OPAL Fuels Inc. (“OPAL Fuels” or the “Company”) (Nasdaq: OPAL),

a leading vertically integrated producer and distributor of

renewable natural gas (RNG), today announced financial and

operating results for the three and twelve months ended December

31, 2022.

“OPAL Fuels has continued to execute on its strategic and

operational goals,” said Co-CEO Adam Comora. “After bringing three

RNG projects online in 2022, we now have seven in operation, six

under construction and a growing Advanced Development Pipeline.

“RNG production in 2022 grew 38% compared to 2021, and we are

forecasting production growth to accelerate to over 50% in 2023. We

also expect accelerated production growth in 2024 as our projects

in construction become operational. In addition, as projects

continue to move into and through our Advanced Development Pipeline

(ADP) and into construction, we are setting the foundation for

meaningful production growth over the coming years.

“The RNG industry continues to benefit from tailwinds as the

potential benefits of the Inflation Reduction Act (IRA) become

clearer. Additionally, new pathways under the Renewable Fuel

Standard (RFS) such as eRINs are being considered and new offtake

markets are developing.

“More importantly, the flexibility of OPAL Fuels’ vertically

integrated business platform continues to maximize value for

stakeholders, reduces volatility from environmental credit pricing

and provides optionality as public policy and markets continue to

evolve. We expect that in the second half of 2023 we will begin to

see the benefits of the IRA’s Investment Tax Credits (ITC)

provisions. Additionally, guidance on the 45Z production tax

credits, and clarification on the proposed eRIN pathway under the

RFS program should be available. This should add to the industry

tailwinds, providing meaningful benefits to our vertically

integrated business.”

“We anticipate putting at least 2.0 million MMBtu of RNG

projects into construction this calendar year,” said Co-CEO

Jonathan Maurer. “We also continue to expand our Advanced

Development Pipeline1. Recently we added 0.8 million MMBtu of

anticipated nameplate capacity to ADP, and now have a total of

approximately 8.3 million MMBtu, across 19 projects.

“In addition, as we continue to evaluate projects across the

sector, we expect our pipeline of opportunities to grow. We are

pleased that some of the development headwinds we experienced in

2022 have begun to subside.”

Financial Highlights

- Revenue for the three and twelve months ended December 31,

2022, was $66.7 million and $235.5 million, respectively, up 9% and

42%, compared to prior-year periods.

- Net income for the three and twelve months ended December 31,

2022, was $32.0 million and $32.6 million, respectively, compared

to $21.8 million and $40.8 million, in the same period last

year.

- Adjusted EBITDA2 for the three and twelve months ended December

31, 2022, was $20.2 million and $60.7 million, respectively, up 13%

and 50%, compared to prior-year periods.

Operational Highlights

- Produced 0.6 million and 2.2 million MMBtu of RNG, for the

three and twelve months ended December 31, 2022, up 49% and 38%,

compared to prior-year periods.

- Fuel Station Services segment sold, dispensed, and serviced an

aggregate of 33.3 million and 115.9 million GGEs of transportation

fuel for the three and twelve months ended December 31, 2022, up

21% and 20%, compared to prior-year periods. This volume includes

8.9 million and 29.4 million GGEs of RNG dispensing for the three

and twelve months ended December 31, 2022, up 33% and 41%, compared

to prior-year periods.

- Recently renewed agreement with UPS to provide operations and

maintenance services for 51 fueling stations for an additional ten

years.

- During 2022, signed long-term agreements for sales of 10.6

million annual GGE for 17 new OPAL Fuels stations, which are now

under construction.

____________________________

1 The Company's Advanced Development Pipeline ("ADP") comprises

projects that have been qualified and are reasonably expected to be

in construction within the next twelve to eighteen months. The

MMBtu associated with these projects is presented as anticipated

nameplate capacity. Anticipated nameplate capacity is the Company’s

currently anticipated annual design output for each facility and

may not reflect actual production from the projects, which depends

on many variables including, but not limited to, quantity and

quality of the biogas, operational up-time of the facility, and

actual productivity of the facility.

2 Adjusted EBITDA is a non-GAAP measure. A reconciliation of

GAAP Net Income to Adjusted EBITDA has been provided in the

financial tables included in this press release. An explanation of

this measure and how it is calculated is also included below under

the heading “Non-GAAP Financial Measures."

- As of December 31, 2022, the Company had 137 fueling stations

in its dispensing network, of which 26 are under construction. As

part of its dispensing network, OPAL Fuels owns 46 fueling stations

including 20 sites under construction.

Construction Update

- BioTown dairy RNG project commenced commercial operations in

February 2023.

- Anticipate three landfill gas projects to commence operations

in 2023 - Emerald RNG in mid-2023, as well as Prince William RNG

and Sapphire RNG in the fourth quarter of 2023.

