false

0001649989

0001649989

2024-11-27

2024-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): November 27, 2024

Outlook Therapeutics,

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

001-37759 |

38-3982704 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

111 S. Wood Avenue, Unit #100

Iselin, New Jersey |

08830 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code:

(609) 619-3990

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Stock |

|

OTLK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

On November 27, 2024, Outlook Therapeutics, Inc. issued a press release

announcing preliminary topline results of NORSE EIGHT clinical trial. The press release is attached as Exhibit 99.1 to this Current Report

on Form 8-K and incorporated into this item 8.01 by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Outlook Therapeutics, Inc. |

| |

|

| Date: November 27, 2024 |

By: |

/s/ Lawrence A. Kenyon |

| |

|

Lawrence A. Kenyon |

| |

|

Chief Financial Officer |

Exhibit 99.1

Outlook Therapeutics® Announces Preliminary

Topline Results of NORSE EIGHT Clinical Trial

| · | Final efficacy data expected in January 2025 |

| · | Anticipate resubmission of BLA in calendar Q1 2025 |

ISELIN,

N.J., November 27, 2024 — Outlook Therapeutics, Inc. (Nasdaq: OTLK), a biopharmaceutical company that achieved regulatory approval

in the European Union and the United Kingdom earlier

this year for the first authorized use of an ophthalmic formulation of bevacizumab for the treatment of wet

age-related macular degeneration (wet AMD), today announced preliminary topline results

of NORSE EIGHT, the second of two adequate and well controlled clinical trials evaluating ONS-5010 in wet AMD patients. Upon the completion

of analysis of the final results of NORSE EIGHT, Outlook Therapeutics plans to resubmit the Biologics License Application (BLA) application

for ONS-5010 in the first quarter of calendar 2025.

In the NORSE

EIGHT trial, ONS-5010 did not meet the pre-specified non-inferiority endpoint at week 8 set forth in the special protocol assessment (SPA)

with the U.S. Food and Drug Administration (FDA). However, the preliminary data from the trial demonstrated an improvement in vision

and the presence of biologic activity, as well as a continued favorable safety profile for ONS-5010. Analysis of the data is ongoing as

the month 3 data from NORSE EIGHT is being collected, which is expected to be available in January 2025. Upon

receipt of the full month 3 efficacy and safety results for NORSE EIGHT, Outlook Therapeutics plans to resubmit the BLA application for

ONS-5010 in the first quarter of calendar 2025. In addition, plans for a potential 2025 launch in the UK and Germany are ongoing, where

LYTENAVA™ has received European Commission and MHRA Marketing Authorization for the treatment of wet AMD. Outlook Therapeutics

remains confident that ONS-5010/ LYTENAVA™ is an important therapy for the treatment of wet AMD in place of off-label repackaged

bevacizumab that has not received regulatory approval for use in ophthalmology.

The pre-specified

non-inferiority endpoint at week 8 set forth in the SPA with the FDA was

measured by mean change in best corrected visual acuity (BCVA) from baseline to week 8. The

difference in the means between the ONS-5010 and ranibizumab in the NORSE EIGHT trial was -2.257 BCVA letters with a 95% confidence interval

of (-4.044, -0.470) while the lower bound of the pre-specified non-inferiority margin in

the SPA was -3.5 at a 95% confidence interval; the hypothesis of noninferiority was not met (p>0.025). In the intent-to-treat

(ITT) primary dataset, NORSE EIGHT demonstrated a mean +4.2 letter improvement in BCVA in the ONS-5010 arm and +6.3 letter improvement

in BCVA in the ranibizumab arm.

| |

Mean change in BCVA at week 8 |

Non-Inferiority |

| ONS-5010 1.25 mg |

+4.2 letters |

95%CI: (-4.044, -0.470)

P-value: 0.0863 |

| Ranibizumab 0.5mg |

+6.3 letters |

In NORSE EIGHT, ONS-5010 was generally well-tolerated

with overall ocular adverse event rates comparable to ranibizumab. The safety results demonstrated in NORSE EIGHT are consistent with

previously reported safety results from the NORSE ONE, NORSE TWO, and NORSE THREE clinical trials, with no cases of retinal vasculitis

reported in either study arm. Additional safety and efficacy data from the NORSE EIGHT trial will be analyzed after all subjects complete

their final visit at month 3.

Remediation

of the Chemistry, Manufacturing and Controls (CMC) comments in the Complete Response Letter (CRL) is complete and has been closely aligned

with the FDA in type C and type D meetings.

In the European Union and the United Kingdom,

ONS-5010/LYTENAVA™ (bevacizumab gamma) has already been granted Marketing Authorization. Outlook Therapeutics intends to continue

efforts to begin launching in Europe in 2025 either directly or with a licensing partner. Discussions with potential licensing partners

for markets outside of the United States are ongoing.

About NORSE EIGHT

NORSE

EIGHT was a randomized, controlled, parallel-group, masked, non-inferiority study of newly diagnosed, wet AMD subjects randomized in

a 1:1 ratio to receive 1.25 mg ONS-5010 or 0.5 mg ranibizumab intravitreal injections. Subjects received injections at day 0 (randomization),

week 4, and week 8 visits. The primary endpoint was mean change in best corrected visual acuity (BCVA) from baseline to week 8. For

more information about the NORSE EIGHT study, visit clinicaltrials.gov and reference identifier NCT06190093.

