Outbrain Inc. (Nasdaq: OB), which is operating under the new Teads

brand, announced today financial results for the quarter and full

year ended December 31, 2024.

Fourth Quarter and Full Year

2024 Key Financial Metrics:

|

|

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

| (in millions USD) |

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

Revenue |

$ |

234.6 |

|

|

$ |

248.2 |

|

|

|

(5 |

)% |

|

$ |

889.9 |

|

|

$ |

935.8 |

|

|

|

(5 |

)% |

| Gross profit |

|

56.1 |

|

|

|

53.2 |

|

|

|

5 |

% |

|

|

192.1 |

|

|

|

184.8 |

|

|

|

4 |

% |

| Net (loss) income |

|

(0.2 |

) |

|

|

4.1 |

|

|

|

(104 |

)% |

|

|

(0.7 |

) |

|

|

10.2 |

|

|

|

(107 |

)% |

| Net cash provided by operating

activities |

|

42.7 |

|

|

|

25.5 |

|

|

|

67 |

% |

|

|

68.6 |

|

|

|

13.7 |

|

|

|

399 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Financial

Data* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ex-TAC gross profit |

|

68.3 |

|

|

|

63.8 |

|

|

|

7 |

% |

|

|

236.1 |

|

|

|

227.4 |

|

|

|

4 |

% |

| Adjusted EBITDA |

|

17.0 |

|

|

|

14.0 |

|

|

|

21 |

% |

|

|

37.3 |

|

|

|

28.5 |

|

|

|

31 |

% |

| Adjusted net income (loss) |

|

3.5 |

|

|

|

4.3 |

|

|

|

(20 |

)% |

|

|

4.1 |

|

|

|

(3.9 |

) |

|

|

205 |

% |

| Free cash flow |

|

37.6 |

|

|

|

21.0 |

|

|

|

79 |

% |

|

|

51.3 |

|

|

|

(6.5 |

) |

|

NM |

_____________________________

NM Not meaningful

* See non-GAAP reconciliations

below

“Continued momentum in our growth areas helped

drive accelerated growth and profitability, with a record level of

cash flow” said David Kostman, CEO of Outbrain.

“A few weeks post closing of our merger with

Teads, I am even more excited about combining the category-leading

branding and performance capabilities of Outbrain and Teads into

one of the largest Open Internet platforms. We believe the new

Teads will better serve enterprise brands and agencies, as well as

mid-market and direct response advertisers, by delivering elevated

outcomes from branding to performance across curated, quality media

environments from digital to CTV,” added Kostman.

Recent Developments

On February 3, 2025, we completed the

acquisition of Teads, for total value of approximately $900

million, comprised of $625 million in cash and 43.75 million shares

of Outbrain common stock. The combined company will operate under

the name Teads.

In connection with the acquisition:

- On February 3,

2025, entered into a credit agreement with Goldman Sachs Bank, U.S.

Bank Trust Company, and certain other lenders, which provided,

among other things, for a new $100.0 million super senior secured

revolving credit facility maturing on February 3, 2030, which may

be used for working capital and other general corporate

purposes.

- On February 11,

2025, completed the private offering of $637.5 million in aggregate

principal amount of 10.0% senior secured notes due 2030 at an issue

price of 98.087% of the principal amount in a transaction exempt

from registration. The proceeds were used, together with cash on

hand, to repay in full and cancel a bridge credit facility used to

finance the cash consideration paid at closing.

- Terminated the

existing revolving credit facility with the Silicon Valley Bank, a

division of First Citizens Bank & Trust Company, dated as of

November 2, 2021.

- We expect to

realize approximately $65 million to $75 million of annual

synergies in 2026 with further opportunities for expanded

synergies. Of this amount, approximately $60 million relates to

cost synergies, including approximately $45 million of

compensation-related expenses, with approximately 70% of the

estimated compensation-related synergies already actioned in

February.

Fourth Quarter

2024 Business Highlights:

- Continued

acceleration of year-over-year growth of Ex-TAC gross profit,

improvement in Ex-TAC gross margin, and growth in Adjusted

EBITDA.

- Fifth consecutive

quarter of year-over-year RPM growth.

- Strong initial

reception of our Moments offering, launched in Q3 and live on over

40 publishers, including New York Post, NewsCorp Australia, RTL and

Rolling Stone.

-

Continued growth in advertiser spend on Outbrain DSP (previously

known as Zemanta), by approximately 45% in FY 2024, as compared to

the prior year.

- Continued supply

expansion outside of traditional feed product representing

approximately 30% of our revenue in Q4 2024, versus 26% in Q4

2023.

- Premium supply

competitive wins include Penske Media (US) and Prensa Ibérica

(Spain), and renewals including Spiegel (Germany), Il Messaggero

(Italy), and Grape (Japan).

Fourth Quarter

2024 Financial Highlights:

- Revenue of $234.6

million, a decrease of $13.6 million, or 5%, compared to $248.2

million in the prior year period, including net unfavorable foreign

currency effects of approximately $1.8 million.

- Gross profit of

$56.1 million, an increase of $2.9 million, or 5%, compared to

$53.2 million in the prior year period. Gross margin increased 250

basis points to 23.9%, compared to 21.4% in the prior year

period.

- Ex-TAC gross profit

of $68.3 million, an increase of $4.5 million, or 7%, compared to

$63.8 million in the prior year period, as lower revenue was more

than offset by our Ex-TAC gross margin improvement of approximately

340 basis points to 29.1%, compared to 25.7% in the prior year

period.

- Net loss of $0.2

million, compared to net income of $4.1 million in the prior year

period. Net loss in the current period includes acquisition-related

costs of $3.6 million, net of taxes.

- Adjusted net income

of $3.5 million, compared to adjusted net income of $4.3 million in

the prior year period.