- OPAL Fuels’ share of annual nameplate capacity3 for Emerald,

Prince William, and Sapphire projects is approximately 3.8 million

MMBtu.

Development Update

- Anticipate placing at least 2.0 million MMBtu of RNG projects

(representing OPAL Fuels’ proportional ownership) into construction

in 2023.

- Added 0.8 million MMBtu of anticipated nameplate capacity to

the Company’s Advanced Development Pipeline4, bringing it to

approximately 8.3 million MMBtu across 19 projects, which are

primarily landfill gas projects.

- The Advanced Development Pipeline includes four landfill

gas-to-electric projects that are candidates for conversion to

RNG.

- The Advanced Development Pipeline excludes 12 landfill

gas-to-electric projects in our portfolio, which may be available

to generate eRINs from a potential new RFS pathway proposed by the

EPA in their proposed set rule.

____________________________________________

3 Nameplate capacity is the annual design output for each

facility and may not reflect actual production from the projects,

which depends on many variables including, but not limited to,

quantity and quality of the biogas, operational up-time of the

facility, and actual productivity of the facility.

4 The Company's Advanced Development Pipeline comprises projects

that have been qualified and are reasonably expected to be in

construction within the next twelve to eighteen months. The MMBtu

associated with these projects is presented as anticipated

nameplate capacity. Anticipated nameplate capacity is the Company’s

currently anticipated annual design output for each facility and

may not reflect actual production from the projects, which depends

on many variables including, but not limited to, quantity and

quality of the biogas, operational up-time of the facility, and

actual productivity of the facility.

2023 Guidance Expectations

- The Company currently estimates that Adjusted EBITDA9 for the

full year 2023 will range between $85 and $95 million. This

guidance assumes an average annual price of $2.25/gallon for a D3

RIN, $3.00/MMBtu brown gas, and $90/MT LCFS credit pricing and is

based off the midpoint of the expected range of expected RNG

production. 5

- RNG produced for the full year 2023 is anticipated to range

between 3.2 million MMBtu and 3.6 million MMBtu compared with 2.2

million MMBtu in 2022.6

- RNG dispensing volume is anticipated to range between 53

million GGEs and 57 million GGEs, compared with 29.4 million GGEs

in 2022, an increase ranging from 80% to 94%.7

All guidance is current as of the date of this release and is

subject to change.

($ millions, except production data)

Estimated Full Year 2023

Ranges

RNG Production (million MMBtu) 8

3.2

—

3.6

RNG Fuel sold as transport fuel (million

GGE)

53

—

57

Estimated Adjusted EBITDA 9

$

85

—

$

95

Capex

$

220

—

$

240

___________________

5 Estimated 2023 annualized commodity and environmental

attribute sensitivities to 2023 Estimated Adjusted EBITDA are as

follows: approximately $8 million change for every $0.25/gallon

change in D3 RIN price, a $1.4 million change for every $0.50/MMBtu

change in natural gas price, and a $0.4 million change for every

$10/MT change in LCFS credit price.

6 Reflects OPAL Fuels proportional ownership with respect to RNG

projects owned with joint venture partners.

7 Includes volumes sold in OPAL Fuel's proprietary dispensing

network as well as third party stations that are serviced and

maintained by OPAL Fuels.

8 RNG Production reflects OPAL Fuels' proportional share with

respect to RNG projects owned with joint venture partners.

9 Estimated Adjusted EBITDA is a non-GAAP financial measure. A

reconciliation of the full year estimated Adjusted EBITDA to net

income, the closest GAAP measure, cannot be provided due to the

inherent difficulty in quantifying certain amounts including but

not limited to changes in fair value of the derivative instruments

and other items, due to a number of factors including the

unpredictability of underlying price movements, which may be

significant.

Results of Operations

($ thousands of dollars)

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

2021

2022

2021

Revenue

RNG Fuel

$

43,634

$

33,294

$

126,830

$

70,360

Fuel Station Services

13,716

14,880

69,240

50,440

Renewable Power

9,367

12,982

39,461

45,324

Total Revenue

$

66,717

$

61,156

$

235,531

$

166,124

Net income

$

32,019

$

21,819

$

32,579

$

40,769

Adjusted EBITDA

$

20,154

$

17,824

$

60,744

$

40,609

RNG Fuel volume produced (Million

MMBtus)

0.6

0.4

2.2

1.6

RNG Fuel volume sold (Million GGEs)

8.9

6.7

29.4

20.8

Total volume delivered (Million GGEs)

33.3

27.6

115.9

96.4

Revenue for the three months ended December 31, 2022, was $66.7

million, an increase of 9%, or $5.6 million, compared to $61.2

million in the prior year. While two of our three business segments

experienced growth during the year, the increase was primarily

driven by the RNG Fuel segment. Total revenue for the twelve months

ended December 31, 2022, was $235.5 million compared to $166.1

million in the prior-year period.

