FALSE000174972300017497232024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 1, 2024

New Fortress Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38790 | 83-1482060 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

111 W. 19th Street, 8th Floor New York, NY | | 10011 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (516) 268-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 per share

| “NFE”

| NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry into a Material Definitive Agreement

Transaction Support Agreement

On September 30, 2024, New Fortress Energy Inc. (the “Company,” “we,” “us” and “our”) entered into a Transaction Support Agreement (the “Transaction Support Agreement”) with certain holders of the Company’s existing 6.750% Senior Notes due 2025 (the “Existing 2025 Notes”), the Company’s existing 6.500% Senior Notes due 2026 (the “Existing 2026 Notes”) and the Company’s existing 8.75% Senior Secured Notes due 2029 (the “Existing 2029 Notes,” and together with the Existing 2025 Notes and the Existing 2026 Notes, the “Existing Notes”). The Transaction Support Agreement relates to a series of transactions (the “Transactions”), among the Company, certain of the Company’s direct and indirect subsidiaries and the Supporting Holders, intended to extend the maturity profile of the Company’s indebtedness while providing additional operating liquidity and financial flexibility. These Transactions include: (a) redeeming in full the Existing 2025 Notes with a portion of the net proceeds from the issuance and sale to the Supporting Holders (the “New Notes Transaction”) of $1.2 billion aggregate principal amount of 12.000% senior secured notes due 2029 (the “New Notes”) to be issued by a newly-formed, wholly-owned indirect subsidiary of the Company (the “Subsidiary Issuer”) and (b) the exchange (the “Private Exchange Transaction”) by the Supporting Holders, and subsequent cancellation by the Company, of approximately $1.4 billion aggregate principal amount of Existing 2026 Notes and Existing 2029 Notes on a dollar-for-dollar basis for additional New Notes.

The Company intends to use any remaining net cash proceeds from the consummation of the Transactions for general corporate purposes. The Transactions will be consummated on the terms set forth in definitive documentation in form and substance satisfactory to the Company and the Supporting Holders holding a majority in principal amount of each series of the Existing Notes (the “Majority Supporting Holders”).

Subject to the terms and conditions set forth in the Transaction Support Agreement, the Supporting Holders have agreed to (a) exchange all of their Existing 2026 Notes and Existing 2029 Notes in the Private Exchange Transaction for New Notes and (b) purchase for cash the New Notes in the New Notes Transaction (the “New Money Commitment”). The Supporting Holders’ obligations under the Transaction Support Agreement are conditioned upon (a) the sale by the Company of common equity yielding gross cash proceeds to the Company of not less than $250.0 million (the “Equity Raise”), (b) the effectiveness of certain amendments to the Company’s existing credit agreements and (c) other customary conditions, including the negotiation and execution of definitive documents.

Upon the successful completion of the transactions described in the Transaction Support Agreement, the holders of the New Notes will benefit from a first-priority perfected security interest in and lien on all assets and property of the Subsidiary Issuer, which will include up to a 49% equity interest in the holding company that indirectly owns the Company’s business in Brazil and, subject to compliance with the agreements governing the Company’s outstanding indebtedness, certain other assets that do not currently constitute collateral under the Revolving Credit Facility, the Letter of Credit Facility, the Term Loan B Facility or the Term Loan A Facility. The New Notes will also be guaranteed by any wholly-owned subsidiaries of the Subsidiary Issuer. Through certain intercompany transactions to be completed in connection with the issuance of the New Notes, the New Notes will benefit from direct or indirect first priority secured claims against the remainder of the equity interest in the holding company that indirectly owns the Company’s business in Brazil, certain other assets that do not currently constitute collateral under the Revolving Credit Facility, the Letter of Credit Facility, the Term Loan B Facility or the Term Loan A Facility, as well as direct or indirect first priority secured claims against the collateral securing the Existing 2025 Notes, Existing 2026 Notes and Existing 2029 Notes. However, the New Notes will be effectively junior in right of payment to the Revolving Credit Facility, the Letter of Credit Facility and the Term Loan B Facility to the extent of the value of the assets constituting the Company’s first fast liquified natural gas (“Fast LNG”) unit off the coast of Altamira, Mexico, and effectively junior in right of payment to the Revolving Credit Facility, the Letter of Credit Facility, the Term Loan B Facility and the Term Loan A Facility to the extent of the value of the assets constituting the Company’s second FLNG unit, the Company’s subsidiary owners of which guarantee those credit facilities, and which does not constitute collateral for the Existing Notes and will not constitute collateral for the New Notes.

