0001377121

false

0001377121

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2023

PROTAGONIST THERAPEUTICS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-37852 |

|

98-0505495 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Protagonist Therapeutics, Inc.

7707 Gateway Blvd., Suite 140

Newark, California 94560-1160

(Address of principal executive offices,

including zip code)

(510) 474-0170

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.00001 |

|

PTGX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations

and Financial Condition.

On August 3, 2023, Protagonist

Therapeutics, Inc. reported its financial results for the second quarter ended June 30, 2023. A copy of the press release titled

“Protagonist Therapeutics Reports Second Quarter 2023 Financial Results and Provides Corporate Update” is furnished pursuant

to Item 2.02 as Exhibit 99.1 hereto and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

The information in this report, including the exhibit hereto, shall

not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein

and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission

made by Protagonist Therapeutics, Inc., whether made before or after the date hereof, regardless of any general incorporation language

in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Protagonist Therapeutics, Inc. |

| Dated: August 3, 2023 |

|

| |

|

| |

By: |

/s/ Asif Ali |

| |

|

Asif Ali |

| |

|

Chief Financial Officer |

Exhibit 99.1

Protagonist Reports

Second Quarter 2023 Financial Results and Provides Corporate Update

Positive topline results from the Phase 2b FRONTIER

1 study of JNJ-2113 (formerly PN-235), the first and only IL-23 receptor antagonist oral peptide drug candidate for the treatment of moderate-to-severe

plaque psoriasis, presented at the World Congress of Dermatology.

JNJ-2113 now advances toward a Phase 3 study

in moderate-to-severe psoriasis and a Phase 2b study in ulcerative colitis.

Positive data from the randomized withdrawal

portion of the Phase 2 REVIVE study of rusfertide in polycythemia vera (PV) presented as a late breaker at the annual Congress of the

European Hematology Association (EHA2023); the global Phase 3 VERIFY study continues, with sites recruiting globally.

NEWARK, Calif., August 3, 2023 – Protagonist

Therapeutics (Nasdaq: PTGX) (“Protagonist” or “the Company”) today reported financial results for the second

quarter ended June 30, 2023, and provided a corporate update.

“The second quarter of 2023 was transformative for Protagonist,

marked by the disclosure of strongly positive data from FRONTIER 1, a Phase 2b study of JNJ-2113, at the World Congress of Dermatology,

and the decision by our partner, Janssen, to move forward into a Phase 3 clinical program in psoriasis and a Phase 2b study in ulcerative

colitis,” said Dinesh V. Patel, Ph.D., President and CEO of Protagonist. “JNJ-2113 is a first-in-class and only oral IL-23

receptor antagonist peptide that has the potential to lead the field of oral therapy for psoriasis. Today, a significant number of people

living with moderate-to-severe plaque psoriasis are eligible for, but are still not receiving, advanced therapies, and JNJ-2113 can potentially

offer a highly convenient, effective and safe solution to a broad category of eligible individuals.”

“We

have also made impressive strides forward in the clinical development of our fully owned asset, rusfertide, in polycythemia vera,”

Dr. Patel continued. “The Phase 2 REVIVE study results were presented to a large audience as a late breaker at EHA2023. The

Phase 3 VERIFY clinical trial is continuing to enroll study participants at sites globally, with enrollment completion projected by the

end of the first quarter of 2024. Our cash position remains strong, with estimated cash runway through end of 2025. This estimate does

not include the potential $200 million in milestones associated with a successful Phase 3 study, NDA filing, and approval of JNJ-2113

in psoriasis.”

Q2 and Recent Corporate Highlights

| · | Positive Phase 2b FRONTIER 1 topline results were presented at the World

Congress of Dermatology in Singapore in July 2023. All primary and secondary efficacy endpoints were achieved in the study, which

evaluated five different dosing regimens of JNJ-2113 in adult patients with moderate-to-severe plaque psoriasis. |

| · | JNJ-2113 is a novel oral IL-23R antagonist peptide which binds with high

affinity to the IL-23 receptor. |

| · | In the FRONTIER 1 study, a greater proportion of patients who received JNJ-2113

achieved Psoriasis Area and Severity Index (PASI) 75 (primary endpoint), as well as PASI 90 and PASI 100 (75, 90 and 100 percent improvement

in skin lesions as measured by PASI, respectively), compared to placebo, at week 16. |

| · | 78.6 percent, 59.5 percent and 40.5 percent of adult patients who received

JNJ-2113 at 100 mg twice daily achieved PASI 75, 90 and 100, respectively, at week 16. |

| · | Five treatment groups were evaluated in the study, ranging from 25 mg once

daily to 100 mg twice daily. |

| · | Treatment was generally well tolerated, and the proportions of patients with

adverse events were comparable between patient groups. |

| · | The proportion of participants experiencing one or more adverse events was

52.4 percent in the combined JNJ-2113 group and 51.2 percent in the placebo group. |

| · | JNJ-2113 is advancing into Phase 3 development for moderate-to-severe plaque

psoriasis and in a Phase 2b clinical trial for adults living with ulcerative colitis. |

| · | Pre-clinical and Phase 1 data for JNJ-2113 were presented at the International