Net income for the three months ended December 31, 2022, was

$32.0 million, compared to $21.8 million in the prior year. The

fourth quarter includes $33.1 million of change in derivative

instruments primarily attributable to our earnout liabilities

assumed after the closing of the business combination.

Net income for the twelve months ended December 31, 2022, was

$32.6 million compared to $40.8 million for the prior year. Full

year 2022 net income was impacted by lower margins reducing our

operating income year-over-year and higher transaction costs

associated with becoming a public company, offset by change in fair

value of derivative instruments.

Adjusted EBITDA2 for the three months ended December 31, 2022,

was $20.2 million, reflecting an increase of 13%, compared to $17.8

million for the prior-year period. Adjusted EBITDA for the twelve

months ended December 31, 2022, was $60.7 million compared to $40.6

million in the prior-year period.

Timing of Sales of RINs for Gas in Storage

Under generally accepted accounting principles (“GAAP”), the

timing of revenue recognition for stand-alone RIN sales contracts

is tied to the delivery of the RIN to our counterparties and not

the production of the RIN. To better align timing of when costs are

recognized for the production of RNG in a current period, in

Adjusted EBITDA, we include the value of that RNG, and

environmental credits held in inventory.

At December 31, 2022, the Company had biogas in storage from

fourth quarter production that was pending certification for

generation of environmental credits for the Sunoma dairy RNG

project and other third-party supply. Upon completion of

certification, RINs and LCFS credits associated with this stored

biogas will be monetized under a blend of forward and merchant

sales contracts.

Adjusted EBITDA as of December 31, 2022, includes adjustments

for $7.4 million of environmental credits that are anticipated to

be generated from this stored RNG and other environmental credits

held in inventory. Conversely, $7.5 million related to stored gas

and environmental credits that was included in third quarter

Adjusted EBITDA has been subtracted from fourth quarter Adjusted

EBITDA for consistency of presentation.

Segment Revenues

RNG Fuel

Revenue from RNG Fuel was $43.6 million, an increase of $10.3

million, or 31%, for the three months ended December 31, 2022,

compared to the three months ended December 31, 2021. This change

was attributable primarily due to an increase in environmental

credits and brown gas sales driven by additional volumes and higher

prices.

For the twelve months ended December 31, 2022, revenue from RNG

Fuel increased by $56.5 million, or 80%, compared to the year ended

December 31, 2021. This increase was attributable primarily to the

impact of a full year of Beacon revenue in 2022 versus only eight

months in 2021, an increase from brown gas sales and the sale of

environmental credits.

Fuel Station Services

Revenue from Fuel Station Services was $13.7 million, a decrease

of $1.2 million, or 8%, for the fourth quarter of 2022, compared to

the three months ended December 31, 2021. Revenues from fuel

station construction for third parties are recognized on a

percentage of completion basis and can fluctuate based on equipment

deliveries and the incurrence of the construction expenses.

For the year ended December 31, 2022, revenue from Fuel Station

Services increased by $18.8 million, or 37%, compared to the year

ended December 31, 2021. This was primarily attributable to an

increase from fuel station construction projects which were

completed into 2022, coupled with an increase in volumes at

existing and new service sites and from the sale of portable

fueling stations. We also signed $61 million in third-party fuel

station construction contracts during 2022. Third-party

construction revenue backlog was approximately $65.7 million at

December 31, 2022.

Renewable Power

Revenue from Renewable Power was $9.4 million, a decrease of

$3.6 million, or 28%, for the quarter ended December 31, 2022,

compared to the fourth quarter of 2021. This is primarily due to

the shutdown of one of our electricity generation facilities as our

gas rights agreement concluded.

For the twelve months ended December 31, 2022, revenue from

Renewable Power decreased by $5.9 million, or 13%, compared to the

prior year. In addition to the shut down at the end of the third

quarter of one of our electricity generation facilities as our gas

rights agreement concluded, this change was attributable to a

decrease from the conversion of one of our electricity generation

facilities into an RNG facility.

Liquidity

As of December 31, 2022, our liquidity is $257.2 million

consisting of cash and cash equivalents of $40.4 million,

restricted cash of $36.8 million, plus an additional $65.0 million

in short-term investments maturing within 90 days. Our liquidity

includes aggregate availability of $105 million senior secured

credit facilities after a drawdown of $10.0 million in March

2023.

We believe that our available cash, anticipated cash flows from

operations, available lines of credit under existing debt

facilities, and access to expected sources of capital will be

sufficient to meet our existing commitments and funding needs.