- Adjusted EBITDA of

$17.0 million, compared to Adjusted EBITDA of $14.0 million in the

prior year period. Adjusted EBITDA included net unfavorable foreign

currency effects of approximately $0.8 million.

- Generated net cash

provided by operating activities of $42.7 million, compared to

$25.5 million in the prior year period. Free cash flow was $37.6

million, as compared to $21.0 million in the prior year

period.

- Cash, cash

equivalents and investments in marketable securities were $166.1

million, comprised of cash and cash equivalents of $89.1 million

and short-term investments in marketable securities of $77.0

million as of December 31, 2024.

Full Year 2024

Financial Results:

- Revenue of $889.9

million, a decrease of $45.9 million, or 5%, compared to $935.8

million in the prior year period, including net unfavorable foreign

currency effects of approximately $2.4 million.

- Gross profit of

$192.1 million, an increase of $7.3 million, or 4%, compared to

$184.8 million in the prior year period, including net unfavorable

foreign currency effects of approximately $1.3 million. Gross

margin increased 190 basis points to 21.6% in 2024, compared to

19.7% in 2023.

- Ex-TAC gross profit

of $236.1 million, an increase of $8.7 million, or 4%, compared to

$227.4 million in the prior year period, including net unfavorable

foreign currency effects of approximately $1.3 million.

- Net loss of $0.7

million, including net one-time expenses of $4.8 million, compared

to net income of $10.2 million, including net one-time benefits of

$14.1 million in the prior year. See non-GAAP reconciliations below

for details of one-time items.

- Adjusted net income

of $4.1 million, compared to adjusted net loss of $3.9 million in

the prior year.

- Adjusted EBITDA of

$37.3 million, compared to $28.5 million in the prior year.

Adjusted EBITDA included net unfavorable foreign currency effects

of approximately $1.2 million.

- Generated net cash

provided by operating activities of $68.6 million, compared to net

cash provided $13.7 million in the prior year. Free cash flow was

$51.3 million, compared to a use of cash of $6.5 million in the

prior year.

Share

Repurchases:

There were no share repurchases during the three

months ended December 31, 2024. During the twelve months ended

December 31, 2024, we repurchased 1,410,001 shares for

$5.8 million, including related costs, under our $30 million

stock repurchase program authorized in December 2022. The remaining

availability under the repurchase program was $6.6 million as of

December 31, 2024.

2025 Full Year and First

Quarter Guidance

The following forward-looking statements reflect

our expectations for 2025, including the contribution from

Teads.

For the first quarter ending March 31, 2025,

which includes the results for the legacy Outbrain business plus

the addition of operating results for legacy Teads beginning on

February 3, 2025, we expect:

- Ex-TAC gross profit

of $100 million to $105 million

- Adjusted EBITDA of

$8 million to $12 million

For the full year ending December 31, 2025, we

expect:

- Adjusted EBITDA of

at least $180 million

The above measures are forward-looking non-GAAP

financial measures for which a reconciliation to the most directly

comparable GAAP financial measure is not available without

unreasonable efforts. See “Non-GAAP Financial Measures” below. In

addition, our guidance is subject to risks and uncertainties, as

outlined below in this release.

Conference Call and

Webcast Information

Outbrain will host an investor conference call

this morning, Thursday, February 27 at 8:30 am ET. Interested

parties are invited to listen to the conference call which can be

accessed live by phone by dialing 1-877-497-9071 or for

international callers, 1-201-689-8727. A replay will be available

two hours after the call and can be accessed by dialing

1-877-660-6853, or for international callers, 1-201-612-7415. The

passcode for the live call and the replay is 13750872. The replay

will be available until March 13, 2025. Interested investors and

other parties may also listen to a simultaneous webcast of the

conference call by logging onto the Investors Relations section of

the Company’s website at https://investors.outbrain.com. The online

replay will be available for a limited time shortly following the

call.

Non-GAAP Financial Measures

In addition to GAAP performance measures, we use

the following supplemental non-GAAP financial measures to evaluate

our business, measure our performance, identify trends, and

allocate our resources: Ex-TAC gross profit, Ex-TAC gross margin,

Adjusted EBITDA, free cash flow, adjusted net income (loss), and

adjusted diluted EPS. These non-GAAP financial measures are defined

and reconciled to the corresponding GAAP measures below. These

non-GAAP financial measures are subject to significant limitations,

including those we identify below. In addition, other companies in

our industry may define these measures differently, which may

reduce their usefulness as comparative measures. As a result, this

information should be considered as supplemental in nature and is

not meant as a substitute for revenue, gross profit, net income

(loss), diluted EPS, or cash flows from operating activities

presented in accordance with U.S. GAAP.

Because we are a global company, the

comparability of our operating results is affected by foreign

exchange fluctuations. We calculate certain constant currency

measures and foreign currency impacts by translating the current

year’s reported amounts into comparable amounts using the prior

year’s exchange rates. All constant currency financial information

that may be presented is non-GAAP and should be used as a

supplement to our reported operating results. We believe that this

information is helpful to our management and investors to assess

our operating performance on a comparable basis. However, these

measures are not intended to replace amounts presented in

accordance with GAAP and may be different from similar measures

calculated by other companies.

The Company is also providing fourth quarter and

full year guidance. These forward-looking non-GAAP financial

measures are calculated based on internal forecasts that omit

certain amounts that would be included in GAAP financial measures.

The Company has not provided quantitative reconciliations of these

forward-looking non-GAAP financial measures to the most directly

comparable GAAP financial measures because it is unable, without

unreasonable effort, to predict with reasonable certainty the

occurrence or amount of all excluded items that may arise during

the forward-looking period, which can be dependent on future events

that may not be reliably predicted. Such excluded items could be

material to the reported results individually or in the

aggregate.