Upon consummation of the Transactions, the Transaction Support Agreement provides that Supporting Holders may elect to receive, in addition to the New Notes, a commitment fee equal to either (i) 5.00% of the aggregate principal amount of such Supporting Holder’s New Notes, payable in Class A common stock of the Company at the share price to be paid by investors in the Equity Raise (the “Equity Commitment Fee”), (ii) 2.00% of the aggregate principal amount of such Supporting Holder’s New Notes, payable in kind in the form of additional New Notes (the “PIK Commitment Fee”), or (iii) a combination of the foregoing. In the event any Supporting Holder elects to receive the PIK Commitment Fee, the Equity Commitment Fee that would have been payable to such Supporting Holder shall be ratably reallocated among each Supporting Holder that elects the Equity Commitment Fee.

Additionally, the Supporting Holders’ have agreed, in connection with the Transactions, to consent to certain amendments to the indentures pursuant to which the Existing 2026 Notes and the Existing 2029 Notes were issued, which amendments will become effective upon consummation of the Transactions. These consents would permit the Company to execute a supplemental indenture or take other action, together with the trustee under each such indenture, to subordinate the liens on certain of the collateral securing the obligations under each indenture and related notes to the liens on the same collateral securing the obligations under the Company’s existing credit facilities, and to remove all covenants and events of default that may be removed in compliance with terms of such indentures.

The Transaction Support Agreement includes representations, warranties, covenants (including restrictions on certain corporate actions during the term of the Transaction Support Agreement) and closing conditions customary for agreements of this type. Pursuant to the terms of the Transaction Support Agreement, the Company has agreed, through November 30, 2024, to work solely with the Supporting Holders to consummate the Transactions, and not to solicit, discuss, agree to or otherwise pursue alternative transactions to refinance its indebtedness. The Transaction Support Agreement also grants the Majority Supporting Holders (or holders of more than 50% of the principal amount of the New Notes after the closing date of the Transactions) the right to appoint a director to the Company’s board of directors (the “Board”), provided that such representative shall be reasonably acceptable to the chairman of the Board. The Transaction Support Agreement will, among other circumstances, terminate upon the earliest of: (a) mutual written consent of the Company and the Majority Supporting Holders, (b) on the settlement date of the Transactions, or (c) on November 30, 2024, if the Transactions have not yet been consummated.

The foregoing is a summary of the material terms of, and is qualified by, the Transaction Support Agreement.

Item 3.02. Unregistered Sales of Equity Securities.

The information included in Item 1.01 is incorporated by reference into this Item 3.02.

Item 8.01. Other Events.

Series B Convertible Preferred Stock

On or about October 1, 2024, the Company expects to issue shares of its 4.8% Series B Convertible Preferred Stock (the “Series B Convertible Preferred Stock”) as previously disclosed on its Current Report on Form 8-K filed on September 27, 2024.

Compliance with Financial Covenants

As previously disclosed, on August 31, 2024, the Company entered into the fourth amendment to its uncommitted letter of credit and reimbursement agreement (the “Fourth Amendment”), the first amendment to its term loan A credit agreement (the “First Amendment”), and the eighth amendment (the “Eighth Amendment”; and collectively with the Fourth Amendment and the First Amendment, the “Amendments”) to its revolving credit agreement (the “Revolving Credit Agreement”). On September 30, 2024, the Company amended and restated each of the Amendments (each such amendment and restatement, an “Amended and Restated Amendment”; the revolving credit facility, the term loan A facility, and the letter of credit facility, as amended by the respective Amended and Restated Amendments, the “Revolving Credit Facility,” the “Term Loan A Facility” and the “Letter of Credit Facility” and collectively, the “Amended Agreements”).

The Company expects that it will be in compliance with the financial covenants that were not suspended as part of the Amended Agreements through the end of the fiscal year ending December 31, 2025. The Company’s expectations regarding its covenant compliance is based, in part, on its ability to complete anticipated sales of certain assets, the receipt of certain payments related to cost savings recognized by PREPA, revenues from the commencement of operations in Brazil and Nicaragua and revenues from certain contracts expected to be received in future periods, as well as the achievement of certain expected cost savings and a reduction in SG&A. The Company’s ability to remain in compliance is subject to a number of risks, some of which are outside the Company’s control, and there can be no assurances that the Company will be able to comply with its financial covenants in future periods. See “Cautionary Statement Regarding Forward-Looking Statements.”