Capital Expenditures

During the year ended 2022, OPAL Fuels invested $108.3 million10

across six RNG projects and 21 owned fueling stations in

construction as compared to $30.2 million in 2021.

Earnings Call

A webcast to review OPAL Fuels’ Fourth Quarter and Full Year

2022 results is being held tomorrow, March 28, 2023 at 11:00AM

Eastern Time.

Materials to be discussed in the webcast will be available

before the call on the Company's website.

Participants may access the call at

https://edge.media-server.com/mmc/p/wi45x8o3, and a live webcast

will also be available at

https://investors.opalfuels.com/news-events/events-presentations.

_____________________

10 Capital Expenditures reflect net investment in RNG projects

net of proceeds received from our non-redeemable non-controlling

interests. We received $23.1 million and $59.4 million from such

parties for the year ended December 31, 2022 and 2021,

respectively. These amounts have been excluded to reflect only

capital expenditures attributable to OPAL Fuels.

Glossary of terms

“Environmental Attributes” refer to federal, state, and local

government incentives in the United States, provided in the form of

Renewable Identification Numbers, Renewable Energy Credits, Low

Carbon Fuel Standard credits, rebates, tax credits and other

incentives to end users, distributors, system integrators and

manufacturers of renewable energy projects that promote the use of

renewable energy.

“GGE” refers to Gasoline gallon equivalent. It is used to

measure the total volume of RNG production that OPAL Fuels expects

to dispense each year. The conversion ratio is 1MMBtu equal to 7.74

GGE.

“LFG” refers to landfill gas.

“MMBtu” refers to British thermal units.

“Renewable Power” refers to electricity generated from renewable

sources.

“RNG” refers to renewable natural gas.

“D3” refers to cellulosic biofuel with a 60% GHG reduction

requirement.

“RIN” refers to Renewal Identification Numbers.

“EPA” refers to Environmental Protection Agency.

About OPAL Fuels Inc.

OPAL Fuels Inc. (Nasdaq: OPAL) is a leading vertically

integrated renewable fuels platform involved in the production and

distribution of renewable natural gas (RNG) for the heavy-duty

truck market. RNG is a proven low-carbon fuel that is rapidly

decarbonizing the transportation industry now while also

significantly reducing fuel costs for fleet owners. OPAL Fuels

captures harmful methane emissions at the source and recycles the

trapped energy into a commercially viable, lower-cost alternative

to diesel fuel. The company also develops, constructs, and services

RNG and hydrogen fueling stations. As a producer and distributor of

carbon-reducing fuel for heavy-duty truck fleets for more than a

decade, OPAL Fuels delivers complete renewable solutions to

customers and production partners. To learn more about OPAL Fuels

and how it is leading the effort to capture North America’s harmful

methane emissions and decarbonize the transportation industry,

please visit https://opalfuels.com/ and follow the company on

LinkedIn and Twitter at @OPALFuels.

Forward-Looking Statements

Certain statements in this communication may be considered

forward-looking statements within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995. Forward-looking statements are statements that

are not historical facts and generally relate to future events or

OPAL Fuels’ (the “Company”) future financial or other performance

metrics. In some cases, you can identify forward-looking statements

by terminology such as “believe,” “may,” “will,” “potentially,”

“estimate,” “continue,” “anticipate,” “intend,” “could,” “would,”

“project,” “target,” “plan,” “expect,” or the negatives of these

terms or variations of them or similar terminology. Such

forward-looking statements are subject to risks and uncertainties,

which could cause actual results to differ materially from those

expressed or implied by such forward looking statements. New risks

and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. These

forward-looking statements are based upon estimates and assumptions

that, while considered reasonable by the Company and its

management, as the case may be, are inherently uncertain and

subject to material change. Factors that may cause actual results

to differ materially from current expectations include various

factors beyond management’s control, including but not limited to

general economic conditions and other risks, uncertainties and

factors set forth in the sections entitled “Risk Factors” and

“Cautionary Statement Regarding Forward-Looking Statements” in the

Company's quarterly report on Form 10Q filed on November 14, 2022,

and other filings the Company makes with the Securities and

Exchange Commission. Nothing in this communication should be

regarded as a representation by any person that the forward-looking

statements set forth herein will be achieved or that any of the

contemplated results of such forward-looking statements will be

achieved. You should not place undue reliance on forward-looking

statements in this communication, which speak only as of the date

they are made and are qualified in their entirety by reference to

the cautionary statements herein. The Company expressly disclaims

any obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

Disclaimer

This communication is for informational purposes only and is

neither an offer to purchase, nor a solicitation of an offer to

sell, subscribe for or buy, any securities, nor shall there be any

sale, issuance or transfer or securities in any jurisdiction in

contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended.

