UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

December 10, 2014

Date of report (Date of earliest event reported)

RENASANT

CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Mississippi |

|

001-13253 |

|

64-0676974 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

209 Troy Street, Tupelo, Mississippi 38804-4827

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (662) 680-1001

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On December 10, 2014, representatives of Renasant Corporation

(“Renasant”) made a presentation to employees of Heritage Financial Group, Inc. (“Heritage”) in connection with the merger of Heritage with and into Renasant following the announcement of the entry into the merger agreement after

the close of the market on December 10, 2014. A copy of the presentation materials is filed as Exhibit 99.1 to this Form 8-K. Additionally, an information sheet about Renasant that is expected to be made available to Heritage customers at

Heritage branch locations is filed as Exhibit 99.2 to this Form 8-K.

Additional Information About the Renasant/Heritage Transaction

This communication is being made in respect of the proposed merger transaction involving Renasant and Heritage. In connection with the

proposed merger, Renasant and Heritage will file a registration statement on Form S-4 that will include a joint proxy statement/prospectus, and other relevant documents concerning the proposed merger, with the Securities and Exchange Commission (the

“SEC”). This report does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE

JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

RENASANT, HERITAGE AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be mailed to shareholders of Renasant and stockholders of Heritage. Investors will also be able to obtain copies of the joint proxy

statement/prospectus and other relevant documents (when they become available) free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Renasant will be available free of charge from Kevin Chapman, Chief

Financial Officer, Renasant Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, telephone: (662) 680-1450. Documents filed with the SEC by Heritage will be available free of charge from Heritage by contacting T. Heath Fountain, Chief

Financial Officer, Heritage Financial Group, Inc., 721 N. Westover Blvd, Albany, Georgia, telephone: (229) 878-2055.

Renasant,

Heritage and certain of their directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Renasant and the stockholders of Heritage in

connection with the proposed merger. Information about the directors and executive officers of Renasant is included in the proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on March 11, 2014. Information

about the directors and executive officers of Heritage is included in the proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 25, 2014. Additional information regarding the interests of such

participants and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Congress passed the

Private Securities Litigation Act of 1995 in an effort to encourage companies to provide information about their anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects a company from unwarranted

litigation if actual results are different from management expectations. This report reflects the current views and estimates of future economic circumstances, industry conditions, company performance, and financial results of the management of

Renasant and Heritage. These forward-looking statements are subject to a number of factors and uncertainties which could cause Renasant’s, Heritage’s or the combined company’s actual results and experience to differ from the

anticipated results and expectations expressed in such forward-looking statements, and such differences may be material. Forward-looking statements speak only as of the date they are made and neither Renasant nor Heritage assumes any duty to update

forward-looking statements. In addition to factors previously disclosed in Renasant’s and Heritage’s reports filed with the SEC and those identified elsewhere in this report, these forward-looking statements include, but are not limited

to, statements about (i) the expected benefits of the transaction between Renasant and Heritage and between Renasant Bank and HeritageBank of the South, including future financial and operating results, cost savings, enhanced revenues and the

expected market position of the combined company that may be realized from the transaction, and (ii) Renasant’s and Heritage’s plans, objectives, expectations and intentions and other statements

contained in this report that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks,” “estimates,” “targets,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. These statements are based upon the current beliefs

and expectations of Renasant’s and Heritage’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these

forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements, and such

differences may be material.

The following risks, among others, could cause actual results to differ materially from the anticipated

results or other expectations expressed in the forward-looking statements: (1) the businesses of Renasant and Heritage may not be integrated successfully or the integration may be more difficult, time-consuming or costly than expected;

