false

0001761312

0001761312

2024-05-28

2024-05-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |

|

Date of Report (Date of earliest event reported): May 28, 2024

|

| |

|

Palomar Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

Commission File Number: 001-38873

|

| |

| |

|

|

|

Delaware

|

|

83-3972551

|

|

(State or other jurisdiction

of incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

| |

| |

|

7979 Ivanhoe Avenue, Suite 500

La Jolla, California 92037

|

|

(Address of principal executive offices, including zip code)

|

| |

| |

|

(619) 567-5290

|

|

(Registrant’s telephone number, including area code)

|

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

PLMR

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Selection 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On May 28, 2024, the Company issued a press release announcing the successful completion of certain reinsurance programs incepting June 1, 2024, and increased the Company’s full year 2024 adjusted net income guidance. A copy of the press release is attached hereto as Exhibit 99.1.

The Company’s reinsurance coverage now exhausts at $3.06 billion for earthquake events, $735 million for Hawaii Hurricane events, and $117.5 million for all continental United States hurricane events. The reinsurance program provides ample capacity for the Company’s growth in the subject business lines as well as coverage to a level exceeding Palomar’s 1:250-year peak zone Probable Maximum Loss (“PML”).

The Company’s per occurrence catastrophe event retention is now $15.5 million for hurricane events, reduced from $17.5 million the previous year, and $20 million for earthquake events, levels that continue to be meaningfully within management’s previously stated guideposts of less than one quarter’s adjusted net income and less than 5% of the Company’s surplus on an after-tax basis.

$420 million of the $3.06 billion earthquake limit was sourced through a new catastrophe bond, Torrey Pines Re Series 2024-1. The new catastrophe bond issuance is the fifth Insurance Linked Securities (“ILS”) transaction Palomar has sponsored.

Other highlights of the Company’s reinsurance program include:

● $895 million of multi-year ILS capacity providing diversifying collateralized reinsurance capital;

● A reinsurance panel of 90 reinsurers and ILS investors, including multiple new reinsurers, all of which have an “A-” (Excellent) or better financial strength rating from A.M. Best and/or S&P (Standard & Poor’s) or are fully collateralized;

● Prepaid reinstatements for substantially all layers that include a reinstatement provision, thereby limiting the pre-tax net loss to $15.5 million for hurricane events and $20 million for earthquake events, with modest additional reinsurance premium due.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

| |

|

|

| |

|

PALOMAR HOLDINGS, INC.

|

| |

|

|

| |

|

|

|

Date:

|

May 28, 2024

|

/s/ T. Christopher Uchida

|

| |

|

T. Christopher Uchida

|

| |

|

Chief Financial Officer

|

| |

|

(Principal Financial and Accounting Officer)

|

Palomar Holdings, Inc. Announces Successful Completion of June 1 Reinsurance Renewal

~ Full Year 2024 Adjusted Net Income Guidance Increased to $122 Million to $128 Million ~

LA JOLLA, Calif., May 28, 2024 -- Palomar Holdings, Inc. (NASDAQ: PLMR) (“Palomar” or the “Company”) today announced the successful completion of certain reinsurance programs incepting June 1, 2024, and increased the Company’s full year 2024 adjusted net income guidance.

The Company procured approximately $400 million of incremental limit to support the growth of its Earthquake franchise. Palomar’s reinsurance coverage now extends to $3.06 billion for earthquake events, $735 million for Hawaii hurricane events, and $117.5 million for all continental United States hurricane events. The reinsurance program provides ample capacity for the Company’s growth in the subject business lines as well as coverage to a level exceeding Palomar’s 1:250-year peak zone Probable Maximum Loss.

Palomar’s per occurrence event retention is $15.5 million for hurricane events, reduced from $17.5 million the previous year, and $20 million for earthquake events, levels that continue to be meaningfully within management’s previously stated guideposts of less than one quarter’s adjusted net income and less than 5% of the Company’s surplus on an after-tax basis.

$420 million of the $3.06 billion earthquake limit was sourced through a new catastrophe bond, Torrey Pines Re Series 2024-1. The new catastrophe bond issuance is the fifth Insurance Linked Securities (“ILS”) transaction Palomar has sponsored.

