Filed by RF Acquisition Corp.

pursuant to Rule 425 under the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: RF Acquisition Corp.

(File No. 333- 261765)

GCL Asia and Wan Xin Culture Technology Company

Announce Signing of MOU Allocating USD $100 Million Collaboration to Boost Southeast Asian Gaming Market

| · | Epicsoft Asia, a subsidiary of GCL Asia, and

Wan Xin Culture Technology Company, a subsidiary of Wan Xin Media Group, have signed an MoU, allocating over USD $100 million to

a five-year collaboration focused on innovating intellectual property creation, game development, publishing, and studio acquisitions |

| · | The team-up anticipates introducing a real-time

platform for managing digital game codes for transparent sales reporting, potentially driving efficiency and business growth |

| · | A robust revenue optimization strategy will

also be introduced to target online game piracy, leading to increase in recovered revenues |

Singapore, May 23,

2024 — Leading Southeast Asian games distributor Epicsoft Asia, a subsidiary of GCL Asia, has signed

a Memorandum of Understanding (MoU) with Wan Xin Culture Technology Company, a subsidiary of Chinese conglomerate Wan Xin Media

Group. This MoU marks the beginning of an anticipated five-year collaboration to jointly allocate over USD 100 million to

investment in intellectual property (IP) creation, game development, publishing opportunities exploration, and game studio acquisitions.

The anticipated joint investment will provide

Wan Xin access to GCL Asia’s extensive network of publishing partners, including its subsidiary, 4Divinity, and forthcoming game

IPs, to achieve co-publishing targets. The result will be enhanced capabilities for both parties to manage larger titles globally and

foster content creation within emerging game studios worldwide.

The funding will also allow GCL Asia and Wan Xin

to invest in high-potential game studios worldwide that are seeking to launch their upcoming titles in the fast-growing Asian market.

A Revenue Optimization Strategy (ROS)

With the collaboration in place, Epicsoft and

Wan Xin will spearhead a robust revenue optimization strategy to combat piracy and unauthorized software use in the gaming industry.

A number of trials involving five triple AAA game

titles yielded at least a 30%- 40% increase in recovered revenues for game publishers. This approach to targeting unlicensed sales channels

has proven highly effective and scalable.

Real-time Digital Game Codes Management Platform

The collaboration’s cornerstone is a cutting-edge

digital game code platform that generates real-time insights into consumer behavior, purchasing patterns, and market dynamics. The platform

is expected to facilitate stakeholders with transparent sales reporting, enhance marketing efficiency, and streamline decision-making,

further driving operational optimization and revenue growth.

"Data is indispensable to monetizing entertainment

IP, and even more so in the gaming industry. The implementation of our dashboard marks a significant milestone, offering game publishers

unprecedented insights into market dynamics,” says Sebastian Toke, CEO of GCL Asia. “With this tool at our disposal,

we anticipate meaningful improvements in revenue conversion, resulting in a surge in deal opportunities, highlighting the game-changing

impact of data-driven decision-making, anti-piracy, and transparent monetization."

Connected Game Toy Development

In addition to

software innovations, the collaboration will aim to bridge the physical and digital experiences in gaming through the development of

connected game toys. These toys serve as collectibles and can be used to access digital game content through mobile applications.

Given the over USD 300 billion game and toy market in 2023, both parties anticipate a high growth opportunity over the

next three years by introducing this new fan-engagement avenue.

Epicsoft Asia and Wan Xin Culture Technology Company

will also explore establishing brand consistency and presenting a cohesive image to external stakeholders. Through strategic branding

initiatives, this tie-up aims to solidify its position as a global leader in the gaming industry, driving innovation and shaping the future

of interactive entertainment.

About Epicsoft Asia

Epicsoft Asia is a leading channel partner for

games and entertainment software in Asia. With more than a decade of game publisher relationships, retail network management, marketing

services, and creative media design capabilities, the company is the appointed distribution partner for Take-Two, CD Projekt Red, SEGA®,

and WB Games in the Southeast Asia and Greater China regions.

About GCL Asia

GCL Asia is a group of four key businesses that

collectively provide an entire suite of services and reach, enabling creators to deliver fun experiences to the fast-growing Asian gamers

market. With distribution channels in seven countries, GCL Asia's Epicsoft Asia, 4Divinity, 2Game.com, and Titan Digital Media,

connect with developers, publishers, and brand owners to establish entertainment properties with consumers in the region.

