0001122904false00011229042024-08-282024-08-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 28, 2024

NETGEAR, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

000-50350 |

|

77-0419172 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

|

|

|

350 East Plumeria Drive |

San Jose, |

CA |

95134 |

(Address, including zip code, of principal executive offices) |

|

|

(408) |

907-8000 |

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

Title of each class |

|

Trading symbol(s): |

|

Name of each exchange on which registered |

Common Stock, $0.001 par value |

|

NTGR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Litigation Settlement

On August 28, 2024, NETGEAR, Inc. (the “Company”) entered into a Settlement Agreement (the “Settlement Agreement”) with TP-Link Systems Inc. (“TP-Link”), regarding all of their respective pending U.S. International Trade Commission and patent infringement disputes, and TP-Link’s patent challenges and breach of contract claims. Consistent with the terms of the Settlement Agreement, all pending litigation between the parties will be dismissed or not further pursued, as applicable, and NETGEAR has received a $135 million payment as consideration for the same.

Third Fiscal Quarter Ending September 29, 2024 Guidance Update

The Company today provided an update to its business outlook for the third fiscal quarter ending September 29, 2024. The updated guidance reflects the above-referenced litigation settlement, as well as the earlier than anticipated launch of its next generation 5G mobile hotspot in the third quarter which was previously expected to occur in the fourth quarter of 2024.

Driven by the earlier than anticipated launch of its latest 5G mobile hotspot, NETGEAR currently expects net revenue for the third quarter of 2024 to be between $170 million and $180 million, compared to prior guidance of $160 million to $175 million for the third quarter of 2024.

The Q3 GAAP impact of the settlement is expected to be as follows:

•NETGEAR expects to report a net benefit before taxes of $103.6 million after backing out associated fees. Of this amount:

o$10.9 million is expected to be recorded as a reduction in GAAP G&A expenses to offset actual fees incurred to date

o$92.7 million is expected to be recorded as a contra-expense in litigation reserves, net within operating expenses which will more than offset the Company’s total operating expenses for the quarter and lead to a significant GAAP operating profit

•Additionally, NETGEAR will reverse the $8.2 million contingent fee recorded in its second quarter of 2024 as all associated fees are captured in the net benefit noted above

•As such, NETGEAR currently expects GAAP operating margin for the third quarter of 2024 to be between 48.0% and 51.0%, compared to prior guidance of (15.3)% to (12.3)%, with the change primarily driven by the settlement and the profits from the expected increase in revenue

• The Company now expects its GAAP tax expense to be in the range of $19.0 million to $20.0 million, compared to prior guidance of $1.0 million to $2.0 million

The full benefit of the settlement will not be included in the third quarter Non-GAAP earnings. The portion of the settlement to be included in the Q3 Non-GAAP earnings is expected to be as follows:

•$10.9 million is expected to be recorded as a reduction in G&A expenses, reflecting a reversal of the actual fees incurred prior to the settlement which were previously included in Non-GAAP earnings

•As such, NETGEAR currently expects Non-GAAP operating margin for Q3 to be between (4.0)% and (1.0)%, compared to prior guidance of (11.0)% to (8.0)%, with the change primarily driven by the settlement and the profits from the expected increase in revenue

•The Company now expects its Non-GAAP tax expense to be in the range of zero to $1.0 million, compared to prior guidance of a tax benefit of $1.5 million to $2.5 million

The Company believes that the cash benefit of the settlement after associated fees and expected tax, net of other applicable tax benefits anticipated in the year, will be approximately $90.3 million. Additionally, the Company

has repurchased approximately 99,000 shares of its common stock for $1.5 million, or $14.92 per share quarter to date, and does not expect any further repurchases to occur in the third quarter, due to trading window restrictions.

A reconciliation between the updated Business Outlook on a GAAP and Non-GAAP basis is provided in the following table:

|

|

|

|

|

|

|

Three months ending |

|

|

September 29, 2024 |

(In millions, except for percentage data) |

|

Operating Margin

Rate |

|

Tax Expense (Benefit) |

|

|

|

|

|

GAAP |

|

48.0% - 51.0% |

|

$19.0 - $20.0 |

Estimated adjustments for1: |

|

|

|

|

Stock-based compensation expense |

|

3.0% |

|

- |

Restructuring and other charges |

|

0.8% |

|

- |

Litigation reserves, net |

|

(55.8)% |

|

|

Non-GAAP tax adjustments |

|

- |

|

$(19.0) |

Non-GAAP |

|

(4.0)% - (1.0)% |

|

$0.0 - $1.0 |

A reconciliation between the previously provided Business Outlook on a GAAP and Non-GAAP basis is provided in the following table:

