U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-34409

RECON TECHNOLOGY, LTD

Room 601, No.1 Shui’an South Street

Chaoyang District

Beijing, 100012

People's Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Explanatory Note

On December 14, 2023,

Recon Technology, Ltd (the “Company”) entered into a Warrant Purchase Agreement with certain accredited investors (the “Sellers”)

pursuant to which the Company agreed to buy back an aggregate of 17,953,269 warrants (the “Warrants”) from the Sellers,

and the Sellers agreed to sell the Warrants back to the Company. These Warrants were sold to these Sellers in two previous transactions

that closed on June 16, 2021, and March 14, 2023. The purchase price for each Warrant is $0.25, and the terms of each Warrant Purchase

Agreement are substantially identical.

Maxim Group LLC acted

as the exclusive advisor in connection with the Warrant Purchase Agreement between the Company and the Sellers.

At closing, which occurred

substantially concurrently with the execution of the Warrant Purchase Agreement, the Company shall pay the purchase price to the Sellers

by wire transfer. The Sellers shall undertake to deliver the Warrant to the Company for cancellation as soon as practicable following

the closing date. Notwithstanding the foregoing, the Warrant shall be deemed cancelled upon the receipt by the Sellers of the purchase

price.

The Company has agreed

that if the Company repurchases any other warrants prior to June 14, 2024 at a higher purchase price per Warrant than the purchase price

per Warrant stated in the Warrant Purchase Agreement, then the Company shall pay Sellers the difference between the purchase prices per

Warrant. Similarly, if the Company enters into or announces any Fundamental Transactions as defined in the Warrants, and the Black-Scholes

Value is a purchase price per Warrant that is higher than the purchase price per Warrant stated in the Warrant Purchase Agreement, then

the Company shall pay Sellers the difference between the Black-Scholes Value purchase price per Warrant and the stated purchase price

per Warrant in the Warrant Purchase Agreement.

Exhibits

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

RECON TECHNOLOGY, LTD |

| |

|

| |

/s/ Shenping Yin |

| |

Shenping Yin |

| |

Chief Executive Officer |

| |

(Principal Executive Officer) |

Dated: December 15, 2023

Exhibit 4.1

WARRANT

PURCHASE AGREEMENT

This WARRANT PURCHASE AGREEMENT

(this “Agreement”), dated as of December 14, 2023, is made and entered into between Recon Technology Ltd, a Cayman

Island exempted company with limited liability duly registered with the Cayman Islands Registrar of Companies (the “Company”),

and [·] (“Seller”), a [·]

organized under the laws of [·].

RECITALS

WHEREAS,

Seller is the owner of ordinary share purchase warrants of the Company, issued on March 17, 2023 (the “2023 Warrants”),

and ordinary share purchase warrants of the Company, issued on June 16, 2021 (the “2021 Warrants”; and together

with the 2023 Warrants, the “Warrants”);

WHEREAS,

Seller desires to sell to the Company, and the Company desires to purchase from Seller, certain Repurchased Warrants (as defined herein)

beneficially owned by Seller upon the terms and conditions set forth in this Agreement; and

WHEREAS,

the Company intends to cancel the Repurchased Warrants (as defined herein) upon their transfer to the Company pursuant to this Agreement.

NOW,

THEREFORE, for and in consideration of the mutual covenants and agreements contained in this Agreement, the receipt and sufficiency

of which are hereby acknowledged, and intending to be legally bound, the parties hereby agree as follows:

Article I

SALE AND PURCHASE

Section 1.1 Purchase

of Warrants; Purchase Price.

(a) On

and subject to the terms and conditions of this Agreement, the Company agrees to purchase from Seller, all of its Warrants (the “Repurchased

Warrants”), being the number of Warrants set forth opposite the name of the Seller in Schedule I hereto, at the aggregate purchase

price set forth on Schedule I hereto for such Repurchased Warrants (the “Purchase Price”) (such transactions, collectively,

the “Repurchase Transaction”).

(b) If

at any time from the date of this Agreement until June 14, 2024, the Company purchases any warrants of the same class as any of

the Warrants from any other holder thereof, (an “Other Holder”) at a price per warrant (the “MFN Price”)

that is higher than the purchase price per Warrant, as set forth on Schedule I hereto (the “Purchase Price per Warrant”),

then the Company shall pay Seller the difference between such MFN Price and Purchase Price per Warrant for each Repurchased Warrant of

such class purchased by the Company in the Repurchase Transaction. If at any time from the date of this Agreement until June 14,

2024, the Company enters into or announces any Fundamental Transaction (as defined in the Repurchased Warrants) and the Black Scholes

Value (as defined in the Repurchased Warrants) is a price per warrant (the “BSV Price”) that is higher than the Purchase

Price per Warrant (or a higher MFN Price if that amount has previously been paid to Seller), then the Company shall pay Seller the difference

between such BSV Price and Purchase Price per Warrant (or a higher MFN Price if that amount has previously been paid to Seller) for each

Repurchased Warrant of such class purchased by the Company in the Repurchase Transaction.