Controlled Company Status

Because affiliates of certain entities controlled by Wesley Edens, Randal Nardone and affiliates of Fortress Investment Group LLC, together with affiliates of Energy Transition Holdings LLC, collectively hold more than 50% of the voting power of the Company’s Class A common stock, the Company is currently a “controlled company” under the

Nasdaq corporate governance standards. While the Company is currently a controlled company, as a result of the issuance of shares of the Company’s Class A common stock pursuant to various transactions under consideration by the Company, the Company may cease to qualify as a controlled company. As such, the Company has determined to proactively transition to a governance structure compliant with the Nasdaq Capital Market listing rules for a listed company that is no longer a “controlled company”.

As part of this transition, on September 30, 2024, Messrs. Edens and Nardone resigned from the Compensation Committee of the Company’s Board of Directors, effective as of such date. Such resignations are not a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. In addition, the Board made related changes to the Compensation Committee, the members of which are now David G. Grain, Timothy W. Jay and C. William Griffin. Furthermore, the Board adopted amended corporate governance guidelines and amended the compensation committee charter to comply with the Nasdaq corporate governance standards.

Risk Factors

Risks Related to Our Business

Failure to obtain and maintain permits, approvals and authorizations from governmental and regulatory agencies and third parties on favorable terms could impede operations and construction.

The design, construction and operation of our infrastructure, facilities and businesses, including our FSRUs, FLNG units and LNG carriers, the import and export of LNG, exploration and development activities, and the transportation of natural gas, among others, are highly regulated activities at the national, state and local levels and are subject to various approvals and permits. The process to obtain the permits, approvals and authorizations we need to conduct our business, and the interpretations of those rules, is complex, time-consuming, challenging and varies in each jurisdiction in which we operate. We may be unable to obtain such approvals on terms that are satisfactory for our operations and on a timeline that meets our commercial obligations. Many of these permits, approvals and authorizations require public notice and comment before they can be issued, which can lead to delays to respond to such comments, and even potentially to revise the permit application. Jurisdiction-specific employment, labor, and subcontracting laws may also affect contracting strategies and impact construction and operations. We may also be (and have been in select circumstances) subject to local opposition, including citizens groups or non-governmental organizations such as environmental groups, which may create delays and challenges in our permitting process and may attract negative publicity, which may create an adverse impact on our reputation. In addition, such rules change frequently and are often subject to discretionary interpretations, including administrative and judicial challenges by regulators, all of which may make compliance more difficult and may increase the length of time it takes to receive regulatory approval for our operations, particularly in countries where we operate, such as Mexico and Brazil. For example, in Mexico, we have obtained substantially all permits but are awaiting final approvals for our power plant and permits necessary to operate our terminal. In connection with our application to the U.S. Maritime Administration (“MARAD”) related to our FLNG project off the coast of Louisiana (as discussed further below), MARAD announced it had initially paused the statutory 356-day application review timeline on August 16, 2022 pending receipt of additional information, and restarted the timeline on October 28, 2022. MARAD issued a second stop notice on November 23, 2022 and on December 22, 2022, MARAD issued a third data request for supplemental information. Following review of NFE’s response to the December 2022 data requests, MARAD extended the stop-clock on February 21, 2023 pending clarification of responses and receipt of additional information. In addition, jurisdiction-specific employment, labor, and subcontracting laws may also affect contracting strategies and impact construction and operations. No assurance can be given that we will be able to obtain approval of all applications or receive the required permits, approvals and authorizations from governmental agencies related to our projects with favorable terms on a timely basis or at all. We intend to apply for updated permits for the Pennsylvania Facility with the aim of obtaining these permits to coincide with the commencement of construction activities. We cannot make any assurance as to if or when we will receive these permits, which are needed prior to commencing certain construction activities related to the facility. Any administrative and judicial challenges to our permits can delay and protract the process for obtaining and implementing permits and can also add significant costs and uncertainty. We cannot control the outcome of any review or approval process, including whether or when any such permits and authorizations will be obtained, the terms of their issuance, or possible appeals or other potential interventions by third parties that could interfere with our ability to obtain and maintain such permits and authorizations or the terms thereof. Furthermore, we are developing new technologies and operate in jurisdictions that may lack mature legal and regulatory systems and may experience legal instability, which may be subject to regulatory and legal challenges, instability or clarity of application of laws, rules and regulations to our business and new technology, which can result in difficulties and instability in obtaining or securing required permits or authorizations.