Ex-TAC Gross Profit

Ex-TAC gross profit is a non-GAAP financial

measure. Gross profit is the most comparable GAAP measure. In

calculating Ex-TAC gross profit, we add back other cost of revenue

to gross profit. Ex-TAC gross profit may fluctuate in the future

due to various factors, including, but not limited to, seasonality

and changes in the number of media partners and advertisers,

advertiser demand or user engagements.

We present Ex-TAC gross profit, Ex-TAC gross

margin (calculated as Ex-TAC gross profit as a percentage of

revenue), and Adjusted EBITDA as a percentage of Ex-TAC gross

profit, because they are key profitability measures used by our

management and board of directors to understand and evaluate our

operating performance and trends, develop short-term and long-term

operational plans, and make strategic decisions regarding the

allocation of capital. Accordingly, we believe that these measures

provide information to investors and the market in understanding

and evaluating our operating results in the same manner as our

management and board of directors. There are limitations on the use

of Ex-TAC gross profit in that traffic acquisition cost is a

significant component of our total cost of revenue but not the only

component and, by definition, Ex-TAC gross profit presented for any

period will be higher than gross profit for that period. A

potential limitation of this non-GAAP financial measure is that

other companies, including companies in our industry, which have a

similar business, may define Ex-TAC gross profit differently, which

may make comparisons difficult. As a result, this information

should be considered as supplemental in nature and is not meant as

a substitute for revenue or gross profit presented in accordance

with U.S. GAAP.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss)

before gain on convertible debt; interest expense; interest income

and other income (expense), net; provision for income taxes;

depreciation and amortization; stock-based compensation; and other

income or expenses that we do not consider indicative of our core

operating performance, including but not limited to, merger and

acquisition costs, regulatory matter costs, and severance costs

related to our cost saving initiatives. We present Adjusted EBITDA

as a supplemental performance measure because it is a key

profitability measure used by our management and board of directors

to understand and evaluate our operating performance and trends,

develop short-term and long-term operational plans and make

strategic decisions regarding the allocation of capital, and we

believe it facilitates operating performance comparisons from

period to period.

We believe that Adjusted EBITDA provides useful

information to investors and others in understanding and evaluating

our operating results in the same manner as our management and

board of directors. However, our calculation of Adjusted EBITDA is

not necessarily comparable to non-GAAP information of other

companies. Adjusted EBITDA should be considered as a supplemental

measure and should not be considered in isolation or as a

substitute for any measures of our financial performance that are

calculated and reported in accordance with U.S. GAAP.

Adjusted Net Income (Loss) and Adjusted

Diluted EPS

Adjusted net income (loss) is a non-GAAP

financial measure, which is defined as net income (loss) excluding

items that we do not consider indicative of our core operating

performance, including but not limited to gain on convertible debt,

merger and acquisition costs, regulatory matter costs, and

severance costs related to our cost saving initiatives. Adjusted

net income (loss), as defined above, is also presented on a per

diluted share basis. We present adjusted net income (loss) and

adjusted diluted EPS as supplemental performance measures because

we believe they facilitate performance comparisons from period to

period. However, adjusted net income (loss) or adjusted diluted EPS

should not be considered in isolation or as a substitute for net

income (loss) or diluted earnings per share reported in accordance

with U.S. GAAP.

Free Cash Flow

Free cash flow is defined as cash flow provided

by (used in) operating activities less capital expenditures and

capitalized software development costs. Free cash flow is a

supplementary measure used by our management and board of directors

to evaluate our ability to generate cash and we believe it allows

for a more complete analysis of our available cash flows. Free cash

flow should be considered as a supplemental measure and should not

be considered in isolation or as a substitute for any measures of

our financial performance that are calculated and reported in

accordance with U.S. GAAP.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the federal securities laws, which

statements involve substantial risks and uncertainties.

Forward-looking statements may include, without limitation,

statements generally relating to possible or assumed future results

of our business, financial condition, results of operations,

liquidity, plans and objectives, and statements relating to our

recently completed acquisition of Teads S.A., a public limited

liability company(société anonyme) incorporated and existing under

the laws of the Grand Duchy of Luxembourg (“Teads”). You can

generally identify forward-looking statements because they contain

words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “guidance,” “outlook,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“foresee,” “potential” or “continue” or the negative of these terms

or other similar expressions that concern our expectations,

strategy, plans or intentions or are not statements of historical

fact. We have based these forward- looking statements largely on

our expectations and projections regarding future events and trends

that we believe may affect our business, financial condition, and

results of operations. The outcome of the events described in these

forward-looking statements is subject to risks, uncertainties and

other factors including, but not limited to: the ability of

Outbrain to successfully integrate Teads or manage the combined

business effectively; our ability to realize anticipated benefits

and synergies of the acquisition, including, among other things,

operating efficiencies, revenue synergies and other cost savings;

our due diligence investigation of Teads may be inadequate or risks

related to Teads’ business may materialize; unexpected costs,

charges or expenses resulting from the acquisition; the outcome of

any securities litigation, stockholder derivative or other

litigation related to the acquisition; our ability to raise

additional financing in the future to fund our operations, which

may not be available to us on favorable terms or at all; the

volatility of the market price of our common stock and any drop in

the market price of our common stock following the acquisition; our

ability to attract and retain customers, management and other key

personnel; overall advertising demand and traffic generated by our

media partners; factors that affect advertising demand and

spending, such as the continuation or worsening of unfavorable

economic or business conditions or downturns, instability or

volatility in financial markets, and other events or factors

outside of our control, such as U.S. and global recession concerns,

geopolitical concerns, including the ongoing war between

Ukraine-Russia and conditions in Israel and the Middle East,

tariffs and trade wars, supply chain issues, inflationary

pressures, labor market volatility, bank closures or disruptions,

the impact of challenging economic conditions, political and policy

changes or uncertainties in connection with the new U.S.