(2) the expected growth opportunities or costs savings from the transaction may not be fully realized or may take longer to realize than expected; (3) revenues following the transaction may be lower than expected as a result of losses of

customers or other reasons, including issues arising in connection with Heritage’s integration of Alarion Financial Services, Inc.; (4) deposit attrition, operating costs, customer loss and business disruption following the transaction,

including difficulties in maintaining relationships with employees, may be greater than expected; (5) governmental approvals of the transaction may not be obtained on the proposed terms or expected timeframe; (6) Renasant’s

shareholders or Heritage’s stockholders may fail to approve the transaction; (7) the terms of the proposed transaction may need to be modified to satisfy such approvals or conditions; (8) reputational risks and the reaction of the

companies’ customers to the transaction; (9) diversion of management time on merger related issues; (10) changes in asset quality and credit risk; (11) inflation; (12) the cost and availability of capital; (13) customer

acceptance of the combined company’s products and services; (14) customer borrowing, repayment, investment and deposit practices; (15) the introduction, withdrawal, success and timing of business initiatives; (16) the impact,

extent, and timing of technological changes; (17) severe catastrophic events in the companies’ respective geographic area; (18) a weakening of the economies in which the combined company will conduct operations may adversely affect

its operating results; (19) the U.S. legal and regulatory framework, including those associated with the Dodd Frank Wall Street Reform and Consumer Protection Act, could adversely affect the operating results of the combined company;

(20) the interest rate environment may compress margins and adversely affect net interest income; and (21) competition from other financial services companies in the companies’ markets could adversely affect operations. Additional

factors that could cause Renasant’s and Heritage’s results to differ materially from those described in the forward-looking statements can be found in Renasant’s and Heritage’s reports (such as Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). All subsequent written and oral forward-looking statements concerning Renasant, Heritage or the proposed merger

or other matters and attributable to Renasant, Heritage or any person acting on either of their behalf are expressly qualified in their entirety by the cautionary statements above. Renasant and Heritage do not undertake any obligation to update any

forward-looking statement, whether written or oral, to reflect circumstances or events that occur after the date the forward-looking statements are made.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Presentation materials, dated December 10, 2014. |

|

|

| 99.2 |

|

Renasant information sheet. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

RENASANT CORPORATION |

|

|

|

| Date: December 11, 2014 |

|

By: |

|

/s/ E. Robinson McGraw |

|

|

|

|

E. Robinson McGraw |

|

|

|

|

Chairman, President and Chief Executive Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Presentation materials, dated December 10, 2014. |

|

|

| 99.2 |

|

Renasant information sheet. |

|

|

|

Renasant

Renasant

Company Overview

Company Overview

Exhibit 99.1 |

|

|

| 2

This presentation contains forward looking statements with respect to the

financial condition, results of operations and business of Renasant

Corporation (“Renasant”). These forward looking

statements include, but are not limited to, statements about

Renasant’s plans, objectives, expectations and intentions and other

statements contained in this presentation that are not historical

facts. Other statements identified by

words

such

as

“expects,”

“anticipates,”

“intends,”

“plans,”

“believes,”

“seeks,”

“estimates,”

“targets,”

“projects”

or words of similar meaning generally are intended

to identify forward looking statements. These statements are based upon

the current beliefs and expectations of Renasant’s management

and are inherently subject to significant business, economic and

competitive risks and uncertainties, many of which are beyond

Renasant’s control. In addition, these forward looking statements

are subject to assumptions with respect to future business strategies and

decisions that

are

subject

to

change.

Actual

results

may

differ

materially

from

those

indicated

or implied in the forward looking statements. Renasant does not assume any

obligation to update forward looking statements.

Forward Looking Statement |

|

|

| 3

Founded in 1904

Approximately 1,400 employees

NASDAQ Global Select: RNST

Market cap ($mm) = $925 mm

Operates more than 120 banking,

lending, financial services and

insurance offices in MS, TN, AL and

GA

Financial highlights at

September 30, 2014:

Assets

$5.75 billion

Loans

3.96 billion

Deposits

4.76 billion

Renasant Bank Background |

|

|

| 7

Our vision is to be the financial services advisor and provider of choice

in each community we serve

The franchise approach empowers community bank presidents to execute their

own business plans in order to achieve our vision

Although decision-making remains at a local level, the centralization

of main departments helps maintain consistent quality and enables

attainment economies of scale

Our core values:

