false

0001448431

0001448431

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

August 8, 2024

OptimizeRx Corporation

(Exact name of registrant as specified in charter)

| Nevada |

|

001-38543 |

|

26-1265381 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 260 Charles Street, Suite 302, Waltham, MA |

|

02453 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 248.651.6568

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 Par Value |

|

OPRX |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On August 8, 2024, OptimizeRx Corporation issued

a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished

with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 and Exhibit

99.1 attached hereto are furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information

be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly

set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

OPTIMIZERX CORPORATION |

| |

|

|

| Date: August 8, 2024 |

By: |

/s/ Edward Stelmakh |

| |

Name: |

Edward Stelmakh |

| |

Title: |

Chief Financial Officer |

2

Exhibit

99.1

OptimizeRx

Reports Second Quarter 2024 Financial Results

- Q2 revenue of $18.8 million, increasing 36% year-over-year

- Q2 gross profit increased 50% year-over-year to $11.7 million with a gross margin of 62%

- Won 8 DAAP deals during Q2

WALTHAM,

Mass. – August 8, 2024 – OptimizeRx Corp. (the “Company”) (Nasdaq: OPRX), the leading provider of healthcare

technology solutions helping life sciences companies reach and engage healthcare professionals (HCPs) and patients, reported results

for the three months ended June 30, 2024. Quarterly comparisons are to the same year-ago period.

Financial

Highlights

| ● | Revenue

in the second quarter of 2024 increased 36% to $18.8 million, as compared to $13.8 million in the same year ago period. |

| ● | Gross

profit in the second quarter of 2024 increased 50% year-over-year to $11.7 million, from $7.8 million during the second quarter of 2023. |

| ● | GAAP

net loss totaled $(4.0) million or $(0.22) per basic and diluted share in the second quarter, as compared to $(4.1) million or $(0.24)

during the second quarter of 2023. |

| ● | Non-GAAP

net income in the second quarter totaled $0.3 million, or $0.02 per diluted share, as compared to non-GAAP net loss of $(0.2) million

or $(0.01) per diluted share during the second quarter of 2023 (see definition of these non-GAAP measures and reconciliation to GAAP

below). |

| ● | Adjusted

EBITDA for the second quarter of 2024 came in at $0.5 million compared to $(0.8) million in the same year ago period (see definition

of this non-GAAP measure and reconciliation to GAAP below). |

| ● | Cash,

cash equivalents and short-term investments totaled $15.0 million as of June 30, 2024 as compared to $13.9 million as of December 31,

2023. |

Will

Febbo, OptimizeRx CEO commented, “In the second quarter, revenue came in short of our expectations and consensus midpoint while

adjusted EBITDA came in above consensus. This was primarily a result of a timing issue with closing one of our largest DAAP deals. We

are having success in converting our DAAP pipeline into closed deals; however, because DAAP is a new, innovative solution in the market,

there are additional approvals at the pharma customer level required to close out all the items that would allow us to take the revenue

in the quarter. To be more specific, one of our long-standing customers committed to moving forward with an approximately $6 million

multi-brand DAAP program that was due to launch in the second quarter of 2024 and got slightly delayed in their internal approval process.

Without this delay, I believe we would have exceeded consensus expectations both on the top and bottom lines.”

“In

the meantime, we’ve observed a significant distinction among our top 3 pharma clients, with an average revenue per client at

approximately $9.7 million, compared to an average revenue of $2.7 million for our top 20 pharma clients. This highlights the value

our top clients see in our DAAP solutions, as they continue to allocate larger portions of their commercial budgets to OptimizeRx.

The strong performance with our top 3 customers signals robust market adoption of our evolving solutions, which we are leveraging

across other accounts.”

| Key Performance Indicators (KPIs)* | |

Rolling Twelve Months Ended 6/30/2024 | | |

Rolling Twelve Months Ended 6/30/2023 | |

| | |

(in thousands, except percentages) | |

| Average revenue per top 20 pharmaceutical manufacturer | |

$ | 2,699 | | |

$ | 1,804 | |

| Percent of top 20 pharmaceutical manufacturers that are customers | |

| 100 | % | |

| 100 | % |

| Top 20 pharmaceutical manufacturers as percent of total net revenues | |

| 65 | % | |

| 59 | % |

| Net revenue retention | |

| 124 | % | |

| 89 | % |

| Revenue per averages full-time employee (FTE) | |

$ | 658 | | |

$ | 565 | |

2024

Financial Outlook

For

the full year 2024, the Company is reiterating its 2024 guidance and expects revenue to be at least $100 million with an Adjusted EBITDA

of at least $11 million.

