Novan, Inc. (“the Company” or “Novan”) (Nasdaq: NOVN), today

announced its financial and operating results for the third quarter

ended September 30, 2022 and provided a corporate update. The

Company will host a conference call and webcast, today, November

14, 2022, at 8:30 a.m. ET (details below).

Paula Brown Stafford, President and Chief

Executive Officer of Novan commented, “In the third quarter, we

were able to achieve a number of our internal goals, as we retired

the remaining debt on the note related to our acquisition of EPI

Health; we progressed as planned toward a year-end submission of

the NDA for berdazimer gel, 10.3%; and we delivered year-on-year

growth across our promoted products. We believe we are primed for

an exciting fourth quarter as we continue to prepare for our first

NDA submission, finalize our license agreement with Sato to

potentially market Rhofade in Japan and work to continue our

commercial product prescription growth trajectory.”

Corporate Update

- As

previously disclosed, on July 13, 2022, Novan reached agreement

with Evening Post Group, LLC regarding payment and termination of

the then outstanding $16.5 million note related to the EPI Health

acquisition. The Company achieved this termination by a payment of

$10.0 million, or an approximate 39% discount on the original

principal amount of the note. Removing this previously existing

liability allows the Company to use its cash for development of its

product candidates, rather than debt servicing, and to support the

commercialization of its products.

- On

November 11, 2022, Novan entered into a nonbinding memorandum of

understanding with Sato Pharmaceutical Co., Ltd (“Sato”) for a

proposed exclusive license to Novan's patents covering Rhofade,

which would grant Sato the right to develop, manufacture and market

Rhofade for rosacea in Japan. In addition, Sato would have a right

of first negotiation related to Rhofade in certain other countries

in the Asia Pacific region.

Financial Results for Third Quarter 2022

- As of September

30, 2022, Novan had a total cash and cash equivalents balance of

$14.9 million.

- Novan reported

total revenue of $5.1 million and $0.7 million for the three months

ended September 30, 2022 and 2021, respectively.

- Net product

revenues for the three months ended September 30, 2022 were $4.6

million, which represented the sales of medical dermatology

products, including Rhofade, Wynzora, and Minolira.

- License and

collaboration revenues were $0.5 million and $0.7 million for the

three months ended September 30, 2022 and 2021, respectively.

- Product cost of

goods sold was $1.4 million for the three months ended September

30, 2022, and includes all costs directly incurred to produce net

product revenues from the Company's marketed portfolio of medical

dermatology products.

- Research and

Development expenses were $4.3 million for the three months ended

September 30, 2022, compared to $4.3 million for the three months

ended September 30, 2021.

- Selling, general

and administrative expenses were $8.6 million for the three months

ended September 30, 2022, compared to $3.0 million for the three

months ended September 30, 2021. The increase of $5.6 million was

primarily due to (i) $4.4 million of expenses incurred to support

the conduct of EPI Health’s commercial sales operations during the

three months ended September 30, 2022, which were not incurred

during the comparative period in 2021, (ii) a $0.4 million increase

in support costs related to the SB206 prelaunch strategy and

commercial preparation, and (iii) an approximate $0.8 million

increase in facility and deprecation costs, personnel and benefit

costs, and corporate tax, consulting and personnel costs.

- Total other

income, net was $3.8 million for the three months ended September

30, 2022, which was primarily comprised of $4.3 million of gain on

debt extinguishment related to the promissory note issued in March

2022 in connection with the EPI Health acquisition.

- Novan reported total net loss of

$6.0 million and $6.5 million for the three months ended September

30, 2022 and 2021, respectively.

Medical Dermatology Commercial Product Portfolio

Update

Total prescription activity for third quarter

2022:

-

RHOFADE® (oxymetazoline

hydrochloride)

- 37% growth in third quarter

year-to-date compared to same period in 2021;

- 31% growth in third quarter

compared to third quarter 2021; and

- 7% decrease in third quarter

compared to second quarter 2022.

