0001293818

false

0001293818

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

August

10, 2023

Date of Report (date of earliest event reported)

_________________

OpGen, Inc.

(Exact name of Registrant as specified in its charter)

_________________

|

Delaware

(State or other jurisdiction of incorporation or

organization) |

|

001-37367

(Commission

File Number) |

|

06-1614015

(I.R.S. Employer

Identification Number) |

9717

Key West Ave, Suite 100

Rockville, MD

20850

(Address of principal executive offices)(Zip code)

(240) 813-1260

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_________________

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

OPGN |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 10, 2023, OpGen, Inc. (the “Company”) issued a press

release announcing its second quarter financial results for the quarter ended June 30, 2023. The full text of such press release is furnished

as Exhibit 99.1 to this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The information included in Item 2.02 herein and in Exhibit 99.1

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

|

|

|

| Date: August 10,

2023 |

|

OpGen, Inc. |

| |

|

|

|

| |

|

By: |

|

/s/ Albert Weber |

| |

|

|

|

Name: |

|

Albert Weber |

| |

|

|

|

Title: |

|

Chief

Financial Officer |

Exhibit 99.1

OpGen Reports Second Quarter 2023 Financial

Results and Provides Business Update

| · | Total revenue for the first half of 2023 was approximately $1.65 million, an increase of approximately 15% compared to approximately

$1.44 million in the first half of 2022 |

| · | Signed FIND R&D collaboration contract extension |

| · | Entered distribution agreement with Fisher Healthcare for the distribution of the Unyvero A50 platform in the U.S. |

| · | Management conference call is scheduled for August 10, 2023, at 4:30 p.m. ET |

ROCKVILLE, Md., August 10, 2023 (GLOBE NEWSWIRE)

– OpGen, Inc. (Nasdaq: OPGN, “OpGen” or “the Company”), a precision medicine company harnessing the power

of molecular diagnostics and bioinformatics to help combat infectious disease, reported its second quarter and first half of 2023 financial

and operating results. Management will host an investor call to discuss quarterly results and provide a business update.

Second Quarter 2023 and First Half 2023 Financial Results of

OpGen, Inc.

| · | Total revenue for the second quarter of 2023 was approximately $0.7 million compared to the company’s

revenue of approximately $1.0 million in the second quarter of 2022, which was primarily driven by the one-time sale of a pool of Unyvero

instrument systems to Menarini in Q2-2022. Total revenue for the first half of 2023 was approximately $1.65 million, an increase of approximately

15% compared to the company’s revenue of approximately $1.44 million in the first half of 2022. |

| · | Total operating expenses decreased in the second quarter of 2023 to approximately $5.9 million compared

to approximately $6.2 million for the second quarter of 2022. Total operating expenses decreased by approximately 6% in the first half

of 2023 to approximately $11.9 million compared to approximately $12.6 million for the same period in 2022. |

| · | Cash and cash equivalents were approximately $3.2 million as of June 30, 2023, compared with approximately

$7.4 million as of December 31, 2022. |

As previously reported, and in light of

the Company’s business performance and current cash position, the Company does not expect that its current cash will be sufficient

to fund operations beyond September 2023. Since the end of the second quarter, the Company has pursued options to improve its cash position

or mitigate a liquidity shortfall. Nevertheless, the Company has concluded that there is substantial doubt about the Company’s ability

to continue as a going concern. The Company continues to consider all alternatives, including restructuring or refinancing its debt, seeking

additional debt or equity capital, reducing or delaying the Company’s business activities, selling assets, and other strategic transactions

or other measures, including obtaining relief under U.S. as well as applicable foreign bankruptcy laws. There is no guarantee that the

Company will be able to identify and execute on any of these alternatives or that any of them will be successful.