Conference

Call

Date: Thursday,

August 8, 2024

Time: 4:30

p.m. Eastern Time (1:30 p.m. Pacific Time)

Toll

Free: 1-800-343-4849

International: 1-203-518-9848

Conference

ID: “OPRXQ2”

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1679004&tp_key=4b22d66114

Definition

and Use of Non-GAAP Financial Measures

This

earnings release includes a presentation of non-GAAP net loss and non-GAAP net loss per diluted share or non-GAAP EPS, and Adjusted EBITDA,

all of which are non-GAAP financial measures.

The

Company defines non-GAAP net loss as GAAP net loss with an adjustment, as applicable, to add back depreciation, amortization, amortization

of debt issuance costs, stock-based compensation, acquisition expenses, severance expenses, income or loss related to the fair value

of contingent consideration, gain or loss from the disposal of a business, asset impairment charges, other income (loss), and deferred

income taxes. Non-GAAP EPS is defined as non-GAAP net loss divided by the number of weighted average shares outstanding on a diluted

basis. Adjusted EBITDA is defined as GAAP net loss with an adjustment, as applicable, to add back depreciation, amortization, interest,

stock-based compensation, acquisition expenses, severance expenses, income or loss related to the fair value of contingent consideration,

gain or loss from the disposal of a business, asset impairment charges, other income (loss), and deferred income taxes. The Company has

provided non-GAAP financial measures to aid investors in better understanding its performance. Management believes that these non-GAAP

financial measures provide additional insight into the operations and cash flow of the Company.

Because

of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact a Company’s

non-cash operating expenses, management believes that providing non-GAAP financial measures that exclude non-cash expenses allows for

meaningful comparisons between the Company’s business operating results and those of other companies, as well as provides an important

tool for financial and operational decision making and for evaluating the Company’s business operating results over different periods

of time.

The

Company’s non-GAAP financial measures may not provide information that is directly comparable to that provided by other companies

in the Company’s industry, as other companies in the industry may calculate such non-GAAP financial results differently. The Company’s

non-GAAP net loss, non-GAAP EPS and Adjusted EBITDA are not measurements of financial performance under GAAP and should not be considered

as an alternative to operating income or as an indication of operating performance or any other measure of performance derived in accordance

with GAAP. The Company does not consider these non-GAAP measures to be substitutes for or superior to the information provided by its

GAAP financial results.

The

table, “Reconciliation of Non-GAAP to GAAP Financial Measures,” included below, provides a reconciliation of Non-GAAP net

(loss), Non-GAAP EPS and Adjusted EBITDA for the three and six months ended June 30, 2024 and 2023. Although the Company provides

guidance for Adjusted EBITDA, it is not able to provide guidance to the most directly comparable GAAP measures. Reconciliations for forward-looking

figures would require unreasonable efforts at this time because of the uncertainty and variability of the nature and amount of certain

components of various necessary GAAP components, including, for example, those related to compensation, acquisition expenses, amortization

or others that may arise during the year, and the Company’s management believes such reconciliations would imply a degree of precision

that would be confusing or misleading to investors. For the same reasons, the Company is unable to address the probable significance

of the unavailable information.

Definition

of Key Performance Indicators*

Top

20 pharmaceutical manufacturers: We have updated the definition of “top 20 pharmaceutical manufacturers” in our key performance

indicators to be based upon Fierce Pharma’s most updated list of “The top 20 pharma companies by 2023 revenue”. We

previously used “The top 20 pharma companies by 2022 revenue”. As a result of this change, prior periods have been restated

for comparative purposes.

Net

revenue retention: Net revenue retention is a comparison of revenue generated from all clients in the previous period to total revenue

generated from the same clients in the following year (i.e., excludes new client relationships for the most recent year).

Revenue

per average Full Time Employee: We define revenue per average full-time employee (FTE) as total revenue over the last 12 months (LTM)

divided by the average number of employees over the LTM, which is calculated by taking our total number of FTEs at the end of the prior

year period by our total FTE headcount at the end of the most recent.