OPAL FUELS INC.

CONSOLIDATED BALANCE SHEETS (In thousands of U.S.

dollars, except per share data)

December 31,

2022

December 31, 2021 (1)

Assets

Current assets:

Cash and cash equivalents (includes

$12,506 and $1,991 at December 31, 2022 and December 31, 2021,

respectively, related to consolidated VIEs)

$

40,394

$

39,314

Accounts receivable, net (includes $966

and $40 at December 31, 2022 and December 31, 2021, respectively,

related to consolidated VIEs)

31,083

25,391

Accounts receivable, related party

12,421

—

Restricted cash - current (includes $6,971

and $— at December 31, 2022 and December 31, 2021, respectively,

related to consolidated VIEs)

32,402

—

Short term investments

64,976

—

Fuel tax credits receivable

4,144

2,393

Contract assets

9,771

8,484

Parts inventory

7,311

5,143

Environmental credits held for sale

1,674

386

Prepaid expense and other current assets

(includes $415 and $113 at December 31, 2022 and December 31, 2021,

respectively, related to consolidated VIEs)

7,625

5,482

Derivative financial assets, current

portion

182

382

Total current assets

211,983

86,975

Capital spares

3,443

3,025

Property, plant, and equipment, net

(includes $73,140 and $27,794 at December 31, 2022 and December 31,

2021, respectively, related to consolidated VIEs)

297,323

169,770

Operating right-of use assets

11,744

—

Investment in other entities

51,765

47,150

Note receivable

—

9,200

Note receivable - variable fee

component

1,942

1,656

Derivative financial assets, non-current

portion

954

—

Deferred financing costs

3,013

2,370

Other long-term assets

1,489

489

Intangible assets, net

2,167

2,861

Restricted cash - non-current (includes

$2,923 and $1,163 at December 31, 2022 and December 31, 2021,

respectively, related to consolidated VIEs)

4,425

2,740

Goodwill

54,608

54,608

Total assets

$

644,856

$

380,844

Liabilities and Equity

Current liabilities:

Accounts payable (includes $4,896 and $544

at December 31, 2022 and December 31, 2021, respectively, related

to consolidated VIEs)

22,679

12,581

Accounts payable, related party

1,346

166

Fuel tax credits payable

3,320

1,978

Accrued payroll

7,779

7,652

Accrued capital expenses (includes $7,821

and $1,722 at December 31, 2022 and December 31, 2021,

respectively, related to consolidated VIEs)

11,922

5,517

Accrued expenses and other current

liabilities (includes $646 and $— at December 31, 2022 and December

31, 2021, respectively, related to consolidated VIEs)

10,773

7,220

Contract liabilities

8,013

9,785

Senior Secured Credit Facility - term

loan, current portion, net of debt issuance costs

15,250

73,145

Senior Secured Credit Facility - working

capital facility, current portion

7,500

7,500

OPAL Term Loan, current portion

27,732

13,425

Sunoma loan, current portion (includes

$380 and $756 at December 31, 2022 and December 31, 2021,

respectively, related to consolidated VIEs)

380

756

Convertible Note Payable

28,528

—

Municipality loan

76

194

Derivative financial liability, current

portion

4,596

992

Operating lease liabilities - current

portion

630

—

Other current liabilities

1,085

374

Asset retirement obligation, current

portion

1,296

831

Total current liabilities

152,905

142,116

Asset retirement obligation, non-current

portion

4,960

4,907

OPAL Term Loan

66,600

59,090

Convertible Note Payable

—

58,710

Sunoma loan, net of debt issuance costs

(includes $21,712 and $16,199 at December 31, 2022 and December 31,

2021, respectively, related to consolidated VIEs)

21,712

16,199

Municipality loan

—

84

Operating lease liabilities - non-current

portion

11,245

—

Earn out liabilities

8,790

—

Other long-term liabilities

825

4,781

Total liabilities

267,037

285,887

Commitments and contingencies

Redeemable preferred non-controlling

interests

138,142

30,210

Redeemable non-controlling interests

1,013,833

63,545

Stockholders' (deficit) equity

Class A common stock, $0.0001 par value,

337,852,251 shares authorized as of December 31, 2022; 29,477,766

and 0 shares, issued and outstanding at December 31, 2022 and

December 31, 2021, respectively

3

—

Class B common stock, $0.0001 par value,

157,498,947 shares authorized as of December 31, 2022; None issued

and outstanding as of December 31, 2022 and December 31, 2021

—

—

Class C common stock, $0.0001 par value,

154,309,729 shares authorized as of December 31, 2022; None issued

and outstanding as of December 31, 2022 and December 31, 2021

—

—

Class D common stock, $0.0001 par value,

154,309,729 shares authorized as of December 31, 2022; 144,399,037

issued and outstanding at December 31, 2022 and December 31,

2021

14

14

Additional paid-in capital

—

—

Accumulated deficit

(800,813

)

—

Accumulated other comprehensive income

195

—

Total Stockholders' (deficit) equity

attributable to the Company

(800,601

)

14

Non-redeemable non-controlling

interests

26,445

1,188

Total Stockholders' (deficit) equity

(774,156

)

1,202

Total liabilities, Redeemable preferred,

Redeemable non-controlling interests and Stockholders' (deficit)

equity

$

644,856

$

380,844

(1) Retroactively restated for the reverse capitalization upon

completion of Business Combination.

