NeuroMetrix Reports Q2 2024 Business Highlights and Update on Review of Strategic Options

06 August 2024 - 9:00PM

NeuroMetrix, Inc. (Nasdaq: NURO) today reported financial and

business highlights for the quarter and six months ended June 30,

2024. The Company's mission is to reduce the impact of neurological

disorders and pain syndromes through innovative non-invasive

medical devices.

In February of this year, the Company announced

that it had initiated a review of strategic options with an

objective of enhancing shareholder value. Over the past six months,

the Company has invested considerable effort in evaluating a number

of specific strategic directions and also making financial,

operational and commercial optimizations.

-

In collaboration with a financial advisor, the Company conducted an

extensive survey of potential transactions. Detailed diligence was

performed on multiple opportunities; however, the Company

determined that none of these opportunities were in the best

interests of its shareholders at this time.

-

The Company implemented a substantial reduction-in-force at the end

of Q1 to lower operating expenses by over $0.5M per quarter.

-

The Company has been exploring opportunities to monetize certain

assets to offset operating cash consumption. Particular attention

has been placed on international markets that are not central to

the Company's domestic sales focus.

-

The Company engaged in discussions with one of its largest

shareholders that led to the addition of Joshua S. Horowitz as a

new independent director and termination of its at-the-market (ATM)

equity facility in April 2024.

The Company believes it is in the best interests

of shareholders that the strategic review process continues. There

can be no assurance that this process will result in the Company

pursuing or consummating any particular transaction or other

strategic outcome. The Company has not set a timetable for

completion of this evaluation process and may not disclose further

developments unless disclosure is appropriate or necessary.

Business Highlights:

-

Quell® revenue increased by 47% to $192,000 in Q2 2024 from

$131,000 in Q2 2023. Quell revenue includes sales of Quell

Fibromyalgia (prescription) and Quell Relief (OTC). The increase

was entirely from growth in the fibromyalgia indication, which

offset a decrease in OTC revenue due to a commercial pause

initiated in late 2022. The Company is planning to restart OTC

sales in Q4 2024.

-

A total of 540 Quell starter kits (fibromyalgia and OTC) were sold

and there were 3,682 1-month refills ordered, for both indications,

in Q2 2024. This represented starter kit growth of 165% and refill

growth of 13% from Q2 2023.

-

Following engagement with the FDA, the Company decided to proceed

with a De Novo submission for a chemotherapy induced peripheral

neuropathy (CIPN) indication for Quell technology. The filing is

expected to be made in Q4 2024, which may enable a commercial

launch into the oncology market as early as Q4 2025.

-

DPNCheck® revenue of $536,000 in Q2 2024 declined by $869,000 or

62% from Q2 2023. The primary DPNCheck market, Medicare Advantage

(MA), is in the final year of the CMS phase-out of risk-adjustment

compensation for many types of patient screening, including

peripheral neuropathy. The resulting decline in domestic DPNCheck

sales has not yet been offset by alternative markets that the

Company is pursuing. International sales of DPNCheck also declined

from the prior year quarter due to excess inventory at the Japan

distributor. The Company believes this situation is transient, and

these biosensor orders should resume later this year.

-

Several scientific abstracts demonstrating the diagnostic accuracy

and positive clinical outcomes of DPNCheck in patients with

diabetic peripheral neuropathy (DPN) were presented at the Japanese

Diabetes Society meeting in May 2024 and the American Diabetes

Association Scientific Sessions in June 2024.

- The Company received

Health Canada approval to market DPNCheck 2.0, the latest

generation of its point-of-care neurodiagnostic technology.

-

The Company implemented a wind down of its legacy

ADVANCE® business, which has been managed for cash flow for

the past 5 years. This will free up resources and reduce IT

overhead that had become an operational burden relative to the

product's declining financial contribution.

"Quell prescription and OTC indications

represent a substantial growth opportunity. The deliberate and

strategic launch of Quell Fibromyalgia has provided valuable market

insight and clarified tactics. Our initial approach of

direct-to-physician promotion has now been broadened with a

direct-to-patient telemedicine option. In addition, our original

patient cash-pay approach is now complemented by a reimbursed

Veterans Administration (VA) channel. We are also planning to

reactivate our OTC business for lower extremity chronic pain. These

steps should lead to continued top line growth with steadily

improving gross and operating margins," said Shai N. Gozani, M.D.,

Ph.D., Chairman and CEO of NeuroMetrix. "In addition, our efforts

to expand beyond Medicare Advantage and return the DPNCheck

business to growth continue. We are optimistic about several

opportunities and hope to have meaningful updates later this

year."

Financial Results:

Revenue in Q2 2024 of $0.8 million was lower by

$0.9 million or 54% from Q2 2023. The decline in revenue was

attributable to the DPNCheck product line which contracted by $0.9

million or 62%, primarily due to changes in Medicare Advantage

risk-adjustment compensation. The gross margin rate of 64% in Q2

2024 declined from 68% in Q2 2023 due primarily to an unfavorable

shift in product mix and lower production volumes. Operating

expenses were $2.3 million in Q2 2024, a decrease of $0.4 million

from the comparable period in 2023. Reduced personnel costs,

partially offset by professional service fees associated with the

strategic review, contributed to lower operating expenses. The Q2

2024 net loss was $1.5 million ($0.74 per share). This compares to

a net loss of $1.5 million or ($1.56 per share) in Q2 2023. Shares

outstanding were approximately 2.0 million at the end of Q2 2024

and 1.0 million at the end of Q2 2023.