presidential administration, and other factors that have and may

further impact advertisers’ ability to pay; our ability to continue

to innovate, and adoption by our advertisers and media partners of

our expanding solutions; the success of our sales and marketing

investments, which may require significant investments and may

involve long sales cycles; our ability to grow our business and

manage growth effectively; our ability to compete effectively

against current and future competitors; the loss or decline of one

or more of our large media partners, and our ability to expand our

advertiser and media partner relationships; conditions in Israel,

including the sustainability of the recent cease-fire between

Israel and Hamas and any conflicts with other terrorist

organizations; our ability to maintain our revenues or

profitability despite quarterly fluctuations in our results,

whether due to seasonality, large cyclical events, or other causes;

the risk that our research and development efforts may not meet the

demands of a rapidly evolving technology market; any failure of our

recommendation engine to accurately predict attention or

engagement, any deterioration in the quality of our recommendations

or failure to present interesting content to users or other factors

which may cause us to experience a decline in user engagement or

loss of media partners; limits on our ability to collect, use and

disclose data to deliver advertisements; our ability to extend our

reach into evolving digital media platforms; our ability to

maintain and scale our technology platform; our ability to meet

demands on our infrastructure and resources due to future growth or

otherwise; our failure or the failure of third parties to protect

our sites, networks and systems against security breaches, or

otherwise to protect the confidential information of us or our

partners; outages or disruptions that impact us or our service

providers, resulting from cyber incidents, or failures or loss of

our infrastructure; significant fluctuations in currency exchange

rates; political and regulatory risks in the various markets in

which we operate; the challenges of compliance with differing and

changing regulatory requirements; the timing and execution of any

cost-saving measures and the impact on our business or strategy;

and the risks described in the section entitled “Risk Factors” and

elsewhere in the Annual Report on Form 10-K filed for the year

ended December 31, 2023, in our definitive proxy statement filed

with the SEC on October 31, 2024 and in subsequent reports filed

with the SEC. Accordingly, you should not rely upon forward-looking

statements as an indication of future performance. We cannot assure

you that the results, events and circumstances reflected in the

forward-looking statements will be achieved or will occur, and

actual results, events, or circumstances could differ materially

from those projected in the forward-looking statements. The

forward-looking statements made in this press release relate only

to events as of the date on which the statements are made. We may

not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements and you should not

place undue reliance on our forward-looking statements. We

undertake no obligation and do not assume any obligation to update

any forward-looking statements, whether as a result of new

information, future events or circumstances after the date on which

the statements are made or to reflect the occurrence of

unanticipated events or otherwise, except as required by law.

About The Combined Company

Outbrain Inc. (Nasdaq: OB) and Teads combined on

February 3, 2025 and are operating under the new Teads brand. The

new Teads is the omnichannel outcomes platform for the open

internet, driving full-funnel results for marketers across premium

media. With a focus on meaningful business outcomes, the combined

company ensures value is driven with every media dollar by

leveraging predictive AI technology to connect quality media,

beautiful brand creative, and context-driven addressability and

measurement. One of the most scaled advertising platforms on the

open internet, the new Teads is directly partnered with more than

10,000 publishers and 20,000 advertisers globally. The company is

headquartered in New York, with a global team of nearly 1,800

people in 36 countries.

Media Contact

press@outbrain.com

Investor Relations Contact

IR@outbrain.com

(332) 205-8999

|

OUTBRAIN INC.Condensed Consolidated

Statements of Operations(In thousands, except for

share and per share data) |

| |

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(Unaudited) |

| Revenue |

$ |

234,586 |

|

|

$ |

248,229 |

|

|

$ |

889,875 |

|

|

$ |

935,818 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Traffic acquisition costs |

