OptimumBank Holdings, Inc. (NASDAQ: OPHC) Similar to my comments at

last year’s Annual Shareholder meeting, I want to focus today on

our past year’s results and discuss our expectations for the

remainder of 2023. 2022 was a great year for us, as we had a full

year of normalized results. There was barely any income from any

one-time events, and we saw our net income pre-tax and

pre-allowance jump over 74%. We will discuss earnings later, but

our story today is still all about growth. The growth in 2023 is a

slower growth as we have managed to hold our loan pricing to a

spread over SOFR which brings us to over a 3.5% NIM on current

deposit pricing. I, for one, am in favor of slowing growth during

this strange time in the world with interest rates being as high as

they are. For years, the Company was constrained as to what we were

allowed to do because of circumstances that preceded any of our

current management or board members. Today I feel we are doing

great and now we begin the next phase in the evolution of our bank.

I am fortunate to have an excellent team with me on the board of

directors and I take seriously the responsibility of being their

chairman.

Our singular goal is to provide shareholder

returns and we are poised to continue in 2023 the way we ended

2022. As we have evolved over the last few years, we have seen our

near-term goals come into focus. We expect that by the end of 2024,

meaning over the next 18 months, we will open two new branches in

the Miami area. Those two branches will solidify our foothold with

smaller businesses, and we anticipate many of our current borrowers

will transfer the rest of their banking relationships to us. In the

past six months, we have seen the market lose faith in a few

banking institutions, but our customers have shown their support

and helped grow our deposits 74% from year end 2021 to year end

2022. So far in 2023 we have grown deposits by an additional 3.8%.

Fortunately for our customers, at the of 2022, the Bank added ICS,

which provides unlimited insurance for our deposits over $250K at

our cost. I would also note that our securities portfolio is

completely marked to market, and we have no securities with built

in losses sitting inside a held to maturity figure.

We continue to improve our online banking, as we

believe the future lies in the online platform and to a lesser

extent in the bricks and mortar locations. We continue to work

towards online account opening and hope to finally get that

accomplished soon. We also expect our website users to be able to

select various language options to better attract foreigners doing

business in America. Lastly, we imminently expect to offer our

customers peer-to-peer money transfer services which will allow

individuals to send and receive money with each other through

connected bank accounts through Zelle®.

In the last few years, we grew our SNF Accounts

Receivable lending program to now include a dedicated lender and

underwriter to be able to continue the growth in that segment of

our loan portfolio. We felt as a board, with Michael and I being on

the board and being heavily involved in the healthcare space, that

we should start a lending platform for healthcare providers needing

financing for government receivables. We expect the size of that

segment of the loan portfolio to increase to $40MM by the end of

2023.

Previously, I said that I appreciated the

confidence you have in me to lead our Board and help OptimumBank

Holdings, Inc. in reaching our singular goal of bringing

shareholder returns, while safeguarding the Company’s equity. 2022

was our best year and we reached a core profitability of almost

$5.4MM without adding back provision. The consolidated net income

after provision and income tax expense was $4,023,000. The

provision for loan loss in 2022 was $3,466,000 as compared to

$1,173,000 in 2021. The reason for the extraordinary high provision

is from our extraordinary loan growth. I would note that other than

bad debt from our consumer lending, we have not had a single dollar

of loan loss in the prior few years. If you add back the provision

and tax, we made in 2022 over $8.8MM and we expect that number to

grow slightly to break $9MM. So far in 2023, our first quarter

pre-tax income is over $1,546,000 after a loan loss provision of

$726,000. In addition, we are fully allowanced. In fact, we have a

higher percentage in our allowance than many of our peers, yet we

have a lower bad debt as previously mentioned.

Our total loans have grown from $247MM at the

end of 2021 to $477MM at the end of 2022. That is a 93% growth

rate, and I am sure that we are doing better than our fellow banks

in Florida. As of March 31, 2023, our loan portfolio was at $496MM,

which is a growth rate of more than 81% year over year. Our secret

sauce lies in the fact that our customers all have long term

relationships with people at the bank, the bank itself or board

members. We are currently closing loans for borrowers that were

referred by borrowers who were referred by borrowers before them.

We currently spend little in annual marketing fees as it is not

needed. Nevertheless, we have added an employee for investor

relations and also to help with moving our bank into the social

media space to attract outside customers that typically would not

have banked with us. We expect that as our lending limits increase,

we will be able to keep lending to our base and future

referrals.