Societies for Investigative Dermatology meeting in Tokyo, Japan in May 2023, showing selective systemic IL-23 pathway inhibition

in pre-clinical rat models and systemic pharmacodynamic activity in healthy human volunteers in a Phase 1 trial. |

| · | Positive topline results from the blinded, placebo-controlled, randomized

withdrawal portion of the Phase 2 REVIVE study of rusfertide in polycythemia vera were presented in Frankfurt, Germany in June 2023

at EHA2023. |

| · | The Company completed a $115 million equity financing in April 2023. |

Second Quarter 2023 Financial Results

| · | Cash, Cash Equivalents and Marketable Securities: Cash, cash equivalents and marketable securities as of June 30, 2023,

were $313.4 million. |

| · | License and Collaboration Revenue: License and collaboration revenue was zero for the three and six months ended June 30,

2023 as we completed our performance obligation associated with the Janssen License and Collaboration Agreement as of June 30, 2022.

License and collaboration revenue for the three and six months ended June 30, 2022 was $0.9 million and $26.6 million, respectively.

The six months to June 30, 2022 included a one-time $25.0 million milestone earned by the Company following the dosing of the third

patient in the Janssen Phase 2b FRONTIER 1 clinical trial of JNJ-2113. |

| · | Research and Development ("R&D") Expenses: R&D expenses were $33.2 million and $60.6 million for the three

and six months ended June 30, 2023, respectively, as compared to $34.6 million and $70.9 million for the same periods in 2022. The

decreases in R&D expenses from prior year periods was primarily due to decreases in PN-943 expenses and costs related to the completion

of PN-232 Phase 1 trials, partially offset by an increase in rusfertide expenses related primarily to the Phase 3 VERIFY clinical trial. |

| · | General and Administrative ("G&A") Expenses: G&A expenses were $9.2 million and $17.8 million for the three

and six months ended June 30, 2023, respectively, as compared to $7.7 million and $18.2 million for the same periods in 2022. The

increase in G&A expenses from the prior year quarter was primarily due to increases in payroll and stock-based compensation and general

expenses. The decrease in G&A expenses from the prior year was primarily due to one-time costs incurred in the first quarter of 2022. |

| · | Net Loss: Net loss was $38.5 million, or $0.68 per share, for the three months ended June 30, 2023 as compared to a net

loss of $41.0 million, or $0.84 per share, for the three months ended June 30, 2022. Net loss was $72.2 million, or $1.34 per share,

for the six months ended June 30, 2023 as compared to a net loss of $62.0 million, or $1.27 per share, for the six months ended June 30,

2022. |

PROTAGONIST THERAPEUTICS, INC.

Condensed Consolidated Statements of Operations

(Unaudited)

(Amounts in thousands except share and per

share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| License and collaboration revenue | |

$ | - | | |

$ | 859 | | |

$ | - | | |

$ | 26,581 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development (1) | |

| 33,182 | | |

| 34,611 | | |

| 60,598 | | |

| 70,929 | |

| General and administrative (1) | |

| 9,172 | | |

| 7,691 | | |

| 17,777 | | |

| 18,206 | |

| Total operating expenses | |

| 42,354 | | |

| 42,302 | | |

| 78,375 | | |

| 89,135 | |

| Loss from operations | |

| (42,354 | ) | |

| (41,443 | ) | |

| (78,375 | ) | |

| (62,554 | ) |

| Interest income | |

| 3,913 | | |

| 484 | | |

| 6,404 | | |

| 652 | |

| Other expense, net | |

| (19 | ) | |

| (78 | ) | |

| (214 | ) | |

| (65 | ) |

| Net loss | |

$ | (38,460 | ) | |

$ | (41,037 | ) | |

$ | (72,185 | ) | |

$ | (61,967 | ) |

| Net loss per share, basic and diluted | |

$ | (0.68 | ) | |

$ | (0.84 | ) | |

$ | (1.34 | ) | |

$ | (1.27 | ) |

| Weighted-average shares used to compute net loss per share, basic and diluted | |

| 56,775,742 | | |

| 49,049,902 | | |

| 53,691,965 | | |

| 48,902,047 | |

| (1) | Amount includes non-cash stock-based compensation expense. |

PROTAGONIST THERAPEUTICS, INC.