|

|

|

|

|

|

|

Three months ending |

|

|

September 29, 2024 |

(In millions, except for percentage data) |

|

Operating Margin

Rate |

|

Tax Expense (Benefit) |

|

|

|

|

|

GAAP |

|

(15.3)% - (12.3)% |

|

$1.0 - $2.0 |

Estimated adjustments for1: |

|

|

|

|

Stock-based compensation expense |

|

3.4% |

|

- |

Restructuring and other charges |

|

0.9% |

|

- |

Non-GAAP tax adjustments |

|

- |

|

$(3.5) |

Non-GAAP |

|

(11.0)% - (8.0)% |

|

$(2.5) - $(1.5) |

1 Business outlook does not include estimates for any currently unknown income and expense items which, by their nature, could arise late in a quarter, including: litigation reserves, net; acquisition-related charges; impairment charges; restructuring and other charges and discrete tax benefits or detriments that cannot be forecasted (e.g., windfalls or shortfalls from equity awards or items related to the resolution of uncertain tax positions). New material income and expense items such as these could have a significant effect on our guidance and future GAAP results.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This Current Report on Form 8-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The words “anticipate,” “expect,” “believe,” “will,” “estimate,” “outlook,” “forecast” or other similar words are used to identify such forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, the Company’s estimates of future revenues, operating margin, tax expense, and cash benefit from the litigation settlement. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to be materially different from the historical results and/or from any future results or outcomes expressed or implied by such forward-looking statements. Such factors include, among others, the Company’s completion of its third fiscal quarter operations and risks attendant thereto, and third quarter financial close processes, including without limitation its tax expense calculations. Such factors are further addressed in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024 and such other documents as are filed with the Securities and Exchange Commission from time to time (available at www.sec.gov). Given these circumstances, you should not place undue reliance on these forward-looking statements. The Company assumes no obligation, except as required by law, to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release.

Non-GAAP Financial Information:

To supplement the Company’s unaudited selected financial data presented on a basis consistent with Generally Accepted Accounting Principles (“GAAP”), the Company discloses certain non-GAAP financial measures that exclude certain charges, including non-GAAP operating margin and non-GAAP tax expense (benefit). These supplemental measures exclude adjustments for stock-based compensation expense, restructuring and other charges, litigation reserves, net, and adjust for effects related to non-GAAP tax adjustments. These non-GAAP measures are not in accordance with or an alternative for GAAP, and may be different from non-GAAP measures used by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measures. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our operating performance on a period-to-period basis because such items are not, in our view, related to our ongoing operational performance. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with forecasts and strategic plans, and for benchmarking performance externally against competitors. In addition, management’s incentive compensation is determined using certain non-GAAP measures. Since we find these measures to be useful, we believe that investors benefit from seeing results “through the eyes” of management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by offering:

• the ability to make more meaningful period-to-period comparisons of our on-going operating results;

• the ability to better identify trends in our underlying business and perform related trend analyses;

• a better understanding of how management plans and measures our underlying business; and

• an easier way to compare our operating results against analyst financial models and operating results of competitors that supplement their GAAP results with non-GAAP financial measures.

The following are explanations of the adjustments that we incorporate into non-GAAP measures, as well as the reasons for excluding them in the reconciliations of these non-GAAP financial measures:

Stock-based compensation expense consists of non-cash charges for the estimated fair value of stock options, restricted stock units, performance shares and shares under the employee stock purchase plan granted to employees. We believe that the exclusion of these charges provides for more accurate comparisons of our operating results to peer companies due to the varying available valuation methodologies, subjective assumptions and the variety of award types. In addition, we believe it is useful to investors to understand the specific impact stock-based compensation expense has on our operating results.

Other items consist of certain items that are the result of either unique or unplanned events, including, when applicable: restructuring and other charges, litigation reserves, net, and gain/loss on investments, net. It is difficult to predict the occurrence or estimate the amount or timing of these items in advance. Although these events are reflected in our GAAP financial statements, these unique transactions may limit the comparability of our on-going operations with prior and future periods. The amounts result from events that often arise from unforeseen circumstances, which often occur outside of the ordinary course of continuing operations. Therefore, the amounts do not accurately reflect the underlying performance of our continuing business operations for the period in which they are incurred.

Non-GAAP tax adjustments consist of adjustments that we incorporate into non-GAAP measures in order to provide a more meaningful measure on non-GAAP net income (loss). We believe providing financial information with and without the income tax effects relating to our non-GAAP financial measures, as well as adjustments for valuation allowances on deferred tax assets, provides our management and users of the financial statements with better clarity regarding both current period performance and the on-going performance of our business. Non-GAAP income tax expense (benefit) is computed on a current and deferred basis with non-GAAP income (loss) consistent with use of non-GAAP income (loss) as a performance measure. The Non-GAAP tax provision (benefit) is calculated by adjusting the GAAP tax provision (benefit) for the impact of the non-GAAP adjustments, with specific tax provisions such as state income tax and Base-erosion and Anti-Abuse Tax recomputed on a non-GAAP basis, as well as adjustments for valuation allowances on deferred tax assets. The tax valuation allowance is a non-cash adjustment primarily reflecting our expectations of, and assumptions as to, future operating results and applicable tax laws, that are not directly attributable to the current quarter’s operating performance. For interim periods, the non-GAAP income tax provision (benefit) is calculated based on the forecasted annual non-GAAP tax rate before discrete items and adjusted for interim discrete items.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 11, 2024

NETGEAR, INC.

|

|

|

By: |

|

/s/ Kirsten J. Daru |

|

|

Kirsten J. Daru |

|

|

General Counsel and Chief Privacy Officer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

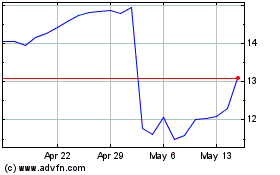

NETGEAR (NASDAQ:NTGR)

Historical Stock Chart

From Dec 2024 to Dec 2024

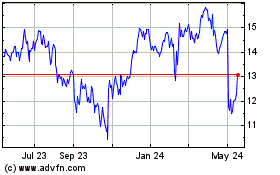

NETGEAR (NASDAQ:NTGR)

Historical Stock Chart

From Dec 2023 to Dec 2024