In 2022, net interest income increased by

$6,432,000 or 68% over 2021. In totality, net interest income in

2022 was $15,836,000, and we are anticipating that number to be

over $20MM in 2023. At December 31, 2022, total assets amounted to

approximately $585MM, as compared to $351MM for the prior year,

which represents a growth of $233MM or 66%. At March 31, 2023, we

reached $622MM and expect to surpass $750MM before the end of the

year. The increase in total assets during 2022 was mainly driven by

a growth of $229MM in loans and $13MM in cash, cash equivalents and

investments. For the period ended March 31, 2023, we continued

growing our loan portfolio by $19MM. In order to fund the growth,

the Bank undertook a significant program of increasing non-maturity

deposits such as checking accounts and money market accounts. From

the end of the year 2021 until the end of the year 2022, we grew by

74% or $292MM, which put us at $508MM. At March 31, 2022, deposits

have grown to over $527MM. I am personally excited by how our

depositor base has stood behind our bank. We do not have a single

customer that has more than 5% of our deposits, but rather we have

many smaller loyal customers banking with us. I, in fact, know many

of our customers, and I am able to call them friends.

In 2022, our equity rose to $62.5MM from $38.5MM

at year end 2021 after accumulated other comprehensive losses. We

did this by selling a $20MM mixture of common and preferred stock,

while the rest came from net income. We expect that by the end of

2024, we will do an equity offering to the public, which we will

change our balance sheet as well as our public profile. We expect

that the next infusion of capital will bolster our market cap and

improve our float and stock price to the public. We want to get to

a billion dollars in assets and to do that we need over $100MM of

equity. At this point, capital is not an obstacle to the Company’s

growth. As has been noted in the past, the Company and the Bank are

fortunate to enjoy a broad-based Boards of Directors with access to

capital.

Based on 7,058,897 shares outstanding at

December 31, 2022, we had an Earnings Per Share (EPS) of 68 cents.

As of March 31, 2023, with the same common shares outstanding, we

have an EPS of 16 cents. I would note that the equity came in at

the end of the year and these results do not reflect the money

being put out to use as of yet. We expect ending the year with an

EPS of approximately 68 cents.

As many of you shareholders know, I am CEO and

Chairman of a different company named Strawberry Fields REIT. The

reason I bring this up is because Strawberry has taught me many

things. One of the things I have learned and have begun to

integrate is the managing of the stock price. I learned that I have

not succeeded the way I should have succeeded for the shareholders

of OPHC. I am by nature programmed to work on fundamentals, and

when I became involved in our bank, we focused on fundamentals. In

2010. when I joined the bank board, we were bleeding money. We

fixed that and in the last five years we have gone from losing

$589k in 2017 to making over $4MM in 2022. We have gone from $62MM

of deposits in 2017 to $507MM in 2022. Our loans went from $68MM in

2017 to $477MM in 2022. Lastly, our assets grew from $68MM in 2017

to $585MM in 2022. I realize of course because of the experience

with STRW that now we need to finally attract the institutions. We

also need to get analyst coverage of our stock. Lastly, we need to

create that relationship with the investor public so that we could

raise equity from outside the current board of directors.

In conclusion, my comments are similar to

previous years comments. It’s been a few years since we created a

Strategic Plan which provided the roadmap for growing our bank.

Since that time as stated earlier, we have grown our assets,

deposits, loan portfolio as well as our net interest income, fee

service income and lastly, net income growth. We believe we are

doing great so as we go forward, we will continue doing what we are

doing. As we succeed, we will keep pushing the goals further out so

that we can improve on our results and truly succeed in bringing

returns to all of our shareholders.

We will continue working hard and expect great

things to happen in the future.

Thank you,

Moishe Gubin, Chairman

About

OptimumBank Holdings, Inc.

OptimumBank Holdings, Inc. operates as the bank

holding company for OptimumBank that provides a range of consumer

and commercial banking services to individuals and businesses. The

company accepts demand interest-bearing and noninterest-bearing,

savings, money market, NOW, and time deposit accounts, as well as

certificates of deposit; and offers residential and commercial real

estate, commercial, and consumer loans, as well as lending lines

for working capital needs. It also provides debit and ATM cards;

investment, cash management, and notary and night depository

services; and direct deposits, money orders, cashier's checks,

domestic collections, drive-in tellers, and banking by mail, as

well as Internet banking services. In addition, the company engages

in holding, managing, and disposing foreclosed real estate. It

operates through banking offices located in Broward County,

Florida. OptimumBank Holdings, Inc. was founded in 2000 and is

based in Fort Lauderdale, Florida.

Investor Relations:OptimumBank Holdings.

Inc.investor@optimumbank.com +1.954.900.2850

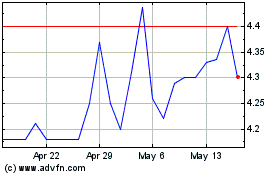

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Feb 2025 to Mar 2025

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Mar 2024 to Mar 2025