In addition, our LNG transportation activities are subject to a broad array of regulations, and our operations are dependent upon obtaining and maintaining required permits and authorizations. For example, the United States Coast Guard (“Coast Guard”) regulates the navigable waterways through which vessels we own, lease or direct must traverse to

supply LNG in Puerto Rico. Our business in Puerto Rico must comply with all applicable Coast Guard regulations. We recently received a letter from the Coast Guard alleging that some aspects of our vessel operations may not comply with all applicable requirements. If we are incorrect in our interpretation of applicable requirements, of if there is a change in the interpretation or application of those requirements, the Coast Guard could determine that we have not complied with applicable requirements, which could lead to fines or restrictions on our operations.

There is no assurance that we will obtain and maintain these permits and authorizations on favorable terms, or that we will be able to obtain them on a timely basis, and we may not be able to complete our projects, start or continue our operations, recover our investment in our projects and may be subject to financial penalties or termination under our customer and other agreements, which could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Risks Related to Ownership of Our Class A Common Stock

In connection with the transactions described in this Report and our Form 8-K filed with the SEC on September 27, 2024, including any potential issuances of additional equity securities in an Equity Raise and as satisfaction of the Equity Commitment Fees, we will have issued a significant number of additional shares of Class A common stock which will be generally freely tradeable. As a result, the following risks could be exacerbated:

The market price and trading volume of our Class A common stock may be volatile, which could result in rapid and substantial losses for our stockholders.

The market price of our Class A common stock may be highly volatile and could be subject to wide fluctuations. In addition, the trading volume in our Class A common stock may fluctuate and cause significant price variations to occur. If the market price of our Class A common stock declines significantly, you may be unable to resell your shares at or above your purchase price, if at all. The market price of our Class A common stock may fluctuate or decline significantly in the future. Some of the factors that could negatively affect our share price or result in fluctuations in the price or trading volume of our Class A common stock include:

◦a shift in our investor base;

◦our quarterly or annual earnings, or those of other comparable companies;

◦actual or anticipated fluctuations in our operating results;

◦changes in accounting standards, policies, guidance, interpretations or principles;

◦announcements by us or our competitors of significant investments, acquisitions or dispositions;

◦the failure of securities analysts to cover our Class A common stock;

◦changes in earnings estimates by securities analysts or our ability to meet those estimates;

◦the operating and share price performance of other comparable companies;

◦overall market fluctuations;

◦general economic conditions; and

◦developments in the markets and market sectors in which we participate.

Stock markets in the United States have experienced extreme price and volume fluctuations. Market fluctuations, as well as general political and economic conditions such as acts of terrorism, prolonged economic uncertainty, a recession or interest rate or currency rate fluctuations, could adversely affect the market price of our Class A common stock.

In the past, securities class action litigation has often been brought against companies following periods of volatility in the market price of their securities. We are currently subject to a putative securities class action complaint relating to a drop in our share price as further described in Item 8.01 of this Report and could become involved in additional litigation of this type in the future if our share price is volatile for any reason. This type of litigation could result in reputational damage, substantial costs and a diversion of management’s attention and resources needed to successfully run our business.

Future sales and issuances of our Class A common stock, securities convertible or exchangeable into our Class A common stock or rights to purchase our Class A common stock could result in additional dilution of the percentage ownership of our shareholders and may cause our share price to fall.

To raise capital, we may sell substantial amounts of Class A common stock or securities convertible into or exchangeable for Class A common stock. These future issuances of Class A common stock or Class A common stock-related securities to purchase Class A common stock, together with the exercise of outstanding restricted stock units and any additional shares issued in connection with other transactions, if any, may result in material dilution to our investors. Such sales may also result in material dilution to our existing shareholders, and new investors could gain rights, preferences and privileges senior to those of holders of our Class A common stock. In particular, in connection with currently contemplated transactions, we expect to (i) issues shares in connection with an Equity Raise, (ii) issue shares as

Equity Commitment Fees in connection with the transactions contemplated by the Transaction Support Agreement and (iii) issue shares in connection with the exchangeable notes in the Potential Brazil Financing. Additionally, we have outstanding 96,746 shares of our 4.8% Series A Convertible Preferred Stock, par value $0.01 per share and liquidation preference $1,000 per share (the “Series A Preferred Stock”), which is convertible by holders thereof into shares of Class A common stock at a price of $47.43 per share. As described under “Series B Convertible Preferred Stock” of this Item 8.01, we expect to issue 96,746 shares of our 4.8% Series B Convertible Preferred Stock, par value $0.01 per share and liquidation preference $1,000 per share, on or about October 1, 2024. The Series B Convertible Preferred Stock will be convertible into shares of Class A common stock at a price of $9.9645 per share.