“We are very pleased with the successful June 1 placement and are very grateful for the continued support of our reinsurance and ILS partners,” commented Mac Armstrong, Palomar’s Chairman and Chief Executive Officer. “Importantly, we renewed our reinsurance program at terms and pricing that were better than our initial expectations and reduced our hurricane event retention. As a result, we are raising our full year 2024 adjusted net income guidance to a range of $122 million to $128 million from the previously indicated range of $113 million to $118 million.”

Other highlights of the Company’s reinsurance program include:

| |

-

|

$895 million of multi-year ILS capacity providing diversifying collateralized reinsurance capital;

|

| |

-

|

A reinsurance panel of 90 reinsurers and ILS investors, including multiple new reinsurers, all of which have an “A-” (Excellent) or better financial strength rating from A.M. Best and/or S&P (Standard & Poor’s) or are fully collateralized;

|

| |

-

|

Prepaid reinstatements for substantially all layers that include a reinstatement provision, thereby limiting the pre-tax net loss to $15.5 million for hurricane events and $20 million for earthquake events, with modest additional reinsurance premium due.

|

Palomar’s Chief Risk Officer, Jon Knutzen, added, “We are grateful for the broad-based support we received from the reinsurance market. It is a testament to our business mix and risk profile, which has been curated with the goal of delivering more stable, predictable results. We appreciate all our incumbent and new reinsurance partners who have helped us successfully complete our June 1 placement.”

About Palomar Holdings, Inc.

Palomar Holdings, Inc. is the holding company of subsidiaries Palomar Specialty Insurance Company (“PSIC”), Palomar Specialty Reinsurance Company Bermuda Ltd., Palomar Insurance Agency, Inc., Palomar Excess and Surplus Insurance Company (“PESIC”), and Palomar Underwriters Exchange Organization, Inc. Palomar's consolidated results also include Laulima Reciprocal Exchange, a variable interest entity for which the Company is the primary beneficiary. Palomar is an innovative specialty insurer serving residential and commercial clients in five product categories: Earthquake, Inland Marine and Other Property, Casualty, Fronting, and Crop. Palomar’s insurance subsidiaries, Palomar Specialty Insurance Company, Palomar Specialty Reinsurance Company Bermuda Ltd., and Palomar Excess and Surplus Insurance Company, have a financial strength rating of “A-” (Excellent) from A.M. Best.

To learn more, visit PLMR.com.

Follow Palomar on LinkedIn: @PLMRInsurance

Safe Harbor Statement

Palomar cautions you that statements contained in this press release may regard matters that are not historical facts but are forward-looking statements. These statements are based on the company’s current beliefs and expectations. The inclusion of forward-looking statements should not be regarded as a representation by Palomar that any of its plans will be achieved. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in the Company’s business. The forward-looking statements are typically, but not always, identified through use of the words "believe," "expect," "enable," "may," "will," "could," "intends," "estimate," "anticipate," "plan," "predict," "probable," "potential," "possible," "should," "continue," and other words of similar meaning. Actual results could differ materially from the expectations contained in forward-looking statements as a result of several factors, including unexpected expenditures and costs, unexpected results or delays in development and regulatory review, regulatory approval requirements, the frequency and severity of adverse events and competitive conditions. These and other factors that may result in differences are discussed in greater detail in the Company's filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Contact

Media Inquiries

Lindsay Conner

1-551-206-6217

lconner@plmr.com

Investor Relations

Jamie Lillis

1-203-428-3223

investors@plmr.com

Source: Palomar Holdings, Inc.

v3.24.1.1.u2

Document And Entity Information

|

May 28, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Palomar Holdings, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 28, 2024

|

| Entity, File Number |

001-38873

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, Tax Identification Number |

83-3972551

|

| Entity, Address, Address Line One |

7979 Ivanhoe Avenue, Suite 500

|

| Entity, Address, City or Town |

La Jolla

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92037

|

| City Area Code |

619

|

| Local Phone Number |

567-5290

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PLMR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001761312

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

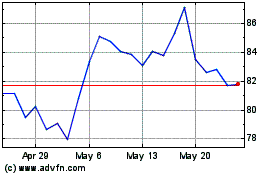

Palomar (NASDAQ:PLMR)

Historical Stock Chart

From May 2024 to Jun 2024

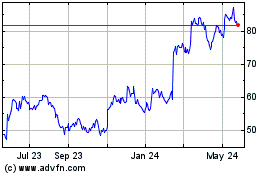

Palomar (NASDAQ:PLMR)

Historical Stock Chart

From Jun 2023 to Jun 2024