0000076605false00000766052024-01-102024-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 OR 15(d) Of The Securities Exchange Act Of 1934

| | | | | |

Date of report (Date of earliest event reported) | January 10, 2024 |

| |

| PATRICK INDUSTRIES, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Indiana | | 000-03922 | | 35-1057796 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | | | | | | | | | | | | | | | | |

| 107 W. Franklin Street, P.O. Box 638 | | | | | |

| Elkhart, | Indiana | | 46515 | | (574) | 294-7511 |

| (Address of Principal Executive Offices) | | (Zip Code) | | Registrant's Telephone Number, including area code |

| | |

|

| (Former name or former address if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, no par value | PATK | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry Into a Material Definitive Agreement

On January 10, 2024, Patrick Industries, Inc. (the "Company") signed a definitive agreement to acquire all outstanding stock of Off Road Holdings, LLC ("Sportech") for approximately $315 million. Sportech, based in Elk River, Minnesota, is the leading designer and manufacturer of high-value, complex component solutions to powersports OEMs and the aftermarket, including integrated door systems, roofs, canopies, bumpers, windshields, fender flares and cowls.

The transaction is expected to close on or before January 24, 2024, subject to customary closing conditions, including regulatory approval.

The all-cash transaction will be funded under the Company’s existing credit facility and cash on hand.

Item 7.01 Regulation FD Disclosure

The information referenced in this Form 8-K is furnished pursuant to Item 7.01, “Regulation FD Disclosure.” Such information, including the Exhibit attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

(a) Press Release - Dated January 11, 2024 as contained in Exhibit 99.1

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104 - Cover Page Interactive Date File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PATRICK INDUSTRIES, INC. |

| (Registrant) |

| | | | | | | | |

Date: January 11, 2024 | By: | /s/ Matthew S. Filer |

| Matthew S. Filer |

| Interim Executive Vice President - Finance, Chief Financial Officer, and Treasurer |

Patrick Industries, Inc. Signs Definitive Agreement to Acquire Sportech, LLC – a Leading Supplier of Premium Component Solutions to Powersports OEMs

ELKHART, IN, January 11, 2024 – Patrick Industries, Inc. (NASDAQ: PATK) (“Patrick” or the “Company”), a leading component solutions provider for the Outdoor Enthusiast and Housing markets, today announced that it has signed a definitive agreement to acquire Sportech, LLC (“Sportech”) for approximately $315 million. The transaction is expected to close on or before January 24, 2024, and is subject to customary closing conditions and regulatory approval.

Sportech, based in Elk River, Minnesota, is a leading designer and manufacturer of high-value, complex component solutions to powersports OEMs, adjacent market OEMs and the aftermarket, including integrated door systems, roofs, canopies, bumpers, windshields, fender flares and cowls. With a focus on supplying premium components to the powersports industry, particularly the attractive utility vehicle segment of the market, Sportech recorded estimated calendar year 2023 revenue of approximately $255 million, resulting in a five-year compound annual growth rate of 17%. The acquisition is expected to be immediately accretive to profit margins and net income per share.

“We are delighted to welcome Sportech’s Chief Executive Officer, Jim Glomstad, and the entire Sportech team to the Patrick family,” said Andy Nemeth, Chief Executive Officer of Patrick. "Sportech’s long history of passion-driven innovation, profitable growth, and excellent customer service, along with its strong culture, is a great fit with our Outdoor Enthusiast vision and brand-forward go-to-market strategy. Sportech provides meaningful scale as a supplier of key and synergistic solutions to powersports OEMs, many of which Patrick has established relationships with through our RV, marine, and existing powersports businesses. Sportech offers a solid platform for future organic and strategic growth within the powersports market, enabling us to continue to accelerate our momentum in the attractive Outdoor Enthusiast space, where we have industry-leading platforms in the RV and marine markets and see a clear pathway to revenue and cost synergies. We look forward to supporting Sportech’s team as they continue to focus on what they do best.”

