QuinStreet, Inc. (Nasdaq:QNST), a leader in vertical marketing and

media online, today announced its financial results for the fiscal

second quarter ended December 31, 2010.

For the quarter, the Company reported total revenue of $97.6

million, an increase of 27% over revenue reported in the same

quarter last year.

Adjusted EBITDA for the quarter was $21.7 million, or 22% of

revenue.

The Company reported net income of $6.9 million, or $0.14 per

diluted share, for the quarter. Adjusted net income for the quarter

was $12.3 million, or $0.25 per diluted share. Adjusted net income

excludes stock-based compensation expense and amortization of

intangible assets, net of estimated tax.

Revenue for the Financial Services client vertical was $44.0

million, an increase of 36% compared to the same quarter last year.

Revenue for the Education client vertical was $43.2 million, an

increase of 18% compared to the year-ago quarter. Excluding the

effects from one large education client undergoing a previously

disclosed change in its online marketing strategy, revenue for the

Education client vertical grew 24%. The large client change was

"lapped" in November and will no longer be reported separately

going forward. Revenue for Other client verticals was $10.4

million, an increase of 29% versus the year-ago quarter.

Reconciliations of adjusted net income to net income, adjusted

EBITDA to net income, and free cash flow to net cash provided by

operating activities are included in the accompanying tables.

"We reported another good quarter of financial

results. Education performance was particularly impressive,

returning to target double-digit growth ahead of forecast. Overall

seasonal effects were in line with historic norms and projections,"

commented Doug Valenti, QuinStreet CEO. "We have a lot of momentum

in our two largest verticals, Education and Financial Services.

Execution by our client, media and technology teams has been

outstanding. Demand from clients is strong. We remain excited about

the enormous size of our markets. While we are not a young company

– this is our ninth consecutive year of strong revenue growth and

strong, consistent profitability – we are still in the early stages

of this long-term business opportunity."

Conference Call

QuinStreet will host a conference call and corresponding live

webcast at 2:00 p.m. PT today. To access the conference call, dial

1-866-240-0819 for the U.S. and Canada and 1-973-200-3360 for

international callers. The webcast will be available live on the

investor relations section of the Company's website at

http://investor.quinstreet.com, and via replay beginning

approximately two hours after the completion of the call until the

Company's announcement of its financial results for the next

quarter. An audio replay of the call will also be available to

investors beginning at approximately 5:00 p.m. PT on February 2,

2011 until 11:59 p.m. PT on February 10, 2011 by dialing

1-800-642-1687 in the U.S. and Canada, or 1-706-645-9291 for

international callers, using passcode 36582926#. This press

release, the financial tables, as well as other supplemental

financial information are also available on the investor relations

section of the Company's website at

http://investor.quinstreet.com.

Final operating results will be included in the Company's

quarterly report on Form 10-Q, which will be filed with the

Securities and Exchange Commission no later than February 14,

2011.

About QuinStreet

QuinStreet, Inc. (Nasdaq:QNST) is a leader in vertical marketing

and media online. QuinStreet is headquartered in Foster City, CA.

For more information, please visit www.quinstreet.com.

Non-GAAP Financial Measures

This release and the accompanying tables include a discussion of

adjusted EBITDA, adjusted net income, adjusted diluted net income

per share and free cash flow, all of which are non-GAAP financial

measures that are provided as a complement to results provided in

accordance with accounting principles generally accepted in the

United States of America ("GAAP"). The term "adjusted EBITDA"

refers to a financial measure that we define as net income less

provision for taxes, depreciation expense, amortization expense,

stock-based compensation expense, interest and other income

(expense), net. The term "adjusted net income" refers to a

financial measure that we define as net income adjusted for

amortization expense and stock-based compensation expense, net of

estimated taxes. The term "adjusted diluted net income per share"

refers to a financial measure that we define as adjusted net income

divided by weighted average diluted shares outstanding. The term

"free cash flow" refers to a financial measure that we define as

net cash provided by operating activities, less capital

expenditures and internal software development costs. These

non-GAAP measures should be considered in addition to results

prepared in accordance with GAAP, but should not be considered a

substitute for, or superior to, GAAP results. In addition, our

definition of adjusted EBITDA, adjusted net income, adjusted

diluted net income per share and free cash flow may not be

comparable to the definitions as reported by other companies.

