Form 8-K - Current report

28 September 2024 - 6:34AM

Edgar (US Regulatory)

FALSE000174972300017497232024-09-232024-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 23, 2024

New Fortress Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38790 | 83-1482060 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

111 W. 19th Street, 8th Floor New York, NY | | 10011 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (516) 268-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 per share

| “NFE”

| NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 3.02. Unregistered Sales of Equity Securities.

In August 2024, pursuant to the terms of the Certificate of Designations (the “Series A Preferred Stock Certificate of Designations”) of New Fortress Energy Inc. (the “Company”) relating to the Company’s 4.8% Series A Convertible Preferred Stock, par value $0.01 per share and liquidation preference $1,000 per share (the “Series A Convertible Preferred Stock”), the holders of the Company’s Series A Convertible Preferred Stock received the right, upon majority consent of such holders and subject to the terms of the Series A Preferred Stock Certificate of Designations, to require the Company to repurchase the Series A Convertible Preferred Stock in full. On September 23, 2024, the Company entered into a definitive agreement (the “Exchange Agreement”) with Ceiba Energy US LP (“Ceiba Energy”), pursuant to which the Company has agreed to issue to Ceiba Energy 96,746 shares of the Company’s 4.8% Series B Convertible Preferred Stock, par value $0.01 per share and liquidation preference $1,000 per share (the “Series B Convertible Preferred Stock”), in exchange for all outstanding shares of the Company’s Series A Preferred Stock, of which 86,746 are held by Ceiba Energy and 10,000 of which are held in an escrow account (the “Exchange”). The Exchange remains subject to various conditions to closing and the Company can make no assurance that the Exchange will be consummated (the “Closing”). Under the terms of the Exchange Agreement, 10,000 of the shares of Series B Convertible Preferred Stock will be issued upon Closing into an escrow account to satisfy potential indemnification claims arising under the Exchange Agreement and may be issued to Ceiba Energy during or upon expiration of certain indemnification periods or upon final resolution or determination of all indemnification claims.

Each share of Series B Convertible Preferred Stock will be convertible by its holder at any time after Closing into shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at a conversion price of $9.9645 per share of Common Stock, subject to downward adjustment to 105% of the price per share of Common Stock in a primary offering by the Company after the Closing and prior to December 31, 2024 if such price per share is less than $9.49 per share, and certain customary anti-dilution adjustments. The Company will have the right at any time to redeem the Series B Convertible Preferred Stock in full, but not in part, at a redemption price dependent on the timing and circumstances of the redemption. Additionally, upon the occurrence of certain events set forth in the Series B Certificate of Designations (as defined below), each Holder of the Series B Convertible Preferred Stock will have the right to require the Company to repurchase its shares of Series B Convertible Preferred Stock, in full but not in part, for the liquidation preference plus any accrued and unpaid dividends thereon. The settlement consideration may consist of cash, shares of Common Stock or a combination thereof depending on the circumstances of the redemption or repurchase, but in all cases, a Holder may elect to require settlement in full in shares of Common Stock with respect to its shares of Series B Convertible Preferred Stock to be redeemed or repurchased. The foregoing is only a summary of certain rights under the Series B Convertible Preferred Stock, does not purport to be complete and is qualified in its entirety by reference to the full description of the powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series B Convertible Preferred Stock that will be set forth in a Certificate of Designations, to be filed with the Delaware Secretary of State, subject to satisfaction or waiver of the conditions to the Closing (the “Series B Certificate of Designations”).

The Company intends to issue the Series B Convertible Preferred Stock in reliance upon the exemption from registration requirements under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 3(a)(9) thereof, on the basis that this is an exchange with existing holders of the Company’s securities and no commission or other compensation was or will be paid to any party for soliciting such exchange. The Company relied upon representations, warranties, certifications and agreements of Ceiba Energy in support of the satisfaction of the conditions contained in Section 3(a)(9) of the Securities Act.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | NEW FORTRESS ENERGY INC. |

| | |

| Date: September 27, 2024 | By: | /s/ Christopher S. Guinta |

| | Name: | Christopher S. Guinta |

| | Title: | Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

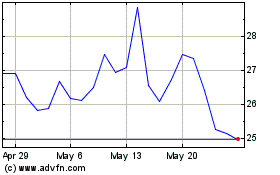

New Fortress Energy (NASDAQ:NFE)

Historical Stock Chart

From Jan 2025 to Feb 2025

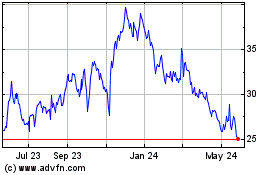

New Fortress Energy (NASDAQ:NFE)

Historical Stock Chart

From Feb 2024 to Feb 2025