(1) employees are our greatest assets

(2) quality is not negotiable

(3) clients’

trust is foremost

Our Vision and Core Values |

|

|

| 8

Build Capital Ratios

Enhance Profitability

Aggressively Manage

Problem Credits

Capitalize on

Opportunities

•

Loan growth

•

Core deposit growth

•

Net interest margin expansion / mitigate interest rate risk

•

Noninterest expense control

•

Focus on acquisition opportunities

•

Leverage existing markets

•

Seek new markets

•

New lines of business

•

Quarantine troubled assets

•

Selective balance sheet growth

•

Maintain dividend

•

Non-TARP participant

Four Key Strategic Initiatives |

|

|

|

More

than

125

banking,

lending,

financial

services

and

insurance

offices

9

West

27%

North

27%

East

28%

South

18%

Portfolio Loans

West

37%

North

16%

East

21%

South

26%

Total Deposits

Current Footprint |

|

|

| 10

RNST Footprint –

June 2010 |

|

|

| 11

De novo expansion:

Columbus, MS

2010

De novo expansion:

Montgomery, AL

Starkville, MS

Tuscaloosa, AL

De novo expansion:

Maryville, TN

Jonesborough, TN

FDIC-Assisted

Transaction:

Crescent Bank and Trust

Jasper, GA

Assets: $1.0 billion

FDIC-Assisted

Transaction:

American Trust Bank

Roswell, GA

Assets: $145 million

Trust Acquisition:

RBC (USA) Trust Unit

Birmingham, AL

Assets: $680 million

Whole Bank

Transaction:

First M&F Corporation

Kosciusko, TN

Assets: $1.6 billion

2011

2012

2013

De novo expansion:

Bristol, TN

Johnson City, TN

Market Expansion Experience Since 2010 |

|

|

| 12

Expansions in 2010 –

2013

RNST

De Novo

FMFC

Acquisition

Our Current Footprint |

|

|

| 13

Alabama

Georgia

Mississippi

Tennessee

Source: SNL Financial

Data as of 6/30/13

Deposits

Market

Rank

Institution

($mm)

Share

Branches

1

Regions Financial Corp.

$14,432

32.56

%

118

2

Banco Bilbao Vizcaya Argentaria SA

7,103

16.02

46

3

Wells Fargo & Co.

5,777

13.03

65

4

BB&T Corp.

2,540

5.73

30

5

Synovus Financial Corp.

2,471

5.57

27

6

ServisFirst Bancshares Inc.

2,132

4.81

7

7

PNC Financial Services Group Inc.

1,437

3.24

31

8

Cadence Bancorp LLC

1,054

2.38

26

9

Bryant Bank

919

2.07

12

10

Renasant Corp.

759

1.71

15

Deposits

Market

Rank

Institution

($mm)

Share

Branches

1

SunTrust Banks Inc.

$26,163

35.55

%

65

2

Bank of America Corp.

15,175

20.62

46

3

Wells Fargo & Co.

14,737

20.02

79

4

BB&T Corp.

4,160

5.65

25

5

Regions Financial Corp.

1,823

2.48

30

6

Synovus Financial Corp.

1,480

2.01

13

7

BankCap Equity Fund LLC

939

1.28

1

8

State Bank Financial Corp.

839

1.14

3

9

JPMorgan Chase & Co.

672

0.91

28

10

United Community Banks Inc.

667

0.91

10

11

Renasant Corp.

587

0.80

12

Deposits

Market

Rank

Institution

($mm)

Share

Branches

1

Trustmark Corp.

$4,720

19.03

%

76

2

Regions Financial Corp.

4,216

17.00

75

3

BancorpSouth Inc.

3,358

13.54

67

4

Renasant Corp.

2,883

11.62

77

5

BancPlus Corp.

1,370

5.52

40

6

Cadence Bancorp LLC

716

2.89

15

7

Community Bancshares of Mississippi

714

2.88

15

8

Bankfirst Capital Corp.

