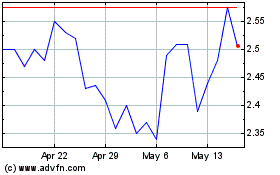

Minerva Neurosciences (NASDAQ:NERV)

Historical Stock Chart

From Jan 2025 to Feb 2025

Minerva Neurosciences (NASDAQ:NERV)

Historical Stock Chart

From Feb 2024 to Feb 2025