Stock-based Compensation (Unaudited)

(In thousands)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Research and development | |

$ | 4,809 | | |

$ | 4,106 | | |

$ | 9,391 | | |

$ | 7,432 | |

| General and administrative | |

| 3,534 | | |

| 2,699 | | |

| 6,536 | | |

| 5,308 | |

| Total stock-based compensation expense | |

$ | 8,343 | | |

$ | 6,805 | | |

$ | 15,927 | | |

$ | 12,740 | |

PROTAGONIST THERAPEUTICS, INC.

(Unaudited)

Selected Consolidated Balance Sheet Data

(In thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Cash, cash equivalents and marketable securities | |

$ | 313,401 | | |

$ | 237,355 | |

| Working capital | |

| 290,543 | | |

| 211,898 | |

| Total assets | |

| 320,466 | | |

| 247,928 | |

| Accumulated deficit | |

| (608,940 | ) | |

| (536,755 | ) |

| Total stockholders' equity | |

| 294,068 | | |

| 215,608 | |

About Protagonist

Protagonist Therapeutics is a biopharmaceutical

company with peptide-based new chemical entities (NCEs) rusfertide and JNJ-2113 (formerly PN-235) in advanced stages of clinical development,

both derived from the Company's proprietary technology platform. Protagonist scientists jointly discovered PN-235 (now known as JNJ-2113)

as part of Protagonist’s Interleukin-23 receptor (IL-23R) collaboration with Janssen and followed it through IND-enabling pre-clinical

and Phase 1 studies, with Janssen assuming responsibility for further clinical development. Rusfertide, a mimetic of the natural hormone

hepcidin, is the Company's lead drug candidate currently in a global Phase 3 development program. The Phase 2 REVIVE study is now complete,

with an open-label extension underway. The global Phase 3 VERIFY study of rusfertide in polycythemia vera is ongoing. Protagonist retains

all worldwide development and commercialization rights to rusfertide.

More information on Protagonist,

its pipeline drug candidates and clinical studies can be found on the Company's website at protagonist-inc.com.

Cautionary Note on Forward-Looking

Statements

This press release contains forward-looking

statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

include statements regarding the potential benefits of JNJ-2113, our expectations regarding the clinical development of JNJ-2113, our

potential receipt of milestone and royalty payments under our collaboration agreement with Janssen Biotech, Inc., our forecasted

cash runway and our expectations regarding enrollment in the REVIVE Phase 3 trial. In some cases, you can identify these statements by

forward-looking words such as "anticipate," "believe," "may," "will," "expect," or the

negative or plural of these words or similar expressions. Forward-looking statements are not guarantees of future performance and are

subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including,

but not limited to, our ability to develop and commercialize our product candidates, our ability to earn milestone payments under our

collaboration agreement with Janssen Biotech, Inc., our ability to use and expand our programs to build a pipeline of product candidates,

our ability to obtain and maintain regulatory approval of our product candidates, our ability to operate in a competitive industry and

compete successfully against competitors that have greater resources than we do, and our ability to obtain and adequately protect intellectual

property rights for our product candidates. Additional information concerning these and other risk factors affecting our business can

be found in our periodic filings with the Securities and Exchange Commission, including under the heading "Risk Factors" contained

in our most recently filed periodic reports on Form 10-K and Form 10-Q filed with the Securities and Exchange Commission. Forward-looking

statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity, and the

development of the industry in which we operate, may differ materially from the forward-looking statements contained in this press release.

Any forward-looking statements that we make in this press release speak only as of the date of this press release. We assume no obligation

to update our forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this press

release.

Contact

Jami Taylor

Email: j.taylor@ptgx-inc.com

v3.23.2

Cover

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity File Number |

001-37852

|

| Entity Registrant Name |

PROTAGONIST THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001377121

|

| Entity Tax Identification Number |

98-0505495

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7707 Gateway Blvd.

|

| Entity Address, Address Line Two |

Suite 140

|

| Entity Address, City or Town |

Newark

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94560-1160

|

| City Area Code |

510

|

| Local Phone Number |

474-0170

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001

|

| Trading Symbol |

PTGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

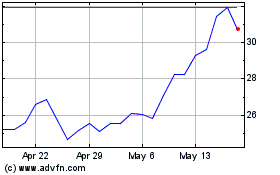

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Apr 2024 to May 2024

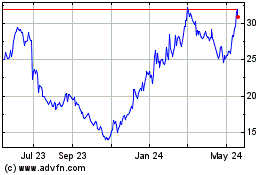

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From May 2023 to May 2024