In the reporting quarter and year to date,

the Company reached the following key milestones:

| · | OpGen subsidiary, Curetis, and FIND signed an extension to their R&D collaboration agreement for the development of an AMR panel

on the Unyvero A30 RQ platform for low- and middle-income countries. This next phase covers full development of AMR assay and cartridge,

analytical testing and software development. |

| · | Curetis successfully completed the first phase of its FIND collaboration, including the expanded scope

of the FIND project in Q1 and Q2, respectively. The FIND collaboration contributed $609 thousand to first half 2023 revenue. |

| · | In June 2023, OpGen received ten Unyvero A30 C-Series instruments which will be used in the next phase

of the FIND collaboration. |

| · | Curetis announced the completion of two interim milestones of its collaboration project with InfectoGnostics

under the PREPLEX grant. |

| · | The Company submitted a De Novo classification request to the FDA for marketing authorization of

the Unyvero Urinary Tract Infection (UTI) panel. Following the FDA’s substantive review of the Company’s submission, the Company

received a formal communication from the FDA requesting certain additional information on June 30, 2023. The FDA has provided OpGen with

180 days to fully respond to their requests. |

| · | OpGen entered into a distribution agreement with Fisher Healthcare, a division of Thermo Fisher Scientific,

for the distribution of the Unyvero A50 platform and in vitro diagnostic tests for pneumonia and urinary tract infections in the

U.S. During the second quarter and year-to-date, the Company successfully completed vendor set-up of OpGen under Fisher Healthcare’s

systems, trained the Fisher Healthcare sales teams across the U.S., created digital marketing campaigns, and identified several hundred

potential high priority leads with the Fisher Healthcare team. In several territories, the teams are already working towards commercial

customer contract opportunities. |

| · | With the assistance of a U.S.-Chinese strategic advisory firm, OpGen continues to have an active strategic

corporate business development campaign to over 40 Chinese corporate IVD companies potentially interested in the Unyvero A30 RQ. |

| · | Following a successful feasibility assessment, the Ares

team recently signed an annual genomic surveillance contract with a major U.S. healthcare network to sequence and analyze pathogen isolates

on a twice weekly basis. In addition, the team has signed multiple new ARESiss contracts for isolate sequencing and new AREScloud subscriptions

for web-based sequence analysis. |

| · | On the IP front, OpGen’s subsidiary, Ares Genetics, successfully defended a key patent that was

being contested in Europe. In the ruling, the European Patent Office ruled in favor of maintaining the patent, which broadly covers the

prediction of AMR in pathogens based on any genetic determinants involving two or more nucleotides. |

| · | Ares recently announced a new feature release for its AREScloud software designed to enhance genomic surveillance.

These features include a Single Nucleotide Polymorphism (SNP) analysis module and interpretation of plasmids with reporting customized

for the needs of hospital epidemiologists. |

Conference Call Information

OpGen’s management will host a conference

call today, August 10, 2023 at 4:30 p.m. ET, to review the second quarter 2023 financial results and business activities, but will not

be taking any questions.

Conference Call Details

U.S. Dial-in Number: 1-877-704-4453

International Dial-in Number: 1-201-389-0920

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1618010&tp_key=fc7c8907d6

Following the conclusion of the conference

call, a replay will be available through August 24, 2023. The live, listen-only webcast of the conference call may also be accessed by

visiting the Investors section of the Company’s website at www.opgen.com. A replay of the webcast

will be available following the conclusion of the call and will be archived on the Company’s website under Financials & Filings.

Replay Details

U.S. Dial-in Number: 1-844-512-2921

International Dial-in Number: 1-412-317-6671

Replay PIN: 13739109

About OpGen, Inc.

OpGen, Inc. (Rockville, Md., U.S.A.) is a precision

medicine company harnessing the power of molecular diagnostics and bioinformatics to help combat infectious disease. Along with our subsidiaries,

Curetis GmbH and Ares Genetics GmbH, we are developing and commercializing molecular microbiology solutions helping to guide clinicians

with more rapid and actionable information about life threatening infections to improve patient outcomes, and decrease the spread of infections

caused by multidrug-resistant microorganisms, or MDROs. OpGen’s current product portfolio includes Unyvero, Acuitas AMR Gene Panel,

and the ARES Technology Platform including ARESdb, NGS technology and AI-powered bioinformatics solutions for antibiotic response prediction

including ARESiss, ARESid, ARESasp, and AREScloud.

For more information, please visit www.opgen.com

Forward-Looking Statements

This press release includes statements regarding

the second quarter 2023 and the current business of OpGen. These statements and other statements regarding OpGen’s future plans

and goals constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and are intended to qualify for the safe harbor from liability established by the Private Securities

Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties that are often difficult to predict, are beyond

our control, and which may cause results to differ materially from expectations. Factors that could cause our results to differ materially

from those described include, but are not limited to, our ability to continue to finance our business and operations, the result of any

alternatives to mitigate the Company’s cash position, including restructuring or refinancing of our debt, seeking additional debt

or equity capital, reducing or delaying our business activities, selling assets, other strategic transactions or other measures, including

obtaining relief under U.S. bankruptcy laws, and the terms, value and timing of any transaction resulting from such alternatives, our

ability to satisfy debt obligations under our loan with the European Investment Bank, and our liquidity and working capital requirements.