About

OptimizeRx

OptimizeRx

provides best-in-class health technology that enables care-focused engagement between life sciences organizations, healthcare providers,

and patients at critical junctures throughout the patient care journey. Connecting over 2 million U.S. healthcare providers and millions

of their patients through an intelligent technology platform embedded within a proprietary digital point-of-care network, as well as

mass digital communication channels, OptimizeRx helps life sciences organizations engage and support their customers.

For

more information, follow the Company on Twitter, LinkedIn or visit www.optimizerx.com.

Important

Cautions Regarding Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such

as “anticipates”, “believes”, “estimates”, “expects”, “forecasts”, “intends”,

“plans”, “projects”, “targets”, “designed”, “could”, “may”, “should”,

“will” or other similar words and expressions are intended to identify these forward-looking statements. All statements that

reflect the Company’s expectations, assumptions, projections, beliefs or opinions about the future, other than statements of historical

fact, are forward-looking statements, including, without limitation, statements relating to the Company’s growth, business plans,

future performance. These forward-looking statements are based on the Company’s current expectations and assumptions regarding

the Company’s business, the economy, and other future conditions. The Company disclaims any intention or obligation to publicly

update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except as required

by applicable law. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted, or

quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward-looking

statements. The risks and uncertainties to which forward-looking statements are subject include, but are not limited to, the effect of

government regulation, seasonal trends, our ability to maintain our contracts with electronic prescription platforms, competition, and

other risks summarized in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, its subsequent

Quarterly Reports on Form 10-Q, and its other filings with the Securities and Exchange Commission.

OptimizeRx

Contact

Andy

D’Silva, SVP Corporate Finance

adsilva@optimizerx.com

Investor

Relations Contact

Ashley

Robinson

LifeSci

Advisors, LLC

arr@lifesciadvisors.com

OPTIMIZERX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands except share and per share data)

(UNAUDITED)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 14,959 | | |

$ | 13,852 | |

| Accounts receivable, net | |

| 24,521 | | |

| 36,253 | |

| Taxes receivable | |

| 1,842 | | |

| 1,036 | |

| Prepaid expenses and other | |

| 4,647 | | |

| 3,190 | |

| Total current assets | |

| 45,969 | | |

| 54,331 | |

| Property and equipment, net | |

| 171 | | |

| 149 | |

| Other assets | |

| | | |

| | |

| Goodwill | |

| 78,357 | | |

| 78,357 | |

| Other intangibles, net | |

| 14,470 | | |

| 15,198 | |

| Tradename and customer relationships, net | |

| 33,003 | | |

| 34,198 | |

| Operating lease right of use assets, net | |

| 472 | | |

| 573 | |

| Security deposits and other assets | |

| 435 | | |

| 568 | |

| Total other assets | |

| 126,736 | | |

| 128,894 | |

| TOTAL ASSETS | |

$ | 172,876 | | |

$ | 183,374 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Current portion of long-term debt | |

$ | 3,300 | | |

$ | 2,000 | |

| Accounts payable – trade | |

| 2,980 | | |

| 2,227 | |

| Accrued expenses | |

| 5,310 | | |

| 7,706 | |

| Revenue share payable | |

| 2,094 | | |

| 5,506 | |

| Taxes payable | |

| — | | |

| 49 | |

| Current portion of lease liabilities | |

| 219 | | |

| 222 | |

| Deferred revenue | |

| 1,053 | | |

| 172 | |

| Total current liabilities | |

| 14,956 | | |

| 17,881 | |

| Non-current liabilities | |

| | | |

| | |

| Long-term debt, net | |

| 32,296 | | |

| 34,231 | |

| Lease liabilities, net of current portion | |

| 271 | | |

| 371 | |

| Deferred tax liabilities, net | |

| 4,337 | | |

| 4,337 | |

| Total liabilities | |

| 51,860 | | |

| 56,821 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, none issued and outstanding at June 30, 2024 or December 31, 2023 | |

| — | | |

| — | |

| Common stock, $0.001 par value, 166,666,667 shares authorized, 20,061,907 and 19,899,679 shares issued at June 30, 2024 and December 31, 2023, respectively | |

| 20 | | |

| 20 | |

| Treasury stock, $0.001 par value, 1,741,397 shares held at June 30, 2024 and December 31, 2023. | |

| (2 | ) | |

| (2 | ) |

| Additional paid-in-capital | |

| 196,164 | | |

| 190,793 | |

| Accumulated deficit | |

| (75,166 | ) | |

| (64,258 | ) |

| Total stockholders’ equity | |

| 121,016 | | |

| 126,553 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 172,876 | | |

$ | 183,374 | |

OPTIMIZERX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands except share and per share data)

