Novan Announces $6.0 Million Registered Direct Offering

14 March 2023 - 11:00PM

Novan, Inc. (“the Company” or “Novan”) (Nasdaq: NOVN), today

announced that it has entered into definitive agreements for the

issuance and sale in a registered direct offering of an aggregate

of (i) 5,042,017 shares of its common stock (or pre-funded warrants

to purchase common stock in lieu thereof) and (ii) warrants (the

“Common Warrants”) to purchase up to 5,042,017 shares of common

stock, at an effective combined purchase price of $1.19 per share

(or pre-funded warrant) and associated Common Warrant. The Common

Warrants will become exercisable six months from the date of

issuance at an exercise price of $1.20 per share and will expire

five years following the initial exercise date.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

The gross proceeds to Novan from this offering

are expected to be approximately $6.0 million, before deducting the

placement agent’s fees and other offering expenses payable by

Novan. Novan intends to use the net proceeds from the offering to

fund its berdazimer gel, 10.3% (SB206) development program

activities, support sales and marketing efforts for the Company’s

marketed products and for general working capital purposes and

other operating expenses. The offering is expected to close on or

about March 16, 2023, subject to satisfaction of customary closing

conditions.

The securities described above are being offered

by Novan pursuant to a shelf registration statement (Registration

No. 333-262865) originally filed by Novan with the Securities and

Exchange Commission (“SEC”) on February 18, 2022 and that became

effective on February 25, 2022. The offering is being made only by

means of a prospectus supplement and accompanying prospectus that

forms a part of the registration statement. A prospectus supplement

and accompanying prospectus relating to the registered direct

offering will be filed with the SEC and, when available, may be

obtained for free on the SEC’s website located at

http://www.sec.gov. When available, electronic copies of the final

prospectus supplement and accompanying prospectus relating to the

offering may be obtained by contacting H.C. Wainwright & Co.,

LLC, 430 Park Avenue, 3rd Floor, New York, NY 10022, or by

telephone at (212) 856-5711, or by email to

placements@hcwco.com.

The Company also has agreed that certain

existing warrants to purchase up to an aggregate of 5,261,311

shares of common stock at an exercise price of $2.851 per share and

an expiration date of June 13, 2027, will be amended effective upon

the closing of the offering, such that the amended warrants will

have a reduced exercise price of $1.20 per share following the

closing of the offering, will become exercisable six months after

the closing of the offering and will be exercisable until December

13, 2027.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Novan

Novan, Inc. is a medical dermatology company

primarily focused on researching, developing, and commercializing

innovative therapeutic products for skin diseases. Our goal is to

deliver safe and efficacious therapies to patients, including

developing product candidates where there are unmet medical needs.

Novan has a robust commercial infrastructure across sales,

marketing, and communications, as well as fully dedicated market

access and pharmacy relation teams, promoting products for plaque

psoriasis, rosacea and acne. The U.S. Food and Drug Administration

(“FDA”) accepted for filing Novan’s New Drug Application (“NDA”)

seeking approval for berdazimer gel, 10.3% (SB206) for the

treatment of molluscum contagiosum. The Company also has a pipeline

of potential product candidates using its proprietary nitric

oxide-based technology platform, NITRICIL™, to generate new

treatments for multiple indications.

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “believe,” “expect,” “target,”

“anticipate,” “may,” “plan,” “potential,” “will,” “look forward to”

and similar expressions, and are based on the Company’s current

beliefs and expectations. These forward-looking statements include,

but are not limited to, statements relating to closing of the

offering and satisfaction of closing conditions, the expected gross

proceeds from the offering; and statements regarding the

anticipated use of proceeds from the offering. Forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from the Company’s

expectations, including, but not limited to, risks and

uncertainties associated with market and other conditions and the

satisfaction of customary closing conditions related to the

offering, and other risks and uncertainties described in the

Company’s annual report filed with the Securities and Exchange

Commission on Form 10-K for the twelve months ended December 31,

2021, and in the Company’s subsequent filings with the Securities

and Exchange Commission. Such forward-looking statements speak only

as of the date of this press release, and the Company disclaims any

intent or obligation to update these forward-looking statements to

reflect events or circumstances after the date of such statements,

except as may be required by law.

INVESTOR AND MEDIA CONTACT:Jenene ThomasJTC

Team, LLC833-475-8247NOVN@jtcir.com

Novan (NASDAQ:NOVN)

Historical Stock Chart

From Feb 2025 to Mar 2025

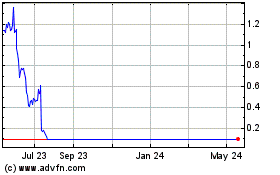

Novan (NASDAQ:NOVN)

Historical Stock Chart

From Mar 2024 to Mar 2025