We do not intend to pay dividends on our Class A common stock for the foreseeable future.

We currently intend to retain our future earnings, if any, to finance our operations and growth of our business and, subject to the discussion of the Dividend in the Report, currently do not plan to pay any cash dividends in the foreseeable future. As a result, only appreciation of the price of our Class A common stock will provide a return to stockholders for the foreseeable future. Our debt financing arrangements may contain terms prohibiting or limiting the amount of dividends that may be declared or paid on our Class A common stock. There can be no assurance that we will pay a dividend in the future or continue to pay any dividend if we do commence paying dividends. The declaration and payment of dividends to holders of our Class A common stock will be at the discretion of our board of directors in accordance with applicable law after taking into account various factors, including actual results of operations, liquidity and financial condition, net cash provided by operating activities, restrictions imposed by applicable law, restrictions imposed by our debt agreements, our taxable income, our operating expenses and other factors our board of directors deem relevant. To the extent we pay dividends in the future, because we are a holding company and have no direct operations, we will only be able to pay dividends from our available cash on hand and any funds we receive from our subsidiaries and our ability to receive distributions from our subsidiaries may be limited by the financing agreements to which they are subject.

The incurrence or issuance of debt which ranks senior to our Class A common stock upon our liquidation, including the New Notes to be issued in connection with the transactions contemplated by the Transaction Support Agreement, and future issuances of equity or equity-related securities, which would dilute the holdings of our existing Class A common stockholders and may be senior to our Class A common stock for the purposes of making distributions, periodically or upon liquidation, may negatively affect the market price of our Class A common stock.

We have incurred and may in the future incur or issue debt, including the New Notes to be issued in connection with the transactions contemplated by the Transaction Support Agreement, or issue equity or equity-related securities to finance our operations, acquisitions or investments. Upon our liquidation, lenders and holders of our debt and holders of our preferred stock, such as the Series B Convertible Preferred Stock that we expect to issue in exchange for the Series A Convertible Preferred Stock issued upon closing of the acquisition of PortoCem Geração de Energia S.A., would receive a distribution of our available assets before Class A common stockholders. Any future incurrence or issuance of debt would increase our interest cost and could adversely affect our results of operations and cash flows. We are not required to offer any additional equity securities to existing Class A common stockholders on a preemptive basis. Therefore, additional issuances of Class A common stock, whether directly, through convertible securities, such as the Series B Convertible Preferred Stock, or exchangeable securities (including limited partnership interests in our operating partnership), warrants or options, will dilute the holdings of our existing Class A common stockholders and such issuances, or the perception of such issuances, may reduce the market price of our Class A common stock. Any preferred stock issued by us would likely, and the Series B Convertible Preferred Stock will have a preference on distribution payments, periodically or upon liquidation, which could eliminate or otherwise limit our ability to make distributions to Class A common stockholders. Because our decision to incur or issue additional debt or equity or equity-related securities (other than the Series B Convertible Preferred Stock) in the future will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing, nature or success of our future capital raising efforts. Thus, Class A common stockholders bear the risk that our future incurrence or issuance of debt or issuance of equity or equity-related securities will adversely affect the market price of our Class A common stock.

Risks Related to our Indebtedness

Our substantial indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations.

We have, and after giving effect to the Transactions, will continue to have, a substantial amount of indebtedness, which will require significant interest and principal payments. As of June 30, 2024, we had approximately $7.8 billion aggregate principal amount of indebtedness outstanding on a consolidated basis (which does not include any unconsolidated debt). In addition, as part of the transactions described in the Transaction Support Agreement, we will issue New Notes to refinance our Existing 2025 Notes and substantial portions of our Existing 2026 Notes and Existing 2029 Notes, while also incurring an additional approximately $300.0 million of indebtedness.

Our and our subsidiaries’ substantial amount of indebtedness could have important consequences to holders of the Notes, including:

◦requiring us and certain of our subsidiaries to dedicate a substantial portion of our cash flow from operations to the payment of principal of and interest on our indebtedness, thereby reducing the funds available for operations and any future business opportunities;

◦limiting flexibility in planning for, or reacting to, changes in our business or the industry in which we operate;

◦placing us at a competitive disadvantage compared to our competitors that have less indebtedness;

◦increasing our vulnerability to adverse general economic or industry conditions; and

◦limiting our ability to obtain additional financing to fund working capital, capital expenditures, acquisitions or other general corporate requirements and increasing our cost of borrowing, and our ability to refinance our indebtedness outstanding from time to time.