Helmed by games industry veteran and group Chairman

Jacky Choo, GCL’s vision is to be the next Asian powerhouse in games entertainment and content marketing, delivering high-quality,

engaging gaming experiences to the entire region with brand partners and content creators.

In October of 2023,

GCL Asia announced that it has entered into a definitive business combination agreement (“BCA”) with RF Acquisition Corp (“RF

Acquisition”) (NASDAQ: RFAC), a publicly traded special purpose acquisition company, that will result in GCL becoming a publicly

listed company on the NASDAQ stock market, subject to regulatory and shareholder approvals and other customary closing conditions.

About

Wan Xin Culture Technology Company

Wan Xin

Culture Technology Co. Limited was established in 2011 with a registered capital of 100 million RMB. A wholly-owned subsidiary of Anhui

Xinhua Media Co., Ltd., a large listed cultural enterprise in Anhui Province. The main business is in game research and development,

as well as technical and publishing services. It owns a well-known domestic game platform, "Cube Game", the company continues

to launch excellent games in China as a distribution and publishing house, co-development work and other forms, committed to providing

users with rich and colourful entertainment content. The games such as "Sword and Fairy" series, "Sekiro: Shadows Die Twice"

are highly received among players.

About

Wan Xin Media Group

Established

in 2002, Wanxin Media is primarily engaged in the development, publishing, and distribution of content in different fields, including

magazines, books, textbooks, audio, video, and digital advertising. In 2010, Wanxin Media successfully achieved a Shanghai Stock Exchange

A-share IPO, raising 1.3 billion RMB. Since then, Wanxin Media’s market capitalisation has reached over 10 billion RMB.

About

RF Acquisition Corp.

RF

Acquisition is a blank check company incorporated as a Delaware corporation whose business purpose is to effect a merger, capital stock

exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. While RF Acquisition

may pursue an initial business combination target in any business, industry, or geographic location, it intends to search globally for

target companies within the Southeast Asian new economy sector or elsewhere. RF Acquisition was incorporated in 2021 and is based in Singapore.

Additional

Information and Where to Find It

In

connection with the proposed business combination transaction (the “Proposed Transaction”) between RF Acquisition Corp. and

GCL Asia (the “Company”), RF Acquisition and the Company intend to cause a registration statement on Form F-4 to be filed

with the SEC, which will include a proxy statement to be distributed to RF Acquisition’s shareholders in connection with RF Acquisition’s

solicitation for proxies for the vote by RF Acquisition’s shareholders in connection with the Proposed Transaction and other matters

as described in the registration statement, as well as a prospectus relating to the Company’s securities to be issued in connection

with the Proposed Transaction. RF Acquisition’s shareholders and other interested persons are advised to read, once available, the

preliminary proxy statement/prospectus and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection

with RF Acquisition’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things,

the Proposed Transaction, because these documents will contain important information about RF Acquisition, the Company, and the Proposed

Transaction. After the registration statement is filed and declared effective, RF Acquisition will mail a definitive proxy statement and

other relevant documents to its shareholders as of the record date to be established for voting on the Proposed Transaction. Shareholders

may also obtain a copy of the preliminary and definitive proxy statement/prospectus to be included in the registration statement, once

available, as well as other documents filed with the SEC regarding the Proposed Transaction and other documents filed with the SEC, without

charge, at the SEC’s website located at www.sec.gov.

Forward-Looking

Statements

This

press release includes “forward-looking statements” which may be identified by the use of words such as “estimate,”

“plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,”

“believe,” “seek,” “target” or other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These forward-looking statements also include, but are not limited to, statements

regarding projections, estimates, and forecasts of revenue and other financial and performance metrics, projections of market opportunity

and expectations, the estimated implied enterprise value of the Combined Company, GCL’s ability to scale and grow its business,

the advantages and expected growth of the Combined Company, the Combined Company’s ability to source and retain talent, the cash

position of the Combined Company following the closing of the Proposed Transaction, RF Acquisition’s and GCL’s ability to

consummate the Proposed Transaction, and expectations related to the terms and timing of the Proposed Transaction, as applicable. These

statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of RF Acquisition’s

and GCL’s management and are not predictions of actual performance.