(UNAUDITED)

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net revenue | |

$ | 18,812 | | |

$ | 13,818 | | |

$ | 38,502 | | |

$ | 26,821 | |

| Cost of revenues, exclusive of depreciation and amortization presented separately below | |

| 7,108 | | |

| 5,993 | | |

| 14,595 | | |

| 11,563 | |

| Gross profit | |

| 11,704 | | |

| 7,825 | | |

| 23,907 | | |

| 15,258 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 14,380 | | |

| 12,242 | | |

| 30,545 | | |

| 26,274 | |

| Depreciation and amortization | |

| 1,073 | | |

| 465 | | |

| 2,140 | | |

| 929 | |

| Total operating expenses | |

| 15,453 | | |

| 12,707 | | |

| 32,685 | | |

| 27,203 | |

| Loss from operations | |

| (3,749 | ) | |

| (4,882 | ) | |

| (8,778 | ) | |

| (11,945 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (1,528 | ) | |

| — | | |

| (3,074 | ) | |

| — | |

| Other income | |

| 75 | | |

| — | | |

| 75 | | |

| — | |

| Interest income | |

| 105 | | |

| 721 | | |

| 125 | | |

| 1,386 | |

| Total other income (expense), net | |

| (1,347 | ) | |

| 721 | | |

| (2,874 | ) | |

| 1,386 | |

| Loss before provision for income taxes | |

| (5,097 | ) | |

| (4,161 | ) | |

| (11,652 | ) | |

| (10,559 | ) |

| Expense (benefit) from income taxes | |

| 1,088 | | |

| 33 | | |

| 744 | | |

| 66 | |

| Net loss | |

$ | (4,008 | ) | |

$ | (4,128 | ) | |

$ | (10,908 | ) | |

$ | (10,493 | ) |

| Weighted average number of shares outstanding – basic | |

| 18,257,879 | | |

| 16,992,100 | | |

| 18,213,992 | | |

| 17,043,493 | |

| Weighted average number of shares outstanding – diluted | |

| 18,257,879 | | |

| 16,992,100 | | |

| 18,213,922 | | |

| 17,043,493 | |

| Loss per share – basic | |

$ | (0.22 | ) | |

$ | (0.24 | ) | |

$ | (0.60 | ) | |

$ | (0.62 | ) |

| Loss per share – diluted | |

$ | (0.22 | ) | |

$ | (0.24 | ) | |

$ | (0.60 | ) | |

$ | (0.62 | ) |

OPTIMIZERX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(UNAUDITED)

| | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| OPERATING ACTIVITIES: | |