-

WYNZORA® (calcipotriene and

betamethasone dipropionate)

- 216% growth in third quarter

compared to third quarter 2021, based in part to timing of product

launch in the United States; and 14% decrease in third quarter

compared to second quarter 2022.

-

MINOLIRA™ (minocycline hydrochloride)

- 59% growth in third quarter

year-to-date compared to same period in 2021;

- 78% growth in third quarter

compared to third quarter 2021; and

- 23% growth in third quarter

compared to second quarter 2022.

“We are pleased with our continued

year-over-year prescription growth of our promoted products in the

third quarter. We experienced a slight downturn in two of our

promoted products this quarter in volume compared to the second

quarter, in part due to expected seasonality and related market

conditions. As we have seen in prior years, the summer months

typically show a decrease in number of patient visits to

dermatologists in our competitive disease states,” commented John

Donofrio, Executive Vice President, Chief Operating Officer of

Novan and President, EPI Health. “Our focus in the fourth quarter

is continued execution of our plan: growing awareness with

prescribers and key opinion leaders and enhancing our product

messaging in order to continue to drive year-over-year growth in

our marketed portfolio.”

Medical Dermatology Research & Development

Update

The Company is currently targeting an NDA

submission for berdazimer gel, 10.3% (SB206) as a treatment for

molluscum around the end of 2022. The timing of the targeted NDA

submission is dependent upon preparatory activities and data

accumulation related to the NDA submission, including conducting

customary drug substance and drug product stability protocols,

regulatory and quality documentation compilation related to Novan's

chemistry, manufacturing, and controls data and its drug

manufacturing and related processes.

There are currently no Food and Drug

Administration (“FDA”)-approved prescription drug treatment options

for molluscum. The Company believes that berdazimer gel, 10.3%

(SB206) as a topical prescription therapy with a rapid treatment

benefit, if approved, would satisfy an important patient-care need

for the treatment of molluscum. Detailed results of the pivotal

Phase 3 study, B-SIMPLE4, were published in JAMA Dermatology in

July.

Novan also continues to progress the prelaunch

strategy and commercial preparations for berdazimer gel, 10.3%

(SB206), if approved. The Company believes the addition of the EPI

Health commercial infrastructure across the sales, marketing, and

communications functions, in addition to the fully dedicated market

access and pharmacy relations teams, will benefit the commercial

launch of berdazimer gel, 10.3% (SB206), if approved.

Conference Call and Webcast

Novan management will host a conference call and

webcast presentation for investors, analysts, and other interested

parties today, Monday, November 14, 2022, at 8:30 AM ET.

Interested participants and investors may access

the conference call by dialing (833) 630-1956 (domestic) or (412)

317-1837 (international) and referencing the Novan, Inc. Conference

Call. The live webcast will be accessible on the Events page of the

Investors section of the Novan website, novan.com, and will be

archived for 90 days.

About Novan

Novan, Inc. is a medical dermatology company

primarily focused on researching, developing, and commercializing

innovative therapeutic products for skin diseases. Our goal is to

deliver safe and efficacious therapies to patients, including

developing product candidates where there are unmet medical needs.

We are developing SB206 (berdazimer gel, 10.3%) as a topical

prescription gel for the treatment of viral skin infections, with

current emphasis on molluscum contagiosum.

Novan completed the acquisition of EPI Health in

early 2022. EPI Health equips the company with a robust commercial

infrastructure across sales, marketing, and communications, as well

as fully dedicated market access and pharmacy relation teams.

Following the acquisition, the company employs approximately 100

staff, including sales personnel currently covering 42 territories,

and promotes products for plaque psoriasis, rosacea, acne and

dermatoses. Novan also has a pipeline of potential product

candidates using our proprietary nitric oxide-based technology

platform, NITRICIL™, to generate new treatments for multiple

indications.

