false000008003500000800352024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________

FORM 8-K

_________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

_________________________________________________________

Preformed Line Products Company

(Exact name of Registrant as Specified in Its Charter)

_________________________________________________________

| | | | | | | | |

| Ohio | 0-31164 | 34-0676895 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| 660 Beta Drive | | |

Mayfield Village, Ohio | | 44143 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 440 461-5200

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common | | PLPC | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2024, Preformed Line Products Company issued a press release announcing earnings for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1. This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except, as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | PREFORMED LINE PRODUCTS COMPANY |

| | | |

| Date: | October 30, 2024 | By: | |

| | | Andrew S. Klaus, CFO |

PREFORMED LINE PRODUCTS ANNOUNCES THIRD QUARTER 2024 FINANCIAL RESULTS CLEVELAND, OHIO – October 30, 2024 - Preformed Line Products Company (NASDAQ: PLPC) today reported financial results for its third quarter of 2024.

Net sales in the third quarter of 2024 were $147.0 million compared to $160.4 million in the third quarter of 2023, an 8% decrease. The decrease in sales is primarily related to a continuation of the slowdown in spending in the communications end market. Foreign currency translation reduced third quarter 2024 net sales by $0.8 million.

Net income for the quarter ended September 30, 2024, was $7.7 million, or $1.54 per diluted share, compared to $15.1 million, or $3.03 per diluted share, for the comparable period in 2023. The third quarter of 2024 net income was impacted by decreased gross profit from lower sales levels, similar to our first half 2024 results, partially offset by lower period expenses from our cost containment initiatives, lower net interest expense and reduced income tax expense. Gross profit as a percentage of net sales was 31.2% for the third quarter of 2024, largely consistent with the second quarter of 2024.

Net sales decreased 19% to $426.6 million for the first nine months of 2024 compared to $524.1 million for the first nine months of 2023. The year-over-year decline in sales is due primarily to the slowdown in spending and inventory destocking within the communications end market. Currency translation rates reduced net sales by $1.1 million for the nine months ended September 30, 2024.

Net income for the nine months ended September 30, 2024 was $26.6 million, or $5.37 per diluted share, compared to $57.0 million, or $11.39 per diluted share, for the comparable period in 2023. YTD September 30, 2024 net income was impacted by decreased gross profit resulting from the decrease in sales which was partially offset by lower period expenses, lower net interest expense and reduced income tax expense.

Rob Ruhlman, Executive Chairman, said, “The decline in net sales continues, albeit at a slower pace, primarily related to the softness in the communications end market, caused primarily by a reduction in deployment due to higher borrowing costs and continued inventory destocking to re-align customer inventory levels with current manufacturing lead times. The slower pace of the net sales decline and an increase in order backlog are indicators that we may be nearing the final stages of inventory destocking. Our gross margin percentage has been consistent throughout 2024 aided by our cost reduction activities implemented in 2023. We remain optimistic about the prospects of the markets that we serve and will continue our investment in new product development, streamlining our manufacturing operations and expanding our customer service portfolio. These actions, along with our continued strong liquidity, will allow us to take advantage of favorable market conditions when they return. Our current focus is unchanged: provide our customers with the high-quality products and timely service they have come to expect from PLP.”

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 regarding the Company, including those statements regarding the Company’s and management’s beliefs and expectations concerning the Company’s future performance or anticipated financial results, among others. Except for historical information, the matters discussed in this release are forward-looking statements that involve risks and uncertainties which may cause results to differ materially from those set forth in those statements. Among other things, factors that could cause actual results to differ materially from those expressed in such forward-looking statements include the uncertainty in global business conditions and the economy due to factors such as inflation, rising interest rates, labor disruptions, military conflict, political instability, exchange rates and lingering effects of COVID-19, the strength of demand and availability of funding for the Company’s products and the mix of products sold, the relative degree of competitive and customer price

pressure on the Company’s products, the cost, availability and quality of raw materials required for the manufacture of products, opportunities for business growth through acquisitions and the ability to successfully integrate any acquired businesses, changes in regulations and tax rates, security breaches, litigation and claims and the Company’s ability to continue to develop proprietary technology and maintain high-quality products and customer service to meet or exceed new industry performance standards and individual customer expectations, and other factors described under the headings “Forward-Looking Statements” and “Risk Factors” in the Company’s 2023 Annual Report on Form 10-K filed with the SEC on March 8, 2024 and subsequent filings with the SEC. The Annual Report on Form 10-K and the Company’s other filings with the SEC can be found on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

ABOUT PLP

PLP protects the world’s most critical connections by creating stronger and more reliable networks. The company’s precision-engineered solutions are trusted by energy and communications providers worldwide to perform better and last longer. With locations in 20 countries, PLP works as a united global corporation, delivering high-quality products and unparalleled service to customers around the world.

| | | | | | | | |

| MEDIA RELATIONS | | INVESTOR RELATIONS |

| | |

| JOSH NELSON | | ANDREW S. KLAUS |

| | |

MANAGER, MARKETING COMMUNICATIONS | | CHIEF FINANCIAL OFFICER |

| | |

+1 440 473 9120 |

| +1 440 473 9246 |

| | |

JOSH.NELSON@PLP.COM | | ANDY.KLAUS@PLP.COM |

PREFORMED LINE PRODUCTS COMPANY

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| (Thousands of dollars, except share and per share data) | (Unaudited) | | |