We believe adjusted EBITDA, adjusted net income, adjusted

diluted net income per share and free cash flow are relevant and

useful information because they provide us and investors with

additional measurements to analyze the Company's operating

performance.

Adjusted EBITDA is part of our internal management reporting and

planning process and one of the primary measures used by our

management to evaluate the operating performance of our business,

as well as potential acquisitions. Adjusted EBITDA is useful to us

and investors because it provides information related to the

Company's ability to provide cash flow for acquisitions, capital

expenditures and working capital requirements. Internally, adjusted

EBITDA is used by management for planning purposes, including

preparation of internal budgets; to allocate resources to enhance

financial performance; to evaluate the effectiveness of operational

strategies; and to evaluate the Company's capacity to fund

acquisitions and capital expenditures as well as the capacity to

service debt. Adjusted EBITDA is used as a key financial metric in

senior management's annual incentive compensation program. The

Company believes that analysts and investors use adjusted EBITDA as

a supplemental measurement to evaluate the overall operating

performance of companies in its industry and use adjusted EBITDA

multiples as a metric for analyzing company valuations. It is also

an element of certain maintenance covenants under our debt

agreements.

Adjusted net income and adjusted diluted net income per share

are useful to us and investors because they present an additional

measurement of our financial performance, taking into account

depreciation, which we believe is an ongoing cost of doing

business, but excluding the impact of certain non-cash expenses

(stock-based compensation and amortization of intangible assets).

The Company believes that analysts and investors use adjusted net

income and adjusted diluted net income per share as supplemental

measures to evaluate the overall operating performance of companies

in our industry.

Free cash flow is useful to us and investors because it

represents the cash that our business generates from operations,

before taking into account cash movements that are non-operational,

and is a metric commonly used in our industry to understand the

underlying cash generating capacity of a company's financial model.

The Company believes that analysts and investors use free cash flow

multiples as a metric for analyzing company valuations in our

industry. Free cash flow has certain limitations in that it does

not represent the total increase or decrease in the cash balance

for the period, nor does it represent the residual cash flow for

discretionary expenditures. Therefore, we think it is important to

evaluate free cash flow along with our consolidated statement of

cash flows.

We intend to provide these non-GAAP financial measures as part

of our future earnings discussions and, therefore, the inclusion of

these non-GAAP financial measures will provide consistency in our

financial reporting. A reconciliation of these non-GAAP measures to

GAAP is provided in the accompanying tables.

Legal Notice Regarding Forward Looking

Statements

This press release and its attachments contain forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934 that involve risks and uncertainties. Words

such as "will," "believe," "intend," "potential" and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements include the quotations from

management in this press release, as well as any statements

regarding the Company's anticipated financial results and strategic

and operational plans. The Company's actual results may differ

materially from those anticipated in these forward-looking

statements. Factors that may contribute to such differences

include, but are not limited to: the Company's ability to deliver

an adequate rate of growth and manage such growth; the impact of

changes in government regulation and industry standards; the

Company's ability to maintain and increase the number of visitors

to its websites; the Company's ability to identify and manage

acquisitions; the impact of the current economic climate on the

Company's business; the Company's ability to attract and retain

qualified executives and employees; the Company's ability to

compete effectively against others in the online marketing and

media industry; the impact and costs of any failure by the Company

to comply with government regulations and industry standards; and

costs associated with defending intellectual property infringement

and other claims. More information about potential factors that

could affect the Company's business and financial results is

contained in the Company's annual report on Form 10-K as filed with

the Securities and Exchange Commission on September 13, 2010.