OPAL FUELS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands of

U.S. dollars, except per unit data)

Twelve Months Ended

December 31,

2022

2021

Revenues:

RNG fuel (includes revenues from related

party of $76,920 and $0 for the years ended December 31, 2022 and

2021, respectively)

$

126,830

$

70,360

Fuel station services

69,240

50,440

Renewable Power (includes revenues from

related party of $5,495 and $3,008 for the years ended December 31,

2022 and 2021, respectively)

39,461

45,324

Total revenues

235,531

166,124

Operating expenses:

Cost of sales - RNG fuel

78,953

41,075

Cost of sales - Fuel station services

61,514

42,838

Cost of sales - Renewable Power

31,580

31,152

Selling, general, and administrative

48,569

29,380

Depreciation, amortization, and

accretion

13,136

10,653

Total expenses

233,752

155,098

Operating income

1,779

11,026

Interest and financing expense, net

(6,640

)

(7,467

)

Change in fair value of derivative

instruments, net

33,081

99

Other income

1,943

—

Loss on warrant exchange

(3,368

)

—

Gain on acquisition of equity method

investment

—

19,818

Gain on deconsolidation of VIEs

—

15,025

Income from equity method investments

5,784

2,268

Income before provision for income

taxes

32,579

40,769

Provision for income taxes

—

—

Net income

32,579

40,769

Net income attributable to redeemable

non-controlling interests

22,409

41,363

Net loss attributable to non-redeemable

non-controlling interests

(1,153

)

(804

)

Paid-in-kind preferred dividends (1)

7,932

210

Net income attributable to Class A common

stockholders (2)

$

3,391

$

—

Weighted average shares outstanding of

Class A common stock :

Basic

25,774,312

—

Diluted

26,062,398

—

Per share amounts:

Basic (2)

$

0.13

$

—

Diluted (2)

$

0.12

$

—

(1) Paid-in-kind preferred dividend is allocated between

redeemable non-controlling interests and Class A common

stockholders basis their weighted average percentage of

ownership.

(2) Income per share information has not been presented for the

year ended December 31, 2021 as it would not be meaningful to the

users of these consolidated financial statements.

OPAL FUELS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS In thousands of

U.S. dollars)

Twelve Months Ended

December 31,

2022

2021

Cash flows from operating

activities:

Net income

$

32,579

$

40,769

Adjustments to reconcile net income to net

cash (used in) provided by operating activities:

Income from equity method investments

(5,784

)

(2,268

)

Loss on exchange of Warrants

3,368

—

Depreciation and amortization

13,015

10,078

Amortization of deferred financing

costs

1,943

1,085

Amortization of operating lease

right-of-use assets

770

—

Amortization of PPA liability

—

(260

)

Accretion expense related to asset

retirement obligation

121

575

Stock-based compensation

1,469

639

Provision for bad debts

499

—

Paid-in-kind interest income

(286

)

(406

)

Change in fair value of Convertible Note

Payable

413

3,300

Change in fair value of the earnout

liabilities

(37,111

)

—

Unrealized gain on derivative financial

instruments

3,867

(645

)

Gain on repayment of Note receivable

(1,943

)

—

Gain on acquisition of equity method

investment

—

(19,818

)

Gain on deconsolidation of VIEs

—

(15,025

)

Changes in operating assets and

liabilities, net of effects of businesses acquired:

Accounts receivable

(6,191

)

(2,944

)

Accounts receivable, related party

(12,421

)

—

Proceeds received on previously recorded

paid-in-kind interest income

288

—

Fuel tax credits receivable

(1,751

)

(117

)

Capital spares

(418

)

155

Parts inventory

(2,168

)

(899

)

Environmental credits held for sale

(1,288

)

159

Prepaid expense and other current

assets

(3,108

)

(2,928

)

Contract assets

(1,287

)

(2,960

)

Accounts payable

10,143

2,559

Accounts payable, related party

1,180

(1,413

)

Fuel tax credits payable

1,342

33

Accrued payroll

127

4,864

Accrued expenses

3,237

(1,483

)