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “believe,” “expect,” “target,”

“anticipate,” “may,” “plan,” “potential,” “will,” “look forward to”

and similar expressions, and are based on the Company’s current

beliefs and expectations. These forward-looking statements include,

but are not limited to, statements related to the potential

benefits of the acquisition of EPI Health, the potential terms of

and the potential timing for entering into an exclusive license

agreement with Sato, the therapeutic value and benefits of the

Company’s promoted products, the potential therapeutic value and

benefits of the Company’s Nitricil™ platform technology and its

product candidates, the potential market opportunity for the

Company’s product candidates and promoted products, the Company’s

pharmaceutical development of nitric oxide-releasing product

candidates, such as berdazimer gel, 10.3% (SB206) for molluscum

contagiosum, the timing of regulatory filings, and the availability

of potential financing options. Forward-looking statements are

subject to a number of risks and uncertainties that could cause

actual results to differ materially from the Company’s

expectations, including, but not limited to, risks related to the

acquisition of EPI Health; risks and uncertainties associated with

market conditions and the ability to complete the negotiation of an

exclusive license agreement with respect to Rhofade on terms that

are favorable to the Company or at all and that, even if an

agreement is finalized, the Company will continue to need

significant additional funding to continue its development and

operating activities; risks related to the regulatory approval

process, which is lengthy, time-consuming and inherently

unpredictable, including the risk that the FDA will not agree with

the Company’s approach to a potential NDA submission, that the

Company’s product candidates may not be approved or that additional

studies may be required for approval or other delays may occur,

that the Company may not have sufficient quantities of drug

substance and/or drug product to support regulatory submissions and

that the Company may not obtain funding sufficient to extend its

cash runway or to complete the regulatory or development process;

the Company’s limited experience as a company in obtaining

regulatory approvals for and launching products developed

internally and its ability to recruit and retain qualified

personnel and key talent; changes in the size and nature of the

market for the Company’s product candidates and promoted products,

including potential competition, patient and payer perceptions and

reimbursement determinations; the Company’s ability to grow

revenues from promoted products and the risks that past performance

may not be indicative of future performance; risks and

uncertainties in the Company’s ongoing or future product

development activities and preclinical studies, which may not prove

successful in demonstrating proof-of concept, or may show adverse

toxicological findings, and even if successful may not necessarily

predict that subsequent clinical trials will show the requisite

safety and efficacy of the Company’s product candidates, or that

any of the Company’s product candidates, if approved, will continue

to demonstrate requisite safety and efficacy following their

commercial launch; any operational or other disruptions as a result

of the COVID-19 pandemic and related or unrelated constraints on

the global workforce; risks related to the manufacture of raw

materials and finished drug product, such as supply chain

disruptions or delays, potential price increases, failure to

transfer technology and processes to third parties effectively or

failure of those third parties (or the Company in connection with

the Company’s facility) to obtain approval of and maintain

compliance with the FDA or comparable regulatory authorities; the

Company’s reliance on arrangements with third parties to support

its operations and its development, manufacturing and

commercialization efforts and the risk that such parties will not

successfully carry out their contractual duties or meet expected

deadlines; the Company’s ability to obtain additional funding or

enter into strategic or other business relationships necessary or

useful for the further development or commercialization of the

Company’s product candidates and the operation of its business on

terms that are acceptable to the Company or at all or if such

relationships or transactions are unsuccessful or the Company is

unable to realize the potential economic benefits of such

relationships or transactions; and other risks and uncertainties

described in the Company’s annual report filed with the Securities

and Exchange Commission on Form 10-K for the twelve months ended

December 31, 2021, and in the Company’s subsequent filings with the

Securities and Exchange Commission. Such forward-looking statements

speak only as of the date of this press release, and the Company

disclaims any intent or obligation to update these forward-looking

statements to reflect events or circumstances after the date of

such statements, except as may be required by law.