For a discussion of the most significant risks and uncertainties associated with OpGen's business, please review our filings with the

Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which are based

on our expectations as of the date of this press release and speak only as of the date of this press release. We undertake no obligation

to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

OpGen:

Oliver Schacht

President and CEO

InvestorRelations@opgen.com

OpGen

Investor & Press Contact:

Alyssa Factor

Edison Group

afactor@edisongroup.com

| OpGen, Inc. |

| Consolidated Balance Sheets |

| (unaudited) |

| | |

| | |

| |

| | |

| June 30, 2023 | | |

| December 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,237,176 | | |

$ | 7,440,030 | |

| Accounts receivable, net | |

| 619,575 | | |

| 514,372 | |

| Inventory, net | |

| 1,735,122 | | |

| 1,345,137 | |

| Prepaid expenses and other current assets | |

| 1,637,593 | | |

| 1,355,949 | |

| Total current assets | |

| 7,229,466 | | |

| 10,655,488 | |

| Property and equipment, net | |

| 3,849,734 | | |

| 3,457,531 | |

| Finance lease right-of-use assets, net | |

| 1,833 | | |

| 3,500 | |

| Operating lease right-of-use assets | |

| 2,041,010 | | |

| 1,459,413 | |

| Intangible assets, net | |

| 7,206,382 | | |

| 7,440,974 | |

| Strategic inventory | |

| 1,609,643 | | |

| 2,300,614 | |

| Other noncurrent assets | |

| 496,894 | | |

| 495,629 | |

| Total assets | |

$ | 22,434,962 | | |

$ | 25,813,149 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Current maturities of long-term debt | |

$ | 9,191,151 | | |

$ | 7,023,901 | |

| Accounts payable | |

| 195,253 | | |

| 420,821 | |

| Accrued compensation and benefits | |

| 1,439,181 | | |

| 1,097,654 | |

| Accrued liabilities | |

| 1,043,123 | | |

| 1,526,204 | |

| Deferred revenue | |

| 27,279 | | |

| 142,061 | |

| Short-term finance lease liabilities | |

| 1,962 | | |

| 3,364 | |

| Short-term operating lease liabilities | |

| 517,602 | | |

| 377,626 | |

| Total current liabilities | |

| 12,415,551 | | |

| 10,591,631 | |

| Long-term debt, net | |

| — | | |

| 4,850,686 | |

| Derivative liabilities | |

| 45,656 | | |

| 99,498 | |

| Long-term finance lease liabilities | |

| — | | |

| 280 | |

| Long-term operating lease liabilities | |

| 2,987,194 | | |

| 2,566,138 | |

| Other long-term liabilities | |

| 126,671 | | |

| 129,368 | |

| Total liabilities | |

| 15,575,072 | | |

| 18,237,601 | |

| Stockholders' equity | |

| | | |

| | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized; none issued and

outstanding at June 30, 2023 and December 31, 2022, respectively | |

| — | | |

| — | |

Common stock, $0.01 par value; 100,000,000 shares authorized; 6,967,699 and

2,899,911 shares issued and outstanding at June 30, 2023 and

December 31, 2022, respectively | |

| 69,677 | | |

| 28,999 | |

| Additional paid-in capital | |

| 291,935,388 | | |

| 281,167,161 | |

| Accumulated deficit | |

| (284,388,698 | ) | |

| (272,824,772 | ) |

| Accumulated other comprehensive loss | |

| (756,477 | ) | |

| (795,840 | ) |

| Total stockholders’ equity | |

| 6,859,890 | | |

| 7,575,548 | |

| Total liabilities and stockholders’ equity | |

$ | 22,434,962 | | |

$ | 25,813,149 | |

| | |

| | | |

| | |

OpGen, Inc. |

| Consolidated Statements of Operations and Comprehensive Loss |

| (unaudited) |

| | |

| | |

| | |

| | |

| |

| | |

Three months ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

| | |

| | |

| | |

| |

| Product sales | |

$ | 439,672 | | |

$ | 889,271 | | |

$ | 850,569 | | |

$ | 1,255,323 | |

| Laboratory services | |

| 44,003 | | |

| 20,570 | | |

| 65,676 | | |

| 63,499 | |

| Collaboration revenue | |

| 252,462 | | |

| 57,364 | | |

| 733,336 | | |

| 118,128 | |

| Total revenue | |

| 736,137 | | |

| 967,205 | | |

| 1,649,581 | | |

| 1,436,950 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of products sold | |