Additional information will also be set forth in the Company's

quarterly report on Form 10-Q for the quarter ended December 31,

2010, which will be filed with the SEC during the Company's fiscal

third quarter in 2011. The Company does not intend and undertakes

no duty to release publicly any updates or revisions to any

forward-looking statements contained herein.

| QUINSTREET,

INC. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (In

thousands) |

|

(Unaudited) |

| |

|

|

| |

December 31, |

June 30, |

| |

2010 |

2010 |

| Assets |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

$ 106,821 |

$ 155,770 |

| Marketable securities |

18,903 |

-- |

| Accounts receivable,

net |

52,421 |

51,466 |

| Deferred tax assets |

8,527 |

8,528 |

| Prepaid expenses and other

assets |

10,883 |

3,123 |

| Total current assets |

197,555 |

218,887 |

| |

|

|

| Property and equipment, net |

9,370 |

5,419 |

| Goodwill |

211,161 |

158,582 |

| Other intangible assets, net |

77,182 |

47,156 |

| Deferred tax assets, noncurrent |

3,972 |

3,972 |

| Other assets, noncurrent |

453 |

614 |

| Total assets |

$ 499,693 |

$ 434,630 |

| |

|

|

| Liabilities and Stockholders'

Equity |

|

|

| Current liabilities |

|

|

| Accounts payable |

$ 22,604 |

$ 16,776 |

| Accrued liabilities |

28,597 |

30,144 |

| Deferred revenue |

1,809 |

1,241 |

| Debt |

15,414 |

15,562 |

| Total current liabilities |

68,424 |

63,723 |

| |

|

|

| Deferred revenue, noncurrent |

177 |

305 |

| Debt, noncurrent |

101,607 |

78,046 |

| Other liabilities, noncurrent |

2,926 |

2,534 |

| Total liabilities |

173,134 |

144,608 |

| |

|

|

| Stockholders' equity |

|

|

| Common stock |

49 |

47 |

| Additional paid-in capital |

239,724 |

217,581 |

| Treasury stock |

(7,779) |

(7,779) |

| Accumulated other comprehensive

(loss) income |

(28) |

9 |

| Retained earnings |

94,593 |

80,164 |

| Total stockholders' equity |

326,559 |

290,022 |

| Total liabilities and

stockholders' equity |

$ 499,693 |

$ 434,630 |

| |

| QUINSTREET,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (In thousands,

except per share data) |

|

(Unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

December

31, |

December

31, |

| |

2010 |

2009 |

2010 |

2009 |

| Net revenue |

$ 97,582 |

$ 76,963 |

$ 201,198 |

$ 155,515 |

| Cost of revenue (1) |

70,662 |

56,557 |

144,291 |

111,604 |

| Gross profit |

26,920 |

20,406 |

56,907 |

43,911 |

| Operating expenses: (1) |

|

|

|

|

| Product development |

5,933 |

4,739 |

11,484 |

9,209 |

| Sales and marketing |

4,665 |

3,990 |

9,410 |

7,615 |

| General and administrative |

4,943 |

6,203 |

9,665 |

9,644 |

| Operating income |

11,379 |

5,474 |

26,348 |

17,443 |

| Interest income |

47 |

8 |

114 |

17 |

| Interest expense |

(1,028) |

(881) |

(2,017) |

(1,629) |

| Other income (expense), net |

(79) |

165 |

85 |

285 |

| Income before income taxes |

10,319 |

4,766 |

24,530 |

16,116 |

| Provision for taxes |

(3,391) |

(2,356) |

(10,101) |

(7,193) |

| Net income |

$ 6,928 |

$ 2,410 |

$ 14,429 |

$ 8,923 |

| |

|

|

|

|

| Net income attributable to common

stockholders |

|

|

| Basic |

$ 6,928 |

$ 620 |

$ 14,429 |

