Current Report Filing (8-k)

21 May 2020 - 8:04PM

Edgar (US Regulatory)

false000102240800010224082020-05-152020-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2020

ePlus inc.

EPLUS INC

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-34167

|

|

54-1817218

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

13595 Dulles Technology Drive, Herndon, Virginia 20171-3413

(Address, including zip code, of principal executive offices)

(703)

984-8400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2 below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

Common Stock, $.01 par value

|

PLUS

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement

On May 15, 2020, ePlus

Technology, inc., ePlus Technology Services, inc. and SLAIT Consulting, LLC (together the "Company"), wholly owned subsidiaries of ePlus

inc. (“ePlus”), entered into Amendment No. 10 (the "Amendments") to both its Amended and Restated Agreement for Wholesale Financing, dated July 23, 2012, as amended, and Amended and Restated Business Financing Agreement, dated July

23, 2012, as amended, with Wells Fargo Commercial Distribution Finance, LLC ("Wells Fargo") (f/k/a GE Commercial Distribution Finance), in connection with its credit facility.

Pursuant to the Amendments, the WFCDF credit facility aggregate limit of the two components was increased to $275.0 million

except during a temporary uplift. Additionally, we have an election to temporarily increase the aggregate limit to $350.0 million for a period of not less than 30 days, provided that all such periods shall not exceed 150 days in the

aggregate in any calendar year. Further, the amendment increased the limit on the accounts receivable component of the WFCDF credit facility to $100.0 million, reduced the interest rate to LIBOR plus 2.00%, and removed certain

restrictions on ePlus Technology, inc.’s ability to pay dividends to ePlus inc.

The Company maintains deposit accounts with Wells Fargo, and from time to time the Company and its affiliates sell IT

products and services to affiliates of Wells Fargo. There are no other material relationships between the Company and Wells Fargo.

The foregoing description of the Amendments is a summary and is qualified in its entirety by reference to Amendment No.

10 to the Amended and Restated Agreement for Wholesale Financing, and Amendment No. 10 to the Amended and Restated Business Financing Agreement, copies of which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K

and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a

Registrant

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03 of

this Current Report on Form 8-K.

Item 8.01 Other Events

On May 20, 2020, ePlus inc. (the "Company") announced via press release that its Board of Directors

approved a share repurchase plan. Under the plan the Company may repurchase up to 500,000 shares of ePlus' outstanding common stock beginning on May 28, 2020, through May 27, 2021. The Company's prior repurchase plan expires on May

27, 2020. The Company is authorized to repurchase its common stock through open market purchases, including under a trading plan adopted pursuant to Rule 10b5-1 of the Securities Exchange Act of 1934 (the "Exchange Act"), or

private transactions, in accordance with applicable federal securities laws, including Rule 10b-18 of the Exchange Act. The timing of repurchases and the exact number of shares to be purchased will be determined by the Company's

management, in its discretion, or pursuant to a Rule 10b5-1 trading plan, and will depend upon market conditions and other factors.

A copy of the press release issued by the Company announcing the share

repurchase program is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibits are filed as part of this report:

* Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

ePlus inc.

|

|

|

|

|

|

|

|

|

|

By: /s/ Elaine D. Marion

|

|

|

|

|

Elaine D. Marion

|

|

|

|

|

Chief Financial Officer

|

|

|

Date: May 20, 2020

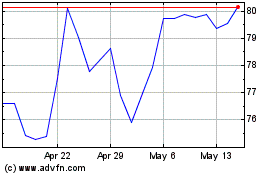

ePlus (NASDAQ:PLUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

ePlus (NASDAQ:PLUS)

Historical Stock Chart

From Jul 2023 to Jul 2024