(c)

Section 1.2 Closing

Date. The closing of the Repurchase Transaction shall occur substantially concurrently with

the execution of this Agreement. At the closing:

(a) The

Company shall pay to Seller the Purchase Price in immediately available funds by wire transfer to the account specified in the instructions

provided by the Seller to the Company on the date hereof; and

(b) Seller

shall surrender the Repurchased Warrants to the Company, together with all documentation reasonably necessary to transfer to the Company

all right, title and interest in and to the Repurchased Warrants.

Article II

REPRESENTATIONS AND WARRANTIES OF SELLER

To induce the Company to

enter into and perform its obligations under this Agreement, Seller hereby represents and warrants to the Company as of the date hereof

as follows:

Section 2.1 Existence.

Seller has been duly organized and is validly existing and in good standing under the laws of its jurisdiction of formation.

Section 2.2 Authority

and Capacity; No Conflicts. Seller has all requisite power, authority and capacity to enter

into and perform its obligations under this Agreement and all action required to be taken for the due and proper authorization, execution

and delivery by it of this Agreement and the consummation of the Repurchase Transaction has been duly and validly taken, and the consummation

of the Repurchase Transaction will not violate any law applicable to Seller or result in a breach of or default under Seller’s

organizational documents or any agreement to which Seller is a party or by which Seller is bound.

Section 2.3 Binding

Agreement. This Agreement has been duly authorized and validly executed and delivered by

or on behalf of Seller and constitutes a valid and binding agreement of the Seller, enforceable in accordance with and subject to its

terms, except to the extent enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement

of creditors’ rights or by general equitable principles.

Section 2.4 Title.

Seller has good and valid title to the Repurchased Warrants, free and clear of all liens, encumbrances, equities or claims, and upon

transfer of the Repurchased Warrants pursuant hereto, good and valid title to the Repurchased Warrants, free and clear of all liens,

encumbrances, equities or claims, will pass to the Company. The Seller has not sold, distributed, pledged or otherwise transferred all

or any portion, or any interest in, the Repurchased Warrants, nor agreed to do so.

Section 2.5 Non-Reliance.

Seller (a) is not relying on the Company for any legal, tax, investment, accounting or regulatory advice, (b) has consulted

with its own advisors concerning such matters and (c) has conducted to its satisfaction an independent investigation and verification

of the financial condition, results of operations, assets, liabilities, properties and operations of the Company, (d) in determining

to proceed with the Repurchase Transaction, has relied solely on the results of such independent investigation and verification and on

the representations and warranties of the Company in Article III,

and (e) acknowledges that the Company is entering into this Agreement with it in reliance on the acknowledgments, agreements, representations

and warranties set forth in this Article II.

The Seller acknowledges that the Company may enter into agreements with other holders of ordinary share purchase warrants of the Company

for the repurchase of such warrants on or about the date of this Agreement at the same price per warrant of such class as provided for

in this Agreement.

Section 2.6 No

Approvals or Consents. No consent, approval or authorization of or exemption by, or declaration,

filing or registration with or notice to, any third party or any legislative, executive, judicial, or administrative body, including

any court, tribunal, arbitrator, authority, agency, commission, official or other instrumentality, of the government of the United States

or of any foreign country, any state or any political subdivision of any such government (whether state, provincial, county, city, municipal

or otherwise) is required in connection with the execution and delivery by Seller of this Agreement or the consummation of the Repurchase

Transaction.

Article III

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

To induce Seller to enter

into and perform its obligations under this Agreement, the Company hereby represents and warrants to Seller as of the date hereof as

follows:

Section 3.1 Existence.

The Company is an entity duly organized, validly existing and in good standing under the laws of the Cayman Islands.

Section 3.2 Authority

and Capacity; No Conflicts. The Company has all requisite power, authority and capacity

to enter into and perform its obligations under this Agreement and all action required to be taken for the due and proper authorization,

execution and delivery by it of this Agreement and the consummation of the Repurchase Transaction has been duly and validly taken, and

the consummation of the Repurchase Transaction will not violate any law applicable to the Company or result in a breach of or default

under the Company’s organizational documents or any agreement to which the Company is a party or by which the Company is bound.