$ 2,831 |

| Diluted |

$ 6,928 |

$ 708 |

$ 14,429 |

$ 3,154 |

| |

|

|

|

|

| Net income per share attributable

to common stockholders |

|

|

| Basic |

$ 0.15 |

$ 0.05 |

$ 0.32 |

$ 0.21 |

| Diluted |

$ 0.14 |

$ 0.04 |

$ 0.30 |

$ 0.20 |

| |

|

|

|

|

| Weighted average shares used in

computing |

|

|

|

| net income per

share attributable to common stockholders |

|

|

| Basic |

45,858 |

13,521 |

45,478 |

13,463 |

| Diluted |

49,194 |

16,958 |

48,153 |

16,169 |

| |

|

|

|

|

| |

|

|

|

|

| (1) Cost of revenue

and operating expenses include stock-based compensation expense as

follows: |

| |

|

|

|

|

| Cost of revenue |

$ 1,129 |

$ 762 |

$ 2,273 |

$ 1,490 |

| Product development |

691 |

631 |

1,415 |

884 |

| Sales and marketing |

992 |

834 |

2,198 |

1,341 |

| General and administrative |

804 |

2,637 |

1,460 |

3,378 |

| |

| QUINSTREET,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS |

| (In

thousands) |

|

(Unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

December

31, |

December

31, |

| |

2010 |

2009 |

2010 |

2009 |

| |

|

|

|

|

| Cash Flows from Operating

Activities |

|

|

|

|

| Net income |

$ 6,928 |

$ 2,410 |

$ 14,429 |

$ 8,923 |

| Adjustments to reconcile net

income to net cash provided by |

|

|

| operating activities: |

|

|

|

|

| Depreciation and

amortization |

6,723 |

4,651 |

12,620 |

8,603 |

| Provision for sales returns and

doubtful accounts receivable |

2 |

(340) |

(468) |

(124) |

| Stock-based compensation |

3,616 |

4,864 |

7,346 |

7,093 |

| Excess tax benefits from

stock-based compensation |

(5,025) |

(1,278) |

(5,312) |

(1,372) |

| Other non-cash adjustments,

net |

70 |

207 |

85 |

309 |

| Changes in assets

and liabilities, net of effects of acquisitions: |

|

|

| Accounts receivable |

10,131 |

1,773 |

123 |

(4,076) |

| Prepaid expenses and other

assets |

(853) |

(4,116) |

(2,705) |

(4,352) |

| Other assets, noncurrent |

147 |

(840) |

167 |

(796) |

| Accounts payable |

(1,705) |

1,103 |

5,255 |

1,946 |

| Accrued liabilities |

73 |

(3,477) |

(2,654) |

752 |

| Deferred revenue |

370 |

(712) |

440 |

(828) |

| Other liabilities,

noncurrent |

397 |

24 |

392 |

(1) |

| Net cash provided by operating

activities |

20,874 |

4,269 |

29,718 |

16,077 |

| Cash Flows from Investing

Activities |

|

|

|

|

| Restricted cash |

-- |

12 |

(6) |

15 |

| Proceeds from sales of property and

equipment |

-- |

(1) |

-- |

43 |

| Capital expenditures |

(2,045) |

(592) |

(2,947) |

(1,035) |

| Business acquisitions, net of notes payable

and cash acquired |

(52,507) |

(34,189) |

(86,628) |

(45,952) |

| Internal software development costs |

(496) |

(331) |

(880) |

(647) |

| Purchases of marketable securities |

(18,916) |

-- |

(18,916) |

-- |

| Net cash used in investing

activities |

(73,964) |

(35,101) |

(109,377) |

(47,576) |

| Cash Flows from Financing

Activities |

|

|

|

|

| Payments for issuance of common stock |

(101) |

(402) |

(106) |

(402) |

| Proceeds from exercise of common stock

options |

7,519 |

956 |

9,614 |

1,252 |

| Proceeds from bank debt |

24,800 |

36,800 |

24,800 |

43,300 |

| Principal payments on bank debt |