|

166,247 |

|

|

|

184,425 |

|

|

|

653,731 |

|

|

|

708,449 |

|

|

Other cost of revenue |

|

12,277 |

|

|

|

10,572 |

|

|

|

44,042 |

|

|

|

42,571 |

|

|

Total cost of revenue |

|

178,524 |

|

|

|

194,997 |

|

|

|

697,773 |

|

|

|

751,020 |

|

| Gross profit |

|

56,062 |

|

|

|

53,232 |

|

|

|

192,102 |

|

|

|

184,798 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

9,434 |

|

|

|

8,369 |

|

|

|

37,080 |

|

|

|

36,402 |

|

|

Sales and marketing |

|

25,736 |

|

|

|

25,254 |

|

|

|

97,498 |

|

|

|

98,370 |

|

|

General and administrative |

|

18,357 |

|

|

|

13,899 |

|

|

|

70,162 |

|

|

|

58,665 |

|

|

Total operating expenses |

|

53,527 |

|

|

|

47,522 |

|

|

|

204,740 |

|

|

|

193,437 |

|

| Income (loss) from

operations |

|

2,535 |

|

|

|

5,710 |

|

|

|

(12,638 |

) |

|

|

(8,639 |

) |

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

Gain on convertible debt |

|

— |

|

|

|

— |

|

|

|

8,782 |

|

|

|

22,594 |

|

|

Interest expense |

|

(699 |

) |

|

|

(965 |

) |

|

|

(3,649 |

) |

|

|

(5,393 |

) |

|

Interest income and other income, net |

|

1,522 |

|

|

|

2,060 |

|

|

|

9,209 |

|

|

|

7,793 |

|

|

Total other income, net |

|

823 |

|

|

|

1,095 |

|

|

|

14,342 |

|

|

|

24,994 |

|

| Income before income

taxes |

|

3,358 |

|

|

|

6,805 |

|

|

|

1,704 |

|

|

|

16,355 |

|

| Provision for income

taxes |

|

3,525 |

|

|

|

2,748 |

|

|

|

2,415 |

|

|

|

6,113 |

|

| Net (loss) income |

$ |

(167 |

) |

|

$ |

4,057 |

|

|

$ |

(711 |

) |

|

$ |

10,242 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

49,767,704 |

|

|

|

50,076,364 |

|

|

|

49,321,301 |

|

|

|

50,900,422 |

|

|

Diluted |

|

49,767,704 |

|

|

|

50,108,460 |

|

|

|

52,709,356 |

|

|

|

56,965,299 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.00 |

|

|

$ |

0.08 |

|

|

$ |

(0.01 |

) |

|

$ |

0.20 |

|

|

Diluted |

$ |

0.00 |

|

|

$ |

0.08 |

|

|

$ |

(0.11 |

) |

|

$ |

(0.06 |

) |

|

OUTBRAIN INC.Condensed Consolidated

Balance Sheets(In thousands, except for number of

shares and par value) |

| |

| |

December 31,2024 |

|

December 31,2023 |

| |

(Unaudited) |

|

|

| ASSETS: |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

89,094 |

|

|

$ |

70,889 |

|

|

Short-term investments in marketable securities |

|

77,035 |

|

|

|

94,313 |

|

|

Accounts receivable, net of allowances |

|

149,167 |

|

|

|

189,334 |

|

|

Prepaid expenses and other current assets |

|

27,835 |

|

|

|

47,240 |

|

|

Total current assets |

|

343,131 |

|

|

|

401,776 |

|

| Non-current assets: |

|

|

|

|

Long-term investments in marketable securities |

|

— |

|

|

|

65,767 |

|

|

Property, equipment and capitalized software, net |

|

45,250 |

|

|

|

42,461 |

|

|

Operating lease right-of-use assets, net |

|

15,047 |

|

|

|

12,145 |

|

|

Intangible assets, net |

|

16,928 |

|

|

|

20,396 |

|

|

Goodwill |

|

63,063 |

|

|

|

63,063 |

|

|

Deferred tax assets |

|

40,825 |

|

|

|

38,360 |

|

|

Other assets |

|

24,969 |

|

|

|

20,669 |

|

| TOTAL ASSETS |

$ |

549,213 |

|

|

$ |

664,637 |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY: |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

149,479 |

|

|

$ |

150,812 |

|

|

Accrued compensation and benefits |

|

19,430 |

|

|

|

18,620 |

|

|

Accrued and other current liabilities |

|

113,630 |

|

|

|

119,703 |

|

|

Deferred revenue |

|

6,932 |

|

|

|

8,486 |

|

|

Total current liabilities |

|

289,471 |

|

|

|

297,621 |

|

| Non-current liabilities: |

|

|

|

|

Long-term debt |

|

— |

|

|

|

118,000 |

|

|

Operating lease liabilities, non-current |

|

11,783 |

|

|

|

9,217 |

|

|

Other liabilities |

|

16,616 |

|

|

|

16,735 |

|

| TOTAL LIABILITIES |

$ |

317,870 |

|

|

$ |

441,573 |

|

| |

|

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

Common stock, par value of $0.001 per share − one billion shares

authorized; 63,503,274 shares issued and 50,090,114 shares

outstanding as of December 31, 2024; 61,567,520 shares issued

and 49,726,518 shares outstanding as of December 31, 2023 |

|

64 |

|

|

|

62 |

|

|

Preferred stock, par value of $0.001 per share − 100,000,000 shares

authorized, none issued and outstanding as of December 31,

2024 and December 31, 2023 |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