Risks Related to the Transactions

The Transactions may not be consummated as scheduled or at all, and even if such transactions are consummated, we may not achieve their anticipated benefits.

We expect that the completion of the Transactions, if consummated, will enhance our liquidity and extend certain of the near-term maturities of our indebtedness. The Transaction Support Agreement is subject to the satisfaction of certain conditions, including (a) completion of the Equity Raise, (b) the effectiveness of certain amendments to the Company’s existing credit agreements and (c) other customary conditions, including the negotiation and execution of definitive documents. The Transaction Support Agreement may also be terminated under certain circumstances, including the earliest to occur of: (a) mutual written consent of the Company and the Majority Supporting Holders, (b) the settlement date of the Transactions or (c) November 30, 2024, if the Transactions have not yet been consummated. For more information, please see “Transaction Support Agreement” under Item 1.01. Entry into a Material Definitive Agreement.

As a result, any or all of the Transactions may not be consummated as originally scheduled or at all. Accordingly, we may not be able to realize the expected benefits from these transactions on a timely basis or at all. Even if we are successful in completing the Transactions, we may not realize some or all of the expected benefits from such transactions. We have incurred, and will continue to incur, significant costs, expenses and fees for professional services and other transaction costs in connection with the Transactions, and these fees and costs are payable by us regardless of whether such transactions are consummated. Pursuing the Transactions has and may continue to divert the attention of our management and disrupt our business, which could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Any of these factors could negatively affect our share price or result in fluctuations in the price or trading volume of our Class A common stock.

Cautionary Note Regarding the Transactions

The closing of the Transactions is conditioned on the satisfaction or waiver of certain conditions precedent, some of which may be outside of the Company’s control. The Transactions may not be completed as contemplated or at all. If the Company is unable to complete the Transactions or any other alternative transactions, on favorable terms or at all, due to market conditions or otherwise, its financial condition may be materially adversely affected. If the Company is unable to fund the Company’s operations and liquidity needs, such as future capital expenditures and payment of the Company’s indebtedness, the Company may be required to refinance all or part of the Company’s then-existing indebtedness, sell assets, reduce or delay capital expenditures, seek to raise additional capital, pursue one or more internal reorganizations and/or other restructuring activities, strategic corporate alignment and cost-saving initiatives or other significant corporate transactions, any of which could have a material adverse effect on the Company’s operations and financial condition. For a description of the other risks and uncertainties that could impact the Company’s business, see “Risk Factors” in the Company’s latest Form 10-K and Form 10-Q, as well as above under the heading “Risks Factors,” as may be updated by future filings.

Cautionary Statement Regarding Forward-Looking Statements

This report contains certain statements and information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this communication other than historical information are forward-looking statements that involve known and unknown risks and relate to future events, the Company’s future financial performance or the Company’s projected business results. You can identify these

forward-looking statements by the use of forward-looking words such as “expects,” “may,” “will,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of those words or other comparable words. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition or the stock prices of the Company. These forward-looking statements represent the Company’s expectations or beliefs concerning future events, and it is possible that the results described herein will not be achieved. These forward-looking statements are necessarily estimates based upon current information and are subject to risks, uncertainties and other factors, many of which are outside of the Company’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the Company’s annual report, quarterly and other reports filed with the SEC, which could cause its actual results to differ materially from those contained in any forward-looking statement. The Company undertakes no duty to update these forward-looking statements, even though its situation may change in the future.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | NEW FORTRESS ENERGY INC. |

| | |

| Date: October 1, 2024 | By: | /s/ Christopher S. Guinta |

| | Name: | Christopher S. Guinta |

| | Title: | Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

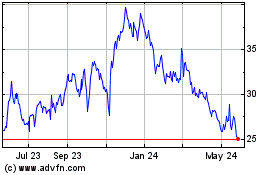

New Fortress Energy (NASDAQ:NFE)

Historical Stock Chart

From Oct 2024 to Nov 2024

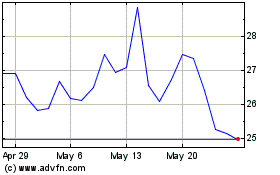

New Fortress Energy (NASDAQ:NFE)

Historical Stock Chart

From Nov 2023 to Nov 2024