Operating lease liabilities - current and

non-current

(640

)

—

Other current and non-current

liabilities

452

699

Contract liabilities

(1,772

)

5,107

Net cash (used in) provided by operating

activities

(1,355

)

18,856

Cash flows from investing

activities:

Purchase of property, plant, and

equipment

(131,410

)

(89,646

)

Cash acquired on acquisition of equity

method investment

—

1,975

Deconsolidation of VIEs, net of cash

—

(21,208

)

Cash paid for short term investments

(64,976

)

—

Capitalized interest attributable to

equity method investments

(597

)

(1,570

)

Purchase of Note receivable

—

(10,450

)

Proceeds received from repayment of Note

receivable

10,855

—

Distributions received from equity method

investment

2,100

3,695

Net cash used in investing activities

(184,028

)

(117,204

)

Cash flows from financing

activities:

Proceeds from Sunoma loan

4,593

15,679

Proceeds from OPAL Term Loan

40,000

75,000

Proceeds received from Business

Combination

138,850

—

Financing costs paid to other third

parties

(8,321

)

(3,607

)

Repayment of Senior Secured Credit

Facility

(58,603

)

(4,901

)

Repayment of Senior Secured Credit

Facility - working capital facility

—

(5,182

)

Repayment of OPAL Term Loan

(18,910

)

—

Repayment of Municipality loan

(202

)

(194

)

Repayment of Trustar Revolver Facility

—

(10,000

)

Proceeds from sale of non-redeemable

non-controlling interest, related party

23,143

38,218

Contributions from non-redeemable

non-controlling interests, related party

—

21,165

Acquisition of non-controlling

interest

—

(5,000

)

Proceeds from issuance of redeemable

preferred non-controlling interests, related party

100,000

—

Contributions from members

—

7,531

Distributions to members

—

(3,695

)

Net cash provided by financing

activities

220,550

125,014

Net increase in cash, restricted cash, and

cash equivalents

35,167

26,666

Cash, restricted cash, and cash

equivalents, beginning of period

42,054

15,388

Cash, restricted cash, and cash

equivalents, end of period

$

77,221

$

42,054

Supplemental disclosure of cash flow

information

Interest paid, net of $3,678 and $861

capitalized, respectively

$

7,013

$

4,339

Noncash investing and financing

activities:

Issuance of Convertible Note Payable

related to business acquisition, excluding paid-in-kind

interest

$

—

$

55,410

Fair value of Class A common stock issued

for redemption of Convertible Note Payable

$

30,595

$

—

Fair value of Class A common stock issued

for redemption of Public and Private warrants

$

25,919

$

—

Fair value of Derivative warrant

liabilities assumed related to Business Combination

$

13,524

$

—

Fair value of Earnout liabilities related

to Business Combination

$

45,900

$

—

Fair value of put option on a forward

purchase agreement related to Business Combination

$

4,600

$

—

Fair value of contingent consideration to

redeem the non-controlling interest included in other long-term

liabilities

$

183

$

4,456

Paid-in-kind dividend on redeemable

preferred non-controlling interests

$

7,932

$

210

Right-of-use assets for finance leases as

of January 1, 2022 included in Property, Plant and equipment,

net

$

801

$

—

Lease liabilities for finance leases as of

January 1, 2022 included in Accrued expenses and other current

liabilities

$

316

$

—

Lease liabilities for finance leases as of

January 1, 2022 included in Other long-term liabilities

$

485

$

—

Accrual for purchase of Property, plant

and equipment included in Accounts payable and Accrued capital

expenses

$

11,922

$

6,205

Accrual for deferred financing costs

included in Accrued expenses and other current liabilities

$

—

$

1,379

Non-GAAP Financial Measures (Unaudited)

To supplement the Company’s unaudited condensed consolidated

financial statements presented in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”), the Company uses a non-GAAP financial measure that it

calls adjusted EBITDA (“Adjusted EBITDA”). This non-GAAP Measure

adjusts net income for realized and unrealized gain on interest

rate swaps, net loss attributable to non-redeemable non-controlling

interests, transaction costs and one time non recurring charges,

non-cash charges, major maintenance for renewable power, unrealized

loss (gain) for derivative instruments, loss on warrant exchange,

non cash gain on reversal of a liability to non redeemable

non-controlling interests, gain on redemption of Note receivable,

environmental credits associated with renewable biogas that has

been produced and is in storage pending completion of certification

of the relevant environmental attribute pathway(s), such credits to

be monetized under a blend of forward and merchant sales contracts,

and gain on acquisition of equity method investment. Management

believes this non-GAAP measure provides meaningful supplemental

information about the Company’s performance, for the following

reasons: (1) it allows for greater transparency with respect to key

metrics used by management to assess the Company’s operating

performance and make financial and operational decisions; (2) the

measure excludes the effect of items that management believes are

not directly attributable to the Company’s core operating

performance and may obscure trends in the business; and (3) the

measure is used by institutional investors and the analyst

community to help analyze the Company’s business. In future

quarters, the Company may adjust for other expenditures, charges or

gains to present non-GAAP financial measures that the Company’s

management believes are indicative of the Company’s core operating

performance.