Section 3.3 Binding

Agreement. This Agreement has been duly authorized and validly executed and delivered by

or on behalf of Seller and constitutes a valid and binding agreement of the Seller, enforceable in accordance with and subject to its

terms, except to the extent enforcement thereof may be limited by bankruptcy, insolvency, reorganization or other laws affecting enforcement

of creditors’ rights or by general equitable principles.

Section 3.4 No

Approvals or Consents. No consent, approval or authorization of or exemption by, or declaration,

filing or registration with or notice to, any third party or any legislative, executive, judicial, or administrative body, including

any court, tribunal, arbitrator, authority, agency, commission, official or other instrumentality, of the government of the United States

or of any foreign country, any state or any political subdivision of any such government (whether state, provincial, county, city, municipal

or otherwise) is required in connection with the execution and delivery by the Company of this Agreement or the consummation of the Repurchase

Transaction.

Article IV

MISCELLANEOUS

Section 4.1 Disclosure

of Repurchase Transaction. The Company shall, on or before 9:30 am New York time, on the

first business day after the date of this Agreement (or on the date of this Agreement, if such Agreement is signed prior to 9:30 am New

York time), furnish or file a Report on Form 6-K or a press release describing all the material terms of the Repurchase Transaction

(the “Announcement”). From and after the Announcement, the Company shall have disclosed all material, non-public information

(if any) provided to Seller by the Company or any of its officers, directors, employees or agents in connection with the Repurchase Transaction.

In addition, effective upon the Announcement the Company acknowledges and agrees that any and all confidentiality or similar obligations

with respect to the Repurchase Transaction under any agreement, whether written or oral, between itself or any of its officers, directors,

affiliates, employees or agents, on the one hand, and any of Seller or any of its affiliates, on the other hand, shall terminate.

Section 4.2 Further

Assurances. Each of the parties hereto shall do and perform and execute and deliver, or

cause to be done and performed or executed and delivered, and without further consideration, all further acts and all other agreements,

certificates, book entries, instruments, instructions and documents as may be necessary or as any other party hereto may reasonably request

in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the Repurchase Transaction.

Section 4.3 Notices.

(a) All

notices and other communications required or permitted to be given under this Agreement shall be in writing and shall be deemed to have

been duly given (i) on the date of delivery, if delivered personally or by e-mail prior to 5:00 p.m., in the place of delivery and

such day is a Business Day; otherwise, the next Business Day, (ii) on the first Business Day following the date of dispatch if delivered

express mail by a recognized overnight courier service or (iii) on the third Business Day following the date of mailing if delivered

by registered or certified mail, return receipt requested, postage prepaid, to the parties to this Agreement at the following address

or to such other address either party to this Agreement shall specify by notice given in accordance with this Section 4.3:

(i) if

to the Company, to:

Recon Technology Ltd

Room 601, Shui’an South Street

Chaoyang

District, Beijing, 100012

Email: ysp33@vip.sina.com

Attention: Shenping Yin, Chief Executive Officer

with a copy to:

Kaufman & Canoles, P.C.

Two James Center

1021 E Cary Street, Suite 1400

Richmond,

VA 23219

Email: Anthony W. Basch, Esq.

Attention: awbasch@kaufcan.com

(ii) if

to Seller, to:

[·]

Email: [·]

Attention: [·]

with a copy to:

[·]

Email: [·]

Attention: [·]

(b) For

the purposes of this Section 4.3, “Business

Day” shall mean any day other than Saturday, Sunday or other day on which commercial banks in New York are authorized or required

by law to remain closed; provided, however, for clarification, commercial banks shall not be deemed to be authorized or

required by law to remain closed due to “stay at home”, “shelter-in-place”, “non-essential employee”

or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority

so long as the electronic funds transfer systems (including for wire transfers) of such commercial banks are generally open for use by

customers on such day.

Section 4.4 Amendments

and Waivers. Any provision of this Agreement may be amended if, but only if, such amendment

is in writing and is duly executed and delivered by the Company and Seller. Any provision of this Agreement may be waived by the party

entitled to the benefit thereof, but only by a writing signed by such party. No failure or delay by any party in exercising any right,

power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or

further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative

and not exclusive of any rights or remedies provided by law.

Section 4.5 Fees

and Expenses. Each party hereto shall pay all of its own fees and expenses (including attorneys’

fees) incurred in connection with this Agreement and the Repurchase Transaction.

Section 4.6 Successors

and Assigns; No Third Party Beneficiaries. The provisions of this Agreement shall be binding

upon and inure to the benefit of the parties hereto and their respective successors and assigns and to no other person, provided that

neither party may assign, delegate or otherwise transfer any of its rights or obligations under this Agreement without the consent of

the other party hereto. Each party to this Agreement acknowledges and agrees that this Agreement is intended for the benefit of the parties

hereto and their respective permitted successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced

by, any other person.