These

statements involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, or achievements

to be materially different from those expressed or implied by these forward-looking statements. Although each of RF Acquisition and GCL

believes that it has a reasonable basis for each forward-looking statement contained in this press release, each of RF Acquisition and

GCL cautions you that these statements are based on a combination of facts and factors currently known and projections of the future,

which are inherently uncertain. In addition, there will be risks and uncertainties described in the proxy statement/prospectus included

in the Registration Statement relating to the Proposed Transaction, which is expected to be filed by the Combined Company with the SEC

and other documents filed by the Combined Company or RF Acquisition from time to time with the SEC. These filings may identify and address

other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking

statements. Neither RF Acquisition nor GCL can assure you that the forward-looking statements in this press release will prove to be accurate.

These forward-looking statements are subject to a number of risks and uncertainties, including, among others, the ability to complete

the Proposed Transaction due to the failure to obtain approval from RF Acquisition’s shareholders or satisfy other closing conditions

in the BCA, the occurrence of any event that could give rise to the termination of the BCA, the ability to recognize the anticipated benefits

of the Proposed Transaction, the amount of redemption requests made by RF Acquisition’s public shareholders, costs related to the

Proposed Transaction, the impact of the global COVID-19 pandemic, the risk that the Proposed Transaction disrupts current plans and operations

as a result of the announcement and consummation of the Proposed Transaction, the outcome of any potential litigation, government or regulatory

proceedings, and other risks and uncertainties, including those to be included under the heading “Risk Factors” in the Registration

Statement to be filed by the Combined Company with the SEC and those included under the heading “Risk Factors” in the Annual

Report on Form 10-K filed with the SEC on April 26, 2023, the Quarterly Reports on Form 10-Q filed with the SEC on June 8,

2022, August 24, 2022, and November 14, 2022, respectively. There may be additional risks that neither RF Acquisition nor GCL

presently know or that RF Acquisition and GCL currently believe are immaterial that could also cause actual results to differ from those

contained in the forward-looking statements. In light of the significant uncertainties in these forward-looking statements, nothing in

this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved

or that any of the contemplated results of such forward-looking statements will be achieved. The forward-looking statements in this press

release represent the views of RF Acquisition and GCL as of the date of this press release. Subsequent events and developments may cause

those views to change. However, while RF Acquisition and GCL may update these forward-looking statements in the future, there is no current

intention to do so, except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements

as representing the views of RF Acquisition or GCL as of any date subsequent to the date of this press release. Except as may be required

by law, neither RF Acquisition nor GCL undertakes any duty to update these forward-looking statements.

Participants

in the Solicitation

RF

Acquisition, GCL, and their respective directors, executive officers, and other members of management and employees may, under SEC rules,

be deemed to be participants in the solicitations of proxies from RF Acquisition’s shareholders in connection with the Proposed

Transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of RF Acquisition’s

shareholders in connection with the Proposed Transaction will be set forth in the proxy statement/prospectus included in the Registration

Statement to be filed with the SEC in connection with the Proposed Transaction. You can find more information about RF Acquisition’s

directors and executive officers in RF Acquisition’s final prospectus related to its initial public offering dated March 23,

2022. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests

will be included in the proxy statement/prospectus when it becomes available. Shareholders, potential investors, and other interested

persons should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

You may obtain free copies of these documents from the sources indicated above.

No

Offer or Solicitation

This

press release is not a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect

of the potential Transaction and does not constitute an offer to sell or the solicitation of an offer to buy any securities of RF Acquisition

Corp., GCL Asia or the combined company, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933,

as amended.

Investor

/ Media Contact:

Crocker

Coulson

CEO,

AUM Media, Inc.

(646)

652 7185

crocker.coulson@aummedia.org

GCL

Contact:

Sebastian

Toke

Chief

Executive Officer, GCL

(65)

9026 5165

Sebastian@gcl.asia

###

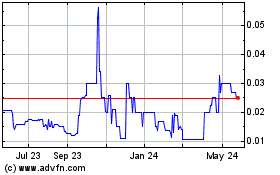

RF Acquisition (NASDAQ:RFACW)

Historical Stock Chart

From Oct 2024 to Nov 2024

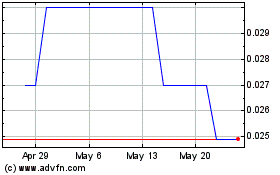

RF Acquisition (NASDAQ:RFACW)

Historical Stock Chart

From Nov 2023 to Nov 2024