Non-GAAP financial measures are limited as an analytical tool

and should not be considered in isolation from, or as a substitute

for, the Company’s GAAP results. The Company expects to continue

reporting non-GAAP financial measures, adjusting for the items

described below (and/or other items that may arise in the future as

the Company’s management deems appropriate), and the Company

expects to continue to incur expenses, charges or gains like the

non-GAAP adjustments described below. Accordingly, unless expressly

stated otherwise, the exclusion of these and other similar items in

the presentation of non-GAAP financial measures should not be

construed as an inference that these costs are unusual, infrequent,

or non-recurring. Adjusted EBITDA is not a recognized term under

GAAP and does not purport to be an alternative to GAAP net income

or any other GAAP measure as an indicator of operating performance.

Moreover, because not all companies use identical measures and

calculations, the Company’s presentation of Adjusted EBITDA may not

be comparable to other similarly titled measures used by other

companies.

The following table presents the reconciliation of our Net

income to Adjusted EBITDA:

Reconciliation of GAAP Net

income to Adjusted EBITDA For the Three and Nine Months

Ended December 31, 2022 and 2021 (In thousands of

dollars)

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

2021

2022

2021

Net income

$

32,019

$

21,819

$

32,579

$

40,769

Adjustments to reconcile net income to

Adjusted EBITDA

Interest and financing expense, net

(544

)

1,808

6,640

7,467

Net loss attributable to non-redeemable

non-controlling interests

329

390

1,153

804

Depreciation, amortization and accretion

(1)

4,046

3,981

15,125

11,713

Unrealized loss on derivative instruments

(2)

(30,559

)

89

(32,569

)

2,923

Loss on warrant exchange

3,368

—

3,368

—

Non-cash charges (3)

1,566

160

3,160

639

Transaction costs and one time

non-recurring charges (4)

10,057

3,412

20,558

5,191

Major maintenance for Renewable Power

43

1,190

4,701

5,946

Gain on repayment of Note receivable

(5)

—

—

(1,398

)

—

Gas in storage (6)

(171

)

—

7,427

—

Gain on deconsolidation of entities

—

(15,025

)

—

(15,025

)

Gain on acquisition of equity method

investments

—

—

—

(19,818

)

Adjusted EBITDA

$

20,154

$

17,824

$

60,744

$

40,609

(1) Includes depreciation, amortization and accretion on equity

method investments.

(2) Unrealized loss on derivative instruments includes change in

fair value of interest rate swaps, commodity swaps, earnout

liabilities, warrant liabilities, contingent liability to

non-controlling interest and put option on a forward purchase

agreement.

(3) Non-cash charges includes stock based compensation expense,

certain expenses included in selling, general and administrative

expenses relating to employee benefit accruals, inventory write

down charges included in cost of sales - RNG fuel and loss on

disposal of assets.

(4) Transaction costs relate to consulting and professional fees

incurred in connection with the Business Combination that could not

be capitalized per GAAP. One time non-recurring charges include

certain expenses related to development expenses on our RNG

facilities such as lease expenses incurred during construction

phase that could not be capitalized per GAAP and shutdown costs on

two of our Renewable Power facilities.

(5) Gain on repayment of Note receivable excludes $0.5 million

of prepayment penalty received in cash.

(6) Represents stored biogas anticipated to generate RINs and

LCFSs upon completion of certification. These RINs will be

monetized under a blend of forward and merchant sales

contracts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230327005653/en/

Media Jason Stewart Senior Director Public Relations

& Marketing 914-421-5336 jstewart@opalfuels.com

ICR, Inc. OPALFuelsPR@icrinc.com

Investors Todd Firestone Vice President Investor

Relations & Corporate Development 914-705-4001

investors@opalfuels.com

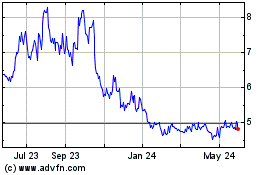

OPAL Fuels (NASDAQ:OPAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

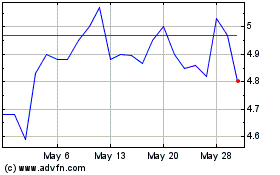

OPAL Fuels (NASDAQ:OPAL)

Historical Stock Chart

From Jan 2024 to Jan 2025