Section 4.7 Independent

Nature of Seller’s Obligations and Rights. The Company acknowledges and agrees that

the obligations of Seller under this Agreement are several and not joint with the obligations of any Other Holder (if any) under any

other agreement related to the repurchase of Warrants (such agreements, if any, the “Other Warrant Agreements”), and

Seller shall not be responsible in any way for the performance of the obligations of any Other Holder under any such Other Warrant Agreement.

Nothing contained in this Agreement, and no action taken by Seller pursuant hereto, shall be deemed to constitute Seller and any Other

Holders as a partnership, an association, a joint venture or any other kind of entity, or create a presumption that Seller and any Other

Holders are in any way acting in concert or as a group with respect to such obligations or the transactions contemplated by this Agreement

or any Other Warrant Agreements, if any, and the Company acknowledges that Seller and the Other Holders are not acting in concert or

as a group with respect to such obligations or the transactions contemplated by this Agreement or any Other Warrant Agreement.

Section 4.8 Governing

Law; Waiver of Jury Trial. This Agreement shall be construed, interpreted and enforced in

accordance with, and shall be governed by, the laws of the State of New York without reference to, and regardless of, any applicable

choice or conflicts of laws principles to the extent that such principles would direct a matter to another jurisdiction. Each party to

this Agreement agrees that it shall bring any action or proceeding in respect of any claim arising out of or related to this Agreement

exclusively in the courts of the State of New York and the Federal courts of the United States of America located in the Southern District

of New York (the “Chosen Courts”), and solely in connection with claims arising under this Agreement (i) irrevocably

submits to the exclusive jurisdiction of the Chosen Courts, (ii) waives any objection to laying venue in any such action or proceeding

in the Chosen Courts, (iii) waives any objection that the Chosen Courts are an inconvenient forum or do not have jurisdiction over

any party to this Agreement and (iv) agrees that service of process upon such party in any such action or proceeding shall be effective

if notice is given in accordance with Section 4.3.

Each party to this Agreement irrevocably waives any and all right to trial by jury in any legal proceeding arising out of or relating

to this Agreement.

Section 4.9 Entire

Agreement. This Agreement (including any schedules hereto) constitutes the entire understanding

and agreement of the parties relating to the subject matter hereof and supersedes any and all prior understandings, agreements, negotiations

and discussions, both written and oral, between the parties hereto and/or their affiliates with respect to the subject matter hereof.

Section 4.10 Severability.

In the event that any one or more of the provisions contained herein, or the application thereof in any circumstances, is held invalid,

illegal or unenforceable in any respect for any reason, the validity, legality and enforceability of any such provision in every other

respect and of the remaining provisions contained herein shall not be in any way impaired thereby, it being intended that all of the

rights and privileges of the parties shall be enforceable to the fullest extent permitted by law. To the extent that any such provision

is so held to be invalid, illegal or unenforceable, the parties shall in good faith use commercially reasonable efforts to find and effect

an alternative means to achieve the same or substantially the same result as that contemplated by such provision.

Section 4.11 Counterparts.

This Agreement may be executed in multiple counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same the same instrument. Counterparts may be signed by any electronic signature and be delivered via electronic mail (including

pdf) or other electronic transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered

and be valid and effective for all purposes.

[Signature Page Follows]

IN WITNESS WHEREOF, this

Agreement has been signed by the parties hereto as of the date first above written.

| |

|

RECON TECHNOLOGY LTD |

| |

|

|

| |

By: |

|

| |

Name: |

Shenping Yin |

| |

Title: |

Chief Executive Officer |

SCHEDULE

I

Schedule of Purchases

| Class of

Warrants |

Purchase

Price per Warrants

to purchase one share of

Common Stock |

Number

of Repurchased

Warrants to be sold by Seller |

Aggregate

Purchase Price

payable for the Repurchased

Warrants |

| 2021

Warrants |

$0.25 |

[·] |

$[·] |

| 2023

Warrants |

$0.25 |

[·] |

$[·] |

| |

|

Total:

[·] |

Total:

$[·] |

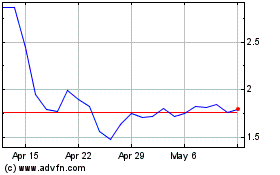

Recon Technology (NASDAQ:RCON)

Historical Stock Chart

From Feb 2025 to Mar 2025

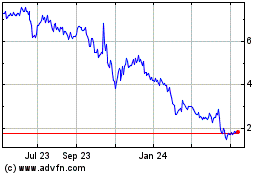

Recon Technology (NASDAQ:RCON)

Historical Stock Chart

From Mar 2024 to Mar 2025