484,541 |

|

|

|

468,525 |

|

|

Treasury stock, at cost − 13,413,160 shares as of December 31,

2024 and 11,841,002 shares as of December 31, 2023 |

|

(74,289 |

) |

|

|

(67,689 |

) |

|

Accumulated other comprehensive loss |

|

(9,480 |

) |

|

|

(9,052 |

) |

|

Accumulated deficit |

|

(169,493 |

) |

|

|

(168,782 |

) |

| TOTAL STOCKHOLDERS’ EQUITY |

|

231,343 |

|

|

|

223,064 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

549,213 |

|

|

$ |

664,637 |

|

|

OUTBRAIN INC.Condensed Consolidated Statements of

Cash Flows(In thousands) |

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

(Unaudited) |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

| Net (loss) income |

$ |

(167 |

) |

|

$ |

4,057 |

|

|

$ |

(711 |

) |

|

$ |

10,242 |

|

| Adjustments to reconcile net

(loss) income to net cash provided by (used in) operating

activities: |

|

|

|

|

|

|

|

|

Gain on convertible debt |

|

— |

|

|

|

— |

|

|

|

(8,782 |

) |

|

|

(22,594 |

) |

|

Stock-based compensation |

|

3,974 |

|

|

|

2,988 |

|

|

|

15,461 |

|

|

|

12,141 |

|

|

Depreciation and amortization of property and equipment |

|

1,658 |

|

|

|

1,720 |

|

|

|

6,312 |

|

|

|

6,915 |

|

|

Amortization of capitalized software development costs |

|

2,477 |

|

|

|

2,372 |

|

|

|

9,758 |

|

|

|

9,633 |

|

|

Amortization of intangible assets |

|

850 |

|

|

|

853 |

|

|

|

3,409 |

|

|

|

4,154 |

|

|

Provision for credit losses |

|

55 |

|

|

|

1,931 |

|

|

|

3,006 |

|

|

|

8,008 |

|

|

Non-cash operating lease expense |

|

1,305 |

|

|

|

1,092 |

|

|

|

5,130 |

|

|

|

4,453 |

|

|

Deferred income taxes |

|

(664 |

) |

|

|

(1,478 |

) |

|

|

(5,095 |

) |

|

|

(4,312 |

) |

|

Amortization of discount on marketable securities |

|

(396 |

) |

|

|

(729 |

) |

|

|

(2,235 |

) |

|

|

(3,604 |

) |

|

Other |

|

665 |

|

|

|

(483 |

) |

|

|

47 |

|

|

|

(717 |

) |

| Changes in operating assets and

liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

4,471 |

|

|

|

(16,939 |

) |

|

|

35,905 |

|

|

|

(12,946 |

) |

|

Prepaid expenses and other current assets |

|

9,291 |

|

|

|

2,409 |

|

|

|

18,412 |

|

|

|

843 |

|

|

Accounts payable and other current liabilities |

|

18,867 |

|

|

|

27,127 |

|

|

|

(11,696 |

) |

|

|

(1,228 |

) |

|

Operating lease liabilities |

|

(1,223 |

) |

|

|

(1,018 |

) |

|

|

(5,092 |

) |

|

|

(4,297 |

) |

|

Deferred revenue |

|

555 |

|

|

|

1,524 |

|

|

|

(1,496 |

) |

|

|

1,621 |

|

|

Other non-current assets and liabilities |

|

945 |

|

|

|

51 |

|

|

|

6,228 |

|

|

|

5,434 |

|

|

Net cash provided by operating activities |

|

42,663 |

|

|

|

25,477 |

|

|

|

68,561 |

|

|

|

13,746 |

|

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

Acquisition of a business, net of cash acquired |

|

— |

|

|

|

(77 |

) |

|

|

(181 |

) |

|

|

(389 |

) |

|

Purchases of property and equipment |

|

(2,712 |

) |

|

|

(2,257 |

) |

|

|

(7,380 |

) |

|

|

(10,127 |

) |

|

Capitalized software development costs |

|

(2,321 |

) |

|

|

(2,243 |

) |

|

|

(9,913 |

) |

|

|

(10,107 |

) |

|

Purchases of marketable securities |

|

(34,436 |

) |

|

|

(44,658 |

) |

|

|

(90,602 |

) |

|

|

(131,543 |

) |

|

Proceeds from sales and maturities of marketable securities |

|

31,068 |

|

|

|

35,228 |

|

|

|

175,325 |

|

|

|

221,878 |

|

|

Other |

|

(15 |

) |

|

|

(63 |

) |

|

|

(96 |

) |

|

|

(72 |

) |

|

Net cash (used in) provided by investing activities |

|

(8,416 |

) |

|

|

(14,070 |

) |

|

|

67,153 |

|

|

|

69,640 |

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

Repayment of long-term debt obligations |

|

— |

|

|

|

— |

|

|

|

(109,740 |

) |

|

|

(96,170 |

) |

|

Payment of deferred financing costs |

|

(598 |

) |

|

|

— |

|

|

|

(1,099 |

) |

|

|

— |

|

|

Treasury stock repurchases and share withholdings on vested

awards |

|

(210 |

) |

|

|

(5,270 |

) |

|

|

(6,600 |

) |

|

|

(18,521 |

) |

|

Principal payments on finance lease obligations |

|

— |

|

|

|

(353 |

) |

|

|

(263 |

) |

|

|

(1,830 |

) |

|

Payment of contingent consideration liability up to

acquisition-date fair value |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(547 |

) |

|

Net cash used in financing activities |

|

(808 |

) |

|

|

(5,623 |

) |

|

|

(117,702 |

) |

|

|

(117,068 |

) |

| |

|

|

|

|

|

|

|

|

Effect of exchange rate changes |

|

(1,400 |

) |

|

|

564 |

|

|

|

634 |

|

|

|

(1,004 |

) |

| |

|

|

|

|

|

|

|

| Net increase (decrease) in cash,

cash equivalents and restricted cash |

$ |

32,039 |

|

|

$ |

6,348 |

|

|

$ |

18,646 |

|

|

$ |

(34,686 |

) |

| Cash, cash equivalents and

restricted cash — Beginning |

|

57,686 |

|

|

|

64,731 |

|

|

|

71,079 |

|

|

|

105,765 |

|

| Cash, cash equivalents and

restricted cash — Ending |

$ |

89,725 |

|

|

$ |

71,079 |

|

|

$ |

89,725 |

|

|

$ |

71,079 |

|

|

OUTBRAIN INC.Non-GAAP

Reconciliations(In

thousands)(Unaudited) |

|

|

The following table presents the reconciliation

of Gross profit to Ex-TAC gross profit and Ex-TAC gross margin, for

the periods presented:

| |

Three Months Ended December

31, |

|

Twelve Months Ended December

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

234,586 |

|

|

$ |

248,229 |

|

|

$ |

889,875 |

|

|

$ |

935,818 |

|

| Traffic acquisition costs |

|

(166,247 |

) |

|

|

(184,425 |

) |

|

|

(653,731 |

) |

|

|

(708,449 |

) |

| Other cost of revenue |

|

(12,277 |

) |

|

|

(10,572 |

) |

|

|

(44,042 |

) |

|

|

(42,571 |

) |

|

Gross profit |

|

56,062 |

|

|

|

53,232 |

|

|

|

192,102 |

|

|

|

184,798 |

|

| Other cost of revenue |

|

12,277 |

|

|

|

10,572 |

|

|

|

44,042 |

|

|

|

42,571 |

|

|

Ex-TAC gross profit |

$ |

68,339 |

|

|

$ |

63,804 |

|

|

$ |

236,144 |

|

|

$ |

227,369 |

|

| |

|

|

|

|

|

|

|

| Gross margin (gross profit as

% of revenue) |

|

23.9 |

% |

|

|

21.4 |

% |

|

|

21.6 |

% |

|

|

19.7 |

% |

| Ex-TAC gross margin (Ex-TAC

gross profit as % of revenue) |

|

29.1 |

% |

|

|

25.7 |

% |

|

|

26.5 |

% |

|

|

24.3 |

% |

The following table presents the reconciliation of net income

(loss) to Adjusted EBITDA, for the periods presented:

