Current Report Filing (8-k)

01 June 2023 - 6:14AM

Edgar (US Regulatory)

false000146715400014671542023-05-312023-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 31, 2023

_____________________

Novan, Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Delaware | | 001-37880 | | 20-4427682 | |

| (State or other jurisdiction of

incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

4020 Stirrup Creek Drive, Suite 110, Durham, North Carolina 27703

(Address of principal executive offices) (Zip Code)

(919) 485-8080

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value | NOVN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities.

On May 31, 2023, Novan, Inc. (the “Company”) commenced a restructuring of the Company’s commercial segment, resulting in a reduction in force of approximately 50% of employees, primarily among its field sales representatives. The Company took these steps in order to focus its resources on pursuing the regulatory approval for the Company’s SB206 product candidate.

The Company estimates that it will incur approximately $0.9 million in charges related to the reduction in force, substantially all of which are cash expenditures for one-time termination benefits and associated costs. The Company expects to record the charges in the second quarter of 2023 and to make substantially all of the related payments over a period of twelve months.

After taking into account the reduction in force described above, the Company believes that its existing cash and cash equivalents as of March 31, 2023, plus expected receipts associated with product sales from its commercial product portfolio, will provide it with liquidity to fund its planned operating needs into late June of 2023. Notwithstanding the initiatives described in this Form 8-K, the Company does not currently have sufficient funds to complete commercialization of any of its product candidates that are under development, and its funding needs will largely be determined by its commercialization strategy for SB206, subject to the regulatory approval process and outcome, and the operating performance of its commercial product portfolio, including the impacts of the reduction in force described herein. The inability of the Company to generate sufficient net revenues to fund its operations or obtain significant additional funding on acceptable terms in the near term, could have a material adverse effect on the Company’s business and cause the Company to alter or reduce its planned operating activities, including, but not limited to, delaying, reducing, terminating or eliminating planned product candidate development activities and preparations for potential commercialization activities, furloughing employees or further reducing the size of the workforce, to conserve its cash and cash equivalents. The Company has pursued and is continuing to pursue additional capital through equity or debt financings or from other sources, including partnerships, collaborations, licensing, grants or other strategic relationships. The Company’s anticipated expenditure levels may change as it adjusts its current operating plan to conserve cash. Such actions could delay development timelines and have a material adverse effect on its business, results of operations, financial condition and market valuation. The Company is also exploring the potential for additional strategic transactions, such as sales, out-licenses or divestitures of some of its assets, or other potential strategic transactions, which could include a sale of the Company. If the Company were to pursue such a transaction, it may not be able to complete the transaction on a timely basis or at all or on terms that are favorable to the Company. Alternatively, if the Company is unable to obtain significant additional funding on acceptable terms or progress with a strategic transaction, it could instead determine to dissolve and liquidate its assets or seek protection under the bankruptcy laws. If the Company decides to dissolve and liquidate its assets or to seek protection under the bankruptcy laws, it is unclear to what extent the Company would be able to pay its obligations, and, accordingly, it is further unclear whether and to what extent any resources would be available for distributions to stockholders.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 31, 2023, Paula Brown Stafford, the Company’s President and Chief Executive Officer, voluntarily agreed to a temporary reduction of approximately 33% in the base salary otherwise payable to her in 2023 from $604,608 to $400,000 to align with the Company’s cost-cutting measures as described in Item 2.05 of this Current Report on Form 8-K. This salary reduction is not intended to reduce any benefits otherwise provided to Mrs. Stafford and will not modify other rights under any applicable employment agreements or arrangements for Mrs. Stafford determined by reference to her base salary. Those agreements and arrangements will continue to be applied based on the base salary in effect prior to this reduction, except to the extent required by law.

Item 7.01. Regulation FD Disclosure.

On May 31, 2023, the Company issued a press release announcing the Company’s restructuring initiatives. The press release is furnished as Exhibit 99.1 and incorporated herein by reference.

The information set forth in Item 7.01 and Exhibit 99.1 is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements regarding the Company’s current expectations. These forward-looking statements include, without limitation, statements regarding the Company’s expectations with respect to the planned restructuring, including the amount of termination costs, charges to be incurred, the Company’s plans to continue to focus its resources on the development of its SB206 product candidate, and the Company’s cash runway. Factors that could cause actual results to differ include, but are not limited to, risks and uncertainties related to the Company’s ability to retain qualified personnel and recruit in the future, constraints on the Company’s operations stemming from the restructuring, including impacts on the Company’s ongoing commercialization efforts, higher than anticipated costs in connection with the reduction in force and restructuring efforts, and risks and uncertainties related to the ability to raise additional

capital, such as the timing of cash needs. Additional risks and uncertainties regarding the Company’s business can be found in the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2023 filed with the United States Securities and Exchange Commission (SEC), and future filings and reports that the Company’s makes from time to time with the SEC. The information contained in this Current Report on Form 8-K is as of the date hereof, and the Company undertakes no duty to update forward-looking statements contained in this Current Report on Form 8-K except as required by applicable laws.

Item 9.01. Financial Statements and Exhibits.

EXHIBIT INDEX

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

The inclusion of any website address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Novan, Inc. |

| | | |

Date: May 31, 2023 | | | | By: | | /s/ Paula Brown Stafford |

| | | | | | Paula Brown Stafford |

| | | | | | President and Chief Executive Officer |

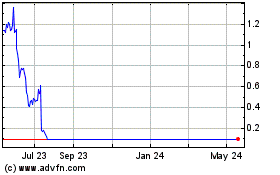

Novan (NASDAQ:NOVN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Novan (NASDAQ:NOVN)

Historical Stock Chart

From Feb 2024 to Feb 2025