(875) |

(750) |

(1,775) |

(1,500) |

| Principal payments on acquisition-related

notes payable |

(3,746) |

(880) |

(7,111) |

(2,843) |

| Excess tax benefits from stock-based

compensation |

5,025 |

1,278 |

5,312 |

1,372 |

| Repurchases of common stock |

-- |

(138) |

-- |

(715) |

| Net cash provided by financing

activities |

32,622 |

36,864 |

30,734 |

40,464 |

| Effect of exchange rate changes on cash and

cash equivalents |

(5) |

12 |

(24) |

(8) |

| Net (decrease) increase in cash and cash

equivalents |

(20,473) |

6,044 |

(48,949) |

8,957 |

| Cash and cash equivalents at beginning of

period |

127,294 |

28,095 |

155,770 |

25,182 |

| Cash and cash equivalents at end of

period |

$ 106,821 |

$ 34,139 |

$ 106,821 |

$ 34,139 |

| |

|

|

|

|

| QUINSTREET,

INC. |

| RECONCILIATION OF NET

INCOME TO |

| ADJUSTED NET

INCOME |

| (In thousands,

except per share data) |

|

(Unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

December

31, |

December

31, |

| |

2010 |

2009 |

2010 |

2009 |

| Net Income |

$ 6,928 |

$ 2,410 |

$ 14,429 |

$ 8,923 |

| Amortization of intangible

assets |

5,529 |

3,805 |

10,451 |

6,960 |

| Stock-based compensation |

3,616 |

4,864 |

7,346 |

7,093 |

| Tax impact of the above

items |

(3,750) |

(3,159) |

(6,423) |

(5,044) |

| Adjusted net income |

$ 12,323 |

$ 7,920 |

$ 25,803 |

$ 17,932 |

| |

|

|

|

|

| Adjusted diluted net income per share |

$ 0.25 |

|

$ 0.54 |

|

| |

|

|

|

|

| Weighted average shares used in

computing |

|

|

| adjusted diluted net income per

share |

49,194 |

|

48,153 |

|

| |

|

|

|

|

| |

|

|

|

|

| QUINSTREET,

INC. |

| RECONCILIATION OF NET

INCOME TO |

| ADJUSTED

EBITDA |

| (In

thousands) |

|

(Unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

December

31, |

December

31, |

| |

2010 |

2009 |

2010 |

2009 |

| Net income |

$ 6,928 |

$ 2,410 |

$ 14,429 |

$ 8,923 |

| Interest and other income

(expense), net |

1,060 |

708 |

1,818 |

1,327 |

| Provision for taxes |

3,391 |

2,356 |

10,101 |

7,193 |

| Depreciation and

amortization |

6,723 |

4,651 |

12,620 |

8,603 |

| Stock-based compensation |

3,616 |

4,864 |

7,346 |

7,093 |

| Adjusted EBITDA |

$ 21,718 |

$ 14,989 |

$ 46,314 |

$ 33,139 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| RECONCILIATION OF NET

CASH PROVIDED BY |

| OPERATING ACTIVITIES TO

FREE CASH FLOW |

| (In

thousands) |

|

(Unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Six Months

Ended |

| |

December

31, |

December

31, |

| |

2010 |

2009 |

2010 |

2009 |

| Net cash provided by operating

activities |

$ 20,874 |

$ 4,269 |

$ 29,718 |

$ 16,077 |

| Capital expenditures |

(2,045) |

(592) |

(2,947) |

(1,035) |

| Internal software development

costs |

(496) |

(331) |

(880) |

(647) |

| Free cash flow |

$ 18,333 |

$ 3,346 |

$ 25,891 |

$ 14,395 |

CONTACT: Erica Abrams or Matthew Hunt

(415) 217-5864 or (415) 489-2194

erica@blueshirtgroup.com

matt@blueshirtgroup.com

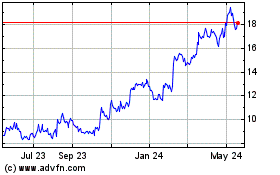

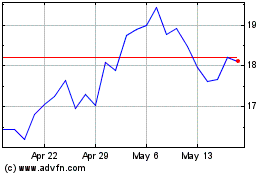

QuinStreet (NASDAQ:QNST)

Historical Stock Chart

From Jun 2024 to Jul 2024

QuinStreet (NASDAQ:QNST)

Historical Stock Chart

From Jul 2023 to Jul 2024