| 714,392 | | |

| 646,389 | | |

| 1,306,770 | | |

| 938,386 | |

| Cost of services | |

| 204,102 | | |

| 15,650 | | |

| 332,408 | | |

| 46,212 | |

| Research and development | |

| 1,388,792 | | |

| 2,273,756 | | |

| 3,201,624 | | |

| 4,590,197 | |

| General and administrative | |

| 2,425,007 | | |

| 2,134,266 | | |

| 4,848,960 | | |

| 4,759,319 | |

| Sales and marketing | |

| 1,160,200 | | |

| 1,169,349 | | |

| 2,186,287 | | |

| 2,220,781 | |

| Total operating expenses | |

| 5,892,493 | | |

| 6,239,410 | | |

| 11,876,049 | | |

| 12,554,895 | |

| Operating loss | |

| (5,156,356 | ) | |

| (5,272,205 | ) | |

| (10,226,468 | ) | |

| (11,117,945 | ) |

| Other (expense) income | |

| | | |

| | | |

| | | |

| | |

| Interest and other income | |

| 31,215 | | |

| 13,851 | | |

| 61,323 | | |

| 16,972 | |

| Interest expense | |

| (684,498 | ) | |

| (779,912 | ) | |

| (1,301,796 | ) | |

| (2,049,493 | ) |

| Foreign currency transaction (losses) gains | |

| (60,401 | ) | |

| 271,967 | | |

| (152,396 | ) | |

| 470,707 | |

| Change in fair value of derivative financial instruments | |

| 42,717 | | |

| (74,116 | ) | |

| 55,411 | | |

| 35,628 | |

| Total other expense | |

| (670,967 | ) | |

| (568,210 | ) | |

| (1,337,458 | ) | |

| (1,526,186 | ) |

| Loss before income taxes | |

| (5,827,323 | ) | |

| (5,840,415 | ) | |

| (11,563,926 | ) | |

| (12,644,131 | ) |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| Net loss | |

$ | (5,827,323 | ) | |

$ | (5,840,415 | ) | |

$ | (11,563,926 | ) | |

$ | (12,644,131 | ) |

| Net loss available to common stockholders | |

$ | (5,827,323 | ) | |

$ | (5,840,415 | ) | |

$ | (11,563,926 | ) | |

$ | (12,644,131 | ) |

| Net loss per common share - basic and diluted | |

$ | (0.93 | ) | |

$ | (2.51 | ) | |

$ | (2.13 | ) | |

$ | (5.43 | ) |

| Weighted average shares outstanding - basic and diluted | |

| 6,246,326 | | |

| 2,328,725 | | |

| 5,424,542 | | |

| 2,326,485 | |

| Net loss | |

$ | (5,827,323 | ) | |

$ | (5,840,415 | ) | |

$ | (11,563,926 | ) | |

$ | (12,644,131 | ) |

| Other comprehensive (loss) income - foreign currency translation | |

| (113,704 | ) | |

| (1,227,142 | ) | |

| 39,363 | | |

| (1,710,991 | ) |

| Comprehensive loss | |

$ | (5,941,027 | ) | |

$ | (7,067,557 | ) | |

$ | (11,524,563 | ) | |

$ | (14,355,122 | ) |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

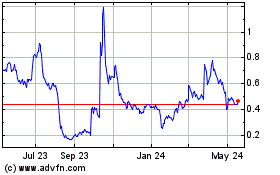

OpGen (NASDAQ:OPGN)

Historical Stock Chart

From Apr 2024 to May 2024

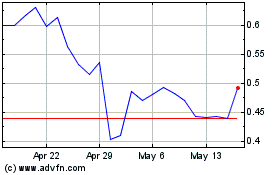

OpGen (NASDAQ:OPGN)

Historical Stock Chart

From May 2023 to May 2024