492

1.99

10

9

Citizens Holding Co.

470

1.90

11

10

First Horizon National Corp.

437

1.76

6

Deposits

Market

Rank

Institution

($mm)

Share

Branches

1

First Horizon National Corp.

$10,100

18.69

%

86

2

Regions Financial Corp.

9,545

17.66

97

3

Bank of America Corp.

6,948

12.86

45

4

SunTrust Banks Inc.

6,408

11.86

81

5

Pinnacle Financial Partners Inc.

2,508

4.64

14

6

Wells Fargo & Co.

1,450

2.68

19

7

Fifth Third Bancorp

1,230

2.28

28

8

U.S. Bancorp

1,201

2.22

42

9

CapStar Bank

917

1.70

5

10

Independent Holdings Inc.

717

1.33

10

12

Renasant Corp.

644

1.19

14

Deposit Market Share –

Combined Counties of Operation |

|

|

| 14

Ownership

•

11 Research Analysts:

Drexel Hamilton

FIG Partners

Hilliard Lyons

Hovde

Jefferies

Keefe, Bruyette, & Woods, Inc.

Raymond James

Sandler O’Neill and Partners

Stephens, Inc.

Sterne Agee

Wunderlich

•

Mean Recommendation: Buy

•

Market Cap: $925M

•

3 Month Average Daily Trading

Volume: 65,248

Analyst Coverage

Institutional

48.4%

Insider

5.1%

Retail

46.5%

Strong Institutional Following |

|

|

| 15

Historical Dividend per Share Since 2000

Historical dividends adjusted for stock splits in December 2003 and August

2006 $0.39

$0.43

$0.46

$0.50

$0.55

$0.58

$0.63

$0.66

$0.68

$0.68

$0.68

$0.68

$0.68

$0.68

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Consistent and Strong Dividend |

|

|

| 17

Renasant and Heritage will be filing a joint proxy statement/prospectus,

and other relevant documents concerning the merger

with the Securities and Exchange

Commission (the “SEC”). This presentation does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation

of any vote or approval. INVESTORS ARE URGED TO READ

THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE

FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED

BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RENASANT, HERITAGE

AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be mailed to

shareholders

of

both

Renasant

and

Heritage.

Investors

will

also

be

able

to

obtain

copies

of

the

joint

proxy

statement/prospectus

and other relevant documents (when they become available) free of

charge at the SEC’s Web site (www.sec.gov). In addition,

documents filed with the SEC by Renasant will be available free of

charge from Kevin Chapman, Chief Financial Officer, Renasant

Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, telephone: (662) 680-1450.

Renasant, Heritage and certain of their directors, executive officers

and other members of management and employees may be deemed

to be participants in the solicitation of proxies from the shareholders of Renasant and Heritage in

connection with the proposed merger. Information about the

directors and executive officers of Renasant is included in the

proxy statement for its 2014 annual meeting of shareholders, which was

filed with the SEC on March 11, 2014. Information about

the directors and executive officers of Heritage is included in the proxy statement for its 2014 annual meeting of

shareholders, which was filed with the SEC on April 25, 2014.

Additional information regarding the interests of such

participants

and

other

persons

who

may

be

deemed

participants

in

the

transaction

will

be

included

in

the

joint

proxy

statement/prospectus

and

the

other

relevant

documents

filed

with

the

SEC

when

they

become

available.

Additional Information |

Exhibit 99.2

Exhibit

99.2

Understanding You

HISTORY OF STRENGTH

Founded in 1904 in Tupelo,

Mississippi, Renasant Bank is one of the South’s oldest financial institutions. During the past 10 years, Renasant has expanded into markets which include Memphis, TN (2004), Birmingham, Huntsville, and Decatur, AL (2005), Nashville, TN (2007),

Northern Georgia (2010,) Tuscaloosa and Montgomery, AL (2011), Starkville, MS (2011), East Tennessee (2012) and the recently acquired territories of First M&F (2013).