| | |

| |

| Net loss | |

$ | (10,908 | ) | |

$ | (10,493 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,140 | | |

| 929 | |

| Stock-based compensation | |

| 5,926 | | |

| 7,884 | |

| Increase in bad debt reserve | |

| 132 | | |

| 239 | |

| Amortization of debt issuance costs | |

| 365 | | |

| — | |

| Changes in: | |

| | | |

| | |

| Accounts receivable | |

| 11,600 | | |

| 3,635 | |

| Prepaid expenses and other assets | |

| (1,457 | ) | |

| (1,772 | ) |

| Accounts payable | |

| 752 | | |

| (732 | ) |

| Revenue share payable | |

| (3,412 | ) | |

| (1,269 | ) |

| Accrued expenses and other liabilities | |

| (2,264 | ) | |

| (1,097 | ) |

| Taxes payable | |

| (855 | ) | |

| — | |

| Deferred revenue | |

| 881 | | |

| 287 | |

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | |

| 2,900 | | |

| (2,389 | ) |

| | |

| | | |

| | |

| INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (77 | ) | |

| (49 | ) |

| Purchases of held-to-maturity investments | |

| — | | |

| (109,501 | ) |

| Redemptions of held-to-maturity investments | |

| — | | |

| 112,501 | |

| Acquisition of intangible assets, including intellectual property rights | |

| — | | |

| (3 | ) |

| Capitalized software development costs | |

| (162 | ) | |

| (1,274 | ) |

| NET CASH (USED IN) PROVIDED BY INVESTING ACTIVITIES | |

| (239 | ) | |

| 1,674 | |

| | |

| | | |

| | |

| FINANCING ACTIVITIES: | |

| | | |

| | |

| Cash paid for employee withholding taxes related to the vesting of restricted stock units | |

| (555 | ) | |

| (244 | ) |

| Proceeds from exercise of stock options | |

| — | | |

| 145 | |

| Repurchase of common stock | |

| — | | |

| (7,522 | ) |

| Repayment of long-term debt | |

| (1,000 | ) | |

| — | |

| NET CASH USED IN FINANCING ACTIVITIES | |

| (1,555 | ) | |

| (7,621 | ) |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | |

| 1,106 | | |

| (8,335 | ) |

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD | |

| 13,852 | | |

| 18,209 | |

| CASH AND CASH EQUIVALENTS - END OF PERIOD | |

$ | 14,958 | | |

$ | 9,874 | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid for interest | |

$ | 2,710 | | |

$ | — | |

| Cash paid for income taxes | |

$ | 110 | | |

$ | — | |

OPTIMIZERX CORPORATION

RECONCILIATION of GAAP to NON-GAAP FINANCIAL

MEASURES

(in thousands, except share and per share data)

(UNAUDITED)

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net loss | |

$ | (4,008 | ) | |

$ | (4,128 | ) | |

$ | (10,908 | ) | |

$ | (10,493 | ) |

| Depreciation and amortization | |

| 1,073 | | |

| 465 | | |

| 2,140 | | |

| 929 | |

| Stock-based compensation | |

| 2,903 | | |

| 3,503 | | |

| 5,926 | | |

| 7,884 | |

| Severance expenses | |

| 241 | | |

| — | | |

| 660 | | |

| — | |

| Other Income | |

| (75 | ) | |

| — | | |

| (75 | ) | |

| — | |

| Amortization of debt issuance costs | |

| 182 | | |

| — | | |

| 365 | | |

| — | |

| Acquisition expenses | |

| — | | |

| — | | |

| 243 | | |

| — | |

| Non-GAAP net income (loss) | |

$ | 316 | | |

$ | (160 | ) | |

$ | (1,649 | ) | |

$ | (1,681 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income (loss) per share | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

$ | 0.02 | | |

$ | (0.01 | ) | |

$ | (0.09 | ) | |

$ | (0.10 | ) |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

| 18,358,543 | | |

| 16,992,100 | | |

| 18,213,922 | | |

| 17,043,793 | |

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net loss | |

$ | (4,008 | ) | |

$ | (4,128 | ) | |

$ | (10,908 | ) | |

$ | (10,493 | ) |

| Depreciation and amortization | |

| 1,073 | | |

| 465 | | |

| 2,140 | | |

| 929 | |

| Expense (benefit) from income taxes | |

| (1,088 | ) | |

| 33 | | |

| (744 | ) | |

| 66 | |

| Stock-based compensation | |

| 2,903 | | |

| 3,503 | | |

| 5,926 | | |

| 7,884 | |

| Severance expenses | |

| 241 | | |

| — | | |

| 660 | | |

| — | |

| Acquisition expenses | |

| — | | |

| — | | |

| 243 | | |

| — | |

| Other Income | |

| (75 | ) | |

| — | | |

| (75 | ) | |

| — | |

| Interest (income) expense, net | |

| 1,422 | | |

| (721 | ) | |

| 2,949 | | |

| (1,386 | ) |

| Adjusted EBITDA | |

$ | 468 | | |

$ | (848 | ) | |

$ | 191 | | |

$ | (3,000 | ) |

7

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

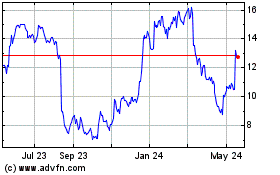

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Jan 2024 to Jan 2025