| |

Three Months Ended December

31, |

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net (loss) income |

$ |

(167 |

) |

|

$ |

4,057 |

|

|

$ |

(711 |

) |

|

$ |

10,242 |

|

|

Interest expense |

|

699 |

|

|

|

965 |

|

|

|

3,649 |

|

|

|

5,393 |

|

|

Interest income and other income, net |

|

(1,522 |

) |

|

|

(2,060 |

) |

|

|

(9,209 |

) |

|

|

(7,793 |

) |

|

Gain on convertible debt |

|

— |

|

|

|

— |

|

|

|

(8,782 |

) |

|

|

(22,594 |

) |

|

Provision for income taxes |

|

3,525 |

|

|

|

2,748 |

|

|

|

2,415 |

|

|

|

6,113 |

|

|

Depreciation and amortization |

|

4,985 |

|

|

|

4,945 |

|

|

|

19,479 |

|

|

|

20,702 |

|

|

Stock-based compensation |

|

3,974 |

|

|

|

2,988 |

|

|

|

15,461 |

|

|

|

12,141 |

|

|

Regulatory matter costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

742 |

|

|

Acquisition-related costs |

|

5,469 |

|

|

|

— |

|

|

|

14,256 |

|

|

|

— |

|

|

Severance and related costs |

|

— |

|

|

|

361 |

|

|

|

742 |

|

|

|

3,509 |

|

| Adjusted EBITDA |

$ |

16,963 |

|

|

$ |

14,004 |

|

|

$ |

37,300 |

|

|

$ |

28,455 |

|

| |

|

|

|

|

|

|

|

| Net (loss) income as % of

gross profit |

|

(0.3 |

)% |

|

|

7.6 |

% |

|

|

(0.4 |

)% |

|

|

5.5 |

% |

| Adjusted EBITDA as % of Ex-TAC

Gross Profit |

|

24.8 |

% |

|

|

21.9 |

% |

|

|

15.8 |

% |

|

|

12.5 |

% |

The following table presents the reconciliation of net income

(loss) and diluted EPS to adjusted net income (loss) and adjusted

diluted EPS, respectively, for the periods presented:

| |

Three Months Ended December

31, |

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss (income) |

$ |

(167 |

) |

|

$ |

4,057 |

|

|

$ |

(711 |

) |

|

$ |

10,242 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

Gain on convertible debt |

|

— |

|

|

|

— |

|

|

|

(8,782 |

) |

|

|

(22,594 |

) |

|

Regulatory matter costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

742 |

|

|

Acquisition-related costs |

|

5,469 |

|

|

|

— |

|

|

|

14,256 |

|

|

|

— |

|

|

Severance and related costs |

|

— |

|

|

|

361 |

|

|

|

742 |

|

|

|

3,509 |

|

| Total adjustments, before

tax |

|

5,469 |

|

|

|

361 |

|

|

|

6,216 |

|

|

|

(18,343 |

) |

|

Income tax effect |

|

(1,844 |

) |

|

|

(97 |

) |

|

|

(1,438 |

) |

|

|

4,234 |

|

| Total adjustments, after

tax |

|

3,625 |

|

|

|

264 |

|

|

|

4,778 |

|

|

|

(14,109 |

) |

| Adjusted net income

(loss) |

$ |

3,458 |

|

|

$ |

4,321 |

|

|

$ |

4,067 |

|

|

$ |

(3,867 |

) |

|

|

|

|

|

|

|

|

|

| Basic weighted-average shares,

as reported |

|

49,767,704 |

|

|

|

50,076,364 |

|

|

|

49,321,301 |

|

|

|

50,900,422 |

|

|

Restricted stock units |

|

793,713 |

|

|

|

32,096 |

|

|

|

519,729 |

|

|

|

— |

|

| Adjusted diluted weighted

average shares |

|

50,561,417 |

|

|

|

50,108,460 |

|

|

|

49,841,030 |

|

|

|

50,900,422 |

|

| |

|

|

|

|

|

|

|

| Diluted net income (loss) per

share - reported |

$ |

— |

|

|

$ |

0.08 |

|

|

$ |

(0.11 |

) |

|

$ |

(0.06 |

) |

|

Adjustments, after tax |

|

0.07 |

|

|

|

0.01 |

|

|

|

0.19 |

|

|

|

(0.02 |

) |

| Diluted net income (loss) per

share - adjusted |

$ |

0.07 |

|

|

$ |

0.09 |

|

|

$ |

0.08 |

|

|

$ |

(0.08 |

) |

The following table presents the reconciliation

of net cash provided by (used in) operating activities to free cash

flow, for the periods presented:

|

|

Three Months Ended December

31, |

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by operating

activities |

$ |

42,663 |

|

|

$ |

25,477 |

|

|

$ |

68,561 |

|

|

$ |

13,746 |

|

|

Purchases of property and equipment |

|

(2,712 |

) |

|

|

(2,257 |

) |

|

|

(7,380 |

) |

|

|

(10,127 |

) |

|

Capitalized software development costs |

|

(2,321 |

) |

|

|

(2,243 |

) |

|

|

(9,913 |

) |

|

|

(10,107 |

) |

| Free cash flow |

$ |

37,630 |

|

|

$ |

20,977 |

|

|

$ |

51,268 |

|

|

$ |

(6,488 |

) |

TeadsNon-IFRS

Reconciliations(In

thousands)(Unaudited)

The below information is presented for

informational purposes only. The acquisition of Teads closed in

February 2025. Therefore, its results are not included in Outbrain

Inc.’s consolidated results of operations for any periods in 2024.