Jim Glomstad commented, “The team at Sportech and I are excited to join the Patrick family of incredible brands and leverage their foundation of resources and support as we continue to implement our strategy to ‘Discover, Design, Develop and Deliver’ for our valued customers. We are confident we can continue to build on our current relationships and expand the portfolio of products and solutions we offer in partnership with our OEM customers while increasing our market share and becoming a valued contributor to Patrick’s vision for its Outdoor Enthusiast ecosystem.”

Acquisition Highlights

•Patrick, through a wholly owned subsidiary, will acquire all outstanding equity of Sportech, LLC, for $315 million. The all-cash transaction will be funded with a combination of borrowings under the Company’s existing credit facility and cash on hand.

•The acquisition of Sportech is expected to be immediately accretive to profit margins and net income per share.

•The transaction is expected to close on or before January 24, 2024, subject to customary closing conditions, including regulatory approval.

•Proforma net leverage ratio (as calculated in accordance with our credit agreement) at closing is expected to approximate 2.9x, with the Company focusing on reducing its net leverage ratio to pre-acquisition levels within the next two to three quarters.

•Following closing, Sportech will continue its operations as a wholly owned subsidiary of Patrick under the Sportech name and within its existing facilities.

Conference Call Webcast

Patrick Industries will host a conference call on Thursday, January 11, 2024 at 8:30 a.m. Eastern Time to discuss the acquisition. Participants on the call will be Andy Nemeth, Chief Executive Officer, Kip Ellis, Chief Operating Officer, and Matt Filer, Interim Chief Financial Officer. In addition, a video which will be presented during the call and a supplemental investor presentation can both be accessed on the Company's website, www.patrickind.com under “For Investors.”

Participation in the question-and-answer session of the call will be limited to institutional investors and analysts. The dial-in number for the live conference call is (877) 407-9036. Interested parties are invited to listen to a live webcast of the call on Patrick's website at www.patrickind.com under "For Investors." A replay of the conference call and the related video will also be available via the Company's investor relations website.

About Sportech, LLC

Sportech designs, manufactures, and assembles cab components and systems for the powersports, golf and turf, industrial, and agricultural end markets. Sportech’s design and engineering capabilities allow the company to provide complex components and assemblies to its original equipment manufacturer customers. Sportech is based in Elk River, Minnesota.

About Patrick Industries, Inc.

Patrick Industries (NASDAQ: PATK) is a leading component solutions provider for the RV, Marine, Powersports and Housing markets. Founded in 1959, Patrick is based in Elkhart, Indiana, employing approximately 10,000 team members throughout the United States.

Forward-Looking Statements

This press release contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any projections of financial performance or statements concerning expectations as to future developments should not be construed in any manner as a guarantee that such results or developments will, in fact, occur. There can be no assurance that any forward-looking statement will be realized or that actual results will not be significantly different from that set forth in such forward-looking statement. Information about certain risks that could affect our business and cause actual results to differ from those expressed or implied in the forward-looking statements are contained in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company's Forms 10-Q for subsequent quarterly periods, which are filed with the Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of this press release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

Contact:

Steve O’Hara

Vice President of Investor Relations

oharas@patrickind.com

574.294.7511

v3.23.4

Cover Document

|

Jan. 10, 2024 |

| Document Entity Information [Abstract] |

|

| Entity Central Index Key |

0000076605

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 10, 2024

|

| Entity Registrant Name |

PATRICK INDUSTRIES, INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

000-03922

|

| Entity Tax Identification Number |

35-1057796

|

| Entity Address, Address Line One |

107 W. Franklin Street, P.O. Box 638

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46515

|

| City Area Code |

(574)

|

| Local Phone Number |

294-7511

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

PATK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

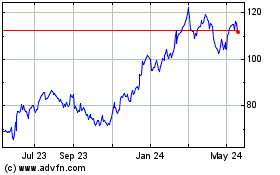

Patrick Industries (NASDAQ:PATK)

Historical Stock Chart

From Jul 2024 to Jul 2024

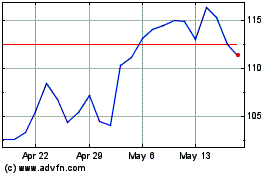

Patrick Industries (NASDAQ:PATK)

Historical Stock Chart

From Jul 2023 to Jul 2024