REMAINING STRONG THROUGHOUT CRISIS AND CALM

While making solid loans, safeguarding deposits and providing personalized service might be boring traditional banking to some, it’s how Renasant has remained strong throughout both

crisis and calm. This dedication to traditional community banking has also allowed Renasant to consistently pay dividends to shareholders during recent turbulent times.

PROVIDING EXTRAORDINARY SERVICE

With services

including traditional banking, asset-based lending, wealth management, insurance, mortgage lending, trust services and many more, Renasant’s number one goal is to understand clients’ needs while providing extraordinary service.

Because of the quality of the employees and the size of the company, Renasant is well positioned to deliver all the

products of a mega-bank but still have the personal touch of a community bank. At its core, Renasant is a bank that knows its clients by name and meets their needs through understanding.

LOOKING FORWARD

Building relationships, helping individuals, families and businesses reach their financial dreams, and supporting the communities Renasant serves has always been the company’s

calling. Renasant has remained strong while others in the financial services industry faltered by holding to this calling and its time-tested conservative business model.

RENASANT LOCATIONS

800.680.1601

renasantbank.com

QUICK FACTS

Renasant Corporation is the parent

company of Renasant Bank and Renasant Insurance, Inc.

The company has assets of approximately $5.75 billion as

of September 30, 2014.

Renasant has more than 120 locations throughout Alabama, Georgia, Mississippi and

Tennessee

Renasant’s common stock is traded on NASDAQ Stock Exchange under the symbol RNST.

Renasant Bank did not participate in the federal government’s Trouble Asset Relief Program (TARP).

A VARIETY OF PERSONAL AND

BUSINESS SERVICES

Checking, Savings and Money

Market Accounts

Certificates of Deposit

IRAs and Health Savings Accounts

Loans and Lines of Credit

Online Banking, Bill

Pay and Mobile Banking

Residential and Commercial Mortgages

Corporate Banking, Bill Pay and Mobile Banking

Treasury Management Services

Retail Brokerage

Services*

Trust and Retirement Planning

Personal and Business Insurance*

facebook/renasantbank

@renasant

/user/RNSTTV

*Investment Services and Insurance Services Are:

Not FDIC-Insured

Not a Deposit

May Go Down in Value

Not Bank Guaranteed

Not Insured by Any Federal Government Agency

UPDATED 12/2014

Additional Information

Renasant and Heritage will

be filing a joint proxy statement/prospectus, and other relevant documents concerning the merger with the Securities and Exchange Commission (the “SEC”). This presentation does not constitute an offer to sell or the solicitation of an

offer to buy any securities or a solicitation of any vote or approval. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN

THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RENASANT, HERITAGE AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be mailed to shareholders of both Renasant and Heritage.

Investors will also be able to obtain copies of the joint proxy statement/prospectus and other relevant documents (when they become available) free of charge at the SEC’s Web site (www.sec.gov). In addition, documents filed with the SEC by

Renasant will be available free of charge from Kevin Chapman, Chief Financial Officer, Renasant Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, telephone: (662) 680-1450.

Renasant, Heritage and certain of their directors, executive officers and other members of management and employees may be

deemed to be participants in the solicitation of proxies from the shareholders of Renasant and Heritage in connection with the proposed merger. Information about the directors and executive officers of Renasant is included in the proxy statement for

its 2014 annual meeting of shareholders, which was filed with the SEC on March 11, 2014. Information about the directors and executive officers of Heritage is included in the proxy statement for its 2014 annual meeting of shareholders, which

was filed with the SEC on April 25, 2014. Additional information regarding the interests of such participants and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and the

other relevant documents filed with the SEC when they become available.

Renasant (NASDAQ:RNST)

Historical Stock Chart

From Jun 2024 to Jul 2024

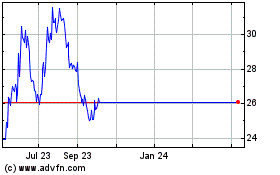

Renasant (NASDAQ:RNST)

Historical Stock Chart

From Jul 2023 to Jul 2024