The following is a summary of Teads’ non-IFRS financial measures,

as calculated based on Teads’ historical financial statements,

which we may publicly present from time to time, and which differ

from US GAAP. Non-IFRS financial measures should be viewed in

addition to, and not as an alternative for, Teads’ historical

financial results prepared in accordance with IFRS. The financial

information set forth below for the three months and twelve months

ended December 31, 2024 is preliminary and is subject to change.

Actual financial results may differ from these preliminary

estimates due to the completion of Teads’ annual audit and are

subject to adjustments and other developments that may arise before

such results are finalized.

Ex-TAC Gross Profit is defined as gross profit

plus other cost of revenue. The following table presents the

reconciliation of Ex-TAC Gross Profit to gross profit for the

periods presented:

| |

Three MonthsEndedMarch 31,2024 |

|

Three MonthsEndedJune 30,2024 |

|

Three MonthsEndedSeptember 30,2024 |

|

Three MonthsEndedDecember 31,2024 |

|

Twelve MonthsEndedDecember 31,2024 |

| |

(in thousands) |

|

Revenue |

$ |

125,372 |

|

|

$ |

153,734 |

|

|

$ |

149,376 |

|

|

$ |

188,953 |

|

|

$ |

617,435 |

|

| Traffic acquisition costs |

|

(46,939 |

) |

|

|

(55,716 |

) |

|

|

(59,085 |

) |

|

|

(69,091 |

) |

|

|

(230,831 |

) |

| Other cost of revenue(a) |

|

(26,387 |

) |

|

|

(26,721 |

) |

|

|

(26,865 |

) |

|

|

(26,441 |

) |

|

|

(106,414 |

) |

|

Gross profit |

|

52,046 |

|

|

|

71,297 |

|

|

|

63,426 |

|

|

|

93,421 |

|

|

|

280,190 |

|

| Other cost of revenue(a) |

|

26,387 |

|

|

|

26,721 |

|

|

|

26,865 |

|

|

|

26,441 |

|

|

|

106,414 |

|

|

Ex-TAC Gross Profit |

$ |

78,433 |

|

|

$ |

98,018 |

|

|

$ |

90,291 |

|

|

$ |

119,862 |

|

|

$ |

386,604 |

|

__________________________________(a) Other cost

of revenue for Teads is subject to accounting policy alignment with

Outbrain, with no impact to Ex-TAC Gross Profit included in the

above table.

Teads defines Adjusted EBITDA as profit (loss)

for the year/period before income tax expense, finance costs, other

financial income and expenses, depreciation and amortization, other

expenses and income (capital gains, non-recurring litigation,

restructuring costs) and share-based compensation. This may not be

comparable to similarly titled measures used by other companies.

Further, this measure should not be considered as an alternative

for net income as the effects of income tax expense, finance costs,

other financial income and expenses, depreciation and amortization,

other expenses and income (such as severance costs, and merger and

acquisition costs) and share-based compensation excluded from

Adjusted EBITDA do affect the operating results. Teads believes

that Adjusted EBITDA is a useful supplementary measure for

evaluating the operating performance of Teads’ business. The

following table provides a reconciliation of profit (loss) for the

period to Adjusted EBITDA, the most directly comparable IFRS

measure, for the periods presented:

| |

Three MonthsEndedMarch 31,2024 |

|

Three MonthsEndedJune 30,2024 |

|

Three MonthsEndedSeptember 30,2024 |

|

Three MonthsEndedDecember 31,2024 |

|

Twelve MonthsEndedDecember 31,2024 |

| |

(in thousands) |

|

(Loss) profit for the period |

|

(36,551 |

) |

|

|

23,323 |

|

|

|

32,933 |

|

|

$ |

46,158 |

|

|

$ |

65,863 |

|

|

Finance Costs |

|

250 |

|

|

|

277 |

|

|

|

532 |

|

|

|

117 |

|

|

|

1,176 |

|

|

Other financial (income) and expenses |

|

20,531 |

|

|

|

(12,432 |

) |

|

|

(20,529 |

) |

|

|

(19,967 |

) |

|

|

(32,397 |

) |

|

Provision for income taxes |

|

716 |

|

|

|

10,800 |

|

|

|

10,597 |

|

|

|

17,637 |

|

|

|

39,750 |

|

|

Depreciation and amortization |

|

3,180 |

|

|

|

3,350 |

|

|

|

3,277 |

|

|

|

3,027 |

|

|

|

12,834 |

|

|

Share-based compensation |

|

25,612 |

|

|

|

5,760 |

|

|

|

(3,284 |

) |

|

|

(134 |

) |

|

|

27,954 |

|

|

Severance costs |

|

281 |

|

|

|

520 |

|

|

|

398 |

|

|

|

394 |

|

|

|

1,593 |

|

|

Merger and acquisition costs |

|

323 |

|

|

|

763 |

|

|

|

(125 |

) |

|

|

4,929 |

|

|

|

5,890 |

|

| Adjusted EBITDA |

$ |

14,342 |

|

|

$ |

32,361 |

|

|

$ |

23,799 |

|

|

$ |

52,161 |

|

|

$ |

122,663 |

|

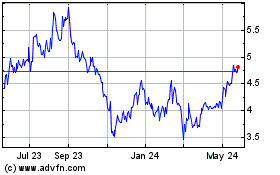

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Feb 2025 to Mar 2025

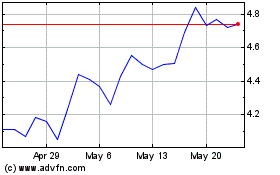

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Mar 2024 to Mar 2025