| ASSETS | | | |

| Cash, cash equivalents and restricted cash | $ | 47,498 | | | $ | 53,607 | |

| Accounts receivable, net | 110,888 | | | 106,892 | |

| Inventories, net | 142,726 | | | 148,814 | |

| Prepaid expenses | 13,053 | | | 8,246 | |

| Other current assets | 6,479 | | | 7,256 | |

| TOTAL CURRENT ASSETS | 320,644 | | | 324,815 | |

| Property, plant and equipment, net | 201,194 | | | 207,892 | |

| Goodwill | 28,672 | | | 29,497 | |

| Other intangible assets, net | 10,983 | | | 12,981 | |

| Deferred income taxes | 9,502 | | | 7,109 | |

| Other assets | 20,958 | | | 20,857 | |

| TOTAL ASSETS | $ | 591,953 | | | $ | 603,151 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Trade accounts payable | $ | 42,426 | | | $ | 37,788 | |

| Notes payable to banks | 8,006 | | | 6,968 | |

| Current portion of long-term debt | 2,618 | | | 6,486 | |

| Accrued compensation and other benefits | 29,499 | | | 28,018 | |

| Accrued expenses and other liabilities | 31,450 | | | 32,057 | |

| TOTAL CURRENT LIABILITIES | 113,999 | | | 111,317 | |

| Long-term debt, less current portion | 24,582 | | | 48,796 | |

| Other noncurrent liabilities and deferred income taxes | 24,385 | | | 26,882 | |

| SHAREHOLDERS' EQUITY | | | |

| Common shares – $2 par value per share, 15,000,000 shares authorized, 4,897,450 and 4,908,413 issued and outstanding, at September 30, 2024 and December 31, 2023 | 13,715 | | | 13,607 | |

| Common shares issued to rabbi trust, 222,741 and 243,118 shares at September 30, 2024 and December 31, 2023, respectively | (9,557) | | | (10,183) | |

| Deferred compensation liability | 9,557 | | | 10,183 | |

| Paid-in capital | 63,108 | | | 60,958 | |

| Retained earnings | 543,743 | | | 520,154 | |

| Treasury shares, at cost, 1,959,512 and 1,894,419 shares at September 30, 2024 and December 31, 2023, respectively | (126,503) | | | (118,249) | |

| Accumulated other comprehensive loss | (65,092) | | | (60,306) | |

| TOTAL PREFORMED LINE PRODUCTS COMPANY SHAREHOLDERS' EQUITY | 428,971 | | | 416,164 | |

| Noncontrolling interest | 16 | | | (8) | |

| TOTAL SHAREHOLDERS' EQUITY | 428,987 | | | 416,156 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 591,953 | | | $ | 603,151 | |

PREFORMED LINE PRODUCTS COMPANY

STATEMENTS OF CONSOLIDATED INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (Thousands of dollars, except per share data) | | | | | | | |

| Net sales | $ | 146,973 | | | $ | 160,438 | | | $ | 426,597 | | | $ | 524,076 | |

| Cost of products sold | 101,195 | | | 106,301 | | | 292,415 | | | 337,328 | |

| GROSS PROFIT | 45,778 | | | 54,137 | | | 134,182 | | | 186,748 | |

| Costs and expenses | | | | | | | |

| Selling | 12,318 | | | 12,732 | | | 36,146 | | | 38,133 | |

| General and administrative | 16,414 | | | 17,794 | | | 48,272 | | | 54,624 | |

| Research and engineering | 5,545 | | | 5,840 | | | 16,334 | | | 16,793 | |

| Other operating expense (income), net | 1,109 | | | (2,307) | | | 186 | | | (10) | |

| 35,386 | | | 34,059 | | | 100,938 | | | 109,540 | |

| OPERATING INCOME | 10,392 | | | 20,078 | | | 33,244 | | | 77,208 | |

| Other income (expense) | | | | | | | |

| Interest income | 538 | | | 478 | | | 1,856 | | | 1,201 | |

| Interest expense | (564) | | | (998) | | | (1,840) | | | (3,198) | |

| Other income, net | 64 | | | 18 | | | 189 | | | 165 | |

| 38 | | | (502) | | | 205 | | | (1,832) | |

| INCOME BEFORE INCOME TAXES | 10,430 | | | 19,576 | | | 33,449 | | | 75,376 | |

| Income tax expense | 2,734 | | | 4,431 | | | 6,783 | | | 18,348 | |

| NET INCOME | $ | 7,696 | | | $ | 15,145 | | | $ | 26,666 | | | $ | 57,028 | |

| Net income attributable to noncontrolling interests | (16) | | | (15) | | | (24) | | | (28) | |

| NET INCOME ATTRIBUTABLE TO PREFORMED LINE PRODUCTS COMPANY SHAREHOLDERS | $ | 7,680 | | | $ | 15,130 | | | $ | 26,642 | | | $ | 57,000 | |

| AVERAGE NUMBER OF SHARES OF COMMON STOCK OUTSTANDING: | | | | | | | |

| Basic | 4,904 | | 4,906 | | 4,911 | | 4,929 |

| Diluted | 4,977 | | 4,990 | | 4,959 | | 5,006 |

| EARNINGS PER SHARE OF COMMON STOCK ATTRIBUTABLE TO PREFORMED LINE PRODUCTS COMPANY SHAREHOLDERS: | | | | | | | |

| Basic | $ | 1.57 | | | $ | 3.08 | | | $ | 5.42 | | | $ | 11.56 | |

| Diluted | $ | 1.54 | | | $ | 3.03 | | | $ | 5.37 | | | $ | 11.39 | |

| | | | | | | |

| Cash dividends declared per share | $ | 0.20 | | | $ | 0.20 | | | $ | 0.60 | | | $ | 0.60 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

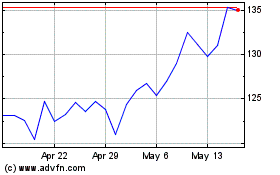

Preformed Line Products (NASDAQ:PLPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Preformed Line Products (NASDAQ:PLPC)

Historical Stock Chart

From Jan 2024 to Jan 2025