Revenues in H1 2024 of $1.9 million were lower

by $1.5 million or 45% from H1 2023. Net loss of $4.5 million or

($2.37) per share in H1 2024 increased from $3.1 million or ($3.20)

per share in H1 2023.

Company to Host Live Conference Call and

Webcast

NeuroMetrix will host a conference call at 8:00 a.m. Eastern

today, August 6, 2024. Participants who wish to access the call

live via telephone and be able to ask questions must register in

advance here. Upon registering, a dial-in and unique PIN will be

provided on screen and via email to join the call. An audio-only

webcast of the call may be accessed in the “Investors Relations”

section of the Company’s website at www.NeuroMetrix.com. A replay

of the call will be available for one year on the Company's website

under the "Investor Relations" tab.

About NeuroMetrix

NeuroMetrix is a commercial stage healthcare

company that develops and commercializes neurotechnology devices to

address unmet needs in the chronic pain and diabetes markets. The

Company's products are wearable or hand-held medical devices

enabled by proprietary consumables and software solutions that

include mobile apps, enterprise software and cloud-based systems.

The Company has two commercial brands. Quell® is a wearable

neuromodulation platform. DPNCheck® is a point-of-care screening

test for peripheral neuropathy. For more information, visit

www.neurometrix.com.

Safe Harbor Statement

The statements contained in this press release

include forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, including, without

limitation, statements regarding the company’s or management’s

expectations regarding the business, as well as events that could

have a meaningful impact on the company’s revenues and cash

resources. While the company believes the forward-looking

statements contained in this press release are accurate, there are

a number of factors that could cause actual events or results to

differ materially from those indicated by such forward-looking

statements, including, without limitation, estimates of future

performance, and the ability to successfully develop, receive

regulatory clearance, commercialize and achieve market acceptance

for any products. There can be no assurance that future

developments will be those that the company has anticipated. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors including those risks,

uncertainties and factors referred to in the company’s most recent

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, as well

as other documents that may be filed from time to time with the

Securities and Exchange Commission or otherwise made public. The

company is providing the information in this press release only as

of the date hereof, and expressly disclaims any intent or

obligation to update the information included in this press release

or revise any forward-looking statements.

Source: NeuroMetrix, Inc.

Thomas T. HigginsSVP and Chief Financial

Officerneurometrix.ir@neurometrix.com

|

NeuroMetrix, Inc.Statements of

Operations(Unaudited) |

| |

| |

Quarters Ended June 30, |

|

Six Months Ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

769,148 |

|

|

$ |

1,655,744 |

|

|

$ |

1,862,704 |

|

|

$ |

3,380,515 |

|

| |

|

|

|

|

|

|

|

| Cost of revenues |

277,229 |

|

|

536,486 |

|

|

853,768 |

|

|

1,062,858 |

|

| |

|

|

|

|

|

|

|

|

Gross profit |

491,919 |

|

|

1,119,258 |

|

|

1,008,936 |

|

|

2,317,657 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

266,932 |

|

|

753,509 |

|

|

1,210,484 |

|

|

1,452,934 |

|

|

Sales and marketing |

435,014 |

|

|

744,963 |

|

|

1,496,743 |

|

|

1,560,835 |

|

|

General and administrative |

1,618,628 |

|

|

1,244,241 |

|

|

3,384,355 |

|

|

2,637,412 |

|

| |

|

|

|

|

|

|

|

|

Total operating expenses |

2,320,574 |

|

|

2,742,713 |

|

|

6,091,582 |

|

|

5,651,181 |

|

| |

|

|

|

|

|

|

|

|

Loss from operations |

(1,828,655 |

) |

|

(1,623,455 |

) |

|

(5,082,646 |

) |

|

(3,333,524 |

) |

| |

|

|

|

|

|

|

|

| Other income |

340,723 |

|

|

86,426 |

|

|

565,140 |

|

|

222,321 |

|

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(1,487,932 |

) |

|

$ |

(1,537,029 |

) |

|

$ |

(4,517,506 |

) |

|

$ |

(3,111,203 |

) |

|

NeuroMetrix, Inc.Condensed Balance

Sheets(Unaudited) |

|

|

|

|

|

June 30,2024 |

|

December 31,2023 |

| |

|

|

|

|

|

Cash, cash equivalents and securities |

|

$ |

16,429,956 |

|

$ |

17,997,151 |

| Other current assets |

|

|

2,046,633 |

|

|

2,857,291 |

| Noncurrent assets |

|

|

453,194 |

|

|

569,999 |

|

Total assets |

|

$ |

18,929,783 |

|

$ |

21,424,441 |

| |

|

|

|

|

|

|

| Current liabilities |

|

$ |

1,589,750 |

|

$ |

1,240,639 |

| Lease obligation, net of

current portion |

|

|

28,210 |

|

|

92,485 |

| Stockholders’ equity |

|

|

17,311,823 |

|

|

20,091,317 |

|

Total liabilities and stockholders’ equity |

|

$ |

18,929,783 |

|

$ |

21,424,441 |

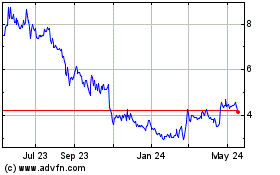

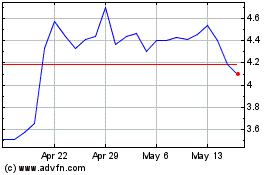

NeuroMetrix (NASDAQ:NURO)

Historical Stock Chart

From Oct 2024 to Nov 2024

NeuroMetrix (NASDAQ:NURO)

Historical Stock Chart

From Nov 2023 to Nov 2024