About ONS-5010 / LYTENAVA™ (bevacizumab-vikg, bevacizumab gamma)

ONS-5010/LYTENAVA™ is an ophthalmic formulation of bevacizumab for the treatment of wet AMD. LYTENAVA™ (bevacizumab gamma)

is the subject of a centralized Marketing Authorization granted by the European Commission in the European Union (EU) and Marketing Authorization

granted by the Medicines and Healthcare products Regulatory Agency (MHRA) in the United Kingdom (UK) for the treatment of wet age-related

macular degeneration (wet AMD).

In the United States, ONS-5010/LYTENAVA™

(bevacizumab-vikg) is investigational and is being evaluated in an ongoing non-inferiority study for the treatment of wet AMD.

Bevacizumab-vikg (bevacizumab gamma in the EU

and UK) is a recombinant humanized monoclonal antibody (mAb) that selectively binds with high affinity to all isoforms of human vascular

endothelial growth factor (VEGF) and neutralizes VEGF’s biologic activity through a steric blocking of the binding of VEGF to its

receptors Flt-1 (VEGFR-1) and KDR (VEGFR-2) on the surface of endothelial cells. Following intravitreal injection, the binding of bevacizumab

to VEGF prevents the interaction of VEGF with its receptors on the surface of endothelial cells, reducing endothelial cell proliferation,

vascular leakage, and new blood vessel formation in the retina.

About Outlook Therapeutics, Inc.

Outlook Therapeutics is a biopharmaceutical company focused on the development and commercialization of ONS-5010/LYTENAVA™ (bevacizumab-vikg;

bevacizumab gamma), for the treatment of retina diseases, including wet AMD. LYTENAVA™ (bevacizumab gamma) is the first ophthalmic

formulation of bevacizumab to receive European Commission and MHRA Marketing Authorization for the treatment of wet AMD. Outlook Therapeutics

is working to initiate its commercial launch of LYTENAVA™ (bevacizumab gamma) in the EU and the UK as a treatment for wet AMD, expected

in the first half of calendar 2025. In the United States, ONS-5010/LYTENAVA™ is investigational, is being evaluated in an ongoing

non-inferiority study for the treatment of wet AMD, and the data may be sufficient for Outlook to resubmit a BLA to the FDA in the United

States. If approved in the United States, ONS-5010/LYTENAVA™, would be the first approved ophthalmic formulation of bevacizumab

for use in retinal indications, including wet AMD.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts are “forward-looking

statements,” including those relating to future events. In some cases, you can identify forward-looking statements by terminology

such as “anticipate,” “believe,” “continue,” “expect,” “may,” “plan,”

“potential,” “target,” “will,” or “would” the negative of terms like these or other comparable

terminology, and other words or terms of similar meaning. These include, among others, ONS-5010’s status as the first and only European

Commission, MHRA approved ophthalmic formulation of bevacizumab for use in treating retinal diseases in the EU and UK, and plans to continue

analyzing data for the NORSE EIGHT trial and the potential to resubmit the BLA for ONS-5010 and the timing thereof, expectations concerning

Outlook Therapeutics’ ability to remediate or otherwise resolve deficiencies identified in the CRL issued by the FDA, including

with respect to an additional clinical trial and CMC issues, expectations concerning decisions of regulatory bodies and the timing thereof,

plans for commercial launch of ONS-5010 in the UK and EU and the timing thereof, including the potential to launch with a partner, expectations

concerning the sufficiency of the Company’s cash resources and other statements that are not historical fact. Although Outlook

Therapeutics believes that it has a reasonable basis for the forward-looking statements contained herein, they are based on current

expectations about future events affecting Outlook Therapeutics and are subject to risks, uncertainties and factors relating

to its operations and business environment, all of which are difficult to predict and many of which are beyond its control. These risk

factors include those risks associated with developing and commercializing pharmaceutical product candidates, risks of conducting clinical

trials and risks in obtaining necessary regulatory approvals, including the risk that the data from the NORSE EIGHT trial does not support

the resubmission or subsequent filing by the FDA of the ONS-5010 BLA, the content and timing of decisions by regulatory bodies, the sufficiency

of Outlook Therapeutics’ resources, as well as those risks detailed in Outlook Therapeutics’ filings with the Securities

and Exchange Commission (the SEC), including the Annual Report on Form 10-K for the fiscal year ended September 30, 2023,

filed with the SEC on December 22, 2023, and future reports Outlook Therapeutics files with the SEC, which

include uncertainty of market conditions and future impacts related to macroeconomic factors, including as a result of the ongoing overseas

conflicts, high interest rates, inflation and potential future bank failures on the global business environment. These risks may cause

actual results to differ materially from those expressed or implied by forward-looking statements in this press release. All forward-looking

statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Outlook Therapeutics does

not undertake any obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future

events or otherwise, except as may be required under applicable securities law.

Investor Inquiries:

Jenene Thomas

Chief Executive Officer

JTC Team, LLC

T: 908.824.0775

OTLK@jtcir.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

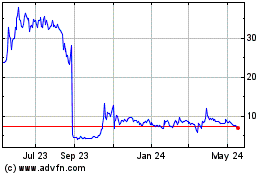

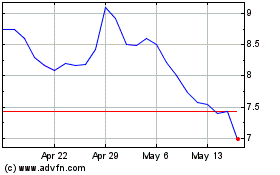

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Feb 2024 to Feb 2025