INVESTOR AND MEDIA

CONTACT:Jenene Thomas JTC Team,

LLC833-475-8247NOVN@jtcir.com

NOVAN, INC.Condensed

Consolidated Statements of Operations and Comprehensive

Loss(unaudited)(in thousands,

except share and per share amounts)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net product revenues |

$ |

4,605 |

|

|

$ |

— |

|

|

$ |

11,131 |

|

|

$ |

— |

|

| License and collaboration

revenues |

|

492 |

|

|

|

680 |

|

|

|

2,010 |

|

|

|

2,174 |

|

| Government research contracts and

grants revenue |

|

18 |

|

|

|

57 |

|

|

|

60 |

|

|

|

129 |

|

|

Total revenue |

|

5,115 |

|

|

|

737 |

|

|

|

13,201 |

|

|

|

2,303 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Product cost of goods sold |

|

1,440 |

|

|

|

— |

|

|

|

4,259 |

|

|

|

— |

|

|

Research and development |

|

4,288 |

|

|

|

4,251 |

|

|

|

12,265 |

|

|

|

15,926 |

|

|

Selling, general and administrative |

|

8,562 |

|

|

|

2,969 |

|

|

|

27,151 |

|

|

|

8,086 |

|

|

Amortization of intangible assets |

|

443 |

|

|

|

— |

|

|

|

1,112 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

186 |

|

|

|

— |

|

|

|

(268 |

) |

|

|

— |

|

|

Impairment loss on long-lived assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

114 |

|

|

Total operating expenses |

|

14,919 |

|

|

|

7,220 |

|

|

|

44,519 |

|

|

|

24,126 |

|

| Operating loss |

|

(9,804 |

) |

|

|

(6,483 |

) |

|

|

(31,318 |

) |

|

|

(21,823 |

) |

| Other income (expense), net: |

|

|

|

|

|

|

|

|

Interest income |

|

38 |

|

|

|

4 |

|

|

|

56 |

|

|

|

10 |

|

|

Interest expense |

|

(635 |

) |

|

|

— |

|

|

|

(1,375 |

) |

|

|

— |

|

|

Gain on debt extinguishment |

|

4,340 |

|

|

|

— |

|

|

|

4,340 |

|

|

|

956 |

|

|

Other income (expense) |

|

31 |

|

|

|

(5 |

) |

|

|

9 |

|

|

|

(602 |

) |

| Total other income (expense),

net |

|

3,774 |

|

|

|

(1 |

) |

|

|

3,030 |

|

|

|

364 |

|

| Net loss and comprehensive

loss |

$ |

(6,030 |

) |

|

$ |

(6,484 |

) |

|

$ |

(28,288 |

) |

|

$ |

(21,459 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.25 |

) |

|

$ |

(0.34 |

) |

|

$ |

(1.33 |

) |

|

$ |

(1.30 |

) |

|

Weighted-average common shares outstanding, basic and diluted |

|

24,462,228 |

|

|

|

18,813,653 |

|

|

|

21,189,799 |

|

|

|

16,476,235 |

|

NOVAN, INC.Selected

Condensed Consolidated Balance Sheet

Data(unaudited)(in

thousands)

| |

September 30, 2022 |

|

December 31, 2021 |

| Cash and cash equivalents |

$ |

14,903 |

|

$ |

47,085 |

| Total current assets |

|

34,627 |

|

|

54,130 |

| Total assets |

|

83,270 |

|

|

68,960 |

| Total current liabilities |

|

35,627 |

|

|

11,150 |

| Total liabilities |

|

76,510 |

|

|

50,641 |

| Total stockholders’

equity |

|

6,760 |

|

|

18,319 |

| Total liabilities and

stockholders’ equity |

$ |

83,270 |

|

$ |

68,960 |

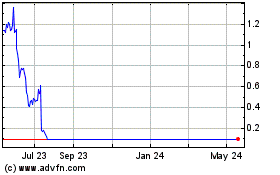

Novan (NASDAQ:NOVN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Novan (NASDAQ:NOVN)

Historical Stock Chart

From Mar 2024 to Mar 2025